Home Improvement

| Older Posts |

Home Improvements Only Offer A Partial Return On Investment But That Is Only Part Of The Story |

|

Given that so many homeowners have fixed mortgage interest rates below 4% (or below 3%) there are plenty of homeowners who are likely to stay in their homes for MANY years to come. Staying in a home for many years to come will likely mean that at some point you are considering some home improvement projects...

The list could go on and on. When asked by homeowners about the return on investment of home improvements I am quick to point out that they all typically offer only a partial return on investment. That is to say that if you spend $25K on project X, your home's value might only increase by $15K. If you spend $85K on project Y, your home's value might only increase by $40K. You get the idea. BUT... looking at the return on investment through that singular lens (change in home value) is only looking at part of the story. Typically, homeowners make improvements to not only increase the value of their home but also to improve their experience of living in the house between now and at whatever future date they sell it. Each of the potential home improvement projects noted above would provide you with some greater enjoyment of your home or greater utility from your home for the duration of your ownership of the home. So... if you plan to stay in your home for a while, and are considering some home improvement projects, don't only look at how those improvements will affect your home value... also consider how they will improve your enjoyment of or your use of your home. | |

To Everyone Not Selling Their Home This Year |

|

Plenty of you won't sell your home this year. You might not sell because... [1] You love your home. [2] You don't want to trade your mortgage's 3-point-something interest rate for a 6-point-something interest rate. [3] Even though you would sell your home for more than you might have imagined last year, you don't want to then have to buy a new home for more than you would have imagined last year. Whatever the reason... plenty of you won't sell your home this year. If you fall into that category (not a seller) I encourage you to think about what small or medium sized (or large!?) improvements you can make to your home. Here's why... [1] You'll love your home even more. [2] You'll make your home more appealing to buyers when you do eventually sell. [3] You'll be removing one item from your list of possible improvements years down the road when you sell. Homes that have not had any improvements or updates for 10, 15 or 20 years can be challenging for sellers to sell and challenging for buyers to get excited about buying. So, if you are not selling your home this year, give some thought to what changes or improvements you might make to your home in 2024. | |

Improving Your Home Might Make More Sense Than Selling And Buying |

|

Let's say your current home doesn't work quite as well for you now as it has in the past. Perhaps you need more room, or a room on the main level, or perhaps you'd like a nicer (newer) kitchen, or deck, or flooring, etc., etc. As a result, you may be faced with a decision of whether to improve your current home (to make it work better for you, or so that you like it a bit more) or to sell your home and buy a new one. Perhaps the improvement(s) you would make would cost $100,000. Yikes! That's a lot. Your next question may very well be whether you will see a $100K increase in your home value -- and the answer is -- probably not. Most home improvement projects do not increase the value of a home by the total cost of the improvement. Perhaps the $100K improvement would only increase your home value by $50K. Hmmm... maybe you should sell your home and buy a new one instead to avoid losing the $50K difference between the improvement cost and the increase in your home value? But... maybe not... let's take a look at why it might make sense to stay and improve your home -- despite not recouping the full cost of the improvements via an increase in your home value. For this fictional example, we're pretending you own a $450K home and you might spend $100K on improving it, after which time it will be worth $500K. $24,000 = approximate transactional cost of selling your $450K home $15,000 = approximate transactional cost of buying the $500K home $11,000 = approximate cost of moving to the new home and making any needed improvements These three costs add up to a total of... $50K! So... you could spend $100K to improve your $450K home to make it worth $500K... and "lose" $50K. Or... you could sell your $450K home, buy a $500K home, have $50K of transactional costs and thus still "lose" $50K. As such, even if the improvement cost of your home exceeds the increase in your home value after the improvement... it still might make sense to make that improvement rather than selling your home and buying a new ones. | |

Will Home Renovations Surge In 2022 and 2023? |

|

This scenario seems to be very common right now... [1] We decided a year or two ago we wanted to sell our house and move to a bigger or nicer or different house. [2] We've been looking at houses, making offers on houses, but haven't been able to secure a contract on a house. [3] Mortgage interest rates have gone up quite a bit and we are now not sure if we want to trade in our 3.75% rate on our current mortgage (with only 20 years to go) for a new 30 year mortgage at 5.25% or higher. [4] Prices of homes we'd buy have increases significantly since we started looking to buy... and when that is combined with the higher interest rates, it really starts to affect our projected monthly payment. [5] Maybe we should stay in our current house and make some renovations or modifications to allow it to work better for us or to allow us to be more excited about staying for another 10+ years!? Staying and renovating won't be the answer for all buyers who have unsuccessfully tried to buy over the past year or two, but I think it is something more would be buyers will be considering given all of the factors outlined above. | |

Home Buyers Who Buy Houses Without A Home Inspection Should Do One After Closing! |

|

On many, many, recent offers on properties I have listed for sale buyers have not been including home inspection contingencies. This seems, in many circumstances, to be the only way to (hopefully) make your offer competitive enough to (hopefully) win out when there are multiple other offers in this frenzied seller's market. In a more balanced market, there are two general outcomes of a buyer having hired a home inspector to conduct a home inspection... [1] First, a buyer affirms their decision to buy based on new information gleaned during a home inspection that they did not know when viewing the house prior to making an offer. If the new information causes them to see the house in a significantly different light, they may very well ask the seller to make some repairs, reduce the price or they might decide not to proceed with the purchase. [2] Second, a buyer typically learns a lot more about the house than they knew before the home inspection. Even if the new information that they learn does not cause them to decide not to buy and does not cause them to try to renegotiate contract terms with the seller, it still helps them to understand what types of future home improvement or preventative maintenance they should anticipate in coming months and years. Given this second factor, particularly, my strong recommendation to home buyers in this current, frenzied market, is to hire a home inspector to inspect your home after you close on the purchase. You are likely to gain additional information and insight into the condition and systems of your home that will serve you well throughout your ownership of the property for years to come! | |

The Challenge Of Suggesting You Stay In Your Home And Improve It Instead Of Selling It And Buying A New One |

|

Plenty of homeowners are *delighted* to see the price for which they could likely sell their home in this fast moving local housing market. :-) Most of those homeowners are then at least slightly *dismayed* when they see what they'd have to pay to buy their next home. :-/ As such, I have suggested to plenty of homeowners lately that they consider staying in their home - and improving it - rather than selling their home and buying a new one. But... that advice is easier to give and receive than it is to implement. Contractors and any such professionals that would make such improvements to your home are in short supply and high demand! Over the past three to six months in conversations with homeowners contemplating staying in their homes -- and making improvements to them -- I have heard over and over again that they are having an extremely difficult time lining up contractors (or other professionals) to do the work they'd like to have done on their house. What then is a homeowner to do? 1. Get in line and patiently wait for the contractors (and the applicable materials) to be available to accomplish your home renovations. 2. Just go ahead and sell your home and buy a new one. There is no easy answer to this conundrum, but I have realized more and more in recent months that suggesting that a homeowner "just stay in their home and renovate it instead of selling it and buying again" might not be the right solution for all homeowners. If you are weighing your options of renovating or selling and buying, let me know if you'd like to think it through and talk it through together. | |

Discover That Your Water Heater Is Leaking BEFORE It Causes Major Damage |

|

Who has had a water heater leak before? (raising my hand) Who has had major damage as a result of a water heater leaking? (thankfully, not raising my hand) Most of us have water heaters tucked away in a closet or the corner of the basement. As a result, if they start to leak (they often will as they get older) it could be hours or days before you realize you have a problem. In that time, the leak may have caused water damage to your floors or personal belongings. Do you have a sump pump in your basement? What would get wet if it stopped working? How often do you check to see if your sump pump is working properly? There are all sorts of reasons why it would be helpful to know about a water leak early - and with Resideo's Wifi Water Leak and Freeze Detector you can know about it early! This handy device...

Consider purchasing a water leak detector to give you a bit more piece of mind that you will know about a potential water leak early and before it causes damage to your home. | |

It Is OK To Improve Your Home Beyond The Value Range Of Your Neighborhood, But Realize That You Are Doing So, And The Potential Consequences |

|

I've written about improving your home a few times this week... Thanks, to Frank, for spurring on many of these thoughts and topics. On to one more important concept to note... It is possible to over improve your home within the context of your neighborhood. A stark example...

As you can imagine, it might be hard to sell a $425K home amidst other homes that are selling for $300K to $350K. So, yes, it is quite possible to over improve your home compared to your neighborhood. It is OK to do so -- but you should just realize, going into the renovation project, that you are doing so -- and understand that it will likely mean you will see an even lower percentage of the cost of improvements contributing towards the post-improvement value of your home. Perhaps, though, I have oversimplified all of this. If you considering making some renovations to your home -- feel free to loop me into your thought process and I'm happy to provide you with some candid feedback to help you think things through. | |

While You Might Not Recoup The Cost Of Remodeling Your Current Home, Maybe You Should Do It Anyway! |

|

As I pointed out yesterday... But... that's not to say that you shouldn't consider remodeling your home... and it certainly doesn't mean that you should just trade up to a nicer home rather than making those improvements to your current home. Let's explore the numbers a bit using one of yesterday's example as a starting point...

Dialing in a bit, let's imagine this is your scenario...

So, given that of your $100K spend, you would not be recouping $40K of the money -- should you just trade up to a nicer home instead? Not so fast... Your costs of trading up to a new home might actually be more expensive than the money you "lost" in doing the renovations. Here are some approximate numbers, imagining an upgrade from a $400K home to a $460K home.

So, there with some very rough estimates, you can see that we made it up to a $44,000 cost to trade up from your current $400K home to a new $460K home. So, before you get overly depressed about spending more on your home renovation than you might see in an increased home value -- just keep in mind that it might be a very reasonable path forward as compared to selling your current house and buying a new one. | |

Basically, All Remodeling Projects Will Cost More Than They Will Add To Your Home Value |

|

Are you looking to renovate your living room, kitchen or bathroom... or replace your siding, roof, windows or deck? Are you curious about how each of these projects will affect your home value? Will spending the money on these major home renovations increase your home value by more than the cost of the renovations? Almost certainly, no. In almost all cases, you will spend more on these major home renovations than you will see in an increase in the value of your home after the renovations. According to the Remodeling 2020 Cost vs. Value Report the amount of your cost that will be recouped through an increase in value ranges from 50% to 70% for almost all of the home improvement projects they analyzed. So...

This lower than 100% return on investment on major home improvement projects often ends up being acceptable to many homeowners who are completing these home improvement projects -- because the balance of the return of the investment is their enjoyment of the utility or feel of the space that they have improved. Check out the actual numbers on each home improvement project by visiting CostVsValue.com. | |

Focus Mostly On The Biggest Issues When Requesting Repairs After A Home Inspection |

|

After a home inspection, a buyer knows more about the house than when they agreed to pay $X to purchase the house. In order for them to still want to pay $X for the house, they may ask the seller to address some of the deficiencies found during the home inspection. Imagine a hypothetical scenario where the following deficiencies are found:

So - which items should the buyer ask the seller to repair? Some could say ALL of them - the buyer didn't agree to pay $X for the house with all of these large and small issues. But I'd advise most buyers to only request that the seller address a subset of those issues:

All of the other items (3-7) are minor issues that won't cost too much (in time or money) to repair after you buy the house. But why not ask the seller to repair these items?

| |

Major Rain Events Stress Test Your House |

|

We had quite a bit of rain in the Harrisonburg area yesterday... and that can serve as a stress test for your house to see if there are any areas that need improvement. Here are some areas and items to check during or after a major rain event... Gutters - When rain is falling quickly, you can much more easily identify any fully or partially clogged gutters or downspouts, as you'll likely see water spilling out over the edge of the gutter instead of going down the gutter to the downspout. Basement - Does any moisture or water start to sneak into your basement during a heavy rainstorm? Check things out at the peak or just after the peak of a major rain event to see if your basement is taking on any moisture. If so, try to identify why it is happening where it is happening. Do gutter downspouts need to be extended? Does the slope of the ground outside of your house need to be adjusted? Roof - If your roof is 25+ years old, it's not a terrible idea to go check out your attic once a year during or just after a major rain event to see if you see any water coming in, or any damp spots on the roof decking visible from your attic. Yard or Driveway - Are there low spots in your yard that always fill up during heavy rain events? Does a part of your driveway (or a culvert on both sides of your driveway) wash out during a major storm? Are there improvements you can make before the next storm? Check out how the water is flowing during a major rain storm to make plans for making any adjustments. Where else did you see impacts on your house and/or land yesterday during our major rainstorm? | |

Go Check Your Basement Walls For Cracks |

|

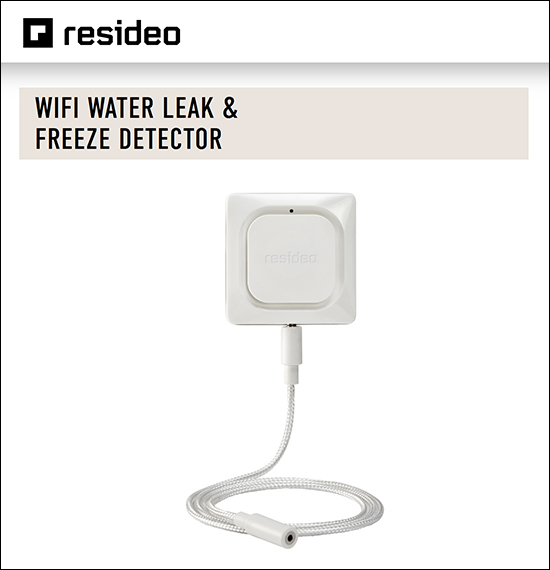

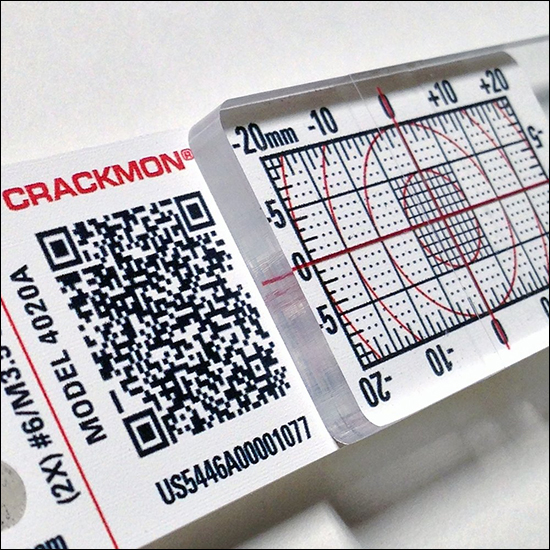

Sometimes during a home inspection, I wish I had a time machine. We'll see a crack in a basement wall -- but we don't know how long it has been that way. The general logic often then goes like this...

Yes, I know, those are sweeping generalizations, but... Because we don't have a time machine, most buyers end up needing to assume that every crack in a basement wall falls into the first category -- recent, and continuing to shift or change, and needing immediate and expensive remediation. But what if today, you installed a crack monitor for your basement wall -- and monitored it quarterly for the next five years -- and then when you were selling your house you could provide documentation that the crack had not changed at all (hopefully) in five years of monitoring... That, my friends, could change the game for a home seller with a crack in their basement wall. So -- check your basement walls for cracks -- and if you have any, consider installing a crack monitor! The photo above is the CRACKMON 4020A Concrete Crack Monitor Kit, which includes three crack monitors and the epoxy adhesive to install them. You can purchase the set for $100 on Amazon and that $100 could be some of the best money you spend on preparing for the future sale of your home if a prospective buyer finds themselves fretting over your cracked basement wall in the future. | |

Sometimes Buyers React Irrationally To Home Inspections |

|

The purpose of a home inspection contingency is to allow a buyer to learn more about the property they have contracted to purchase -- and then to request repairs to the property if they discover new issues of which they were unaware when they contracted to purchase the property. For example -- a buyer contracts to buy a home for $250K and believes the electrical wiring and plumbing are all in good condition. The home inspection takes place and the inspector discovers that there are four plumbing connections that are leaking in the unfinished basement. It is then reasonable for the buyer to ask the seller to repair these plumbing leaks prior to closing. They agreed to pay $250K for a house that they did not believe had plumbing leaks -- and thus they request the seller restore the house to being a leak-free house. This is certainly an oversimplification of the matter, as there are often many discoveries during a home inspection -- of varying levels of seriousness or complexity -- but stick with me for now. Back up at our prior example -- rarely would a seller be disappointed, surprised, or unhappy if a buyer asked for plumbing leaks to be repaired. But what is a seller to do when a buyer starts to behave irrationally -- in a way that the seller believes no other buyer would certainly ever respond? For example --

I could go on and on. The point is -- sometimes buyers behave irrationally -- for whatever reason they have decided that they cannot / will not buy the house, and they are going to dig in their feet and make irrational repair requests until the seller finally caves and releases them from the contract. Or, rather, given the standard Virginia home inspection contingency, the buyer just terminates the contract on the basis of the home inspection even though their decision to do so was based on a view of the property condition (and of needed repairs) that is unlikely to be shared by any other buyer, ever. So, what in the world is a home seller to do in such a situation?

Of course, I hope this advice is absolutely never pertinent to you. May you never be in the midst of a home sale -- under contract -- just working your way through contingencies and excitedly anticipating a closing in the near future -- and then have the rug pulled out from under you by a home buyer with unreasonable expectations or demands. But if you do find yourself in this situation, try to move on quickly and be transparent with future buyers -- after getting angry, frustrated and discouraged, of course! | |

Detect A Leak At Your Water Heater (sump pump, etc) Before It Causes Major Damage |

|

Where is the water heater located in your home? In a closet somewhere? In the basement? Under the stairs? It is likely tucked out of the way, which means that if it starts to leak (they often will as they get older) it could be hours or days before you realize you have a problem. In that time, the leak may have caused water damage to your floors or personal belongings. Do you have a sump pump in your basement? What would get wet if it stopped working? How often do you check to see if your sump pump is working properly? There are all sorts of reasons why it would be helpful to know about a water leak early - and with Honeywell's Wifi Water Leak and Freeze Detector you can know about it early! This handy device...

Consider purchasing a water leak detector to give you a bit more piece of mind that you will know about a potential water leak early and before it causes damage to your home. | |

Focus On The Big Items When Drafting A Repairs Request |

|

After a home inspection, a buyer knows more about the house than when they agreed to pay $X to purchase the house. In order for them to still want to pay $X for the house, they may ask the seller to address some of the deficiencies found during the home inspection. Imagine a hypothetical scenario where the following deficiencies are found:

So - which items should the buyer ask the seller to repair? Some could say ALL of them - the buyer didn't agree to pay $X for the house with all of these large and small issues. But I'd advise most buyers to only request that the seller address a subset of those issues:

All of the other items (3-7) are minor issues that won't cost too much (in time or money) to repair after you buy the house. But why not ask the seller to repair these items?

| |

If Your Basement Wall Has A Crack You Should Definitely Buy A Crack Monitor |

|

Sometimes during a home inspection, I wish I had a time machine. We'll see a crack in a basement wall -- but we don't know how long it has been that way. The general logic often then goes like this...

Yes, I know, those are sweeping generalizations, but... Because we don't have a time machine, most buyers end up needing to assume that every crack in a basement wall falls into the first category -- recent, and continuing to shift or change, and needing immediate and expensive remediation. But what if today, you installed a crack monitor for your basement wall -- and monitored it quarterly for the next five years -- and then when you were selling your house you could provide documentation that the crack had not changed at all (hopefully) in five years of monitoring... That, my friends, would change the game for a home seller with a crack in their basement wall. So -- check your basement walls for cracks -- and if you have any, consider installing a crack monitor! The photo above is the CRACKMON 4020A Concrete Crack Monitor Kit, which includes three crack monitors and the epoxy adhesive to install them. You can purchase the set for $100 on Amazon and that $100 could be some of the best money you spend on preparing for the future sale of your home if a prospective buyer finds themselves fretting over your cracked basement wall in the future. | |

How To Remove Cigarette Smoke Odors From A House |

|

I have shown a few houses lately to buyers where we couldn't help but notice a lingering cigarette smoke odor in the home. That smell was not the only factor that kept these buyers from making an offer on these houses -- but it certainly was a part of the discussion and decision. So how in the world do you get a pervasive cigarette smoke smell out of a house? I'm not an expert, but my understanding is that you may need to consider some or all of these techniques:

Even if you take all of those (not inexpensive) steps above, you may still have some lingering smells -- and if you do, you probably shouldn't be entirely surprised. You might then consider using an ozone generator which can help eliminate odors. If you're going this route, you'll likely want to consult with a professional. In the end -- if you are considering the purchase of a home that has a pervasive smell of cigarette smoke, don't assume that it will be easy or inexpensive to remove that odor! | |

Your Home Is Not Likely Worth The Purchase Price Plus The Cost Of Your Home Improvements |

|

This math doesn't, generally, lead to an accurate understanding of market value -- but sometimes it is how homeowners start to think about market value... $250,000 - how much I paid for the house last year $10,000 - cost of my kitchen remodel $8,000 - cost of replacing my roof $4,000 - cost of replacing the carpet in all bedrooms $2,000 - painting all interior walls $3,000 - landscaping updates $2,000 - replacing some of the kitchen appliances -------------------------------------------------------------------------------- $279,000 - the new value of my home this year Is this home (as described above) now worth $279K? Maybe -- but if so, it is not likely a direct result of only the $29K of improvements -- but perhaps market improvements as well. Basically, the cost of most home improvements do not directly increase the value of your home by the amount you spent to make the improvement. If a home with an older kitchen is worth $250K -- and you spend $10K on a new kitchen -- your home might be worth $255K or $257K -- but not necessarily $260K. The same goes for almost all improvements you might make to your home - and in some ways, the less someone thinks about a home improvement on a daily basis, the less impact it is likely to have on value. If you owned a $250K house with an older but not leaky roof yesterday, and you spend $10K on a new roof today, your home is not likely to be worth $260K tomorrow. So, what then, does this mean for homeowners?

Thinking about making a home improvement but not sure if you should move forward with it based on how long long you might own the home? Feel free to touch base with me to discuss the decision. | |

Do Solar Panels Affect Home Values in Harrisonburg? |

|

So, you're thinking of adding solar panels to your house? You might wonder if this will increase the value of your home -- or make it easier for your house to sell -- or make it more difficult for your house to sell. All good questions. I don't think there is one right answer. Here are some of my thoughts...

So -- if you're installing solar panels with the thought that you'll sell your home in the next year or two, it might not be advisable to do so. After all, you'd likely be passing on most of the cost savings over time to the next owner without the ability to cash in on that from a significantly higher sales price. If you're installing solar panels and you plan to stay in the home for a while, but want to be sure that you'll be OK selling the home in the future, I suspect you'll be just fine, and will likely sell your home for more than if it did not have solar panels. Ironically, one of the reasons that I can't provide much guidance on how solar panels affect home values in our local market is because there aren't many homes with solar panels that sell -- likely because most people who install solar panels plan to stay a while, and thus, don't sell... | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings