| Older Posts |

Should High Gas Costs Drive Buyer Behavior? |

|

This was an interesting question posed by a friend a few weeks ago, and we took some time to do some rough analysis, which seemed to indicate NO. Here's the logic: This was an interesting question posed by a friend a few weeks ago, and we took some time to do some rough analysis, which seemed to indicate NO. Here's the logic:Historically, some people who work in Harrisonburg have chosen to live outside of Harrisonburg where housing is somewhat more affordable. Two classic examples of this are Weyers Cave (14.4 miles away) and Broadway (12.9 miles away). Both Weyers Cave and Broadway have offered home buyers housing at somewhat lower prices, within a reasonable commute to Harrisonburg. But with gas costs going higher and higher, could (or should) this buyer behavior change? The distances above (14.4m, 12.9m) were city-center to town-center. We'll round up, and say the one-way commute for a fictitious commuter is 15 miles. We'll assume a somewhat gas-hungry vehicle that will drive 20 miles per gallon of gas. With current (4/29/2008) gas costs around $3.60, the one-way commute has a gas cost of $2.70. Driving both ways to and from work, 5 days a week, 50 weeks a year, equates to an annual cost of $1,350. If someone lived in Harrisonburg instead (and still worked in Harrisonburg), their commute might be 3 miles, which would equate to an annual cost of $270. Thus, the cost savings in gas consumption (relative to the work commute) of living in Harrisonburg instead of Broadway or Weyers Cave is approximately $1,080 per year. That $1,080 per year, or $90 per month, if used to allow the home owner to afford a larger mortgage payment, would allow for a home purchase of $13,500 greater. That is to say that a $200,000 home ($40k down, 6% rate) would have an $1,100 monthly payment, and a $213,500 home ($40k down, 6% rate) would have an $1,190 monthly payment. So, the question then becomes, does a $200,000 home in Broadway or Weyers Cave cost $213,500 in Harrisonburg, or more, or less? Broadway: 4 bedrooms, 2.5 bathrooms, 1517 SF, circa 2007, garage, $199,900 http://60755.scottprogers.com Weyers Cave: 4 bedrooms, 2 bathrooms, 1584 SF, circa 2003, $199,000 http://64154.scottprogers.com Harrisonburg: 3 bedrooms, 2.5 bathrooms, 1360 SF, circa 2002, garage, $214,900 http://62949.scottprogers.com Though the data in my example is limited, it seems that even accounting for the commuting cost of living in Broadway or Weyers Cave, you can still buy a (somewhat) larger, (somewhat) newer house in those communities as opposed to Harrisonburg. | |

Looking Back at Virginia's First Quarter Home Sales |

|

The Virginia Association of Realtors recently released their First Quarter 2008 housing market report, entitled "The Virginia Housing Market in Uncertain Times." The Virginia Association of Realtors recently released their First Quarter 2008 housing market report, entitled "The Virginia Housing Market in Uncertain Times."Their opening paragraph provides a good summary: The word "uncertainty" sums up the current housing market. A national recession, foreclosures on the rise, tight credit markets, potential federal legislation—all of these factors make it difficult to predict where the market is going. In Virginia, the housing market is performing better than in some other states, although certain local markets within the state are in for a rocky 2008. The report, provided by George Mason University's Office of Housing Policy Research, is based in part on reported sales from around the state of Virginia. The methodology is slightly different than my recent April report, but the numbers are very close. Essentially, sales are down, but prices are up. In the Harrisonburg-Rockingham area, the number of sales was down 21%, but the median price was up 5%, and the average price was up 14%. For even more insight into the first quarter of home sales around Virginia, listen to this media conference call where Realtors from around Virginia (myself included), and staff from George Mason University provide commentary to the media on this recent report. | |

Getting Ready To Buy -- Loan Pre-qualification |

|

In almost all circumstances, buyers should pre-qualify for a mortgage before starting to look for a home. In almost all circumstances, buyers should pre-qualify for a mortgage before starting to look for a home.What is pre-qualification? In short, it means providing basic financial information to a lender so they can give you a preliminary indication of how much money they are willing to lend you for the purchase of a home. What is a lender? A lender can be either a bank, a mortgage company, or a mortgage broker. A bank offers banking services and accounts as well as offering loans. A mortgage company is just in the business of making loans. A mortgage broker contacts multiple "funding sources" on behalf of a home buyer to find the best loan. How hard is it to get "pre-qualified"? It is not difficult at all --- in fact, it can be done over the phone in about 30 minutes. Alternatively, you can set up an appointment with a lender to get "pre-qualified." What is the lender doing when they pre-qualify me? They will be inquiring as to your income, expenses, assets and liabilities. How much do you make per month from your job, and any other income sources? What monthly payments do you already have, such as a car loan, or credit card payments? What other assets do you own, such as a car, boat, additional residence, etc? What other debt do you have, such as another mortgage, personal loans, etc? After having collected this information, they will look at your credit score, and your "debt ratios". What is a "debt ratio"? This is a comparison of your potential monthly housing costs and your monthly income. Some programs, for example, don't like to see more than 28% of your gross monthly income going towards housing expenses. What is the difference between "pre-qualified" and "pre-approved"? This varies from lender to lender, but my general understanding of the distinction is that a pre-approval involves submitting all of your information to an "automated underwriting program" to be able to give you a Fannie Mae or Freddie Mac pre-approval. Why should I pre-qualify first? Having been pre-qualified for a mortgage gives you a realistic idea of how much of a mortgage you can obtain, or want to obtain. This will guide us as we set your home search criteria, so that we are not considering homes that would not be possible for you to purchase. There might be a difference between what I can get, and what I want to get? Absolutely! I have frequently run into situations where a lender will tell my client that they can borrow an amount that would lead to a monthly payment that the borrower is not at all comfortable making. Sometimes the limit is set by the limit from the lender, and sometimes the limit is set by the comfort level of the borrower. How many lenders should I talk to? To start, just talk to one lender to get a general idea of how much money you can borrow for your home purchase. Then, when we have found a home for you to purchase, you can check with multiple lenders to make sure you are getting the best loan terms (interest rate, closing costs, etc). There are likely tens or hundreds of other questions that I could have addressed here. Feel free to ask other questions in the comments of this post, or by e-mailing me at scott@cbfunkhouser.com. I am not a lender myself, but I have become quite familiar with the lending process through assisting many real estate clients in analyzing mortgage options over the years. | |

Change Is Here . . . We Must Adapt! |

|

Slower Home Sales . . . Fewer Mortgage Options . . . Appreciation Remains, But . . . | |

Print It, Pocket It, Prove Those Skeptics Wrong! |

|

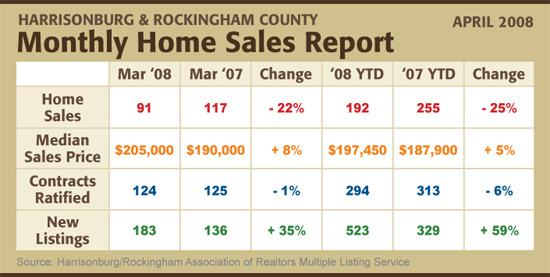

Have you been hearing whispers (or shouts) of "home prices are plummeting" or "real estate is a terrible investment" lately? Prove them wrong! Click on the graphic below to download and print my April 2008 Harrisonburg & Rockingham County Home Sales Report.

Lots of caveats:

| |

Now May Be The Best Time To Sell |

|

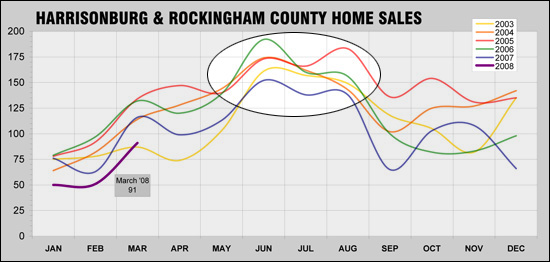

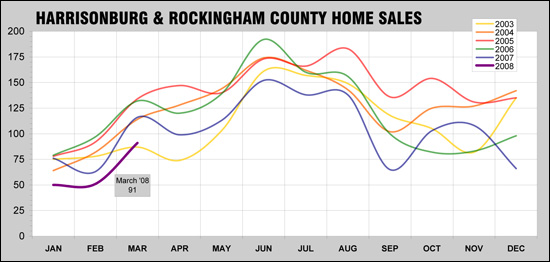

That doesn't mean that it is particularly easy or fast to sell your home right now -- but compared to the last six months, and the coming twelve months, now may be the most likely time that your home will sell. Here's why . . .  Despite lower sales in 2008 than in 2007, and lower sales in 2007 than 2006, sales in Harrisonburg and Rockingham County have continued (in large part) to follow normal month-to-month trends. October-November of 2007 was a bit of an abnormality, but otherwise, you'll see that month-to-month, buyers are coming into and out of the market at the same (proportional) rate as in previous years. This means, that in June, July and August, we will likely have the largest number of closings for the year -- which shouldn't come as any surprise to you. I mention this, however, because some people hear the national news (sales down, prices down), or the local news (sales down by 20%, prices up by 5%), and assume that the month-to-month sales are rather flat, and that it is always a terrible time to sell. Not so. Your home is much more likely to be purchased in the next few months (contract in April, May or June with a closing in June, July or August) than any other time of the year. I'm certainly willing to be proven wrong -- sales during the next few months could defy prior years' month-to-month trends -- but I doubt that will occur. | |

Harrisonburg & Rockingham County Foreclosures |

|

For some time now, I have been posting the details of foreclosures on my blog. I began to post all Harrisonburg and Rockingham County foreclosures because I have had clients interested in buying foreclosed properties. I'm making a change starting today, that I believe will still well serve my clients, and those interested in foreclosure properties. First, let me explain that I categorize foreclosures into three areas:

As I move forward, I will only be posting the foreclosure properties that I would categorize as a "good" or "great" opportunity. | |

Real Property Tax Semantics (City of Harrisonburg) |

|

Currently, property owners in the City of Harrisonburg are taxed at a rate of $0.59 per $100 of assessed value. In other words, a $225,000 home is a tax liability of $1,328 per year. Thus, since real estate values almost always increase in Virginia, unless the City lowers its tax rate, taxes will also almost always increase! And so, this year (2008), the City of Harrisonburg finds itself going through the process of notifying Harrisonburg property owners that they are proposing a real property tax increase. No, they aren't increasing the tax rate ($0.59), but the effective taxes will increase because of increased property values. Here are the details of the changes in the City:

Do you have questions or opinions about this tax increase? You are welcome to voice them here on my blog, in the comment section. Additionally, a public hearing will take place on May 13, 2008 at 7:00 PM in the Harrisonburg Council Chambers located at 409 South Main Street, Harrisonburg, Virginia. | |

Buy A Home, While Supplies Last! |

|

OK --- perhaps that wasn't the most fitting title --- supply continues to be very high in several price ranges in Harrisonburg and Rockingham County.  The graphic above is an illustration of the relationship between our market's supply and demand in four price ranges. The numbers (6, 10, 13, 22) represent the months of supply of properties currently available based on average demand per month in each price range, during the past twelve months. Source: Harrisonburg/Rockingham Association of Realtors | |

(False) News Alert - 20% Down Payment Required |

|

If you read this past Friday's Daily News Record article entitled "National Trend Local, Too", you might think home buying is in your distant future. The article states: If you read this past Friday's Daily News Record article entitled "National Trend Local, Too", you might think home buying is in your distant future. The article states:"Mortgage requirements have been tightened to about the same standards that were in place 10 years ago. That is, borrowers are required to put down 20 percent and prove that they are able to repay the loan." (Source: Daily News Record, April 11, 2008) Wait a minute! What was that?? A 20% down payment is now required to buy a home?? As much as some fear that we are headed in that direction, that is not at all the truth. While 100% financing is harder and harder to find, that is not an indication that a 20% down payment is now required on all purchases. There are quite a few programs that only require a 3% - 5% down payment. Now don't get me wrong, I'm not encouraging financing more of your purchase than is necessary --- if you have a 20% down payment, that's fantastic! However, don't be mislead by the Daily News Record article and think that you must now save up a 20% down payment before buying a home. | |

Foreclosure: 328 S Dogwood Dr, Harrisonburg - $120k opportunity |

|||||||||||||||||||||||||||||||||||

* based on actual rate of 6.375%, assuming fixed rate, 30-year ammortization Source: Daily News Record, April 9, 2008 | |||||||||||||||||||||||||||||||||||

Foreclosure: 492 Lee Ave, Harrisonburg - $76k opportunity |

|||||||||||||||||||||||||||||||||

Source: Daily News Record, April 7, 2008 | |||||||||||||||||||||||||||||||||

Harrisonburg / Rockingham Home Sales Report: 4/8/2008 |

|

A few observations about the current state of our market:

| |

Harrisonburg, Rockingham County Home Sales Increase in March |

|

In March 2008, Harrisonburg and Rockingham County home sales took a big jump up, to 91 sales, as compared to 51 in February, and 50 in January.  While it is exciting to see a strong increase in home sales in March 2008, it is also important to realize the larger context:

| |

2008 SVBA Home & Garden Show UPDATE |

|

| |

Don't Miss The FREE Espresso Beverages! |

|

Don't miss the SVBA's 2008 Home & Garden Show. Coldwell Banker Funkhouser Realtors will again be serving hot, fresh, delicious, FREE espresso beverages (latte, mocha, etc). Just stop by our booth on the court level of the convocation center, and we'll get a drink started for you. But wait --- even more exciting news --- this year, we have partnered with Troy Lucas at Lucas Roasting Company, LLC to provide us with a high quality, extremely fresh espresso blend to use as a base for our espresso beverages. And yes, for those of you who don't care for these fancy (and highly caffeinated) espresso beverages, we'll also have some other options including hot chocolate, and flavored steamers. The show hours include:

| |

Are CMA's Just For Sellers? |

|

Not at all! They are for buyers as well! Not at all! They are for buyers as well!First, a CMA is a comparative (or "competitive", depending on who you ask) market analysis --- or, an analysis that compares one property (the "subject property") to other similar properties that have either recently sold, or are on the market. As I explain to my clients, my CMA's attempt to account for all significant aspects and characteristics of a home including square footage, functional space,age, style, condition, and more. Why would a buyer want a CMA? When making a purchase offer, sometimes buyers determine price based on what they think the seller will accept, or what would be a reasonable offer given the asking price. Ignore the asking price! That's not to say that all offers should be low offers trying to "make a deal", but consider these two examples:

| |

Two Types of Sellers (in Frederick, Maryland, at least) |

|

My parents live in Frederick, Maryland, but are currently in Harrisonburg visiting for a few days. In talking to my dad earlier today, he made some very interesting observations about the real estate market in Frederick. It was my dad's assessments that many properties in and around Frederick may have dropped in value as much as $50k - $100k over the past 1-2 years. His informal, and unscientific, gauge of this value change is based on having regularly looked through the real estate section of the Frederick paper, and seeing that buyers have been able to progressively purchase more and more of a house in the $300k-$350k price range (for example). So --- what he is actually observing is a decrease in asking prices over the past 1-2 years, though it is likely that a relatively similar decrease has occurred in the actual selling price. But --- here's the rub --- he also continues to see lots of houses priced $50k - $100k higher than the rest of the market would dictate that they should be. Some sellers seem to be refusing to accept that home values may have changed (rather significantly) in Frederick, Maryland. To bring it back to Harrisonburg --- none of our price ranges have seen a $50k - $100k drop in value, but it is still the case that some sellers price their house within the context of a realistic understanding of our current real estate market --- and some sellers do not! | |

Mobile Search Is Live --- Let's Hit The Road! |

|

Have you ever driven by a house for sale and wondered about the price or size of the home? In the past, if brochures weren't available by the curb, you would have likely tried to memorize the street address, or jotted it down somewhere to look up the details online when you returned home, or to the office. You no longer have to wait --- you can have instant gratification! Inspired by Verizon Wireless's recent expansion of their EVDO network, I spent some time this past weekend building a mobile search platform. On a web-enabled mobile phone, you can now quickly access the details of a property-for-sale, searching by street address, subdivision, or agent name. Are you ready to start prowling your favorite neighborhoods? Just bookmark this address: http://m.scottprogers.com (My URL preceded by a "m." for mobile). From having talked to many of my clients about this over the past few months, I think I have covered the top few search terms that would be necessary to pinpoint a property --- and I think I have some helpful information displayed when you view a property result. However, feel free to let me know if you have an idea for another helpful way to search while on the road. | |

Don't Miss The 2008 SVBA Home & Garden Show |

|

Be sure to stop by JMU's Convocation Center this coming weekend for the SVBA's 2008 Home & Garden Show. The show hours include: Be sure to stop by JMU's Convocation Center this coming weekend for the SVBA's 2008 Home & Garden Show. The show hours include:

Award-winning garden designer, author and owner of Rockcastle River Trading Company --- Jon Carloftis (pictured above, to the right) will join us this year at the 2008 SVBA Home & Garden Show. Jon is a contributing editor of Garden Design magazine, and a regional writer for Country Gardens. Jon will be appearing on Saturday, April 5 at 1:00 P.M. and 5:00 P.M. in Builders Square at JMU's Convocation Center. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings

There are quite a few local and national changes occurring right now that greatly affect buyers and sellers. Let's contemplate how we must prepare and adjust.

There are quite a few local and national changes occurring right now that greatly affect buyers and sellers. Let's contemplate how we must prepare and adjust.