Market

| Newer Posts | Older Posts |

Our Local Real Estate Market Keeps Testing Basic Economic Theories |

|

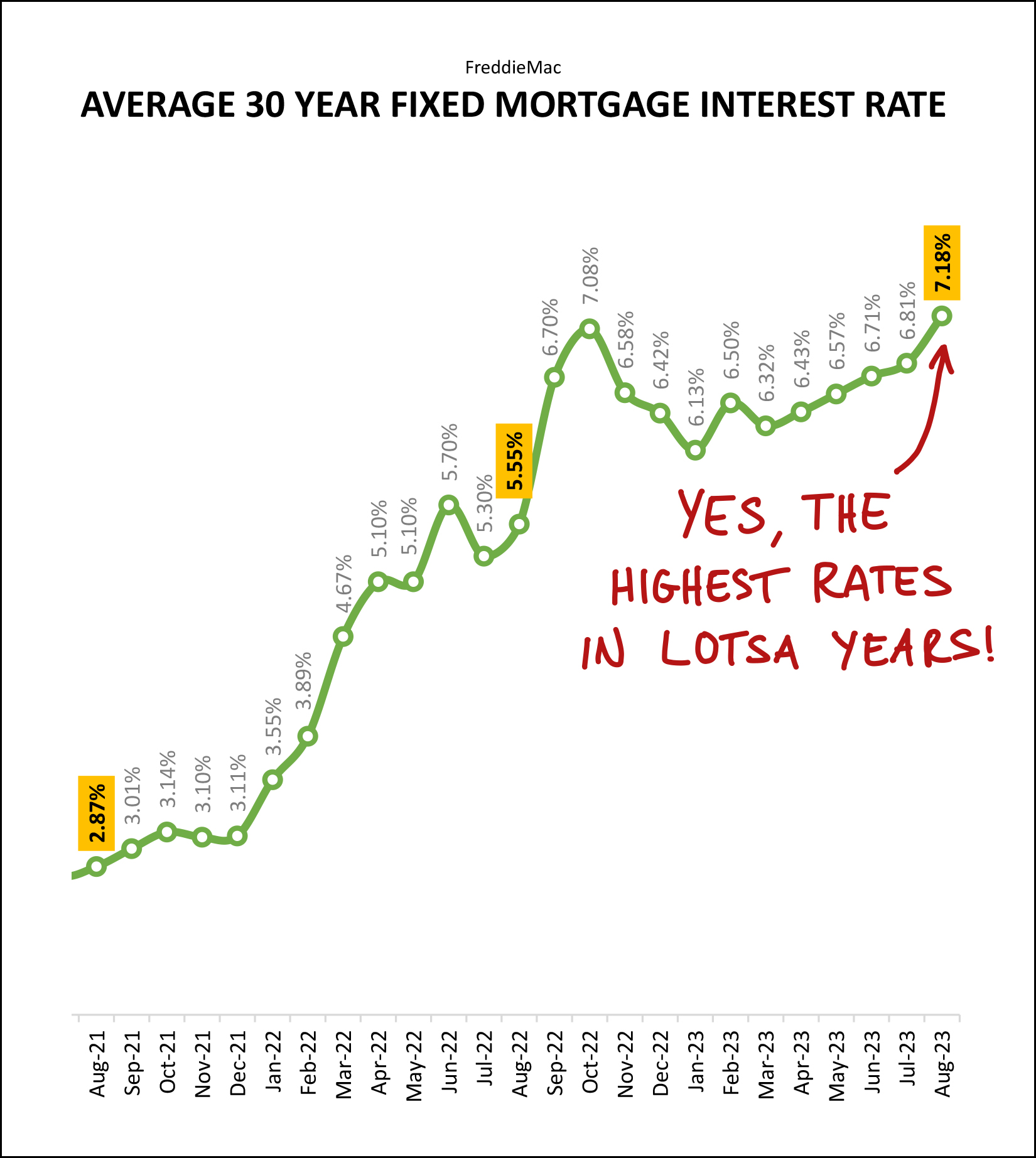

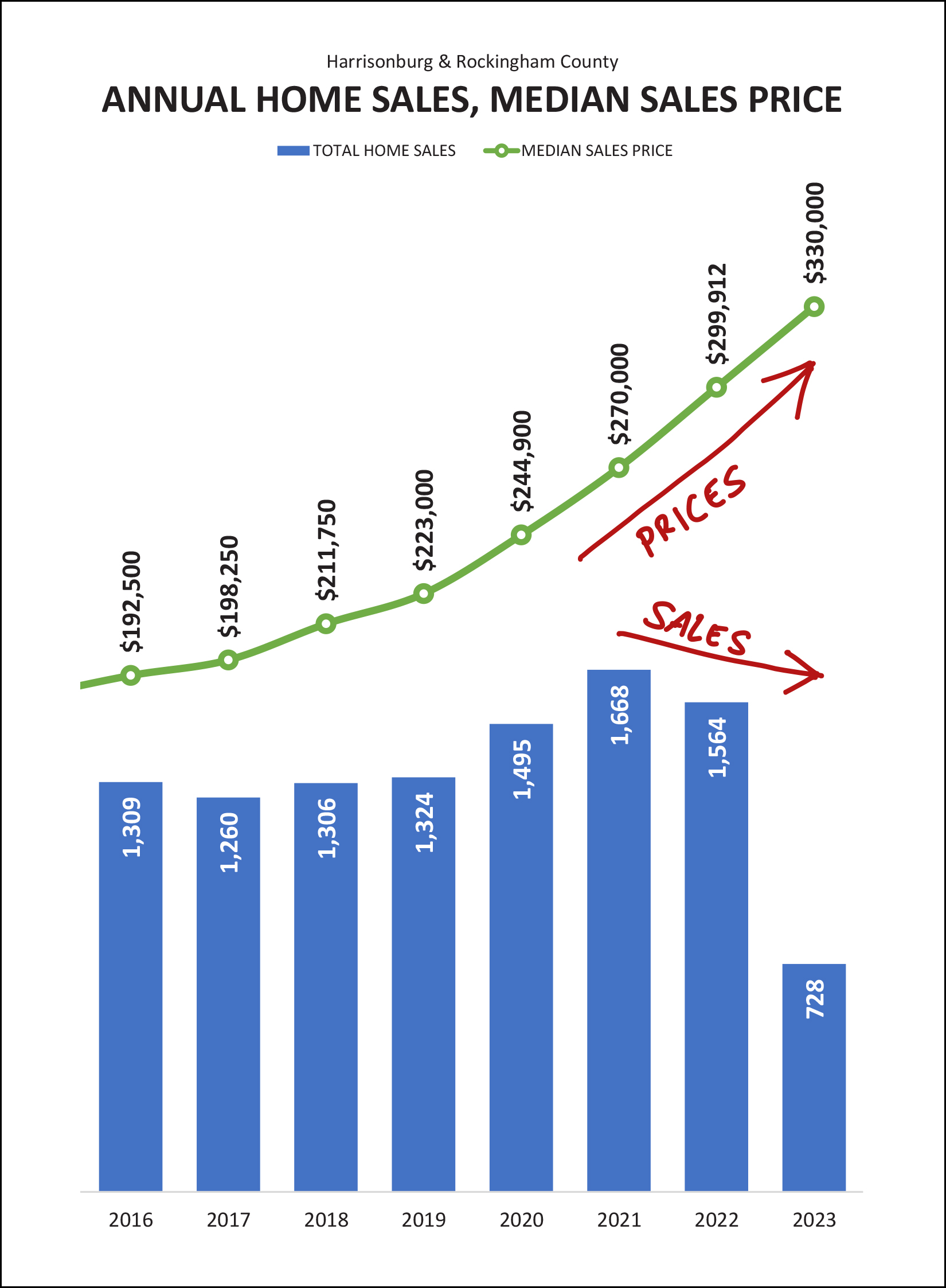

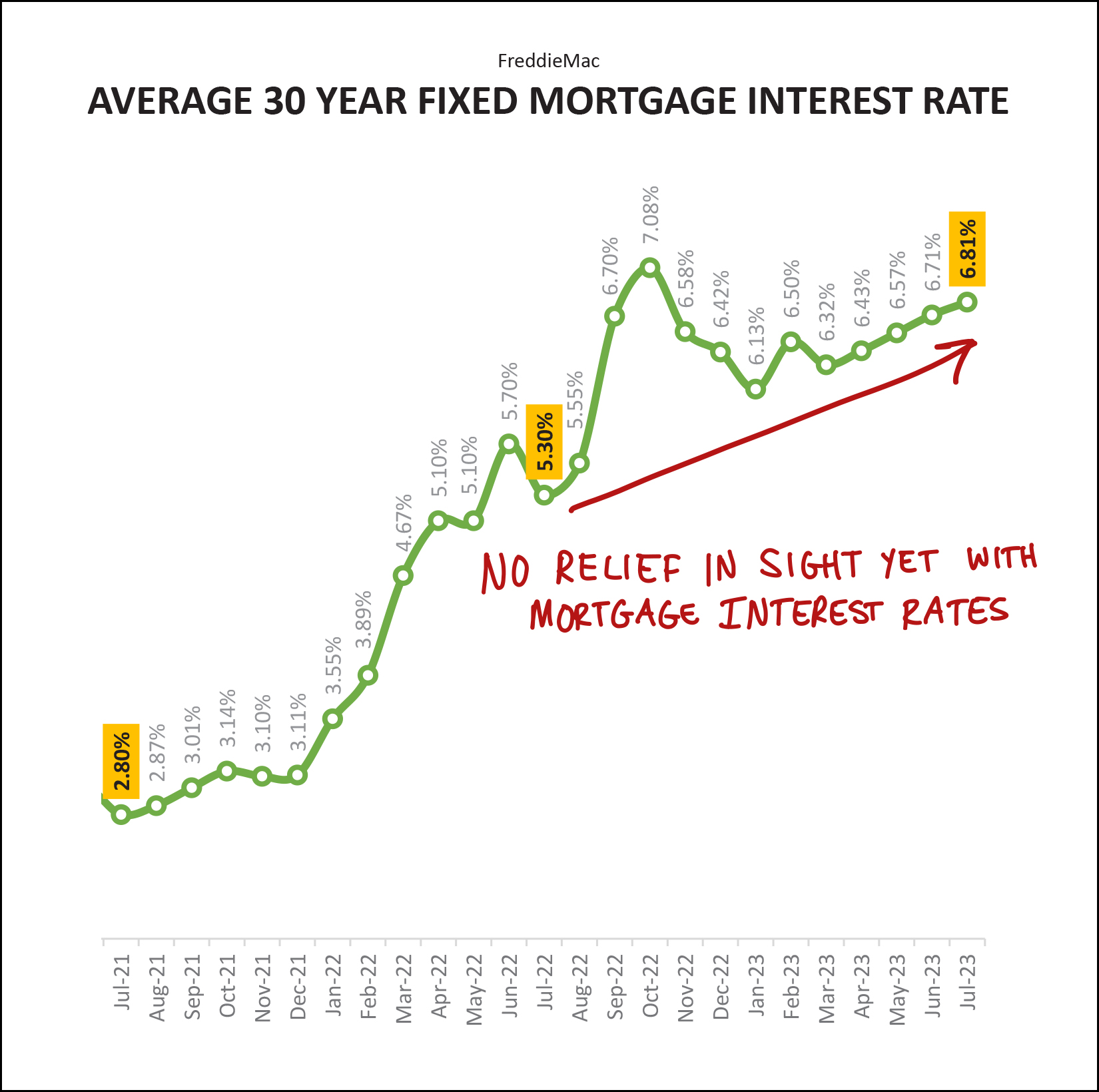

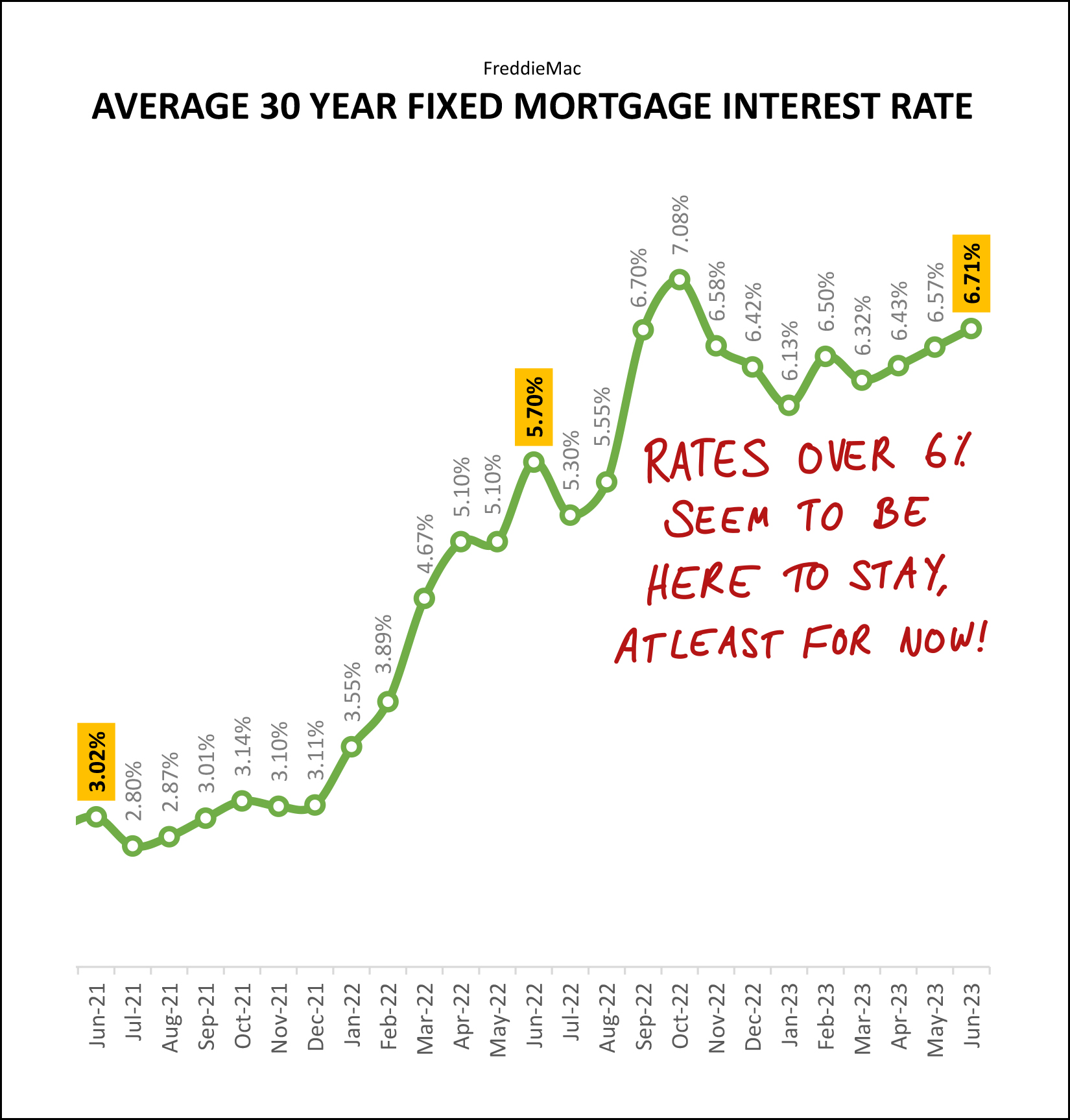

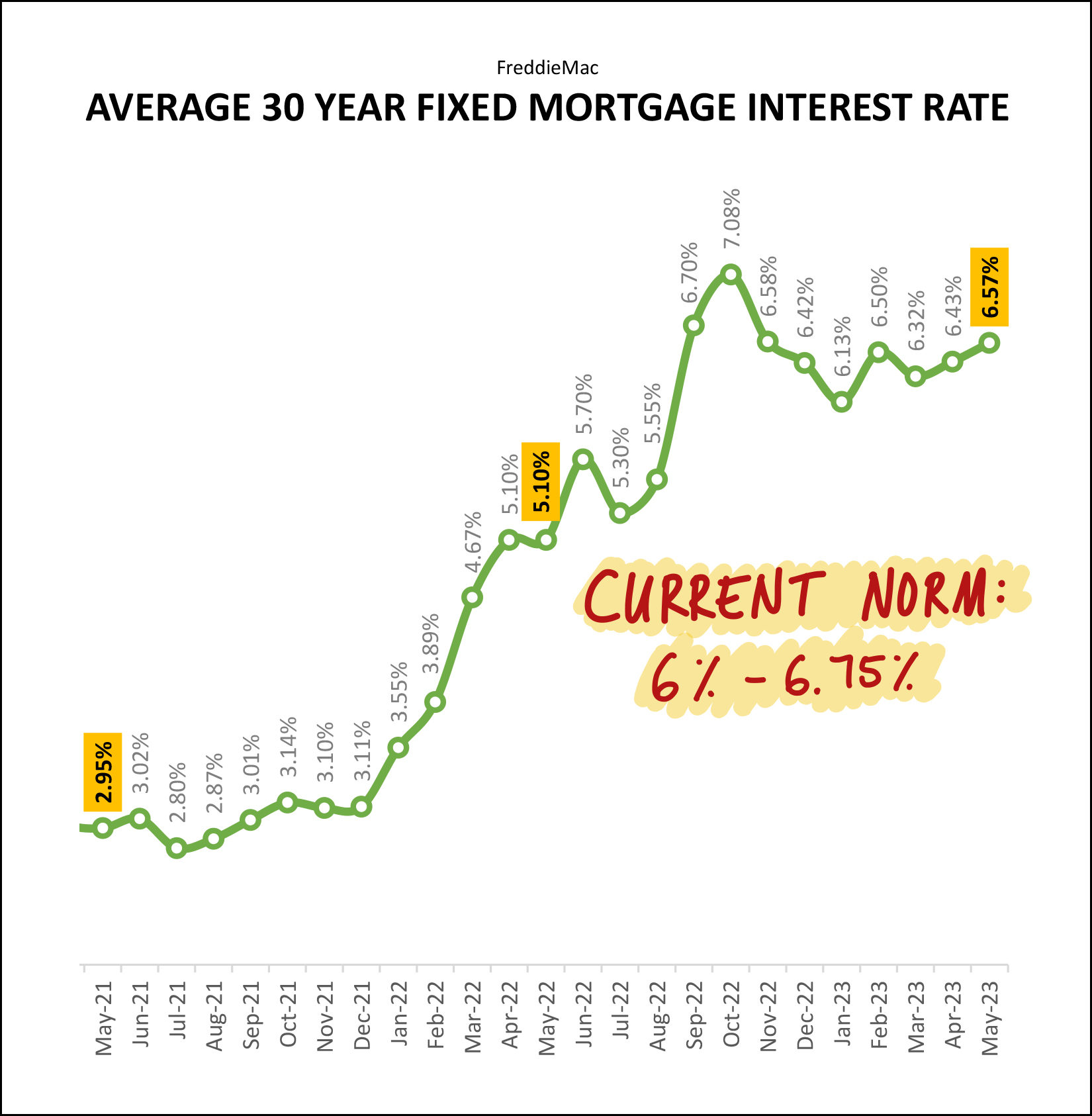

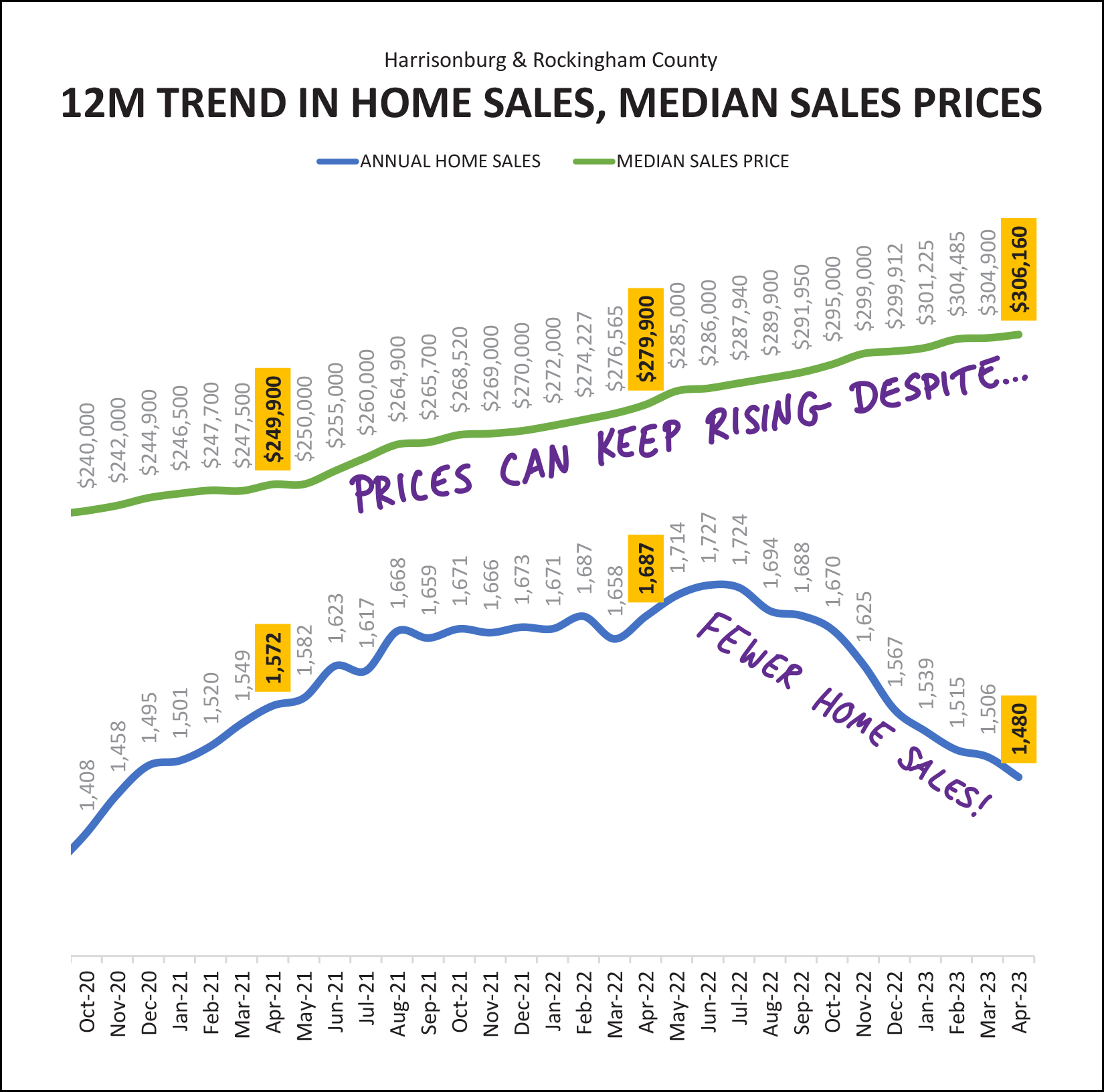

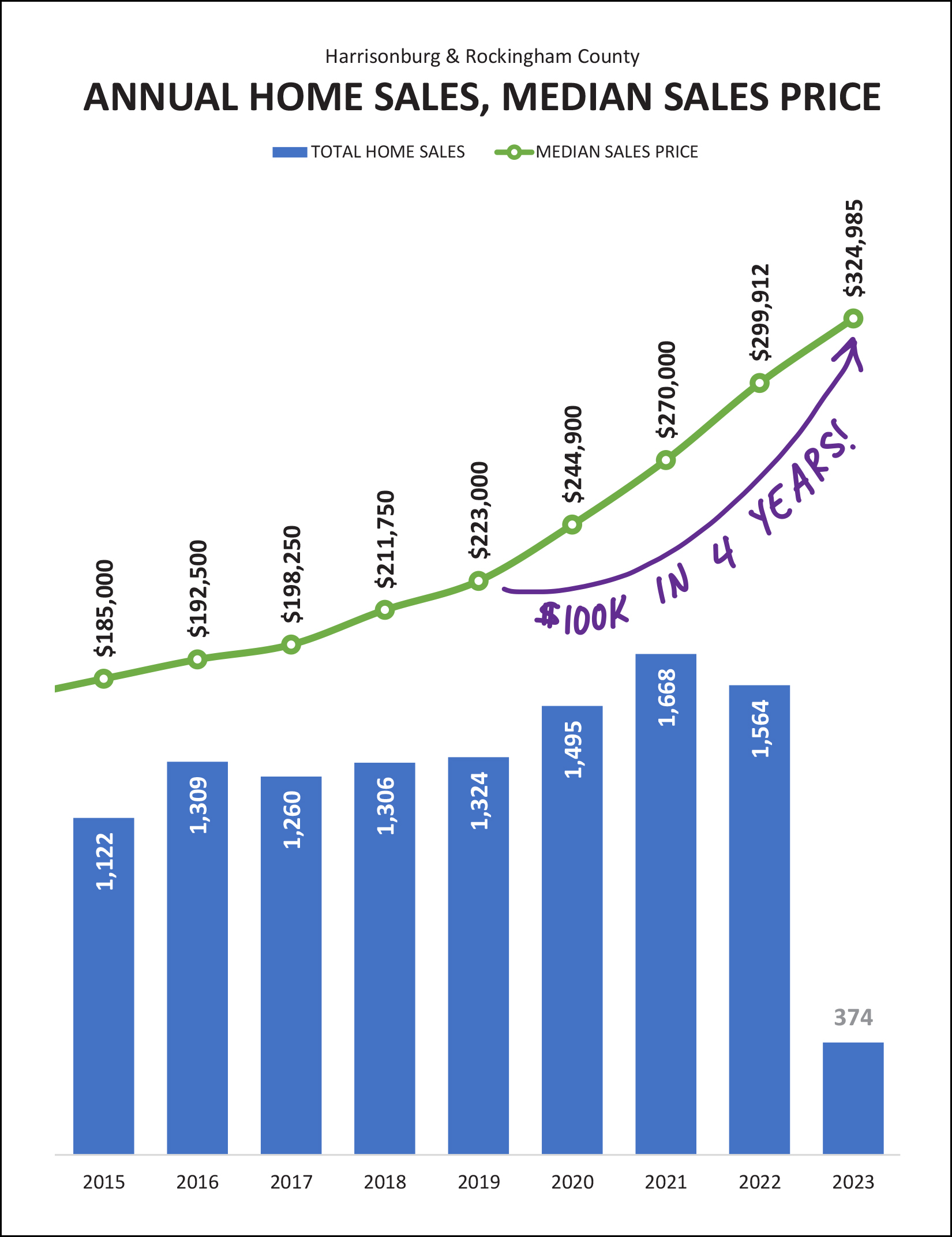

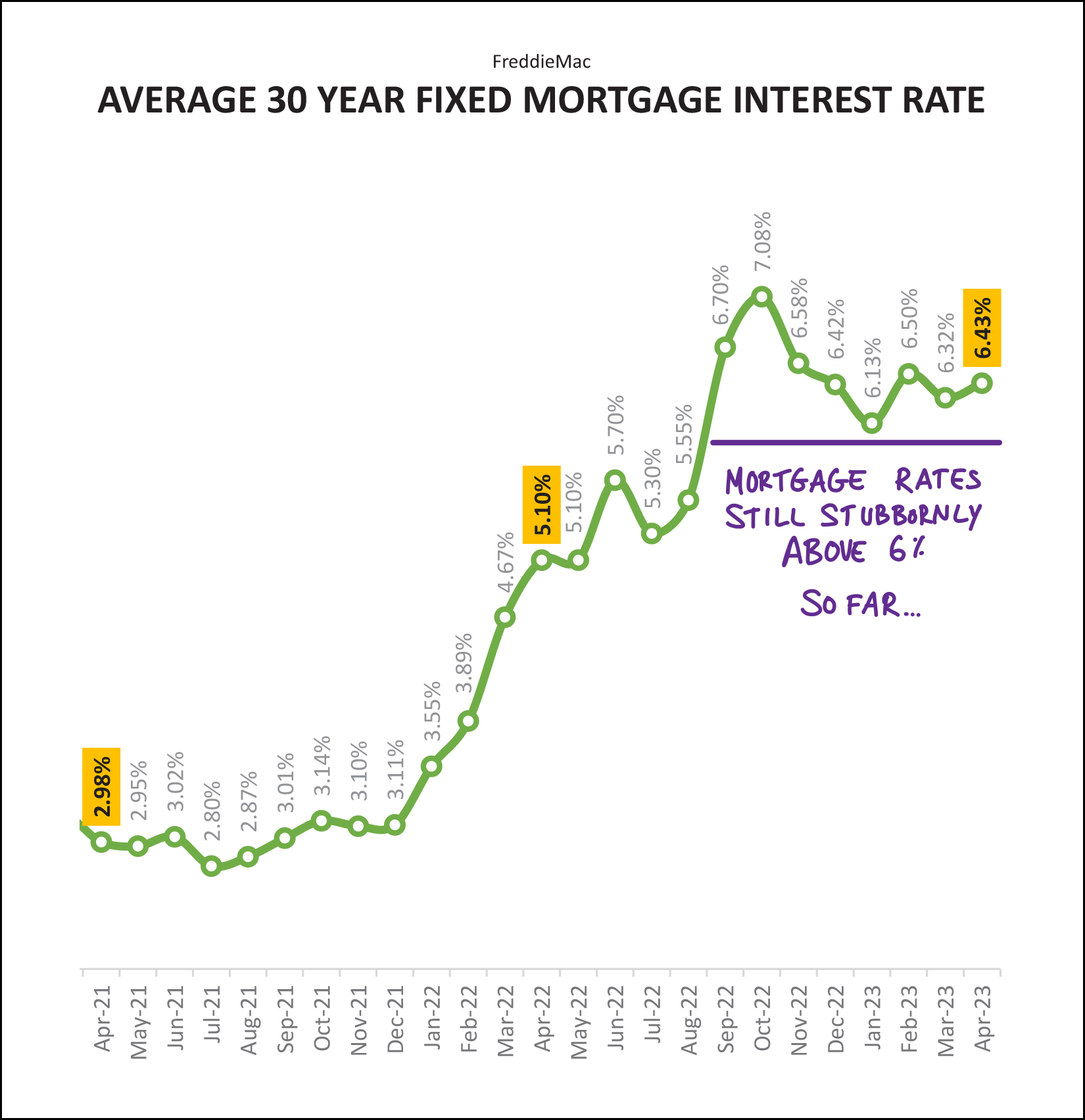

Between 2019 and 2022 we saw an ever increasing number of buyers buying homes (or trying to do so) in Harrisonburg and Rockingham County. Demand for homes skyrocketed, mortgage interest rates fell to historic lows, supply increased a bit (new builds) but not a enough... and perhaps unsurprisingly, median home prices increased 10% per year for three years in a row. But then, 2023... Mortgage interest rates have increased 30% over the past year, and have increased 150% over the past two years, making mortgage payments higher than ever. But yet, the median sales price keeps rising. Demand seems to be falling, with 24% fewer home sales in the first eight months of 2023 as compared to the same timeframe last year. But yet, the median sales price keeps rising. Supply is now starting to increase, with 31% more active listings on the market now as compared to a year ago. But yet, the median sales price keeps rising. What comes next!? As I pointed out yesterday, the higher inventory levels are only higher than the Covid-era lows, and are in line with or lower than pre-Covid levels. And certainly, fewer home sales may be a result of fewer sellers selling just as much as it may be a result of fewer buyers trying to buy. So, over the next two years, will we potentially see slower home sales, higher mortgage interest rates, higher inventory levels -- and yet, still see stability and/or increases in the median sales price? Yes, it seems quite possible. Or, could slower home sales, mortgage interest rates and higher inventory levels lead to a decline in the median sales price? This seems more likely, in theory, but we're just not seeing it yet, and I don't know if we'll see it at all. | |

Recent Rises In Inventory Levels In Context |

|

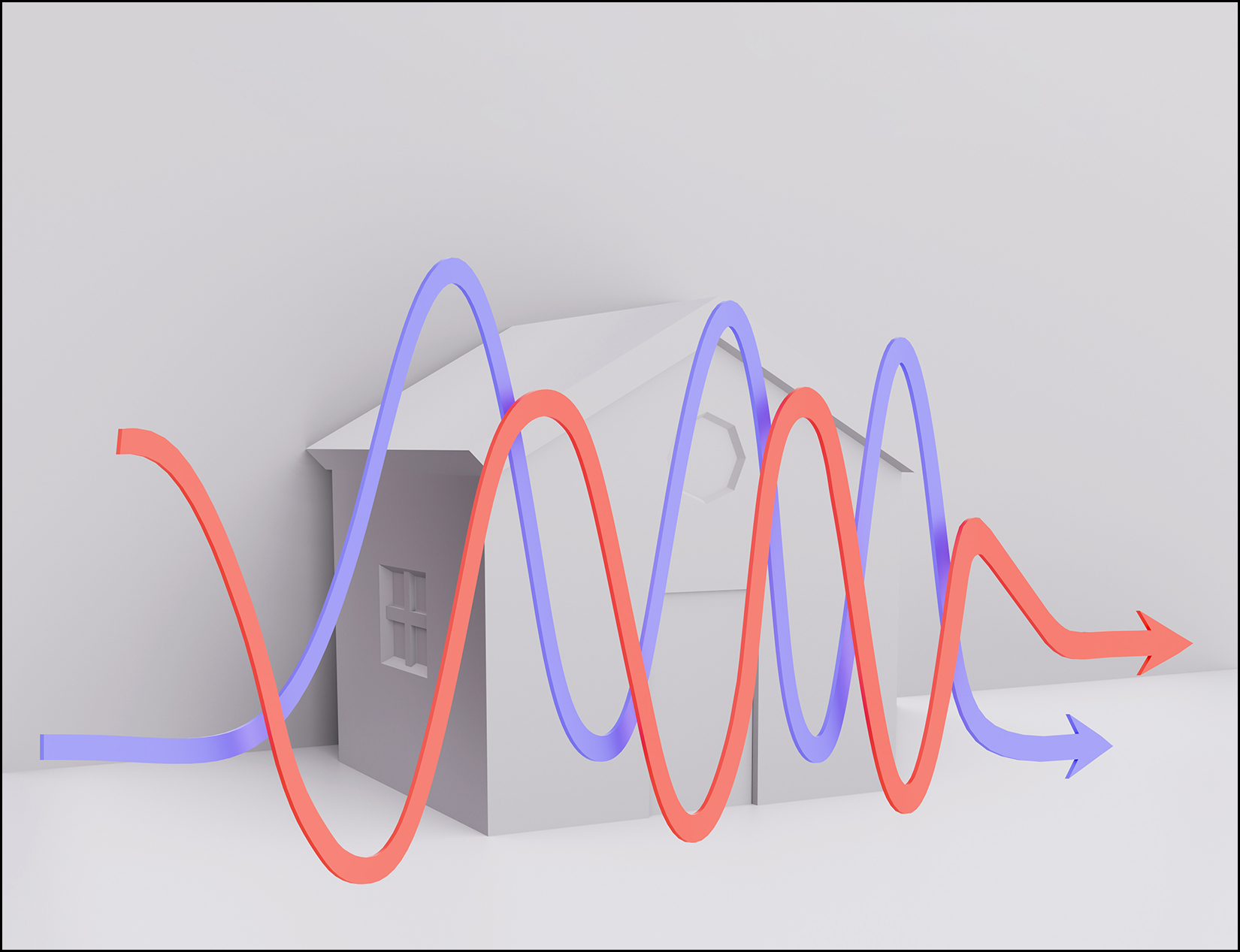

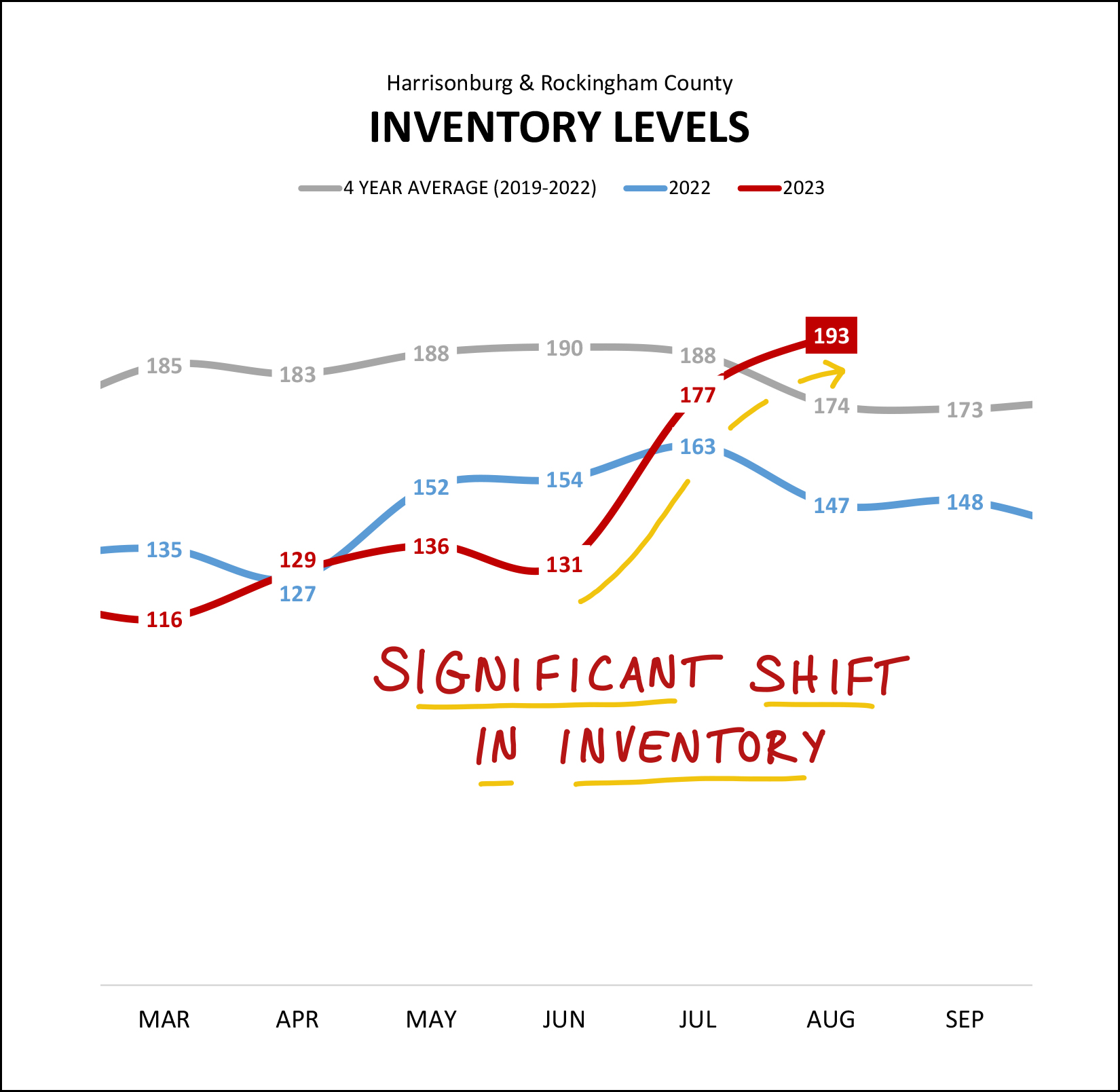

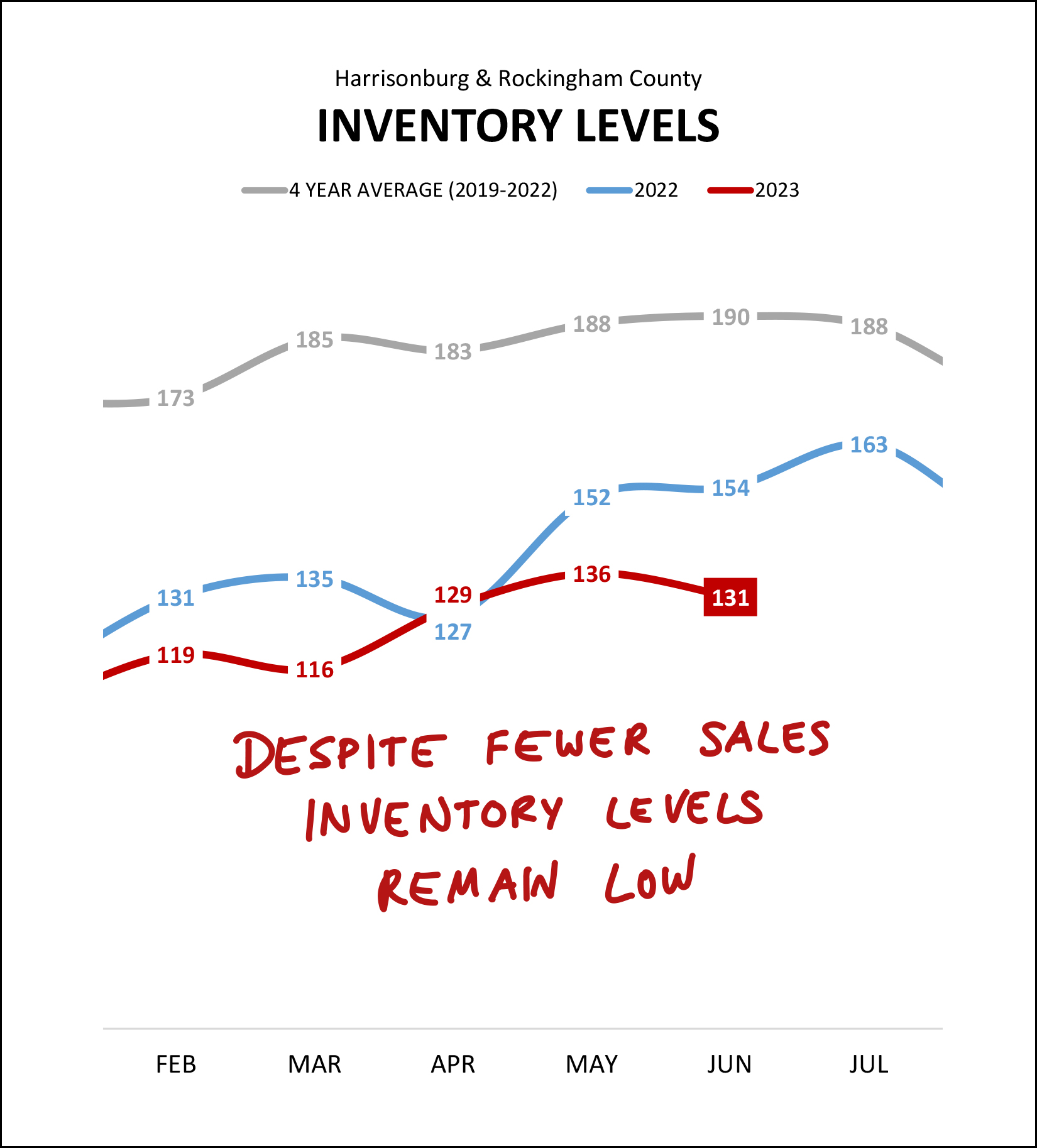

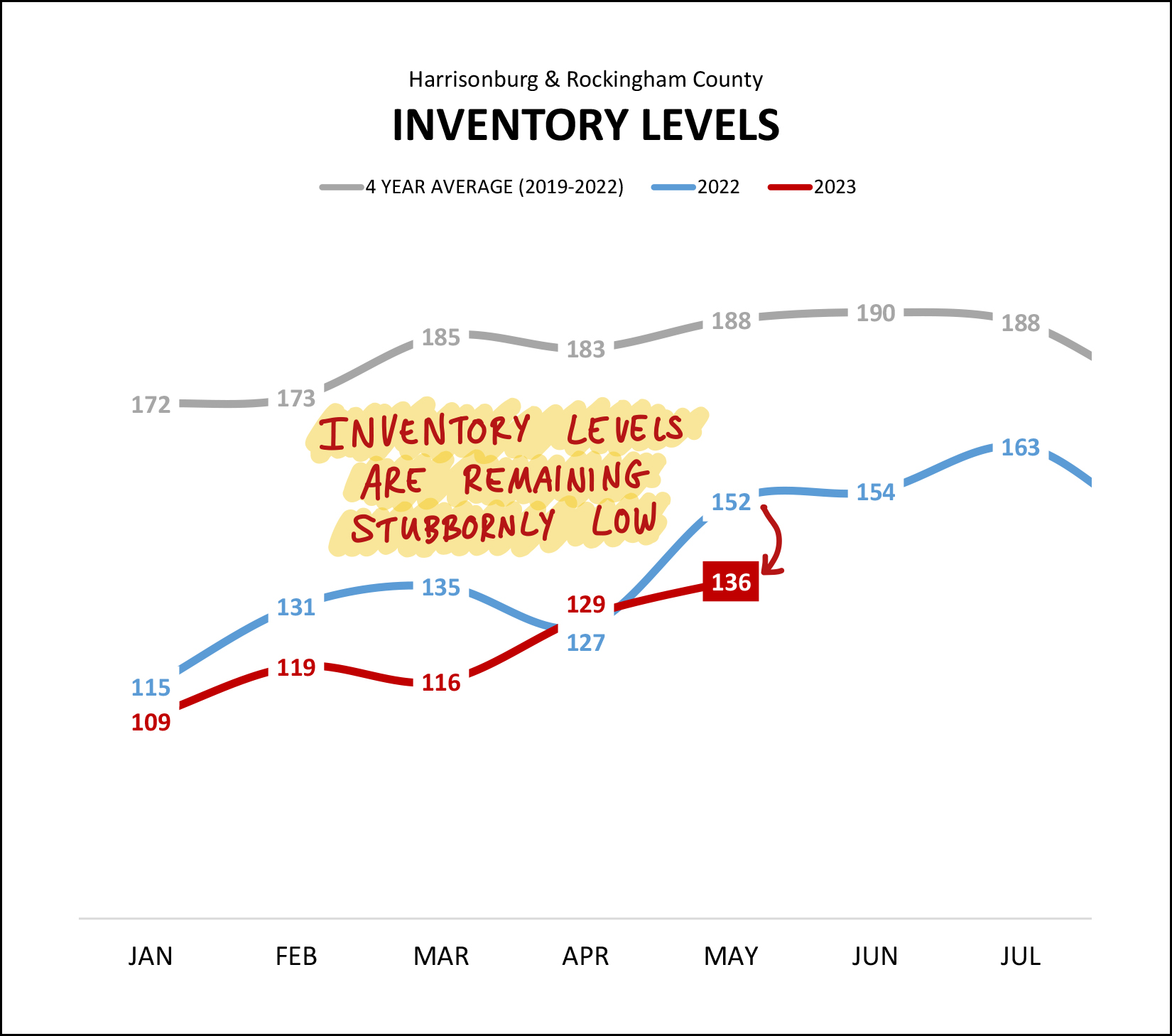

Inventory levels are on the rise in Harrisonburg and Rockingham County. January 2023 = 109 homes for sale August 2023 = 193 homes for sale That's a 77% increase in inventory levels! But... let's put it into a bit larger of a context... Just before Covid began (January 2020) there were 196 homes for sale. So, as shown above, other than during the weird years since the Covid pandemic began (2020-2023) inventory levels have always been above 200 homes for sale in Harrisonburg and Rockingham County... and sometimes well above that mark. So, higher inventory levels today do not necessarily mean we will see a marked change in home prices (for example) in our local market, but we'll have to continue to monitor changes in inventory levels over the next few months to see where they go from here. | |

How Many Homes Are Selling For Less Than The List Price? |

|

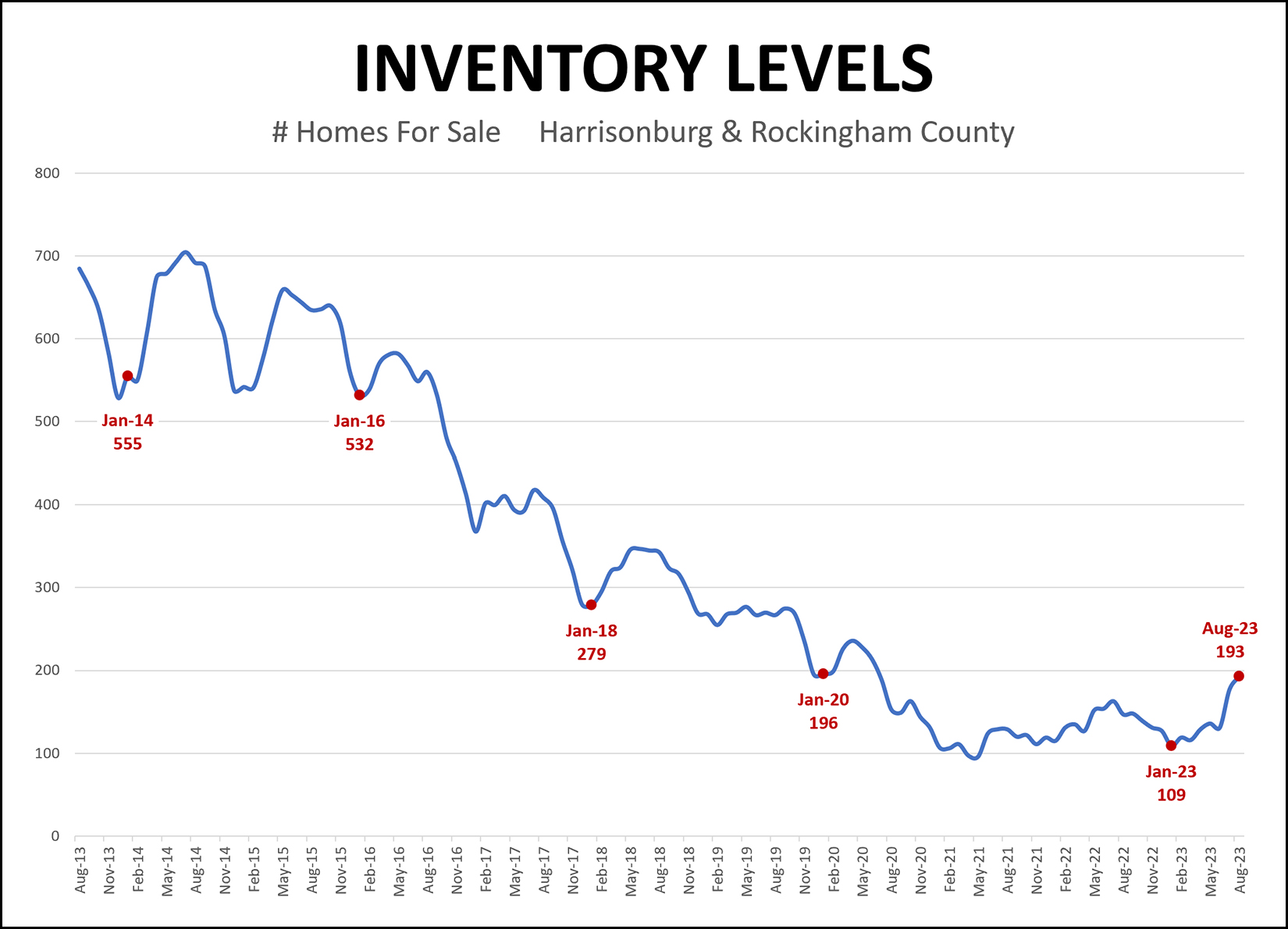

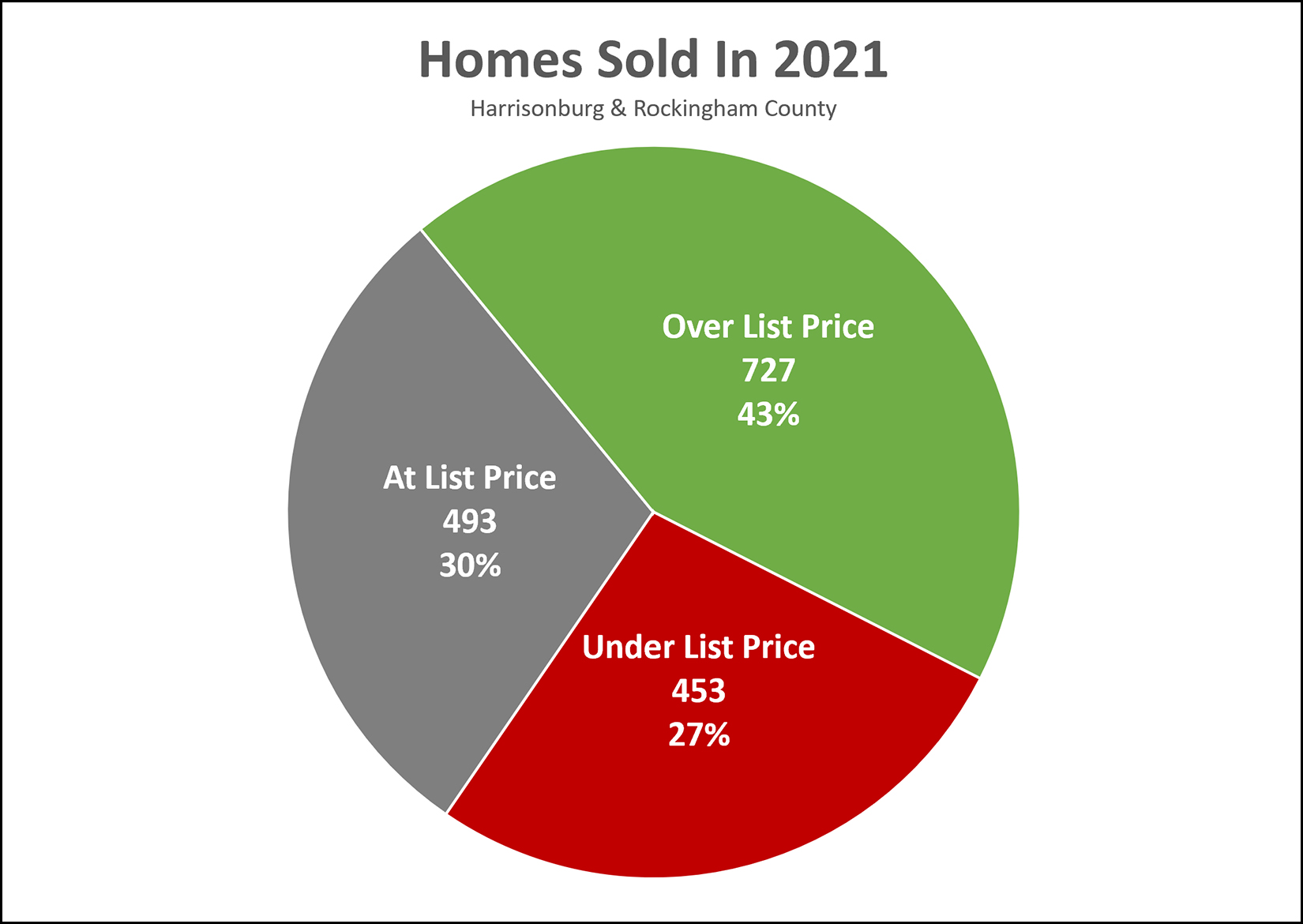

If we look at homes that have sold in the past six months... [1] 68% have sold for the list price or higher. [2] 32% have sold for less than the list price. [3] 40% have sold for over list price. Maybe several of these stats surprise you. Maybe none of them do. I think the most surprising to me is that 32% of homes sold for less than the list price. If often feels like buyers are barely ever able to negotiate on price -- and sellers are barely ever willing to negotiate on price. Interestingly, let's look back a year and a half (ish) to 2021 when mortgage interest rates were in the 3.something range...  The numbers here are certainly different, though not quite as different as you might imagine. For all the homes that sold in 2021... [1] 73% sold for the list price or higher. [2] 27% sold for less than the list price. [3] 43% sold for over list price. So... is every home selling over asking price? Nope. Back in the crazy times of 2021, was every home selling over asking price? Nope. | |

Fewer Homes Are Selling, Though Prices Keep Rising, And Now Inventory Levels Are Rising Too!? |

|

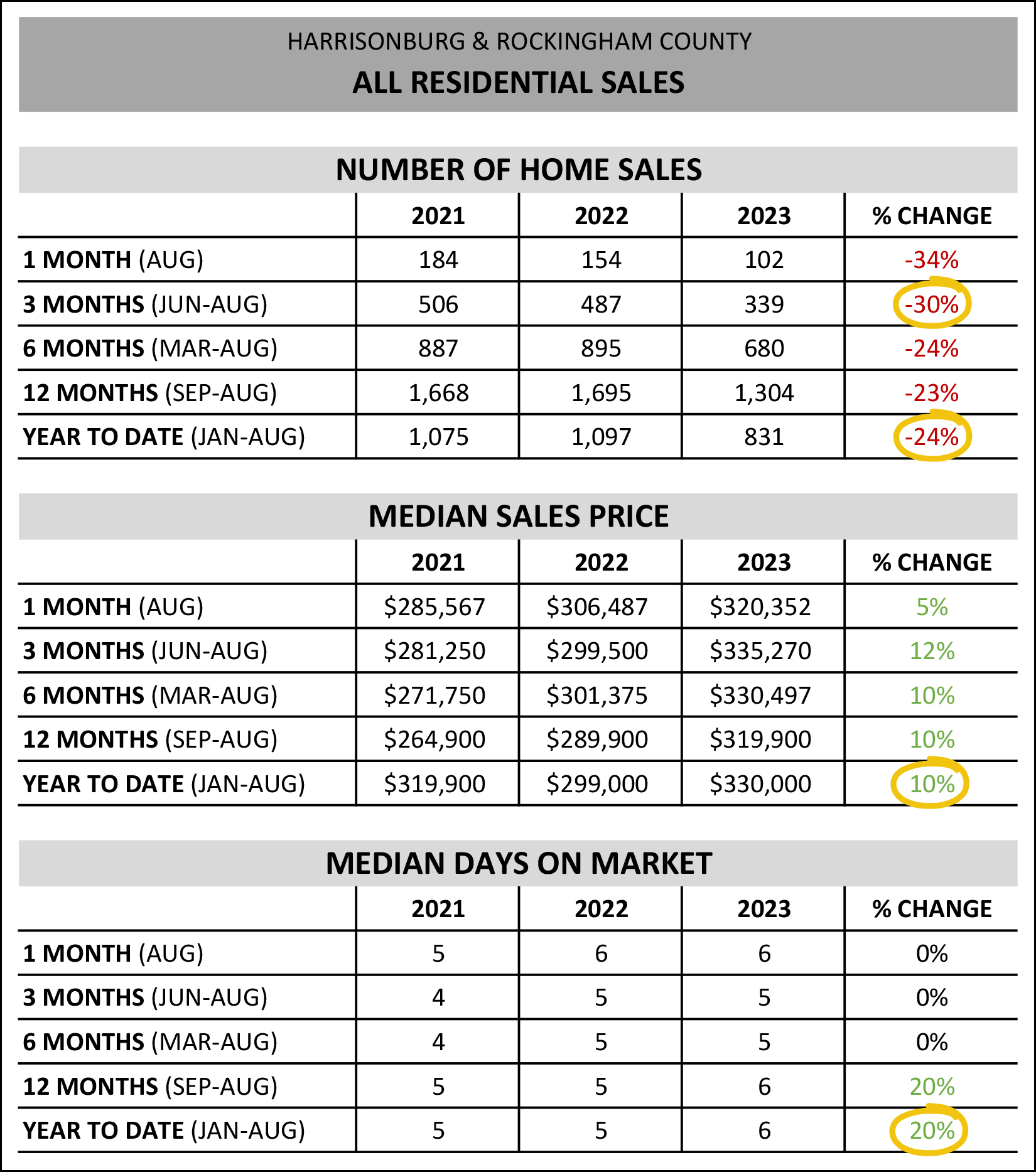

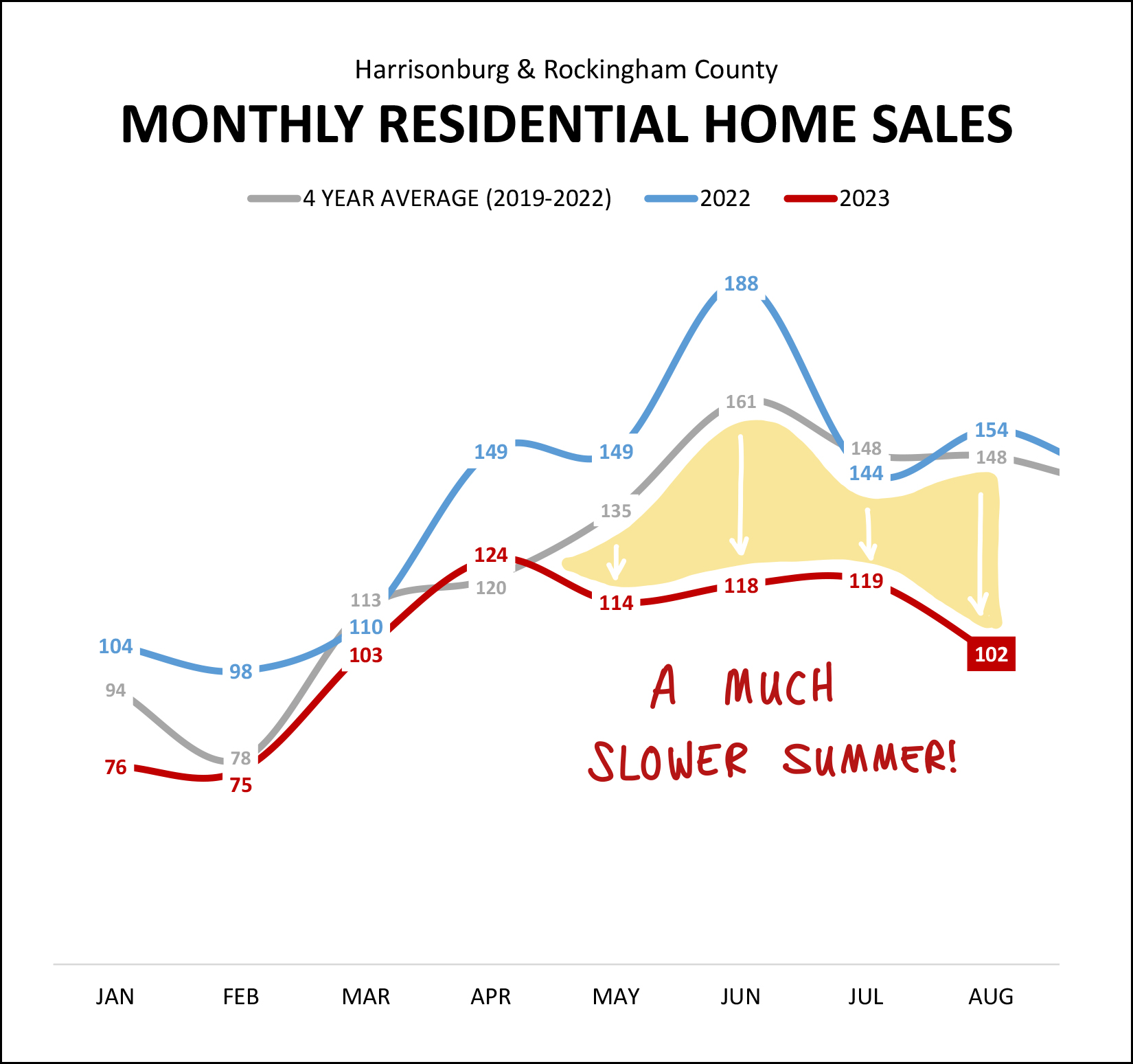

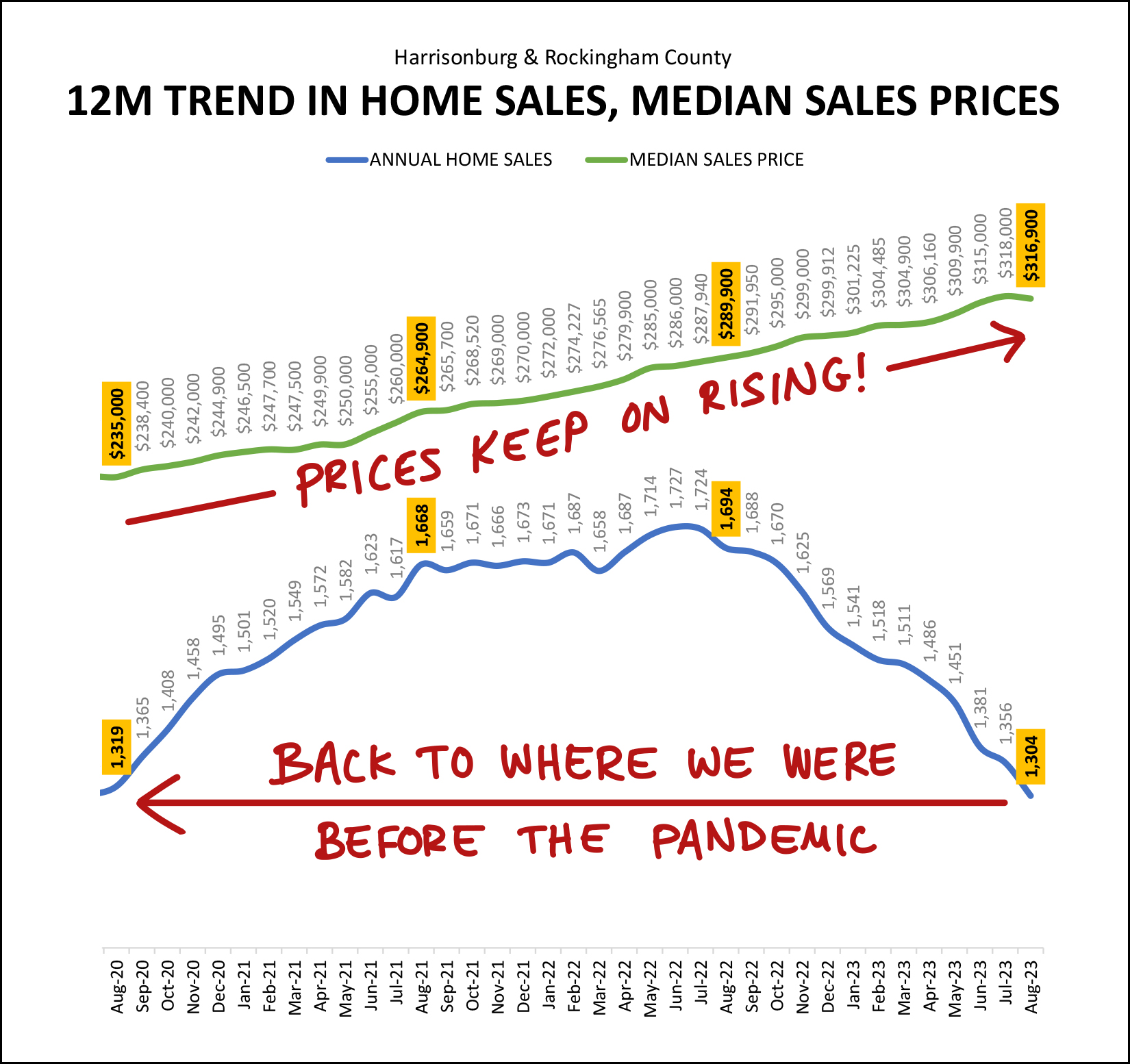

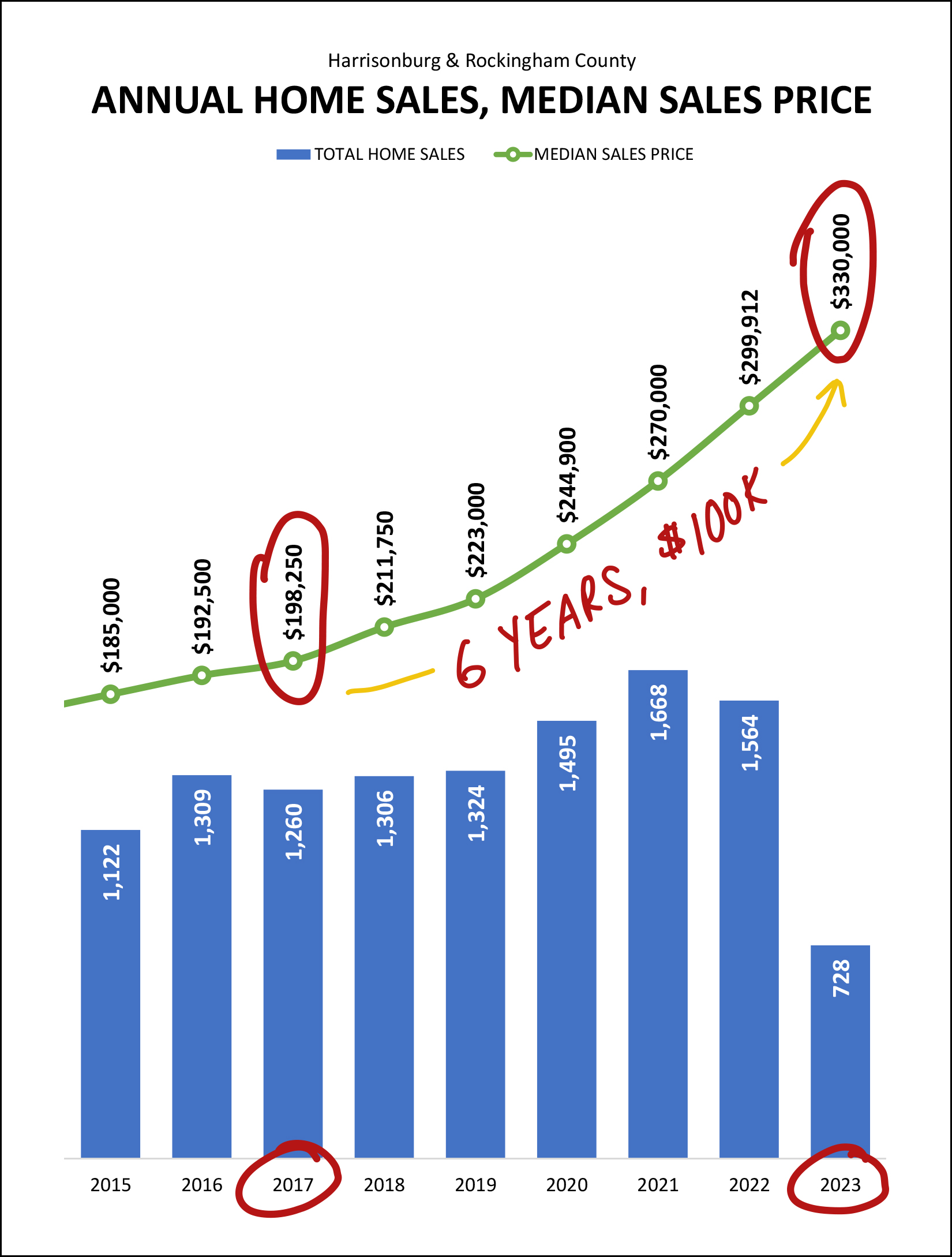

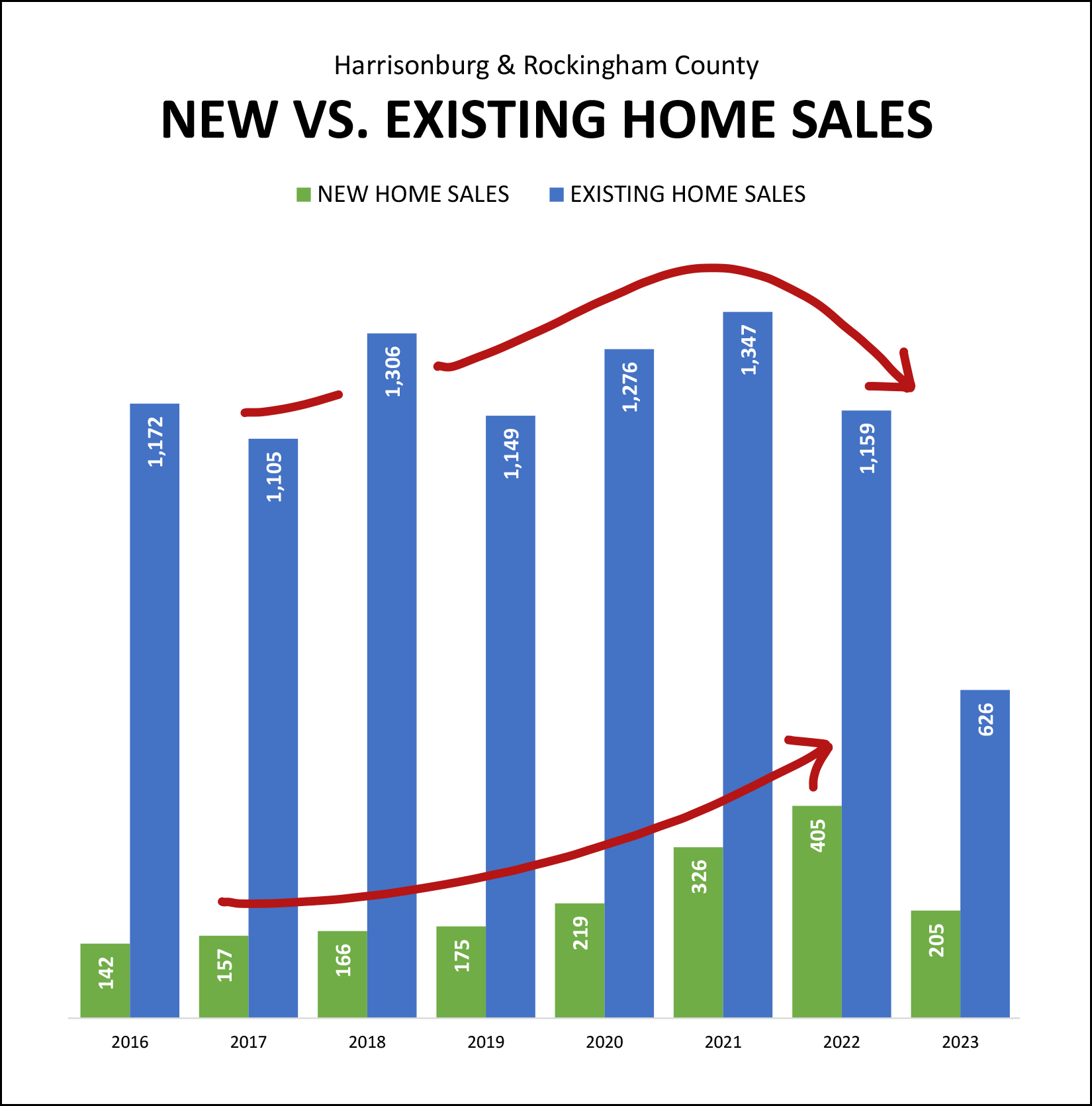

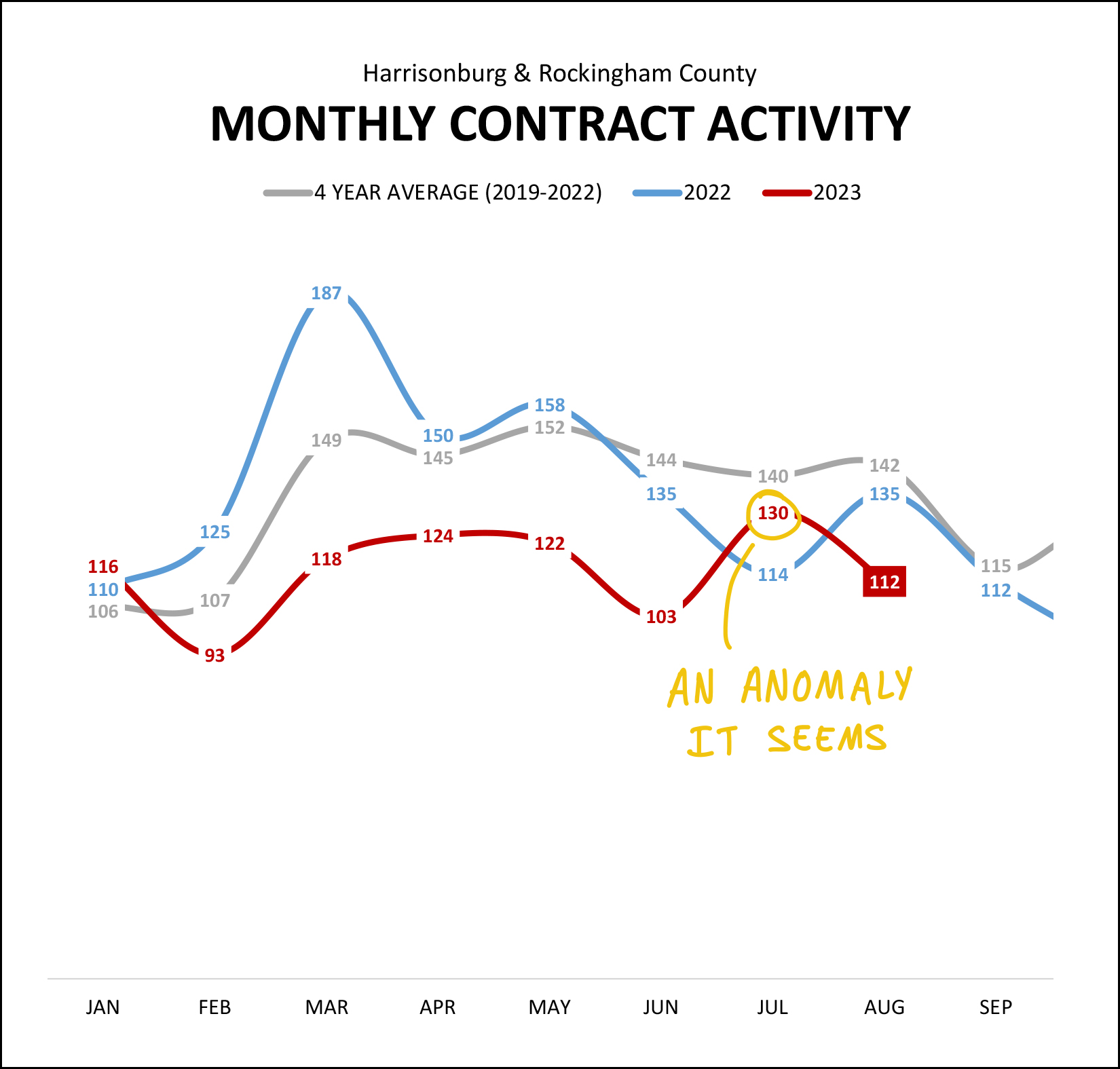

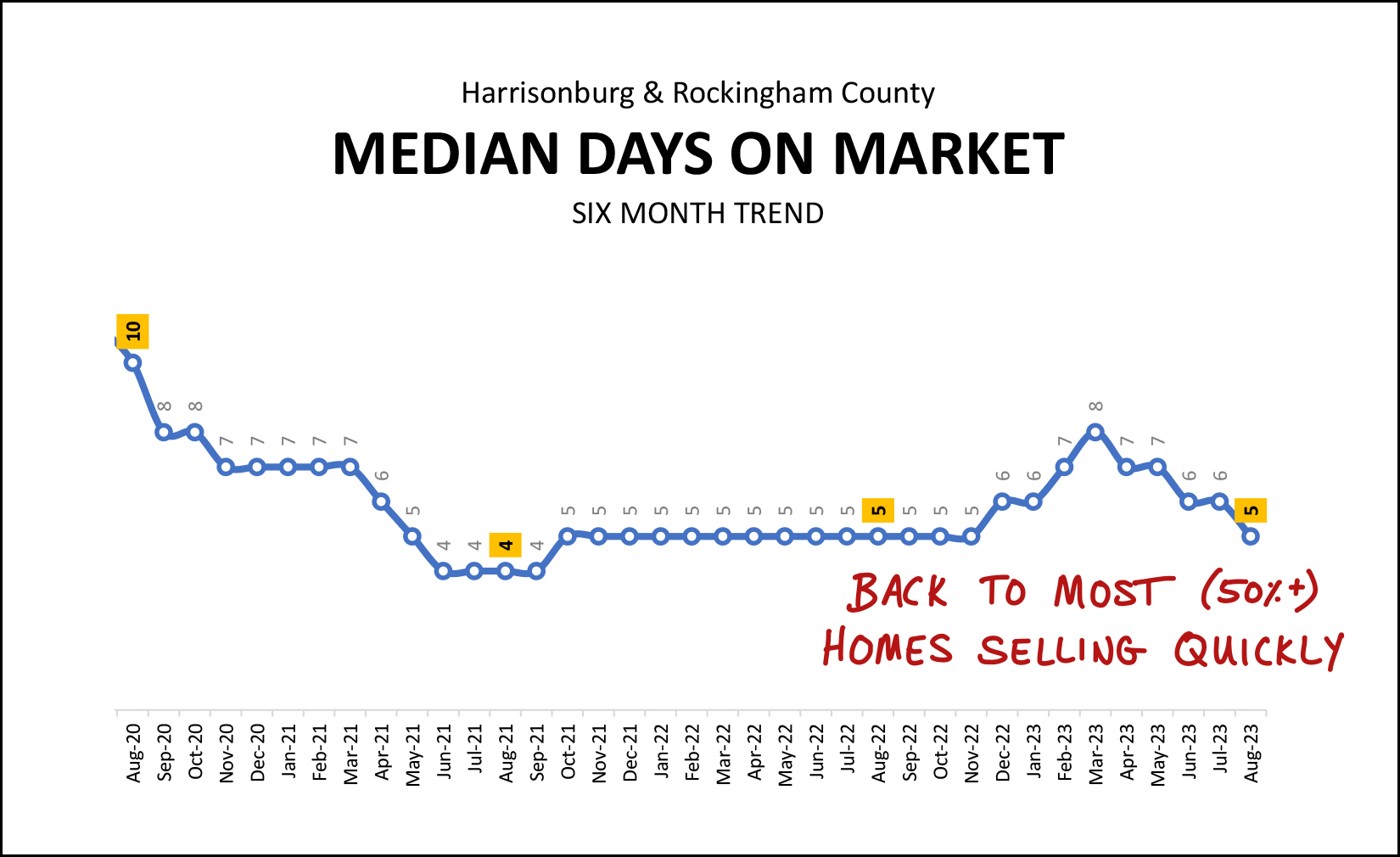

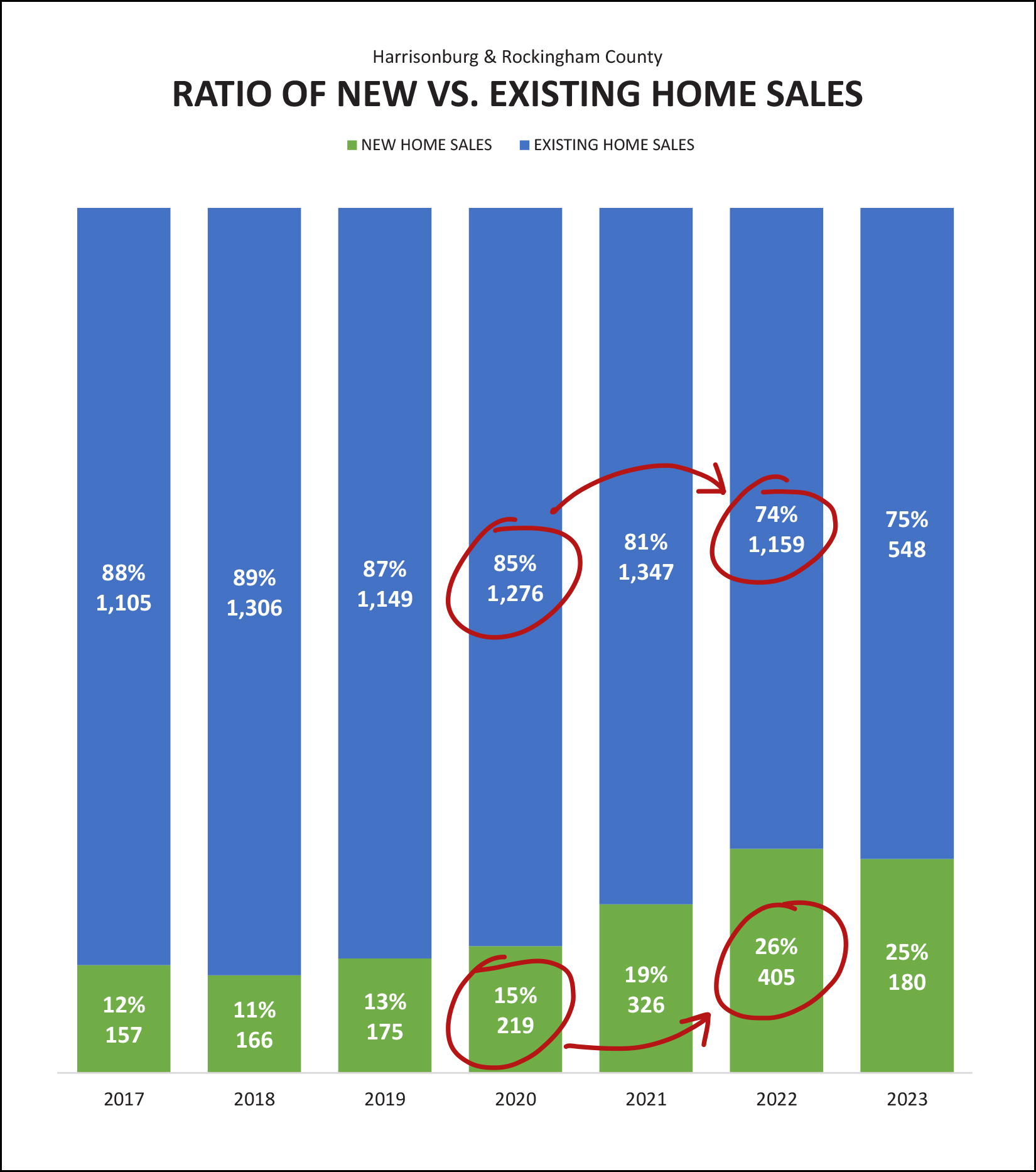

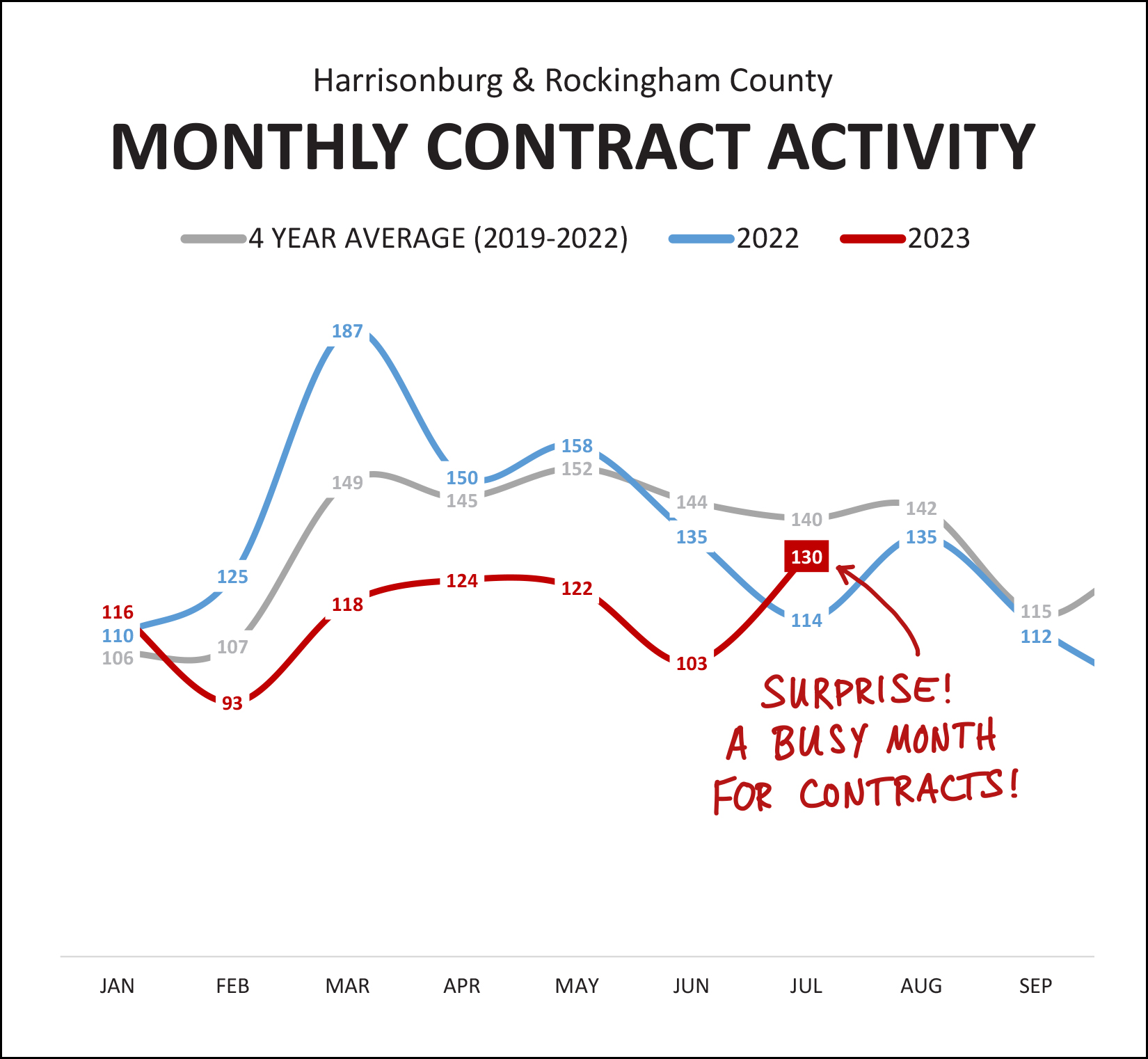

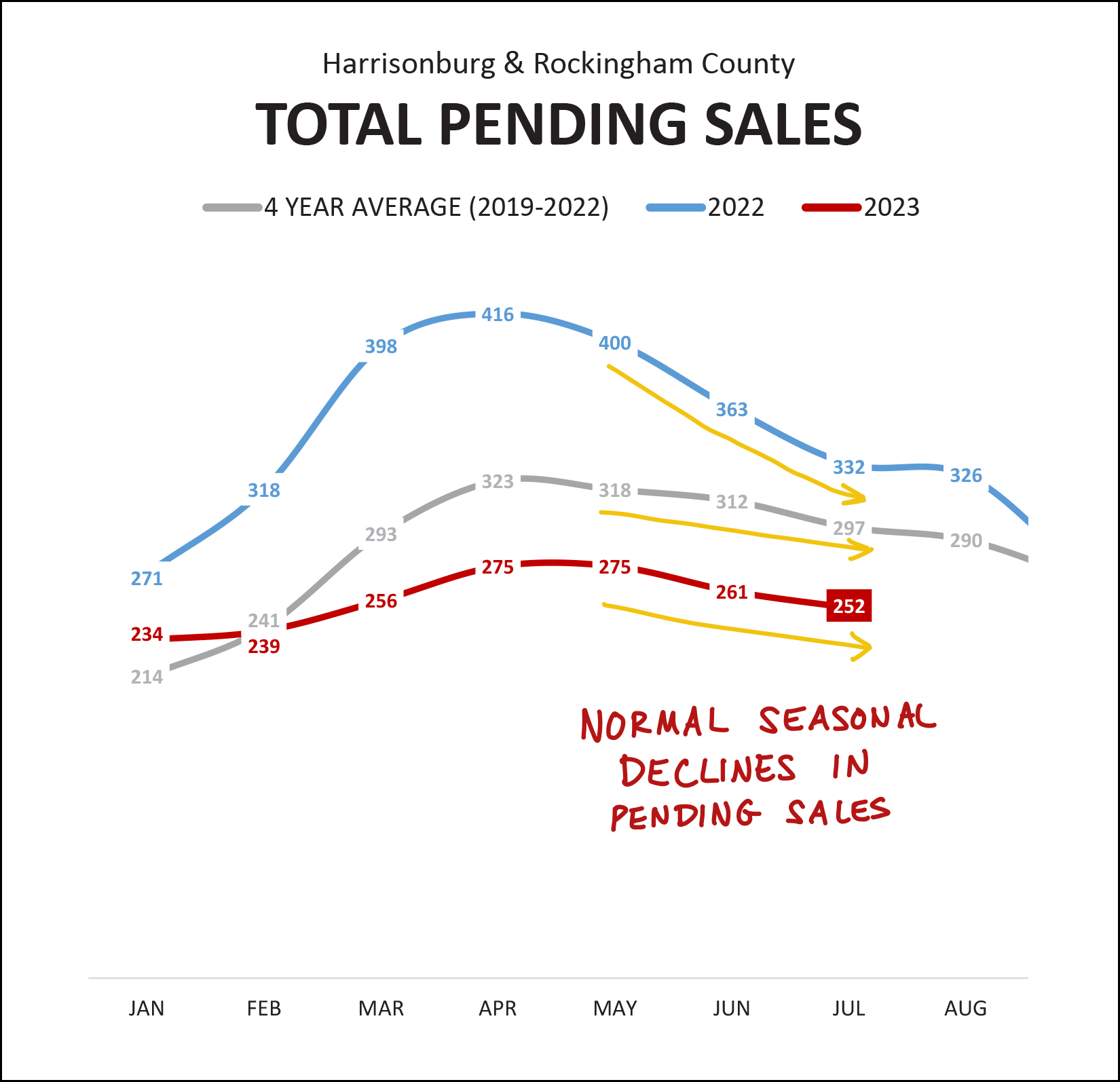

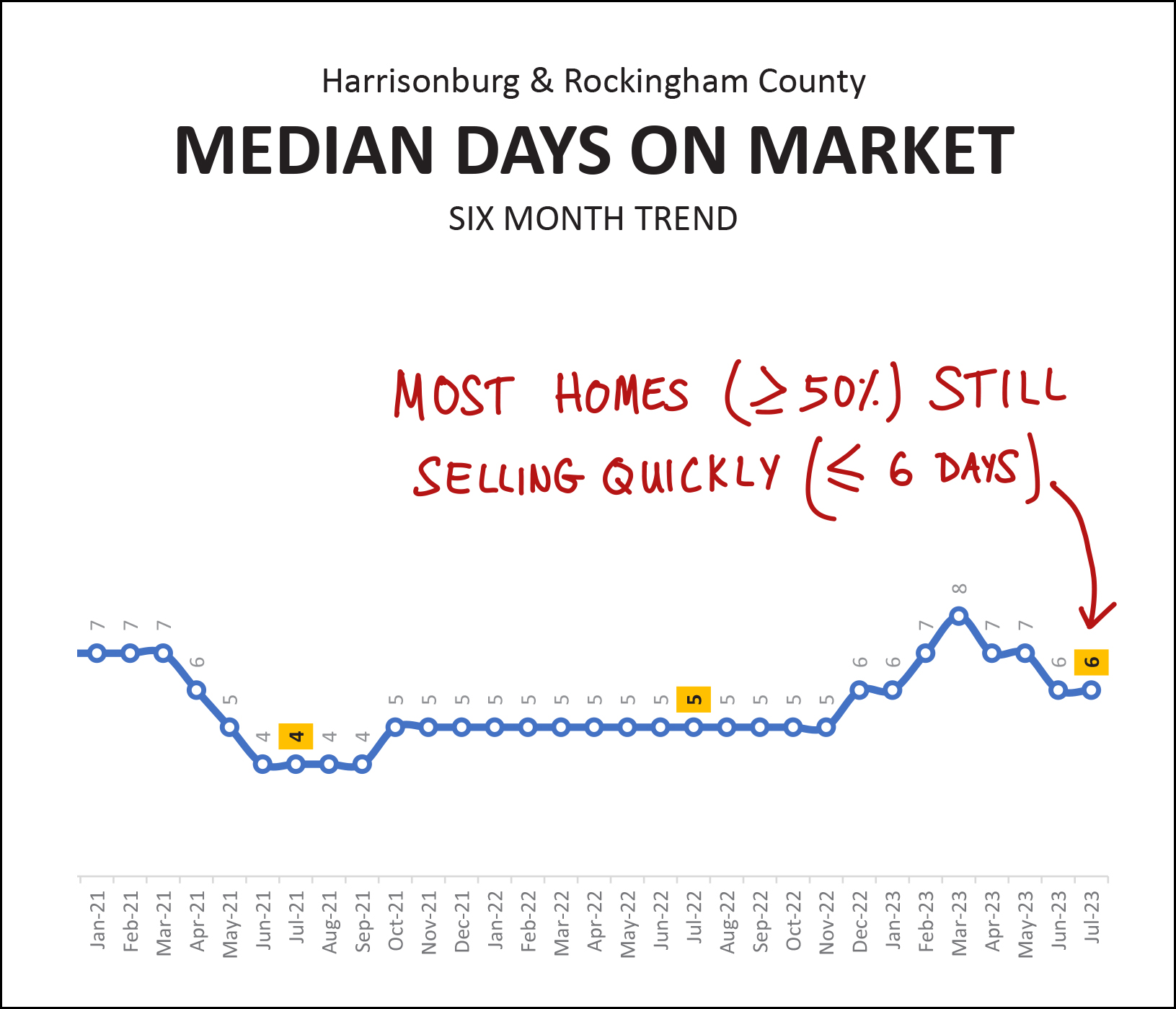

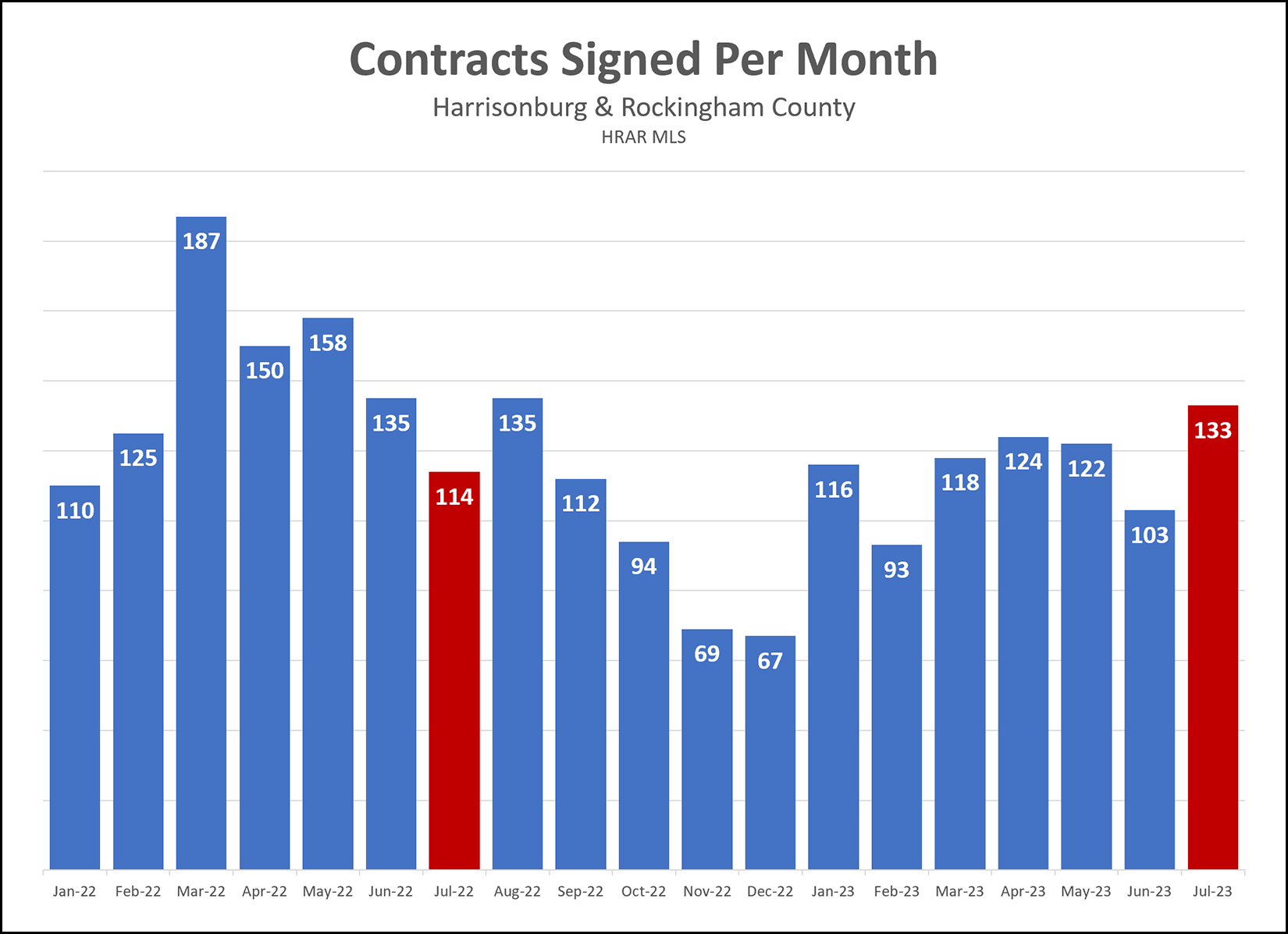

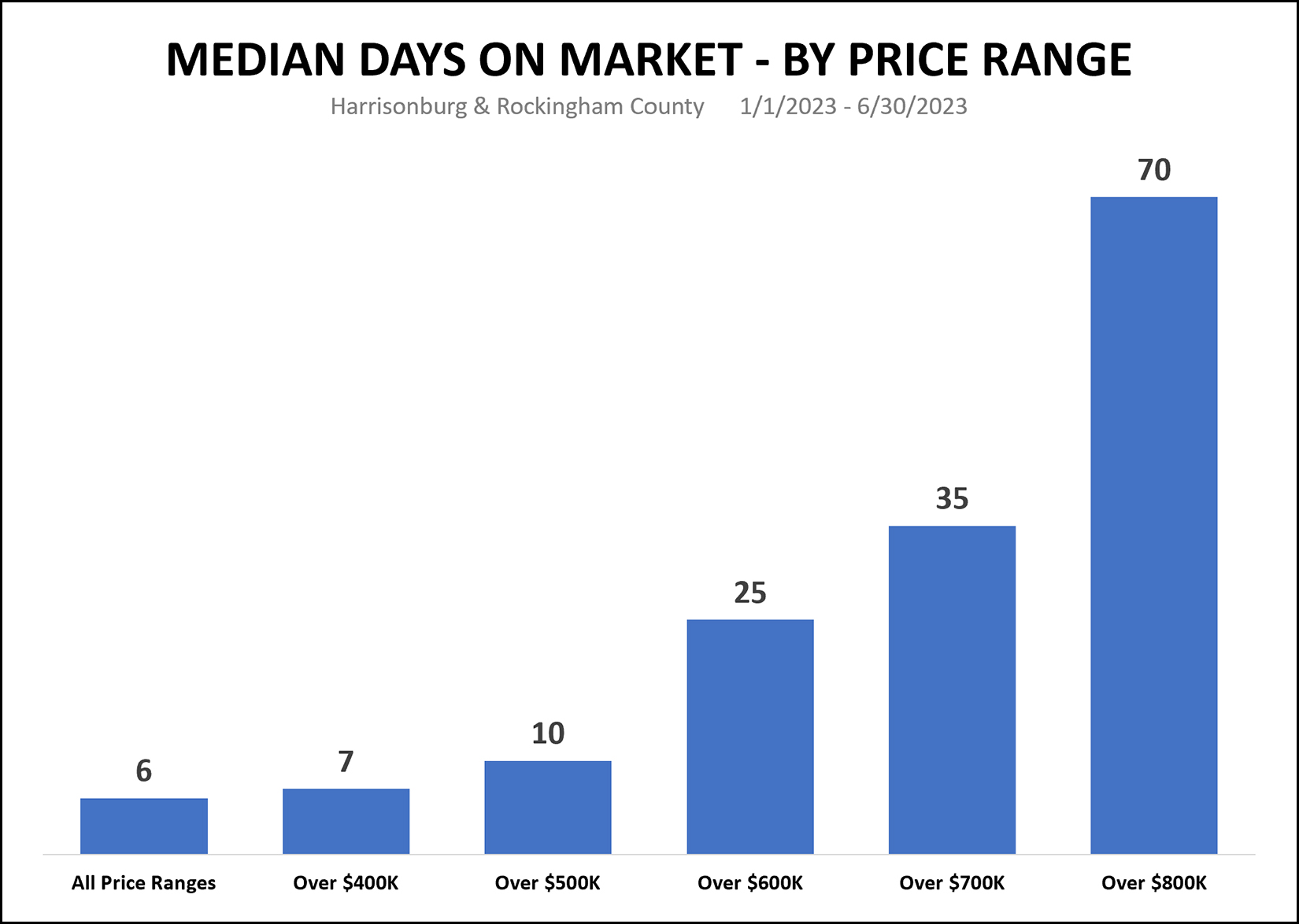

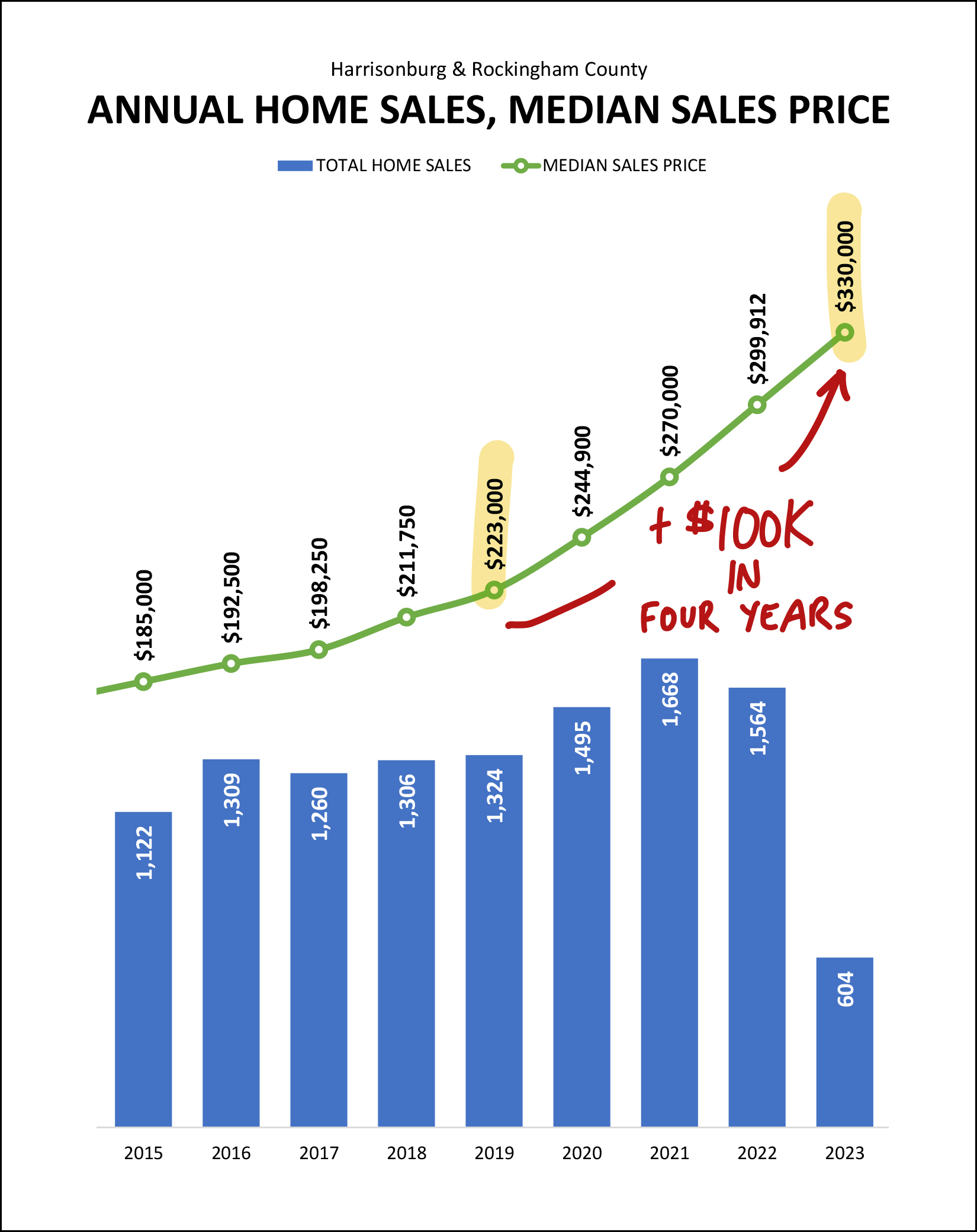

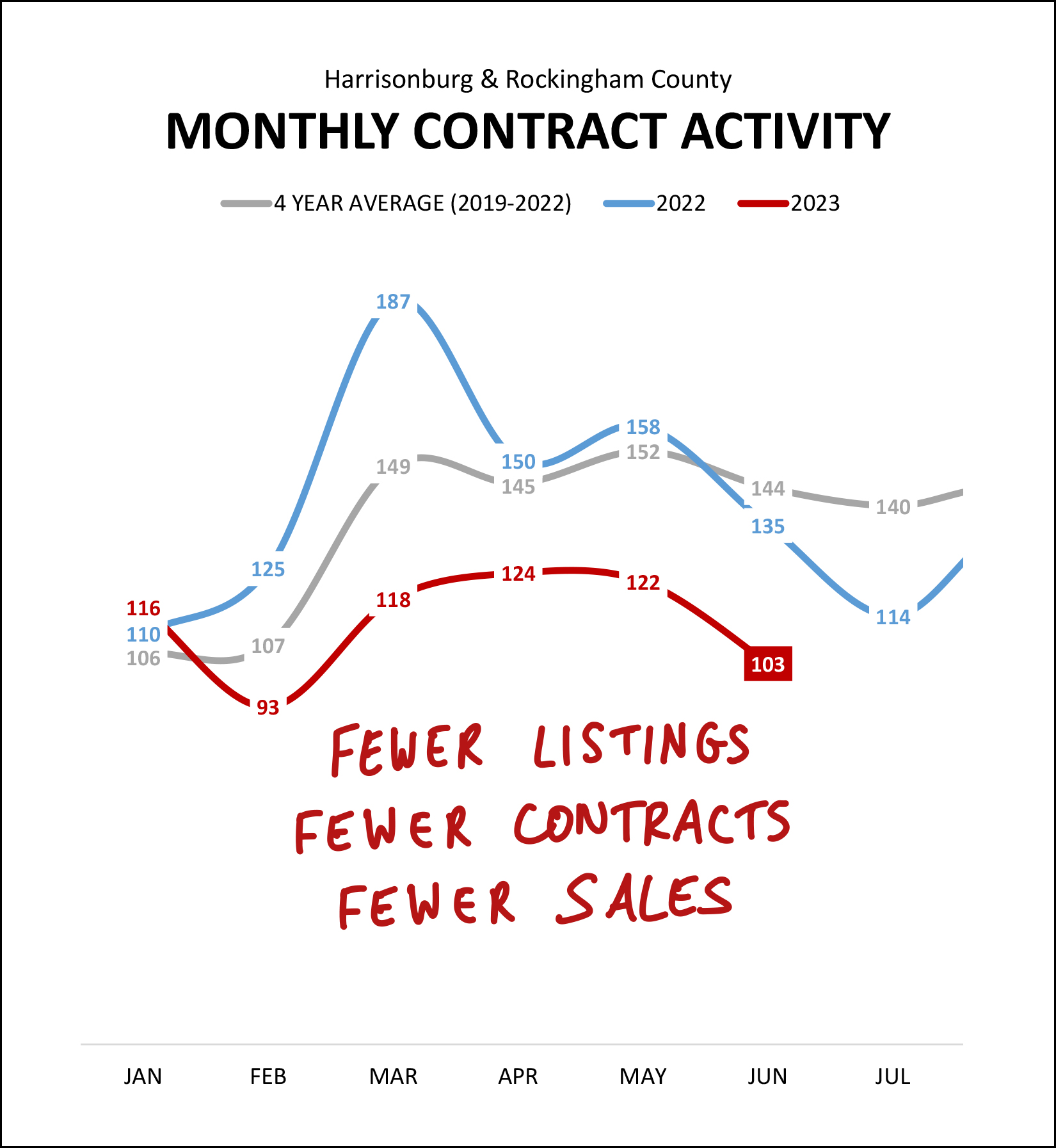

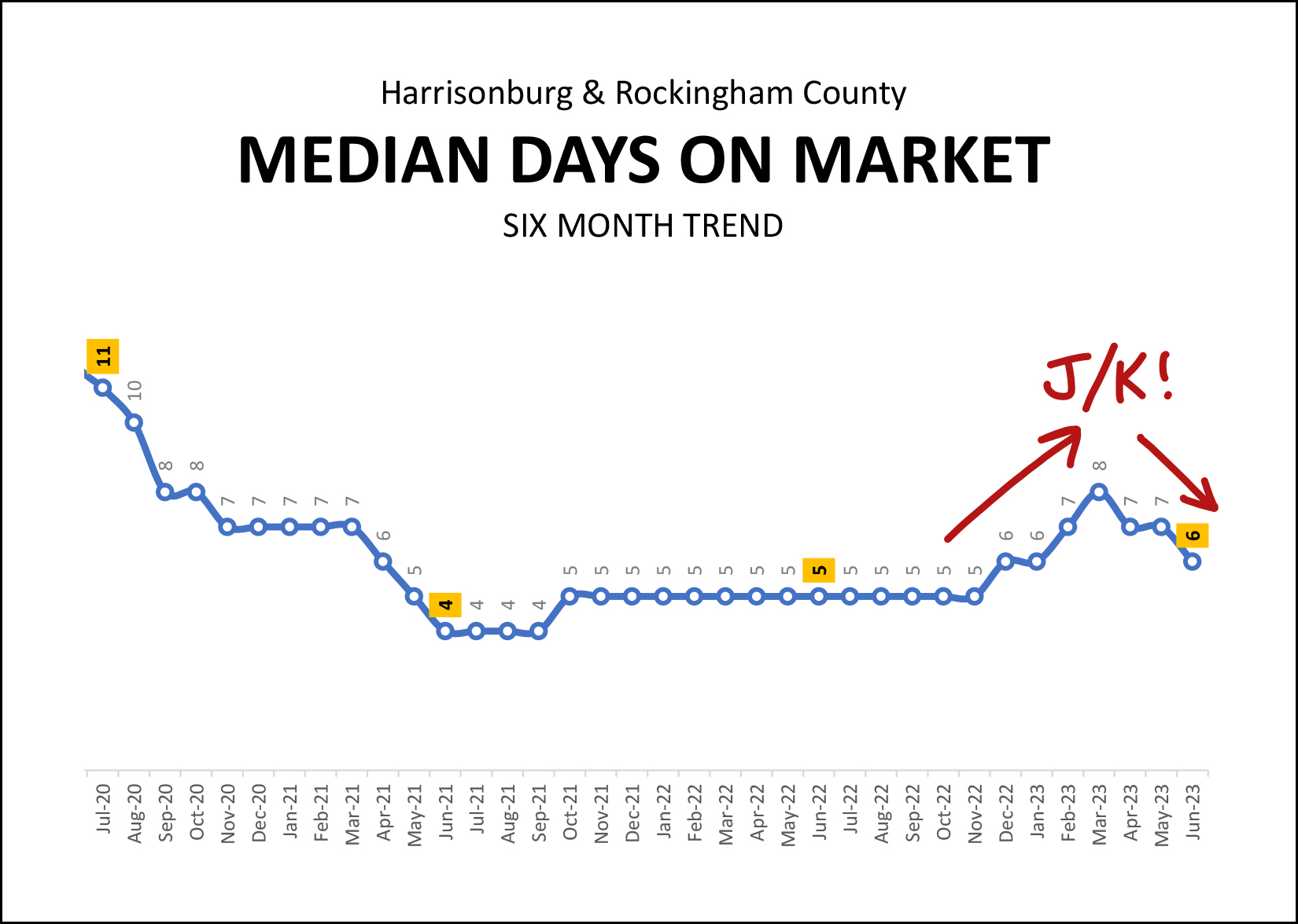

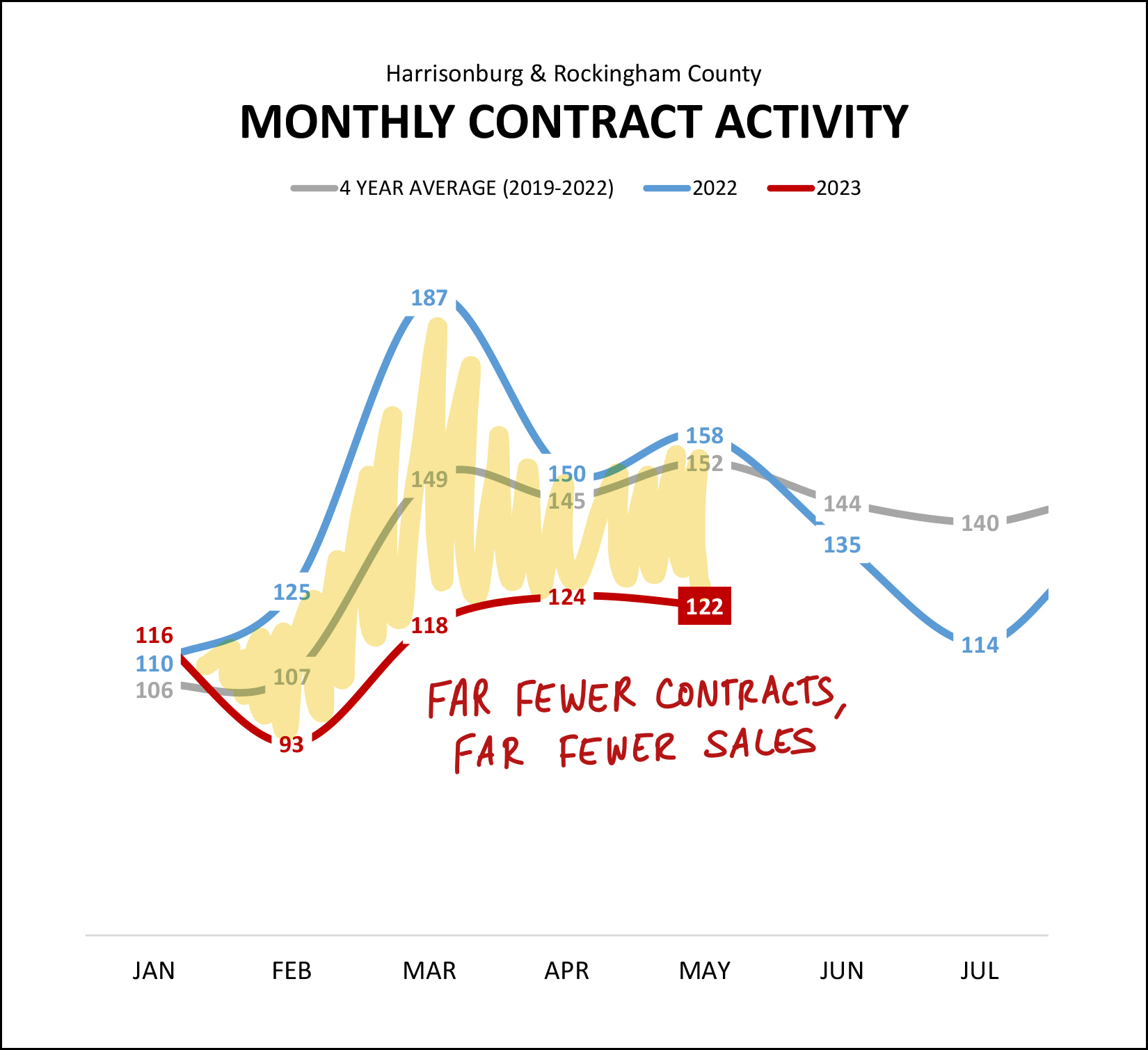

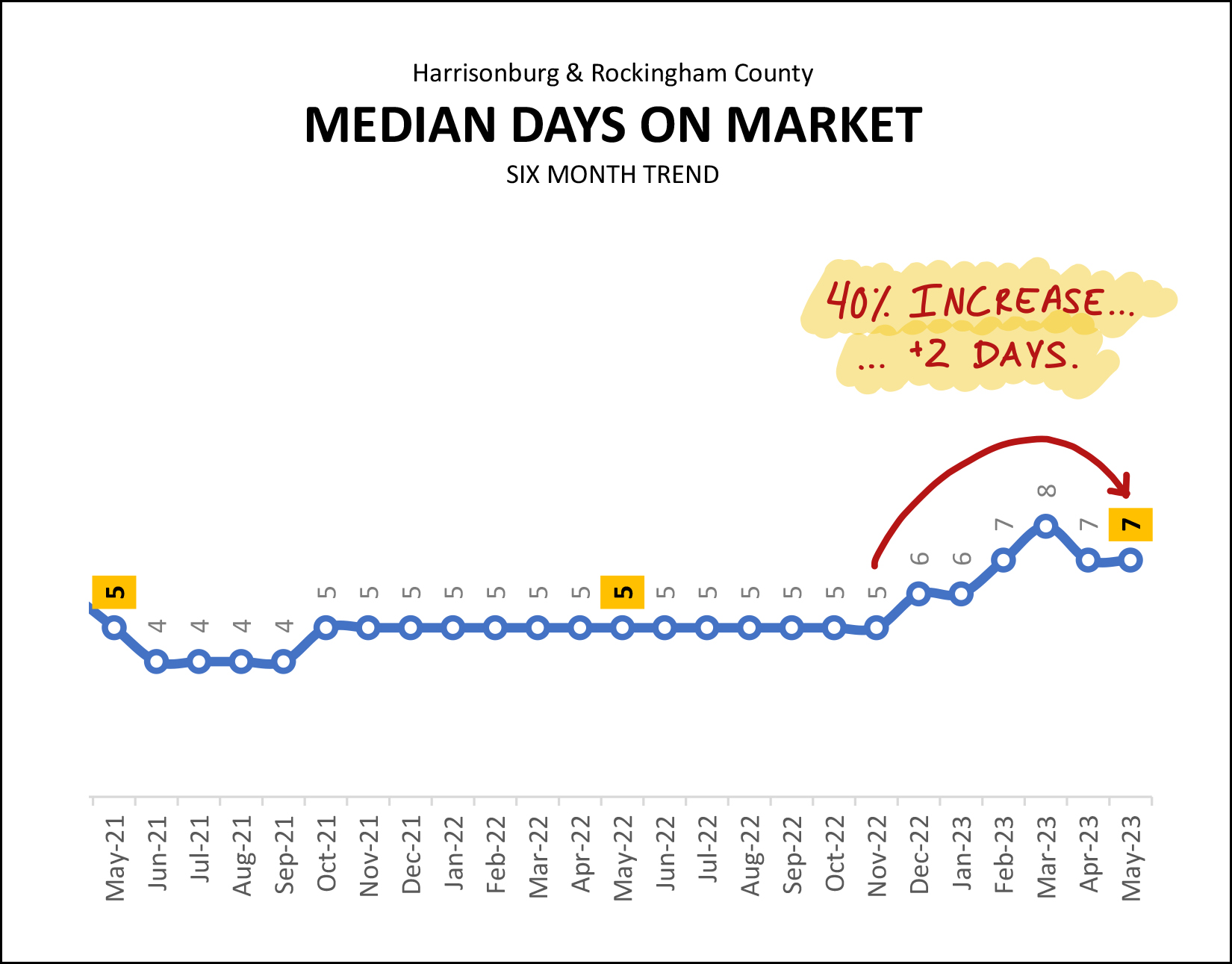

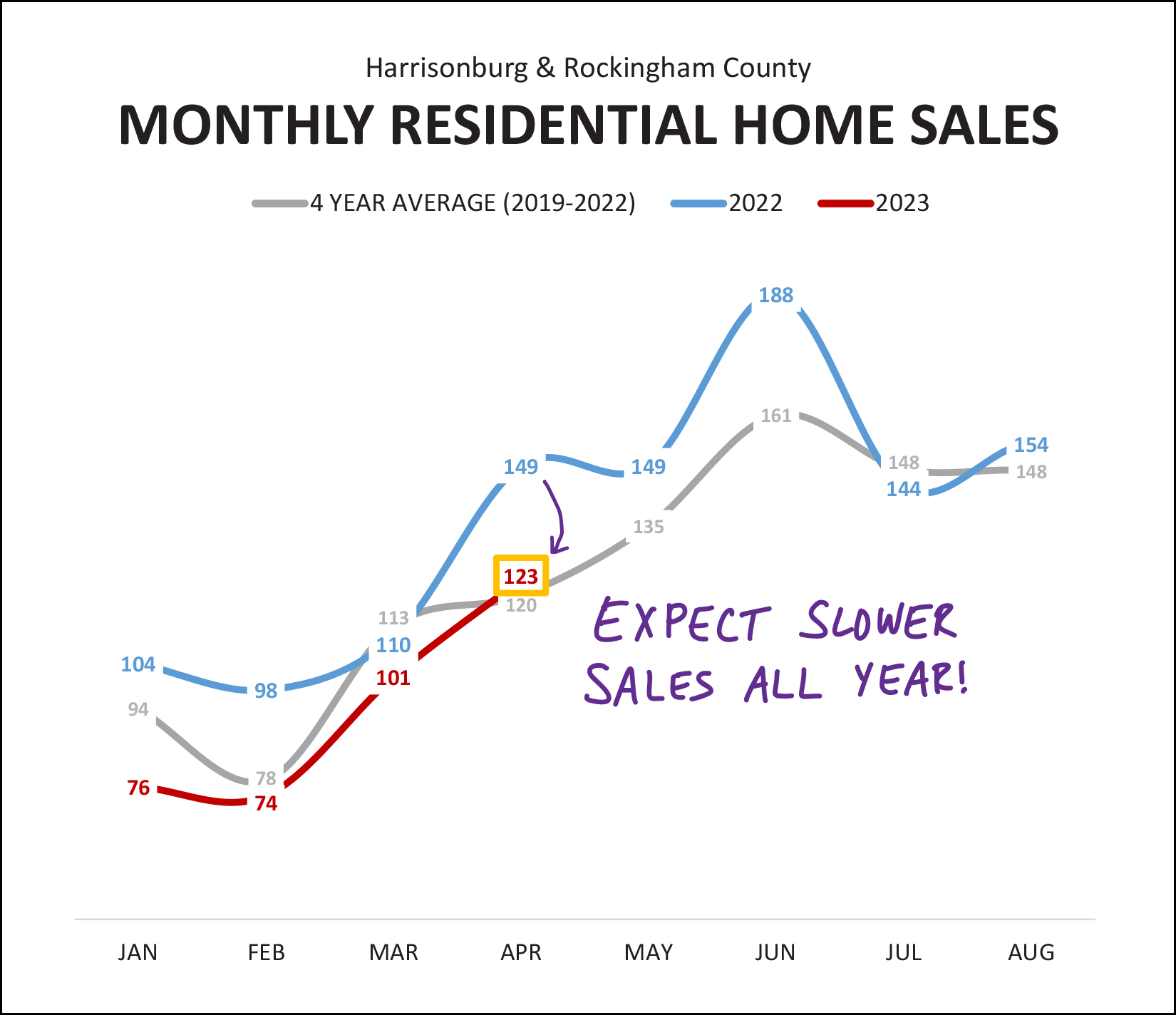

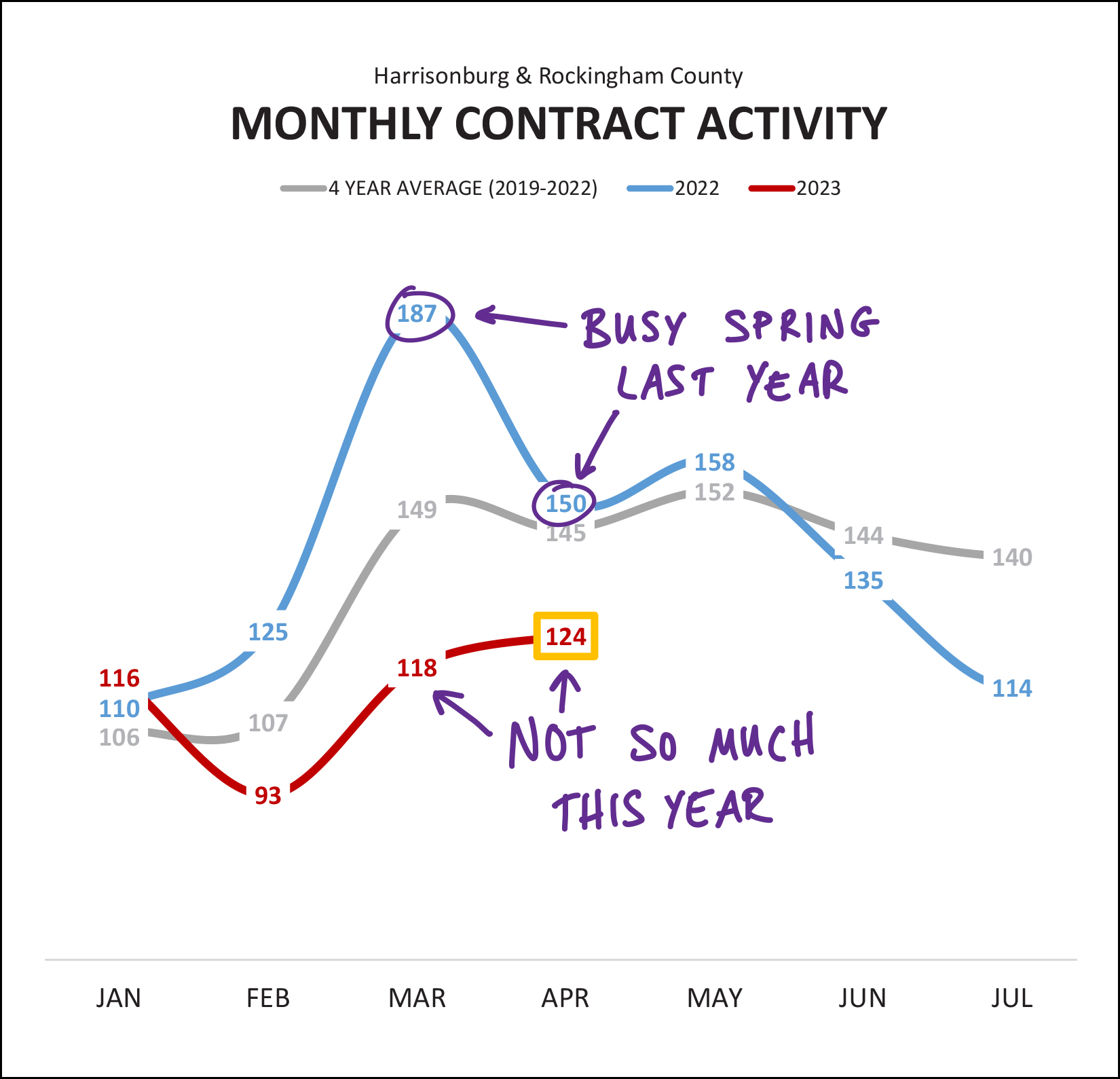

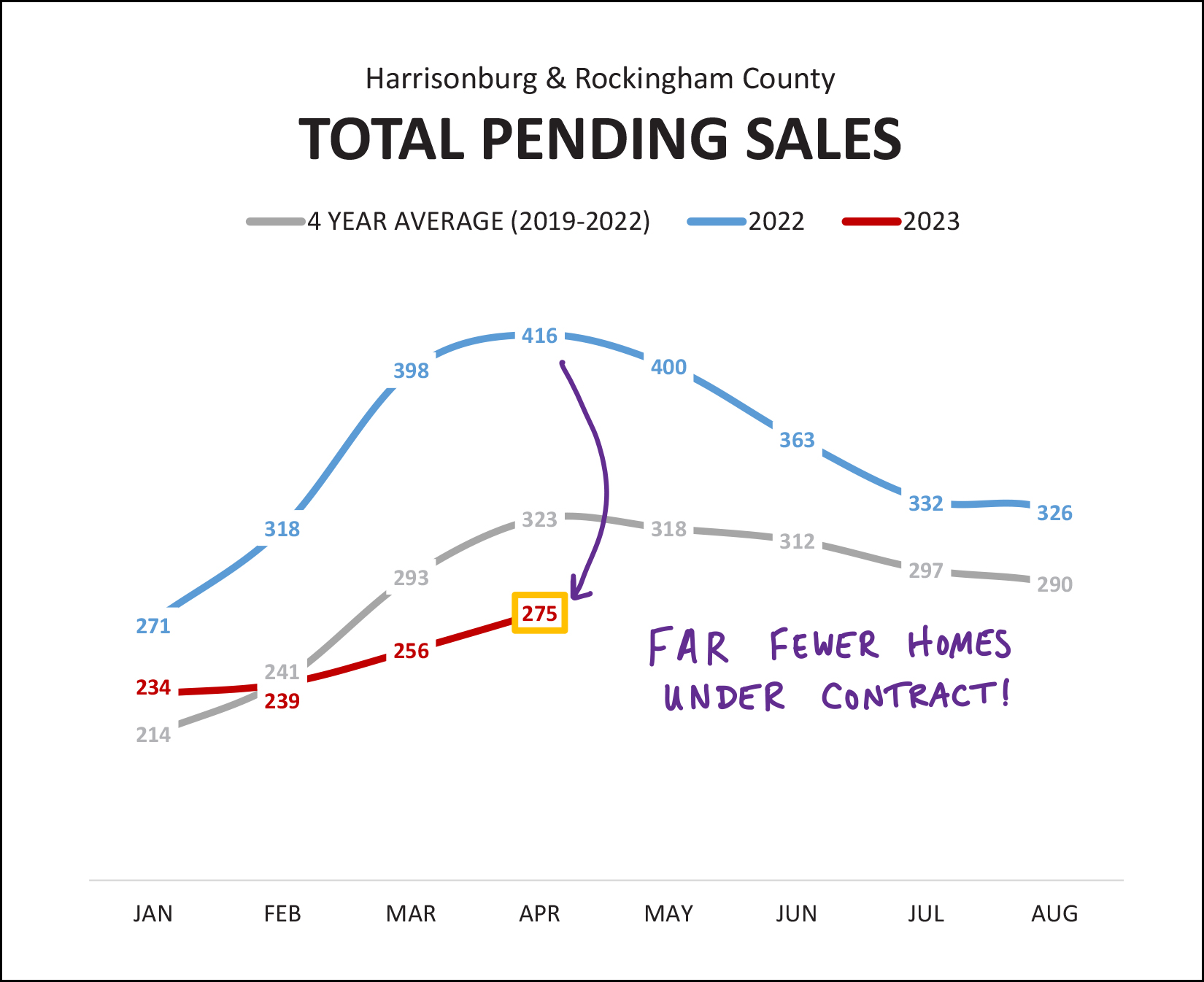

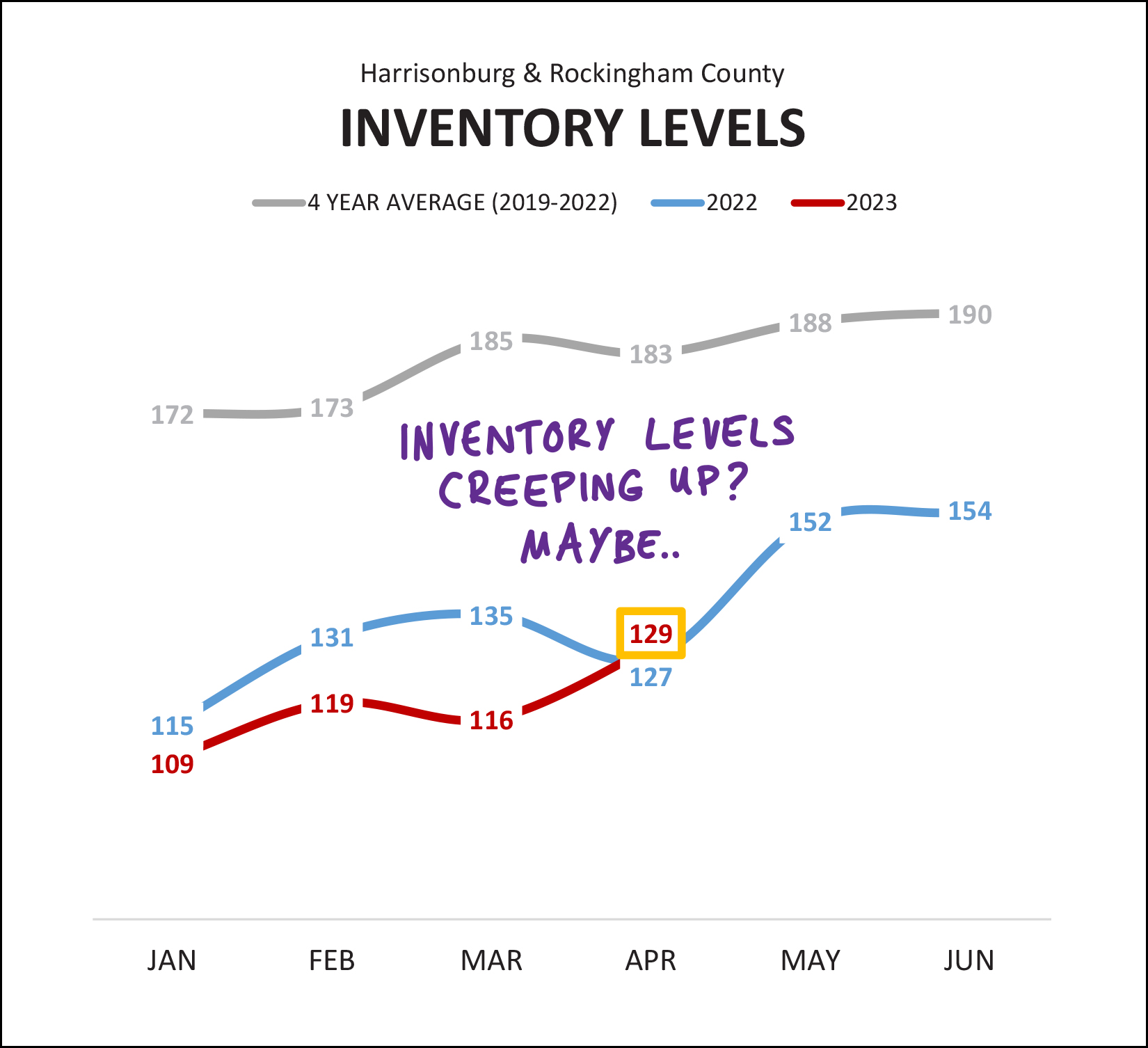

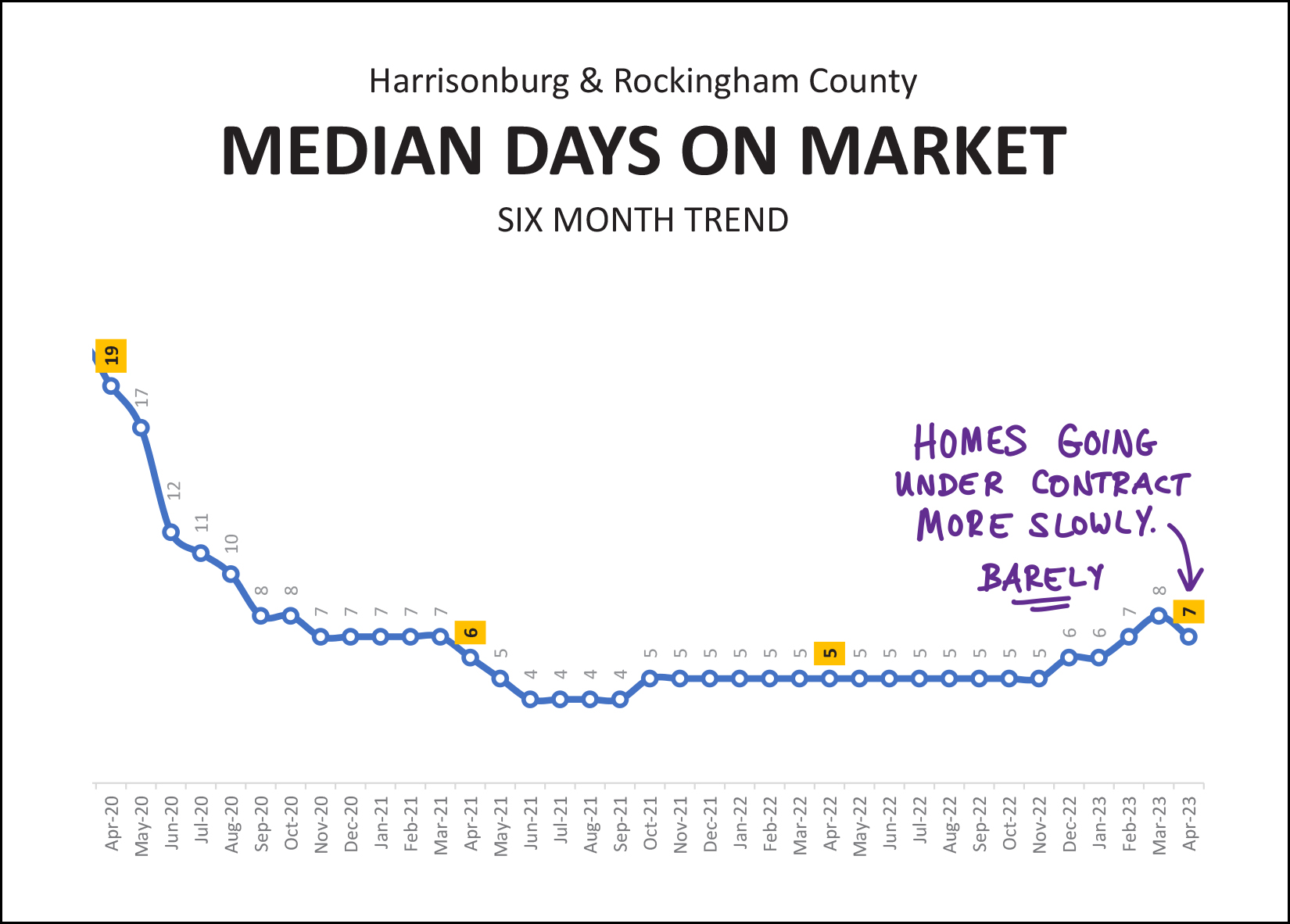

Happy Thursday morning, friends in and around Harrisonburg and beyond! After I process all the data... and create all of the charts and graphs... and doodle on them to notate trends... I then go back and review it all again in order to write the headline of my monthly market report. As it turns out, this month's headline ended up being pretty similar to last month. Fewer home sales... higher sales prices... but also... higher inventory levels. We are definitely seeing some shifts in our local market, though it is not yet clear how significant of an impact those changes will have. But we'll get to all of that real estate data... First, whether you are a teacher, a student, a professor, a school administrator, a staff member at a local college, or a parent, I hope your school year has had a great start. On our end, Luke has started his first semester of classes at Wake Forest and Emily is a few weeks into 10th grade. It has been a fun but busy start to the year, and we're looking forward to visiting with Luke at WFU Family Weekend soon! Secondly, a few listings of potential interest to you... 9926 Goods Mill Road - A modern farmette on 3.3 acres with awesome mountain views in the Spotswood High School district for $575,000. 3986 Dixie Ridge Road - A spacious four (or five) bedroom home with the primary bedroom suite on the main level for $475,000. 3211 Charleston Boulevard - A like-new, upscale townhouse in Preston Lake with a two-car garage with access to many community amenities for $375,000 Congers Creek Townhomes - Three-level, new construction townhomes across Boyers Road from Sentara RMH Medical Center for $306,900 and up. And thirdly, each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included Merge Coffee, Jimmy Madison's and Red Wing Roots tickets. This month I am giving away a $50 gift certificate to a delicious local restaurant, Taste of Thai. I'm writing this report on Wednesday evening... you'll get it Thursday morning... and my writing this evening is powered by one of my go to dishes at Taste of Thai... Massaman Curry. Are you a fan of Taste of Thai as well? Click here to enter to win a $50 gift certificate! And now... on to the data, and charts and graphs...  This first data table above shows much of what we've seen for the past year or so now... [1] We're seeing fewer home sales now than we were a year ago. In the first eight months of this year (Jan-Aug) we've seen 24% fewer home sales than in 2022. If we look only at the summer months (Jun-Aug) we see a slightly larger 30% drop in the number of homes selling. [2] The median sales price continues to rise... it's up 10% in the first eight months of this year (Jan-Aug) as compared to the same timeframe in 2022. [3] Homes are still going under contract rather quickly with a median days on market of six days, which is just a smidge ahead of last year's median of five days. As alluded to above, the summer months were a good bit slower this year than last...  The three lines shown above are as follows... Red = This Year Blue = Last Year Grey = Average of Past Four Years As such, home sales in the summer (+/-) of 2023 were well below the average of the past few years, and even farther below last summer. We saw 102 home sales in August 2023... which is slightly less than we saw in... January 2022. That's actually sort of surprising... a summer month that we would expect to be rather active was slower than a winter month that we would expect to be rather slow. High mortgage interest rates -- we'll get to those below -- likely play a significant role in slowing down the number of homes that are being sold and purchased these days. Now, putting the lower and lower number of home sales in context...  We have seen the number of home sales in a 12 month period drop from about 1700 home sales (summer 2021 through summer 2022) down to only 1300 home sales. But... looking back a bit further, this just takes us back to... where things were at the start of or just before the pandemic. So... yes, we're seeing significantly fewer home sales right now... compared to the significantly higher number of home sales seen in 2020, 2021 and 2022... which were likely high points fueled by low mortgage interest rates and lots of buyers rethinking what they needed in a home during the pandemic and thereafter. And yes, despite the rapid increase (1300 to 1700) and then rapid decrease (1700 to 1300) in home sales, we've seen home prices steadily march on along, upward, during the entirety of the past three years. Looking back a bit further than three years puts the change in median sales price in an even wilder context...  Not too long ago (2017) the median sales price in Harrisonburg Rockingham County was just below $200K. This year (2023) that median sales price is now above $300K. That $100K(+) jump over the course of six years has significantly changed what it looks like to be a first time buyer (or a move up buyer) in our local market. Certainly, the higher mortgage interest rates we have seen in 2023 (and 2022) haven't helped either. The combination of higher sales prices and much higher mortgage interest rates have resulted in much, much higher housing payments for buyers in today's market. Looking for a trend that is heading in two different directions at once? Here's one...  We are currently seeing a downturn (blue bars) in the number of existing homes selling in Harrisonburg and Rockingham County... while at the same time seeing an increase (green bars) in the number of new homes selling in our market. Higher mortgage interest rates are causing many homeowners to have no interest in selling... which is resulting in fewer existing homes being on the market for sale. Thankfully, there are builders helping to add housing stock in our area, resulting in more new homes selling over the past few years. Shifting gears a bit to the here and now... the freshest data to watch for the most recent trends is contract activity...  Last month we saw an increase in contract activity... with 130 homes going under contract, compared to only 114 in the same month last year. It seemed that maybe we would see a sustained surge of buyer activity. But... maybe not. With only 112 contracts signed in August 2023, it seems that the surge of contract activity in July 2023 was an anomaly, and we will still see smaller numbers of contracts being signed in 2023. Darn. And here's the most interesting graph of them all, in my opinion...  Over the past two months we have seen a significant shift in inventory levels -- the number of homes available for sale in Harrisonburg and Rockingham County. For most of this year (red line) we have seen even fewer homes for sale than last year (blue line) but that all changed in July 2023. Over the past two months we have seen inventory levels build up beyond (above) where they have been for the past several years. These higher inventory levels are resulting in... [1] Buyers have slightly more choices of homes to go view. [2] Homes sometimes staying on the market a bit longer than before. [3] Many sellers seeing fewer showings than they expected. [4] Plenty of homes not going under contract in the first few weeks. Will higher inventory levels eventually translate into a higher number of home sales, bringing inventory levels back down? Maybe. Will higher inventory levels eventually lead to some sellers being more flexible on price, and a leveling out of the median sales price, or even a decline in the median sales price? Maybe. I'll continue to monitor inventory levels with interest as higher inventory levels can start to make it a slightly more favorable market for buyers than it has been for the past few years. As already mentioned in this report, despite higher inventory levels, we're still seeing prices rise... and most (50%+) homes are still going under contract quite quickly...  Just to translate the graph above into words... over the past six months the median "days on market" of homes that have sold was five days. Of note... that only measures the median days on market for sold homes... not those that are still on the market for sale. Furthermore, this is just a median -- it's not saying that all homes are going under contract in five or less days. As per how a "median" calculation works... 50% of homes are going under contract in five or fewer days... and 50% are going under contract in five or more days. And finally... I have mentioned higher mortgage interest rates so many times in this market report that you're probably wondering how high they are...  They are QUITE high... higher than they have been in many years... higher than they have been in several decades. It seems quite possible that mortgage interest rates will edge back down below 7% in the coming months... but I'm guessing we'll see mortgage interest rates above 6% for the next year or two. These higher mortgage interest rates significantly affect housing costs for buyers making a decision to buy in today's market. If mortgage interest rates were lower, we would likely see more sellers being willing to sell, and more buyers able to and interested in buying. And just like that, we've breezed our way through all of the charts and graphs I have for you today. My advice to buyers and sellers is relatively similar to recent months gone by, but I'll reiterate it here... Home Buyers -- You might be able to wait a day (or even two) to go see a new listing now, but don't assume that many or most will be there three or four days after they hit the market. Plenty of homes are still going under contract very quickly, particularly those in more desirable price ranges, locations, etc. Talk to a mortgage lender to understand your potential housing costs and get going to see some new listings as they hit the market. Home Sellers -- All homes won't go under contract within five days. Your home might be on the market for a few weeks or even a few months depending on it's condition, location, price range and other attributes that are appealing to either a wide or narrow pool of buyers. Price your home competitively, prepare it well for the market and market it thoroughly and professionally and you should still have success in securing a contract with a buyer -- but it won't necessarily happen overnight like it seemingly always was over the past few years. If you have a real estate question... reach out anytime. It's never too early to have an initial chat about your possible plans to buy, sell or move. I'm happy to provide feedback and input to help you think some things through and make a plan for your housing transition when you're ready to do so. You can reach me most easily at 540-578-0102 (call/text) or by email here. | |

August Contract Activity Was Slower Than In Recent Years |

|

We are seeing fewer home buyers signing contracts to buy homes right now... compared to the past few years. The graph above shows the numbers of homes that went under contract in the first 28 days of August for each of the past six years. The 101 contracts signed in the first 28 days of August 2023 is decidedly lower than the contract activity seen in August 2020, 2021 and 2022 -- though most of those years were much more active than normal given COVID-induced buyer enthusiasm and super low mortgage interest rates. As such, it is not totally surprising to see us return to around 100 contracts signed in August, which is the average of how many we saw in August 2018 and August 2019. With mortgage interest rates around 7% right now, I expect we will continue to see slower months of contract activity as we continue into and through the fall months of 2023. | |

Fewer Home Sales, But Prices Are Rising!? More Contracts But Inventory Levels Are Rising!? |

|

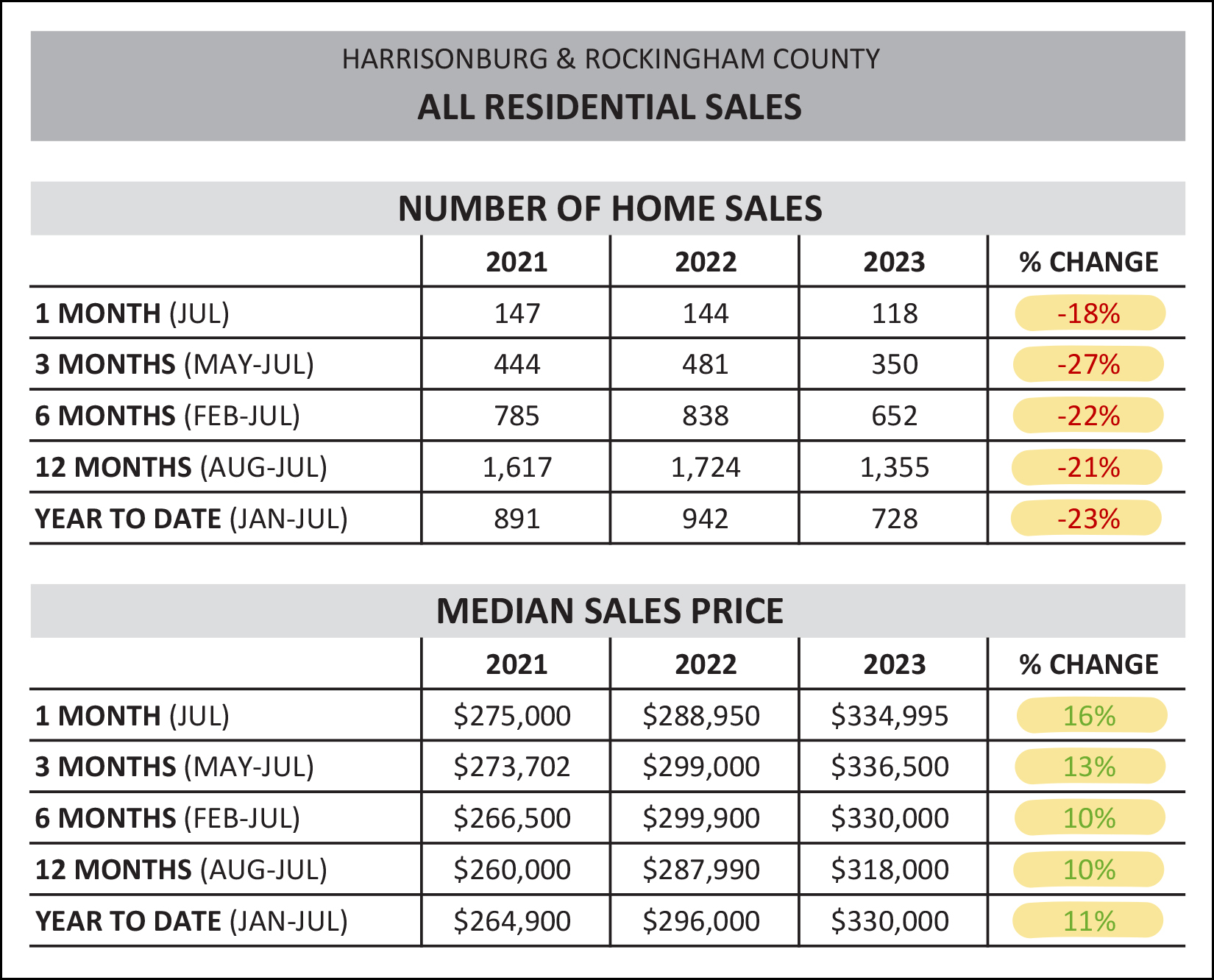

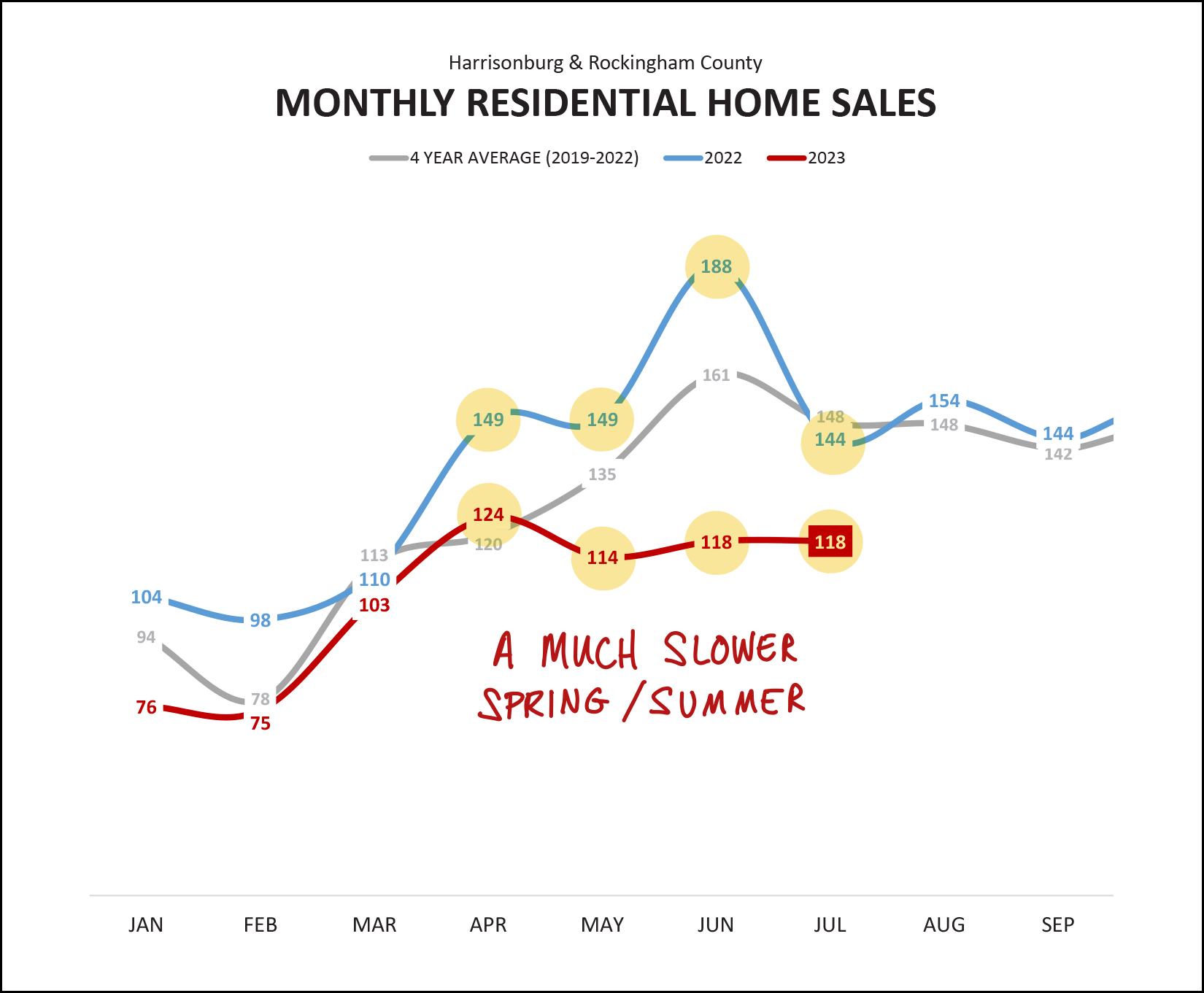

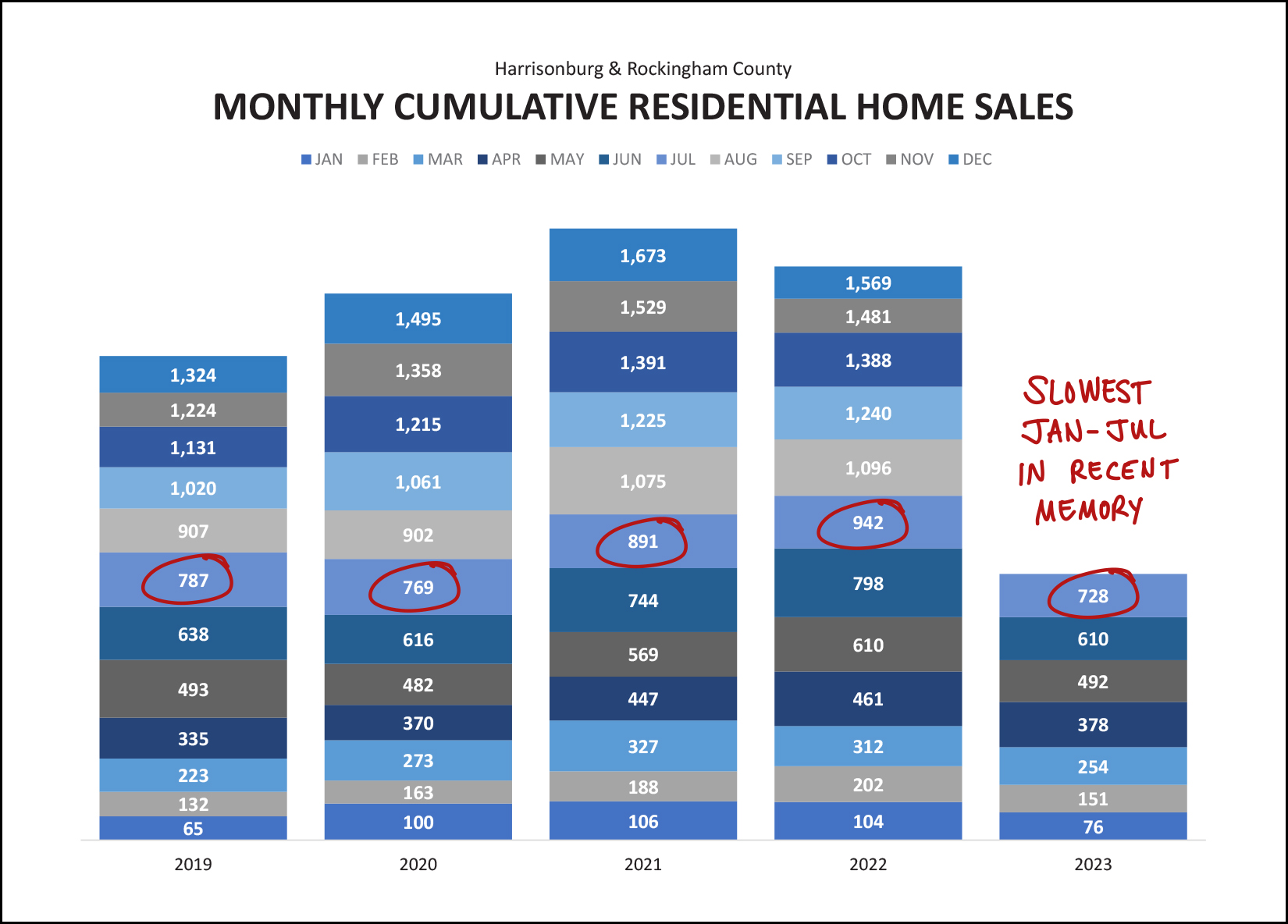

Happy Monday afternoon to you, friends! This monthly market report is one of some enigmas, some contradictions, some puzzlement. Some of these will be familiar, some new, some unrelated to real estate... [1] How can it be that we are seeing fewer home sales, but higher prices!? [2] So, contract activity is increasing, but inventory levels are also rising!? [3] How can I feel so young, yet have a son heading off to college this Friday!? :-)  Indeed, Luke heads off to Wake Forest University this Friday! We are tremendously excited for this next step in his life and educational journey, but we will miss him and his friends greatly as they head off in new directions. Swiveling quickly back to real estate before I spend too much time thinking about the aforementioned major life transition (!!) I'll point you towards a few of my current listings that might be of interest... 9926 Goods Mill Road - A spacious home / farmette on 3.3 acres with wonderful mountain views in the Spotswood High School district. $585,000. 150 Autumn Bluff Drive - A like-new, upscale, custom-built, single-level home in Autumn Breeze on a large corner lot. $445,000. 1210 King Edwards Way - A four bedroom home in the City with an attached two car garage and a large back deck. $389,500. 3211 Charleston Boulevard - An upscale townhouse in Preston Lake with a two-car garage with access to many amenities. $375,000 Congers Creek Townhomes - Three-level, new construction townhomes across Boyers Road from Sentara RMH Medical Center. $306,900 and up. And finally, before we get to the real estate data... Each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included Jimmy Madison's, Red Wing Roots tickets and The Little Grill. Now, then, on to the data. You can likely skim this chart of data rather quickly to get a sense of what I'm going to say...  Regardless of the timeframe outlined above... [1] We are seeing fewer homes selling now than in the recent past in Harrisonburg and Rockingham County. Year to date (Jan-Jul) we have seen a 23% drop in the number of homes selling as compared to last year. [2] We are seeing higher and higher sales prices in Harrisonburg and Rockingham County. Year to date (Jan-Jul) we are seeing a median sales price that is 11% higher than a year ago. Here's a month-by-month visualization of those slower sales we're seeing this year...  The grey line above shows the average number of home sales per month between 2019 and 2022. You'll note that a typical trend is to see more and more home sales (closings) as we move from April through June before starting to see things decline a bit in July. The blue line above shows last year, when April, May and June were well above where we might have expected them to be. Then, there's this year... the red line. We just haven't seen the typical boost in home sales during April, May and June that we would usually expect to see. In fact, July was the third month in a row of between 110 and 120 home sales. So, this year is not a typical year. We are experiencing a much lower spring and summer in the local real estate market. Why, you might ask? Likely because of mortgage interest rates -- which are quite a bit higher than over the past few years -- and because there aren't as many homeowners selling their homes. Stacking all of those months on top of each other, you can see how this year compares to previous years, thus far...  Clearly, this year seems unlikely to come anywhere near the level of sales seen over the past few years (2021 and 2022) and we're likely to finish out the year with fewer home sales than in 2019 and 2020 as well. Here's an illustration of that puzzling increase in sales prices and decline in the number of homes selling...  This is, as some of you would undoubtedly point out, both puzzling... and not. Typically, if demand decreases, sales decrease, and prices decrease. But despite fewer home sales (as shown above) we are not seeing prices decline. Which means... we are not seeing a net overall decrease in demand... but rather... a decrease in supply. So long as home prices keep climbing, I think the decrease in the number of home sales can be almost entirely attributed to fewer sellers selling. Given fewer homeowners being willing to sell, we're likely going to need new construction homes to fill in the gap to help meet buyer demand...  Overall, over the past few years, we have seen new home sales (green bars above) increasing. After only 219 new home sales in 2020, that climbed to 405 in 2022... leading to one in four (26%) homes selling being new homes. We are still seeing similar (75% / 25%) numbers this year. During that same timeframe (2020-2022) we saw a decline in existing home sales... from 1,276 existing home sales in 2020 down to 1,159 existing home sales in 2022. I expect we will see even fewer existing home sales in 2023 based on data from the first seven months of this year. Now, here comes a surprise this month...  Last year we saw a month after month decline in contract activity as we moved from May through July. This year we started to follow that same trend as we saw fewer home sales in June that in May. But, then, July. Contract activity was quite a bit higher than I expected it would be in July 2023. In fact, this was the month with the largest number of contracts signed thus far in 2023. And yet, two other indicators keep me scratching by head a bit...  Despite that uptick in contracts being signed in July 2023... the number of pending (under contract) homes followed its normal seasonal trend of declining slightly between May and July. There are (as shown above) 252 homes under contract in Harrisonburg and Rockingham County right now... which is lower than a month ago (261) and lower than a year ago (297). Furthermore...  Despite lots of homes going under contract in July... inventory levels jumped up quite a bit (131 to 177) in a single month's time. This brings current inventory levels to the highest point that we have seen anytime in the past year. I'll take a closer look at some of these overall trends in the coming days to try to dial in whether there is another story to be told and understood. For now, it's clear that there are quite a few more listings on the market now than anytime of late. Moving through the next few months, it will be interesting to watch... [1] Will inventory levels bounce back downward after buyers have a chance to contract on some of these new listings? [2] Will we see more price reductions on listings as sellers have slightly more competition from other sellers in some price ranges and with some property types? [3] Will we see homes staying on the market longer than they have in the past? I don't know that we need to instantly jump to any conclusions about this increase in inventory levels, but the data over the next few months will help color in the picture of whether we are seeing any sort of a transition in our local housing market. Speaking of median days on the market... is it starting to rise?  Mmmm... nope. Most homes (at least half of them) are still going under contract very quickly (in six days or less) in Harrisonburg and Rockingham County. This metric will continue to be helpful to gauge whether buyer enthusiasm is slowing at all in the local market. What could slow buyer enthusiasm, you ask? How about those mortgage interest rates!?  Don't look too far back on the chart above or you'll note that 2.8% mortgage interest rate two years ago. Wow! Even if we ignore the first year (first half) on the chart above, we still see a significant increase in mortgage interest rates over the past year... from 5.3% to 6.8%. We still aren't seeing any relief in sight with mortgage interest rates. Yet. I am hopeful that we move through the remainder of 2023 we'll start to see mortgage interest rates settle down a bit... but I'm guessing they will almost certainly stay above 6%. So, given all of the data above, what should you be thinking about if you are a home buyer, seller or owner? Home Buyers -- Many new listings are still seeing plenty of action... so you very likely may still find yourself in a competitive offer situation... but not always. Understand how current mortgage interest rates affect your potential monthly mortgage payment... and get out there quickly to see new listings. Home Sellers -- You might talk to friends who saw their home go under contract within three days with multiple offers. You might talk to other friends who have had their home on the market for three or four weeks without an offer. Both of those market realities currently exist... and it varies based on price range, property type, location, and many other factors. We need to take a close look at your corner of the local real estate market to devise a reasonable and realistic pricing and marketing strategy for selling your home in a timeframe that suits your needs. Homeowners -- Enjoy your ever increasing home value. If you're talking to a friend who is trying to buy a home, don't mention your mortgage rate, or how glad you are that you already own a home. ;-) And... that's all for today. I hope that the remaining days or weeks of your summer break (if you had one) are enjoyable, and that the start to the school year goes well for you if you are a parent, teacher or administrator. As always, feel free to reach out to me if I can be of any assistance to you as you make plans to buy or sell. You can reach me most easily at 540-578-0102 (call/text) or by email here. | |

Adjusting Our Thinking About Time On Market |

|

For the past three years we have seen most homes going under contract very quickly. The median days on market (# days between list date and under contract date) has been at or below seven days for 33 out of the past 36 months. But now, some properties seem to be lingering on the market a bit longer than they might have over the past few years. A few related thoughts come to mind based on recent conversations with a variety of sellers, future sellers and fellow agents... [1] The median was always just the median - not the all. :-) When the median days on market was five days -- which it was for about a year -- that didn't mean all homes were going under contract within five days -- it meant that at least half of them were. Thus, there were plenty of homes that were taking longer than five days to go under contract. [2] In the six months leading up to the start of the Covid-19 pandemic, we were seeing median days on market between 14 days and 21 days. As such, if (or when) we see the median days on market figure start to drift upwards there is a lot of room for it to rise before it gets to levels we were seeing prior the past 3.5 crazy years. [3] Flipping backwards five (and six) years -- the median days on market was 29 days (in the 12 months leading up to and including July 2018) and was 42 days (in the 12 months leading up to and including July 2017). [4] It will be a jarring reality for some (or many) home sellers over the next few years if it is taking a month or two for houses to go under contract -- instead of just a week or two. [5] If or as the market continues to adjust relative to how quickly homes are going under contract -- we are going to have to adjust our thinking about "time on market" -- and realize that just because a house isn't under contract within a week, or two, or three -- that doesn't mean it's a terrible house that nobody will ever want to buy. | |

Two Startling (Nationwide) Stats That Show Why Many Homeowners Are Not Likely To Sell Within The Next Few Years |

|

Current mortgage interest rates for a 30 year fixed rate mortgage are averaging at 6.9% per Freddie Mac. Here are the two startling statistics as reported by Business Wire as well as by many others over the past few months... [1] 82% of homeowners have a mortgage interest rate below 5%. An enormous share of homeowners have super low mortgage interest rates on their homes because they bought their home between 2020 and 2022 when we were seeing ridiculously low, historically low, mortgage interest rates -- or they refinanced their mortgage during that time. Most of these 82% of homeowners with a mortgage interest rate below 5% are rather unlikely to sell their home (and pay that off) and buy a new home at current mortgage interest rates that are near 7%. [2] 60% of homeowners with mortgages have lived there for four years or less. We saw record numbers of home sales between 2020 and 2022, as the Covid-19 pandemic (and super low mortgage interest rates) prompted lots of folks to buy a home. Many homeowners eventually find that their home doesn't work as well for them -- based on size, layout, features, etc. -- but that doesn't usually happen within four years. As such, many or most of these 60% of homeowners who have been in their homes for less than four years are not likely to be selling anytime soon. What does all of this mean for our real estate market? We are likely to continue to see low numbers of resale homes coming on the market over the next few years as more homeowners opt to stay put rather than selling their home that likely has a super low mortgage interest rate - and that likely is a home they purchased in the past few years. | |

We Are Starting To See A Few More Homes With Price Changes These Days |

|

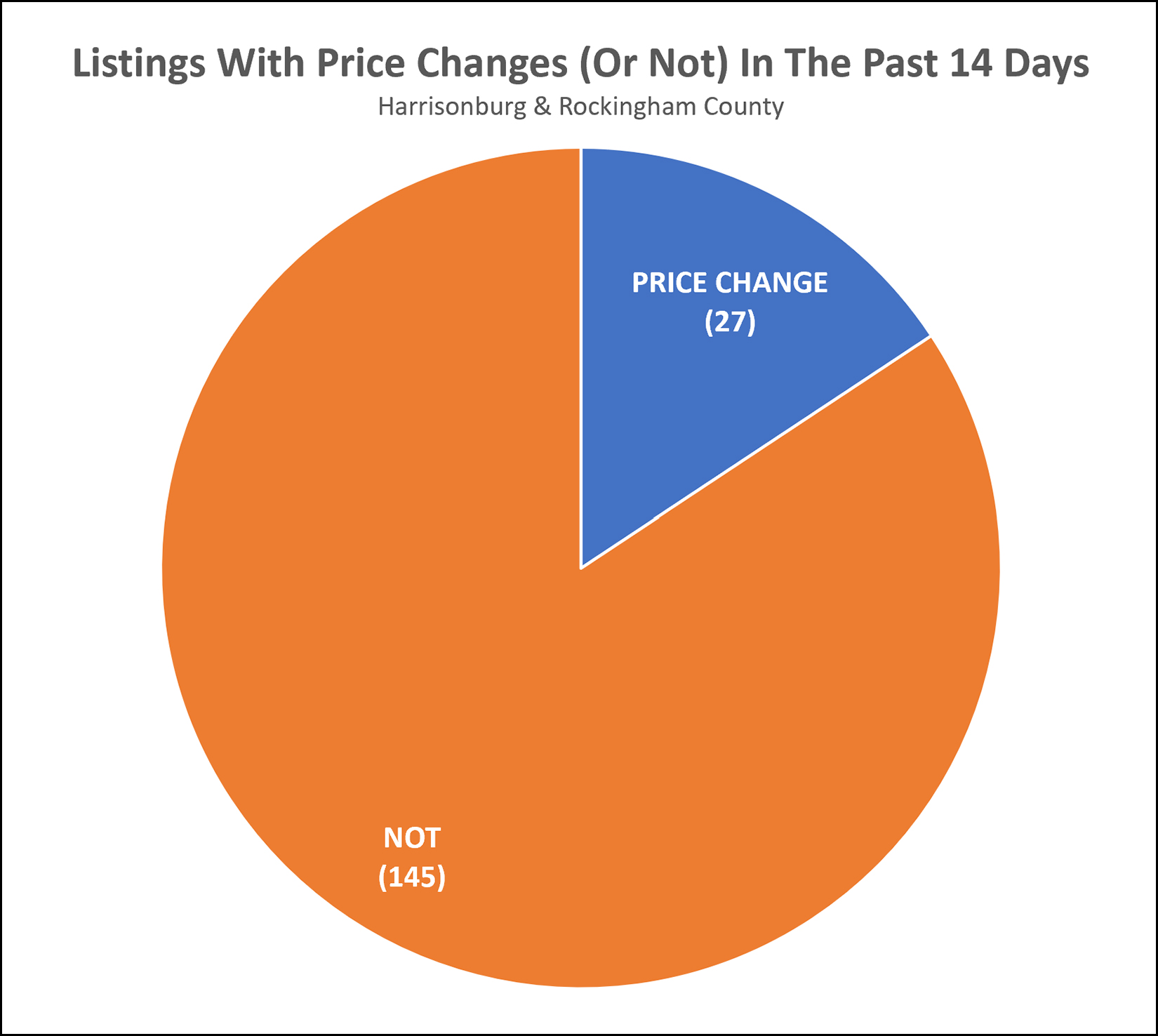

There are 172 active listings (homes for sale) in Harrisonburg and Rockingham County right now. Of those... 27 have had price changes in the past two weeks... and 145 have not. I don't think this number of price changes suggests that homes are selling for less... or that home prices are or will be declining... but some home sellers seem ready to start make adjustments in their asking price if their home is not going under contract as quickly as anticipated. | |

Quite A Few Home Buyers (And Sellers) Signed Contracts In July 2023 |

|

Looking back at the number of contracts signed last month in Harrisonburg and Rockingham County -- there were 133 contracts signed. These 133 contracts signed in July 2023 were... [1] The most contracts signed in a single month thus far in 2023. [2] About 17% more contracts than were signed last July. But... when you look (above) at all of last year and this year thus far, you'll see we never experienced the 150+ contracts per month that we saw last March, April and May. So, perhaps the pace of contract activity is picking up a bit as of last month... but we are still well behind where we were a year ago. | |

How Quickly Your Home Will Sell Might Depend On The Price Range |

|

The "Median Days On Market" in Harrisonburg and Rockingham County is six days... that is to say that half of homes go under contract in six or fewer days and half go under contract in six or more days. That is based on home sales in the first half of 2023. But... when we zoom into some different price ranges we start to see a slightly different story. The median Days On Market for homes over $500K is 10 days... ...for homes over $600K is 25 days... ...for homes over $700K is 35 days... ...and for homes over $800K is 70 days. So, yes, market-wide, the median Days on Market is six days... but that doesn't necessarily mean your home will go under contract in about six days... especially if it is in one of the upper price ranges for our area. | |

Far Fewer Homes Are Selling, But Sales Prices Keep Rising |

|

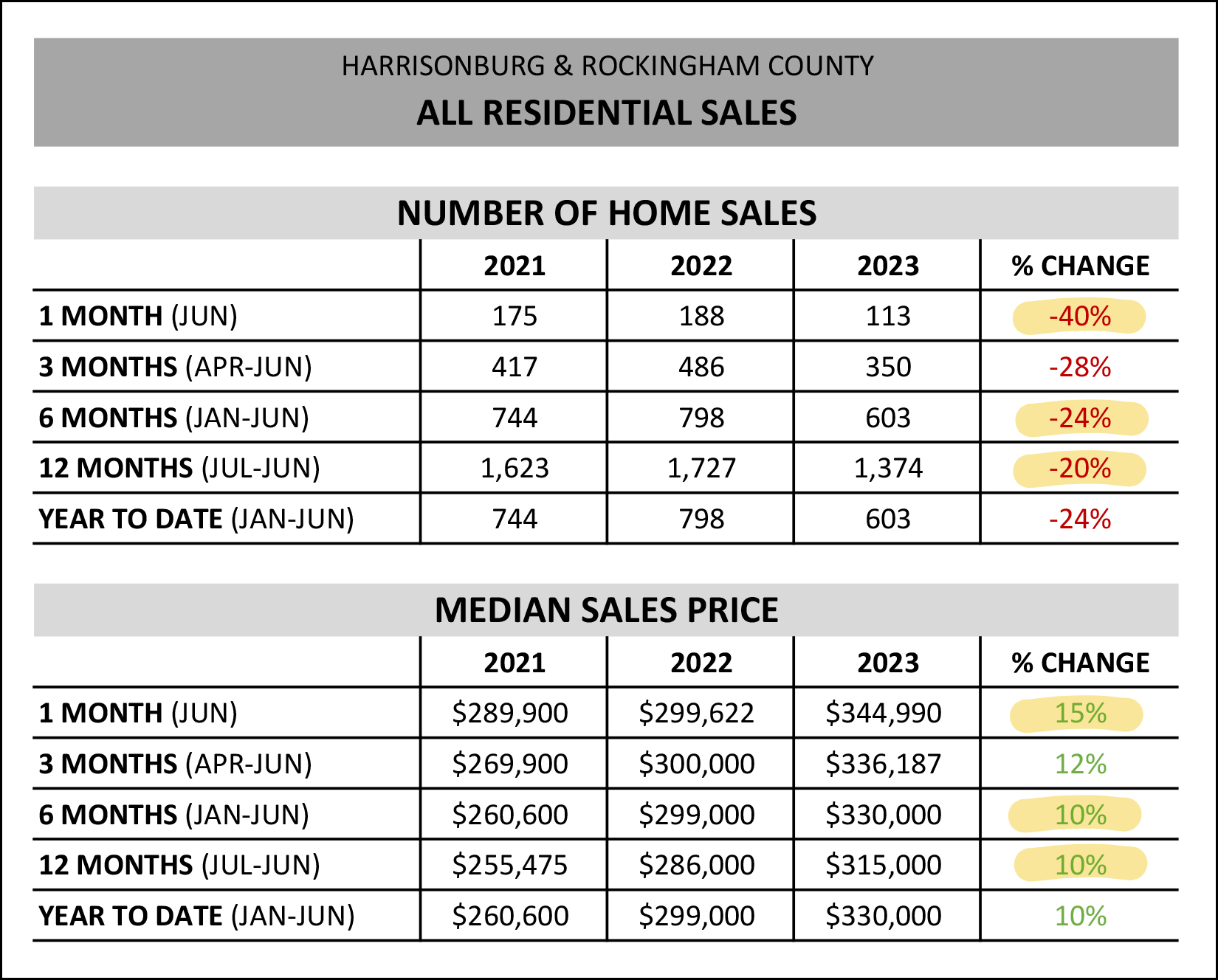

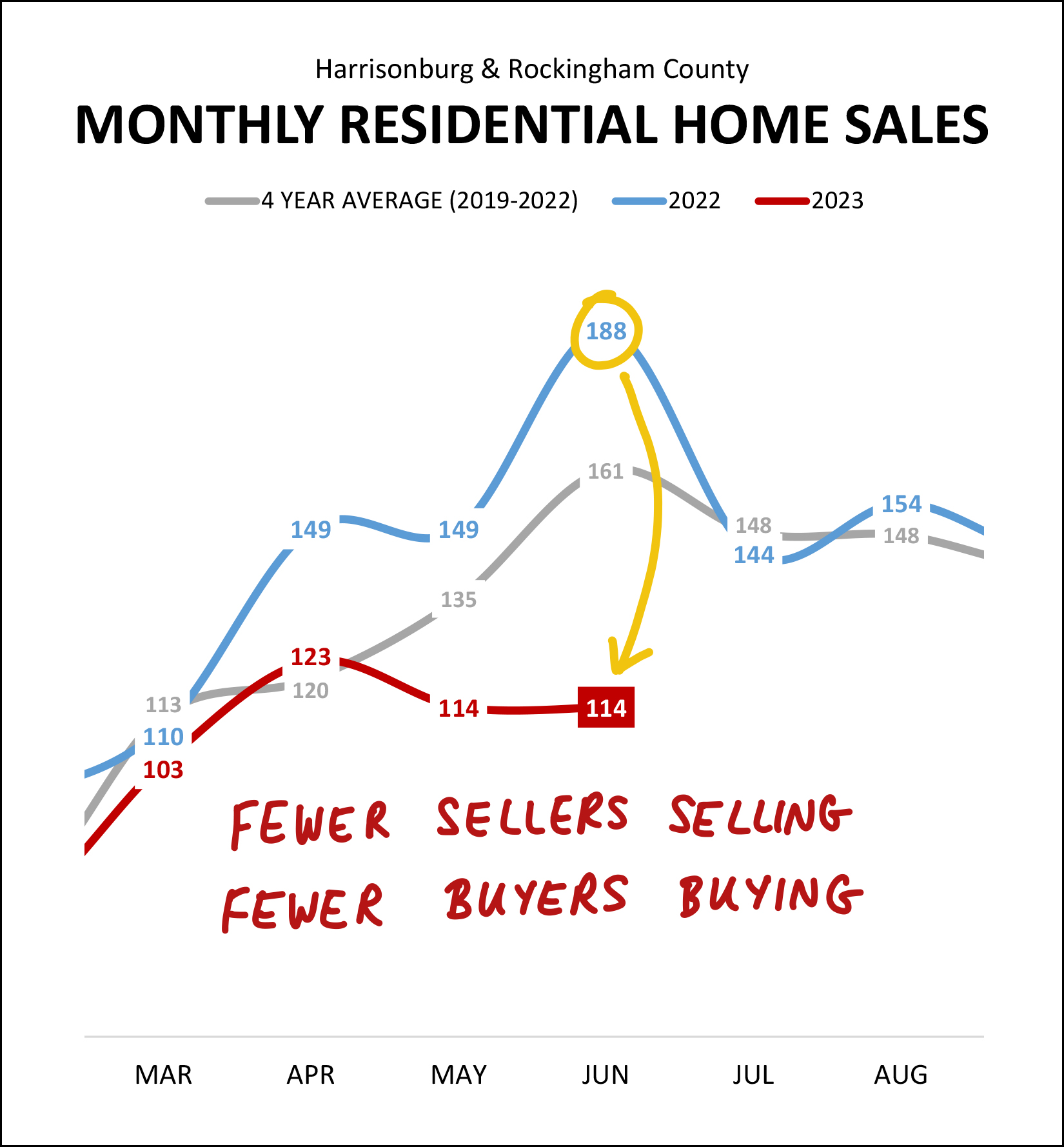

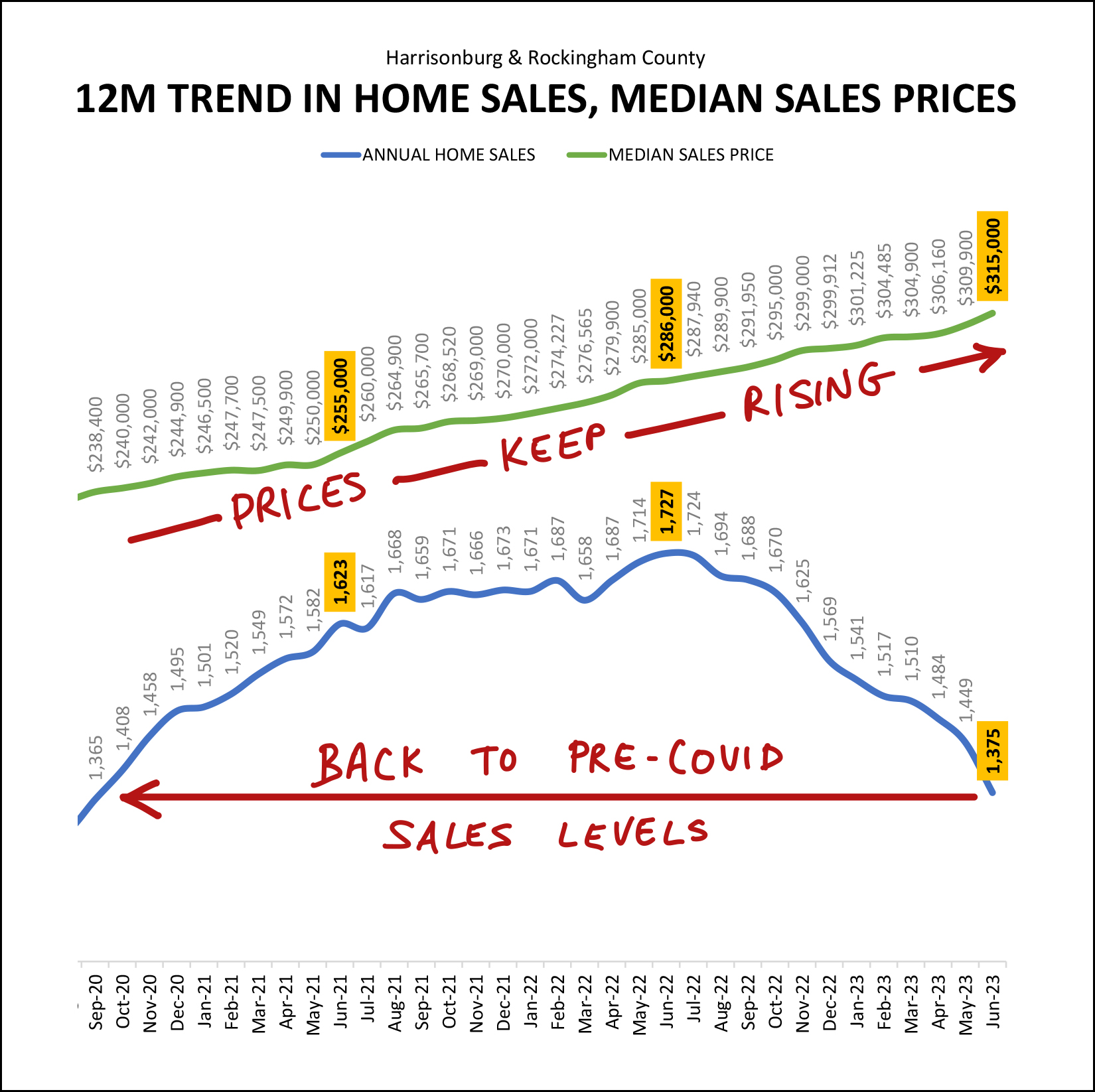

Happy Friday Morning, Friends! As per the headline above, far fewer homes are selling this year, but sales prices keep rising. But before we dive into it... First, if you're looking for a spacious four bedroom home in a neighborhood in the Spotswood High School district, be sure to check out 350 Confederacy Drive... This beautiful, well maintained house in Battlefield Estates has had many updates over the past few years and is currently listed for sale. Find out more at 350ConfederacyDrive.com. Second, I hope you have had a fun first half to your summer. The weeks are flying by and before you know it, we'll be thinking about and planning for the coming school year. I was out of town for a few days last week for some fun on the water...  I have always loved water skiing but in recent years I have become the boat driver so it was great to have Luke drive this year so I could ski again. It was a fun and relaxing time away with family, and I hope you find time to have fun this summer as well... whether at the lake, at the beach, or right here in the beautiful Shenandoah Valley. Third, and finally before we get to the market data, each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included Red Wing Roots tickets, The Little Grill, and Cuban Burger. This month I am giving away a $50 gift certificate to Jimmy Madison's... located in downtown Harrisonburg. If you find me at Jimmy Madison's, I'll be enjoying one of many favorite items from their fantastic menu... but always with a side of their delicious Jimmy Sprouts -- Caramelized Brussels Sprouts with sweet pecans, candied bacon and honey thyme vinaigrette. I'm getting hungry just talking about them! Click here to enter to win the $50 gift certificate to Jimmy Madison's. Now, on to the data...  As shown above... [1] There were only 113 home sales in June 2023, which was a 40% decline from last June. We'll see this visually in a graph in a bit. [2] We've seen 603 home sales in the first half of the year which is a 24% decline from the first half of last year. This is the "far fewer homes are selling" part of my market report. [3] If we stretch back a full year (12 months) we will find 1,374 home sales -- a 20% decline from the 1,727 home sales seen in the 12 months before that. So, regardless of how you slice or dice the data, fewer homes are selling in Harrisonburg and Rockingham County this year than last. But... [4] The median sales price in June 2023 ($344,990) was 15% higher than last year when it was $299,622. [5] The median sales price in the first half of 2023 ($330,000) was 10% higher than the first half of 2022 when it was $299,000. [6] The median sales price over the past 12 months ($315,000) was 10% higher than in the in the 12 months before that when it was $286,000. As such, regardless of how you look at it, the median sales price is still on the rise in Harrisonburg and Rockingham County, despite far fewer homes selling. Here's a visual of the drop off in the number of homes selling...  The blue line above shows the number of homes selling per month last year -- compared to the red line which shows this year's home sales. As is quite evident, the number of homes selling has been far lower this year than last, particularly over the past few months -- April, May and June. The grey line above shows the average number of home sales per month based on the past four years (2019-2022) of data. When looking at all three lines together it becomes clear that home sales last year were significantly above historical averages and home sales this year are now (particularly in May and June) significantly below historical averages. As I'll continue to discuss throughout this report... this decline in the number of homes selling is (perhaps obviously) both a result of fewer sellers selling and fewer buyers buying. We need both a seller and a buyer for a home sale to take place. As we'll see in later graphs, inventory levels remain low -- so it seems likely that the main constraint on home sales is the number of sellers selling... not a limit on the number of buyers who would like to buy. But before we get to inventory levels, let's look at a slightly longer historical perspective...  The blue line above shows the number of home sales per year, updated each month. This snapshot looks back to late 2020 (in the thick of Covid) when home sales were surging upwards, from 1,365 annual sales all the way up to 1,727 annual sales. But over the past year we have seen annual sales steadily drop... all the way back down to 1,375 sales per year... about the same place as where we were in the early months of the pandemic. If the pandemic (and low mortgage interest rates, and lots of people working from home) drove the number of annual home sales up over the course of two years... it was immediately followed by much higher mortgage interest rates driving the number of annual home sales down over the course of the most recent year. When the number of home sales in our market was surging in 2020, 2021 and 2022 it certainly made sense that home prices were rising steadily, as shown in the green line above. But over the past year, even as the number of homes selling has declined, and even with higher mortgage interest rates, we have continued to see home prices keep on rising. This (ever higher prices) is an indication (along with continued low inventory levels) that the limitation of the number of homes selling is almost certainly primarily a supply side issue -- not enough sellers being willing to sell. To put rising home prices in context... take a look at this change in the median sales price in our local market over the past four years...  The median sales price in Harrisonburg and Rockingham County has increased by more than $100,000 over the past four years. Wow! Four years ago your purchase of a median priced home would have had you spending $223,000 -- and today you'd be spending $330,000. This is certainly wonderful news if you have owned a home over the past four years -- or if you bought a home four years ago -- and less exciting news if you do not own a home and/or have been trying to buy a home for any or all of the past four years. It is important to note that these figures are not adjusted for inflation. I'll take a look at that separately, hopefully soon, as we have seen significant changes in what a dollar buys you over the past few years -- not just with houses, but across the majority of the economy. As should come as no surprise, the precursor to fewer home sales is... fewer contracts being signed...  As to the point I made earlier, the blue line above (last year's monthly contracts) was certainly above the historical average (grey line) but this year's trajectory of monthly contracts (red line) is well (well!) below historical averages. Looking ahead to home sales for the rest of the summer and into fall, we are likely to see continued to declines in home sales based on continued low levels of contracts being signed. As mentioned previously, one of the main reasons why we are seeing fewer home selling... is because there are fewer sellers selling...  Over the past four years (grey line above) we have seen an average of 180 to 190 homes for sale as we have rolled through March, April, May and June. This year (red line above) we have seen between 116 and 136 homes for sale during those same months. Inventory levels are remaining low despite far fewer home sales. This is the data point (alongside continued increases in the median sales price) that seems to rather clearly confirm that the decline in home sales is almost entirely related to fewer sellers selling -- and not fewer buyers wanting to buy. Across many (though not all) price ranges and property types, home buyers keep snatching up most new listings that come on the market -- which is keeping inventory levels quite low. How quickly are those new listings getting snatched up, you might ask? That is most readily measured via the "days on market" metric...  The graph above tracks the median "days on market" metric -- looking at six months of data at a time. As such, the most recent data point of a median of six days on the market is based on January 2023 through June 2023 home sales. After dropping, dropping, dropping to a median of only four days on the market in mid-2021, we saw a steady report of a median of five days on the market all the way through the end of 2022. But then, it seemed that things might be changing as the median days on market crept up to eight days on the market in early 2023. But... maybe not, after all... as median days on market has shifted back down to only six days over the past few months. If we ever see a significant shift in market balance -- with more sellers trying to sell than there are buyers to buy -- we are likely see that reflected in this median days on market metric. As is likely evident from the graph above, we're not seeing that type of market shift right now, despite far fewer homes selling this year than last. Finally, how about those mortgage interest rates. :-/  Please only looking briefly (and wistfully) at that 3.02% rate from two years ago... and then focus more on the past year. We have seen relatively volatile mortgage interest rates over the past year -- starting at 5.7%, ending at 6.7%, drifting as high as 7.1% and as low as 6.1%. It seems likely that we will continue to see mortgage interest rates over 6% for the balance of 2023... though home buyers would certainly love to see that be closer to the 6.31% seen in January rather than the 6.7% at the end of June or the 6.96% seen this week. Having sifted through all of the data above, what does it all mean for current home sellers and would be home buyers? Home sellers are likely to still do quite well in the current market, as the median sales price keeps rising and inventory levels (your competition) remain quite low. Home buyers are likely to continue to have difficulty securing a contract on a home as we move through 2023 due to fewer sellers selling, homes still going under contract very quickly, and likely competition from other buyers for many new listings. If you are planning to sell your home, or buy a home, in the coming months I would be happy to chat with you about how your segment of the local housing market (based on location property type and/or price) is performing as it compares to the overall market. Feel free to reach out to me if I can be of any assistance to you as you make plans to buy or sell. You can reach me most easily at 540-578-0102 (call/text) or by email here. Until next month, I hope you find some time to disconnect and enjoy the summer season with your family, friends and loved ones... and if you need me to drive the boat while you water ski... just let me know... ;-) | |

Do We Care How Many Homes Are Selling, Or More About Their Sales Prices? |

|

Each month I publish a comprehensive report on our local housing market. A few years back, after I published a report showing that sales had risen by _% and prices had risen by _%, one of my past clients shared an interesting perspective. He said, I don't care if there are 20% more home sales, or 20% fewer home sales this year... what I care about is the prices that were paid for those homes! I get his point. If home values rose 3% per year over a 10 year period, would you, as an individual homeowner, care if the number of homes selling for year bounced back and forth from 500 to 700 to 400 to 800? Probably not. You might find it interesting to see so much variation in the number of homes selling per year - but you'd mainly be focused on how the prices of those homes changed over time. I'll publish my latest market report later this week if all goes well, and it will likely include statistics somewhere along the lines of... Home Sales Decline 15% - 20% Median Sales Prices Rise 10% So, far fewer homes selling... but at much higher prices. Circling back around to my client's point... will we care? Should we care? If continue to see fewer and fewer home sales per year over the next two to three years... do we care about that decline, if home prices keep on rising? Existing homeowners probably wouldn't care. The number of homes selling per year wouldn't seem to impact them much. Home sellers would likely be glad. Fewer homes selling means less competition -- so long as inventory levels stay relatively low. But (wannabe) home buyers, yeah, they won't be thrilled to see a decline in the number of homes selling. That decline means there are fewer homes that they can attempt to buy - assuming that inventory levels stay relatively low. So, if the number of homes that sell continues to decline, but prices continue to rise, will we care? It depends on who the "we" is. | |

How Could Housing Market Affordability Be Restored? |

|

Here's an interesting article for your perusal... If you can't access the entire article, here's the gist of it... There are three levers that can ease housing affordability:

As per this article... "A new housing report put out by Morningstar expects mortgage rates will indeed be the primary lever that helps to ease housing affordability." "As of Friday, the average 30-year fixed mortgage rate tracked by Mortgage News Daily stands at 7.14%. Morningstar expects that’ll trend down in the second half of the year, and we’ll average 6.25% for 2023. Morningstar’s forecast model then expects mortgage rates will average 5.00% in 2024 followed by 4.00% in 2025." The entire article is worth a read. Other groups putting out predictions for future mortgage interest rates aren't thinking they'll get as low as Morningstar predicts, but they do think they will decline over the next few years. The last paragraph of the article holds a key reminder... "When it comes to mortgage rate and home price forecasts, it might be best to take them with a grain of salt. Uncertainty in the economy makes it hard to predict both mortgage rates and house prices." So... you certainly shouldn't count on lower mortgage rates in the future (relative to either waiting to buy until rates drop, or buying now with a plan/need to refinance to a lower rate later) but it is interesting to see multiple groups now predicting lower mortgage interest rates over the next few years. That change would be welcomed by home buyers! | |

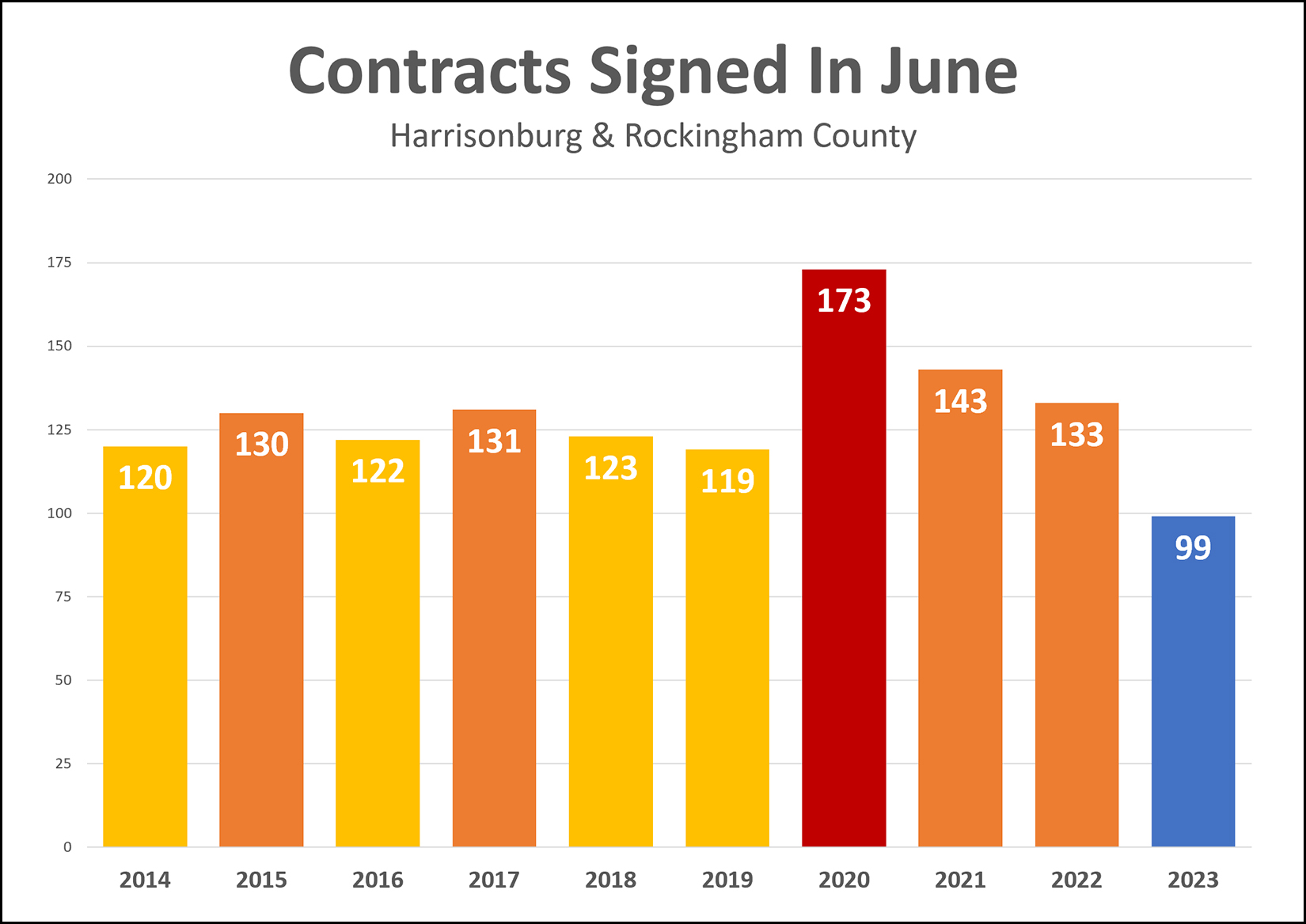

Contract Activity In June 2023 Was The Slowest It Has Been In A Decade, Much To The Dismay Of Would Be Home Buyers |

|

It remains a tough time to buy a home in many or most price ranges and locations -- with limited resale inventory leading to continued low levels of contract activity. As shown above, the 99 contracts that were signed in Harrisonburg and Rockingham County in June 2023 was the lowest number of contracts signed in a month of June for the past decade. At first glance some might assume that the low number of signed contracts is an indication that fewer buyers want to buy homes right now -- but with inventory levels starting the month low and ending the month low -- the bottleneck seems to be almost entirely on the supply side of the equation. There aren't enough sellers willing to sell their homes. Getting into the details of new homes versus resale homes for a moment, let's take a look at the highest and lowest data points... June 2020 = 124 resale homes + 49 new homes = 173 total contracts June 2023 = 73 resale homes + 26 new homes = 99 contracts So, if we take out new homes, not only did only 73 buyers sign contracts to buy home in June 2023 compared to 124 in June 2020... only 73 sellers were willing to sell their homes in June 2023 as compared to 124 in June 2020. I don't expect we'll see much of an increase in resale homes being listed for sale as we continue through 2023, so any upside potential for increased contract activity likely lies on the new home side of the equation. If you were one of the 99 buyers to secure a contract to buy a home in June 2023... congrats! | |

Contract Activity In The First Half Of 2023 Was... Rather Slow |

|

It's the last day of the first half of the year! Wow! As such, I've taken a moment to look at contract activity in the first half of 2023 as compared to the first half of each of the nine years prior to 2023. As you can see, above, contract activity (buyers and sellers signing contracts) has been quite slow this year compared to every other year since 2014. Will we see contract activity ramp up in the second half of 2023? Maybe. But it will have to start with sellers being willing to sell. There are plenty of buyers ready to buy -- but not quite as many sellers willing to sell. | |

Homes Still Selling Quickly, At Record High Prices, Despite Decline In Total Home Sales |

|

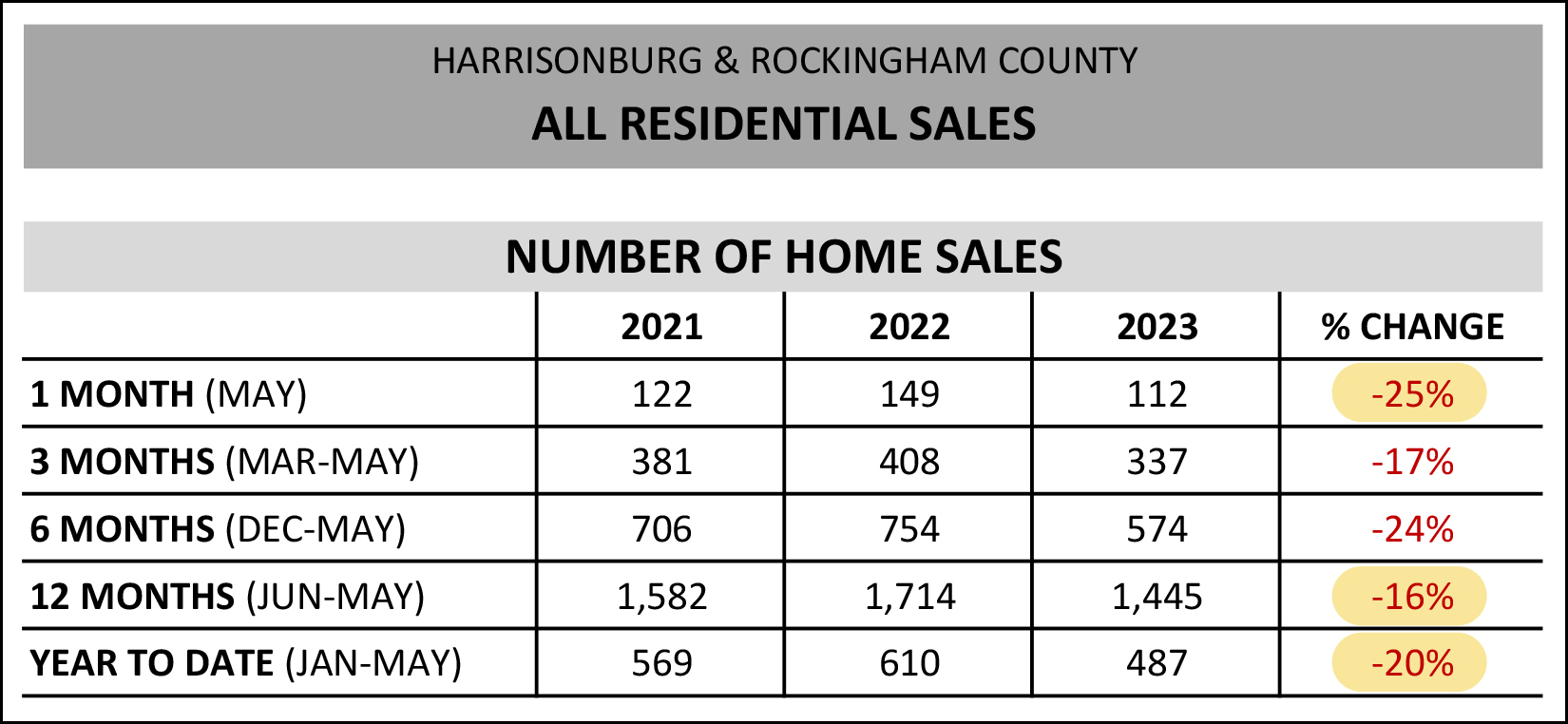

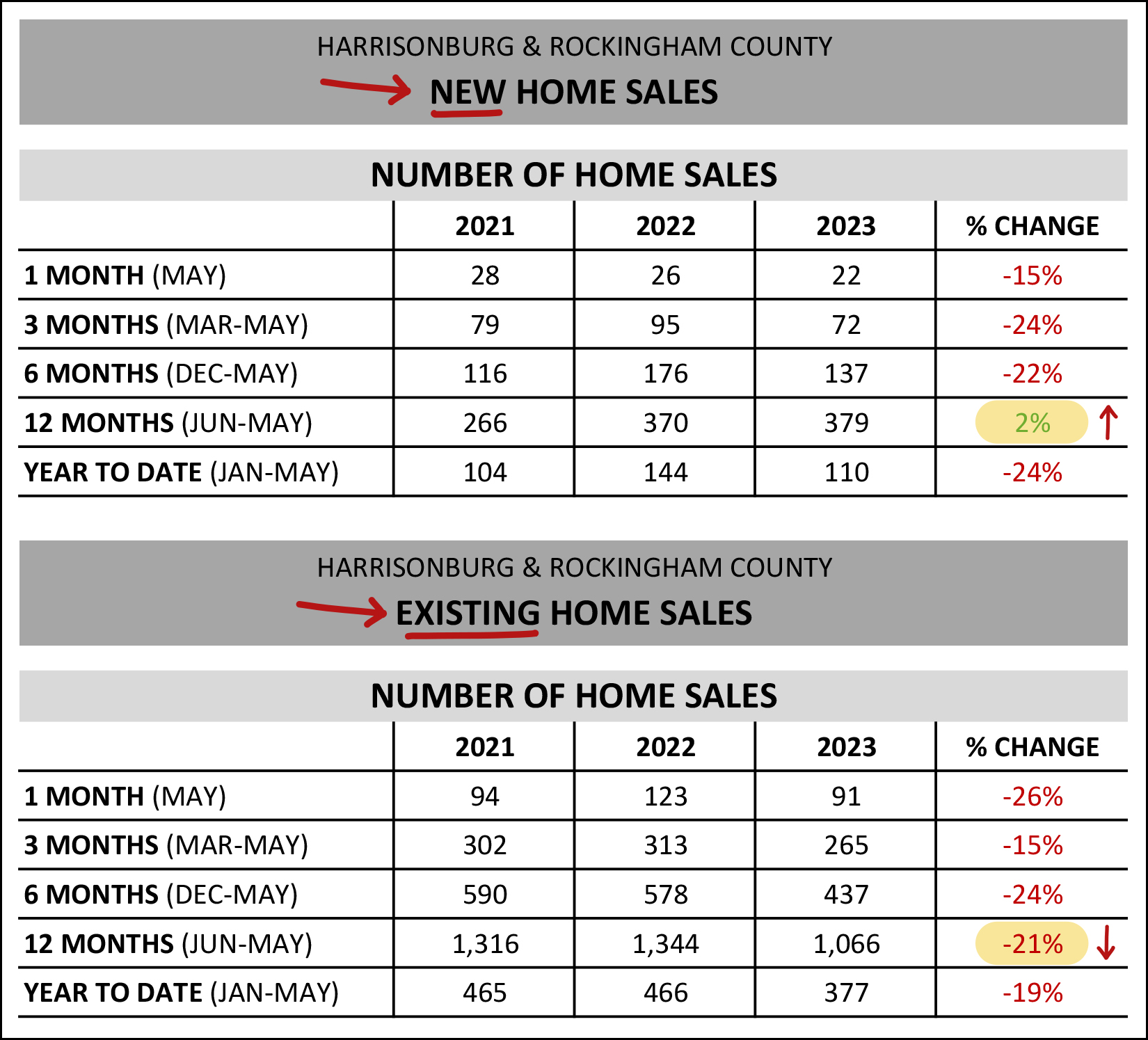

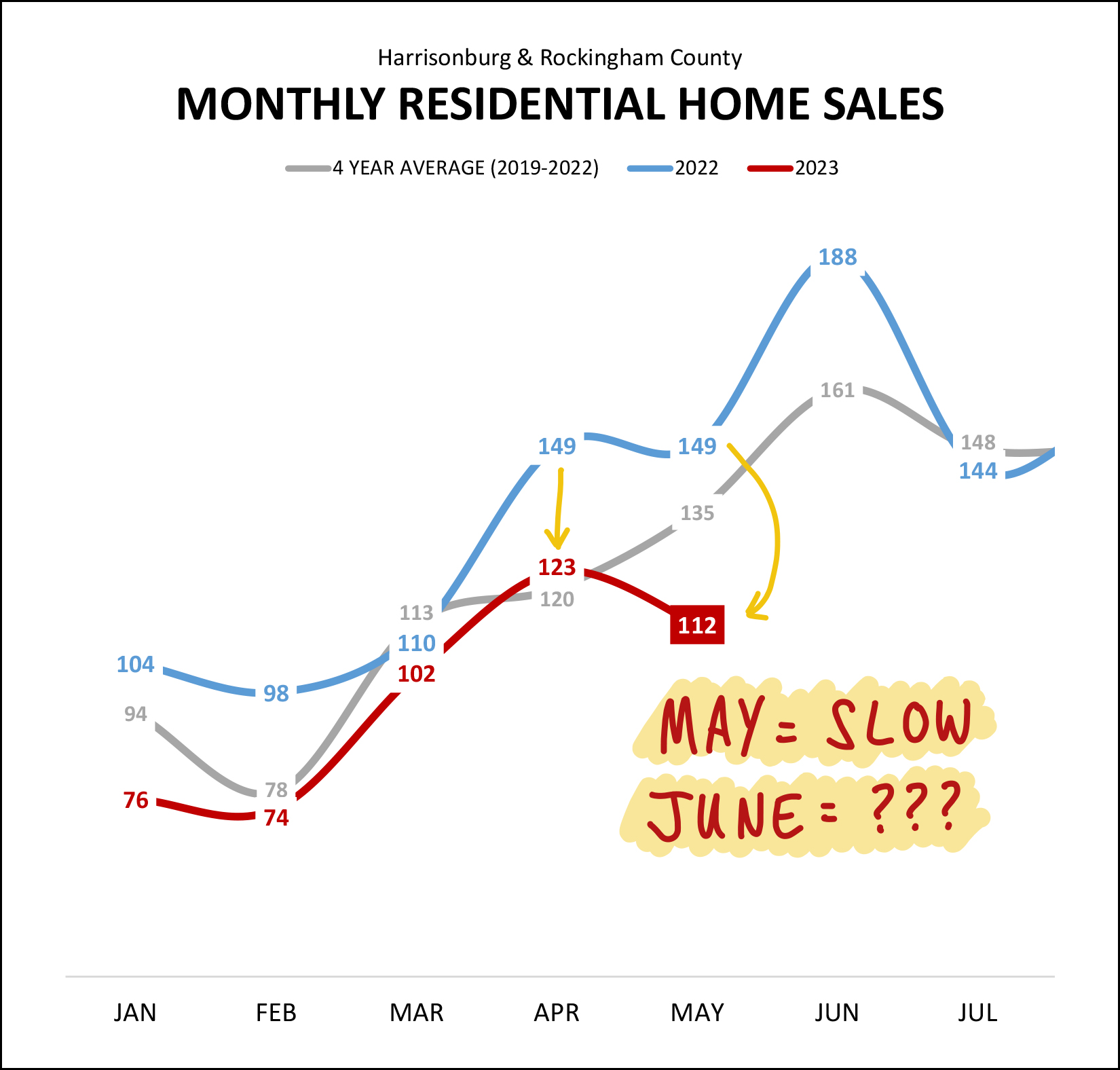

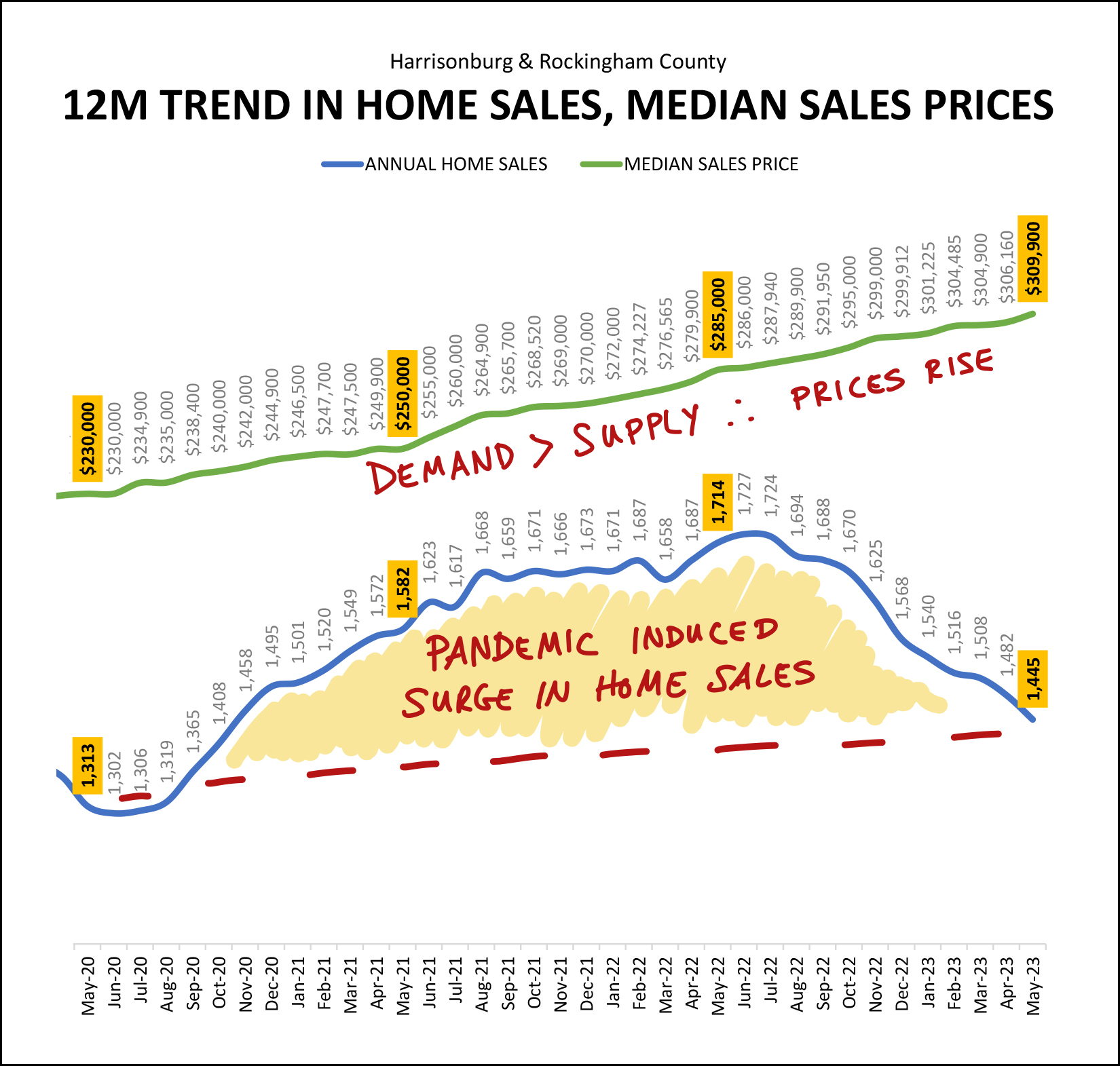

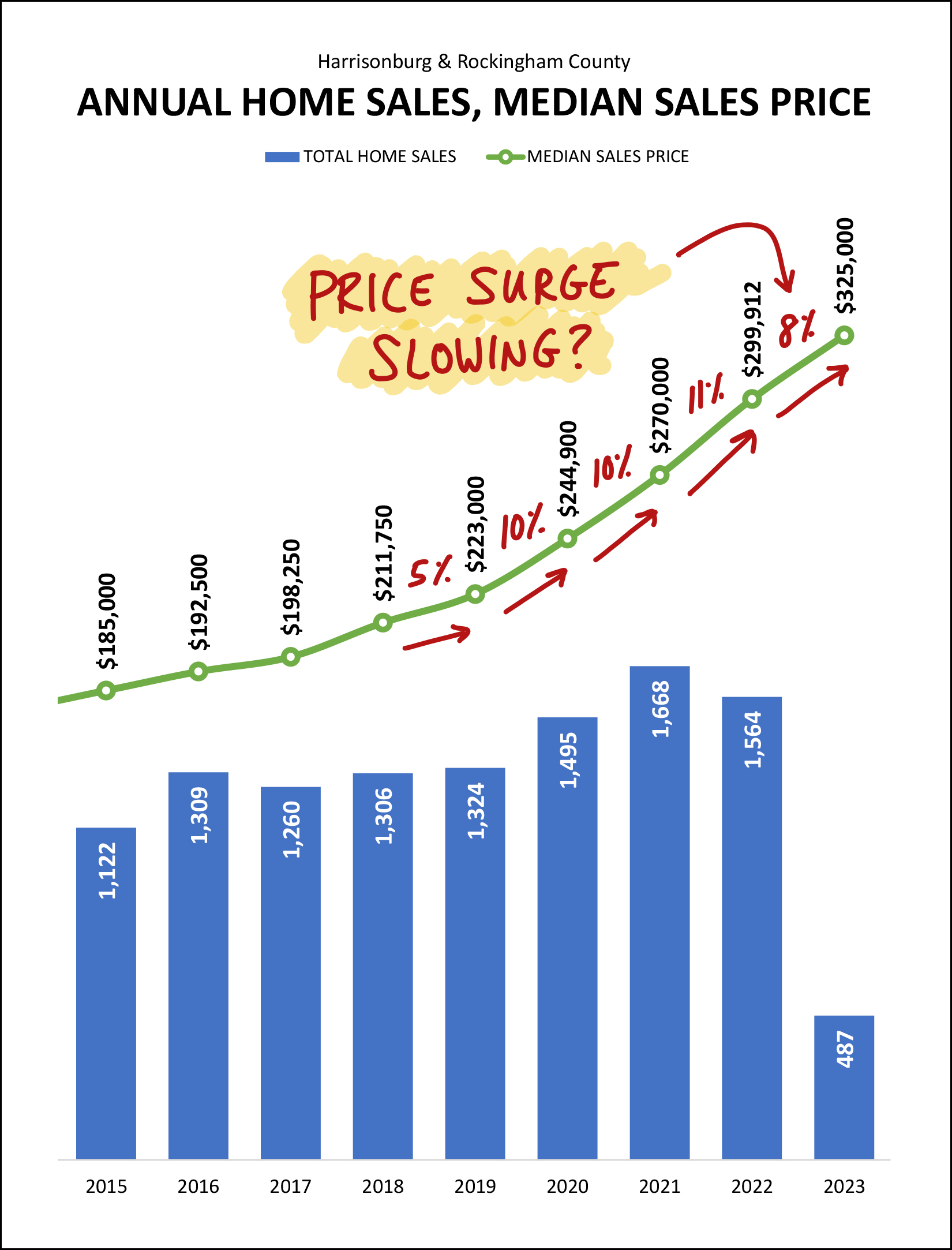

Happy Monday morning, friends! They say summer doesn't start until June 21st, but the 85 degree temps yesterday certainly felt like summer. Regardless of the formal start of the season of summer, most students have finished out their school year now, which also certainly makes it feel like summer. One such student who finished up his school year is this guy, below. Luke has now officially graduated from high school! :-) We are delighted for his accomplishment of this major milestone, and are excited for all that lies ahead. And yes, Emily also finished up 9th grade! These kids they sure do grow up quickly!  Looking for a new (to you) house this summer? Look no further than this brand new listing (just listed this morning) in the City of Harrisonburg... Find out more about this spacious four bedroom City home on a large lot by visiting 3121HorseshoeLane.com. And finally, one last item of business before we get into the real estate data. Each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included The Little Grill, Cuban Burger and Taste of India. This super relaxing and family friendly music festival from June 23 - 25 at Natural Chimneys Park in Mt Solon features wonderful music (on multiple stages throughout the weekend), great food, lots of activities (hiking, biking, running, yoga, kids events), and all around great fun with family and friends. Have you considered going to Red Wing but haven't been yet? Maybe this summer is the time for you to make it one of your favorite family traditions. I am looking forward to being there with my family and I'm hoping you'll join in on the fun... from June 23rd through 25th. If you're interested in going to Red Wing but don't have tickets... I'm giving away a pair of three-day general admission tickets. Click here to enter to win the tickets... I'll pick a winner later this week. Now, on to the real estate data...  As mentioned in the headline, and as shown above, we're seeing far fewer home sales this year than last... [1] This past May (last month) we saw 112 home sales in Harrisonburg and Rockingham County, which marks a 25% decline from last May. [2] When looking at the first five months of this year, there has been a 20% decline in home sales compared to last year during the same (Jan-May) timeframe. [3] When looking at a full year of data (June - May) the number of homes selling in our area has declined 16%. A year ago we were seeing an annual pace of 1,714 home sales... and that metric has now declined to an annual pace of 1,445 home sales! But... fewer home sales has not resulted in lower sales prices...  As home sales have started to decline, some folks speculated that prices would also start to decline. That hasn't been the case, and I believe it's because the decline in sales is a supply side issue, not a demand side issue. There seem to be plenty of buyers still wanting to buy... but fewer sellers willing to sell. We need both a buyer and seller in order for a home sale to happen... so fewer sellers results in fewer home sales... but the continued ready supply of buyers is keeping competition fierce for most new listings, which is causing home prices to keep on rising. As shown above, the median sales price thus far in 2023 ($325,000) is 9% higher than it was a year ago ($298,400) and when we look at 12 months of data (June - May) we also see a 9% increase in the median sales price over the past year. I should point out that each month I prepare many more charges and graphs than make it into this report. You can also view those over at HarrisonburgHousingMarket.com including this month's charts and graphs here. One of the data subsets I dive into in the extra charts and graphs at the link above is the breakdown of new home sales vs. existing home sales...  As shown above, when we look at the past 12 months we see slightly different trajectories when it comes to new vs. resale homes... [1] There have been 2% more new home sales over the past 12 months as compared to the previous 12 months. [2] There have been 21% fewer existing home sales over the past 12 months as compared to the previous 12 months. Certainly, when we look at other timeframes above, we see declines in sales activity of both new and existing home sales, but it's worth nothing that a significant cause of fewer home sales in our market... is a lower number of homeowners who are willing to sell their existing (resale) homes. Why, might you ask? Mortgage interest rates are likely a key piece of the puzzle. Most homeowners have current mortgage interest rates under 5%, and many under 4%... compared to current mortgage interest rates that are above 6%. As such, the difference in mortgage payments is quite significant for a homeowner who would sell their home and pay off a mortgage with an interest rate under 4% (for example) to then take out a mortgage with an interest rate above 6%. I expect we will continue to see lower numbers of homeowners willing to sell their homes throughout the remainder of 2023. Getting into some visuals now, here's how slow May was...  After a 17% decline in April home sales (149 to 123) we then saw a 25% decline in May sales (149 to 112) which is almost certainly going to result in an even larger decline in June home sales... since there were a LOT of sales in June last year. As I have already mentioned, sales prices keep on climbing, so a decline in the number of homes selling isn't really a concern for home sellers, or homeowners, but it is not as exciting of news for would-be home buyers. We are likely to continue to see fewer home sales throughout the remainder of 2023 in Harrisonburg and Rockingham County... and it will be a result of fewer homeowners being willing to sell... not a result of fewer would be home buyers being interested in buying. Here's another visual of the general trends we're seeing in our local housing market right now...  We're still seeing a general increase in the number of homes selling per year if we compared pre-pandemic (early 2020 and prior) and post-pandemic (2023) but we've seen a steady decline in annual home sales over the past year, from 1,714 sales/year to 1,445 sales/year. So, after a steady increase in home sales during the pandemic (largely brought on by the pandemic - with super low mortgage interest rates and everybody needing their home to serve more functions than before) we have now seen a steady decrease in home sales as the pandemic has come to a close. We're returning to where we were pre-pandemic as far as how many homes are selling a year... with the home sales trendline being dragged down by a limited number of home sellers being willing to sell. There seem to still be plenty of buyers ready and willing and able to buy. With continued high levels of demand, but lower levels of supply, we have continued to see steady increases in sales prices as shown by the top line. That trendline (rising prices) seems unlikely to change course significantly anytime in the near future. But even if we aren't likely to see home prices stop rising, or to see them decline, perhaps we'll see a slight tapering off of the surge in sales prices?  In the last full year before the pandemic (2019) we saw a 5% increase in the median sales price in Harrisonburg and Rockingham County. Then, we saw three years of double digit increases in the median sales price with a 10%, 10% and 11% increase in 2020, 2021 and 2022. Thus far in 2023, we are seeing a slightly smaller increase in that median sales price, with an 8% increase through the end of May. Of note... sales prices are not declining... they are just increasing slightly more slowly than they have over the past three years. Stay tuned to see how this metric does or does not continue to change as we move through the next few months. Looking ahead, though, contract activity is our best indication of what we are likely to see in the way of closed home sales over the next few months...  As you can see, we have now closed out the fourth month in a row of significantly lower levels of contract activity in Harrisonburg and Rockingham County. The red line is measuring contracts signed per month this year, and the blue line shows the same months last year. As such, we are likely to continue to see lower levels of closed sales over the next few months, given lower numbers of contracts being signed. And finally, here's a visual of the supply side of the market...  Despite 20% fewer home sales this year... inventory levels are lower than they were a year ago. The red line above shows inventory levels this year, compared to last year in blue. If we were seeing a shift in the market, with demand softening, we would start to see inventory levels increasing. We're just not seeing that. As such, the 20% decline in home sales seems almost certainly to be a result of an insufficient number of homes being available for buyers to buy. Now, for all the stats folks out there, here's the statistic that could be the most misleading...  We have seen a 40% increase in the time it takes for a house to go under contract in Harrisonburg and Rockingham County! Gasp! Oh my! But wait... that just means that it is taking seven days for a house to go under contract... instead of five days? Yes, that is correct. The 40% increase in the median days on market is an increase from five to seven days. Ask just about any would-be buyer and they will report that this doesn't measurably change how quickly they need to act on seeing and pursuing new listings. And another interesting phenomenon in our current market, mortgage interest rates...  Despite fewer homes selling... sales prices keep rising. Despite higher mortgage interest rates... sales prices keep rising. Two years ago the average mortgage interest rate was around 3%. A year ago that had risen to 5%. Now, it is bouncing around between 6% and 7%. And yet, buyers keep buying, and they are paying ever higher prices for the homes they are purchasing. As you can imagine, that means that mortgage payments are higher than ever for today's home buyers -- as a result of both higher sales prices and higher mortgage interest rates -- but these higher rates haven't seemed to have impacted buyer interest enough to then impact sales prices. So, given all of the data above, what does this mean for you? If you are planning to sell... you'll likely still have plenty of interest from buyers, you're likely to sell at a very favorable price, and your home is still likely to be under contract within a week. If you are hoping to buy... you'll need to see homes quickly when they come on the market, you will still have stiff competition from other buyers, and you should talk to a lender to understand mortgage payments based on current mortgage interest rates. If you own a home and aren't planning to sell... lucky you. Home values keep on increasing, and you likely have a low or low-ish mortgage interest rate. I hope this overview of the latest trends in our local housing market has been informative and helpful, especially if you are gearing up to buy or sell soon. Feel free to reach out to me if I can be of any assistance to you as you make those plans. You can reach me most easily at 540-578-0102 (call/text) or by email here. Until next month, I hope you enjoy the start to summer, and perhaps I'll see you at Red Wing! | |

An Early Look At May 2023 Home Sales In Harrisonburg And Rockingham County |

|

May is over! Gasp! It's June. Already! Here's a quick look at a few early indicators of trends in our local housing market in May 2023... May 2020 = 112 home sales May 2021 = 122 home sales May 2022 = 149 home sales May 2023 = 106 home sales So... unless quite a few more (6+) home sales are reported over the next few days as having been sold in May via the HRAR MLS, it seems May 2023 may have been the slowest (number of sales, not speed of sale) month of May in several years. Mortgage interest rates were also a bit higher this May than last, and much higher than two years ago... Early May 2021 = 2.96% Early May 2022 = 5.27% Early May 2023 = 6.39% And yet, despite fewer home sales and higher mortgage interest rates, home prices seem to keep on rising... Median Sales Price, Jan 2022 - May 2022 = $298,400 Median Sales Price, Jan 2023 - May 2023 = $325,000 Stay tuned for a fuller analysis of local market trends in about a week. | |

What Might The Rest Of 2023 Look Like In The Local Housing Market? |

|

Let's take some wild guesses here. Between June and December of 2023, what trends do I expect to see in the following areas... [1] Home Sales = no change (similar pace as early 2023) [2] Home Prices = increase [3] Mortgage Interest Rates = decrease (though likely not by much) [4] Inventory of Resale Homes = no change / decrease [5] Inventory of New Construction Homes = increase What about you? Would you predict anything wildly different? [1] Will mortgage rates drop significantly? [2] Will home prices stop rising? [3] Will inventory levels rise? | |

Median Sales Price Up 10% In 2023 Despite 19% Decline In Home Sales |

|

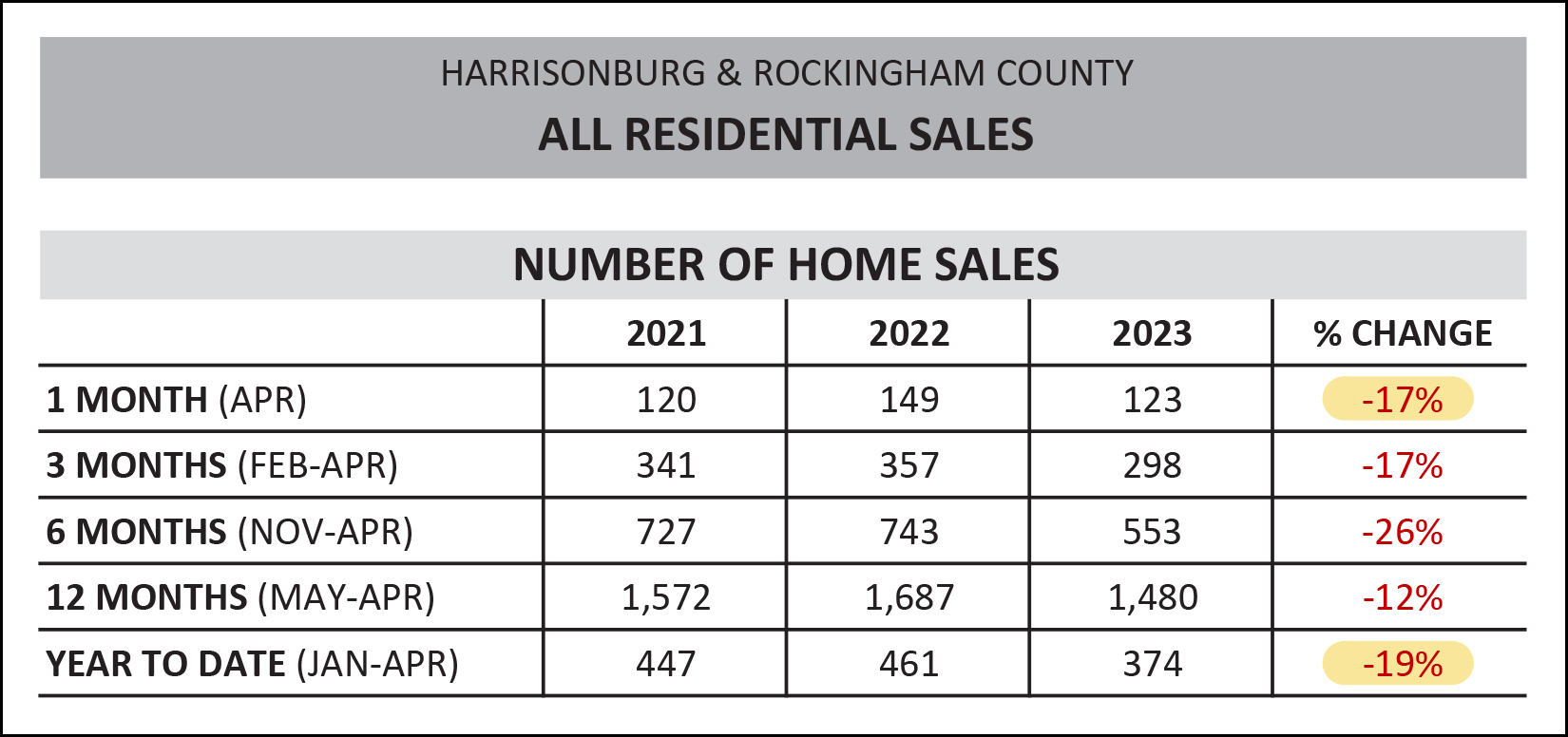

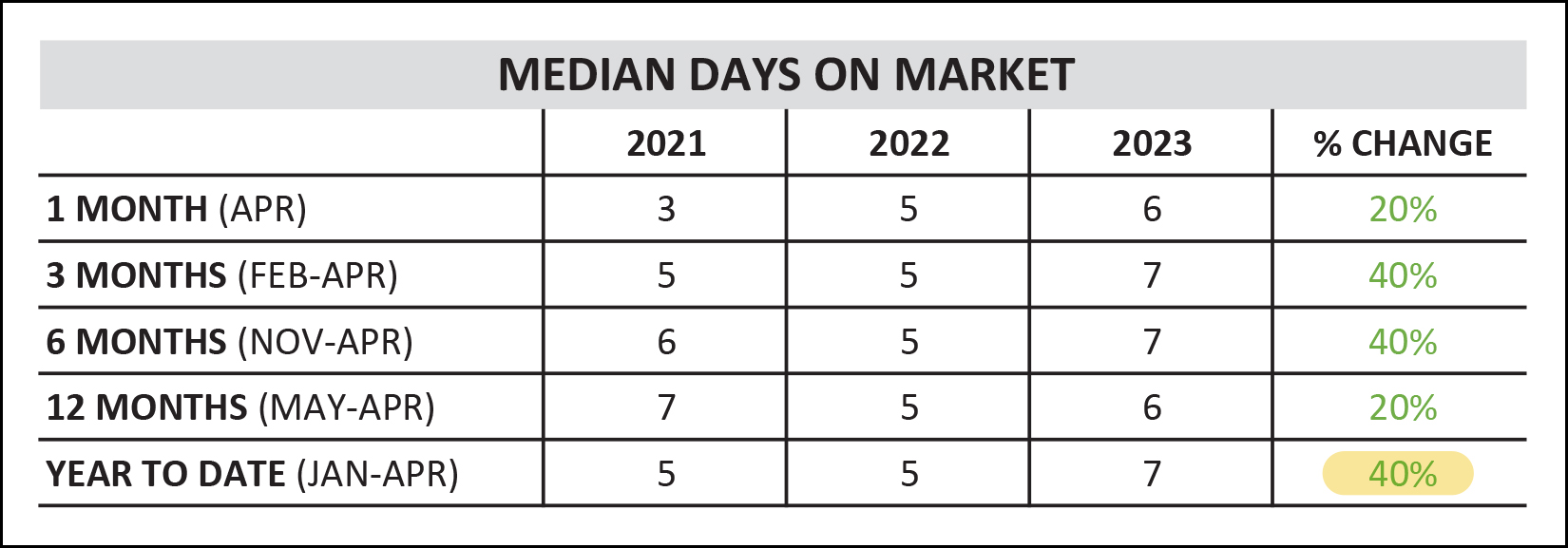

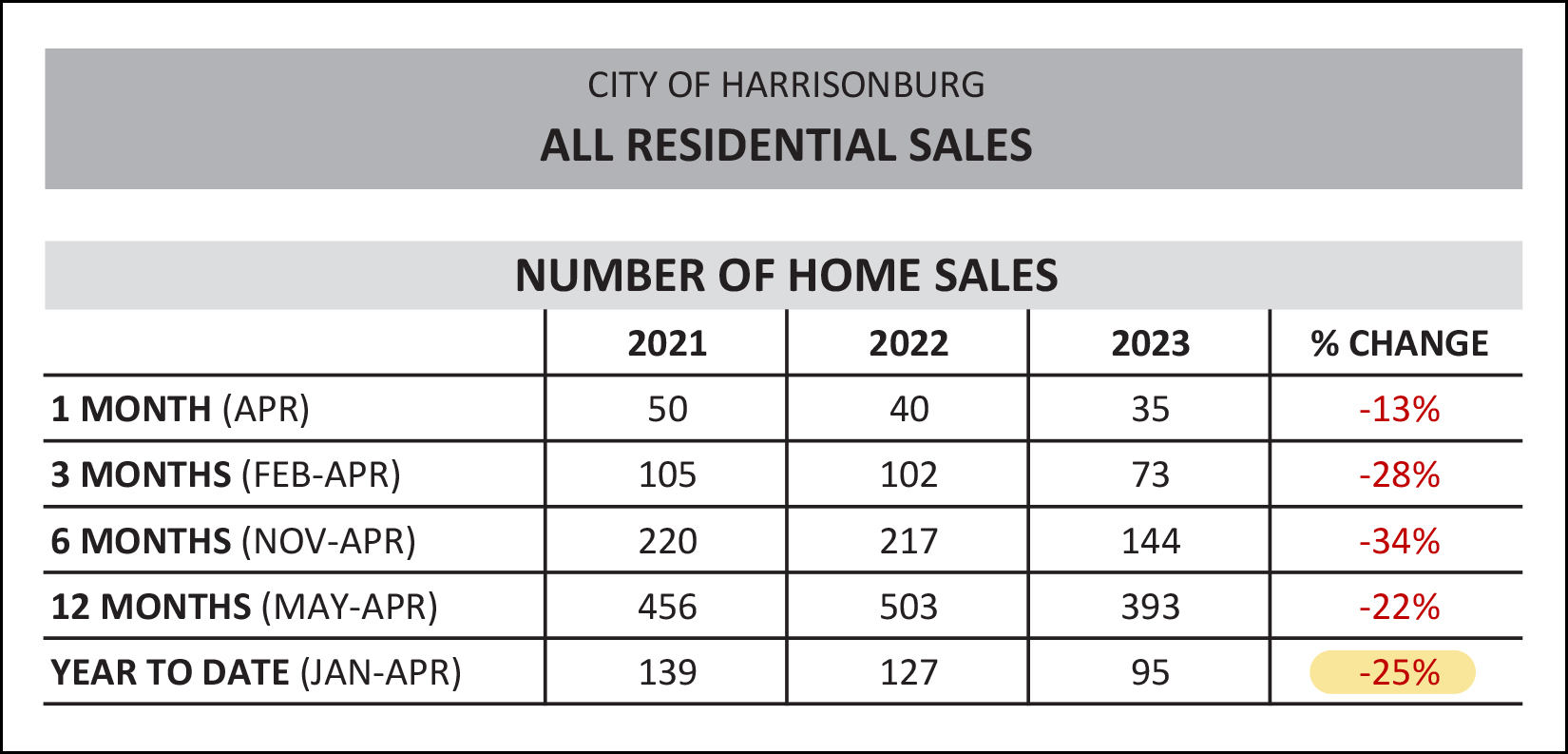

Happy Tuesday morning, friends! We are now -- wait for it -- more than a third of the way through 2023!? How can it be!? And how's the market you might ask? Fewer homes are selling this year, but at higher prices than last year!? Again, how can it be!? -- This whirlwind of a start to 2023 has involved a rather busy few months in the Rogers household -- with a soon-to-be-graduating high school senior (Luke) attending a Junior-Senior banquet and playing in his last few baseball games, and an ever-speedier ninth grader (Emily) running (and jumping) in multiple events on the track team. Whatever is keeping you busy and running all around town this Spring, I hope it is just as fun and fulfilling as it has been for Shaena and I to see our kids growing up over these recent years. Time surely does fly by quickly! -- But, back to real estate. Below I'll delve into all the juicy details of the latest happenings in our local housing market... after I make you hungry... Each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places, things or events in Harrisonburg. Recent highlights have included Cuban Burger, Taste of India and A Bowl of Good. -- OK, now, I'm really getting to the real estate. Jumping right in to where my headline began... home sales (not prices) are declining, rather significantly in Harrisonburg and Rockingham County right now...  As shown above... [1] There were 17% fewer home sales in April 2023... which I suppose isn't too much of a surprise given several other recent months of slower home sales. [2] Looking at the year thus far (Jan - Apr) home sales have declined 19%. During the first four months of 2022 we saw 461 home sales in Harrisonburg and Rockingham County while there have only been 374 home sales thus far in 2023. Generally, there are two reasons why home sales decline: [1] Fewer buyers want to buy. [2] Fewer sellers want to sell. In our local market, the 19% decline in home sales seems to be almost entirely a result of fewer sellers wanting to sell. I come to this conclusion based on continued low inventory levels, which we'll get to in a bit. Despite the 19% decline in the number of homes that are selling, as the headline referenced, we're still seeing home prices rise in Harrisonburg and Rockingham County...  Indeed, when analyzing multiple different timeframes, we are consistently seeing increases in the median sales price in our local area... [1] The median sales price over the past 12 months ($306,160) is 9% higher than it was in the previous 12 months ($279,900). [2] Looking just at the first four months of the year, the median sales price is 10% higher this year ($324,985) than last ($295,490). Will home prices keep rising forever? I can make no promises, but generally speaking, so long as demand (buyers wanting to buy) continues to exceed supply (sellers wanting to sell) we are likely to continue to see prices rise. Will home prices keep rising at a rate of 10% per year? This seems less likely, especially given higher mortgage interest rates right now... though I've been saying this for at least six months now, and thus far, home prices are still rising at about 10% per year. One metric that is running slightly contrary to most others is the time that it takes for a home to go under contract once listed for sale. We have actually seen a slight increase in this "median days on market" statistic over the past year...  I suppose the "gotcha" headline would be that it is taking homes 40% longer to go under contract now as compared to a year ago. :-) But... this was a change from a median of five days to a median of seven days... and seven days is still mighty speedy. I should also note that this slight (two day) slow down is not much consolation to would-be home buyers who are frustrated by how quickly the market is moving right now. Pausing for a moment, as you may or may not know, I compile a bunch of data that is not highlighted in this monthly market narrative. You can find lots of other data tables and graphs over here. Pulling from the variety of other charts and graphs that I generate each month, let's take a peek at one subset of our overall market... home sales within the City of Harrisonburg.  Home sales actually declined *even more* in Harrisonburg than in the market as a whole. The entire market (City + County) has seen a 19% decline in home sales in the first four months of the year... but the City alone has seen a 25% decline. If you're hoping to buy a home in the City of Harrisonburg, it's a tough time to do so based on very limited inventory of homes offered for sale. Now, moving past these charts, to some graphs, for the visual learners amongst us...  Follow the red line on the graph above to see each month of 2023 home sales in Harrisonburg and Rockingham County and you'll find that it is lower than each month on the blue line, which represents home sales last year. March 2023 came close to March 2022 (101 vs. 113) but the gap widened again in April (123 vs. 149) and I am expecting we'll continue to see slower home sales (fewer home sales) for most or all of 2023. I'll talk more about mortgage interest rates further down in this report, but it's worth noting that higher mortgage interest rates seem to be limiting the number of home sales that we're seeing right now -- but it might be stopping just as many sellers from selling as it is stopping buyers from buying. Many homeowners aren't all that interested in selling their homes with mortgages in place with a three-point-something interest rate, to then be replaced by a new mortgage at a six-point-something interest rate. I can't blame them. This is only one of the factors limiting the number of homes that are selling, but I don't think we should overlook its impact. So long as mortgage interest rates stay high, we are likely to continue to see a lower number of home sales this year as compared to last year. Moving on to the opposing trends of price and pace of home sales...  Many assumed that if home sales started to decline (they definitely have) that home prices would be sure to follow. Not so. It seems that the combination of continued strong levels of buyer demand, paired with a smaller number of sellers willing to sell, has resulted in fewer home sales, but higher prices. Over the past year we have seen 1,480 home sales in Harrisonburg and Rockingham County. Back the clock up a year and we were seeing 1,687 home sales a year. That's a rather significant change in the pace of home sales activity in our local market. Over the past year the median sales price has been $306,160 in Harrisonburg and Rockingham County. A year ago, the median sales price was only $279,900. This is, again, a rather significant change, though in the opposite direction (up) that we're seeing when it comes to the number of homes selling (down). Looking at the change in median sales prices a bit differently, here's a startling change over a relatively short timeframe...  If you bought a median priced home four years ago, that home may very well be worth $100,000 more today!?! Now, before you get too excited about this newly discovered six figure pile of equity in your home, keep in mind that these numbers ($223K in 2019 to $325K in 2023) are simply showing overall market-wide trends. Some homes certainly have appreciated by $100K over the past four years -- but not all homes. That said, almost universally, homeowners have been shocked to see how much their home value has increased over the past four years! Now, let's try to guess at where things might go from here over the next few months...  This first graph is showing the number of contracts being signed per month, as compared to previous graphs that showed the number of home sales taking place each month. Over the past two months we have seen 242 contracts signed for buyers to buy (and sellers to sell) in Harrisonburg and Rockingham County. This is quite a decline compared to last year when we saw 337 contracts signed during the same timeframe. Bottom line... this spring (red line) has just not been as active of a "spring market" as last year (blue line)... and it also hasn't kept pace with recent historical trends (grey line). These lower contract numbers have lead to fewer properties being under contract and waiting to get to closing...  One year ago, there were 416 properties under contract just waiting to get to closing. Now, that "pending sales" figure is only at 275. This is the clearest predictor we can get as to the slower months of home sales that seem to be headed our way in May and June. With such a significant decline in contracts signed, and with a much lower number of properties being under contract, are we seeing ever higher inventory levels of homes available for sale?  Mostly, no. Over the past four years (2019-2022) the average number of homes for sale at this time of year (early May) has been 183 homes. Today, that number is 129 homes for sale. So, despite fewer sales and fewer contracts, we are still seeing inventory levels that are well below where inventory levels have been over the past few years. That said, for the first time this month we are seeing the inventory level of homes for sale (129) sneaking past (just barely) the number of homes for sale (127) a year ago. Is this significantly? Give it another month or so to see how things shake out. Keep in mind that to continue this trend (more homes for sale in 2023 than in 2022) we'd have to see inventory levels climb above 152 homes for sale over the next month. Stay tuned. Earlier I mentioned that homes are taking an extra day or two to go under contract right now, as compared to a year ago...  Indeed, after about a year of the median "days on market" statistic hovering right at five days... we have now seen the pace at which homes go under contract slowing, slightly, over the past five months. If I had to hypothesize as to why this number has risen (barely) I would guess it is related to higher mortgage interest rates. I am seeing three things happen when new listings hit the market right now... [1] Slightly fewer showings than we would have seen a year ago. [2] Fewer offers than we would have seen a year ago. [3] Many buyers needing to take a day or two to run numbers with their mortgage lender before making a decision about making an offer. The speed at which homes are going under contract certainly varies quite a bit based on the price range, location and property type -- but as shown above -- it is taking an extra two days (ish) for homes to go under contract right now. This is slightly slower than in 2022, but drastically faster than just about anytime prior to 2021. Finally, mortgage interest rates, which have been mentioned (and blamed) throughout this report...  After multiple years of mortgage interest rates below 4%, we saw them climb quickly through the 5% range (within six months!) and they have stayed above 6% since that time. We are now entering the ninth month of most buyers likely buying homes with mortgage interest rates above 6%. These higher mortgage interest rates, combined with higher sales prices, are significantly increasing the monthly housing cost for any would-be home buyer considering a purchase in 2023. Will mortgage interest rates edge back down below 6%? I think there's a chance they will later in 2023, but it is certainly not... certain. ;-) So... given all of this data, given all of these trends, where does this leave us? Home buyers should still be prepared to go see new listings quickly when they hit the market, and must have their lender on speed dial to confirm a potential mortgage payment given ever changing mortgage interest rates. Depending on the popularity of the home you will be buying, we may very well still be competing with multiple other offers and considering which contingencies you might be willing to omit from your offer. You'll be buying in a challenging market for buyers -- with limited inventory and increasing prices. Buying a home in 2023 is definitely still possible, but it will require patience and perseverance. Home sellers are still in good (great) shape with lots of buyer demand in many or most price ranges... but home sellers should *not* assume that they will definitely have multiple offers, over asking price, with limited contingencies. That might be the situation you find yourself in (hooray!) but if you only have one offer, at the asking price, with some "normal" contingencies - I'll encourage you to still be excited. Pricing your home appropriately, preparing it thoroughly and marketing it professionally are just as important as ever in 2023. That's all for today, friends. I hope you now consider yourself a bit more informed about our local housing market, and a bit hungrier for a delicious meal at The Little Grill. ;-) The next month or so is a busy time for many of us with school years ending, summer beginning, and many other changes. Even as the days inevitably seem to start moving by more quickly than ever, I hope you are able find the time to slow down and meaningfully connect with the people who are important in your life. Send a friend, family member, neighbor or colleague a quick text to check in - or give them a call just to say hello. Make the time to make those connections, and I'm confident you will be glad that you did so. As always, please reach out anytime if I can be of help to you -- with real estate or otherwise. You can reach me most easily at 540-578-0102 (call/text) or by email here. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings