Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Wednesday, June 1, 2022

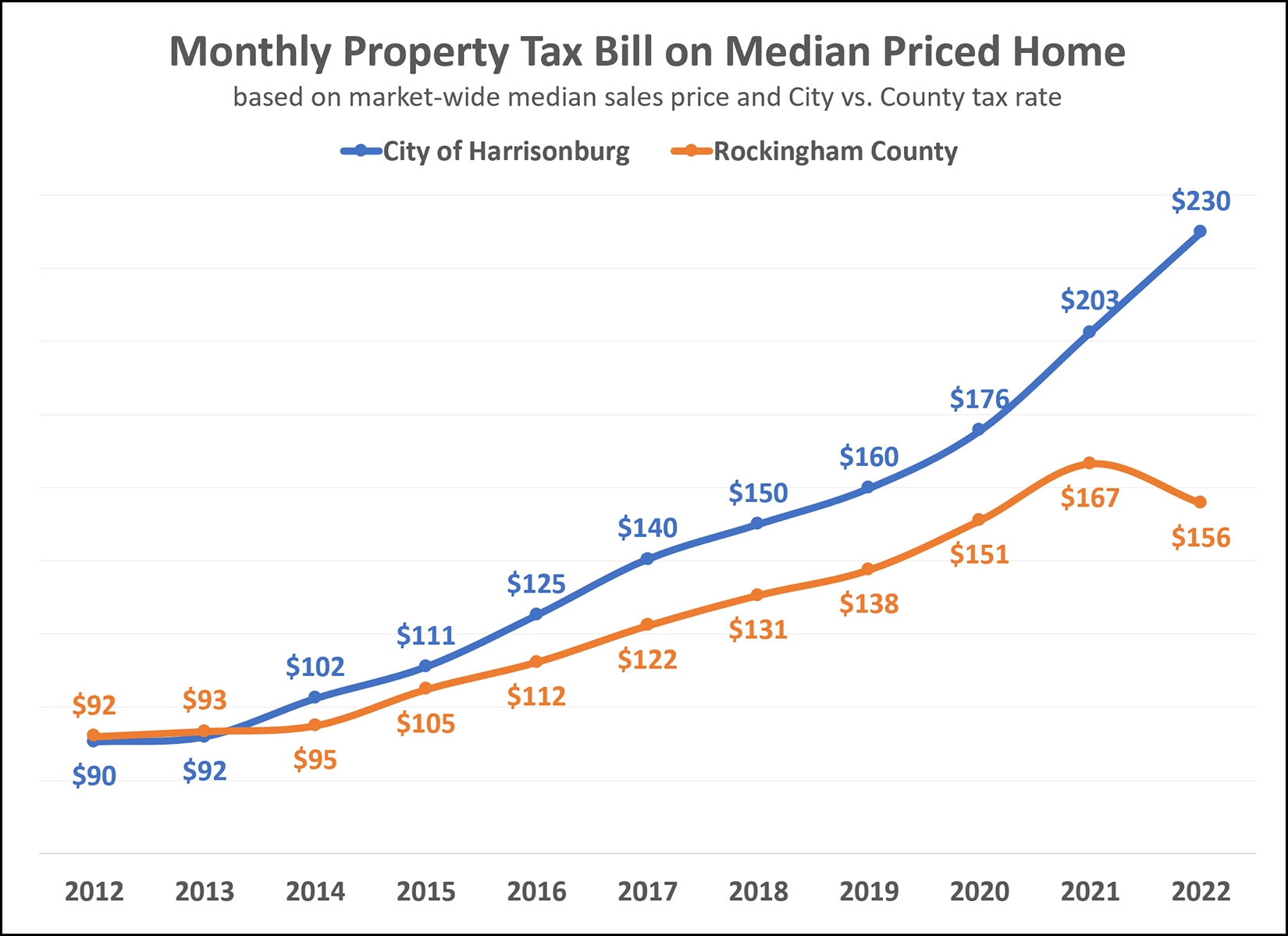

If you're buying a $300K house, will you pay more in property taxes if that house is in the City or the County?

In most cases, you will pay more property taxes if you live in the City.

The analysis above looks at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County.

To be clear, this analysis uses:

- The median sales price of a home for the City + County during each year.

- The property tax rate for the City vs. County for each year.

As shown above, City property taxes have increased by 155% over the past decade while County property taxes have increased by 70% during the same timeframe.