Government

| Older Posts |

Harrisonburg City Council Approves Increase In Real Estate Tax Rate |

|

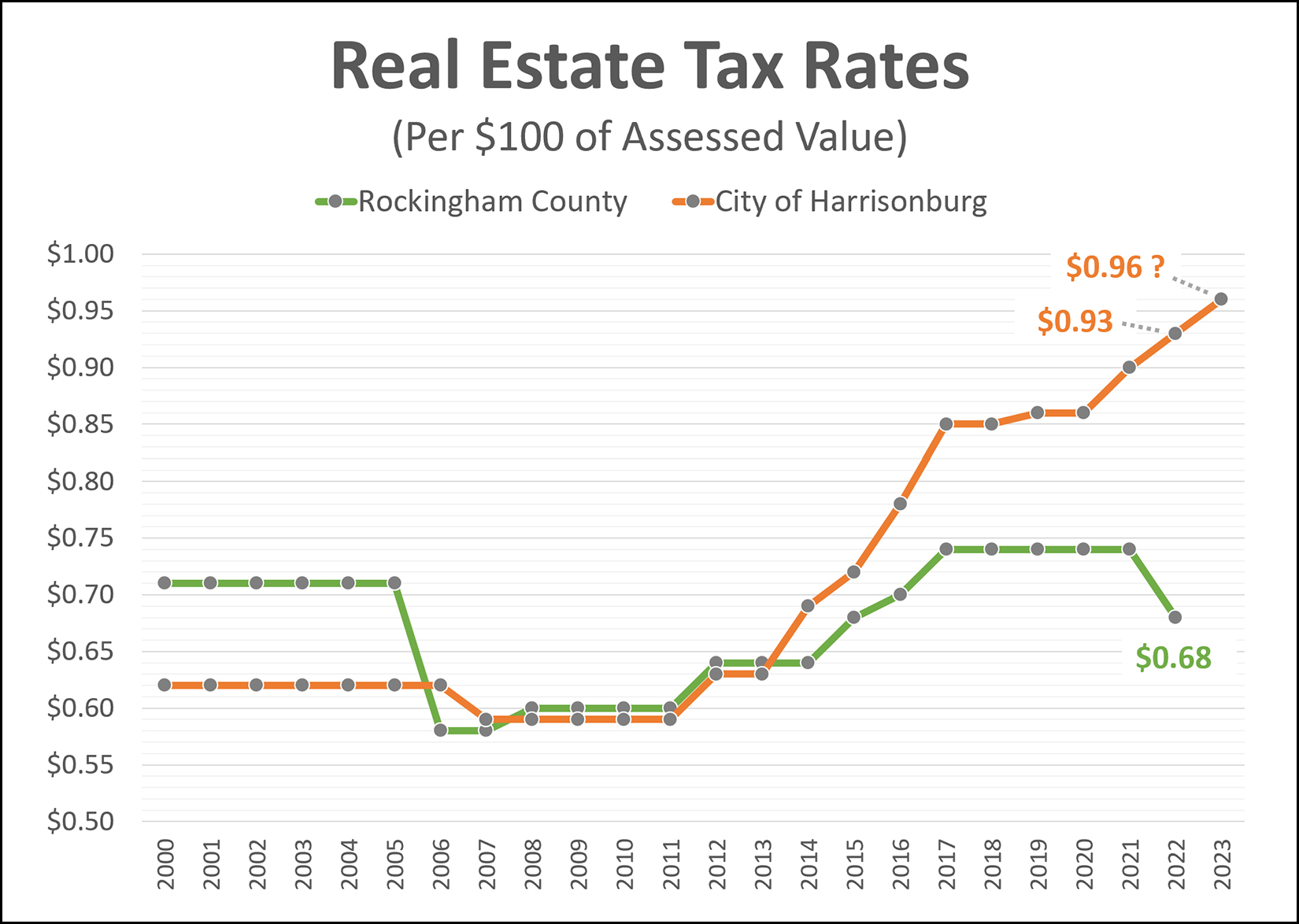

The real estate tax rate in the City of Harrisonburg will be increasing again for the 2024-25 fiscal year... rising $0.05 to $1.01 per $100 of assessed value. This is the fourth year in a row that the City of Harrisonburg has increased the real estate tax rate...

You can read a good bit more about the decision, rationale and citizen comments over at The Citizen... As you likely realize, we have also seen a rather significant increase in home values during the five year period referenced above, which further increases the property tax bill for city property owners. | |

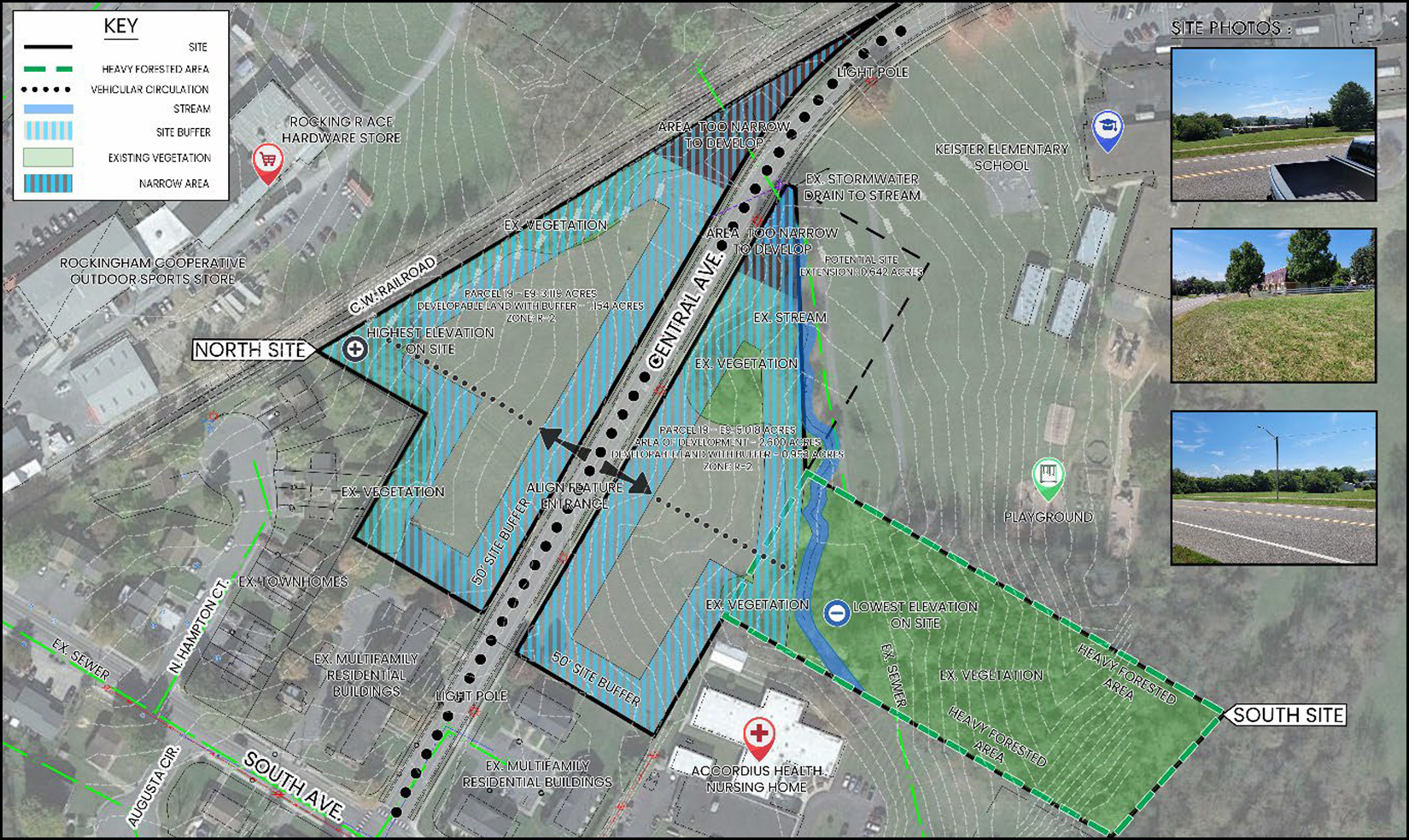

Harrisonburg Explores Options For Developing Housing On City Owned Land |

|

The City of Harrisonburg has been working for the past year on exploring how two City-owned properties might be developed to provide future affordable housing solutions. The first site is an 8.59 acre parcel located on Neff Avenue that would likely allow for the development of either (72) townhomes or up to (200) apartments. Here is an illustration of a potential townhome layout...  The second site is an 8.13 acre parcel on Central Avenue that would likely allow for the development of (36) single family homes, (51) townhomes or up to (133) apartments. Here is an illustration of a potential single family home layout...  Click here to download the full memorandum from Land Planning and Design Associates, Inc. who prepared a detailed technical memorandum outlining opportunities, constraints, possible development solutions and affordable housing solutions. The memorandum also include multiple other renderings of potential development plans for these sites. | |

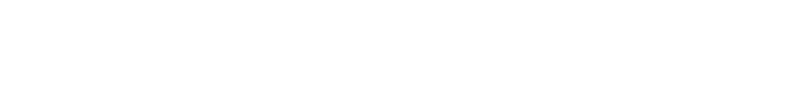

Rockingham County Launches Development Tracker |

|

Exciting news from Kayla Yankey, a planner in the Rockingham County Department of Community Development... Rockingham County has launched a new resource to track development activity occurring throughout the County. This Development Tracker application tracks rezoning and special use permit requests under review and approved, site plans under review and approved, building permits under review, projects under construction, and recently completed building projects. The application is user-friendly and easy to navigate, providing the public with a clear vision of the County’s development pipeline. Information will be updated weekly. For development questions beyond the scope of the Development Tracker, please contact the Rockingham County Department of Community Development at 540-564-3030. This is a great resource to understand developments that have been proposed in Rockingham County. Check it out here. | |

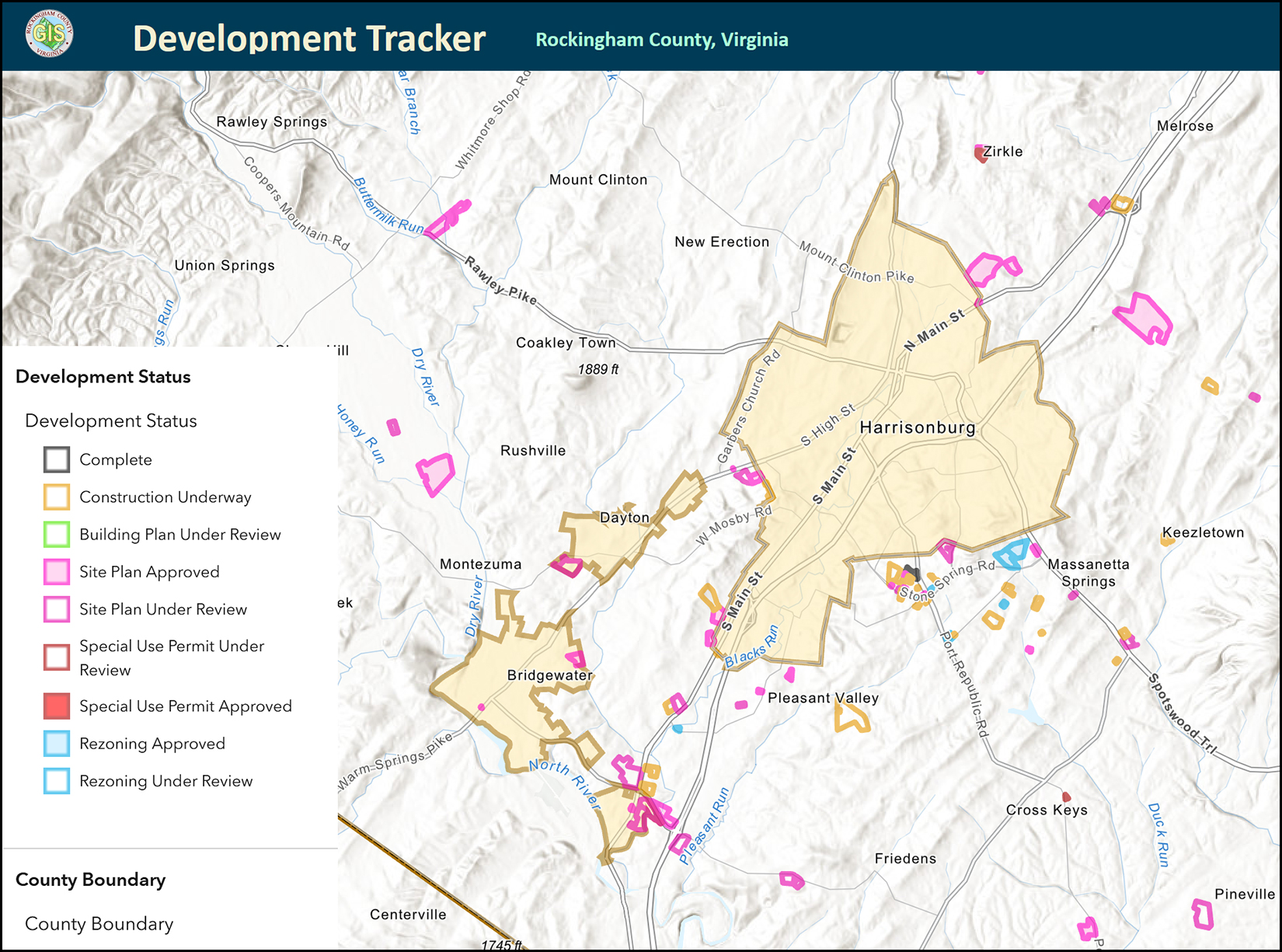

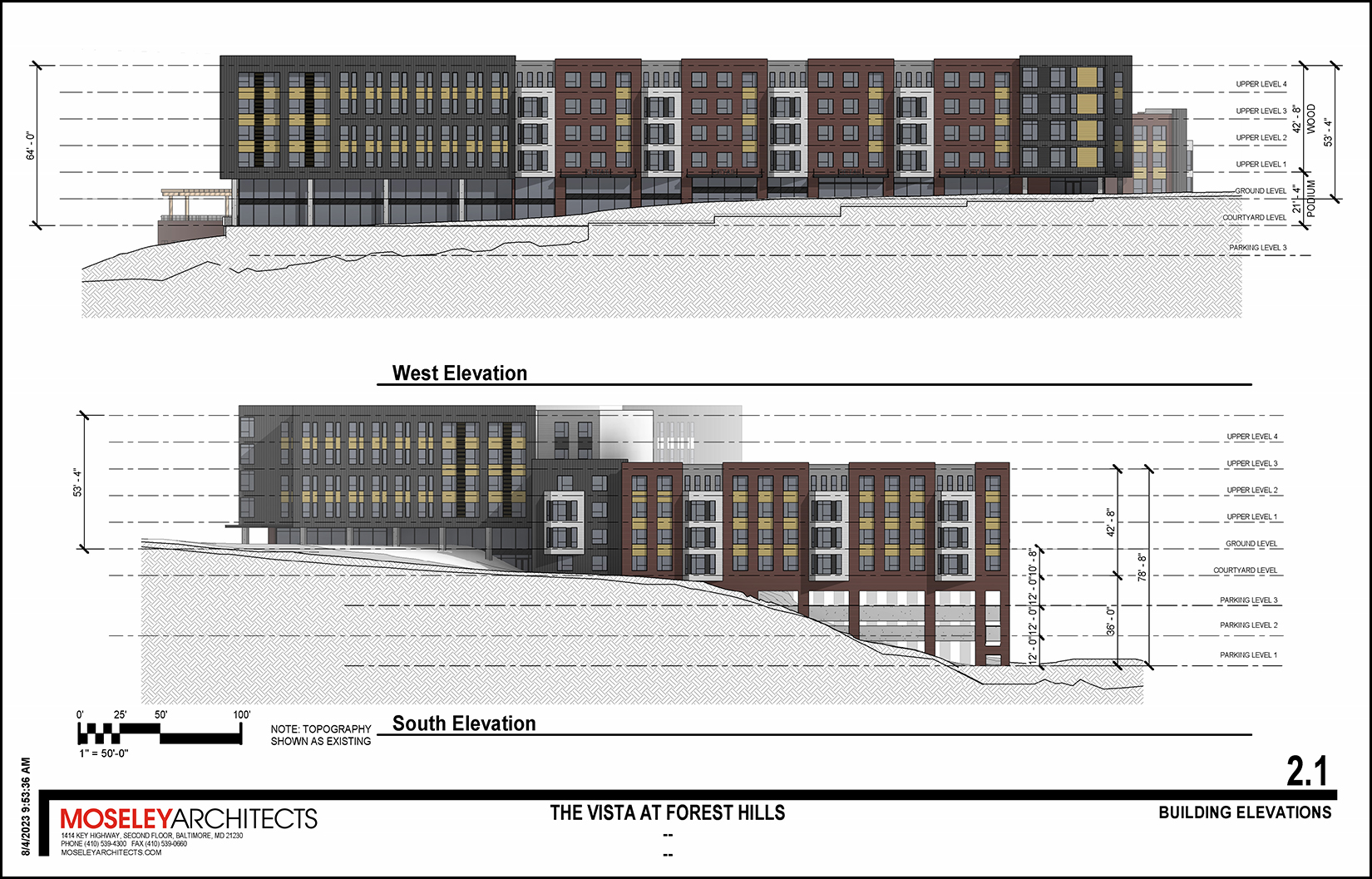

119 Apartments, Convenience Store, Restaurant Proposed At Intersection Of Port Republic Road and Devon Lane |

|

A new development, The Vista at Forest Hills, is being proposed at the intersection of Port Republic Road and Devon Lane, at the current location of a Citgo gas station. The applicant would like to redevelop the site to include a convenience store, restaurant and 119 student apartments. Per the letter from the developer's engineer... [1] The student apartments would consist of no more than 440 bedrooms. [2] The development would have up to three floors of parking garages. Here's another rendering of the proposed structure, from another angle... For one more vantage point, here are two elevations showing how the building will work with the grade of the site... Finally, here's the site plan where you can see how this parcel relates to Port Republic Road, Devon Lane, Bradley Drive and Village Lane... A public hearing will be held on August 9th (Wednesday) related to this proposed development during the City of Harrisonburg Planning Commission meeting. This proposed development would require both a rezoning and a special use permit. Per the Planning Commission packet, City staff has significant concerns about this proposed development regarding "compliance with the SUP development plan requirements and matters associated with the maximum height and minimum setback requirements, parking lot landscaping requirements, and questions regarding proffer statements." Staff is recommending that the Planning Commission hold the public hearing on August 9th but then table the request until their following meeting to allow staff to complete more analysis of the proposed plan and provide further feedback to Planning Commission. | |

280 Unit Rental Community, Stone Ridge Crossing, Proposed For North End Of Boyers Road |

|

Remember the north end of Boyers Road? It used to be connected to Route 33 but now it ends in a cul-de-sac. The proposed development shown above, Stone Ridge Crossing, is proposed for the west side of the north end of Boyers Road. The proposed developer of this parcel is requesting that Rockingham County rezone 27 +/- acres from A-2 (agricultural) to R-5 (residential) to allow for the construction of this apartment style development. According to the developer's Plan Description in the Rezoning Application Packet in the Planning Commission Packet for August 1, 2023 (tonight), the actual residences will be a mix of single family detached, duplex and townhouse style apartment housing -- but they will all be owned by, and rented by, a single entity. As such, this 280 unit residential developments would all be rentals... with none of the residences offered for sale. The developer intends to include a clubhouse fitness facility, swimming pool, and multiple picnic areas, fire pit and grilling areas, as well as pocket parks. Of the proposed 280 residential units, no more than 33% of the units would be 3-bedroom units and none would be 4-bedroom (or more) units. This proposed development would include up to 280 residential rental units, which would join the list of approximately 3,368 other rental units that are already under construction, approved, planned or proposed in the City Harrisonburg and/or in the areas of Rockingham County just surrounding the City. Here are all of the other potential upcoming rental developments on that list of 3,368 potential new rentals...

I imagine many people in our local community would probably prefer that a new 280 unit residential development would be single family detached homes, duplexes and townhomes offered for sale -- instead of for rent -- but the developer who is proposing the rezoning prefers to keep the residences and rent them to tenants. It will be interesting to see how the Rockingham County staff, Planning Commission and Board of Supervisors respond to this request. The Planning Commission will have a public hearing regarding this proposed rezoning tonight, August 1, at 6:30 PM. | |

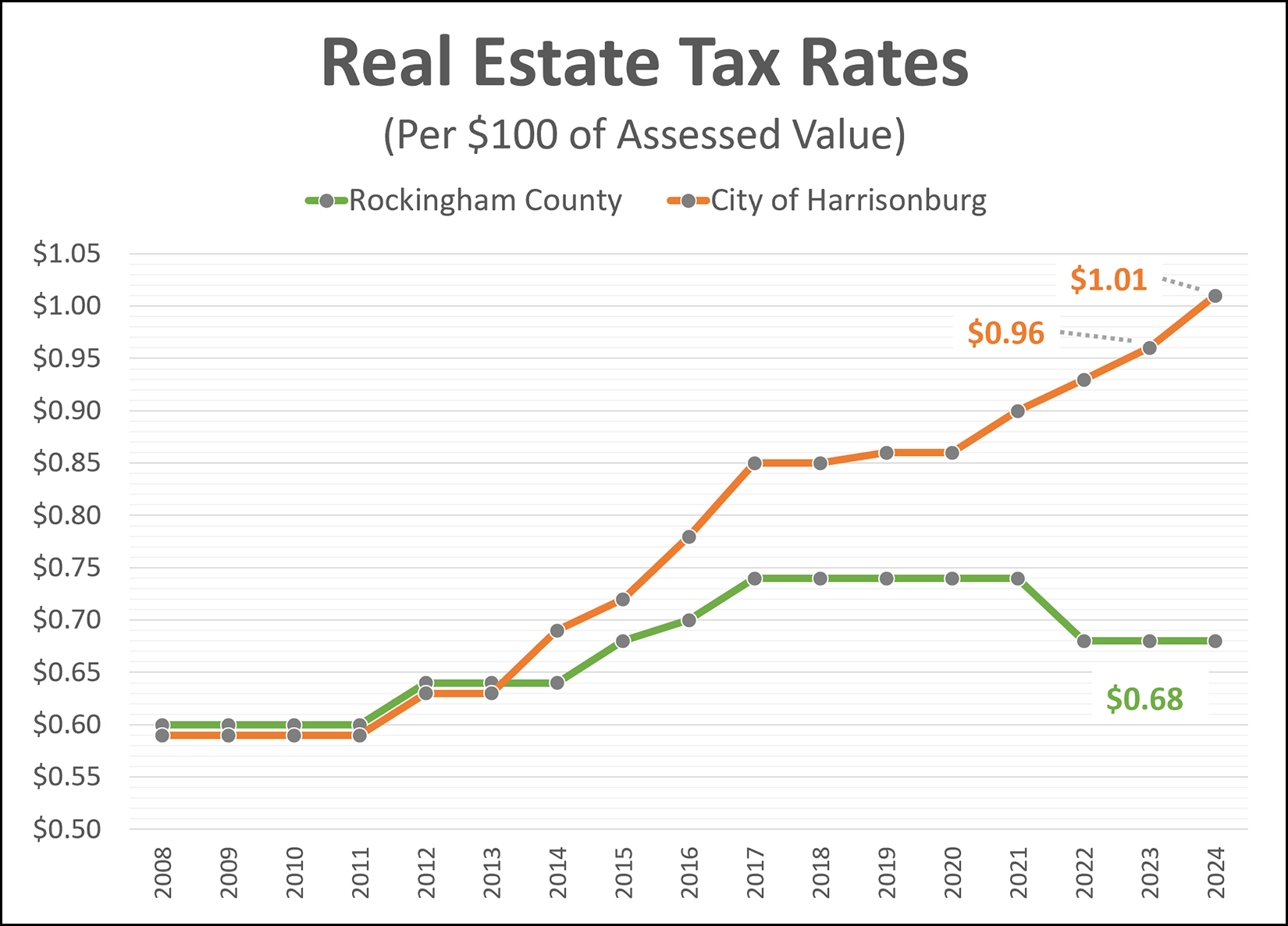

Harrisonburg Considers An Additional Increase In The Real Estate Tax Rate |

|

It's that time of year again... the City of Harrisonburg must decide how much money it can, will or must spend... and where that money will come from. City Council met last week and began to discuss a draft budget for Fiscal Year 2023-2024 presented by City staff. You can read more about the meeting and discussion here. You can view the draft budget here. In summary... the City is planning on a budget of around $362M in FY24, which is about a $27M increase from FY23. Where does all of that money come from? A variety of sources, including these top four funding sources... 34% from real estate taxes 11% from personal property taxes 11% from sales taxes 11% from restaurant food taxes The amount of real estate taxes collected (to fund the budget) depends on... [1] the value of real estate in the City [2] the real estate tax rate The planned budget includes (as shown on the graph above) a $0.03 increase in the real estate tax rate, from $0.93 to $0.96. What impact will this 3% increase in the real estate rate have on owners of real estate in the City of Harrisonburg? The median sales price of homes sold in the City of Harrisonburg over the past year was $255,000. Real estate taxes with a tax rate of $0.93 on this $255K home would cost a homeowner $2,371.50 per year. Real estate taxes with a tax rate of $0.96 on this $255K home would cost a homeowner $2,448.00 per year. So... a $76.50 increase per year... or about $6.38 per month. Two important notes related to these calculations... [1] The $255K figure of the median sales price is not necessarily perfectly aligned with the median tax assessed value of all residential properties in the City. The $255K figure is based on their sales prices... not the assessed values... and just of the homes that have sold... not all homes that exist. [2] The median sales price has increased 12% in the City of Harrisonburg over the past 12 months. This may mean that assessed values will rise when properties are next assessed by the City, which would result in a further actual increase in real estate taxes based on new assessed values. Finally, two other general notes... [1] For anyone wondering what the City spends $362M on in a year, the "Budget in Brief" document found on this page is a very helpful summary of the City budget. [2] From the article on The Citizen linked above (and here)... "This tax increase is a continuation of the city’s plan to raise that tax by 10 cents over three years to pay for the new Rocktown High School, which is expected to cost about $100 million." | |

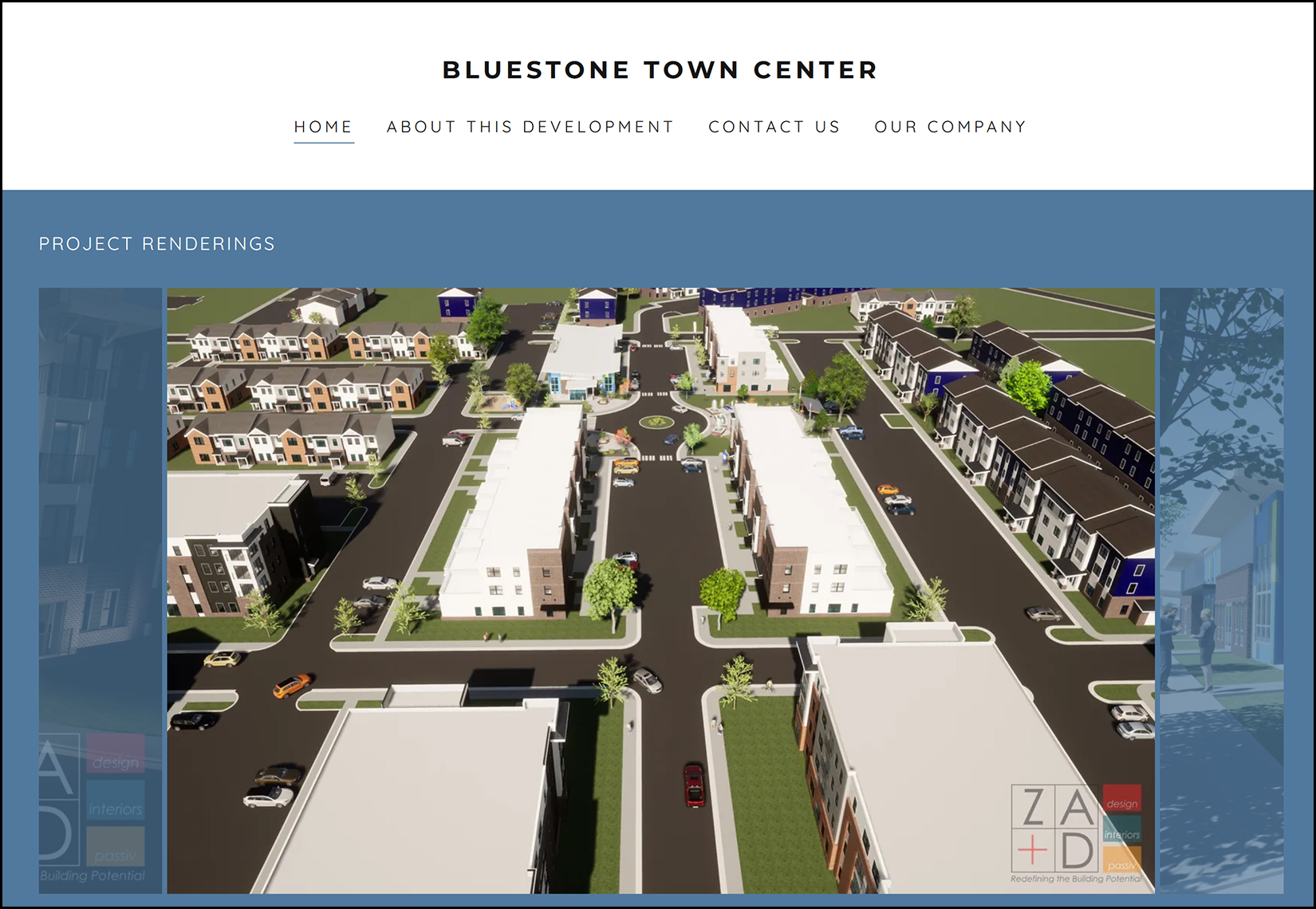

Harrisonburg Planning Commission To Consider 897 Unit Bluestone Town Center Proposal To Include 415 Apartments, 349 Townhomes, 133 Detached Homes |

|

The City of Harrisonburg Planning Commission will hold a public hearing tomorrow, Tuesday, January 17th as they consider a proposal called Bluestone Town Center which would include 897 residences on 90 acres.  In addition to 415 apartments, 349 townhomes and 133 detached homes, the master plan also proposes a community center, playground and retail shops. You can explore the proposed development further on the website put together by those seeking the rezoning... You can download the Planning Commission agenda here which includes links to all of the supporting documents for this rezoning application. It is likely to be a lively public hearing as there seem to be plenty of folks both supporting and opposing this proposal. Change.org Petition #1... Change.org Petition #2... Here are some other my thoughts and observations...

As details of this proposal have become increasingly available over the past few months... [1] I have had many conversations with people who are strongly in support of BTC because they want more affordable housing options to exist in the City. [2] I have had many conversations with people who are strong opposed to BTC because they are concerned about (among other things) what they see as a likely increase in City taxes to pay for the impact of this development. From here, the Planning Commission will review the proposal and make a recommendation to City Council... and then City Council will decide whether to approve this development in the City. The final decision by City Council (to approve or deny) will be a big decision that (regardless of the decision) will affect the future of the City for decades to come. | |

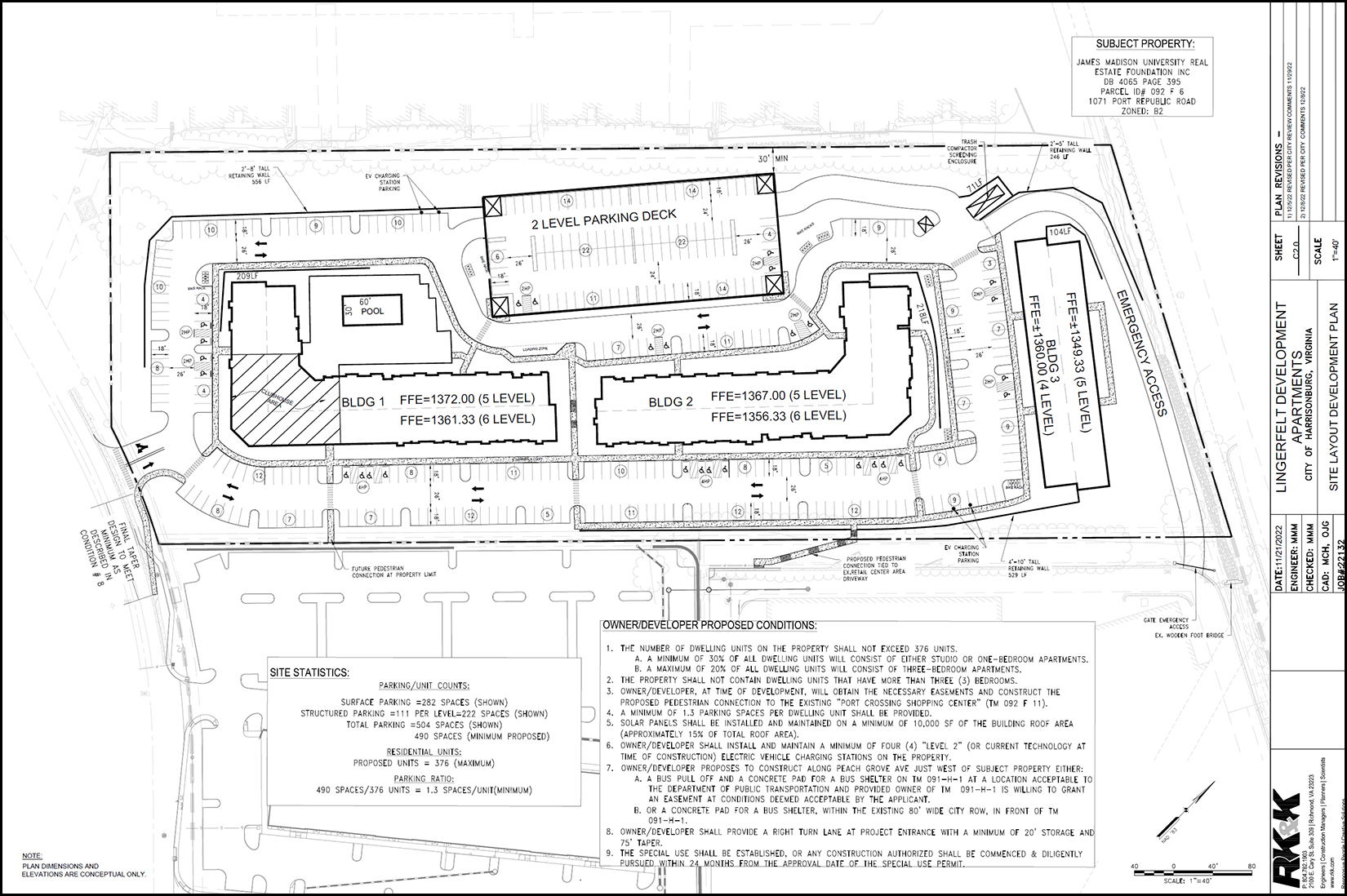

376 Apartments In Three Buildings, With Clubhouse, Pool and Parking Deck Proposed For Peach Grove Avenue |

|

Lingerfelt Development, LLC is requesting a special use permit from the City of Harrisonburg to allow for the development of a 376 unit apartment complex on Peach Grove Avenue on a 9.9 acre parcel of land between The Hills (Southview) Apartments and the proposed 460 bedroom student housing complex, Peach Grove Shoppes. This new proposal for 376 apartments would include... [1] A minimum of 30% studio or one bedroom apartments [2] A maximum of 20% of three bedroom apartments [3] No apartments with more than three bedrooms Here's the proposed layout of the development...  The land for this proposed development is currently owned by the James Madison University Real Estate Foundation. Here's the location of the proposed development...  Read up on all of the details of this proposed development in the special use permit application packet here. 12/14/2022 - tabled by Planning Commission

| |

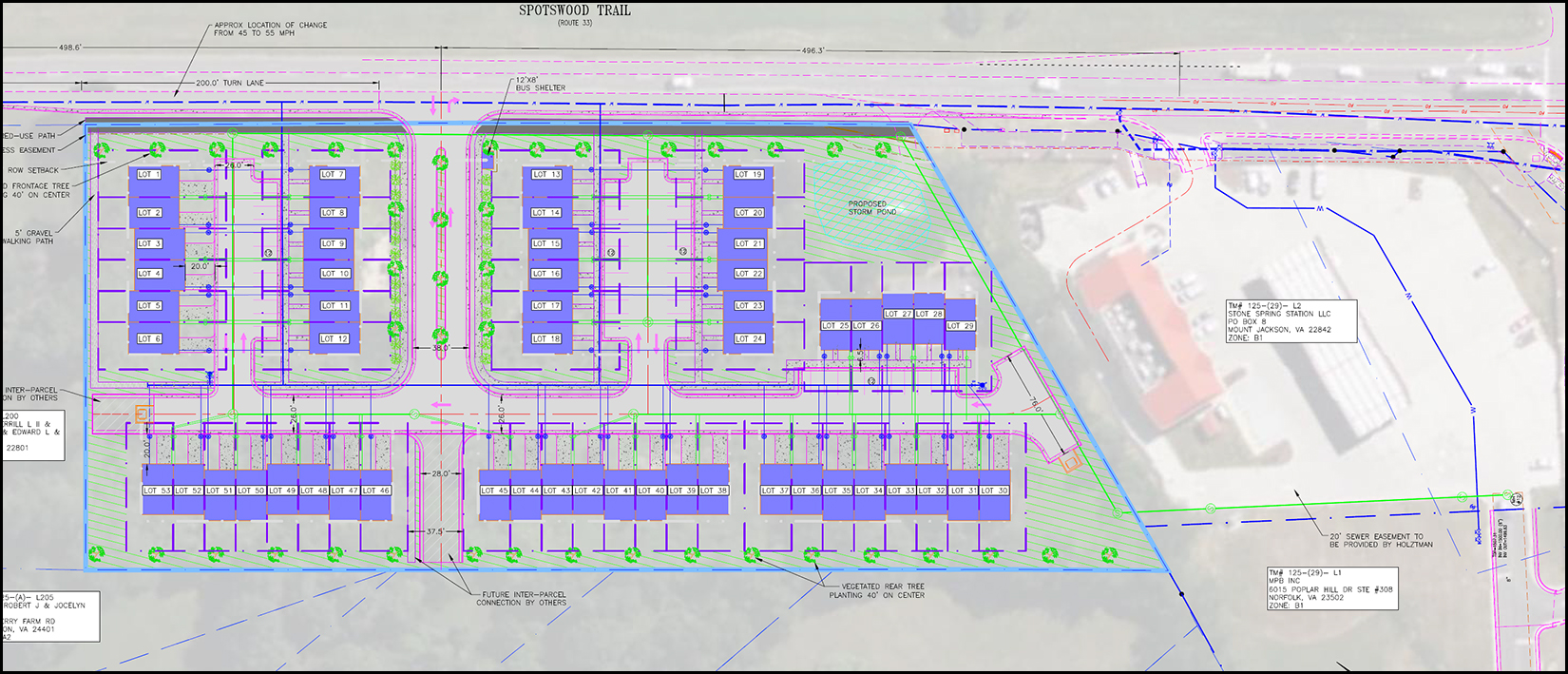

53 Townhomes Proposed Near Intersection Of East Market Street, Stone Spring Road |

|

A 53 unit townhome development is being proposed directly on East Market Street, just prior to the 7-11 gas station at the corner of East Market Street and Stone Spring Road when heading east. This residential development would be built on 4.43 acres that is currently zoned A-2 (general agriculture) and a rezoning is being proposed to allow for the residential development. Here's the proposed layout...  Rockingham County staff has some reservations about this proposed layout of this development because the development utilizes private streets (instead of public roads) and thus would not allow for connectivity between existing public roads and potential future public roads to be built on adjacent parcels. More specifically, from the County... "Privately maintained streets are an unreliable means of serving the long-term, publicly accessed street network that will be needed to serve all the land south and west of this site." Furthermore, the proposed layout (T turnaround) does not meet the requirements of the Rockingham County Fire Prevention Code. The Rockingham County Planning Commission considered this request on Tuesday, December 6th and tabled the proposal. Download the full rezoning application packet here. | |

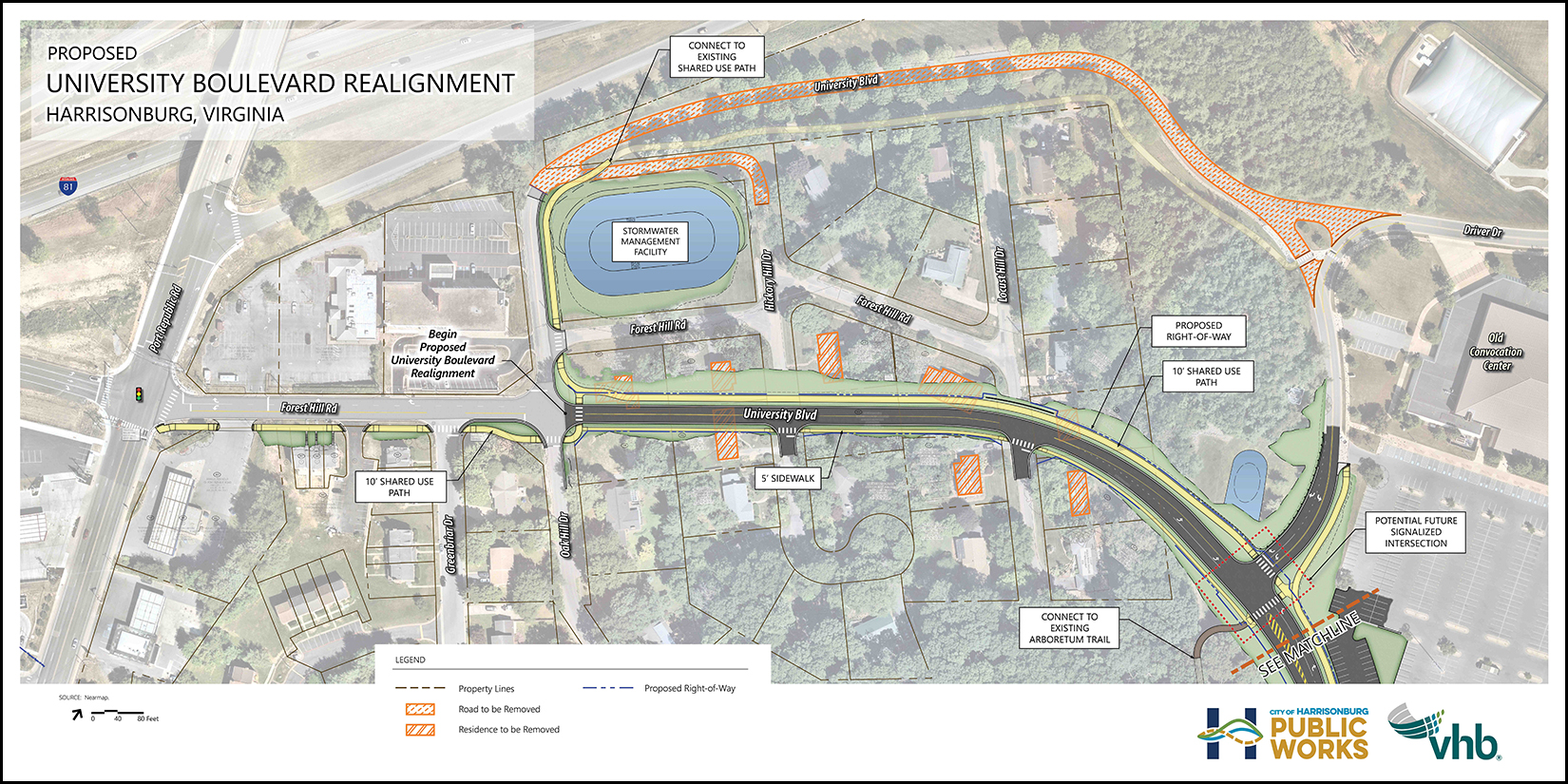

University Boulevard To Be Realigned In Forest Hills Area |

|

The (winding) section of University Boulevard between the Convocation Center parking lot and the intersection of Forest Hills Road and Oak Hill Drive will be realigned and widened to include both a roadway, shared-use path and sidewalk... but, likely not until 2025. Who will pay for this transportation transformation? The project is estimated to cost about $10.4 million and these costs will be paid as follows...

View a larger version of the map above here. Learn all about this realignment project on the City website here, or via this recent Daily News Record article. | |

Updates On Proposed Residential Developments In Rockingham County |

|

BOYERS CROSSING September 2022 - Approved by Rockingham County Board of Supervisors ZEPHYR HILL September 2022 - Approved by Rockingham County Board of Supervisors THE GLEN AT COOKS CREEK August 2022 - Approved by Bridgewater Town Council AND MORE Find out about the many new developments and proposed developments here at HarrisonburgNewHomes.com. | |

Help Shape The Future Of Rockingham County! |

|

Rockingham County is revising and updating its Comprehensive Plan, which is a document that sets the vision and goals for the next 10 to 20 years! The last review was approved by the Board of Supervisors on September 23, 2015. The Comprehensive Plan addresses topics such as:

The policies defined in the plan will guide the County's future direction and priorities for growth, services, and land use regulation. And... YOU... can have a voice in the updated Comprehensive Plan! Take a few minutes to complete the Public Input Survey by clicking here. Find out more about the Comprehensive Plan update here. | |

Harrisonburg to Purchase Shenandoah Presbytery Property For Use As Homeless Shelter |

|

The City of Harrisonburg has contracted to purchase a 6,000+ SF building on the north end of town that used to house the Shenandoah Presbytery. The building is situated on a 3.68 acre parcel just shy of Vine Street and Mt Clinton Pike if you were driving north on Route 11 from downtown Harrisonburg. The City will purchase the property with $700K from the American Rescue Plan Act and the shelter will be operated Open Doors. Read more about this purchase at The Citizen... | |

Almost 1,700 New Homes (or home sites) Are Being Developed or Built in Harrisonburg and Rockingham County With Another 4,000 Planned or Proposed |

|

LOTS of new housing is currently being developed in Harrisonburg and Rockingham County... though mostly in Rockingham County. Below are most that I am aware of, with approximate unit counts, though you can find it in spreadsheet form, with some links, here. 369 Apartments

647 Townhouses & Duplexes

287 Single Family Detached Homes or Home Sites

This is not to mention the 4,314 homes that are being planned or proposed...

The important, and perhaps unanswerable, big questions are... [1] Is enough housing being built or planned to support a growing population? [2] Is too much housing being built or planned beyond what our growing population needs? [3] Is the right type, size, and price of housing being built? | |

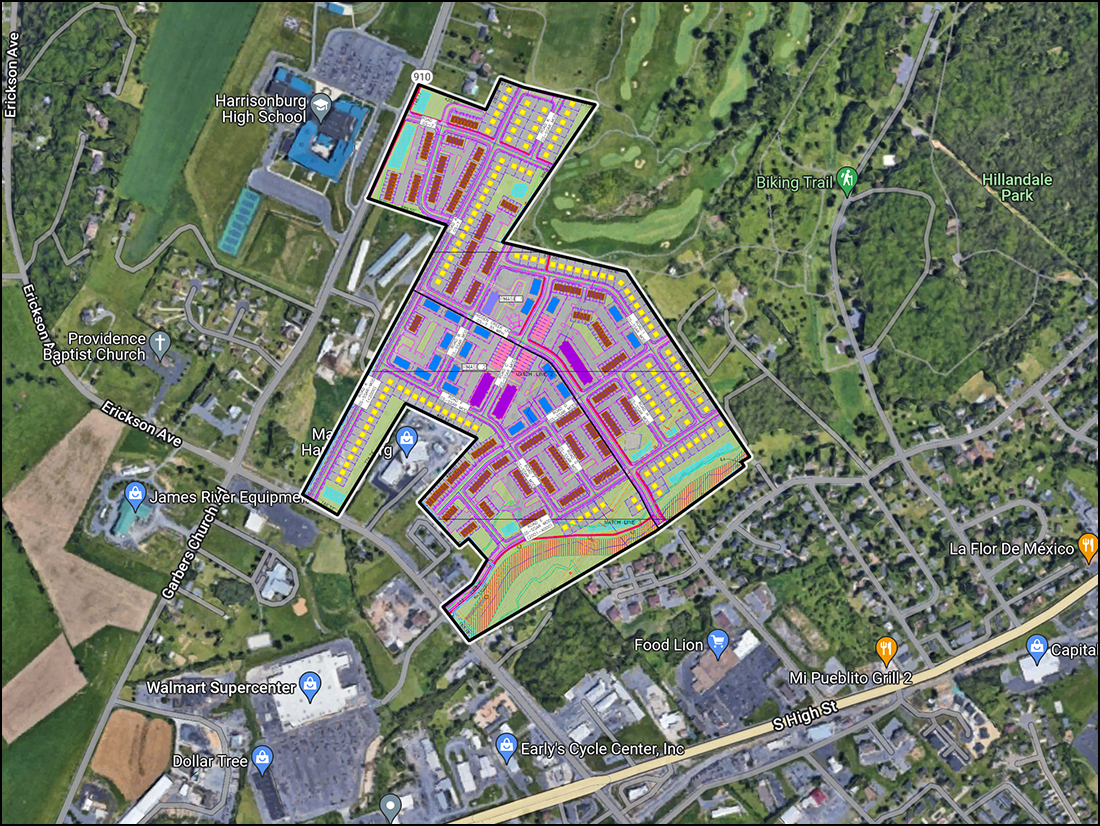

800 Mixed Income Housing Units Planned For Bluestone Town Center |

|

800 (or more) new housing units may soon be coming to Garbers Church Road and Erickson Avenue... at Bluestone Town Center... potentially featuring...

This is a potential joint venture between the Harrisonburg Redevelopment and Housing Authority (not the City of Harrisonburg, but a "political subdivision of Virginia") and Equity Plus (a private entity seemingly out of Mississippi). This potential residential development is intended to offer...

Find out more about this potential development by visiting BluestoneTownCenter.com or by attending the informational session on June 7th (today) from 4:00 PM to 6:00 PM at the Lucy Simms Auditorium. Updated... Daily News Record, June 8, 2022

| |

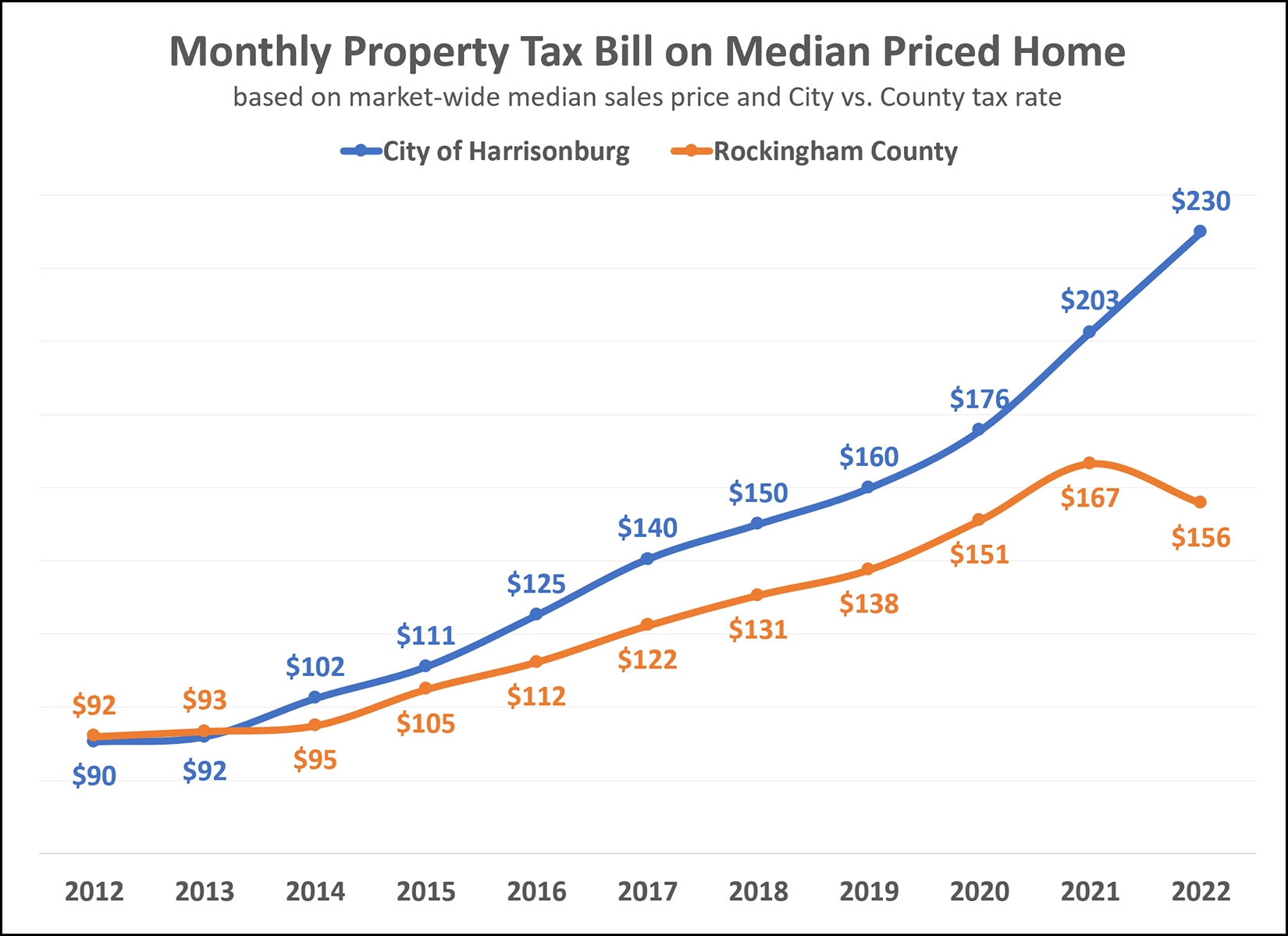

Comparing Tax Bills in the City of Harrisonburg and Rockingham County Over Time |

|

If you're buying a $300K house, will you pay more in property taxes if that house is in the City or the County? In most cases, you will pay more property taxes if you live in the City. The analysis above looks at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County. To be clear, this analysis uses:

As shown above, City property taxes have increased by 155% over the past decade while County property taxes have increased by 70% during the same timeframe. | |

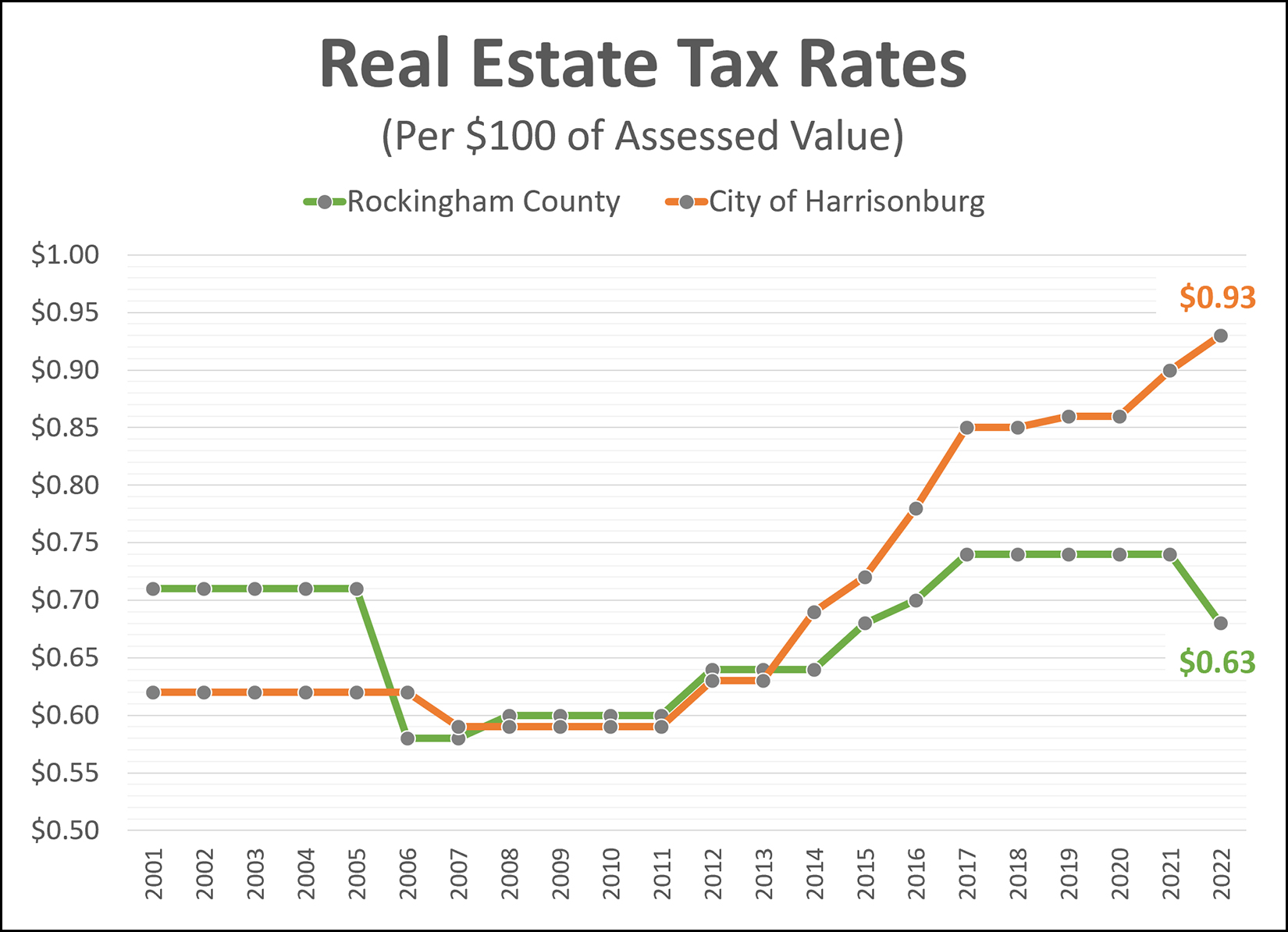

Real Estate Tax Rates Moving Up and Down |

|

Rockingham County - tax rate down 8% The Rockingham County real estate tax rate is currently $0.74 per $100 of asssessed value, but the Board of Supervisors just approved a reduction in the tax rate to $0.68 per $100 of assessed value. But... that is in the context of recently updated tax assessed value for all properties in Rockingham County, most of which increased significantly because the last reassessment took place four years ago before significant shifts in market values in this area. As a result, most Rockingham County property owners will see an increase in their tax bill despite the reduction in the tax rate. City of Harrisonburg - tax rate up 3% (pending approval) The Harrisonburg City Council will soon consider increasing the tax rate from $0.90 per $100 of assessed value to $0.93 per $100 of assessed value. The City of Harrisonburg updates their assessed values every year, so while many or most property owners recently received notice of the updated assessed value of their property, those values likely did not increase as drastically as assessed values did in Rockingham County. As a result, almost all City of Harrisonburg property owners will see an increase in their tax bill because though small increases, their assessed value and tax rate are both likely to have gone up or to go up. | |

Harrisonburg Redevelopment and Housing Authority in Planning Stages of a 1,000 Unit Housing Development Across From Harrisonburg High School |

|

Specific details are still relatively limited, but the Harrisonburg Redevelopment and Housing Authority is planning a LARGE development on land that stretches from Erickson Avenue to Garbers Church Road. Here are some of the details that have been made public thus far...

More details here. Stay tuned for more details as they are made public. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings