Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Friday, April 15, 2022

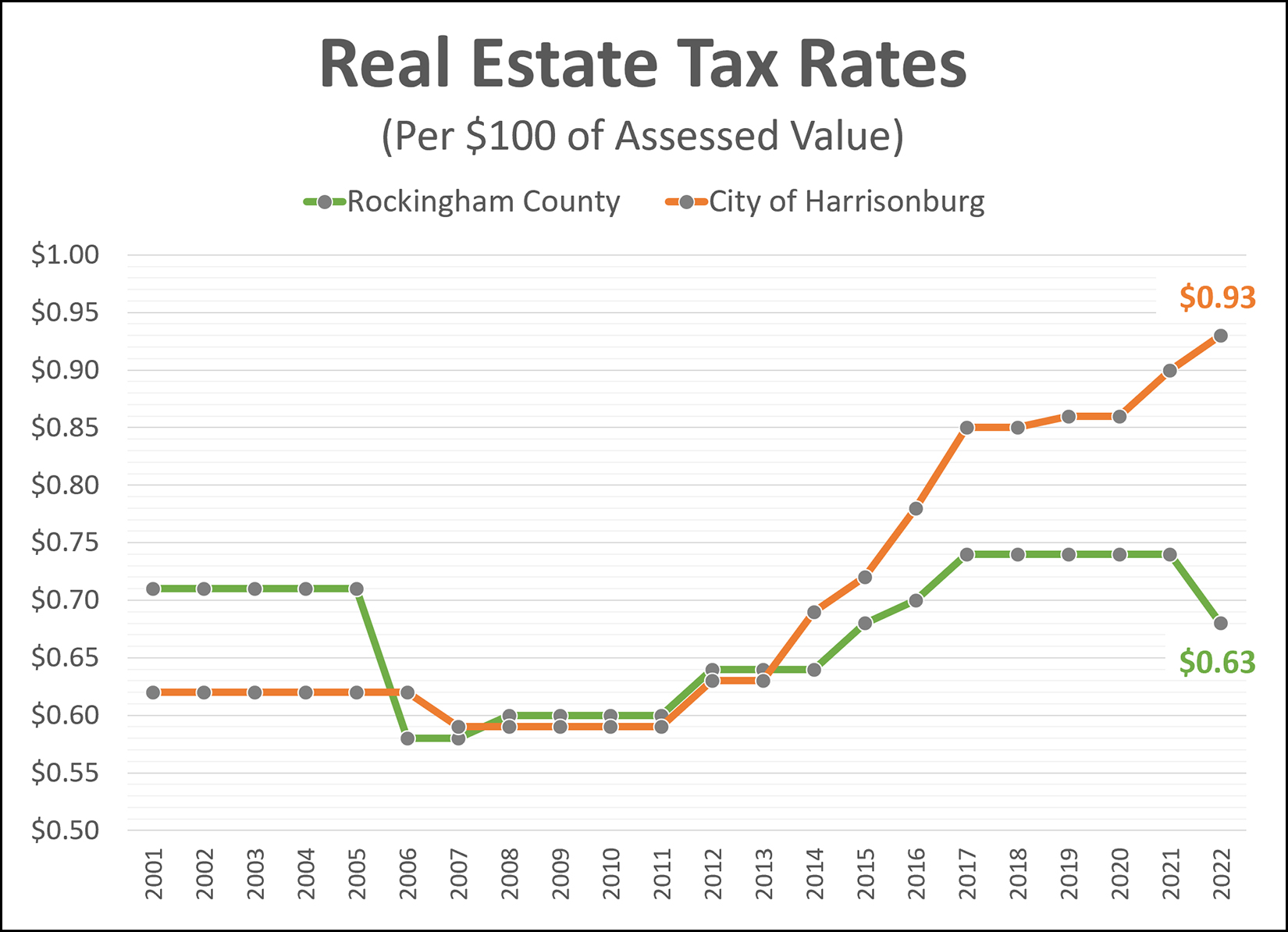

Rockingham County - tax rate down 8%

The Rockingham County real estate tax rate is currently $0.74 per $100 of asssessed value, but the Board of Supervisors just approved a reduction in the tax rate to $0.68 per $100 of assessed value.

But... that is in the context of recently updated tax assessed value for all properties in Rockingham County, most of which increased significantly because the last reassessment took place four years ago before significant shifts in market values in this area.

As a result, most Rockingham County property owners will see an increase in their tax bill despite the reduction in the tax rate.

City of Harrisonburg - tax rate up 3% (pending approval)

The Harrisonburg City Council will soon consider increasing the tax rate from $0.90 per $100 of assessed value to $0.93 per $100 of assessed value.

The City of Harrisonburg updates their assessed values every year, so while many or most property owners recently received notice of the updated assessed value of their property, those values likely did not increase as drastically as assessed values did in Rockingham County.

As a result, almost all City of Harrisonburg property owners will see an increase in their tax bill because though small increases, their assessed value and tax rate are both likely to have gone up or to go up.