An Appraisal Contingency Should Not Worry Most Home Sellers |

|

For a few years now, in a highly competitive seller's market, buyers were waiving contingencies left and right... No Home Inspection Contingency! No Radon Test Contingency! No Appraisal Contingency! No Home Sale or Home Settlement Contingency! Now, though, with much higher interest rates, and somewhat lower levels of buyer interest, we are sometimes seeing some of these contingencies sneaking their way back into offers. One of my general rules of thumb these days is that if you are making the only offer on a property, it is probably reasonable to include some of these contingencies that you might have waived if you had bought in 2020/2021... but if you are competing against multiple other offers, you may want to consider waiving some of these contingencies. As such... some sellers are now receiving offers with... my topic of the day... appraisal contingencies! Should a seller be concerned about an appraisal contingency? Should they counter back and propose not having an appraisal contingency? Generally speaking, I don't think an appraisal contingency should worry most home sellers. Appraisers are not personal crusaders with a mission of lowering market values by strategically coming up with low appraised value to wreak havoc on real estate transactions and to course correct the real estate market because they think homes are overvalued. ;-) Appraisers work to provide a detailed and objective estimate of the value of a house to the lender who is using that house as collateral for a mortgage. So, as a home seller, if your contract price is in line with recent sales prices of similar homes, you likely don't need to get too worried about an appraisal contingency. Certainly, it's another hoop to jump through, or another hurdle to clear, between contract and closing... but the existence of the contingency in an offer should not cause you undue stress or anxiety. | |

Plenty Of Properties Likely Sold Above Appraised Value Over The Past Few Years But Fewer Are Likely To Do So Moving Forward |

|

Home buyer attitude towards appraisals has certainly shifted over the past few years! PRE-COVID... Most buyers would include appraisal contingencies in their offers to reserve the right to have a conversation with the seller about the sales price if the appraised value ended up being lower than the contract price. Most sellers were comfortable with these appraisal contingencies and found them to be reasonable. EARLY COVID... Some buyers started to leave appraisal contingencies out of their offers to compete in multiple offer scenarios. These offers were no longer contingent on the property appraising at or above the contract price. IN THE THICK OF COVID... The market just kept heating up over the past few years, during Covid, and eventually, home buyers almost always found themselves competing with multiple (or many, or multitudes) of other offers. Home buyers started adding in specific language to their offers agreeing to proceed with the purchase so long as the appraised value wasn't any lower than $____ below the sales price, or agreeing to proceed with the purchase regardless of the appraised value. These offers would significantly reduce (or eliminate) the possibility of an appraisal disrupting the home sale. Home buyers were willing to go this route to try to compete to secure a contract on a house... and home sellers were delighted! NOW... Some new listings are still having 5+ offers within a few days, but plenty are only having one or two offers. With fewer competing offers, and with a feeling that the market might be slowing a bit, more home buyers are revisiting the topic of whether to include an appraisal contingency. Some buyers are now including appraisal contingencies in their offers once again. Buyers should likely decide whether to include an appraisal contingency based on whether they are competing with other offers, and based on how much they like a particular property. Some sellers find the return of the appraisal contingency to be quite reasonable. Some sellers think it is a terrible thing, and are insistent that they should be able to sell their home for more than an appraised value. Sellers should likely decide whether to accept an appraisal contingency based on how much interest exists in their home, how many offers they have, how long it has been on the market, etc. A shift in the way that home buyers and sellers see appraisal contingencies is normal as we start to see some early signs that the local housing market might be slowing down from a sprint to a fast run. As with all things housing market related right now, the dynamics described above to not equally apply to all property types, price ranges and locations. :-) | |

I Will Offer You ONE MILLION DOLLARS For Your House... Oh, Contingent On An Appraisal... |

|

I've seen buyers use this strategy quite a few times lately... and sellers usually aren't interested, or fooled, or entertained. Here's the scenario... A house is listed for sale, priced at $250,000. Three offers come in, each one higher than the last, as is typical in this market...

Then, the fourth offer comes in. Offer #4 is an offer of $350,000. Contingent on the property appraising at or above the contract price. I'm exaggerating a bit to make my point here -- but not by much. Basically, a buyer offers WAAAAAY above the asking price -- well beyond what anyone would think would be a reasonable offer for the property -- but makes their offer contingent on an appraisal. I suppose the thought is that surely a seller would pick an offer of $350K instead of an offer of $255K, $260K or $265K, right!? Maybe not. I have had the chance to see several sellers respond to these absurdly, unrealistically high offers and again, sellers usually aren't interested, or fooled or entertained by such offers. Almost every seller I know would happily take Offer #3 as described above before they'd even start to entertain Offer #4. Clearly, buyers can attempt to negotiate however they'd wish to do so, but this particular strategy does not seem, to me, to be a winning strategy. | |

Sometimes, Appraisals Are Reining In High Contract Prices, And That Can Keep Sales Prices From Getting Out Of Hand |

|

Let's say there's a house that comes on the market for $300K. Every Realtor and buyer that looks at it agrees that it is worth $300K because three identical houses sold the prior day for $299K, $300K and $301K. ;-) The house immediately has LOTS of interest, LOTS of showings and LOTS of offers. The house ends up going under contract for $335K. Wow! Now, a few things can happen from here...

So -- even if buyers are willing to (per their offers) pay higher and higher and higher prices for houses -- regardless of what other buyers recently paid for similar houses -- the appraisal process is still, often but not always, keeping things in check and preventing prices from skyrocketing too quickly. | |

What Is A Seller To Do When The Appraisal Comes Back Lower Than The Escalated Contract Price |

|

You're ready to sell your home. Great! We look at comparable sales and decide that your home is likely to sell for $300K in the current market. We debate pricing your home for $299K or $305K and end up going with $305K because we're optimistic about the strength of the current market. After 20 showings in 48 hours, we receive eight offers with prices ranging from $305K to $335K. We settle on the contract with a price of $330K because of some of the other terms included in the offer. Then, the buyer gets the appraisal back and your house appraised for $300K -- all the way back to what we thought it was worth before putting it on the market. The only way the buyer can pay over that $300K is if they scrape together extra cash to bring to closing. They love your house and they find a way to come up with $5K so that they can pay $305K for your house -- but they are not able to pay the $330K contract price that you and they had agreed to some weeks back. Now you, as a seller, have some options to consider... Option 1 - Sell At Or Just Above The Appraised Value Perhaps you look at the big picture and decide that you are OK selling for the price you figured your house with worth ($300K) and maybe a bit above that ($305K) despite the short-lived excitement of thinking you would be selling your house for more than you thought it was worth. It can be somewhat difficult to come to this conclusions -- after all -- a day before the appraisal report was completed you thought you were selling your house for $25K more ($330K) than you would now ($305K) be selling your house. Option 2 - Put Your House Back On The Market And Hope For A Cash Buyer The only way to get completely around an appraisal with certainty is to sell to a cash buyer. It might seem farfetched to think there would be a cash buyer for your home -- but it is definitely possible depending on the price point, property type, etc. Option 3 - Put Your House Back On The Market And Hope For A Buyer Willing To Pay Over Appraised Value If you're not selling to a cash buyer, perhaps you will be able to find a buyer who will contract to buy your home at a price above where you know it recently appraised AND that is willing and able to pay a certain amount above the appraised value. Again, this is not all that farfetched. If a buyer had made an offer of $335K, previously, and now could agree to pay $320K for your house ($15K more than the buyer you are/were under contract with) so long as they were OK with paying up to $20K above the appraised value - they might be quite excited to do so. After all, they were ready to pay $335K for the house -- only having to pay $320K (even with a $300K appraisal) might be seen as a great opportunity. As you think through all of this, you'll likely also be thinking about the value of just moving forward with the buyer who is already under contract to buy your home. Yes, it is likely going to be easier and faster to move forward with that buyer -- but you may be walking away from $10K or $15K or even more by not exploring interest that may exist from other buyers. | |

Several Ways To Think About Appraisal Contingencies |

|

It used to be pretty common for real estate contracts to be contingent on the property appraising at or above the contract price. If a buyer was to be paying $350K for a house -- they wanted to make sure the appraised value was $350K or higher. These days many buyers understand that they might need to be willing (and able) to pay above the appraised value in order to actually buy a home. After all, if a house is listed for $350K and there are six offers on the house, all with escalation clauses and the winning offer is $370K -- that buyer may need to be willing to still pay $370K even if the appraised value ends up being $350K or $360K. Here, then, are a few ways that buyers are thinking about and dealing with appraisal contingencies... Contingent On Appraisal Some buyers are still making offers that are contingent on the appraised value being equal to or greater than the contract price. These offers are often going to be the ones that are least likely to be accepted in a multiple offer scenario if all other terms were the same. It is fine to include this contingency in an offer -- but it greatly reduces the likelihood that the seller will choose to move forward with your offer. An Unspoken But Implied Contingency If you are financing 90% or 95% or 97% or 100% of the purchase price -- even if you don't have an appraisal contingency explicitly included in your contract -- your offer may effectively be contingent on the property appraising at/above the contract price due to the financing contingency. When a buyer is financing 95% of a $250K purchase price -- and the appraisal comes in at $240K, their lender will likely require the buyer to bring extra cash to closing. If the buyer has extra cash -- great. If not, the buyer will not be able to move forward with the purchase as a result of the low appraisal -- even without an appraisal contingency -- because of the financing contingency. A Limited Contingency Perhaps you're offering $310K for a house and you are willing and able to move forward with the purchase so long as the property appraises at or above $300K. As such, you're willing to pay $10K above the asking price. We can make your offer contingent on the property appraising for at least $300K -- which will give the seller more peace of mind because you are willing to pay $10K over the appraised value. Not At All Contingent Maybe you love a house soooo much that you do not even care about the appraised value -- and your financing or cash situation is such that it won't change things if the appraisal comes in slightly or significantly low. In such an instance, we don't need to make the contract contingent on the property appraising at any particular price -- and we might even go so far as to say in the contract that you will proceed with the purchase regardless of the appraised value. In Summary... It's a fast moving market these days and with so many buyers making offers on properties, many buyers are often willing to pay above appraised value for a property that is a great fit for them. It is important to think about and talk about the appraisal process and strategically incorporate (or don't incorporate) whatever contract terms make the most sense given your level of interest in the property, your financing situation, your cash situation, etc. | |

Buyers Seem To More Frequently Be Willing To Pay Above Appraised Value For Houses |

|

In today's local housing market we're seeing...

This disconnect (buyers being willing to pay more than appraised value) is likely because of how appraisals are defined and conducted. An appraisal is an indication of the value of a property based on what other buyers have paid for other similar houses in the recent past - often the last six months. What we now seem to be seeing is that today's buyers are willing to pay more for houses than buyers paid zero to six months ago - which can cause an appraisal to come in lower than the price that the buyer had agreed to pay for the house. So, when there is a low appraisal, where do things go from there? It's different in every transaction and it's all negotiable.

If the appraisal on your house comes in low...

Current conditions in your segment of the local housing market will likely ultimately dictate what a buyer and seller will agree to do with a low appraisal. | |

How To Count Bedrooms In A House |

|

You don't have to be a math major to count bedrooms, right? Well, technically, that's true -- but counting bedrooms for real estate purposes can become a bit nuanced. Now -- the National Appraiser Roster has all sorts of nuances surrounding this topic....

Wow. OK. Lots to consider there. So -- the short answer is that you can count your bedrooms based on whether they have windows and closets -- but it may require a bit more thought and analysis before we decide how many bedrooms we'll say that your home has when we put it on the market. Oh, and two final notes....

| |

How Many Bedrooms Does Your House REALLY Have? |

|

You don't have to be a math major to count bedrooms, right? Well, technically, that's true -- but counting bedrooms for real estate purposes can become a bit nuanced. Now, the basic rule of thumb for what makes a bedroom is that it needs a window and a closet. So -- if you have a room with a bed, where someone sleeps (regularly, or on occasion) but it does not have a window or does not have a closet, it might not be considered by Realtors, buyers or appraisers as being an actual bedroom. Now -- the National Appraiser Roster has all sorts of nuances surrounding this topic....

Wow. OK. Lots to consider there. So -- the short answer is that you can count your bedrooms based on whether they have windows and closets -- but it may require a bit more thought and analysis before we decide how many bedrooms we'll say that your home has when we put it on the market. Oh, and two final notes....

| |

How to Count the Bedrooms in Your House |

|

OK, OK, I am sure you are a very smart person, and certainly excellent at counting. So, why might I be giving you tips on how to count the bedrooms in your house? Well, primarily because counting bedrooms is a bit different in real estate than you might otherwise assume. Now, the basic rule of thumb for what makes a bedroom is that it needs a window and a closet. So -- if you have a room with a bed, where someone sleeps (regularly, or on occasion) but it does not have a window or does not have a closet, it might not be considered by Realtors, buyers or appraisers as being an actual bedroom. Now -- the National Appraiser Roster has all sorts of nuances surrounding this topic....

Wow. OK. Lots to consider there. So -- the short answer is that you can count your bedrooms based on whether they have windows and closets -- but it may require a bit more thought and analysis before we decide how many bedrooms we'll say that your home has when we put it on the market. Oh, and two final notes....

| |

All Square Footage is NOT Created Equal |

|

So -- your neighbor's 2400 SF, circa 2000, 4 BR, 2 BA home just sold for $300K. It's probably reasonable to think that your 2400 SF, circa 2000, 4 BR, 2 BA home will also sell for $300K, right? After all, you have made the same updates (systems and cosmetic) over time -- and you're on the same street! Well, maybe -- but maybe not! Consider the possibility that....

These two homes will not be seen as having an equivalent value -- not by potential purchasers and not by an appraiser. Above grade square footage has a higher value attached to it -- both specifically by appraisers, and generally by purchasers. Even if all of the other factors (condition, age, location, bedrooms, bathrooms) are the same between two houses, if one has a significant portion of the square footage in the basement then it will be seen as less valuable than the home that has all of its square footage above grade. | |

Diving Deep Into APPRAISAL DELAYS |

|

Silly me! Appraisal delays are NOT only related to increasing sales. Teri Robinson, of Vision Appraisal Services, kindly educated me on some of the other factors that are affecting appraisal delays. In summary....

So, it's not just more than just more sales, more fully, it is.... More Sales + More Paperwork + Fewer Appraisers = Appraisal Delays Still want to read more? Keep reading, from Teri....Since the 2008 downturn and subsequent housing collapse, the turmoil in the financial industry created many burdensome regulations on the only Licensed/Certified person in the financial process (prior to Loan Officers having to be Licensed/registered).So -- I stand corrected since yesterday -- yes, higher sales volume is contributing to slower appraisal timelines -- but there are other big picture factors at work here as well. | |

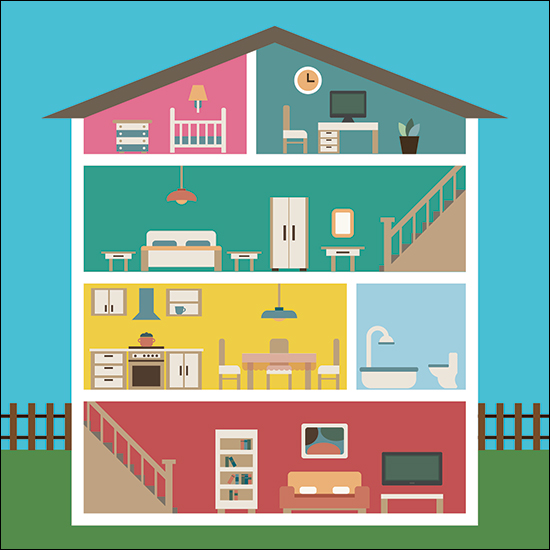

High Sales Volume (GOOD) Creates Long Appraisal Delays (BAD) |

|

Most folks are pretty excited about the fantastic pace of local home sales in the first half of 2016 -- however, there is a downside. As shown above, there are three main hurdles to buying and selling a home -- the home inspection, appraisal and loan commitment. Well, right now, on many if not most of the transactions I am working with, we are experiencing significant delays on appraisals being completed. It seems that local appraisers are having difficulty keeping pace with the roaring pace of home sales. This, then, creates ripple effects as buyers and sellers are either delayed in knowing that the transaction will be successfully moving forward -- are closing dates are pushed back. Again, it's great that we're seeing so many home sales (no complaints there) but the much slower than normal timeframe for appraisals being completed is creating some real headaches for buyers and sellers. So, if you're buying (or selling) EXPECT DELAYS when it comes to the appraisal. | |

What do we do if the real estate market stalls out? |

|

I'm not suggesting that the real estate market has stalled out in Harrisonburg and Rockingham County, but in talking to someone in another part of the country (thanks for the insight, Laura!) we came to a realization that some markets have stalled out -- and it's not clear what will get them started again. Laura and I realized that some markets are stuck in an endless loop: Buyers can't buy because comps aren't available to support appraisals......because buyers haven't bought......but buyers can't buy because comps aren't available to support appraisals............ Some would be quick to blame lenders --- why are they holding back the market? Buyer X wants to buy a house from Seller Y, and has written a contract to do so at a particular price. Why then, is the lender denying the loan on the basis of the appraisal? Well, it's actually quite reasonable for the bank to want and need to protect their interest. If they are going to invest $250k in a mortgage on a $300k purchase, they'd want to know if the house was only worth $200k. If that were the case, they would have made a poor investment, and their collateral (the house) would not sufficiently cover their investment should the borrower stop making payments. But you can likely see why this is frustrating for buyers and sellers alike. Even though it is reasonable for a lender to want to know (via an appraisal) that a house has a particular value --- if a buyer and seller have agreed to terms, and the buyer is not overpaying for the house, why must the entire process be stopped in its tracks simply because there aren't any comps available to support an appraisal. Here is a specific (though fictional) example of what this might look like, in a subdivision in Anytown, USA: 2008 sales prices: $250k, $255k, $260k, $255k, $250k, $255k, $255k, $255k 2009 sales prices: $250k, $245k, $245k, $245k 2010 sales prices: no sales! Then, when a buyer and seller agree on a sales price of $225k in early 2011, they certainly think that everything should go quite smoothly with the transaction. But if the lender can't find any comparable sold properties in the past 6 to 12 months that support , they will likely deny the loan on the basis of the appraisal. What are the buyer and seller to do? How does a market get started again after a very slow spell, given that appraisals are required for loans to move forward, and that comparable sales are required for appraisals??? | |

Everything is worth what its purchaser will pay for it |

|

Stretch back to the 1st century BC, we find the following familiar quotes from Publilius Syrus, a Latin writer of mimes (thanks for the tip, Dave!): Stretch back to the 1st century BC, we find the following familiar quotes from Publilius Syrus, a Latin writer of mimes (thanks for the tip, Dave!):

While this may have been a prevailing theory at the time, modern day appraisal practice takes a bit of a different stance, more along the lines of "Everything is worth what someone else recently paid for something similar." For example.... if three fine homes have recently sold for $325k, $330k and $335k, we'd probably all agree that a fourth similar home is probably worth around $330k. But what if it a buyer and seller agree to a sales price of $345k? The appraisal is likely going to come back low, closer to $330k. But despite Past Buyers #1, #2 and #3 paying around $330k, if Current Buyer #4 wants to pay $345k, doesn't that mean that it some ways the house is indeed worth $345k?? | |

Oops! The Contract Price Is Higher/Lower Than The Appraised Value! |

|

Most sellers want to sell "above value" and most buyers wants to buy "below value." In a balanced world, however, a seller would sell for the "actual value" of their home, and a buyer would buy for the "actual value" of the home. That's in a balanced world --- obviously, it doesn't usually happen that way. We get one glimpse of whether the contract price is off the mark when we learn of the appraised value through the financing process. Here's an oddity (or is it?):

Rent-To-Own Prospect Wants The Best Of Both Worlds A prospective tenant/buyer (rent-to-own) wants to negotiate purchase terms for what is essentially their option to buy a year into the future. They want to buy for the lower of the price agreed to now, and the appraised value a year from now. Wait a minute!?!?! It would seem reasonable (balanced between buyer and seller) to either both take a gamble on ups/downs of the market and agree to a price now OR both agree to use a value determined in the future by an independent appraiser. The lower of the two doesn't seem very reasonable for this prospect who is already trying to negotiate by asking for a lease-to-own when it isn't the seller's intent. Buyer Thinks Seller Should Adjust, But Won't Do The Same This is a bit obvious from the above referenced ways that thisappraisal process works, but it does seem to be a bit odd from theperspective of trying to achieve a balanced transaction between buyerand seller. If the appraisal comes in low, the buyer gets tore-negotiate down. So why doesn't the seller get to re-negotiatehigher if the appraisal comes in high?? Seller Agrees On Price, Then Seeing Appraisal, Refuses Repairs I'm exaggerating this one a bit to make a point, but in a recent transaction, the lender (for some reason???) shared the appraised value with the seller's Realtor. The seller thus was told of the appraised value, which was more than $10,000 higher than the contract price. Certainly, the seller felt like they left money on the table, though the day before they had been quite thankful for the buyer and the price he was paying. As a result of knowing of the value supposedly left on the table, this seller loses much of their desire to negotiate on repairs, even making a remark about how the buyer can make repairs using the free equity inherited from the lower-than-appraisal contract price. And while we're on the subject of appraisals, here's another strange aspect of the appraisal world --- feel free to offer your opinions.... Wikipedia defines the "market value" as determined thorough a real estate appraisal to be: "...the estimated amount for which a property should exchange on the date of valuation between a willing buyer and a willing seller in an arms-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion." So, wait a minute --- read that through again --- isn't that exactly what is evidenced in the real estate contract that is the basis for the appraisal in the first place?? | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings