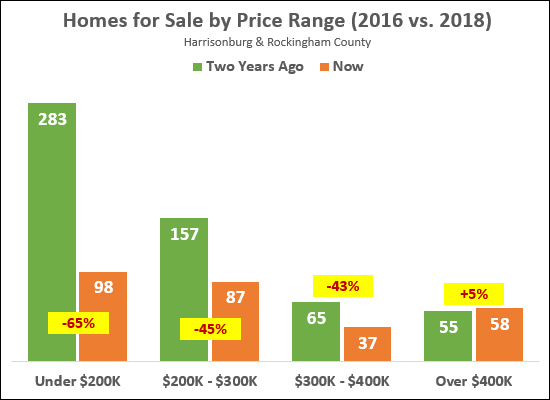

Which price range of homes have been hit the hardest with reduced inventory levels? |

|

Clearly, the under $200K market is extremely tight right now -- with a sharp (65%) decline over the past two years. Some of this is the lack of availability of this housing because more people want to buy these homes than sellers want to sell them -- and some is a result of increases in property values over the past two years, resulting in some "just under $200K" homes becoming "just over $200K" homes and falling into the next price bracket. As shown above, there has also been a significant (45%, 43%) drop in housing inventory levels between $200K-$300K and $300K-$400K. The only stable price range has been the "over $400K" price range where there are just about the same number of homes for sale now (58) as there were two years ago (55). I expect that inventory levels under $200K will drop even lower over the next 12 months You can find out more about the Harrisonburg and Rockingham County real estate market by visiting....  | |

Would your hazard insurance policy protect your house if Paddington stayed overnight? |

|

Emily and I went to see Paddington yesterday - quite a fun movie. Mr. Brown wisely calls his hazard insurance company to make sure that his policy will provide coverage for any damage caused by his overnight guest, Paddington. It is not entirely clear whether he is successful in adding "talking-bear-as-an-overnight-guest" coverage to his policy before Paddington sleds down the spiral staircase in the bathtub. :) So, if Paddington is staying at your house overnight, please call your insurance company first - and then call me - Emily and I would like to stop by to say hello. While you're waiting for Paddington to arrive (perhaps eating a marmalade sandwich?) here are some answers to a few common questions about homeowners insurance (hazard insurance).... My lender's Good Faith Estimate includes a price for hazard insurance - will I be obtaining insurance from my mortgage company?

Why do I have to pay for an entire year of homeowners insurance at closing when I purchase my home?

OK, but then, why does my Good Faith Estimate indicate I'm paying for another three months of insurance even beyond the first year's premium??

What happens to all of this money I'm paying in advance when I sell my house?

Why does my lender escrow funds for taxes and insurance, anyhow?

| |

Do you need Vacant Home Insurance? |

|

If you have moved out of your house, and it is currently vacant, you should likely talk to your insurance company about Vacant Home Insurance. Here are some things you should know before you make the call....

It is best to have these conversations with your insurance company before you move, but regardless of where you are in the process of moving out of your home (and thus leaving it vacant) you need to understand what your current insurance policy will and will not cover so that you can make the appropriate decisions about your insurance coverage into the future.

Please note that I am not endorsing Farmers Insurance, American Family Insurance or Foremost Insurance Group --- I do not know much about any of these companies --- but these are some companies that seem to offer this type of insurance coverage. Please do your due diligence in making any changes to your insurance coverage or company. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings