Archive for November 2011

| Older Posts |

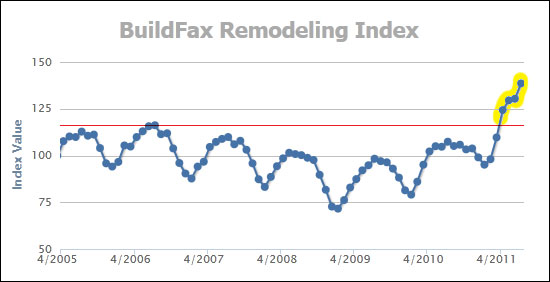

Monthly housing costs down 28% from 2007 peak |

|

How much does it cost on a monthly basis to buy the median price home in our area, assuming 80% financing? Today, that adds up to a $791 monthly payment. That marks a dramatic 28% decline since 2007 when the monthly payment would have been $1,094. The decline in median sales prices over the last few years (from $195K to $175K) combined with the decline in interest rates (from 6.2% to 3.9%) has brought average monthly housing payments down to very affordable levels. Again, the graph above (click here for a more legible PDF) shows the mortgage payment including principal, interest, taxes and insurance (PITI) assuming 80% financing at November's average 30-year interest rate, and assuming Harrisonburg's real estate tax rate ($0.59 per $100). | |

Declining home values don't bother today's buyers |

|

Cars, clothes, and computers all lose value over time as we use them and as they age. Houses, however, typically increase in value over time. While we don't get upset about cars, clothes and computers losing value, it can be quite upsetting if our houses diminish in value. Home values in Harrisonburg and Rockingham County increased through 2008, but then declined 5% in 2009, 3% in 2010 and are on pace to decline another 3% in 2011. But in many ways, today's home buyers aren't too concerned if home values drop even another 3% through next year! If you are considering purchasing a home today, you should be planning to own it for at least four or five years. As was the conventional wisdom of the past (as recent as ten years ago), home buying often isn't a great financial move if you are only planning to own the home for one to four years due to the costs incurred through financing the purchase and then selling the home two years later. The transactional costs of buying and selling are too high, from many people's perspectives, to make it worthwhile to buy a home for a short time period. Thus, if today's home buyers are planning to own their home for at least four or five years, a small decline in value over the next year doesn't, or shouldn't, bother them too much. Today's extraordinarily low interest rates make today's home prices a great value for buyers even if they could buy the home at a slightly lower price a year from now. It will cost you $664 per month (principal and interest only) if you purchase a median priced home ($175,000) at today's mortgage interest rates (4%) with a 20% down payment. If, a year from now, prices are 3% lower ($169,750), but mortgage interest rates are a half a percentage point higher (4.5%) you will be paying more for your house -- $678 per month. With such low interest rates, today's home buyers who are looking for a great deal are buying now to get a great (fixed!) interest rate rather than holding out for a slightly lower home prices with an interest rate that is not quite as favorable. Home buyers realize that improving their quality of life today is worth an extra dollar per day. Even aside from the leveling impact of low interest rates referenced above, most of today's home buyers decide that it is not worthwhile to delay buying and moving into the home that they love just to try to get a slightly lower price one year from now. After all, a mortgage payment on a median priced home ($175,000) will only decline by $25 in the next year if median prices decline by another 3%, assuming a 20% down payment, and a mortgage interest rate of 4% both today and a year from now. For most people, this potential cost savings of $25 per month isn't substantial enough to delay a home purchase and to live in a less than ideal situation for the next year. If you're looking at the real estate market and wondering if you should keep waiting to buy a home because home values might decline over the coming year – just assume that they probably will. But then consider that the many home buyers who are taking action today are seeing beyond a slight decline in home values over the next year. They recognize that they are in it for the mid to long term, they don't want to miss out on today's low interest rates, and they don't want to delay improving their living situation. Carefully examine your housing situation and finances, because if you will be buying a home within the next two years, it might make the most sense to buy it in the near term, even if home values decline a bit further after your purchase. | |

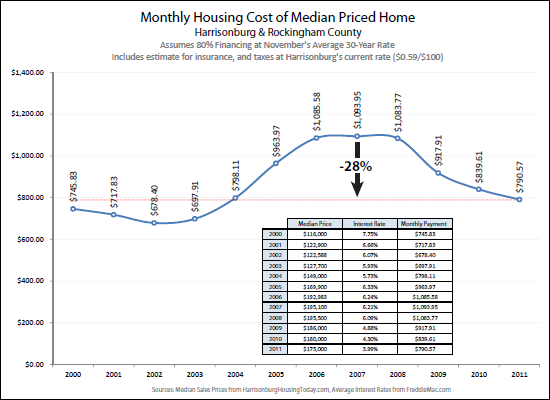

Virginia's median sales prices relatively stable |

|

Certainly, all real estate is local, but it is often insightful to see what is happening on the state level as well. As you'll note above, there hasn't been much of a shift in Virginia's median sales price, aside from seasonal changes. It's interesting to note that we don't see those same seasonal swings in our median sales price. Download the full October 2011 Virginia Home Sales Report (click here) which highlights:

| |

Are you next in line to sell your home? |

|

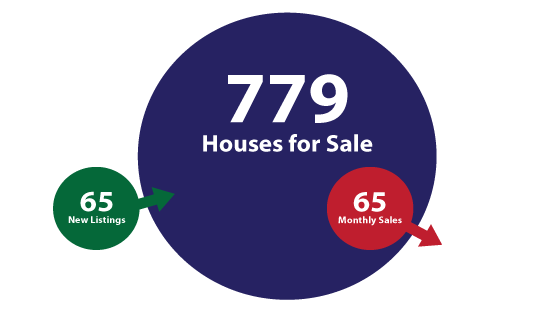

In Harrisonburg and Rockingham County, looking at the year thus far (thru Oct 31, 2011)....

Isn't that wonderful news? Within 12 months, everybody's house will have sold! Rejoice! But wait -- each month, while there are homes selling (perhaps 65) there are also new listings (perhaps 65)....  Thus, inventory always stays (roughly) the same, aside from seasonal ups and downs and long term shifts in inventory levels. So.....the big question, do all of the houses get in line and sell in an orderly fashion? If there are 12 months of homes on the market, certainly the first ones to sell are those that have been on the market for 11 months, right? Because all homes patiently wait in line and let homes that have been on the market longer sell first, right? First come, first serve? Nope, things don't work that way in the real estate market. You don't get "your turn" when it comes to selling your house. Some houses that sell this month will have been on the market for less than a month. Some just for two or three months. And yes, some of the homes that are currently on the market have been sitting there watching sales go by for months or even years. So, if your house is on the market, make sure you're not thinking that you will just wait your turn, and that eventually it will be your house's turn to sell. Think about (or talk to me about) what you can do to make sure your home IS one of the next 65 to sell, and doesn't continue to wait around......as the waiting could go on forever! | |

Blog Reader in Sept 2009: Housing Prices Will Fall 30% From Current Levels |

|

I always encourage (and enjoy) healthy skepticism about anything related to the state of the local housing market. If you think I'm off base with my analysis or predictions, let me know! Revisiting some old exchanges with a reader of my blog, I find the excerpt below, from September 2009 (just over two years ago). This is just an excerpt of a longer exchange, but provides some interesting historical context.... On the other hand, Rockingham County real estate, while not "bubbling" quite like South Florida, California, and Arizona, is still outrageously overpriced. And, unfortunately, the area has yet to start correcting in any meaningful way. As my analyses have shown, the media house price to median family income ratio is still around 4 for this area (190k median house to ~50k median household income) – and the historic norm is closer to 2.5. This ratio will come back in line, which means a 30% + decrease in housing prices from current levels. Supporting this argument is the glut of houses on the market: there's over a 13 month supply of homes (and over 24 months supply in certain sectors). That's way too high. The law of supply and demand has to kick in sometime doesn't it? So, were these predictions true? Did prices fall 30% from the levels seen in September 2009?

So despite only a very small change in the oversupply of housing, we still have not seen very much of an adjustment in sales prices. Furthermore, if you believe my current predictions, we might finally be seeing a turning of the real estate market, as evidenced by:

OK -- now I'm ready for it. Tell me your predictions for the next few years in our local housing market. Feel free to comment below, or just shoot me an e-mail (scott@HarrisonburgHousingToday.com). Perhaps I'll hold onto your comments and reflect back on them two years from now! | |

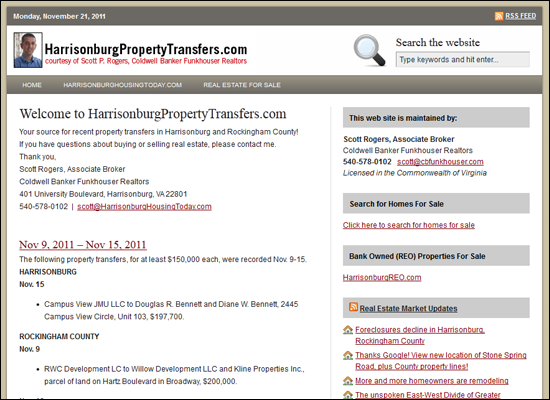

HarrisonburgPropertyTransfers.com, your source for properties transfers in Harrisonburg and Rockingham County |

|

If you are looking for a historical record of property transfers in Harrisonburg and Rockingham County, you can now easily find them on www.HarrisonburgPropertyTransfers.com. Also, don't forget, if you are looking for properties with owner financing available in Harrisonburg and Rockingham County you can find them on www.HarrisonburgOwnerFinancing.com. Also, don't forget, if you are looking for properties available for lease/purchase in Harrisonburg and Rockingham County you can find them on www.HarrisonburgLeasePurchase.com. Also, don't forget, if you are looking for potential short sales in Harrisonburg and Rockingham County you can find them on www.HarrisonburgShortSales.com. Also, don't forget, if you are looking for bank owned (REO) properties in Harrisonburg and Rockingham County you can find them on www.HarrisonburgREO.com. | |

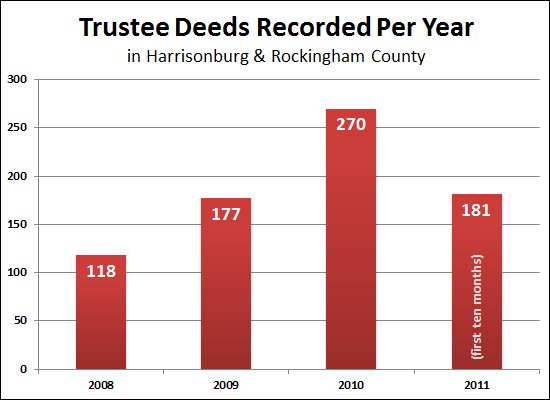

Foreclosures decline in Harrisonburg, Rockingham County |

|

In very good news for the local housing market, foreclosures are declining in Harrisonburg and Rockingham County. The graph above shows the number of Trustee Deeds recorded at the courthouse per year for 2008-2010 and the number recorded in the first ten months of 2011. It is clear that 2011 has marked a sharp turning point in the foreclosure rate in our local area. While we are not yet back to historically normal rates (70-100 per year), we have turned the corner from the peak of 270 in 2010. | |

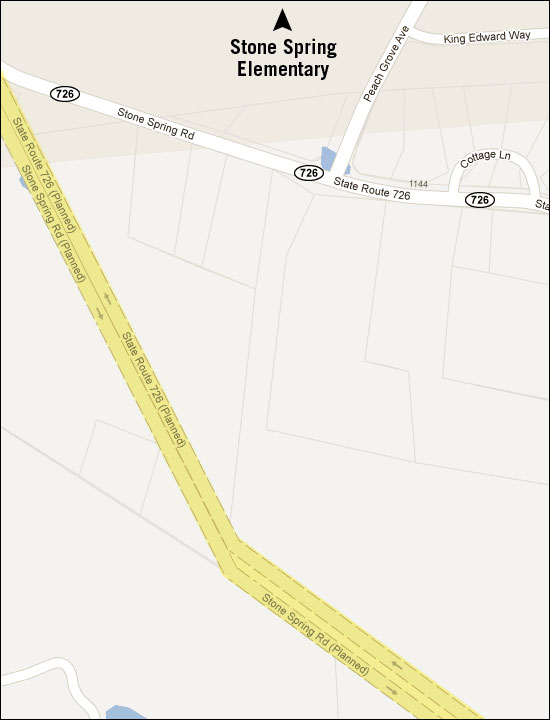

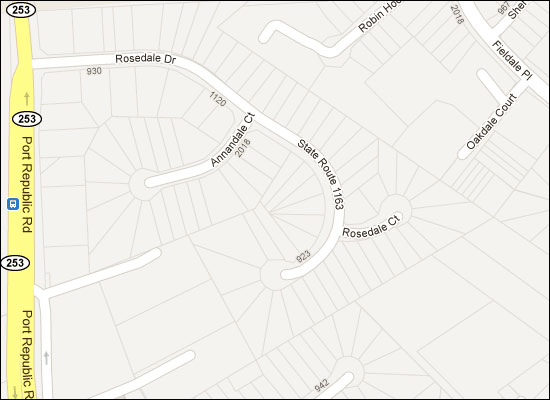

Thanks Google! View new location of Stone Spring Road, plus County property lines! |

|

If you zoom in far enough on Google Maps, you'll see the planned location of the Stone Spring Road. Also of interest, you can now view County property lines in Google Maps.  | |

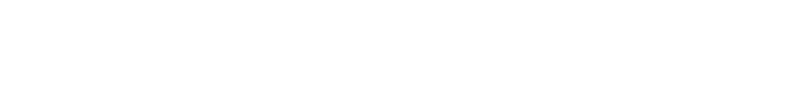

More and more homeowners are remodeling |

|

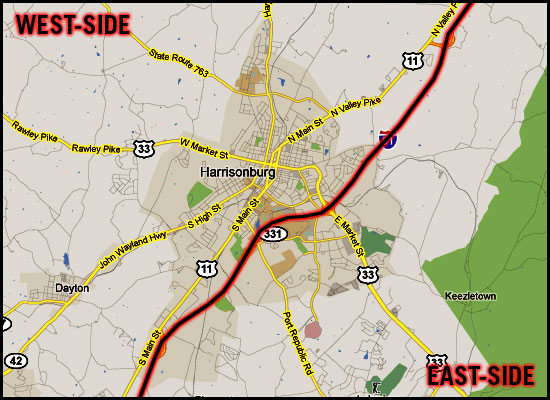

The unspoken East-West Divide of Greater Harrisonburg |

|

I don't know if Interstate 81 is really the dividing line, or if there actually is a dividing line -- but I have found that many (most?) home buyers are strongly oriented to one side of Harrisonburg or the other. EAST: Most of the residential development over the past ten to fifteen years has been on the East side of Harrisonburg, in the general vicinity of the new hospital. This makes it an exciting place to live -- for some people. There are many newer developments where homes have recently been built, and there are newer commercial destinations (Martin's grocery store, Target, etc) all on the East side of town. But this also makes it a bit more hectic for getting around. Of note, there is also plenty of outbound traffic East of town, towards Massanutten, Elkton, Charlottesville, etc. WEST: There hasn't been as much residential development West of Harrisonburg over the past ten to fifteen years (other than Belmont and Monte Vista Estates) and this is just fine with most people who live on the Western side of Harrisonburg. Things are a bit calmer, without as much hustle and bustle, and in some cases with more established neighborhoods. The towns of Dayton and Bridgewater end up falling into this side of town as well for many people. I am not doing justice to all of the differences between the East side of town and the West side of town, but I believe that most people in this area are oriented towards one side of town or the other, for very specific reasons. Furthermore, most people who have spent any considerable amount of time living on one side of Harrisonburg likely wouldn't think about moving over to the other side of Harrisonburg. | |

If you haven't sold your property in two months.... |

|

Click the image above to watch a 4 minute video from the Wall Street Journal (and Smart Money) about the state of the current housing market. From the video.... "As a buyer, if you're seeing properties on the market that have been there for more than two, three months, those properties aren't going to move. There's no real reason to make an offer on those properties. If a property can't sell in the first two months, there's a problem with that price. The price is not realistic for the market, the buyers aren't willing to take it. So, the only way that sellers are going to move their property if they need to sell now is you either are going to price it at what the average price is for your market, or, ideally, slightly below which will bring in more buyers and more attention. If your home is sort of on the market now for months, the chances are moving it at the current price are very slim." So, if we believe the above (two months without a sale = problem with price) then it's interesting to note the following about our local market.... 803 active residential listings (H'burg, Rock Cnty) 660 of those 803 listings are more than 2 months old Thankfully, 405 of those 660 listings have had a price change, but many have then gone another two months without selling. Perhaps it's not true for every property (two months without sale = wrong price) but that logic can certainly be applied to many properties. | |

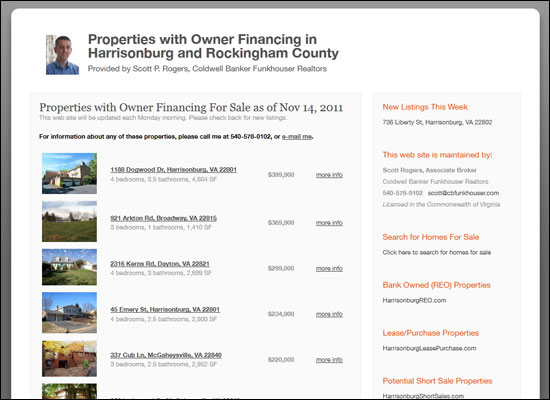

HarrisonburgOwnerFinancing.com, your source for properties with owner financing in Harrisonburg and Rockingham County |

|

If you are looking for properties with owner financing available in Harrisonburg and Rockingham County you can now easily find them on www.HarrisonburgOwnerFinancing.com. Also, don't forget, If you are looking for properties available for lease/purchase in Harrisonburg and Rockingham County you can find them on www.HarrisonburgLeasePurchase.com. Also, don't forget, if you are looking for potential short sales in Harrisonburg and Rockingham County you can find them on www.HarrisonburgShortSales.com. Also, don't forget, if you are looking for bank owned (REO) properties in Harrisonburg and Rockingham County you can find them on www.HarrisonburgREO.com. | |

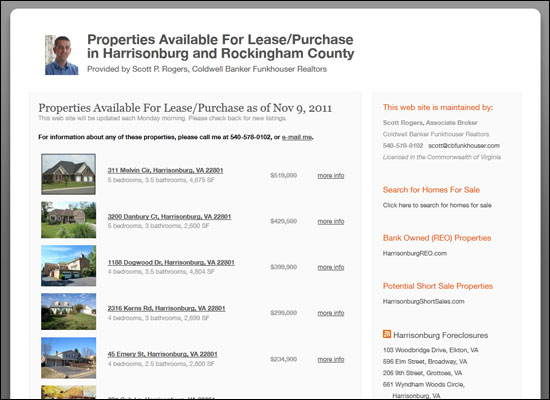

HarrisonburgLeasePurchase.com, your source for properties available for lease/purchase in Harrisonburg and Rockingham County |

|

If you are looking for properties available for lease/purchase in Harrisonburg and Rockingham County you can now easily find them on www.HarrisonburgLeasePurchase.com. Also, don't forget, if you are looking for potential short sales in Harrisonburg and Rockingham County you can find them on www.HarrisonburgShortSales.com. Also, don't forget, if you are looking for bank owned (REO) properties in Harrisonburg and Rockingham County you can find them on www.HarrisonburgREO.com. | |

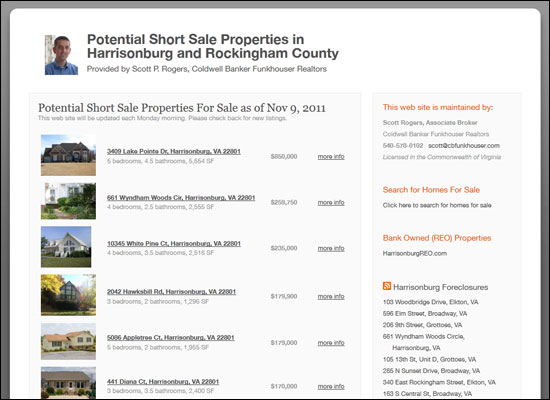

HarrisonburgShortSales.com, your source for potential short sales in Harrisonburg and Rockingham County |

|

If you are looking for potential short sales in Harrisonburg and Rockingham County you can now easily find them on www.HarrisonburgShortSales.com. Also, don't forget, if you are looking for bank owned (REO) properties in Harrisonburg and Rockingham County you can find them on www.HarrisonburgREO.com. | |

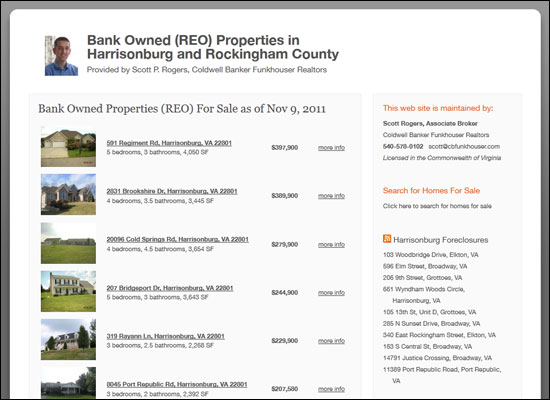

HarrisonburgREO.com, your source for bank owned (REO) properties in Harrisonburg and Rockingham County |

|

If you are looking for bank owned (REO) properties in Harrisonburg and Rockingham County you can now easily find them on www.HarrisonburgREO.com. | |

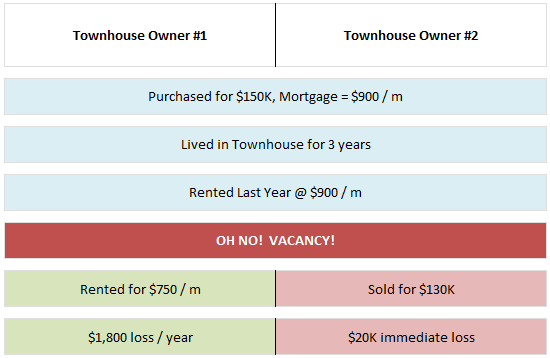

My tenants left, should I sell my townhouse? |

|

In many cases, your better option is to keep renting your townhouse --- and doing whatever it takes to find a tenant --- rather than trying to cut your losses via a sale. In the example above, you could go for years with reduced ($750/m) rent with annual losses of $1800 before you came anywhere close to realizing the full amount of loss realized by a quick sale on day 1. | |

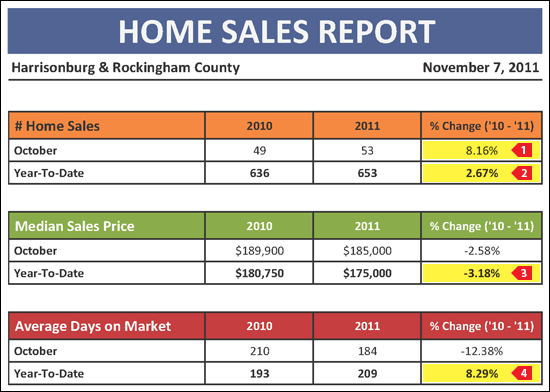

Home sales, contracts increase in October 2011, despite continued slow decline of home values |

|

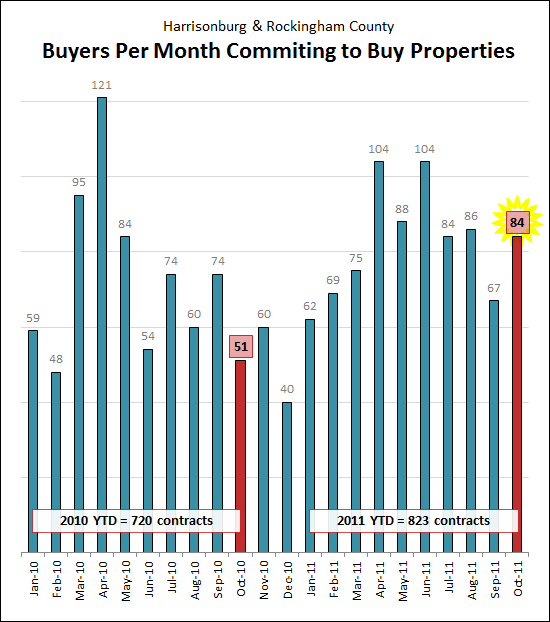

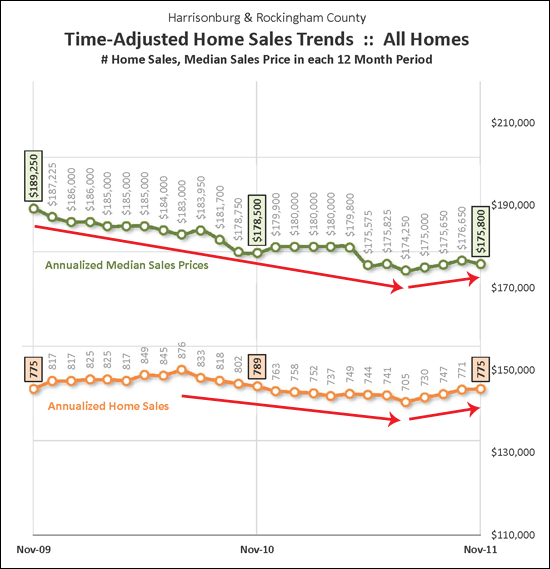

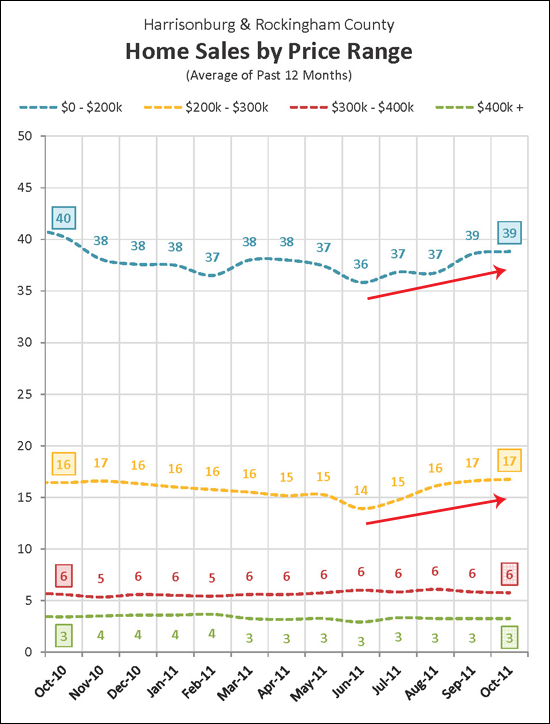

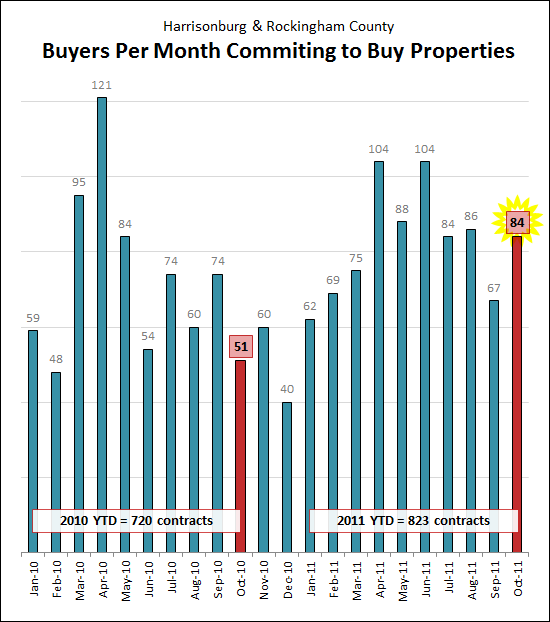

Click here to download my full market report (27 pages, 7 MB, PDF) or read on for highlights....  October was a relatively positive month for the local housing market:

A strong sign of strength to come in the local housing market, October 2011 was a great month of buying activity, with 84 buyers committing to buy homes in Harrisonburg or Rockingham County. This marks a 65% increase in buyer activity as compared to October 2010!  Trends are very slow to reveal themselves in annualized sales figures (shown above) because they are an indication of 12-month rolling averages. That said, it seems that it may be a safe bet that home sales and home prices are on the mend when examining the graph above, which has now been showing increases in these long-term indicators for four months.  Some price ranges are recovering more quickly than others. The graph above shows that the price ranges under $300K have been starting to see increases in sales over the past several months. This should eventually roll over into the higher price ranges as buyers move up the price spectrum.  For an even more in-depth look at the Harrisonburg and Rockingham County real estate market, click the image above to download my full market report (27 pages, 7MB, PDF). If you have questions about the report, or if I can be of assistance to you with real estate that you own, or that you'd like to own, please be in touch. You can reach me most easily at 540-578-0102 or scott@HarrisonburgHousingToday.com. | |

Am I incented to try to get you to pay more for your home? |

|

One of my buyer clients recently asked an excellent question -- whether I am really trying to get the purchase price as low as possible when I am representing a buyer in a transaction. It's a fair question -- my compensation out of said transaction, after all, is based on the purchase price. My client's concern was whether I would really be working hard alongside them in trying to get the price down as low as possible. I reassured that this was the case, for two reasons:

$10,000 increase in sales price leads to.... $500 increase in gross commissions (based on 5%).... $250 increase in commission on the buyer side of the transaction.... $125 increase in commission after broker/agent split. As you can see here, by trying to coerce my clients into paying $10,000 more for the house they are buying, I only stand to gain $125 (approximately). As is probably clear, I'd much rather have $125 less in my pocket and have clients who are happy about the deal we were able to find for them! | |

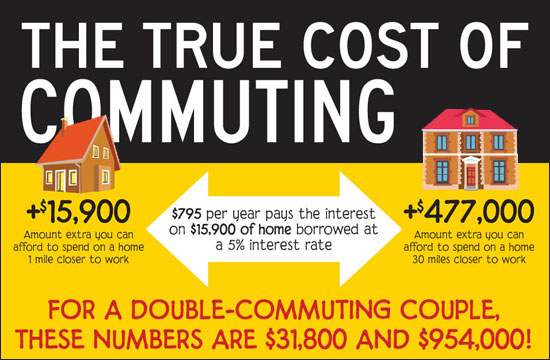

Want a bit more house? Move closer to work! |

|

Sometimes a house closer to your workplace might cost more, but, there can be significant cost savings in buying a house closer to work. Click on the graphic below for the entire story.  Click here to view this entire (very interesting) infographic. | |

LOTS of buyers signed contracts in October 2011 |

|

Despite starting to see some colder weather (and the first snowfall of the year) October 2011 was a strong month of contracts for Harrisonburg and Rockingham County. These 84 contracts was a significant increase over last October's 51 contracts -- and at 84 was right in line with May (88), June (84) and July (86). Wow! | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings