Archive for October 2009

| Older Posts |

Predicting Home Sales Using Online Property Views |

|

Can we predict home sales by examining the number of properties viewed on the network of Coldwell Banker Funkhouser Realtors web sites? Possibly....  Above you'll see a graph that tracks home sales per month in tandem with the number of properties viewed each month on the Coldwell Banker Funkhouser Realtors network of web sites (my web site, the company web site, all other agent web sites). I think there does seem to be a general correlation between the two sets of data. That being the case, we should expect to see home sales level out or decline as we move into the next few months --- which is winter, and typically slow. However ---- an extension and expansion of the home buyers tax credit is being considered, which, if passed, could incent more buyers to get into the market, causing an increase instead of a decrease in the number of home sales in Harrisonburg and Rockingham County. | |

Price Right From The Start, Unless You Find Great Joy In Waiting |

|

As referenced yesterday, we're seeing quite a few price changes --- nearly 700 so far in 2009 --- so let's examine why they are happening, and whether they are necessary. First, most (but not all) price changes are reductions. Price reductions happen primarily because a house isn't selling at the existing asking price, and the hope is that more interest and activity (and perhaps an offer??) will be generated by lowering the price. Put another way, a price reduction is an indication that the original asking price was too high. So.....why is it so important to get your price right from the get go? Mainly because if you don't, you're house will sit on the market until you do. That's right --- my slightly scientific analysis (below) indicates that your house won't sell until you get the asking price set properly. It's a long and arduous task to examine price reductions in detail via our Multiple Listing Service, so I was only able to analyze trends based on a small sample size --- the 60 most recent home sales in Harrisonburg and Rockingham County. Here's what I found.... The 35 homes that did not reduce their asking price:

Thus, if a home is "worth" $200k, there would be two options:

| |

Sellers Must Really Be Dropping Their Prices, Right??? |

|

Sort of....but maybe not effectively?? The chart below shows the number of price changes per year of homes that have sold for each of the past nine years. Some houses that sold may have had multiple price changes --- these figures show the total number of price changes, counting each change on each property.  There was a sharp increase (+29%) in price changes in 2006 (compared to 2005), which would be expected because it was the first year of a reduced number of home sales. However, there was also a sharp increase (+22%) in 2005 (compared to 2005) when the market was still peaking. Perhaps of even more interest is that the number of price reductions per year has slowly decreased over the past several years (-4% in 2007, -7% in 2008). This may be explained by the declining number of home sales, as the number of price changes shown above only accounts for price changes of listings that have sold. This year there have been approximately 600 home sales, and roughly 200 price changes of those homes that have sold . . . but nearly 700 price changes when we include the many houses that are still on the market. Stay tuned for more analysis of how price changes affect the sale of your house. | |

Is Harrisonburg Nearing Break Even Again On 80% LTV Investment Properties With Conservative Calculations? |

|

Many (many, many, many) townhouses were built in Harrisonburg between 2002 and 2007. They are still being built, but not at the same pace. The principal reason for this shift in building is that home values increased faster than rental rates. As such, a smaller and smaller pool of investors are considering purchasing townhomes as income generating properties --- though that may be changing again. Let's see how things compare when buying an income generating property in 2002 versus today. In 2002, a new two-story townhome in the City could be purchased for roughly $100,000, and rented for approximately $725/month. Here's how the annual cash flow looks: + $8,338 of rental income ($725 x 11.5 months) As you can see, this is a barely break even scenario using the conservative calculations above, though more positive cash flow was achieved by most investors by managing the properties by themselves, and because very few repairs were needed.- $5,916 for mortgage payments (80% LTV at 6.25%) - $750 for property management (9%) - optional - $590 for property taxes - $360 for property owners association dues - $300 for repairs - likely unnecessary - $252 for home owners insurance Cash Flow = $170 GAIN in the first year Fast forward to 2009, and here's how the cash flow might look on a new two-story townhome in the City that can be purchased for roughly $150,000, and rented for approximately $900/month: + $10,350 of rental income ($900 x 11.5 months) - $8,172 for mortgage payments (80% LTV at 5.5%) - $932 for property management (9%) - optional - $885 for property taxes - $360 for property owners association dues - $300 for repairs - likely unnecessary - $378 for home owners insurance Cash Flow = $677 LOSS in the first year As you can see, an investor would now have to bring more than 20% as a down payment to even break even in this townhome scenario. There are plenty of investors who do bring more than 20%, or who pursue other properties with better cash flow characteristics, but hopefully this is indicative of how the investment property landscape has changed over the past seven years. But --- perhaps some of those investors are, or should be, looking at the Harrisonburg market yet again. You see, there are quite a few townhouse owners who bought back in 2000, 2001, 2002, or 2003 who bought when townhouse prices were very low. If they haven't refinanced, or taken out a home equity line of credit (HELOC), they likely have a loan payoff significantly below what the market will bear for their townhouse. Thus --- there are deals to be found with investment properties right now in Harrisonburg. They won't always jump out at you, as they may be listed at reasonable "market price" --- but if the owner is motivated to sell, and they bought 7-10 years ago, they likely have quite a bit of equity with which they can negotiate. If you are looking for an income generating property, feel free to call me (540-578-0102) or e-mail me (scott@HarrisonburgHousingToday.com) and I can assist you in determining whether we can meet your investment goals given the opportunities in today's market. | |

What Is HardiePlank Siding, And Is It Being Used In Harrisonburg? |

|

The exterior of your home could be built with so many different materials, for example: stucco, stone, wood, brick, aluminum, concrete, steel and fiber cement. That last one, fiber cement, is a vague and mysterious siding choice also referred to as HardiePlank siding, which has been around since the 1980's. So, what exactly is HardiePlank siding?? First, HardiePlank siding is a fiber cement, made out of sand, water, cellulose wood fibers and cement. Its source materials and design provide it with a number of unique qualities that often interest homeowners....

HardiePlank comes in all sorts of colors and styles, and you'll start to see it on some newly built homes in this area, for example on the Paired Homes at The Glen at Cross Keys, on this EarthCraft home on Cottage Circle, on most of the homes at Preston Lake, and on Urban Exchange. | |

Do I Need A Building Permit To Finish My Basement? |

|

If you are making any additions, improvements or repairs to your home you must pull a building permit, and if it involves electrical or plumbing work you'll also need to pull an electric permit and/or plumbing permit. "But Why?" you might ask.... In the here and now, you need to pull the appropriate permits because that is what Harrisonburg and Rockingham County require of you. Also in the here and now, pulling the permits will thus require inspections, which will go a long way towards assuring that the changes made to your house are safe, per their compliance with the Building Code. In the future --- as in the time when you want to then sell your home --- it is arguably very important to have pulled building permits and to have passed the inspections. In selling your home, you are required to disclose any material adverse facts about your home. In my view, the fact that the basement was finished (or other improvements were made) without permits and inspections is a material adverse fact about the house. It's not necessarily that the house is unsafe, but the fact that parts of the home were never inspected by the locality create that possibility. Pull the permits. Get the inspections! | |

Either The First Time Buyer Tax Credit Is Working, Or The Harrisonburg and Rockingham County Real Estate Market Is Improving, Or Both!??! |

|

For the past three years (2006, 2007, 2008) we have seen a decline in the number of home sales in the 3rd Quarter (July, August, September) as compared to the 2nd Quarter (April, May, June). These "seasonal" declines were 8%, 8% and 1% respectively. This year, we saw a 15% INCREASE in sales in the 3rd Quarter as compared to the 2nd Quarter. As stated, above, I have to conclude that either the First Time Buyer Tax Credit is working (creating more sales as we near the tax credit deadline), or our local real estate market is improving. Or, I suppose, both could be occuring --- either independently, or as cause and effect. If the tax credit is extended or expanded, I hypothesize that we'll continue to see an improving local market. If the tax credit is not extended nor expanded, we'll then perhaps be able to determine whether the 2009-Q3 home sale extravaganza was related to the tax credit, or an improving market. Stay tuned! | |

Can A House In Harrisonburg Zoned R-1 Be Rented? |

|

This is a relatively common question, that usually takes one of the following forms:

The R-1, Single-Family Residential District is intended for low-density, relatively spacious single-family residential development . . . Primary use is for single families, owner occupied dwellings can rent additional rooms, but not to more than two persons, as long as no new kitchen facilities are included. Non-owner occupied dwellings can rent to only one other person, as long as no new kitchen facilities are included. This district is the most restrictive zoning classification for occupancy. To draw out a few points:

| |

Oops! The Contract Price Is Higher/Lower Than The Appraised Value! |

|

Most sellers want to sell "above value" and most buyers wants to buy "below value." In a balanced world, however, a seller would sell for the "actual value" of their home, and a buyer would buy for the "actual value" of the home. That's in a balanced world --- obviously, it doesn't usually happen that way. We get one glimpse of whether the contract price is off the mark when we learn of the appraised value through the financing process. Here's an oddity (or is it?):

Rent-To-Own Prospect Wants The Best Of Both Worlds A prospective tenant/buyer (rent-to-own) wants to negotiate purchase terms for what is essentially their option to buy a year into the future. They want to buy for the lower of the price agreed to now, and the appraised value a year from now. Wait a minute!?!?! It would seem reasonable (balanced between buyer and seller) to either both take a gamble on ups/downs of the market and agree to a price now OR both agree to use a value determined in the future by an independent appraiser. The lower of the two doesn't seem very reasonable for this prospect who is already trying to negotiate by asking for a lease-to-own when it isn't the seller's intent. Buyer Thinks Seller Should Adjust, But Won't Do The Same This is a bit obvious from the above referenced ways that thisappraisal process works, but it does seem to be a bit odd from theperspective of trying to achieve a balanced transaction between buyerand seller. If the appraisal comes in low, the buyer gets tore-negotiate down. So why doesn't the seller get to re-negotiatehigher if the appraisal comes in high?? Seller Agrees On Price, Then Seeing Appraisal, Refuses Repairs I'm exaggerating this one a bit to make a point, but in a recent transaction, the lender (for some reason???) shared the appraised value with the seller's Realtor. The seller thus was told of the appraised value, which was more than $10,000 higher than the contract price. Certainly, the seller felt like they left money on the table, though the day before they had been quite thankful for the buyer and the price he was paying. As a result of knowing of the value supposedly left on the table, this seller loses much of their desire to negotiate on repairs, even making a remark about how the buyer can make repairs using the free equity inherited from the lower-than-appraisal contract price. And while we're on the subject of appraisals, here's another strange aspect of the appraisal world --- feel free to offer your opinions.... Wikipedia defines the "market value" as determined thorough a real estate appraisal to be: "...the estimated amount for which a property should exchange on the date of valuation between a willing buyer and a willing seller in an arms-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion." So, wait a minute --- read that through again --- isn't that exactly what is evidenced in the real estate contract that is the basis for the appraisal in the first place?? | |

Just In Time, The Shenandoah Valley Economy Recovers! |

|

I discovered today that the Harrisonburg and Rockingham County economy is in recovery!  According to the data above, Harrisonburg is in "Recovery" --- though that includes a drop in employment, a drop in housing starts, and a drop in industrial production. Data apparently wasn't available for housing prices, so I'll fill in the blank: median sales prices have decreased by 4% over the past year in Harrisonburg and Rockingham County. So.....does this sound like recovery to you? Dr. Rosser sheds some light on a property perspective in his comment at hburgnews.... "...we are now doing better than most other places, even if it may not feel all that great. The story is correct, and that it does not feel all that great here is just a reminder of how bad it is in so many other places." I have to agree -- we're in a lot better spot than most other areas of Virginia and the U.S., though we still have progress to make before we see those metrics increasing again. | |

How Much Will I Pay In Capital Gains Taxes When I Sell My Investment Property? |

|

First, here's how to calculate your gain or loss on the sale of your investment property.... Selling Price - Purchase Price - Purchase Costs - Improvements - Selling Costs + Depreciation You may have heard of short-term and long-term capital gains --- the difference is in the timing.... If you sell an investment property within one year (including one year exactly) of purchasing it, your "short-term capital gain" will be taxed at the same level at which your ordinary income is taxed. This could be at a rate as high as 35%, but depends on your income level. If you sell an investment property after one year of owning it, your "long-term capital gain" will be taxed at either 0% or 15%. If you (as an investor) are in the 10% or 15% income tax bracket, you will pay 0% (yes, that's right, no taxes) on your long-term capital gains. If your income tax bracket is above 15%, you will still only pay 15% tax on your long-term capital gain. This is important to note, as an investor might pay a 25% tax on their ordinary income, but can pay significantly less (only 15%) on their income (long-term capital gains) on investment properties in that year. Of note, these tax rates (0%, 15%) only last through the end of 2010 given current legislation on the books. If they aren't extended, they will revert back to the previous tax rates of 10% and 20%. | |

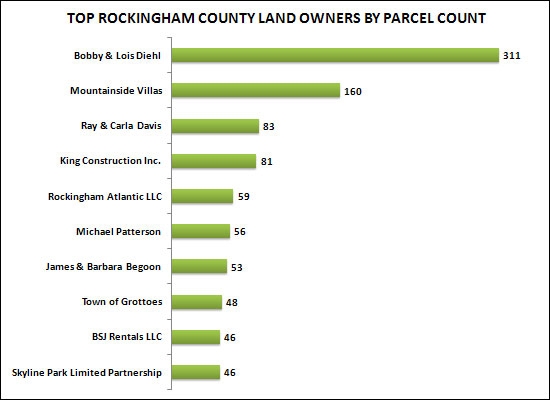

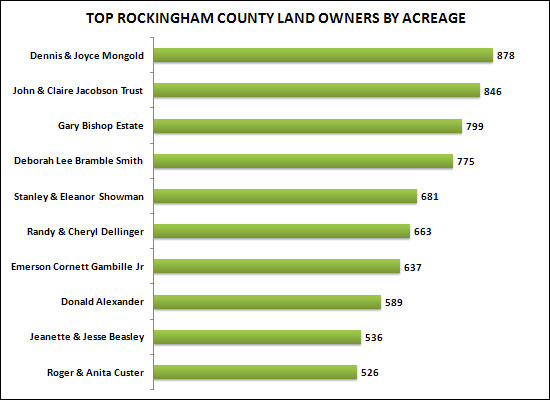

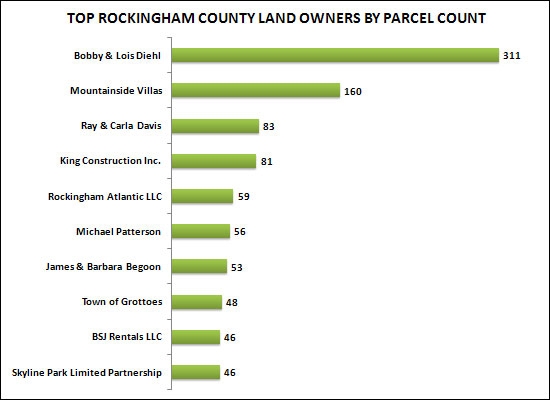

Top Rockingham County Property Owners |

|

A few days agoI provided information on the top 10 property owners in the City of Harrisonburg based on quantity of parcels owned, and total acreage owned. Today, let's take a look at the same breakdown for Rockingham County . . .    One significant note: This analysis does not account for the variety of property owners that own property in slightly different names or under entirely different entity names. | |

A Hidden, Energy-Efficient Gem In The Peak View School District |

|

It's hard to come by a decent sized, relatively new, sub-$300k home in the Peak View Elementary school district. This is the highest growth area of the County, and most homes being built in this school district are priced above $300k (some are way... above $300k). So, what's a buyer to do?? The home pictured above fits this bill, and is energy efficient to boot, as an EarthCraft certified home. What on earth is an EarthCraft home, you might ask? They are homes that (in varying degrees):

Also of note, there will be six other homes built in this neighborhood. If you are interested in building your own EarthCraft home, come take a tour of this existing home, and then we can discuss other house designs, etc. | |

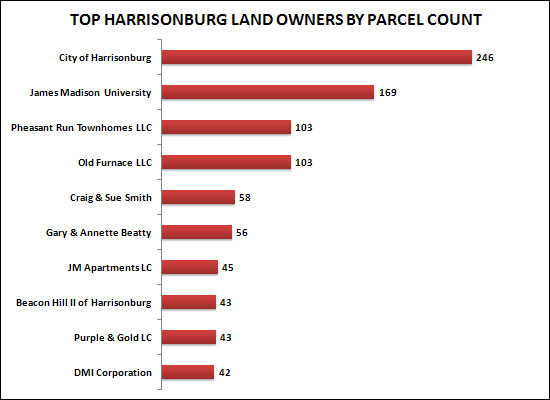

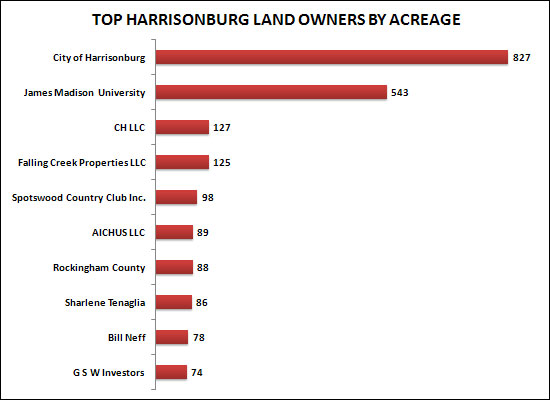

Top Harrisonburg Property Owners |

|

Last week we explored who owns Harrisonburg, based on where those property owners currently live. Below are two additional slices of this data set --- exploring the top real estate owners in the City of Harrisonburg based on the number of parcels that they own, as well as the total acreage of the parcels that they own. The top two in each category probably won't surprise you . . .   One significant note: I did some basic grouping for the City of Harrisonburg and JMU to combine the parcels owned by each in different variations of their names. This analysis does not, however, account for the variety of other property owners that own property in slightly different names or under entirely different entity names. | |

Is the Pace of Home Sales Finally Increasing In Harrisonburg and Rockingham County? |

|

There are some who are predicting that the coming months will be QUITE slow in terms of home sales. After all, the first time buyer tax credit is ending, and we're entering into winter -- a season that always brings slower sales. But looking at the trajectory of sales between the most recent two quarters (2009-Q2, 2009-Q3), I'm left starting to wonder whether things might be picking up in pace....  As you can see in the graph above, there were a roughly equivalent number of Q2 and Q3 homes sales last year. This year, however, despite both data points lying below the 2008 figures --- we saw a 15% increase in sales between Q2 and Q3. With last year's astonishingly slow fourth quarter, I think there is a good chance our local real estate market will finish out the year strong with lots of home sales in October, November and December. Why are home sales picking up in pace? One plausible reason is that lots of first time buyers are getting in the market who might not have otherwise, or might not have last year. Check out the graph below, showing the change in pace of home sales under $175k.  As you can see above, home sales in Q3 of this year surpassed (barely) last year's Q3 sales figure. It seems quite plausible that this trend will continue in Q4, and that it may be largely a result of the tax credit for first time buyers. Stay tuned as we move into and through October, November and December, but I don't believe real estate sales will be as slow as some predict. | |

A Bird In The Hand Is Worth About 1,000 In The Bush! |

|

This is a well-known idiom, but it is sometimes left by the wayside when sellers are negotiating offers on their homes. Thankfully, I don't typically have clients who ignore this concept, but in the last week I have heard of three sellers who need(ed) to take this to heart. The details below have been fudged a bit to prevent you from determining which properties I'm referencing.. Scenario One: The owners of a townhouse arguably worth $170k let contract negotiations fail at $172k. Wait.....what?? They won't accept more than what it's worth?? I suppose this one is a bit subjective, but basically, we'll imagine that they have their townhouse listed around $180k, and have negotiated down to $172k, but won't go a penny lower. The issue is, of course, that the buyer, the buyer's Realtor, and several other Realtors all concur that it would be optimistic to assume that the townhouse is even worth $170k. So here, the homeowner's "sense" of the value of their home is preventing them from moving forward with an excellent offer in hand. Scenario Two: This townhouse has been on the market for roughly a year, and has been reduced in price by tens of thousands of dollars. The owner has actually had quite a few birds in hand, as there have been multiple offers on this property over the months. Here's what happens --- an offer comes in that is around $7k less than the asking price, the seller rejects it, a month or so passes, the seller lowers the price $10k, an offer comes in around $7k less than the asking price, the seller rejects it, a month or so passes, the seller lowers the price $10k, etc., etc., etc. Bird after bird in hand, and then flying away! Scenario Three: I met some homeowners today who made an offer about a year ago on a new construction duplex. Their offer was deemed to be too low by the builder, and thus rejected. Now, a year later, the duplex is still available for sale, and the asking price is now just a hair lower than these homeowners' offer on the property a year ago. With a (rounded) price of $230k, assuming the builder might have been carrying $150k of a construction loan on the property, at perhaps 6%, that decision has likely cost the builder $9,000 in interest over the past year. It is certainly reasonable to strive for the best possible price for your property if you are selling it, but you must carefully weigh the value of a bird (offer) in hand relative to the prospect of waiting (and waiting, and waiting) for the next offer to come along. | |

What Are Your Home Buying Goals: A Place To Live, An Investment, Or Both? |

|

Why do people buy homes? In a context stretching prior to 2002, people bought homes mostly because they needed a place to live --- and buying a home provided stability (your landlord won't kick you out), and had some financial side benefits (gradual appreciation, tax deductions). However, the paradigm of the American dream of home ownership shifted in the beginning of the 21st century when home values started to inflate by 10% - 50% per year in many markets. All of a sudden people weren't just buying houses because they needed somewhere to live --- but also because it would be an incredible investment. This new paradigm can be paralyzing to buyers in today's market. Certainly, people still need a place to live --- but now some buyers become hesitant and unable to act absent confidence that they will also have a strong financial return. I don't fault any buyer for desiring a good return on a home buying investment --- but I don't believe that keeping this new expectation on the forefront of our decision making is sustainable. Let me be more precise:

| |

"Priced To Sell" -- Just Crazy Marketing Talk? |

|

Do you take special interest when you hear (or read) "Priced To Sell"? Should you? There are 20 homes on the market right now in Harrisonburg and Rockingham County described in the MLS as "Priced To Sell". Will they sell faster than the other 893 homes on the market that either aren't priced to sell, or at least aren't described that way? Let's see what history indicates.... In the past year 20 homes have sold that were described in the MLS as "Priced To Sell." They sold, on average, in 165 days. In the past year 756 homes homes sold that were not described as having been "Priced To Sell." They sold, on average, in 186 days. As it turns out, the "Priced To Sell" might have been a fair description --- these homes sold in about 10% less time than those that weren't described as "Priced To Sell." Actually, I was hoping we'd see a more convincing difference --- that perhaps homes that have been "priced to sell" would have sold in half the time of other homes. Aside: Maybe if we add "Priced To Sell" to the description of YOUR home it will shave 10% off the time it will take to sell it?? :) Inside Tip: You can search for "Priced To Sell" or other fun phrases in the MLS remarks of active listings via the "keywords" field on my Power Search. | |

HELP! I'm trying to sell my house for more than $400,000! |

|

Today, there are 128 homes for sale in Harrisonburg and Rockingham County priced above $400,000. One problem -- only 4 or 5 homes sell each month. Thus, as Keston commented here today, it is a bit of a daunting task for a homeowner in this price range to sell their home. There are 27-28 months of supply of these homes on the market!  The eleven houses pictured above are the only homes selling in Harrisonburg and Rockingham County for more than $400,000 in the past three months. It could have / should have taken them 27 months to sell (see above), but here's how many months it took them to sell.... 1, 3, 5, 5, 6, 8, 11, 12, 17, 18, 27 As you can see, it didn't really take these homes 27 months to sell (ok, one house took that look) -- so what's going on here? Even though there are 27 months of supply in this price range, it won't actually take most homes anywhere near that long to sell. Why? Mainly, because there are homes that sell and homes that don't. To assume that it would take 27 months for homes to sell assumes that all homes will sell --- they won't --- many homeowners will decide to take their houses off the market in any given year, and many homes will languish on the market indefinitely. So, what does a homeowner have to do to sell their $400k+ house in this market? How do you become "one of the ones" that will sell? Some things are out of your control --- location, for example. However, there are quite a few other aspects of selling your home that are under your control, specifically condition, pricing and marketing. If you're going to attempt to sell your home above $400,000 in Harrisonburg or Rockingham County --- don't get too overwhelmed by the 27 months of supply, but do know that it is going to require special attention to these details (condition, price, marketing) to be one of the four or five homes that is chosen by a buyer in any given month out of the 128 (+/-) homes that are available. | |

Harrisonburg and Rockingham County Median and Average Sales Price Increase in September 2009, but . . . |

|

Perhaps as a result of the $8,000 tax credit, this month's home sales were not as low as could be expected given the year-to-date trends. During the first nine months of this year, we have seen an overall decline of 21% in home sales, yet September 2009 versus September 2008 only shows a 11% decline. Furthermore, both the median sales price and average sales price increased when comparing September 2009 sales to September 2008 sales. The year-to-date median and average sales prices are still showing declines (4%, 2%), so we won't call this a trend yet -- but hopefully a sign of positive changes to come. To learn more, review the entire September 2009 Harrisonburg & Rockingham County Real Estate Market Report: Read Report Online | Download PDF.  If you find the information in this report to be helpful....

| |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings