Inventory

| Older Posts |

Inventory Levels Are Rising, But Consider The Larger Context |

|

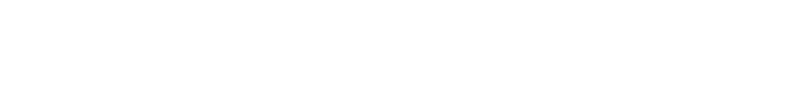

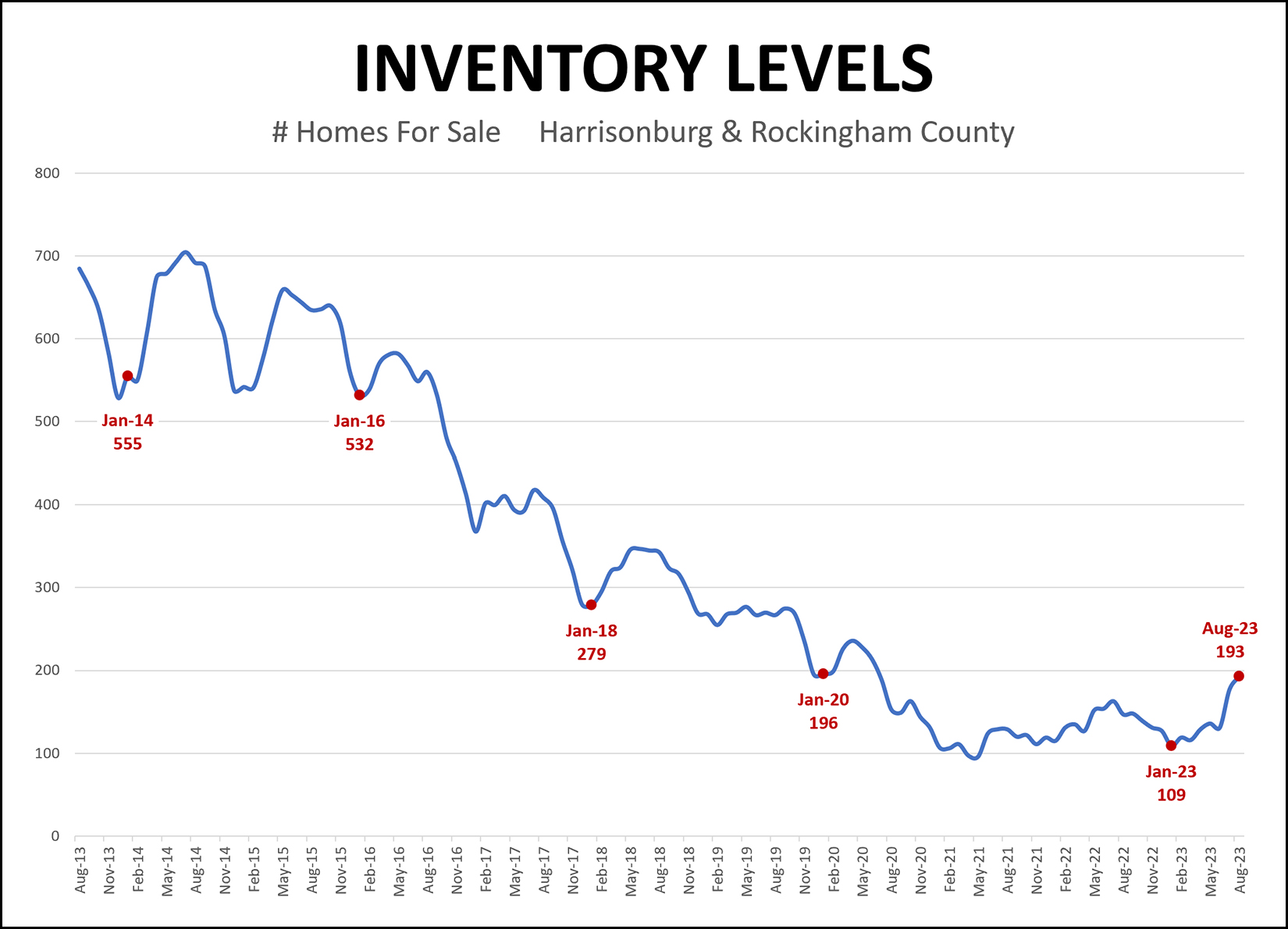

Inventory levels are rising. That much is true. At the end of last month there were 172 homes for sale in Harrisonburg and Rockingham County... well more than the 111 to 135 at the end of March each of the past three years. But... if you consider a context of any length of time longer than four years, you start to see a pretty different story. It's hard to believe, but back in 2008 - 2011 there were over 800 homes for sale at the end of March!?! All the way through 2016 we were generally around or above 600 homes for sale. We did see large year over year declines between 2016 and 2017 (570 down to 400) and between 2020 and 2021 (226 down to 111). So, while we're now seeing "the highest inventory levels we have seen in four years" = it's important to consider the larger context of where we have been over the past 15+ years. | |

Almost Half Of Homes For Sale Are New Homes |

|

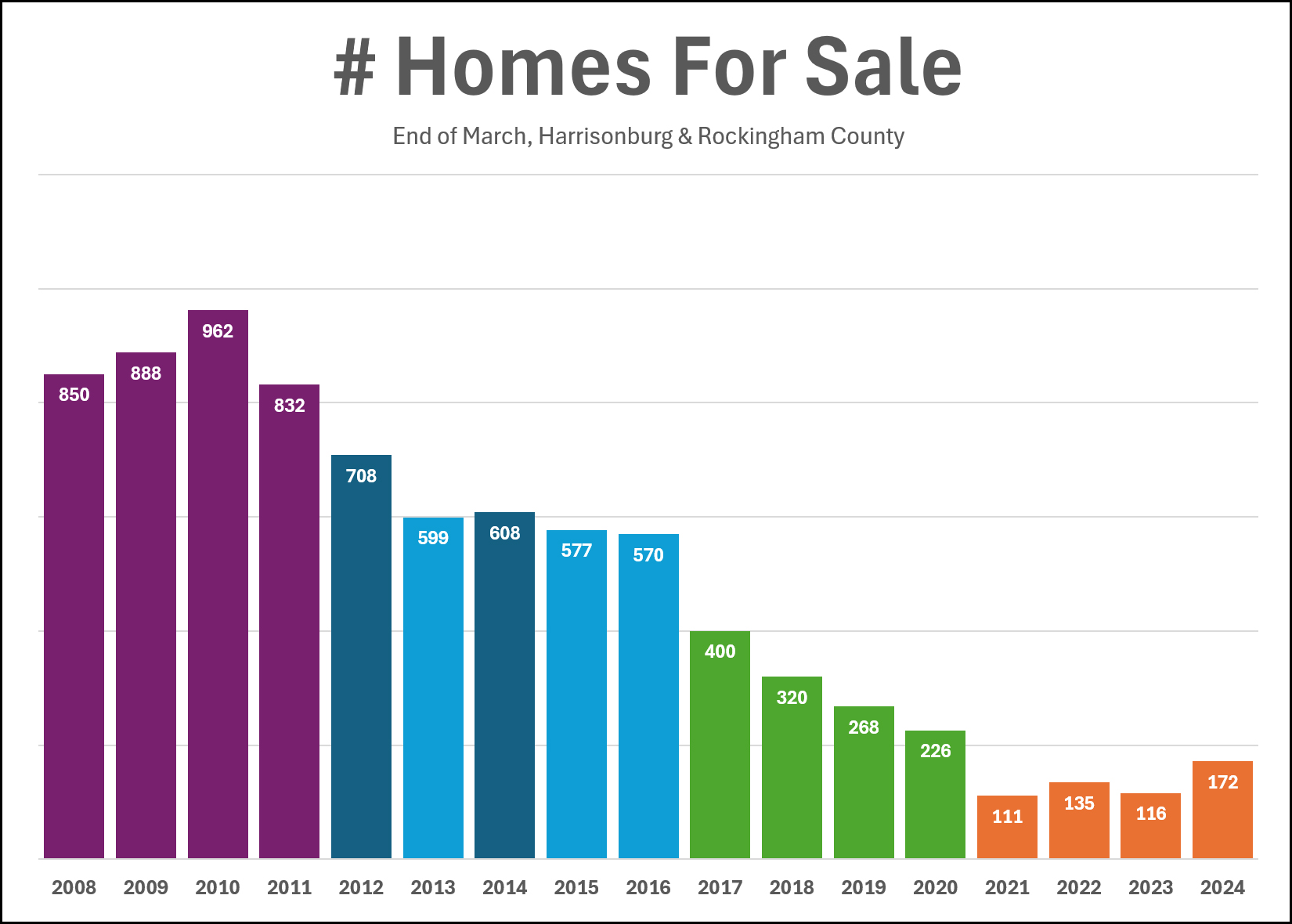

There are SOOOO many homes for sale... 185 of them right now, compared to only 109 a year ago. But... maybe there aren't as many homes for sale as you might think!?! As shown above, almost half of the homes currently listed for sale are new homes! New Homes For Sale = 88 Resale Homes For Sale = 97 So, even before we get to any price or location limitations, if you aren't looking to buy in a new home community you will only actually have 97 homes from which to choose, not 185 homes. These new homes for sale are mostly in these neighborhoods... | |

Maybe We Will See Seasonal Declines In Housing Inventory Levels Again This Year? |

|

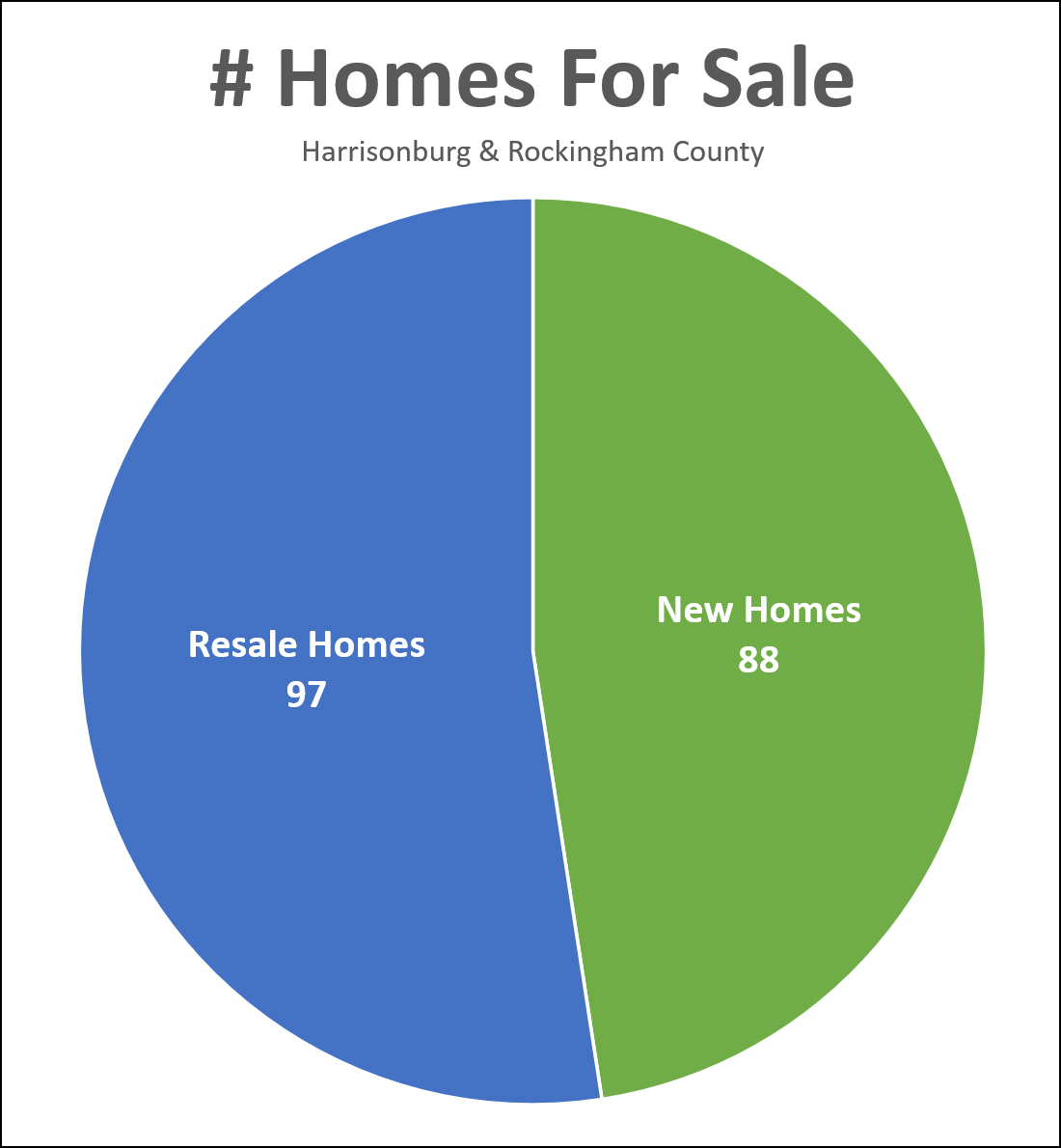

All the way through 2019, we would see a seasonal decline in housing inventory levels each winter. Inventory levels would typically be the lowest between November and February as some sellers took their homes off the market for a few months -- and as some sellers decided to wait until spring to sell their homes. But then between 2020 and 2022, that all changed. The real estate market was on FIRE as Covid-induced work/life/home changes and super low mortgage interest rates pushed more buyers than ever into the housing market. Inventory levels that had been dropping for several years (2016 - 2019) dropped even further. All of a sudden, inventory levels were ALWAYS low. Spring and summer inventory levels - low. Fall and winter inventory levels - low. We stopped seeing seasonal shifts in housing inventory levels. But over the past few months inventory levels have been drifting back upwards a bit. So, as we (eventually?) start to see cooler temperatures, will we start to see seasonal declines in housing inventory levels again? | |

Our Local Real Estate Market Keeps Testing Basic Economic Theories |

|

Between 2019 and 2022 we saw an ever increasing number of buyers buying homes (or trying to do so) in Harrisonburg and Rockingham County. Demand for homes skyrocketed, mortgage interest rates fell to historic lows, supply increased a bit (new builds) but not a enough... and perhaps unsurprisingly, median home prices increased 10% per year for three years in a row. But then, 2023... Mortgage interest rates have increased 30% over the past year, and have increased 150% over the past two years, making mortgage payments higher than ever. But yet, the median sales price keeps rising. Demand seems to be falling, with 24% fewer home sales in the first eight months of 2023 as compared to the same timeframe last year. But yet, the median sales price keeps rising. Supply is now starting to increase, with 31% more active listings on the market now as compared to a year ago. But yet, the median sales price keeps rising. What comes next!? As I pointed out yesterday, the higher inventory levels are only higher than the Covid-era lows, and are in line with or lower than pre-Covid levels. And certainly, fewer home sales may be a result of fewer sellers selling just as much as it may be a result of fewer buyers trying to buy. So, over the next two years, will we potentially see slower home sales, higher mortgage interest rates, higher inventory levels -- and yet, still see stability and/or increases in the median sales price? Yes, it seems quite possible. Or, could slower home sales, mortgage interest rates and higher inventory levels lead to a decline in the median sales price? This seems more likely, in theory, but we're just not seeing it yet, and I don't know if we'll see it at all. | |

Recent Rises In Inventory Levels In Context |

|

Inventory levels are on the rise in Harrisonburg and Rockingham County. January 2023 = 109 homes for sale August 2023 = 193 homes for sale That's a 77% increase in inventory levels! But... let's put it into a bit larger of a context... Just before Covid began (January 2020) there were 196 homes for sale. So, as shown above, other than during the weird years since the Covid pandemic began (2020-2023) inventory levels have always been above 200 homes for sale in Harrisonburg and Rockingham County... and sometimes well above that mark. So, higher inventory levels today do not necessarily mean we will see a marked change in home prices (for example) in our local market, but we'll have to continue to monitor changes in inventory levels over the next few months to see where they go from here. | |

Two Startling (Nationwide) Stats That Show Why Many Homeowners Are Not Likely To Sell Within The Next Few Years |

|

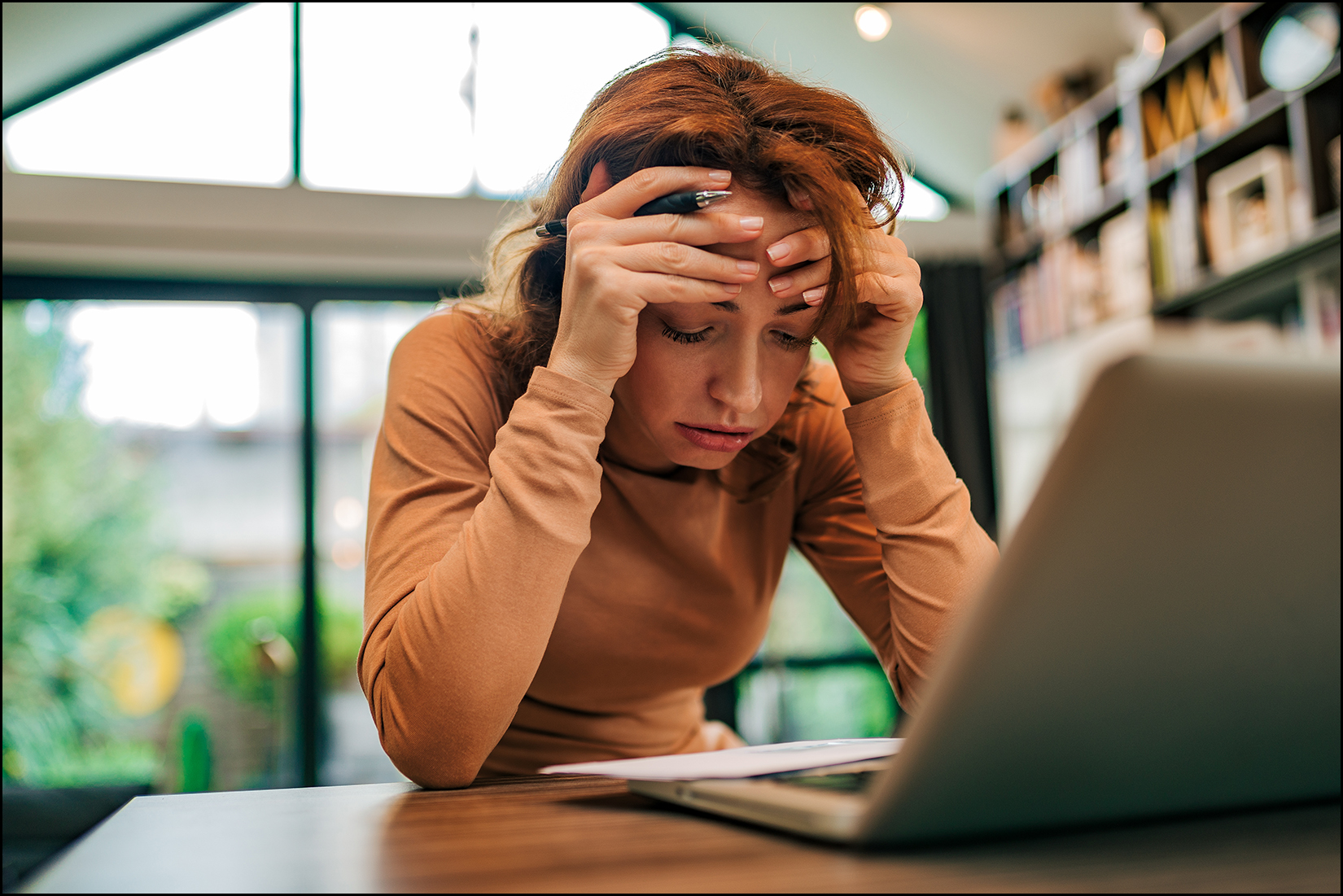

Current mortgage interest rates for a 30 year fixed rate mortgage are averaging at 6.9% per Freddie Mac. Here are the two startling statistics as reported by Business Wire as well as by many others over the past few months... [1] 82% of homeowners have a mortgage interest rate below 5%. An enormous share of homeowners have super low mortgage interest rates on their homes because they bought their home between 2020 and 2022 when we were seeing ridiculously low, historically low, mortgage interest rates -- or they refinanced their mortgage during that time. Most of these 82% of homeowners with a mortgage interest rate below 5% are rather unlikely to sell their home (and pay that off) and buy a new home at current mortgage interest rates that are near 7%. [2] 60% of homeowners with mortgages have lived there for four years or less. We saw record numbers of home sales between 2020 and 2022, as the Covid-19 pandemic (and super low mortgage interest rates) prompted lots of folks to buy a home. Many homeowners eventually find that their home doesn't work as well for them -- based on size, layout, features, etc. -- but that doesn't usually happen within four years. As such, many or most of these 60% of homeowners who have been in their homes for less than four years are not likely to be selling anytime soon. What does all of this mean for our real estate market? We are likely to continue to see low numbers of resale homes coming on the market over the next few years as more homeowners opt to stay put rather than selling their home that likely has a super low mortgage interest rate - and that likely is a home they purchased in the past few years. | |

Home Buyers In Some Price Ranges Are Likely Competing With Would Be Buyers From A Year Ago |

|

Let's focus in on one particular segment of the home buying public... ...those relocating to the Harrisonburg area for employment. Plenty of folks relocated to our area in 2022 for a job and plenty are doing so in 2023. A year ago, in summer 2022, inventory levels were extremely low. Some or perhaps many of those buyers relocating to our area for work were not able to find a home to buy given those low inventory levels. What did they do as a result? They rented a home for a year to pursue buying a home from Harrisonburg now that they are living here. So now, those relocating to Harrisonburg this year for work are not only competing with other would be home buyers also relocating here for work this year but ALSO those would be home buyers that relocate here for work a year ago and have been renting ever since that time. And, perhaps this dynamic has been happening for a few years now, building up an ever larger critical mass of buyers competing for housing. Let's translate it into fictional numbers... 2020 100 would-be buyers relocate to Harrisonburg for work. 100 homes are available for purchase. 100 would-be buyers buy a home. Yay! 2021 100 would-be buyers relocate to Harrisonburg for work. 90 homes are listed for sale and 100 buyers fight over them. 90 buyers buy, 10 would-be buyers rent. Yay-ish 2022 100 would-be buyers relocate to Harrisonburg for work. 10 would-be buyers from 2021 still want to buy a home. 80 homes are listed for sale and 110 buyers fight over them. 80 buyers buy, 30 would-be buyers rent. 2023 100 would-be buyers relocate to Harrisonburg for work. 30 would-be buyers from 2021 and 2022 still want to buy a home. 70 homes are listed for sale and 130 buyers fight over them. 70 buyers buy, 60 would-be buyers rent. This one won't be pleasant... 2024 100 would-be buyers relocate to Harrisonburg for work. 60 would-be buyers from 2021-2023 still want to buy a home. 70 homes are listed for sale and 160 buyers fight over them. 70 buyers buy, 90 would-be buyers rent. I think you get the picture. If buyers keep relocating to the area for work (they will) but inventory levels (sellers willing to sell) continue to remain low -- only so many of those relocating buyers will be able to buy a home. Then, the next year's relocating buyers will be competing with an even larger pool of would-be buyers the following year. So, if you're relocating to the Harrisonburg area for work, great, welcome! If it feels like the competition for homes is rather fierce, you are not wrong... and it seems to be a problem a few years in the making. | |

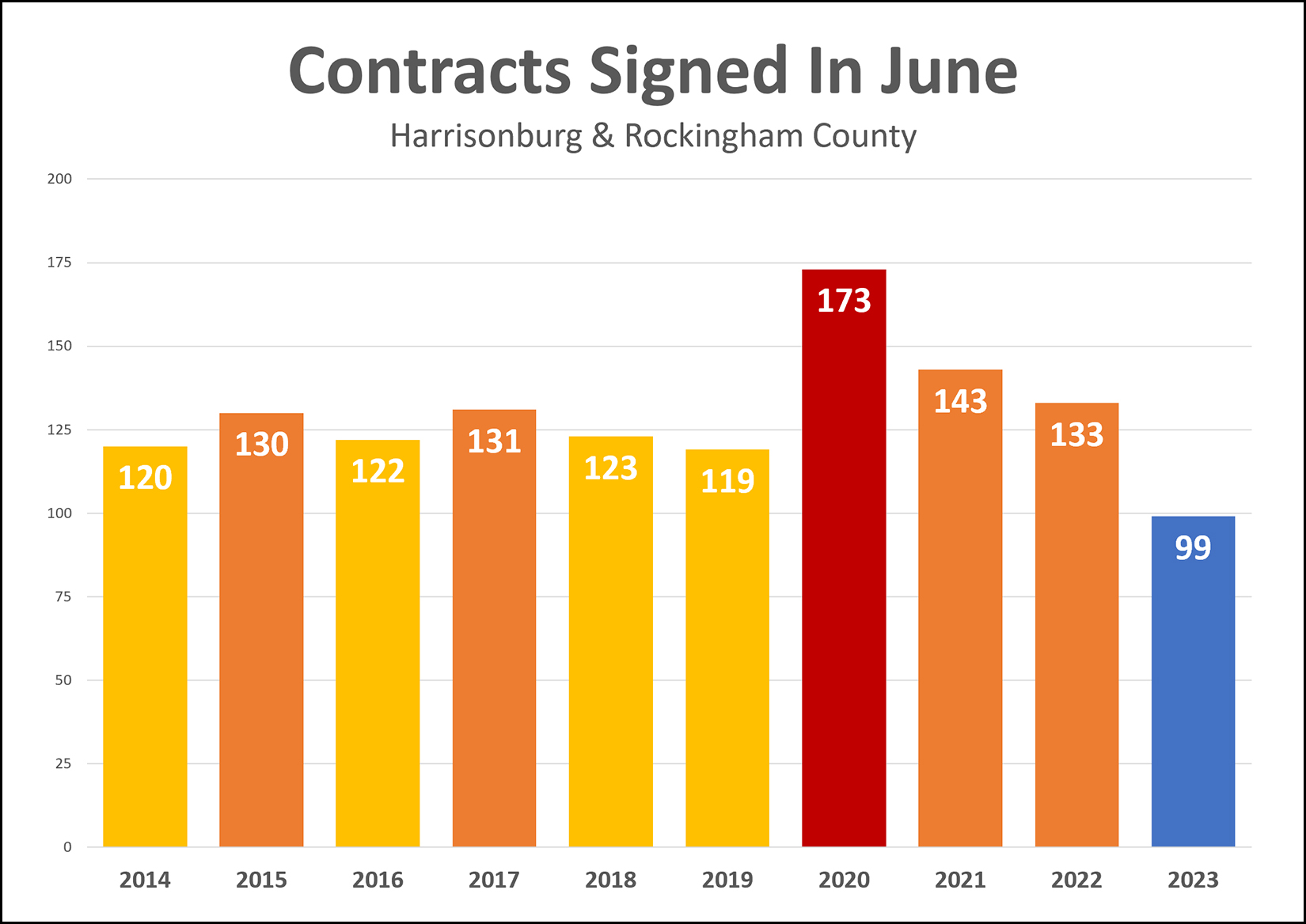

Contract Activity In June 2023 Was The Slowest It Has Been In A Decade, Much To The Dismay Of Would Be Home Buyers |

|

It remains a tough time to buy a home in many or most price ranges and locations -- with limited resale inventory leading to continued low levels of contract activity. As shown above, the 99 contracts that were signed in Harrisonburg and Rockingham County in June 2023 was the lowest number of contracts signed in a month of June for the past decade. At first glance some might assume that the low number of signed contracts is an indication that fewer buyers want to buy homes right now -- but with inventory levels starting the month low and ending the month low -- the bottleneck seems to be almost entirely on the supply side of the equation. There aren't enough sellers willing to sell their homes. Getting into the details of new homes versus resale homes for a moment, let's take a look at the highest and lowest data points... June 2020 = 124 resale homes + 49 new homes = 173 total contracts June 2023 = 73 resale homes + 26 new homes = 99 contracts So, if we take out new homes, not only did only 73 buyers sign contracts to buy home in June 2023 compared to 124 in June 2020... only 73 sellers were willing to sell their homes in June 2023 as compared to 124 in June 2020. I don't expect we'll see much of an increase in resale homes being listed for sale as we continue through 2023, so any upside potential for increased contract activity likely lies on the new home side of the equation. If you were one of the 99 buyers to secure a contract to buy a home in June 2023... congrats! | |

Existing Home Sales Are Down 19% In 2023. Why? |

|

We've seen a 19% decline in existing home sales in 2023 - which includes all home sales in the HRAR MLS except new construction sales. In the first five months of last year there were 466 existing home sales - but there have only been 377 existing home sales in the first five months of 2023. Why are there fewer existing home sales taking place right now in Harrisonburg and Rockingham County? Theory 1 - Affordability Home prices have increased significantly (+32%) over the past three years and mortgage interest rates have as well (+108%) and these two trends have caused housing payments for most new buyers to increase significantly. So, one theory for why we are seeing fewer existing home sales is because homes are less and less affordable. But... if this theory were true... that higher home prices and higher mortgage interest rates were making housing too unaffordable... thus reducing buyer demand for existing homes for sale... then we would see inventory levels starting to climb as a result. But, we're not seeing inventory levels meaningfully rise -- which calls into question whether the reduction in existing home sales could really be related to affordability. Theory 2 - Homeowners Want To Hold Onto Their Low Mortgage Interest Rate Another potential theory for why we are seeing fewer existing home sales... is that perhaps we are not seeing a decline in the number of buyers who want to buy... but rather... a reduction in the number of sellers who are willing to sell. Take a look at the mortgage interest rates of current homeowners! 82% of homeowners have mortgage interest rates below 5%. 62% of homeowners have mortgage interest rates below 4%. If those homeowners sell their current homes (existing homes) they would be trading in their low mortgage interest rate for a new one around 6.5% or a touch higher. Thus, it is quite possible that we are seeing lower number of existing home sales because fewer homeowners are willing to sell... because they LOVE their low mortgage interest rates. Theory 3 - What Say You? Have any other theories? Email me! | |

Home Sellers Will Not Voluntarily Sell Their Homes For Lower Prices Because Of Higher Interest Rates Unless Competition Forces Them To Do So |

|

Quite a headline, I know. All for something that isn't actually happening in the local market. Here it is again... Home Sellers Will Not Voluntarily Sell Their Homes For Lower Prices Because Of Higher Interest Rates Unless Competition Forces Them To Do So Looking back a bit... Mortgage interest rates declined from 5% to 3% between 2018 and 2020 and then remained around 3% until early 2022. Median sales prices rose from $212K to $300K between 2018 and 2022. When mortgage interest rates started rising (quickly) in early 2022, many thought or said... Home prices rose so quickly between 2018 and 2022 (+41%) because mortgage interest rates were so low. ... and ... Now that mortgage interest rates are rising, home prices are destined to decline. We're now more than a year past the rising / higher mortgage interest rates and what can we now conclude? [1] It is quite possible that the rapid rise in sales prices between 2018 and 2022 was partially fueled by super low mortgage interest rates. That wasn't the only thing that caused home prices to increase, but it definitely kept sales moving briskly and prices rising quickly. [2] Despite mortgage interest rates rising from 3% to 6% in a year's time, home prices have not declined in the local real estate market. Which is what causes me to conclude that... Home Sellers Will Not Voluntarily Sell Their Homes For Lower Prices Because Of Higher Interest Rates Unless Competition Forces Them To Do So Certainly, if higher mortgage interest rates slowed down home buyer activity AND if inventory levels started to rise... then we might see home prices start to flatten out or decline as sellers competed with other sellers to attract buyers. But now that we're more than a year into having mortgage interest rates higher than 5% (and eight months into having rates higher than 6%) I think it's safe to say that rising mortgage interest rates have not caused home prices to decline in our local market. | |

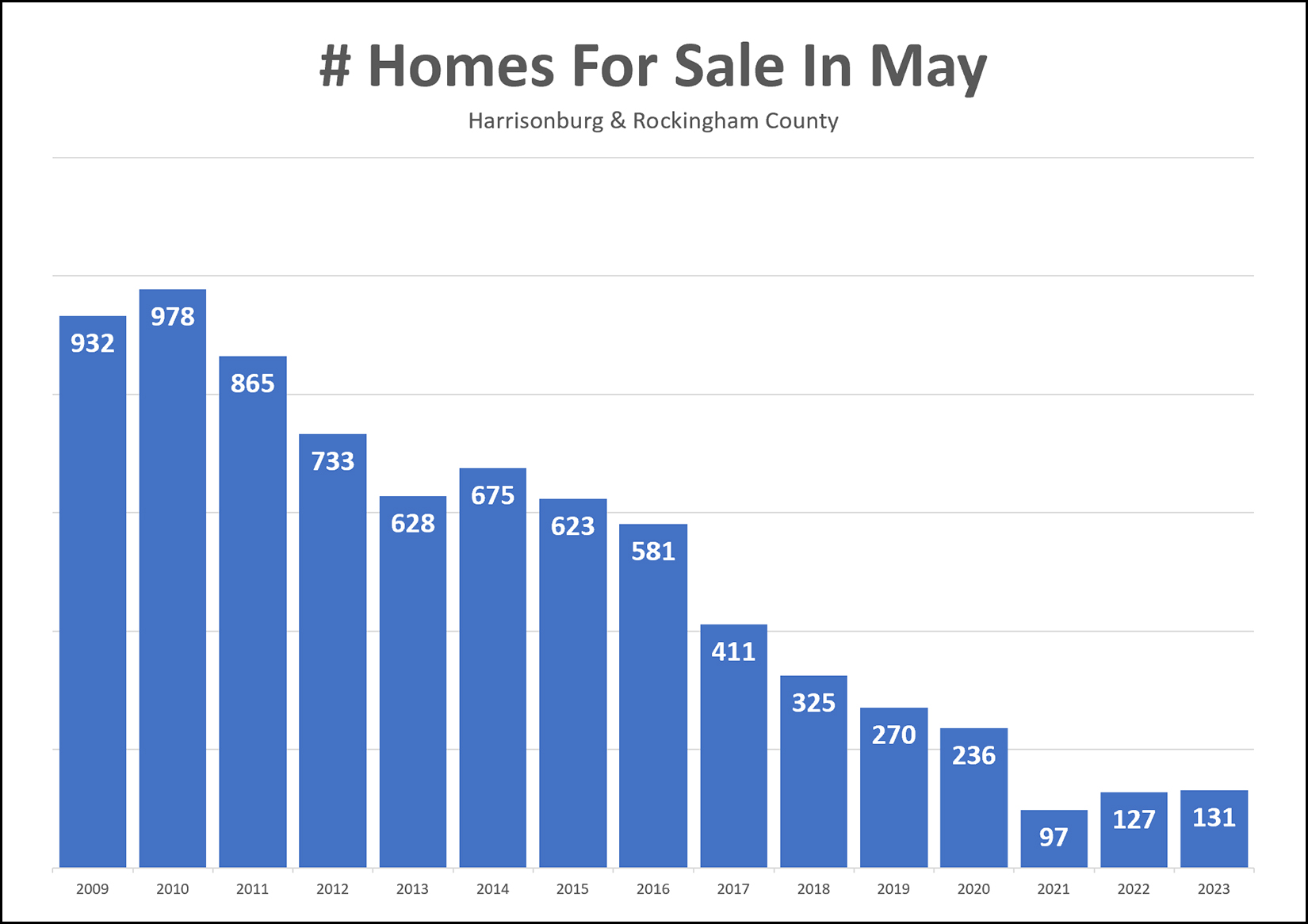

Low Housing Inventory Levels Did Not Sneak Up On Us Overnight |

|

Low housing inventory levels did not sneak up on us overnight -- nor are they a new phenomenon that just came to be during Covid. As show above, we have seen a general decline in housing inventory levels for more than a decade now. This graph shows how many homes are actively for sale at this time (early May) each year, starting in 2009. Why have inventory levels declined so much over the past decade plus? Basically, the number of buyers who want to buy in this area has been larger than the number of sellers who want to sell combined with the number of new homes being built. If, for example, every year for the past 14 years...

...then we would see a 100 home decline in inventory levels each year. New Inventory = Existing Inventory + 700 New Listings + 100 New Homes - 900 Buyers Buying ...would mean that... New Inventory = Existing Inventory - 100 Moving forward, assuming the Harrisonburg area continues to be just as popular as it has been over the past decade and a half... and assuming there isn't a mass exodus of homeowners (creating inventory by selling but not buying) then the only way we'll get out of this low inventory situation is by building more new homes. | |

Employment Growth, Not Just Population Growth, Is A Leading Cause Of Local Housing Inventory Shortages |

|

In conversation with a friend a few weeks ago, he commented that we wouldn't have as much of a shortage of housing inventory if there weren't so many people moving to the Harrisonburg area. I agree... that the housing inventory shortage is a result of more people wanting to live in this area than there is housing to support them... but... With some exceptions, many or most of the people moving to the Harrisonburg area are doing so because they got a job in the area. Merck, Sentara, four local colleges, and many other small, medium and large employers are continuing to bring new jobs to this area. So, if you were really dead set on solving the housing shortage by convincing people not to move here... you'd probably have to convince employers to stop hiring employees. :-) As a growing community, HOW we grow can be one of the most controversial topics up for debate in various circles within the community.

This is just the tip of the iceberg as far as the questions people ponder as they think about growth in the Harrisonburg area -- and most of them are very subjective questions -- there is not a single correct or best answer. I'm glad to have been living in Harrisonburg for the past 27 years... and I have enjoyed seeing the growth in this area... but I do recognize that it does create some unintended consequences along the way. | |

Why Are Housing Inventory Levels So Low In Harrisonburg And Rockingham County? |

|

First, Harrisonburg is a popular place to live. Beyond everyone who is living here now, we continue to see new folks planning to make Harrisonburg their home, including but not limited to...

So, lots of people want to make Harrisonburg their home. Second, I think that more people are moving to Harrisonburg than new housing units are being built. If over a five year period, 5000 new people decided to make Harrisonburg their home, we wouldn't see a change in availability of housing if we also saw 5000 new housing units built. I think that the amount of new moving to (or attempting to move to) Harriosnburg over the past 5 to 10 years has exceeded the number of new housing units built during that same timeframe. Third, I think there is an imperfect match between what home buyers want to buy and new housing units that are being built. First of all, plenty of the new housing units that have been built over the past ten years have been rentals - apartments or otherwise - which hasn't helped provide housing for would be home buyers at all. Furthermore, the "for sale" housing that is being built in this area certainly meets the needs of some buyers, but probably not most or all buyers. If you're hoping to buy a home that is within the location, size parameters and price parameters of one of our area's new home communities -- great, you'll be in good shape! If what you are hoping to buy is not the type / size / price of new homes being built in our area, then the new housing units being built don't help you out at all. As such... the popularity of Harrisonburg and the rate at which new housing units are being built, and the type of housing units being built all contribute to a shortage of housing inventory for many price ranges and property types. | |

Yes, More Houses Will Come On The Market For Sale In The Spring. Yes, More Buyers Will Be Competing For Them. |

|

It's a common question at this time of year... Will more houses come on the market in the spring? There don't seem to be many options at all right now. Great news... There will be more homes coming on the market in the spring. The spring season is one of the most active times of the year for new listings of homes for sale to be coming on the market. But... Bad news... There will also likely be more buyers competing for each of those new listings, as the number of buyers shopping for homes also typically increases significantly in the spring. So... Yes, more houses will come on the market for sale in the spring AND yes, more buyers will be competing for them. :-) :-( I suppose though, that as a buyer, it's still nice to have more listings from which to choose from, even if you have more competition as well? Even with higher mortgage interest rates (relative to the past few years) and even with prices edging higher and higher -- it still seems that the coming spring season will be quite an active one in the Harrisonburg and Rockingham County real estate market. | |

Sometimes Housing Inventory Levels Are Not A Good Indication Of Housing Availability |

|

Reflect with me for a moment on the definition of a paradox... paradox - a seemingly absurd or self-contradictory statement or proposition that when investigated or explained may prove to be well founded or true. Here's the paradox of the day... Sometimes Housing Inventory Levels Are Not A Good Indication Of Housing Availability Let's think it through together... Let's say you want to live in the infamous (and completely fictitious) "Riverside" neighborhood in Rockingham County. If you wanted to get a sense of whether it is possible to find housing in the Riverside neighborhood which method would you use? Method #1 for understanding housing availability... Look at how many homes are for sale in Riverside right at this very moment. There are currently zero homes for sale in Riverside, thus it is seemingly *impossible* to buy a home in Riverside, right? Method #2 for understanding housing availability... Look at how many homes have sold in Riverside during a particular timeframe, such as the past year. Oh, wait. There have been 15 home sales in Riverside over the past year. Thus, you likely will be able to buy a home in Riverside if you can wait for some new listings beyond what happens to be on the market at this very moment in time. As can be seen above, housing inventory levels were not a good indicator of housing availability in Riverside. -- Shifting gears a bit, let's consider whether housing inventory levels are a good indicator of housing availability in a real place, the City of Harrisonburg, but only examining homes priced under $300,000. Method #1 for understanding housing availability... Houses Currently For Sale in the City of Harrisonburg Under $300K = 5 houses Hmmm. Method #1 would lead us to believe that houses are not generally available in the City of Harrisonburg for less than $300,000. Method #2 for understanding housing availability... Houses Sold In The Past Year in the City of Harrisonburg Under $300K = 275 houses Wait a minute. There were 275 home sales under $300K in the City of Harrisonburg over the past year? That seems to point to a rather different conclusion about housing availability. -- And one more real example... Houses in Harrisonburg and Rockingham County combined priced under $200K: Currently Available Homes = 5 Sold Over The Past Year = 211 -- So... again... Sometimes Housing Inventory Levels Are Not A Good Indication Of Housing Availability Now, this does, of course, create the possibility that a would-be home buyer will simultaneously feel... 2. Encouraged... to know that there may very well be 270 more options in over the coming year. -- And one last point... If LOTS of homes sell each year in a particular location and/or price range but VERY FEW are available at any particular moment in time then two things would seem to be true... 1. Houses are generally available for purchase in this location and price range. 2. Demand for said houses likely exceeds supply, and if more such homes existed that could help bring more balance to that segment of the market. -- OK, fine, one more last point... If you are looking to buy a home in the coming year, yes, let's look at what's available now... but much more importantly, let's look at what has sold in the past year. The number of homes that have sold in the past year will likely be the best indicator of what to expect in the year to come. | |

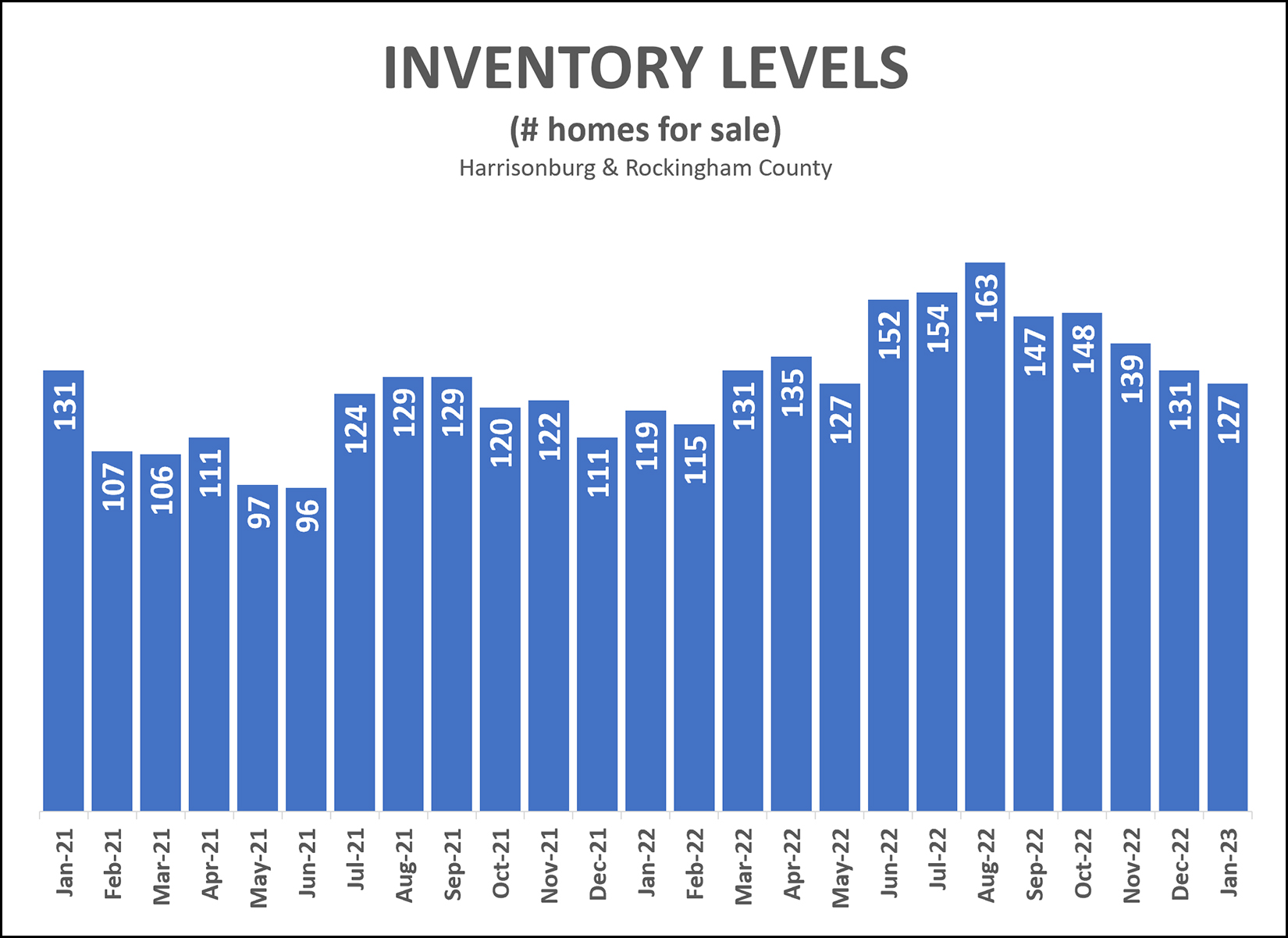

Inventory Levels Largely Unchanged From Two Years Ago |

|

How have inventory levels changed over the past two years in Harrisonburg and Rockingham County? Some might assume there have been fewer (and fewer and fewer) homes on the market as we have progressed through the past 24 months. As it turns out, inventory levels are largely unchanged over the past two years.

Certainly, there have been some changes in between...

But in the end, current inventory levels are in just about the same spot they were two years ago. | |

A New And Improved But In 2023 (Keep Reading, Really) |

|

OK, OK, I'm not talking about workout goals. I'm not suggesting you get a better BUTT in 2023... I'm just pointing out that some would be home sellers have a better BUT this year... A Would Be Home Seller's But In 2022... I would sell my home BUT it's so hard to buy a home right now because soooo many buyers are competing over each new listing. A Would Be Home Seller's BUT in 2023... I would sell my home BUT I have a super low interest rate on my current mortgage and I don't really want to get a new mortgage on the new home with a much higher interest rate. Low inventory issues have been an issue (for buyers) in the Harrisonburg and Rockingham County for the past few years. There have been fewer and fewer options of houses on the market to for a buyer to purchase. It doesn't look like the inventory situation is going to improve anytime soon. Last year plenty of would be home sellers decided not to sell because they weren't confident they'd be able to secure a contract to buy a new home after they sold. This year plenty of would be home sellers likely won't sell because they don't want to let go of their super low interest rate on their current mortgage and exchange it for a higher rate on a new mortgage. So, while we can in some ways blame would be home sellers for the shortage of inventory... we can't really blame them for the reasons why many are choosing not to sell. | |

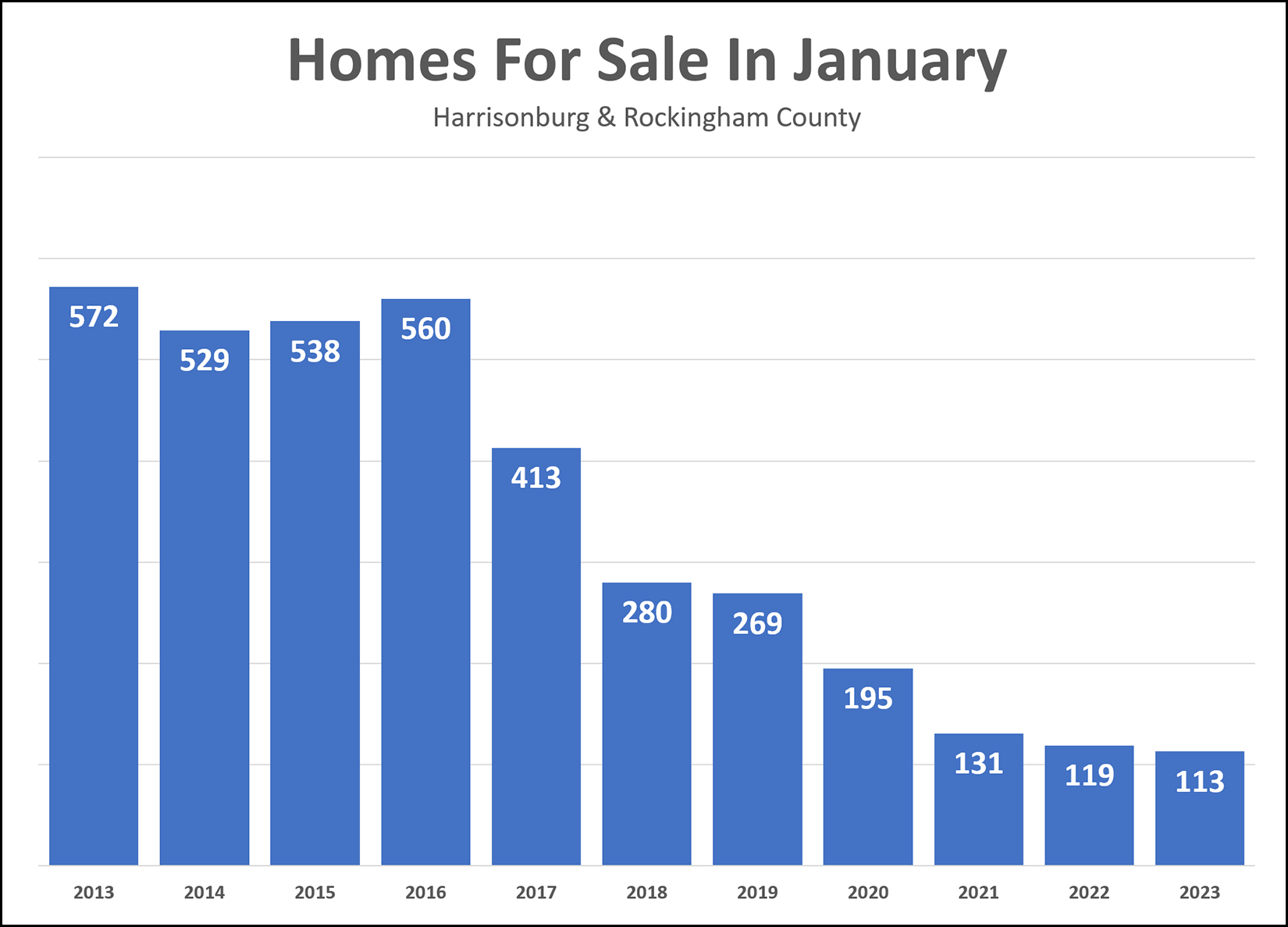

We Are Starting 2023 With Fewer Homes On The Market For Sale Than Anytime In The Past Decade |

|

Yet another reason why it seems relatively unlikely that we will see home prices start to decline in this area... One main factor that could cause downward pressure on home prices would be if inventory levels were starting to meaningfully rise. If more sellers wanted to sell homes than there were buyers to buy them... then we might see prices level out or decline. But... as shown above... we're starting 2023 with fewer homes on the market for sale than anytime in the past decade. So... there's that. Will we see meaningful increases in the number of homes available for sale at any given time during 2023? Buyers sure hope so... but it is not yet clear whether that will actually happen this year! | |

Fewer Resale Home Sales Likely Was And Will Continue To Be A Supply Side Issue |

|

Existing home sales declined 15% in 2022 in Harrisonburg and Rockingham County... 2021 Existing Home Sales = 1,364 2022 Existing Home Sales = 1,165 That said, overall home sales only declined 7% because new home sales increased 28% in 2022... 2021 New Home Sales = 309 2022 New Home Sales = 397 Why did existing home sales decline 15% in 2022? I don't think it was a shortage of demand. If there was a limited amount of demand for existing homes then we would see inventory levels of existing homes for sale increase. We did not see that increase in an inventory in 2022. As such, it seems reasonable to conclude that the decline in existing home sales in 2022 was a supply side issue... there were (perhaps, approximately) 15% fewer sellers willing to sell their existing homes in 2022 as compared to in 2021. Looking ahead, it seems relatively likely that this trend and supply side issue will continue. I think it is likely that we will see another decline in 2023 in the number of existing homes selling in Harrisonburg and Rockingham County... and I think it will still be a supply side issue... there are likely to be somewhat fewer home sellers willing to sell their existing homes in 2023. | |

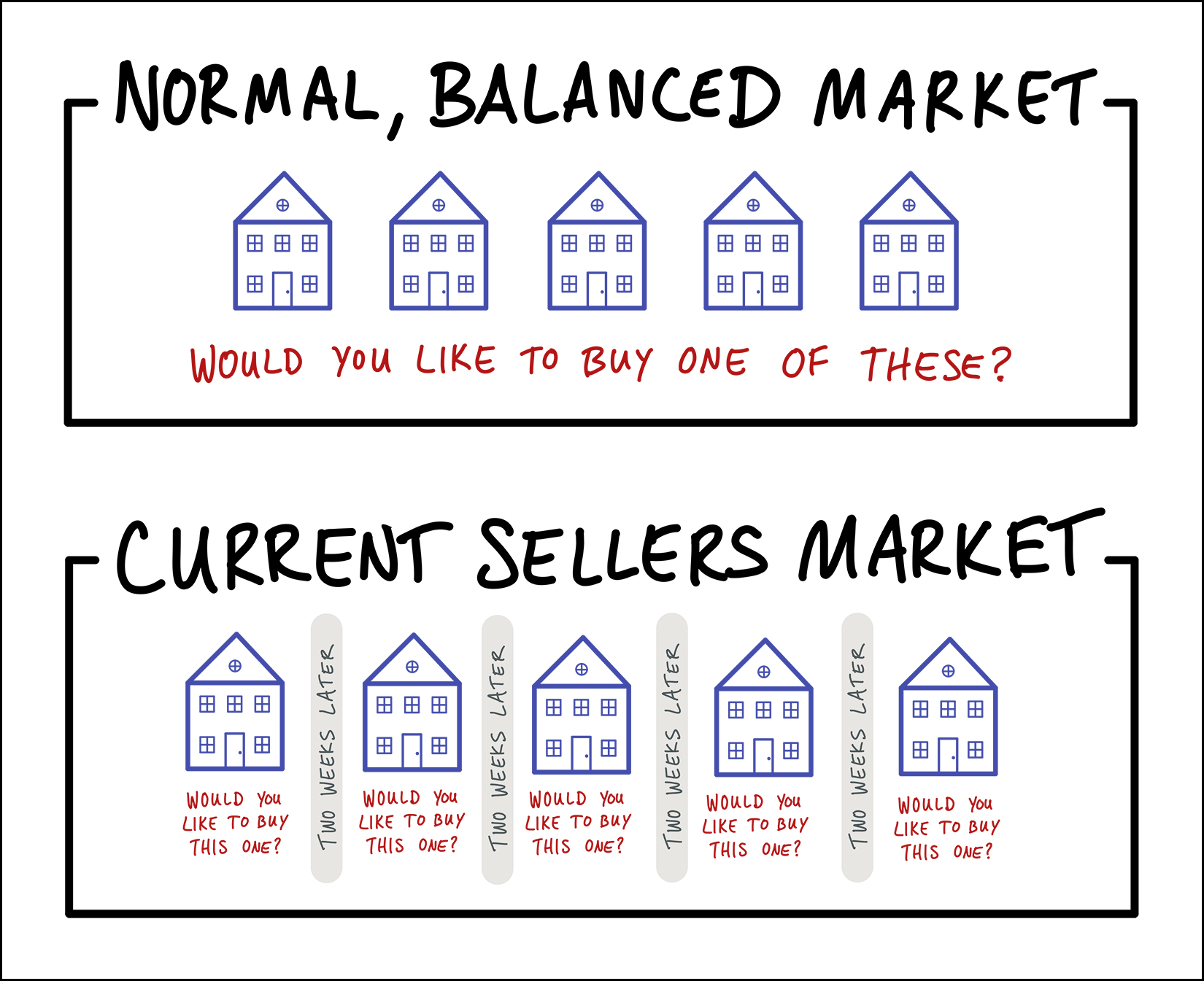

Comparison Shopping (For Homes) Is Difficult In A Low Inventory Market |

|

If you were going to buy a ____, it would probably be nice to look at multiple options, compare them, and then decide which one to buy, right? That is often possible with buying a home, whenever we have a balanced market (or a buyer's market) when buyers can find multiple houses on the market at any given time that might work for them. A buyer would then go view multiple houses, compare them, and decide if they want to make an offer on one of the available homes. These days (and for the past few years) we have been in a strong sellers market, with very low inventory levels. The same number of houses have typically been available for a buyer to consider... but they are often evaluating them one at a time, every few weeks... instead of all at once. Sorta like this...

Basically, home buyers have had to make a decision about whether to buy a house... one house a time... without the ability to compare multiple options that are available at the same time. That may eventually change, in some or most price ranges, if we start to see inventory levels increase over time. Until then, it can be a challenge to be a thoughtful and intentional comparison shopper when trying to buy a home! | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings