Market

| Older Posts |

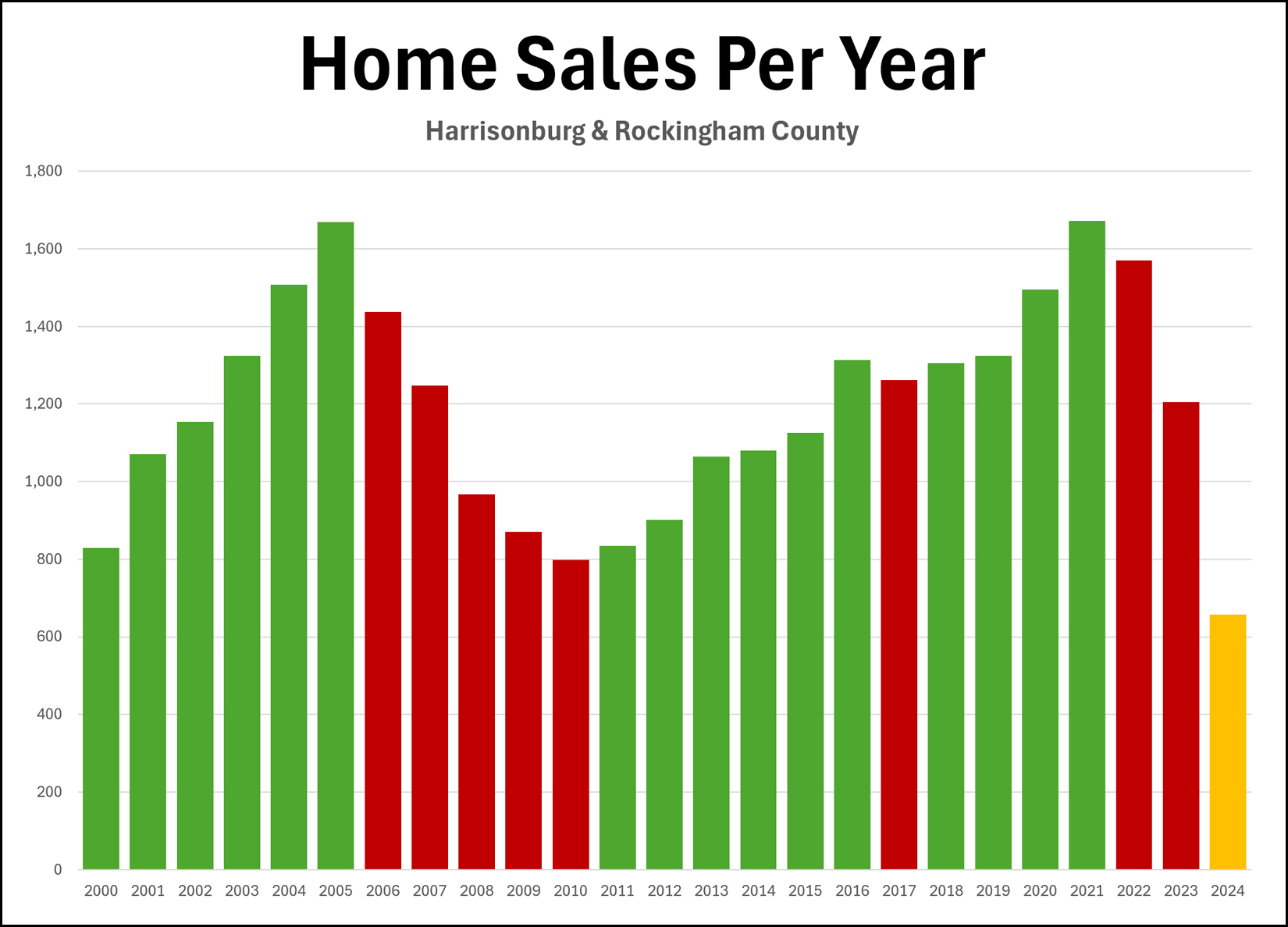

Annual Home Sales Have Been Declining For Two Years But Might Be Rising Again In 2024 |

|

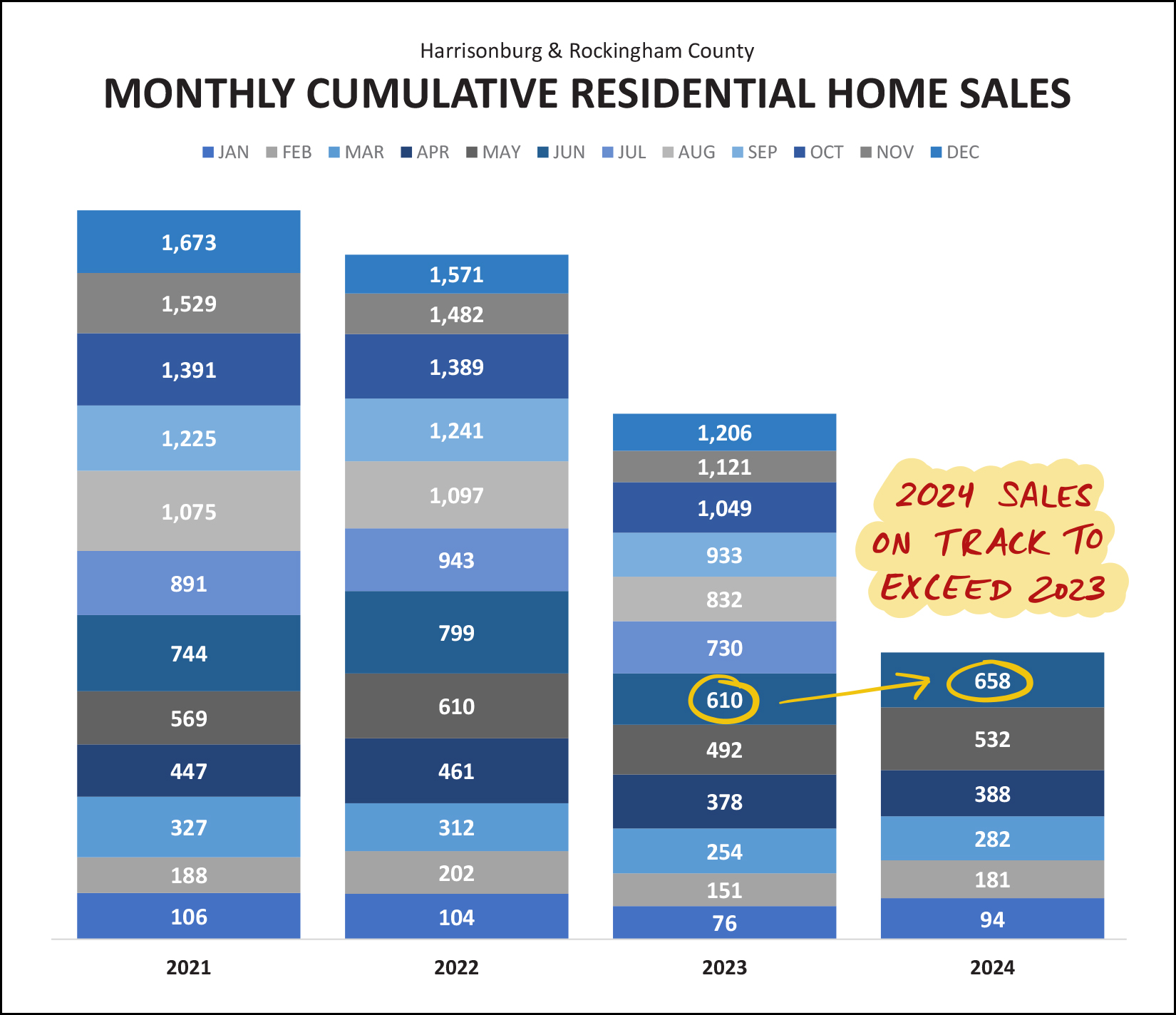

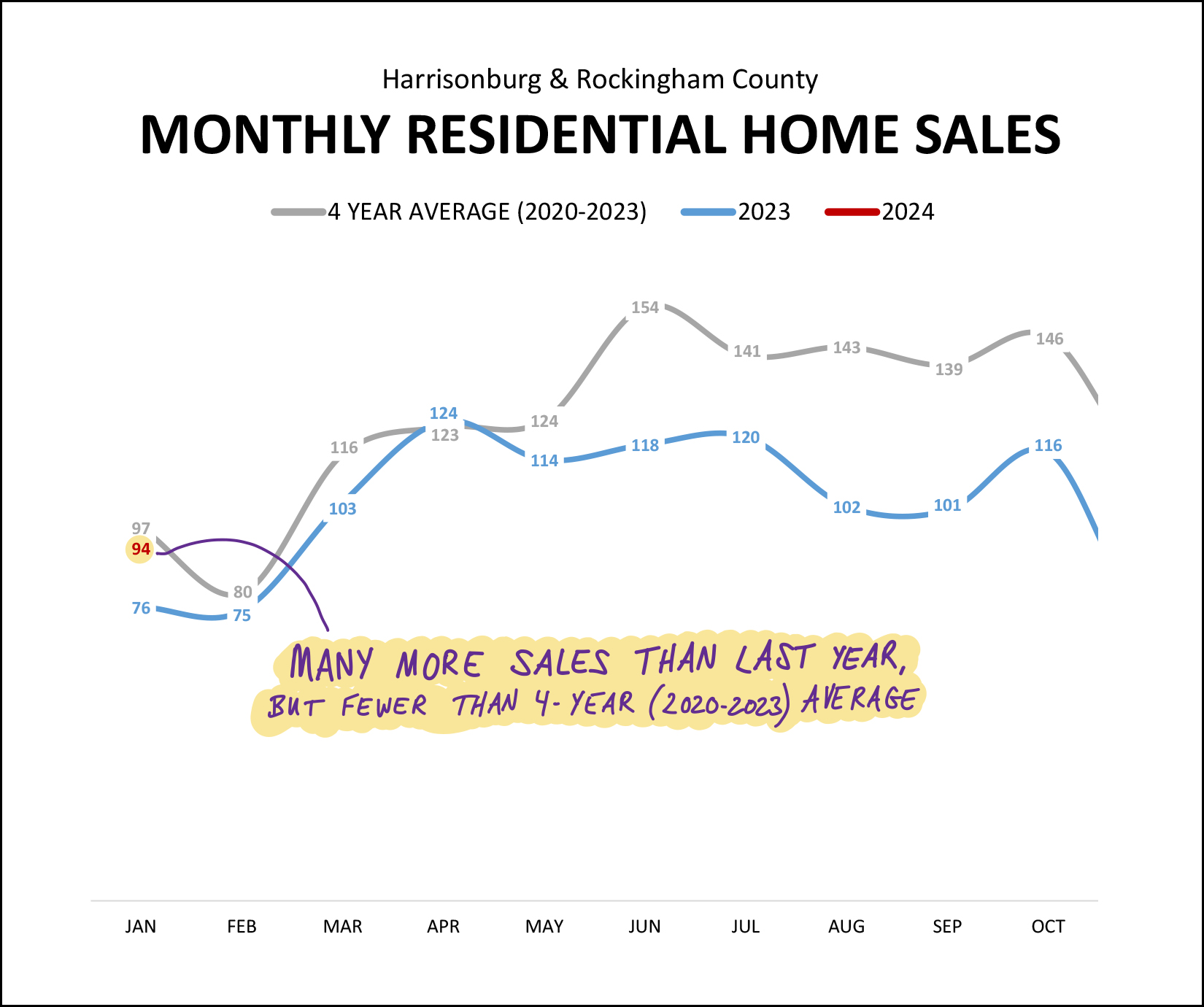

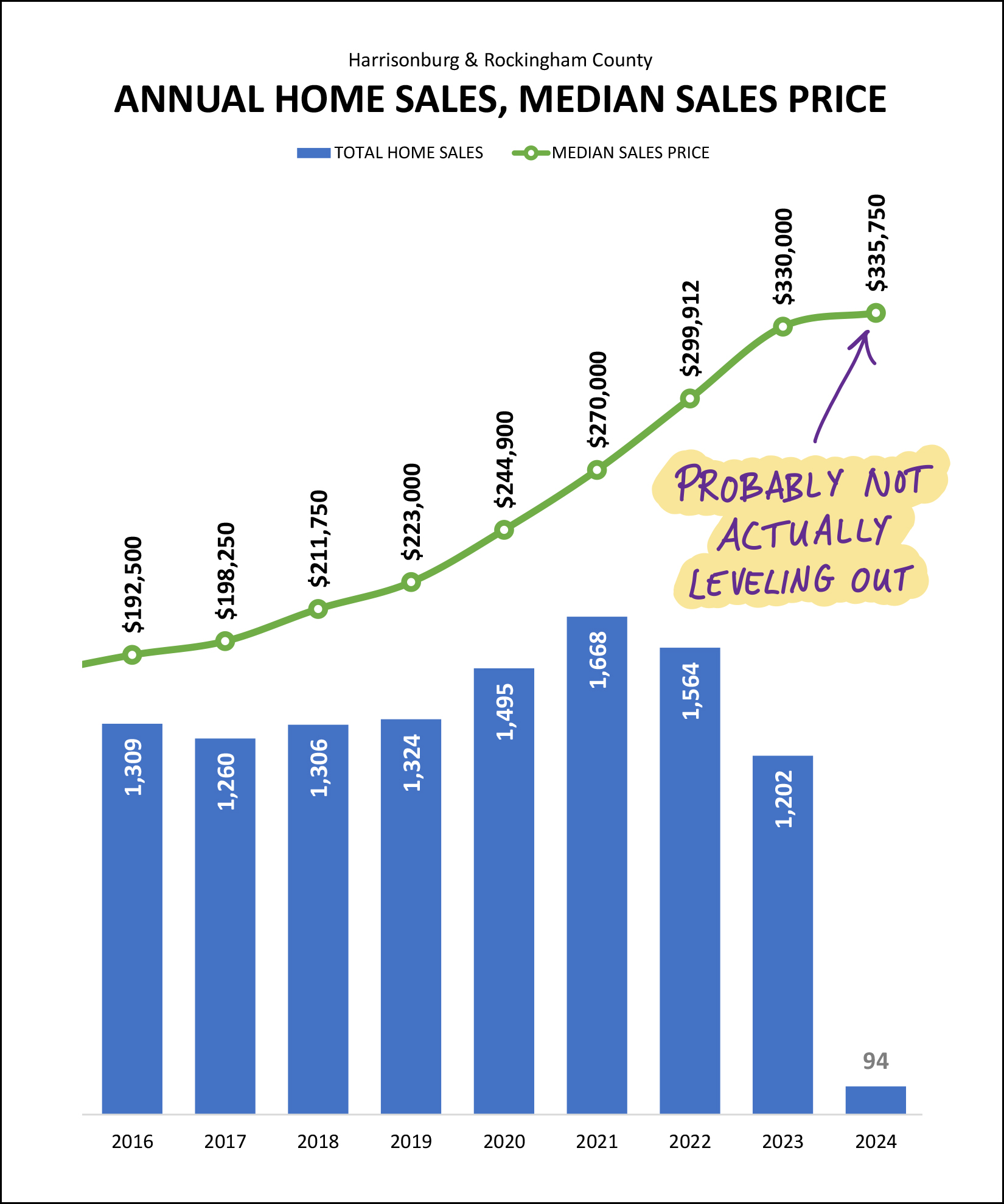

The green bars above show years when the number of home sales (per year) increased compared to the prior year. The red bars above show years when the number of home sales (per year) declined compared to the prior year. The past two years (2023, 2022) showed declines compared to the previous year -- but we seem likely to see an increase in 2024. Home Sales In The First Six Months of 2023 = 610 Home Sales In The First Six Months of 2024 = 658 Perhaps we'll be able to add another green bar to the chart above for 2024, showing an increasing number of annual home sales, yet again. | |

Midway Through 2024, Home Sales Are Increasing But Sales Price Increases May Be Slowing |

|

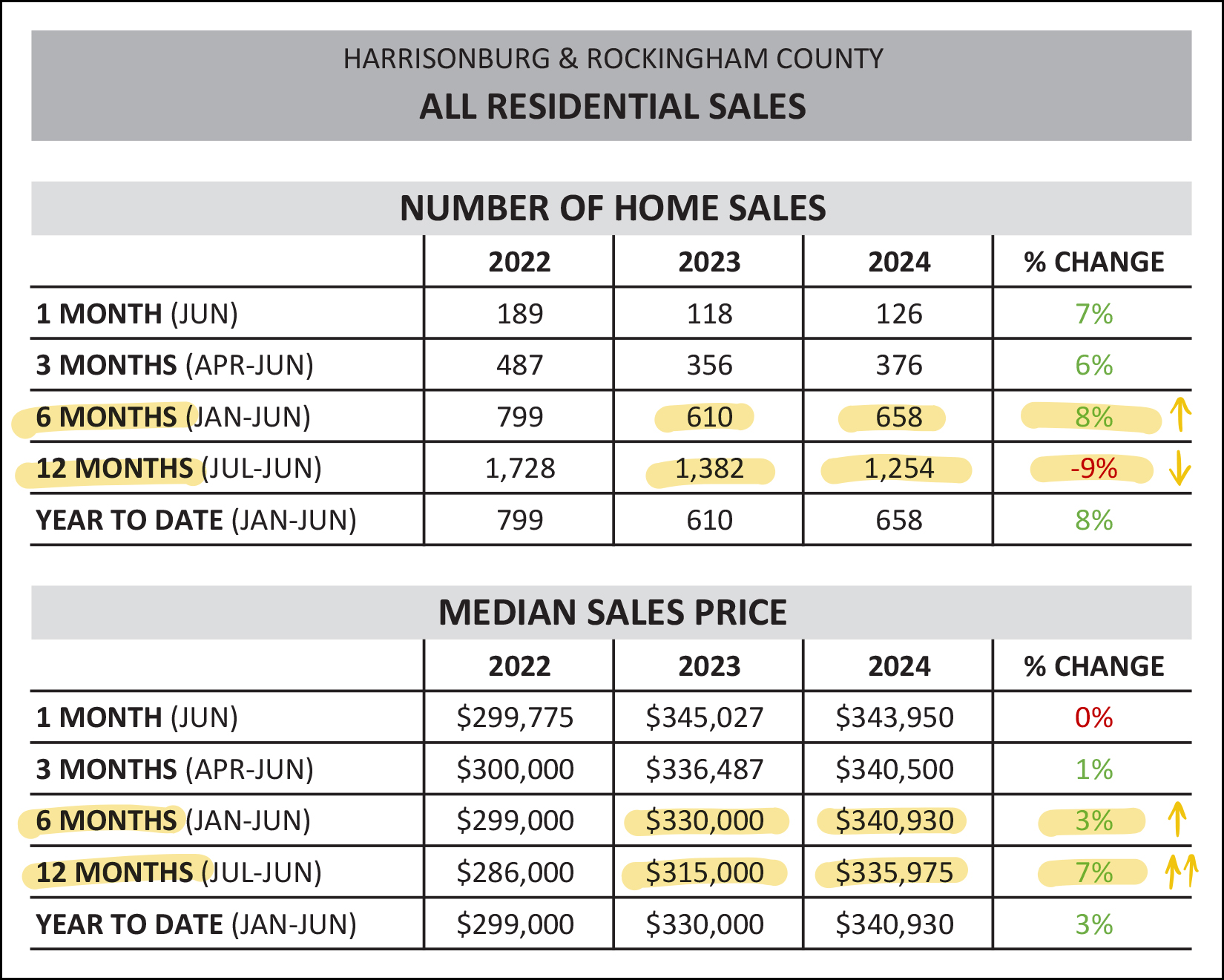

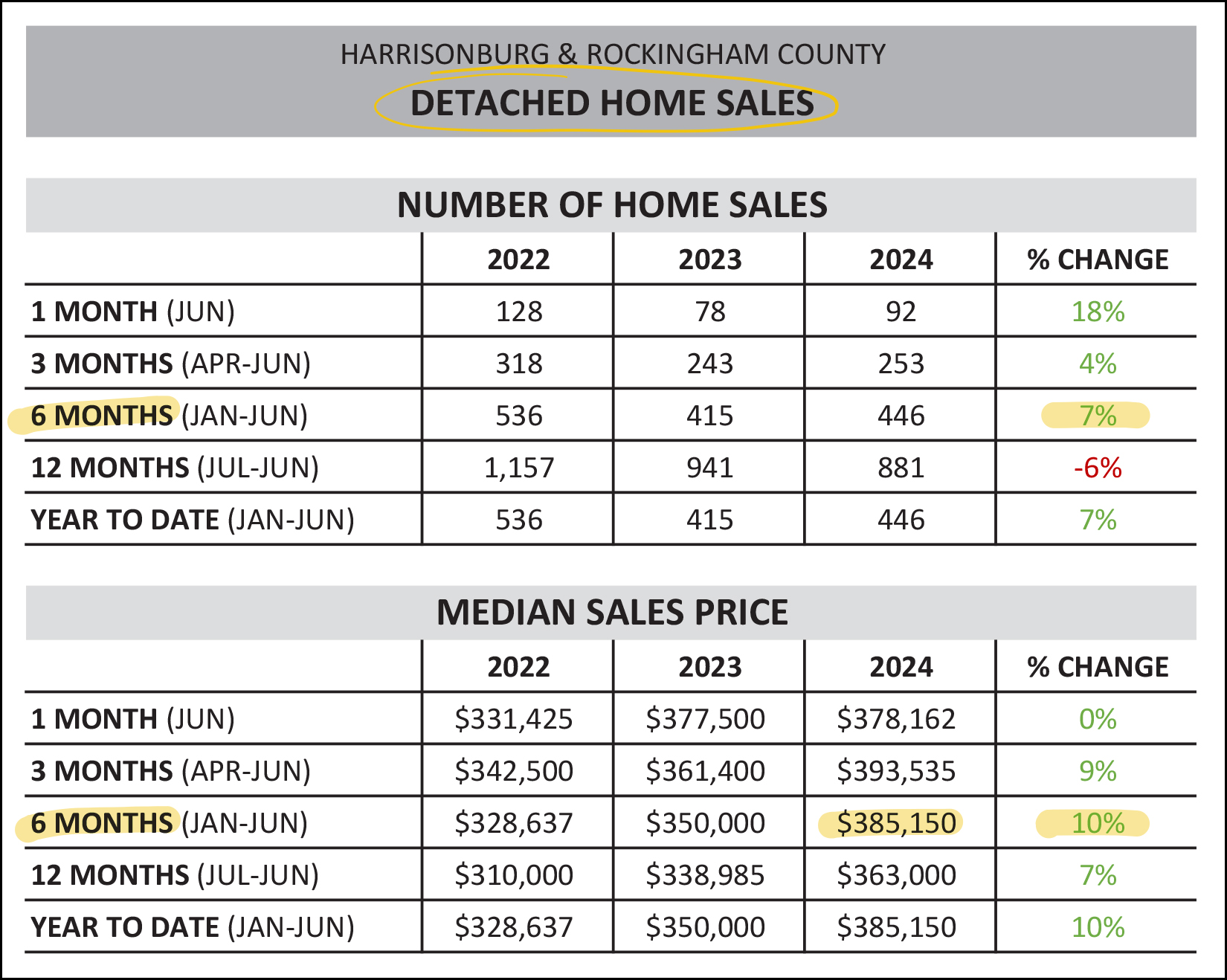

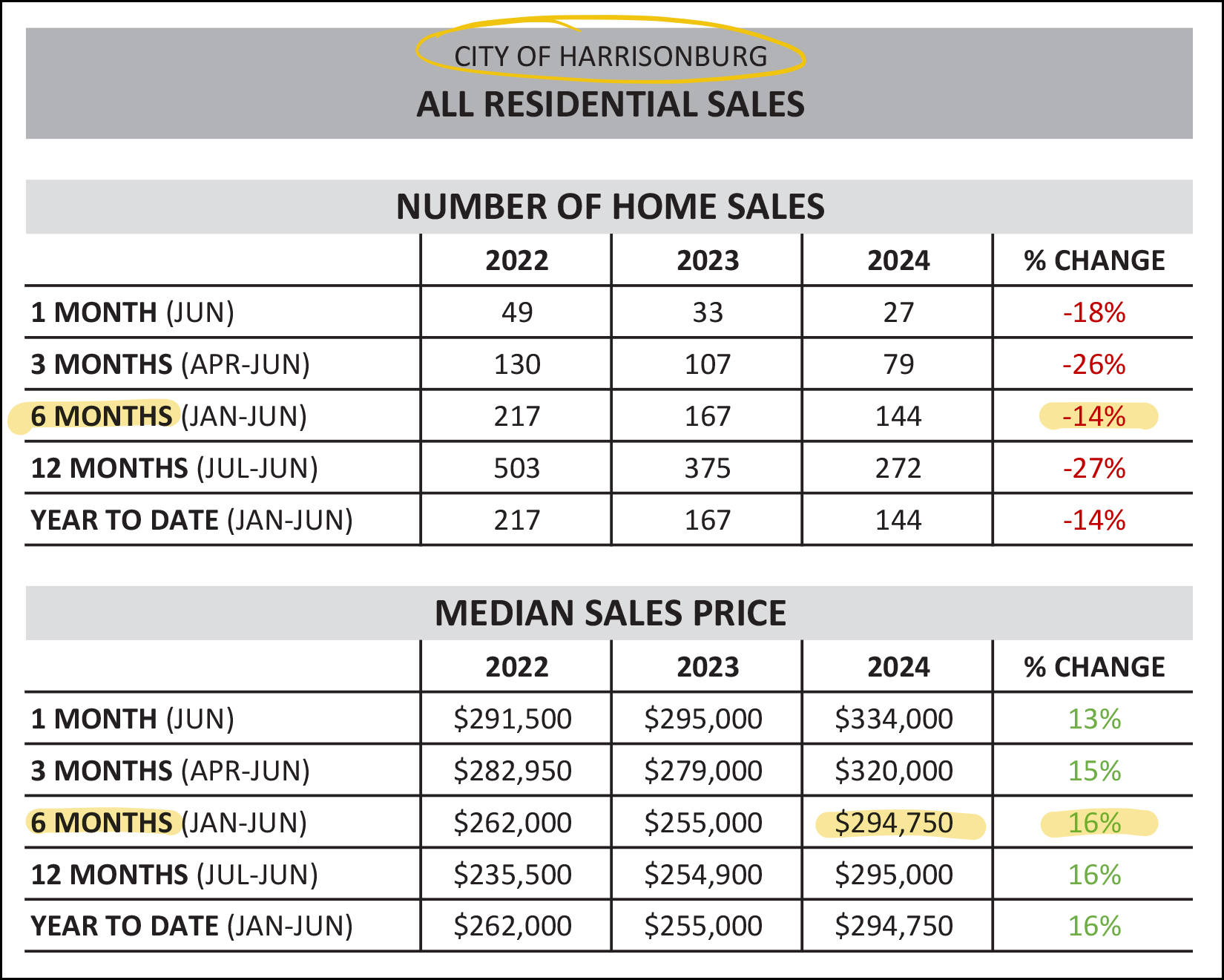

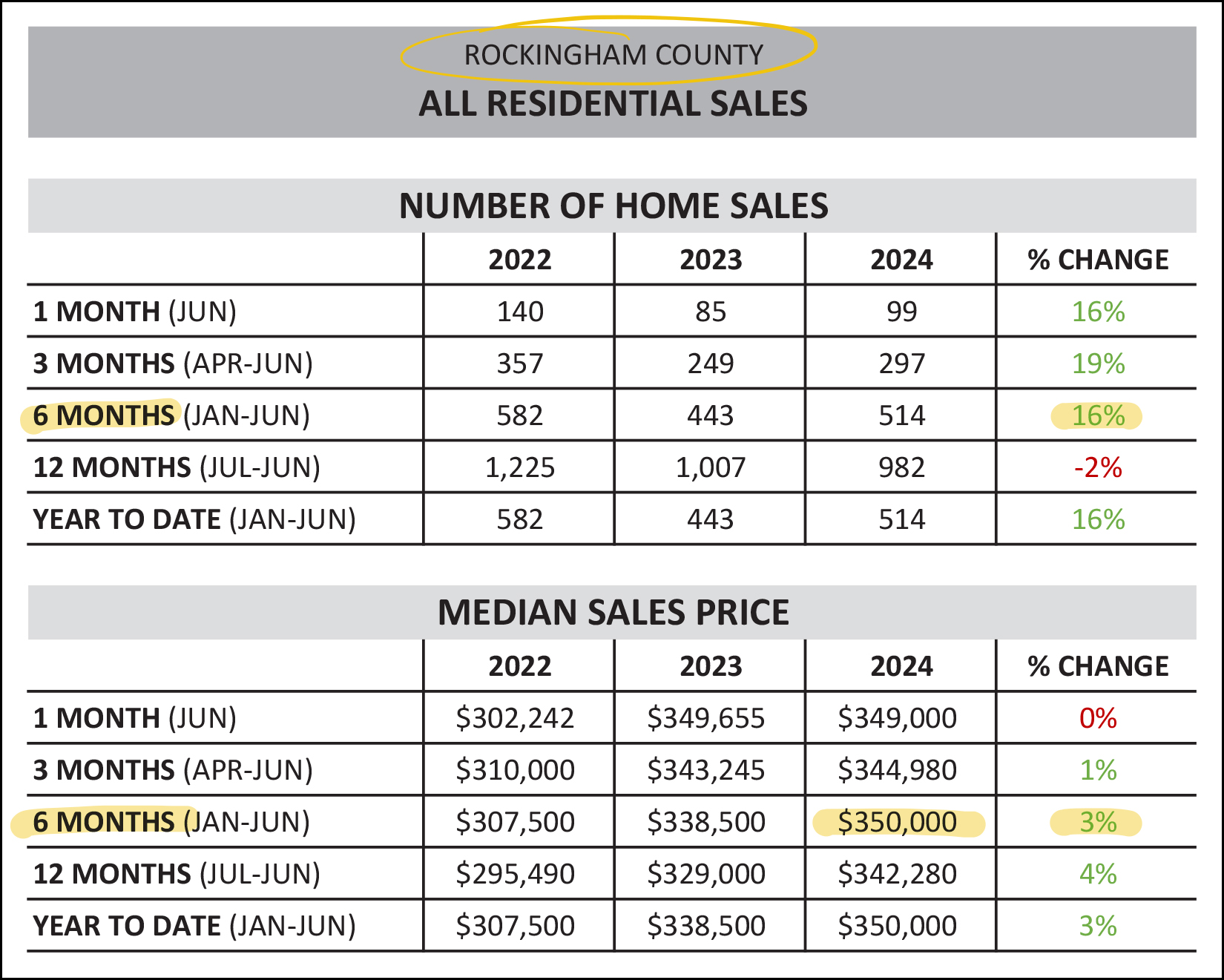

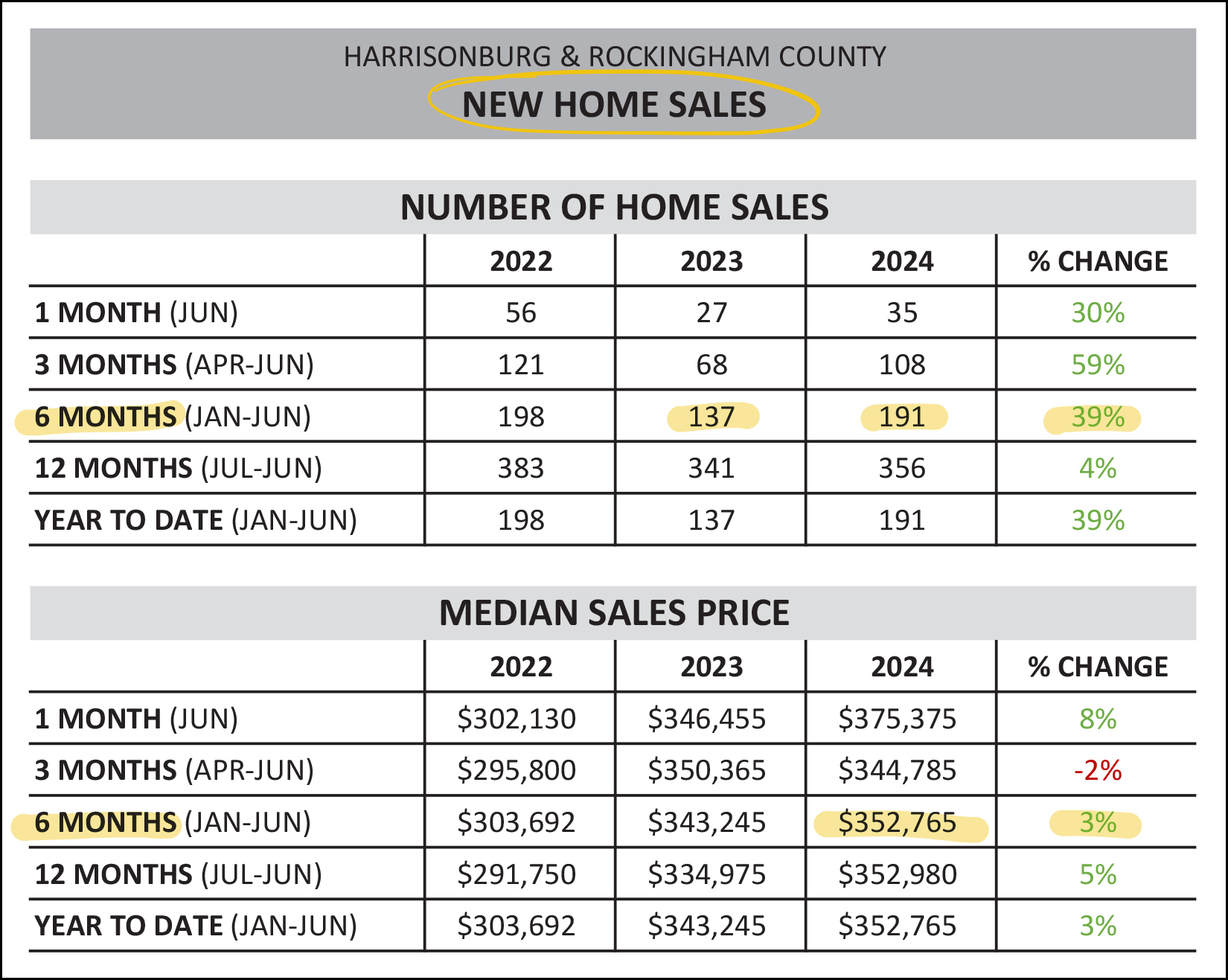

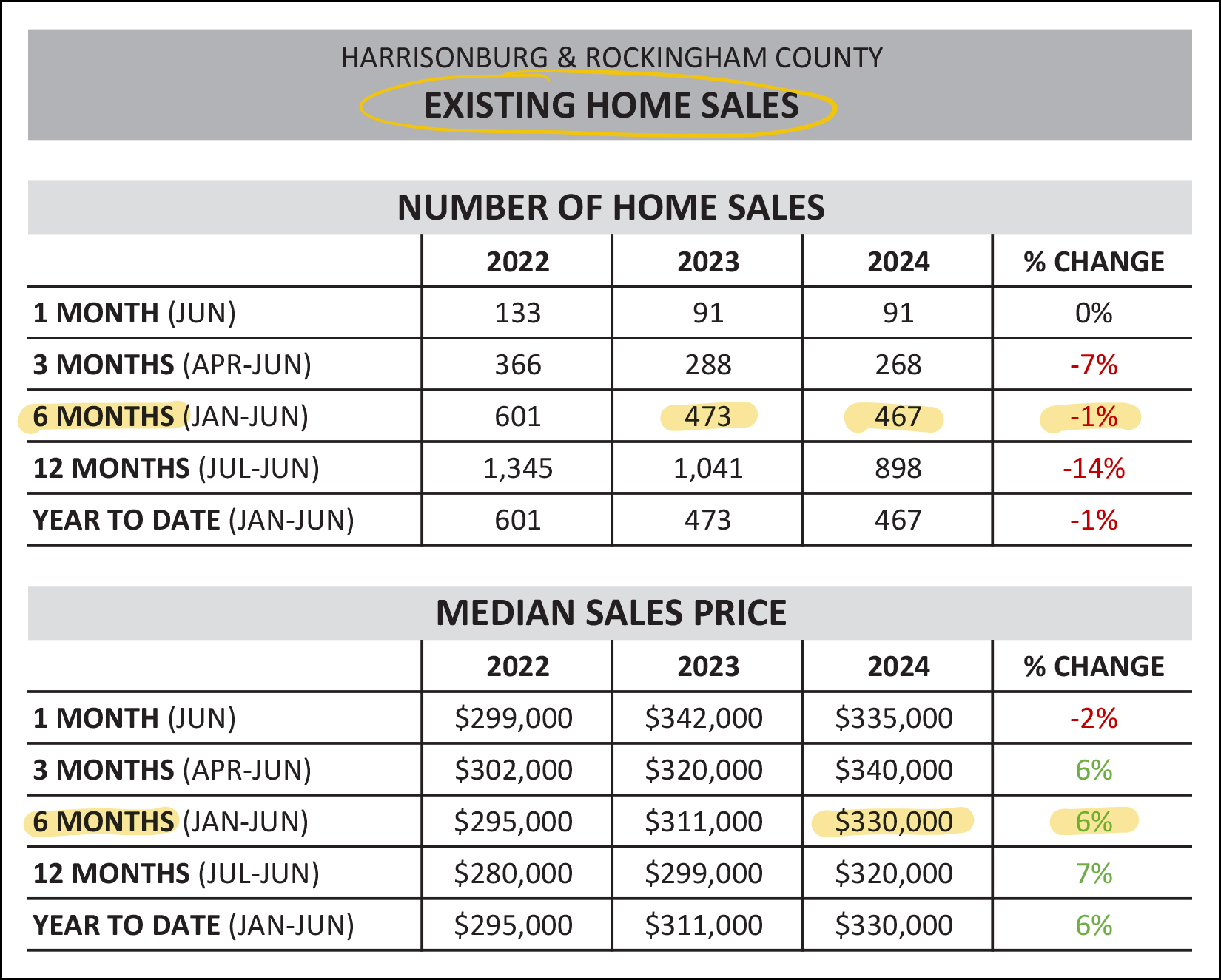

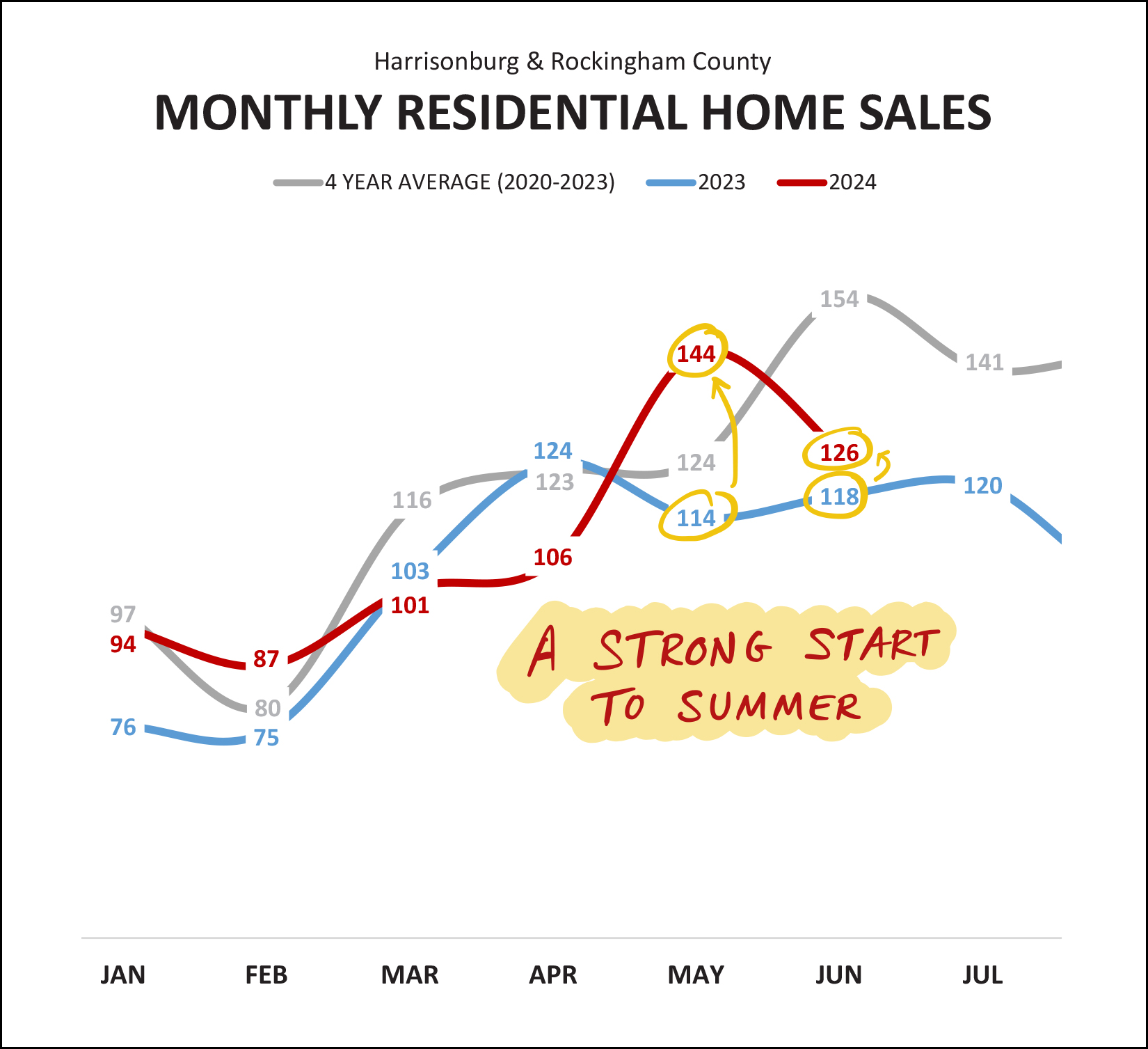

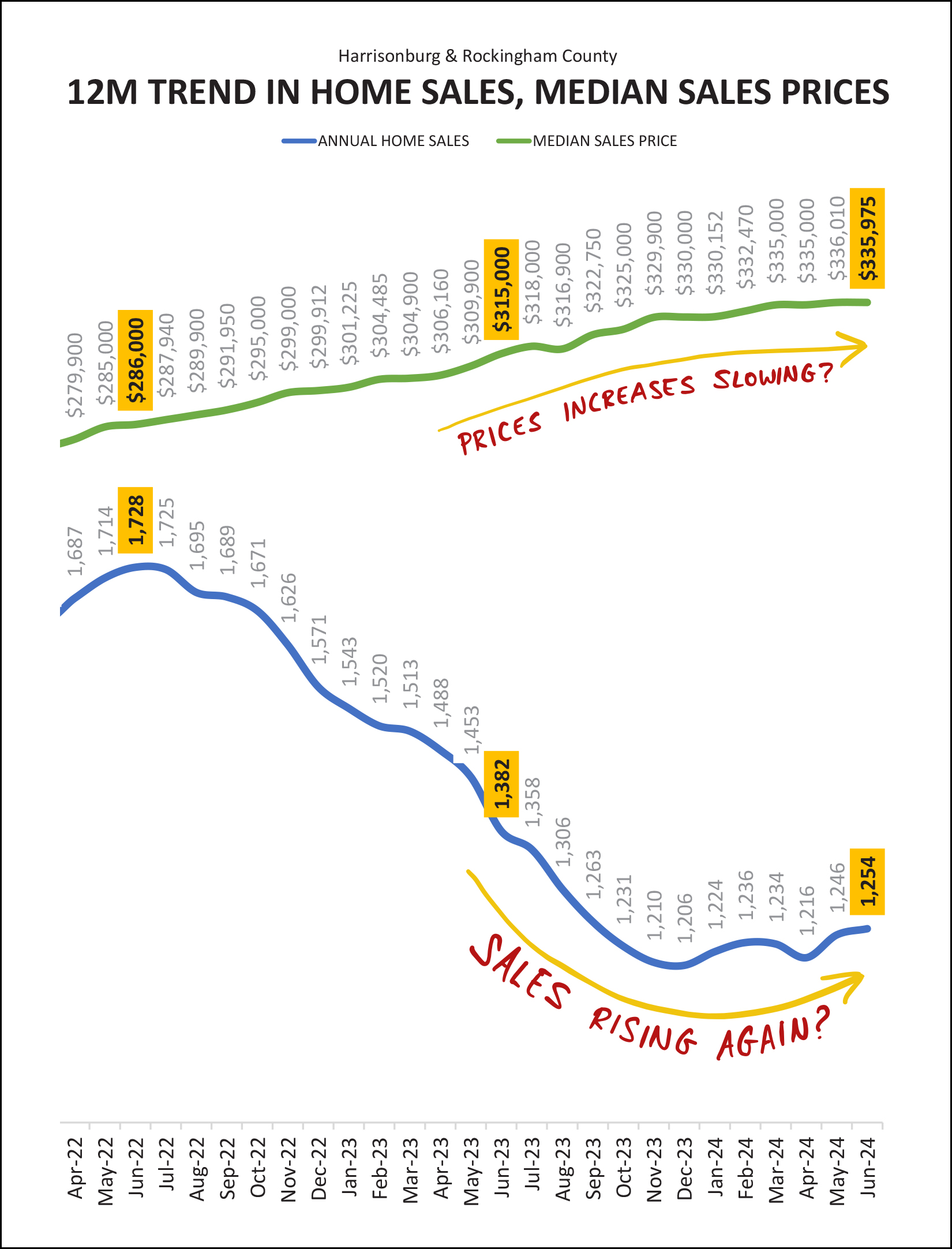

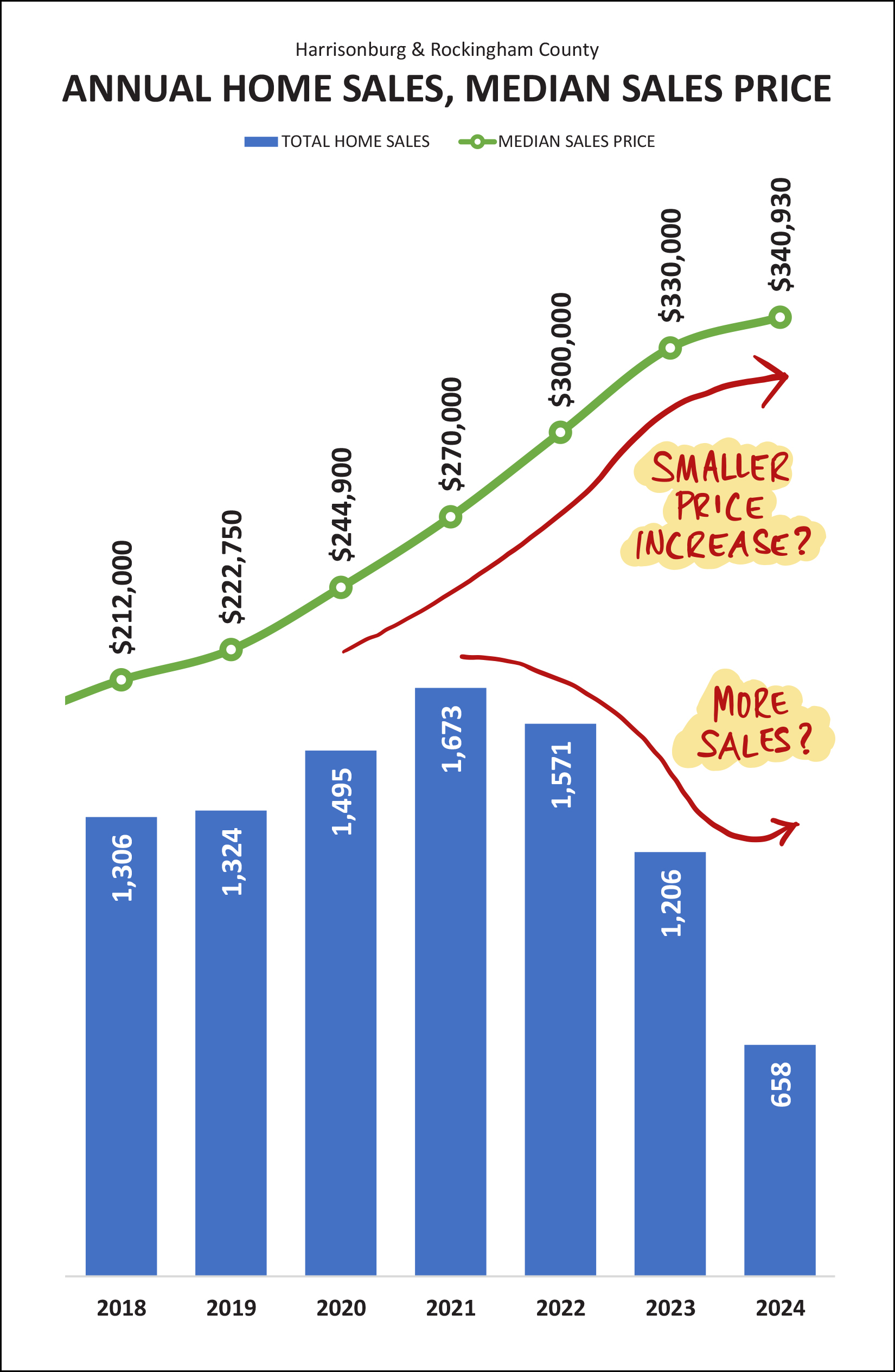

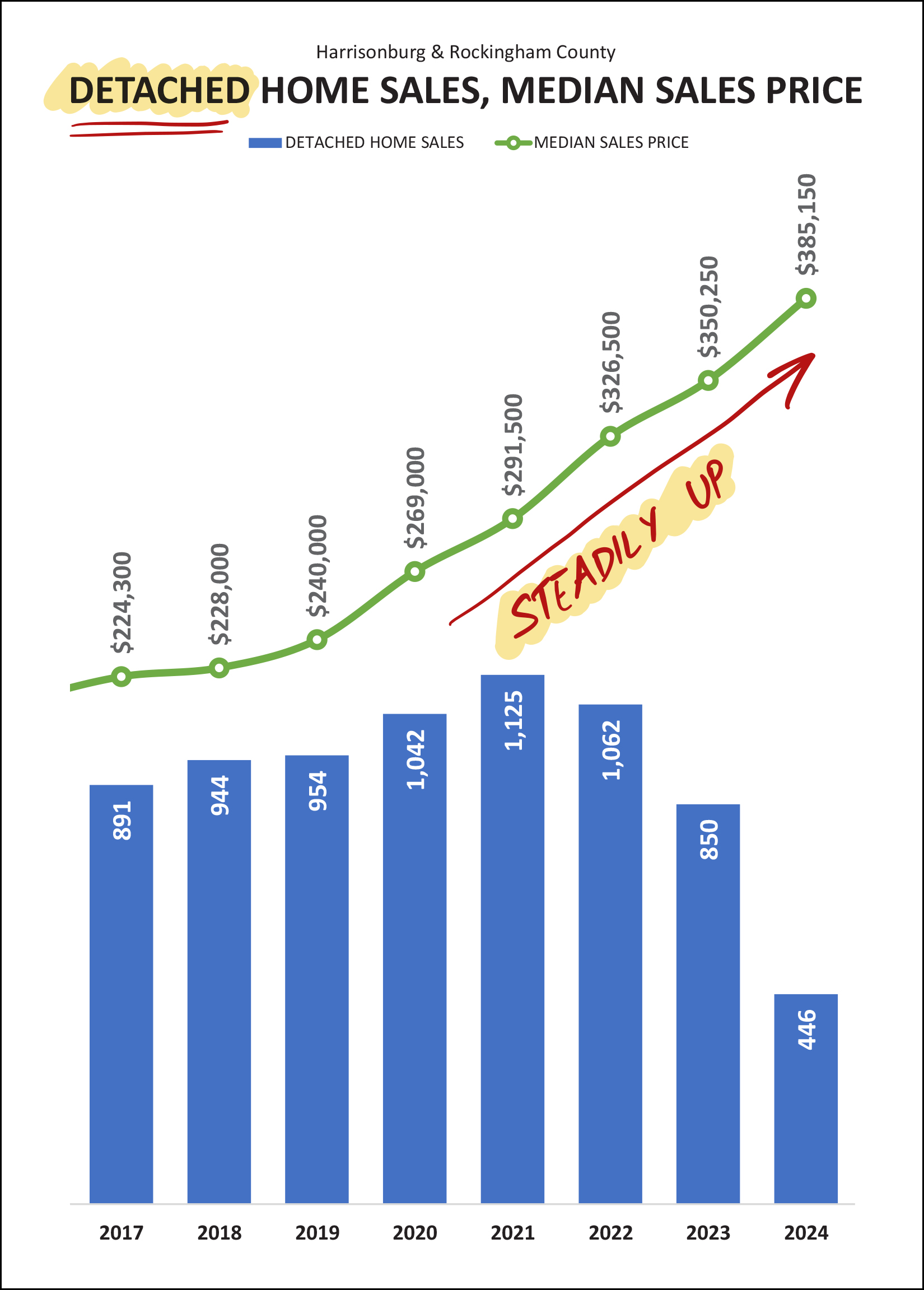

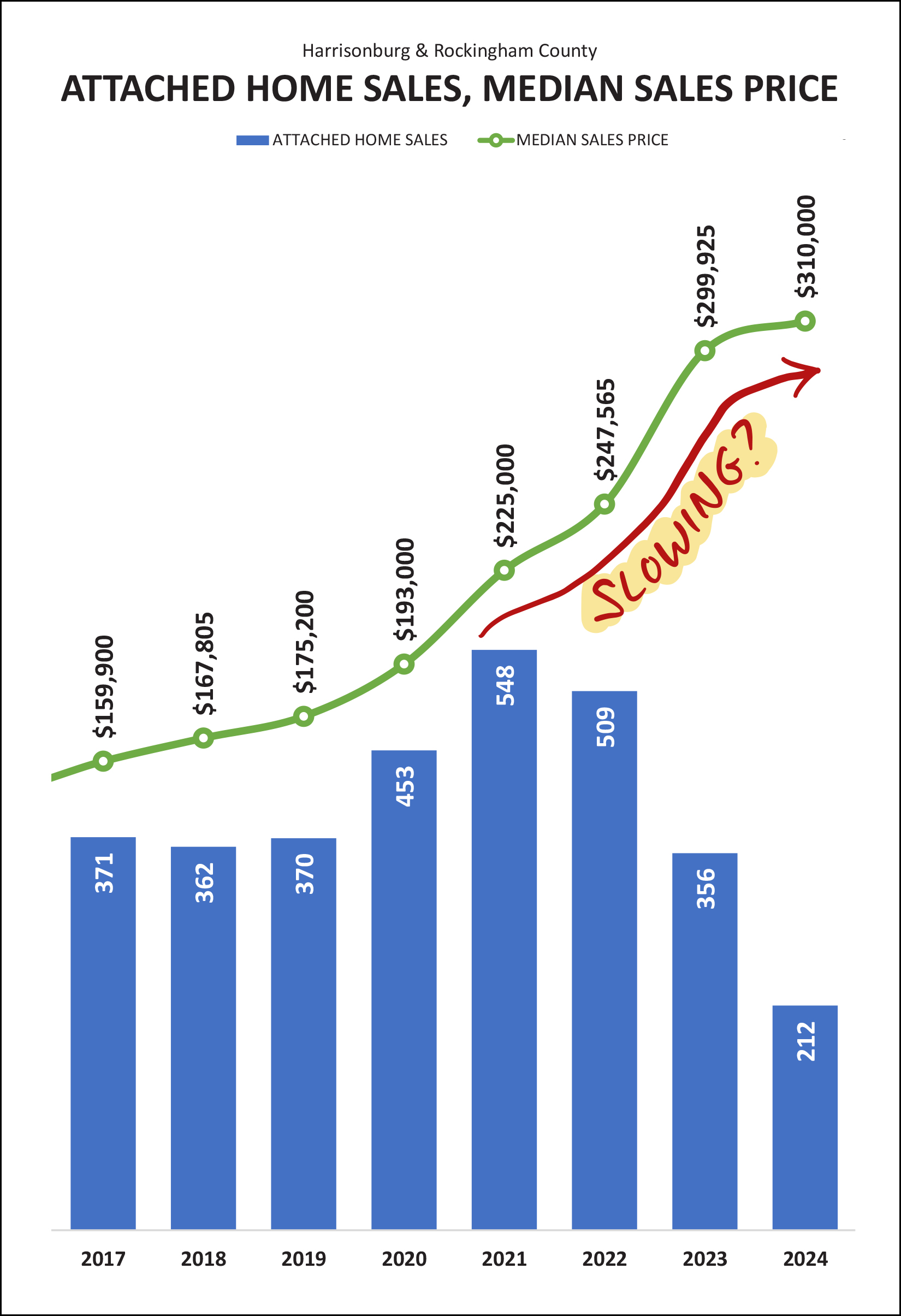

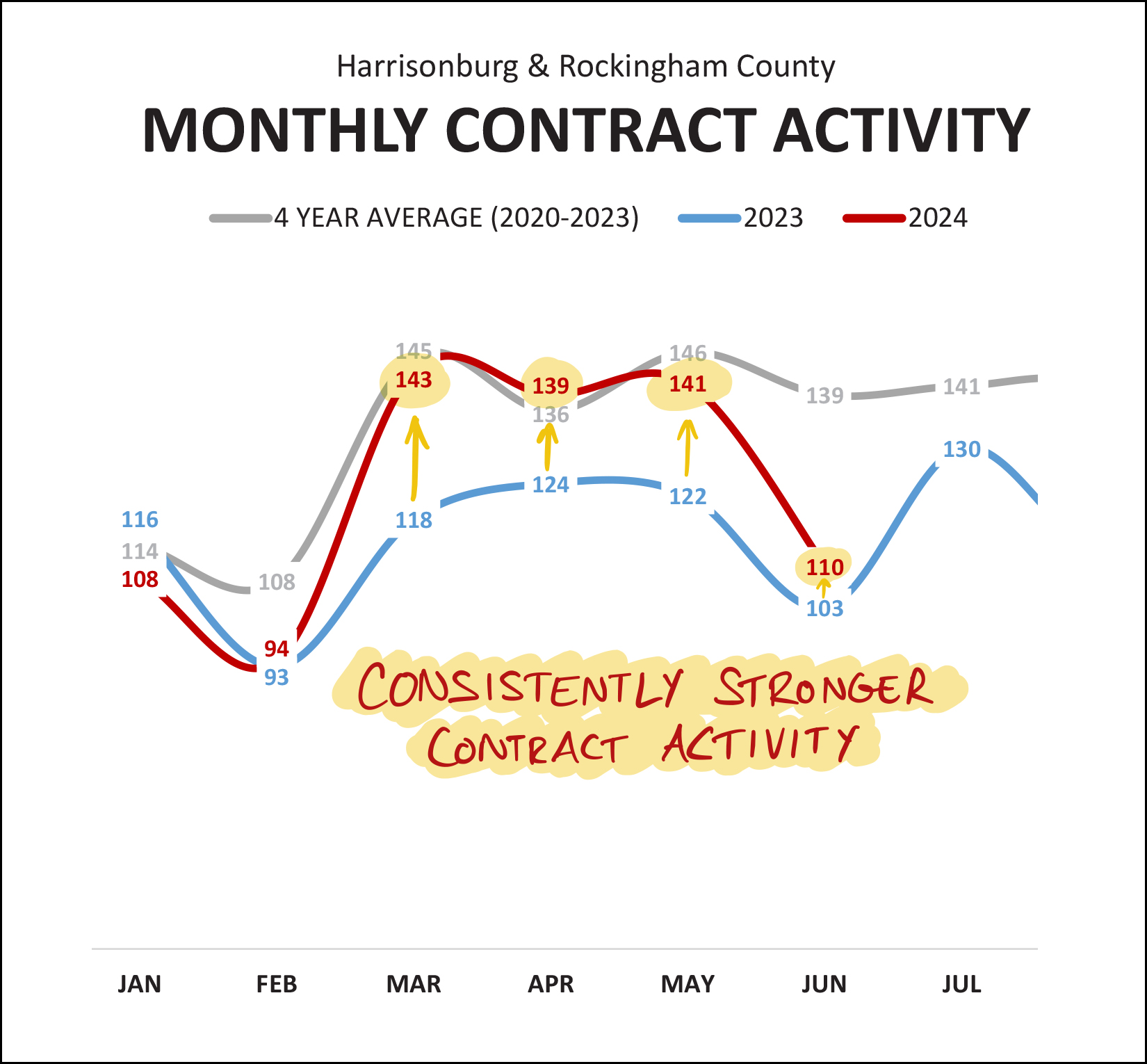

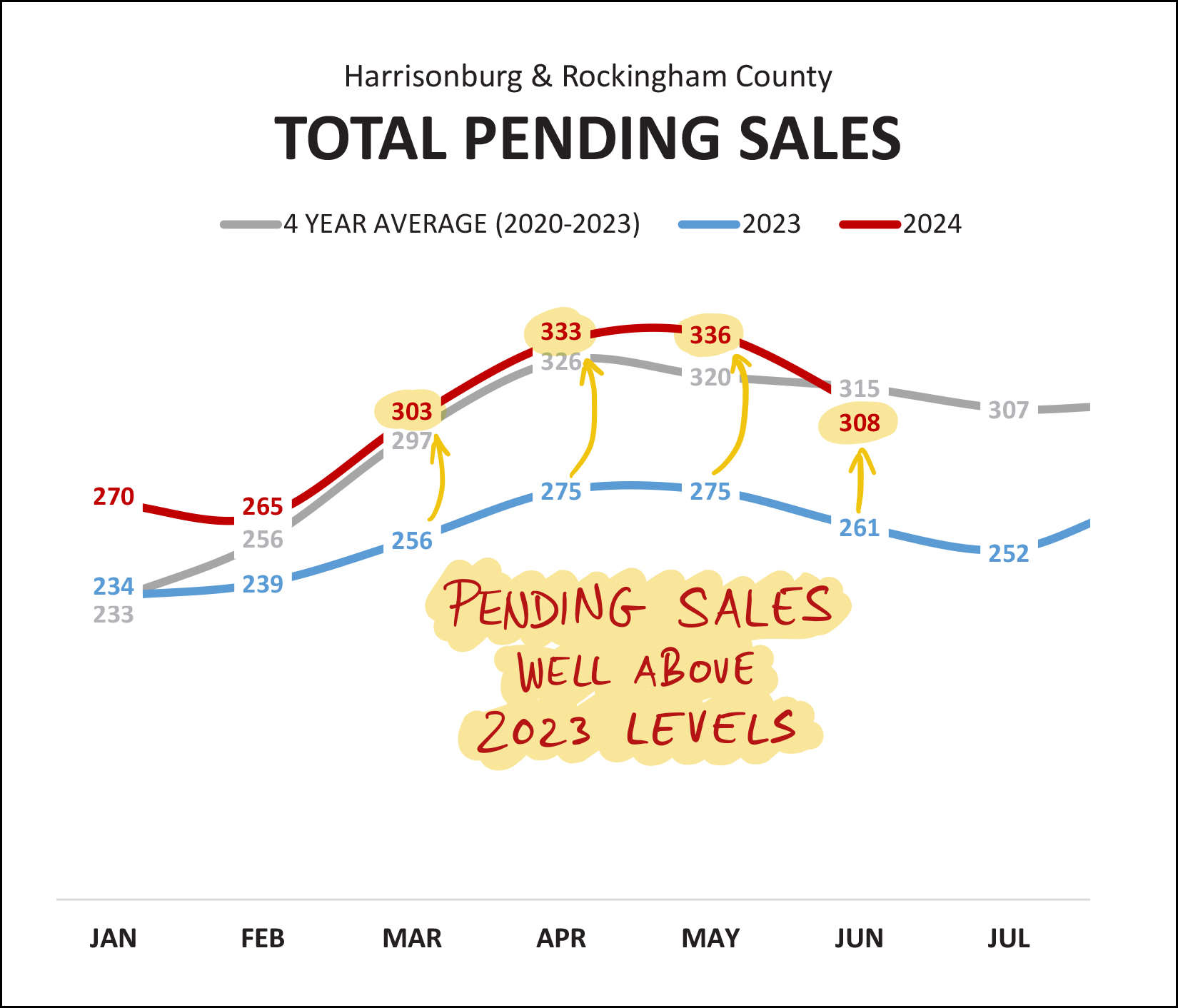

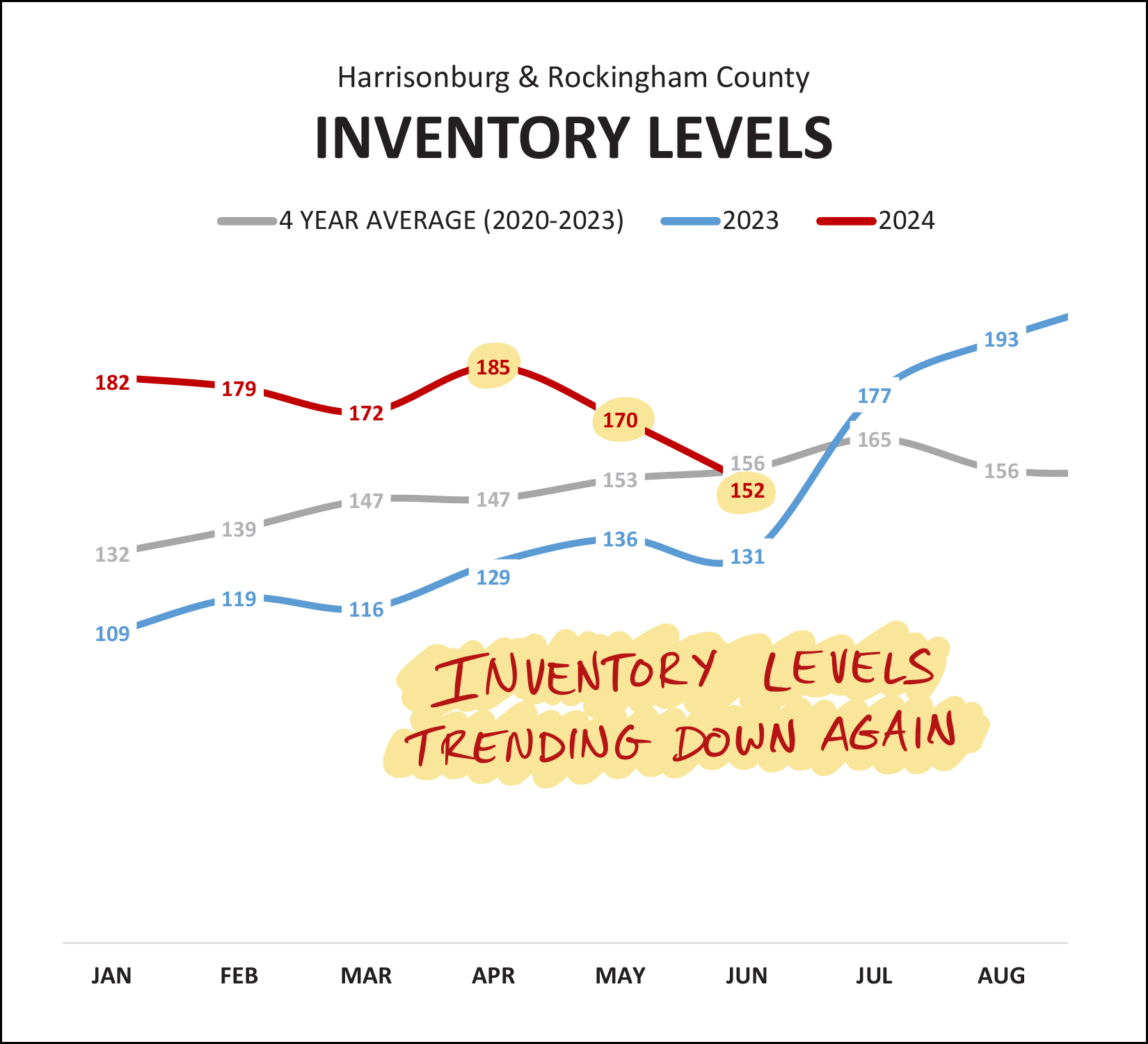

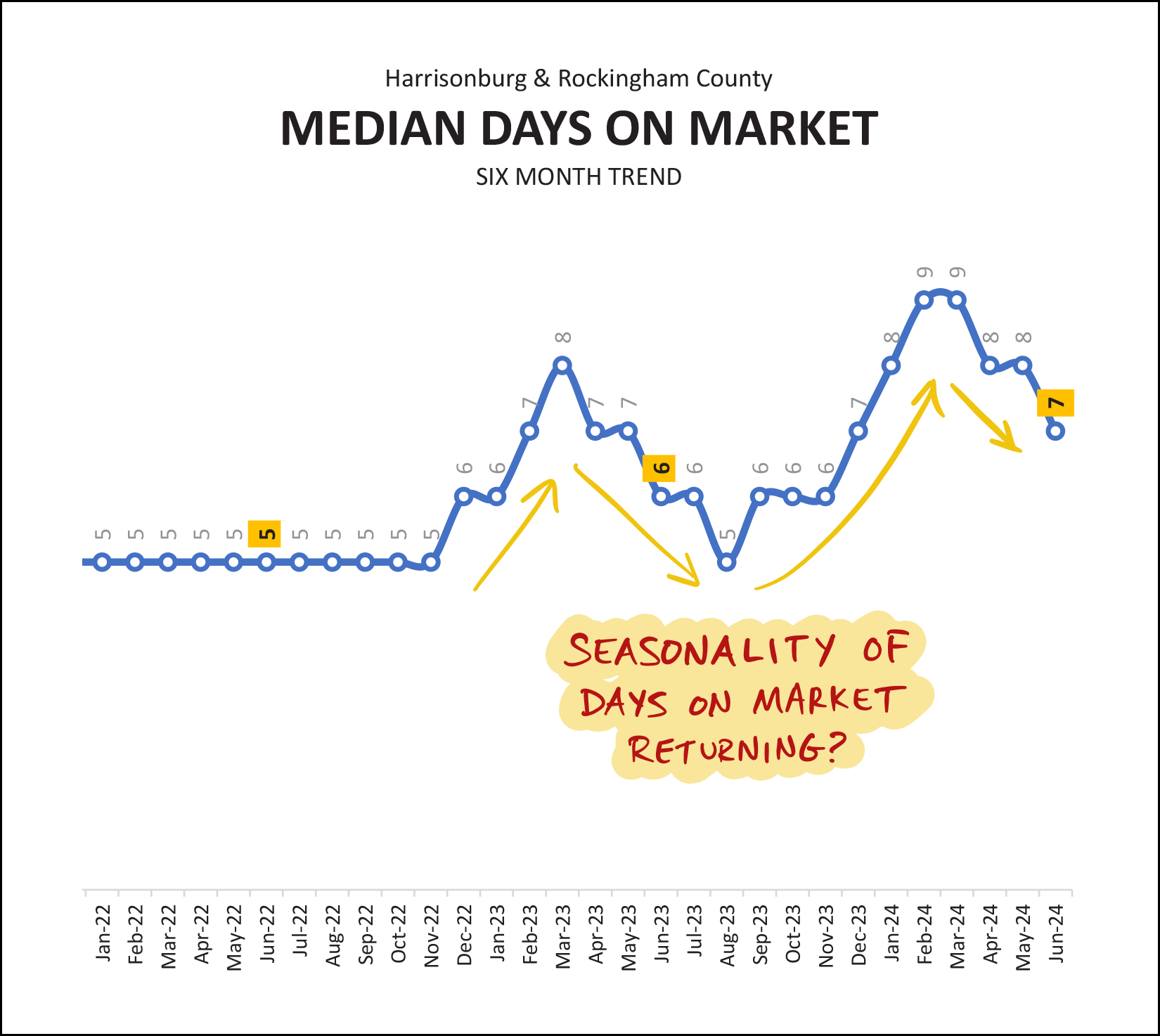

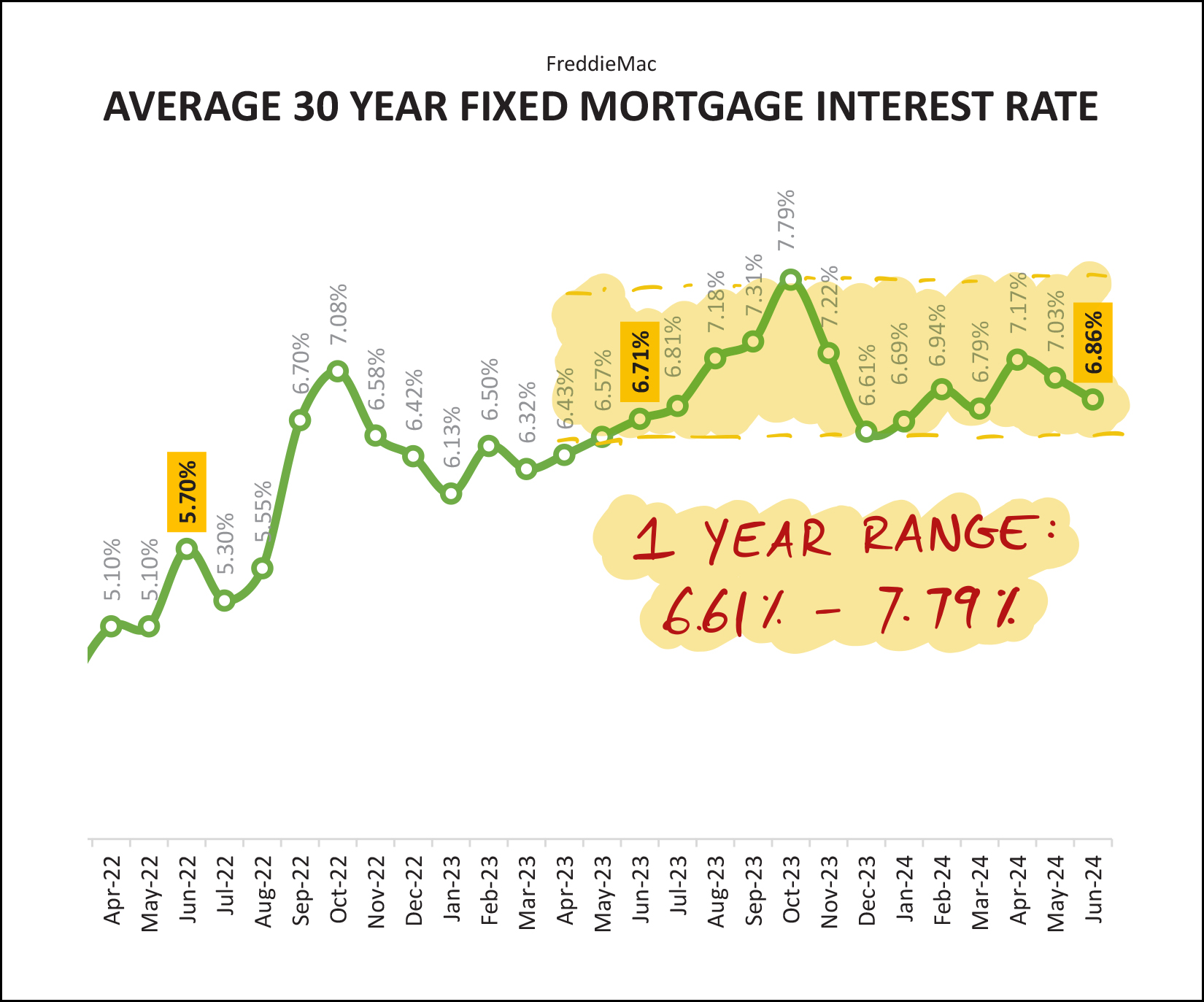

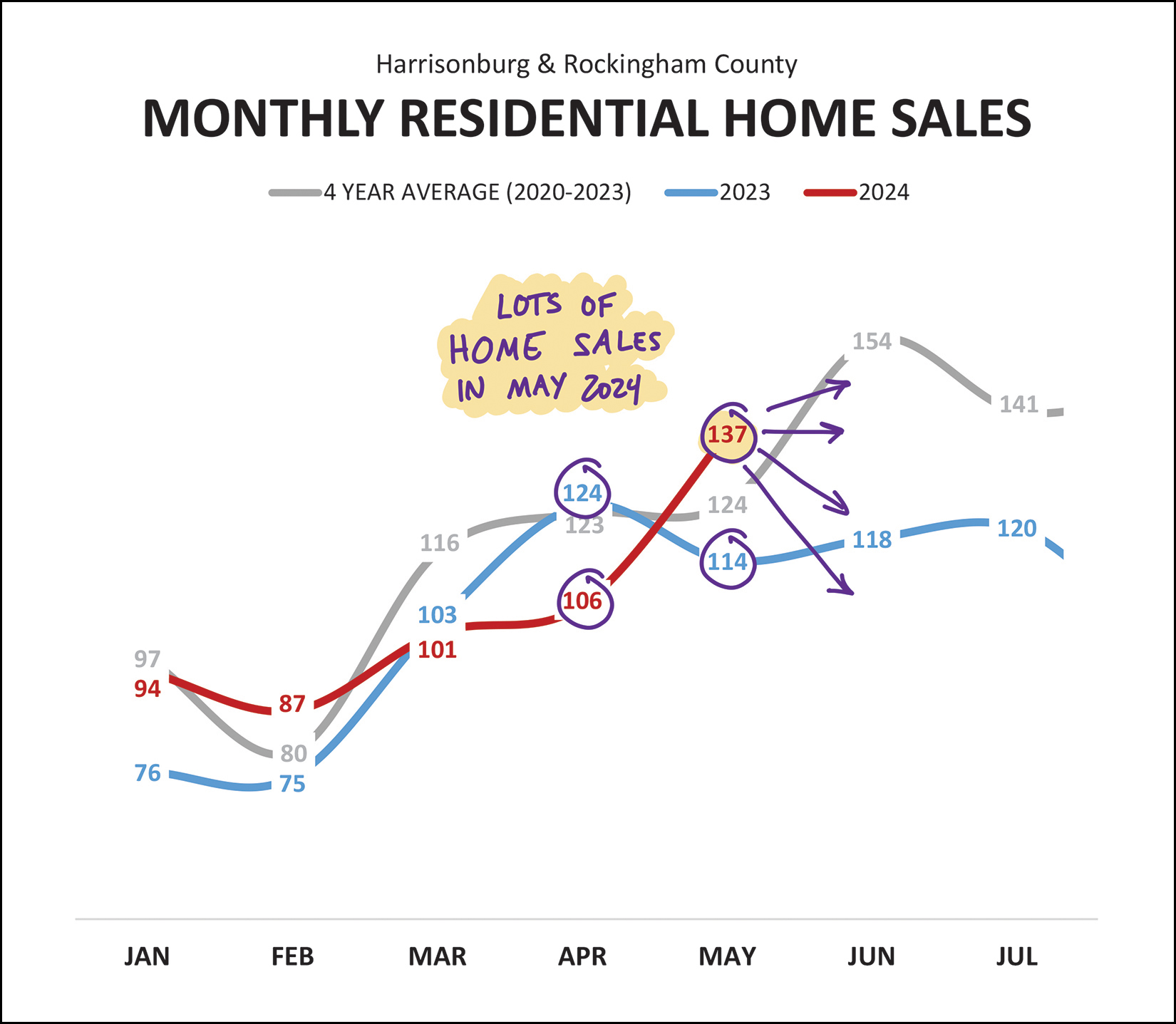

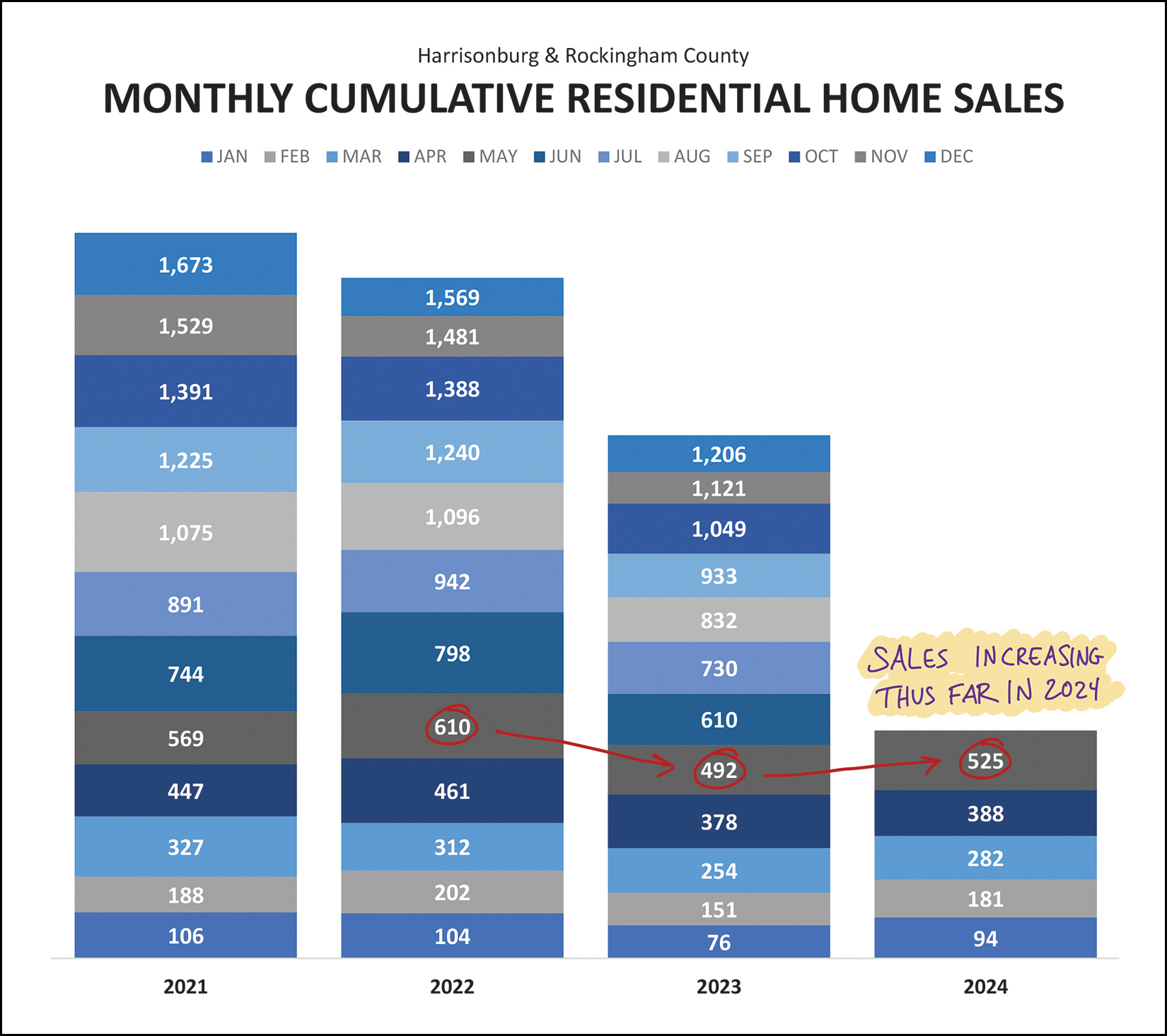

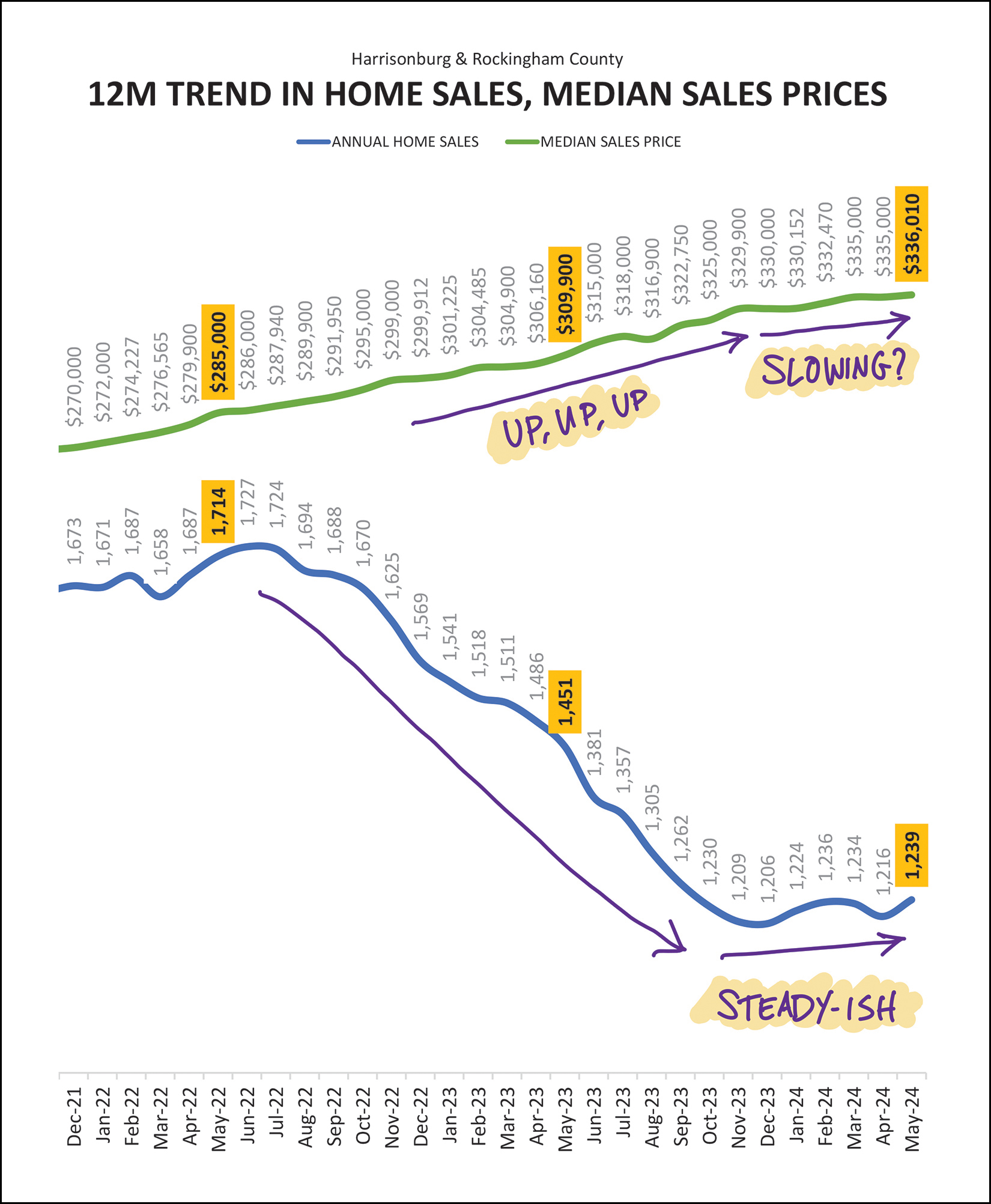

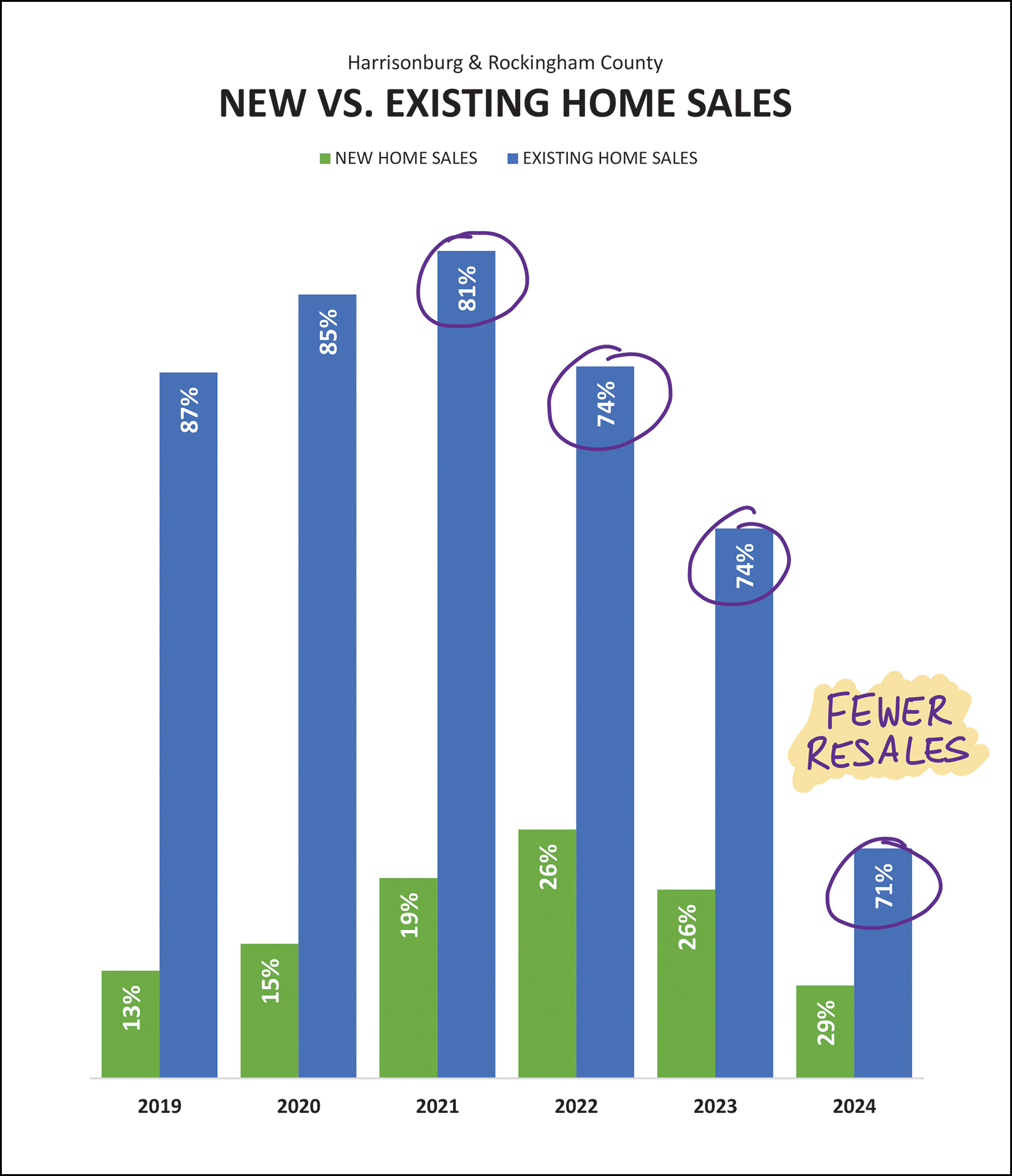

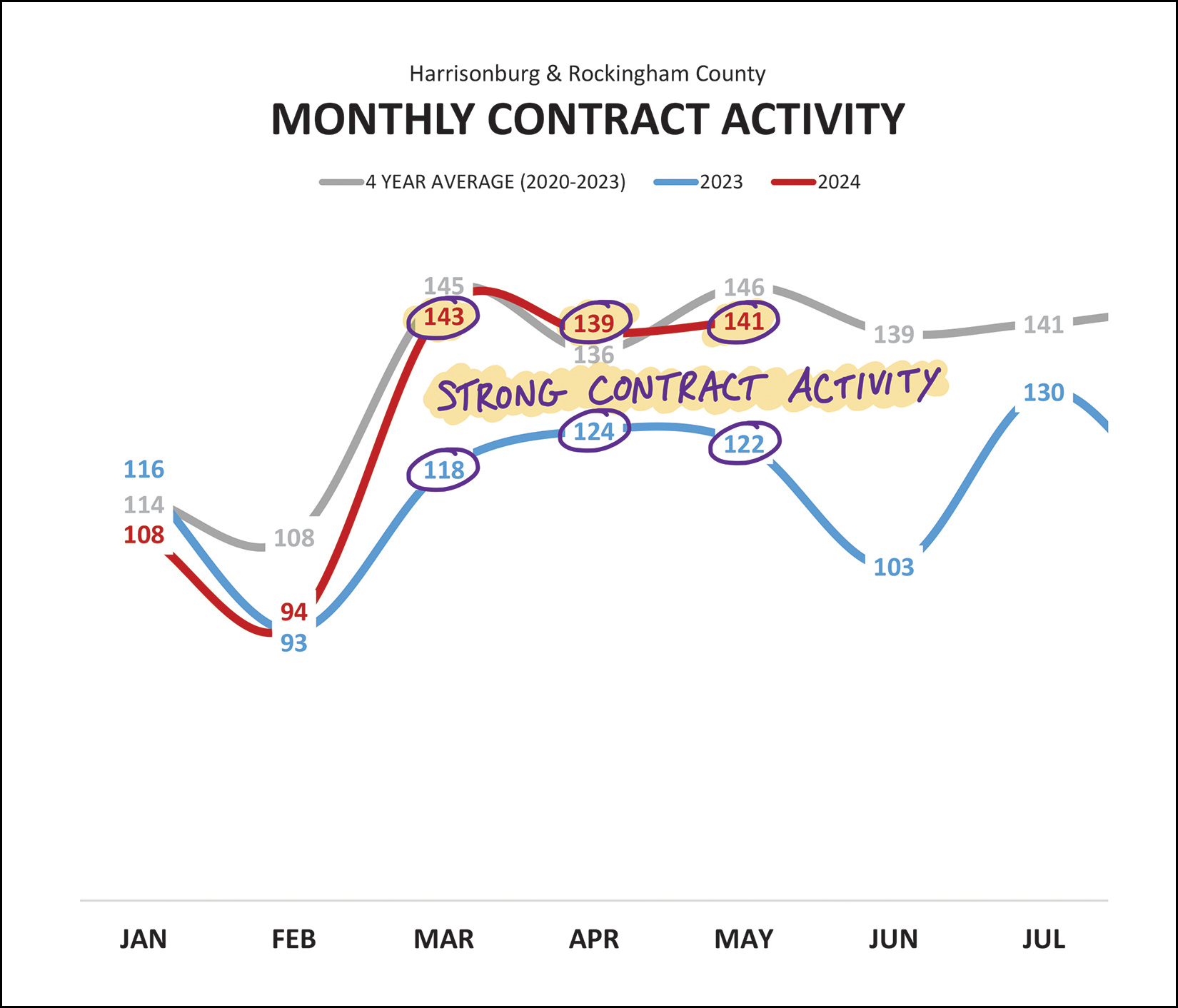

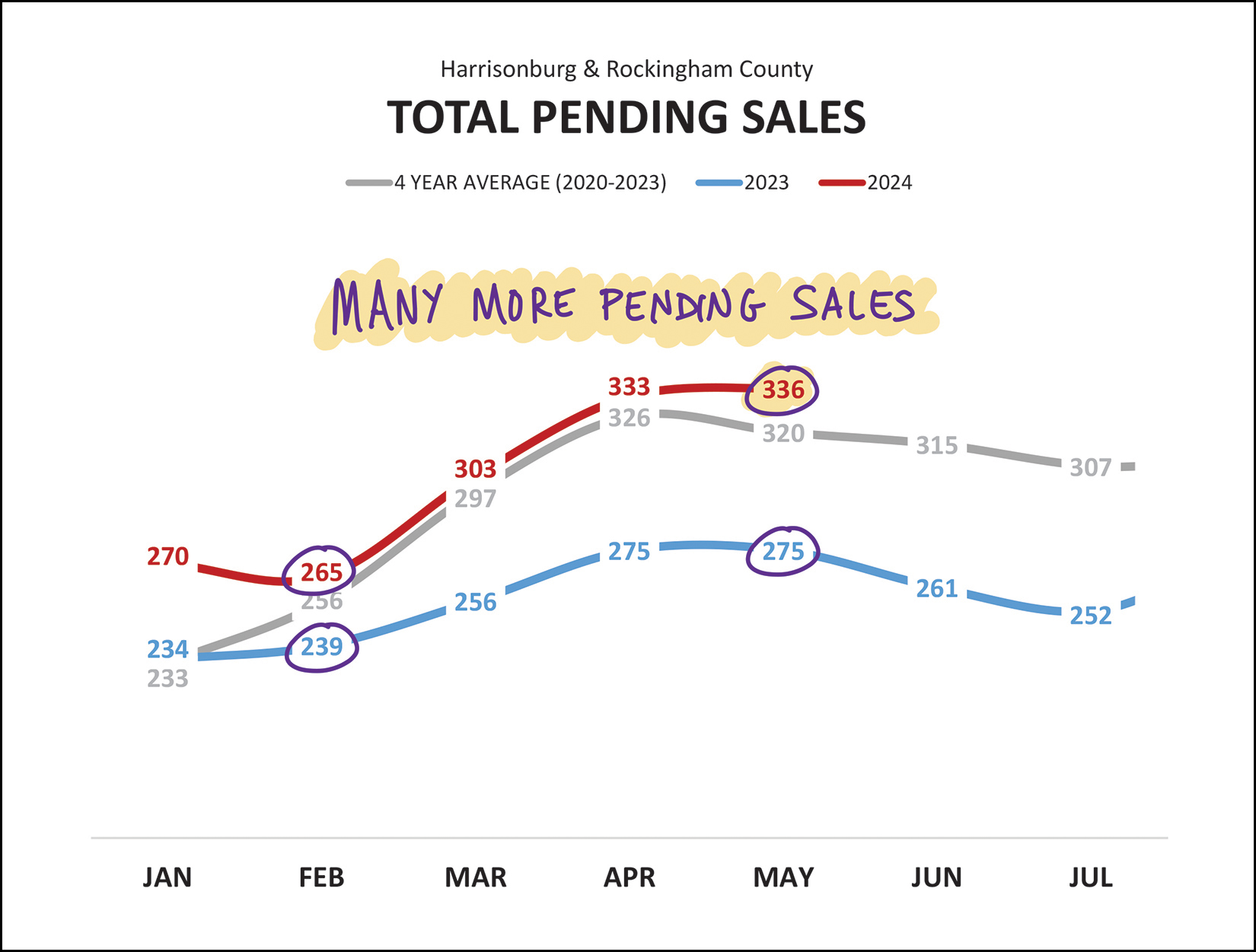

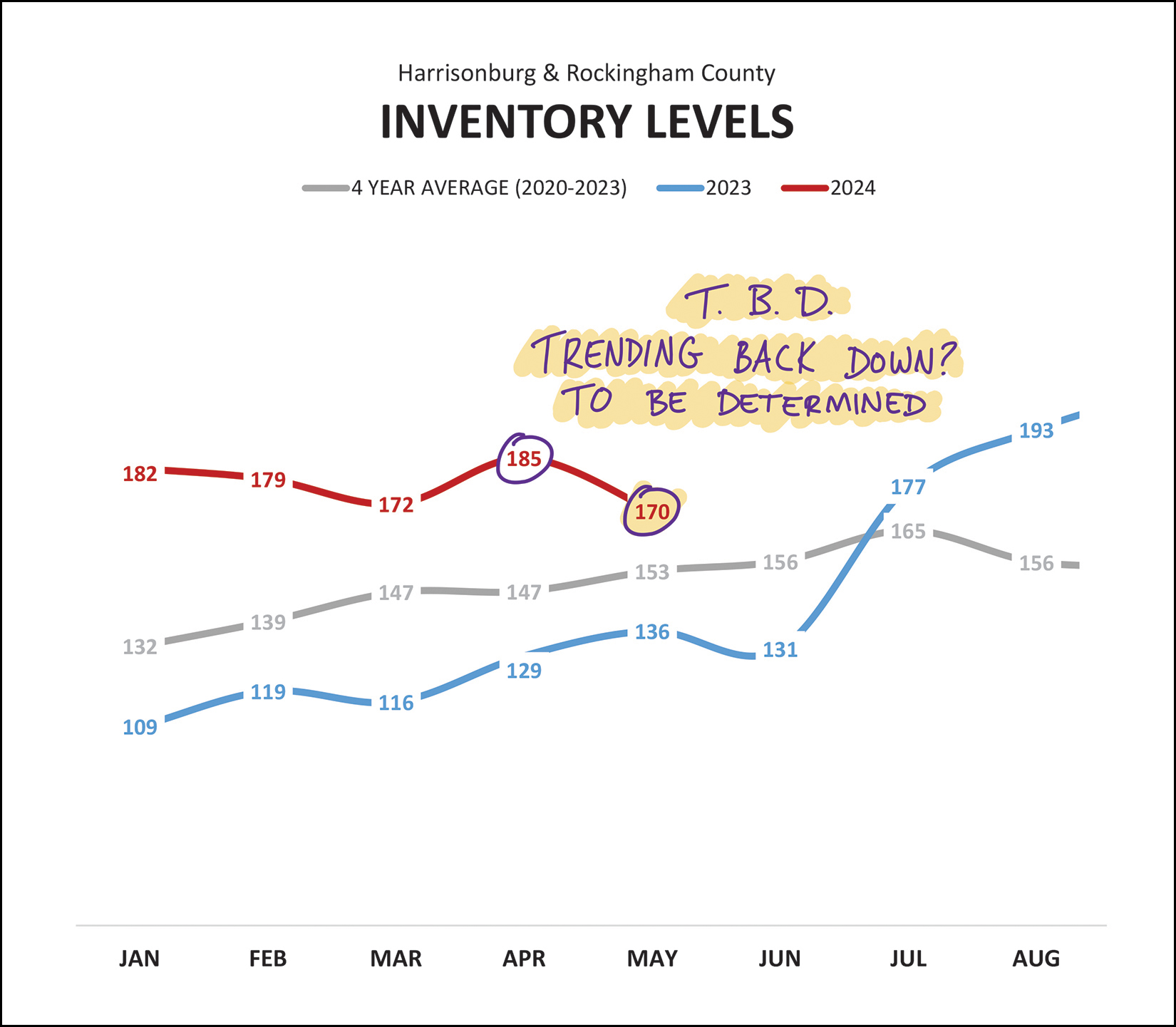

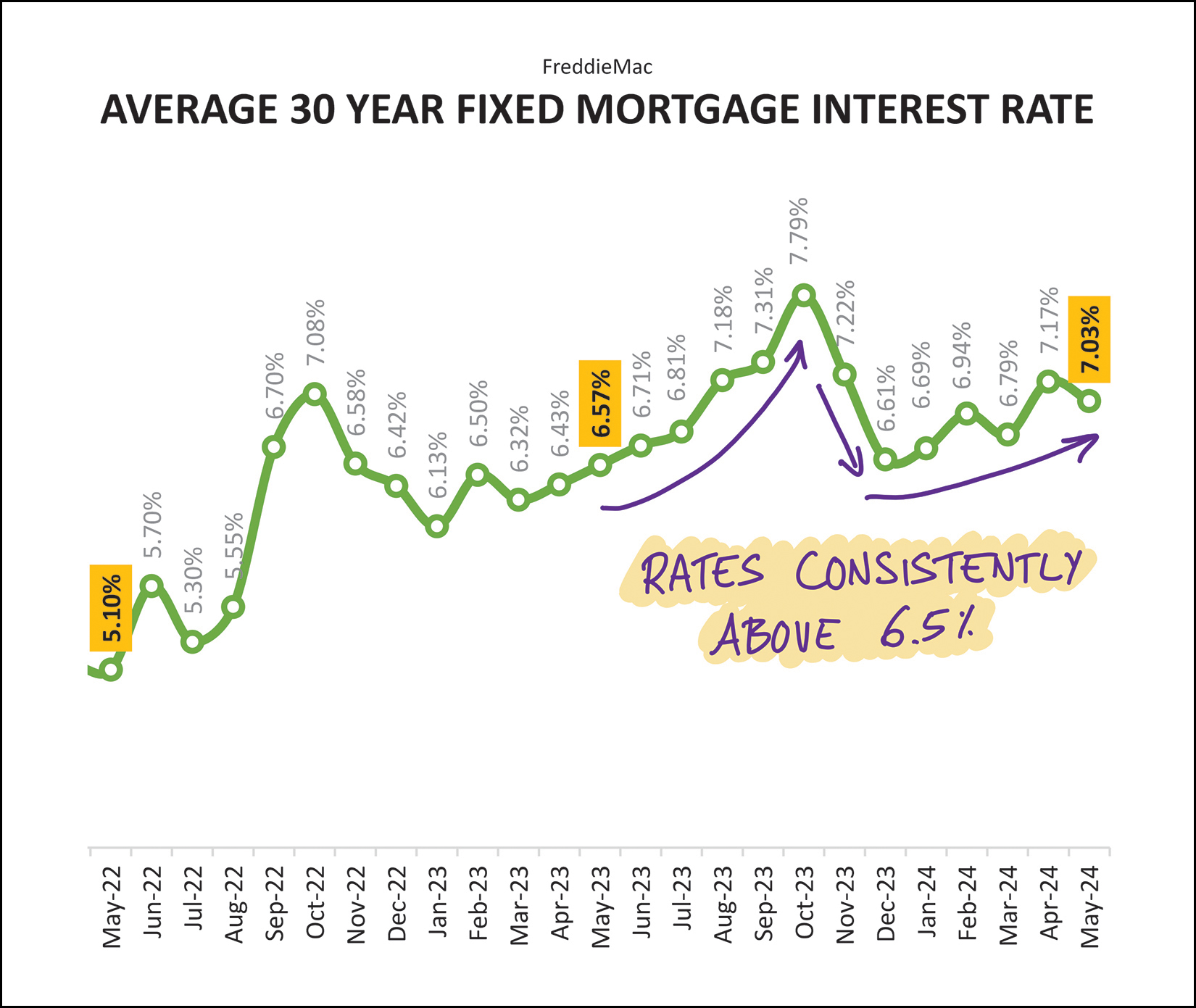

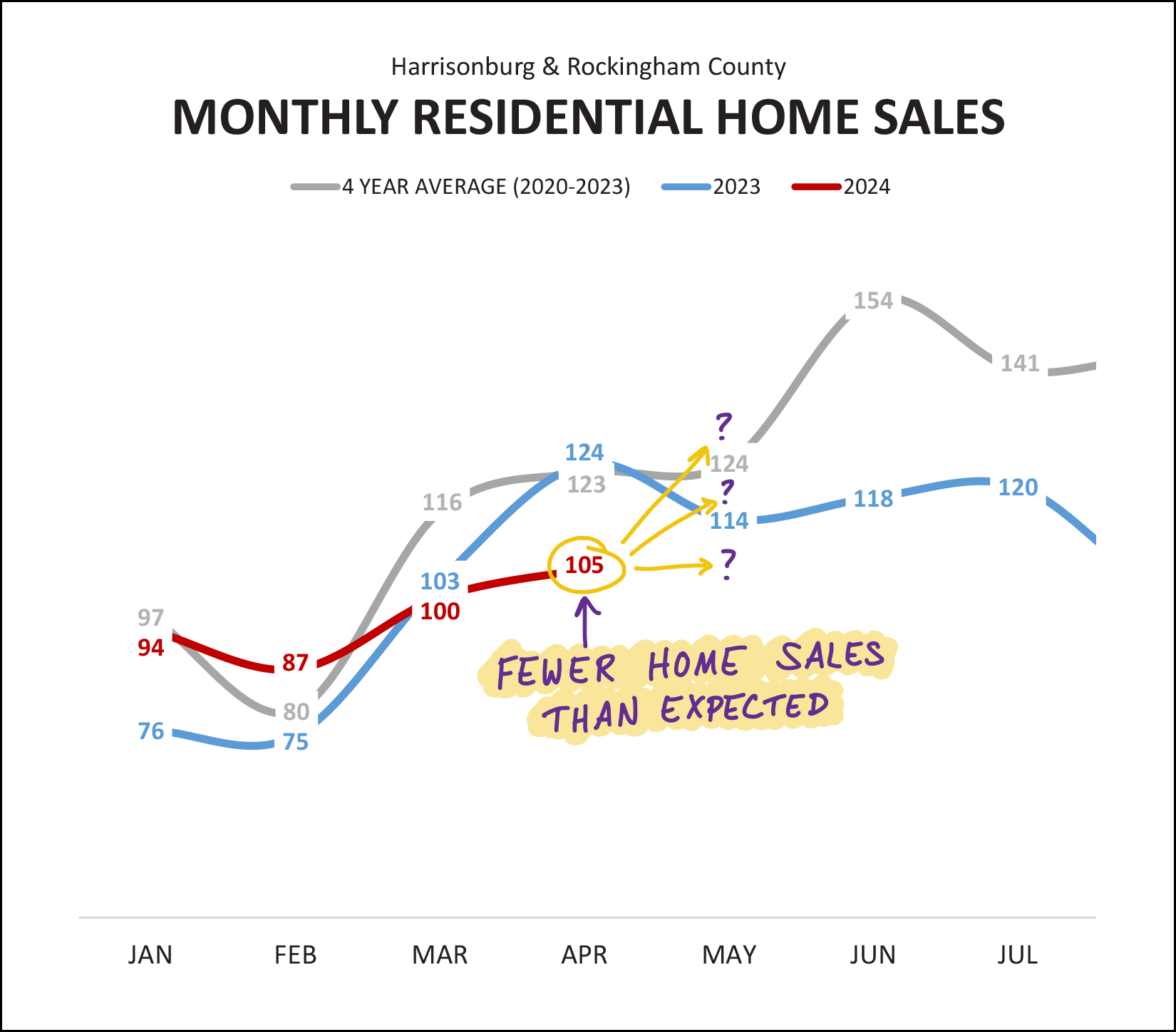

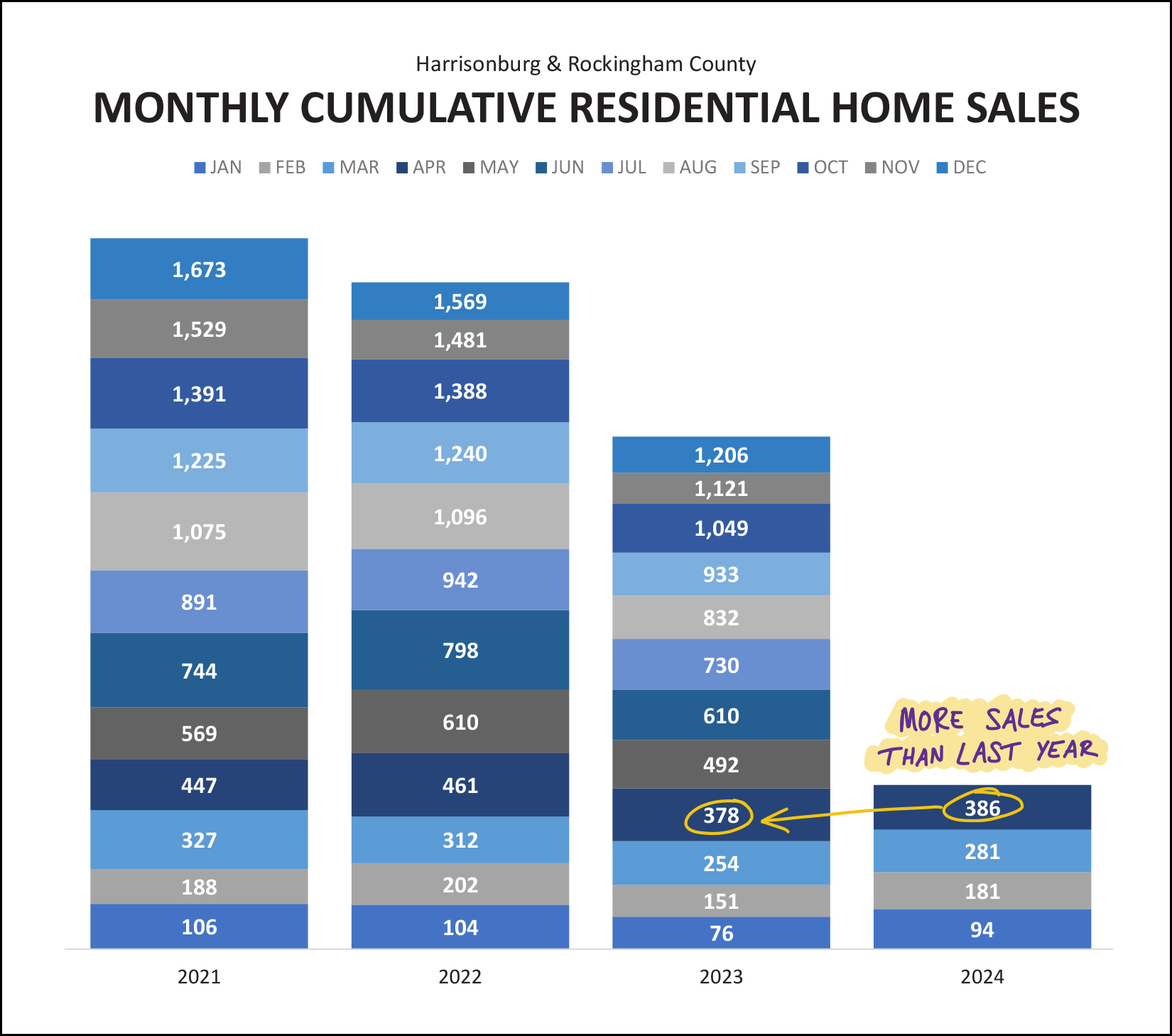

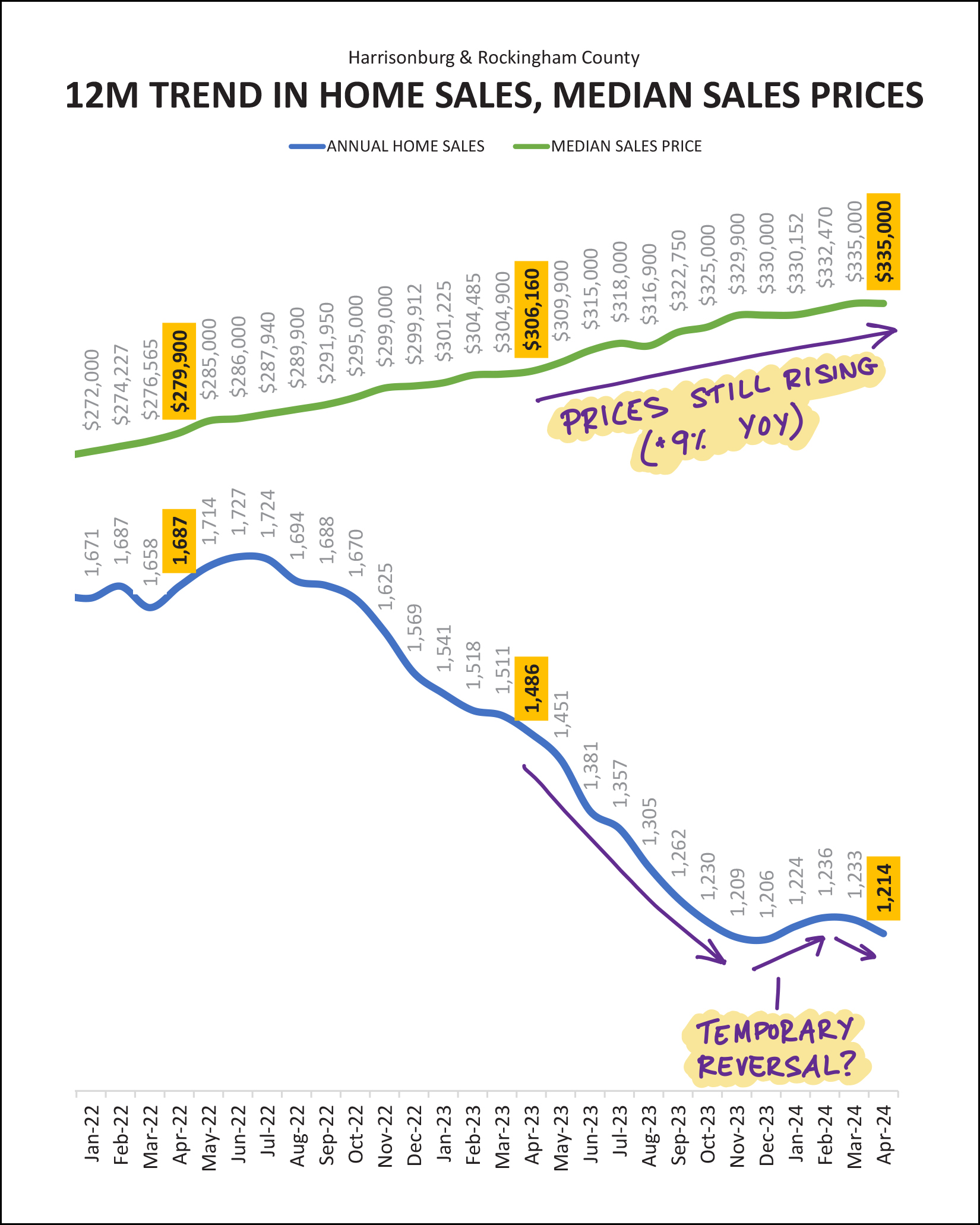

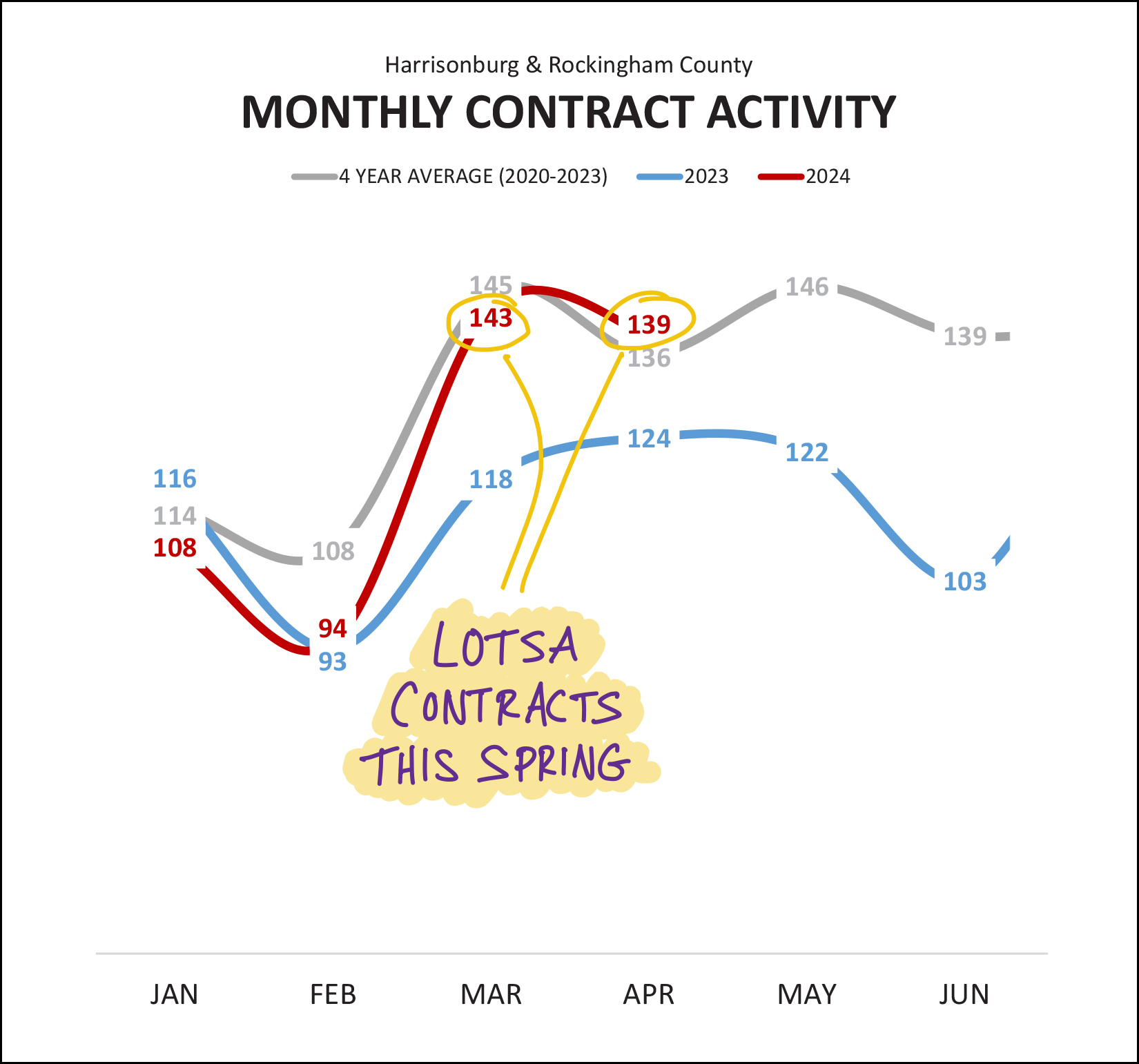

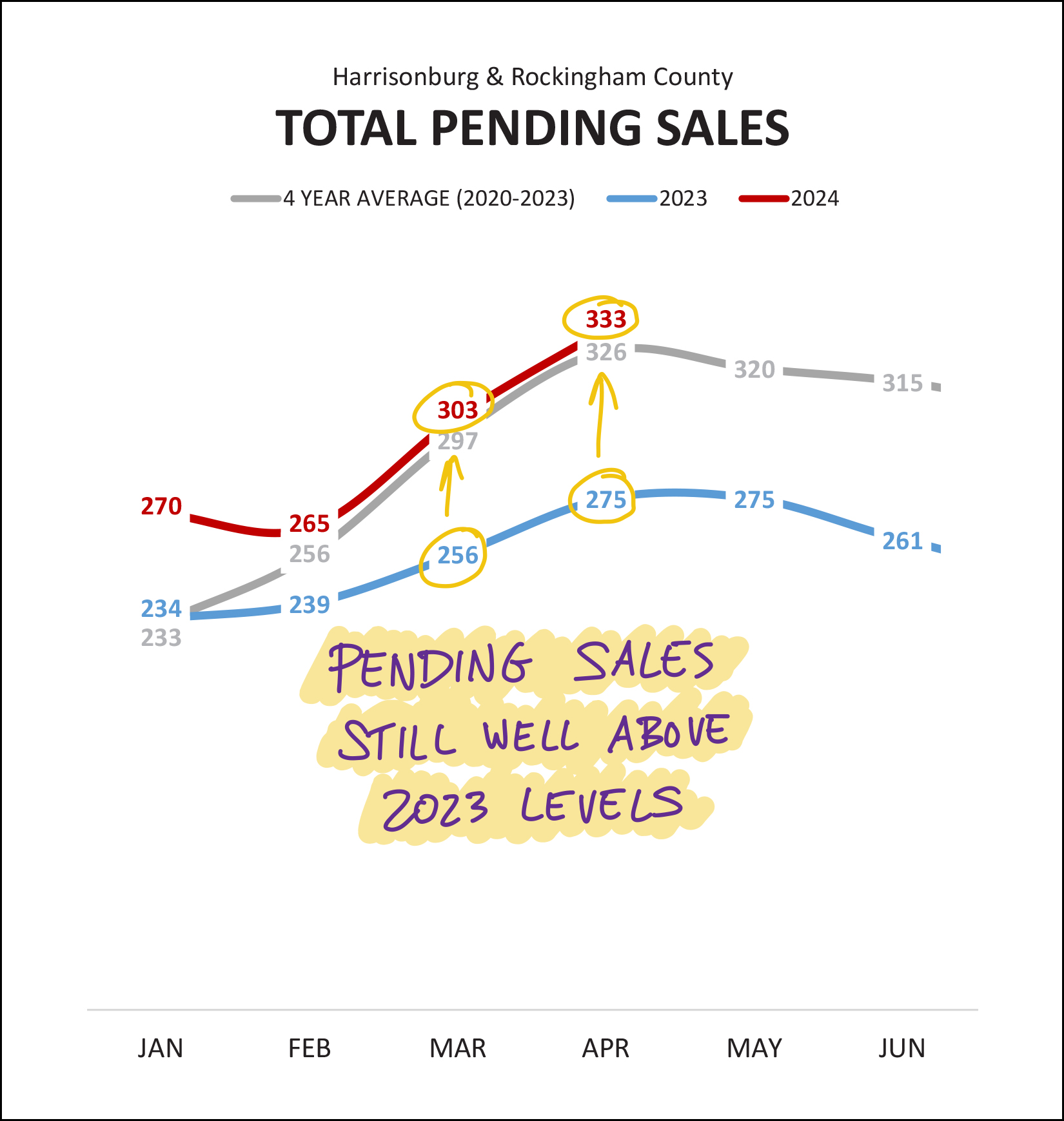

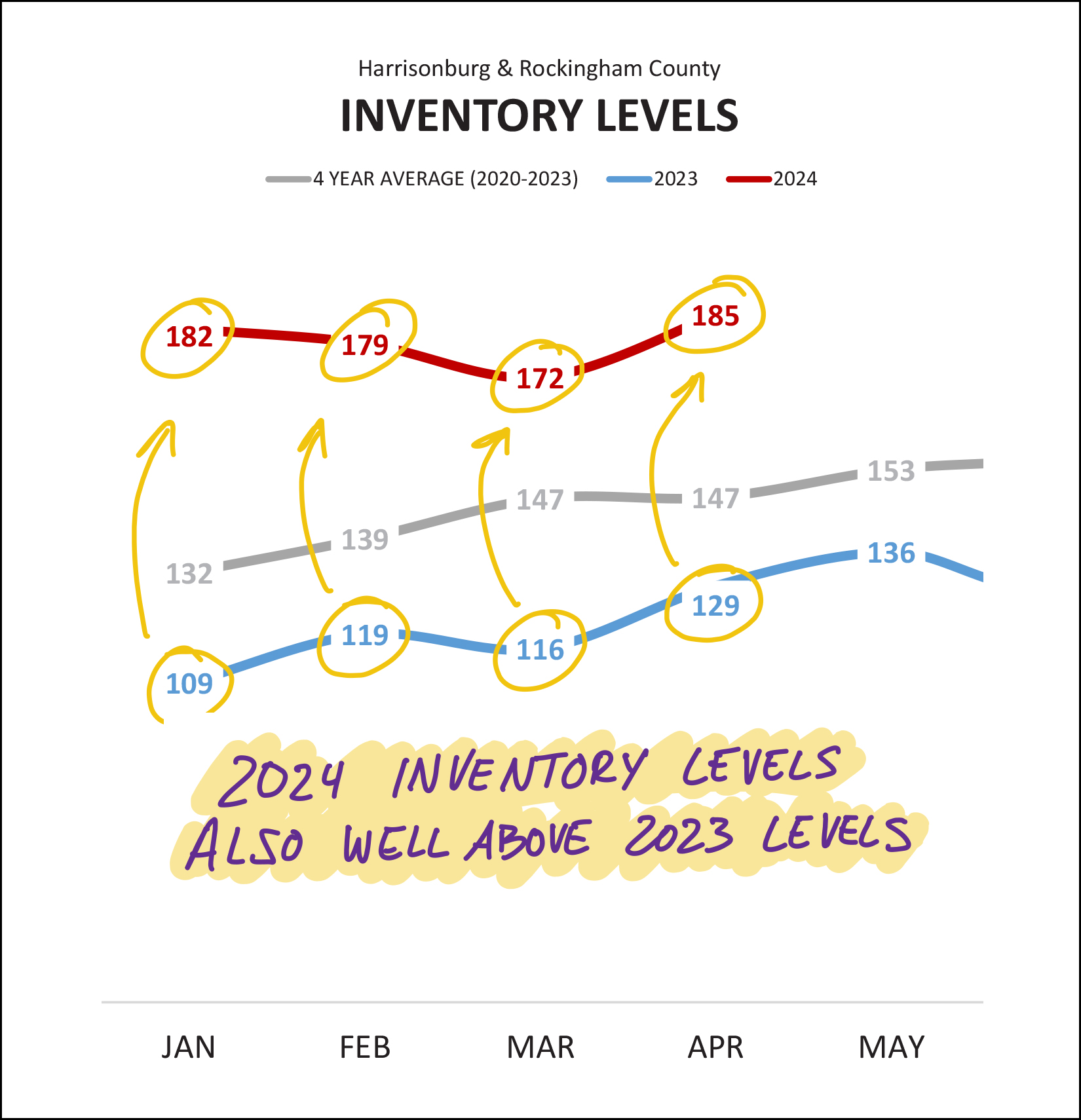

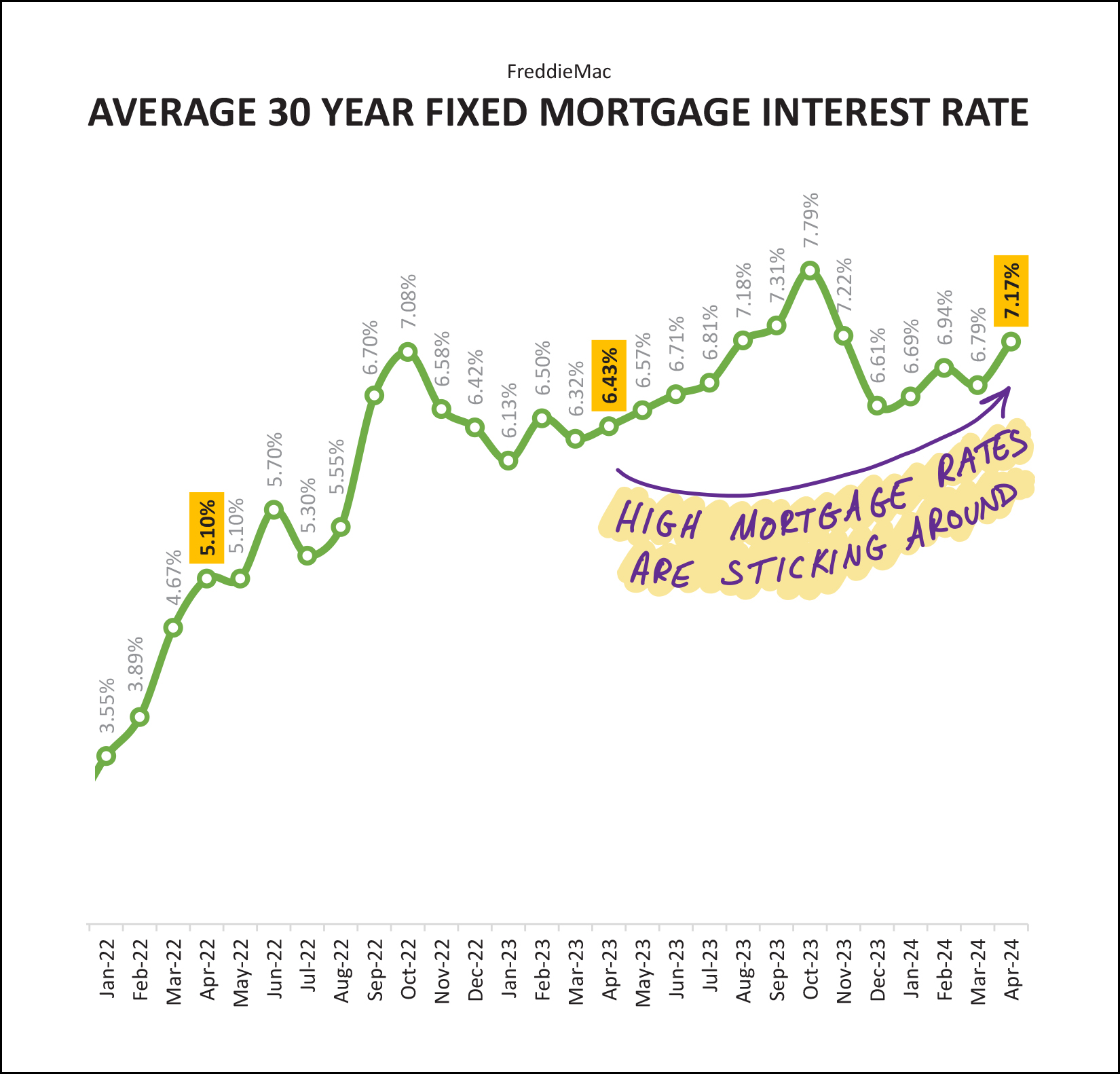

Happy Thursday... and... Happy Free Slurpee Day! ;-) We are officially halfway through 2024! Wow! It has been a whirlwind of a start of the year... and a HOT start to summer. I enjoyed seeing many of you at Red Wing Roots Music Festival earlier this summer, and I am looking forward to several upcoming trips with my family. I recently ran in VA Momentum's Valley 4th Run (5K) and felt both accomplished and old to have been an age group winner. Accomplished for winning my age group... and old for having moved up to the 45 - 54 age group... which is probably also why I was able to win my age group. ;-) But, as a client pointed out... better to feel accomplished and old... than to just feel old!  Before we get started on the latest data on our local housing market, each month I offer a giveaway for readers of my market report. This month I'm giving away a $50 gift card to Broad Porch Coffee. If you haven't checked out their new location on Court Square, you should. I recommend the bread pudding... and many other items on their food and drink menu. Click here to enter to win the gift card. And now, let's take a look at what has been happening in our local housing market over the first half of 2024...  The chart above captures all home sales in Harrisonburg and Rockingham County as reported in the HRAR MLS. I'm noting a few things... [1] Despite a 9% decrease in sales when we compare the past 12 months to the 12 months before that... there has been an 8% increase in home sales when comparing the first six months of 2024 to the first six months of 2023. So... home sales seem to be increasing again in 2024 as compared to where things were in 2023. [2] We have only seen a 3% increase in the median sales price when comparing the first half of 2024 to the first half of 2023... compared to a 7% increase when we look back 12 months compared to the prior 12 months. So... it seems that price increases may be slowing a bit. Read that again, though, prices are still increasing... just more slowly than they had been. But let's dig a bit deeper into a few subsets of the market, starting with detached homes...  When looking only at detached homes (which does not include duplexes, townhomes or condos) we find... [1] There have been 7% more home sales in the first half of 2024 compared to the first half of 2023... which is pretty similar to the 8% increase in the overall market. [2] The median sales price of detached homes has increased 10% in the first half of 2024 to a median sales price of $385,150. That is to say that half of single family homes sold in the first half of 2024 sold for $385,150 or more... and half sold for $385,150 or less. Now, how about those attached homes...  When looking only at attached homes (duplexes, townhomes, condos) we find that... [1] There have been 9% more attached home sales in the first half of this year as compared to the first half of last year. [2] The median sales price of attached homes has risen 9% to $310,000. Again... that means that half of attached homes (that have sold) have sold for $310K or higher, and half sold for $310K or lower. Now what about just the City of Harrisonburg...  It has been a bit harder to find a home to buy in the City this year... with 14% fewer homes selling in the first half of the year as compared to the same timeframe last year. At least part of this is explained by the large number of new homes being built in the County and the small number being built in the City. Without much "for sale" housing being built in the City, the number of homes selling in the City relies almost entirely on resale homes -- current homeowners deciding to sell. Perhaps the limited supply of homes selling in the City is why we have seen a larger (16%) increase in the median sales price of homes sold in the City thus far in 2024. In contrast, in the County...  Perhaps due to the larger number of new homes being built in Rockingham County, we have seen a 16% increase in the number of home sales taking place in the County in the first half of this year compared to the first half of last year. The median sales price, however, has only increased by 3% in Rockingham County compared to the 16% referenced earlier in the City of Harrisonburg. Since I've mentioned new home sales a few times, let's take a look at what is happening there...  As shown above, we have seen a 39% increase in new home sales in the first half of this year (191) compared to the same timeframe last year (137) though this really just brings us back to the same approximate amount that we saw two years ago (198) in the first half of 2022. Also, the median sales price of new homes has only increased 3% over the past year... from $343K-ish to $353K-ish. And if we strip out all of the new homes, here's what we find in the resale market...  Despite an increase in the overall number of homes that are selling in Harrisonburg and Rockingham County... there has actually been a 1% decrease in the number of existing homes that are selling. That's a small change, but it is headed in the opposite direction of our overall market. If the smaller number of existing home sales is at all related to a decreased number of sellers being willing to sell their homes, that might explain the slightly higher increase in the median sales price of existing home sales this year (+6%) as compared to the increase in the median sales price of all homes (3%). OK, taking a breath now... that's all of the charts and numbers. Now let's allow some graphs to help us visual learners understand the latest trends in our local real estate market...  We saw a LOT of home sales in May 2024... 144 of them... compared to only 114 the prior May. This left me at least partially wondering whether we would see fewer home sales this June than last June due to that particularly busy May. But this June outperformed last June, even if not by as much as the month of May. These two months of stronger sales (May, June) compared to last year have contributed to the overall increase in home sales between the first half of 2023 and the first half of 2024. Which is shown... here...  After several years (2022, 2023) of declining numbers of home sales in Harrisonburg and Rockingham County, perhaps we will see an increase in 2024. Given the increase from 610 sales to 658 sales in the first half of 2023 and 2024, it seems likely that we will finish out 2024 with more than the 1,206 home sales seen last year. You can also see that turnaround in the pace of home sales here...  The blue line above is tracking the number of home sales taking place in a year's time, measured each month. As you can see, that metric has started to trend upwards again over the past six-ish months after over a year of declines. The green line above shows the median sales price, which has been steadily increasing for years. The median sales price is still increasing, but those increases might be slowing. Technically, the median sales price decreased a bit over the past month, but only by $35, so we'll wait to see what happens over the next few months before jumping to any conclusions. Here's another look at those same metrics of quantity of sales and home prices...  The green line (median sales price again) clearly seems to be going up (increasing) more slowly in 2024 than it has in previous years. Keep in mind, though, that the rate of price increase over the past few years has been 10% -- per year -- so a smaller increase in prices would certainly be expected at some point. The graph above also shows a few more past years history of the number of homes selling. The 1,206 homes sold in 2023 was the smallest number in more than five years (while not pictured - it was the slowest year since 2014) but we might see more home sales in 2024 than we did in 2023. Interestingly... when we strip out the attached homes (duplexes, townhouses, condos) we actually see a more steady increase in median sales prices...  And when we look only at the duplexes, townhomes and condos we see that slow down in price increases more clearly...  Shifting gears a bit, let's look at contract activity to take a guess at what the next few months of home sales might look like...  June marks the fourth month of stronger contract activity when comparing contracts signed this year to the same month last year -- though the contract signing frenzy cooled a bit in June. These stronger months of contract activity likely mean we will continue to see steady increases in home sales over the next few months. This same trend is seen when tracking pending sales...  Pending sales is a measure of how many homes are under contract, waiting to make it to settlement. There are currently 308 such homes... as compared to only 261 a year ago. This pending sales total in 2024 (red line) has been tracking well above where things were a year ago (blue line) since the start of the year. Lots of buyers and sellers signing contracts sometimes leads to lower levels of homes available for sale...  The last few months of strong contract activity has been followed by steady declines in the number of homes available for sale. Inventory levels have dropped from 185 homes for sale to 152 homes for sale over the past two months. These inventory levels in 2024 (red line) are still higher than they were a year ago (blue line), but that might change within the next few months. With so many homes going under contract, are they going under contract more quickly?  It seems so! The median "days on market" has been trending back downward again over the past few months... and the past year (plus) of data suggests that we might be starting to see some seasonality in this metric once again. In years gone by we would see homes go under contract more quickly in the spring/summer/fall than they would in the winter... though for the past few years (due to Covid, low interest rates) we saw homes go under contract rapidly regardless of the time of year. It seems we might be headed back to a market with a bit more seasonality when it comes to how quickly buyers are contracting to buy homes. But... I will also point out that this median days on market figure does not clearly show that there are plenty of homes that are taking longer than a week (or longer than a month) to go under contract. All homes are not going under contract within seven days... and while most homes are... that "most" is only 51% per how a "median" calculation works. Finally (alert, alert - last graph) mortgage interest rates have been bouncing around this year... but trending downward most recently...  Way back on the far left edge of this graph (above) you'll see that rates were below 5% in early 2022... but they have been above 6% since September 2022, and have been above 7% for six of the past 12 months. It has been a topsy-turvy world when it comes to mortgage interest rates over the past year. Some buyers may have purchased when rates were as high as 7.25% or 7.5%... though today's buyers are likely to be locking in below 7%. I am cautiously optimistic that we might get back down to the 6% - 6.5% range in 2024 or early 2025, but mortgage interest rate trends have been anything but predictable lately. And that brings us to the end of this month's overview of our local housing market. If you made it through all of the charts and graphs, kudos to you for educating yourself on the intricacies of our local housing market. If you plan to buy a home in the second half of 2024... get pre-approved for a mortgage if you haven't already and be sure to go see new listings of interest quickly once they hit the market given that many are still going under contract in a matter of days. If you plan to sell your home in the second half of 2024... you will likely still find selling conditions to be quite favorable, with high levels of buyer interest depending on your price range, property type and the location of your home. If I can be of help to you as you explore the possibility of buying a home, or selling your home, feel free to reach out to chat. You can reach me most easily by phone/text at 540-578-0102 or by email here. I hope you enjoy the remainder of your week (high temp of only 80 degrees tomorrow!) and that you find some time to get away this summer to relax and spend time with family and friends. | |

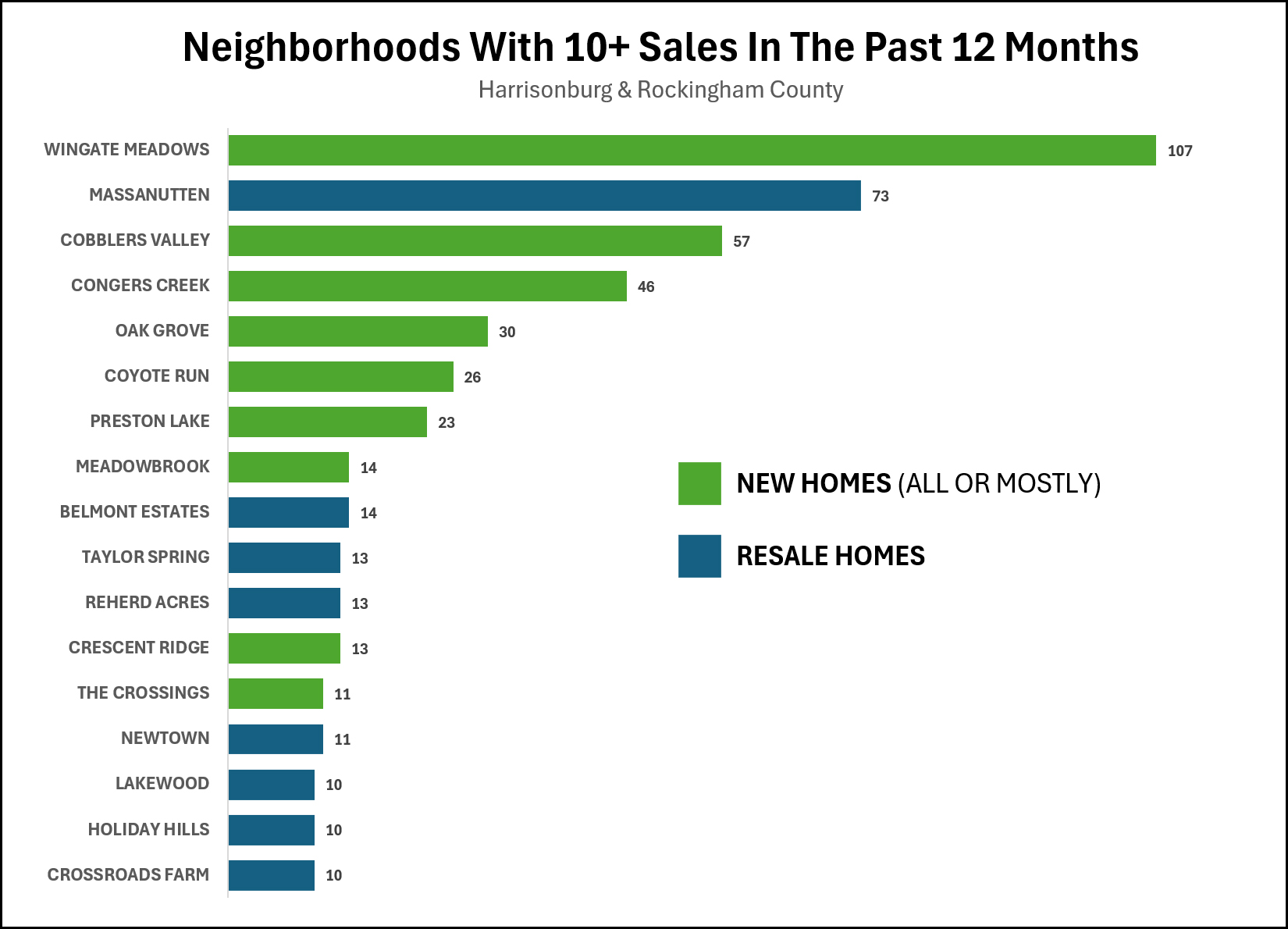

Neighborhoods With 10 Or More Sales In The Past 12 Months |

|

Over the past 12 months we have seen 1,251 home sales in Harrisonburg and Rockingham County as reported in the HRAR MLS. Where have all of these home sales been located? Let's start by taking a look at the neighborhoods where we have seen the most sales over the past 12 months. The graph above shows the neighborhoods that have had at least 10 home sales over the past 12 months. The leader of the pack is Wingate Meadows where 107 homes have sold over the past 12 months -- followed by Massanutten, Cobblers Valley and Congers Creek. The green bars above are neighborhoods where most or all sold homes were new homes -- whereas the blue bars are neighborhoods where most or all have been resale homes. In summary... Over the past 12 months a total of 481 home sales have taken place in these neighborhoods shown above... which is 38% of all home sales in all locations. Of these 481 home sales in these neighborhoods... 154 were in (mostly) resale neighborhoods 327 were in (mostly) new neighborhoods | |

How To Best Understand How Home Values Are Changing |

|

Full Disclosure: I have more questions than answers today. In the first five months of this year versus last year...

Wait, what!? The detached homes that sold in the first five months of this year sold at prices that were 13% higher than last year... and attached homes sold at prices that were 15% higher than last year... but when you combine the two data sets the median sales price is only 5% higher? Yes, that is correct. My first theory to try to explain this was that maybe more detached or attached homes sold in one year versus the other. But, it seems not... 2023: 68% detached, 32% attached 2024: 67% detached, 33% attached Next up I looked at what happens when we take new construction homes out of the mix. When looking at home sales in the first five months of this year versus last year, and when only looking at resale homes, not new homes...

That is certainly much less confusing than the first set of numbers. Where do we go from here? 1. I want to see how some of these numbers change as we have more months of 2024 data to work with. 2. I will be thinking further about how to best understand changes in home values in this area... perhaps it is best to only look at resale home sales, or just look at resale detached home sales? 3. I will welcome the thoughts, theories, guesses and questions from my readers. :-) Yes, that's you. | |

May 2024 Home Sales Outpace Projections, With Median Prices Increasing More Slowly |

|

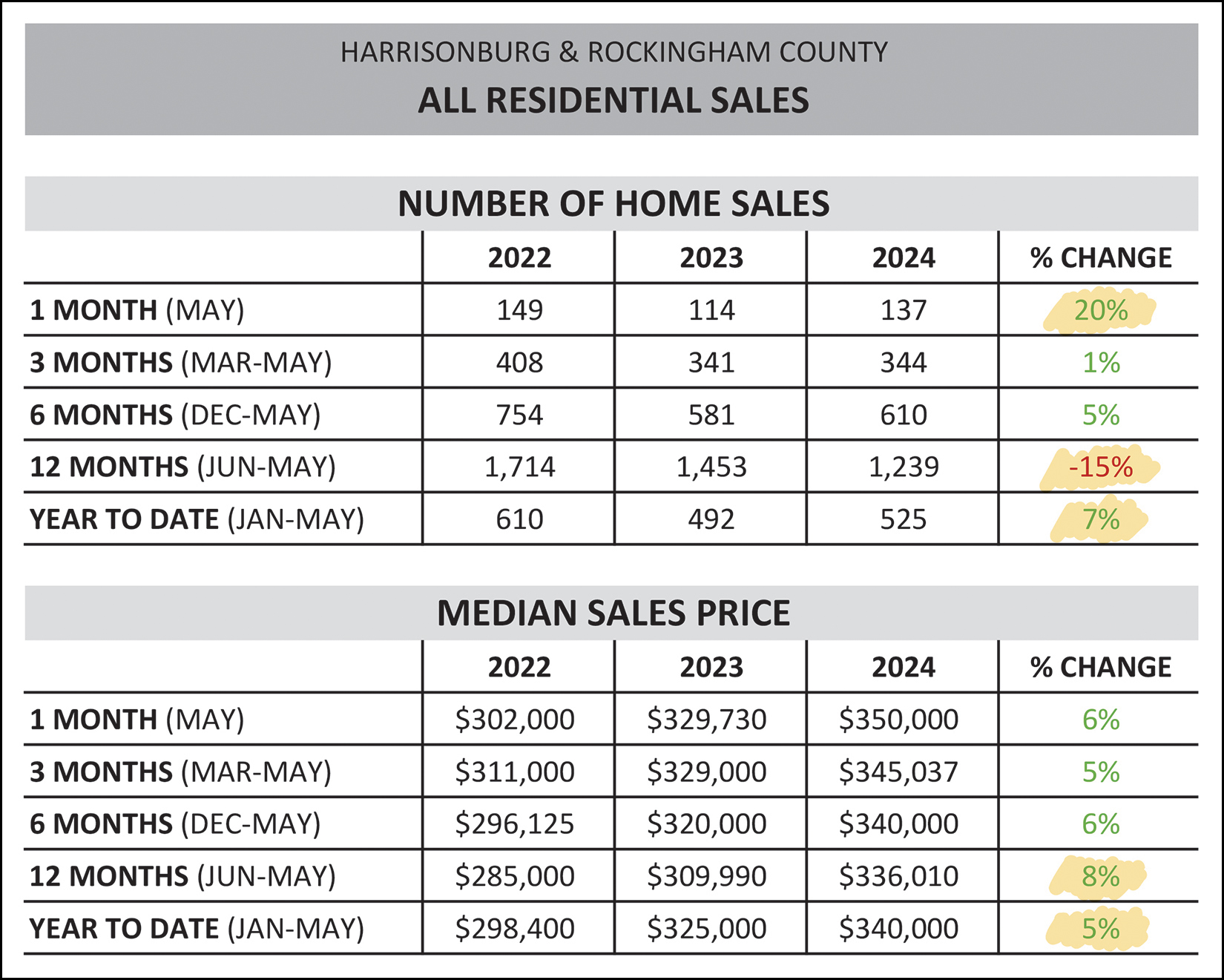

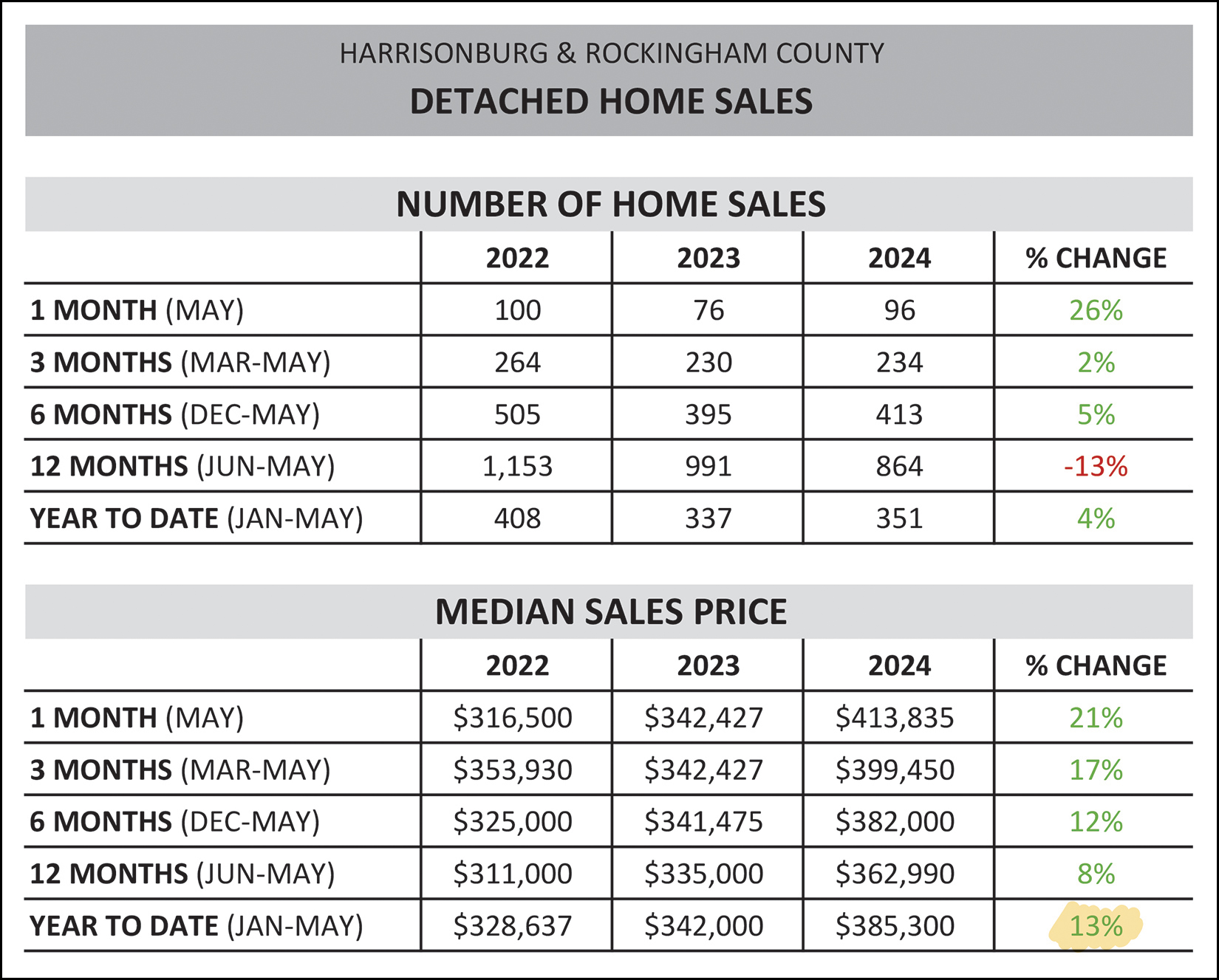

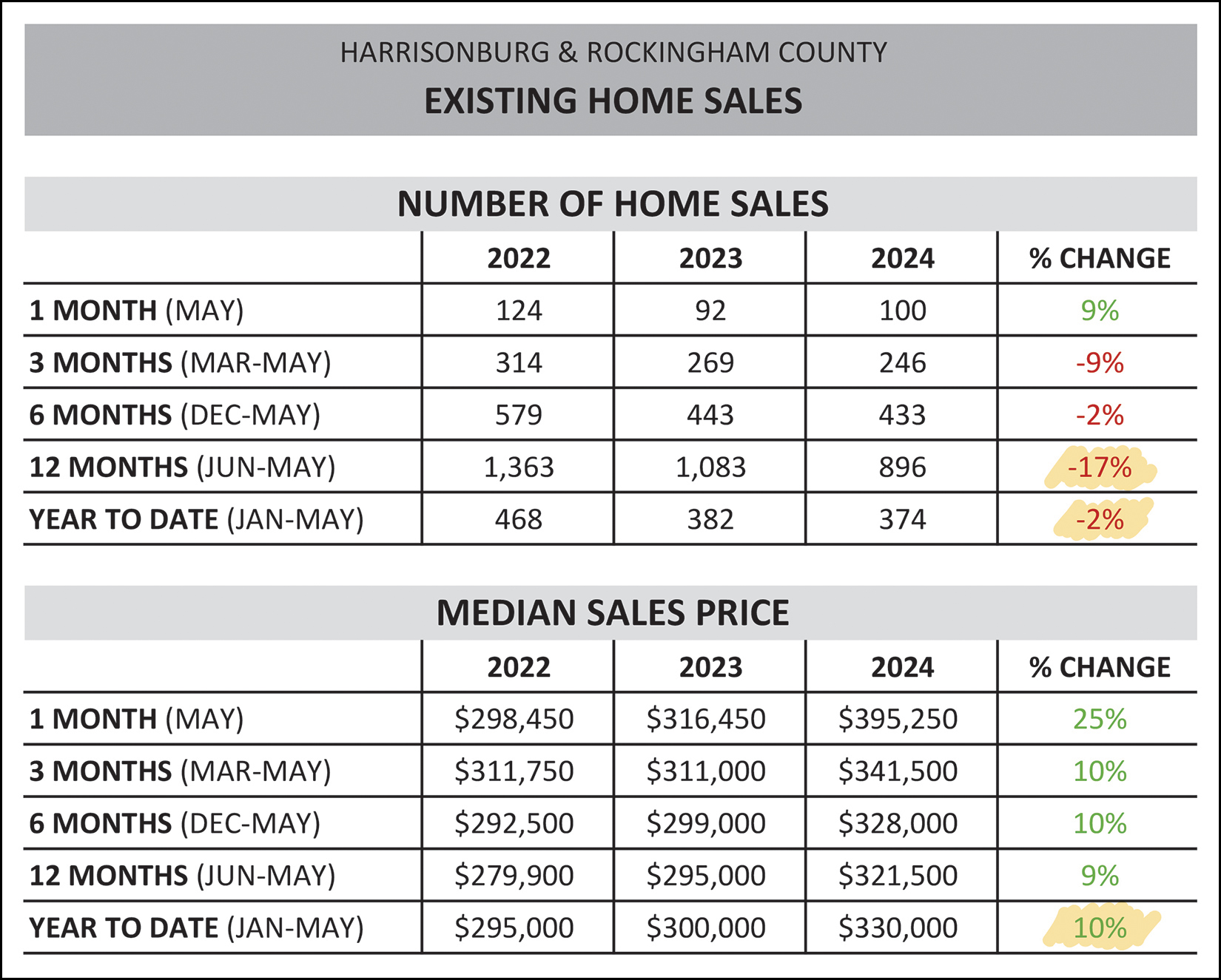

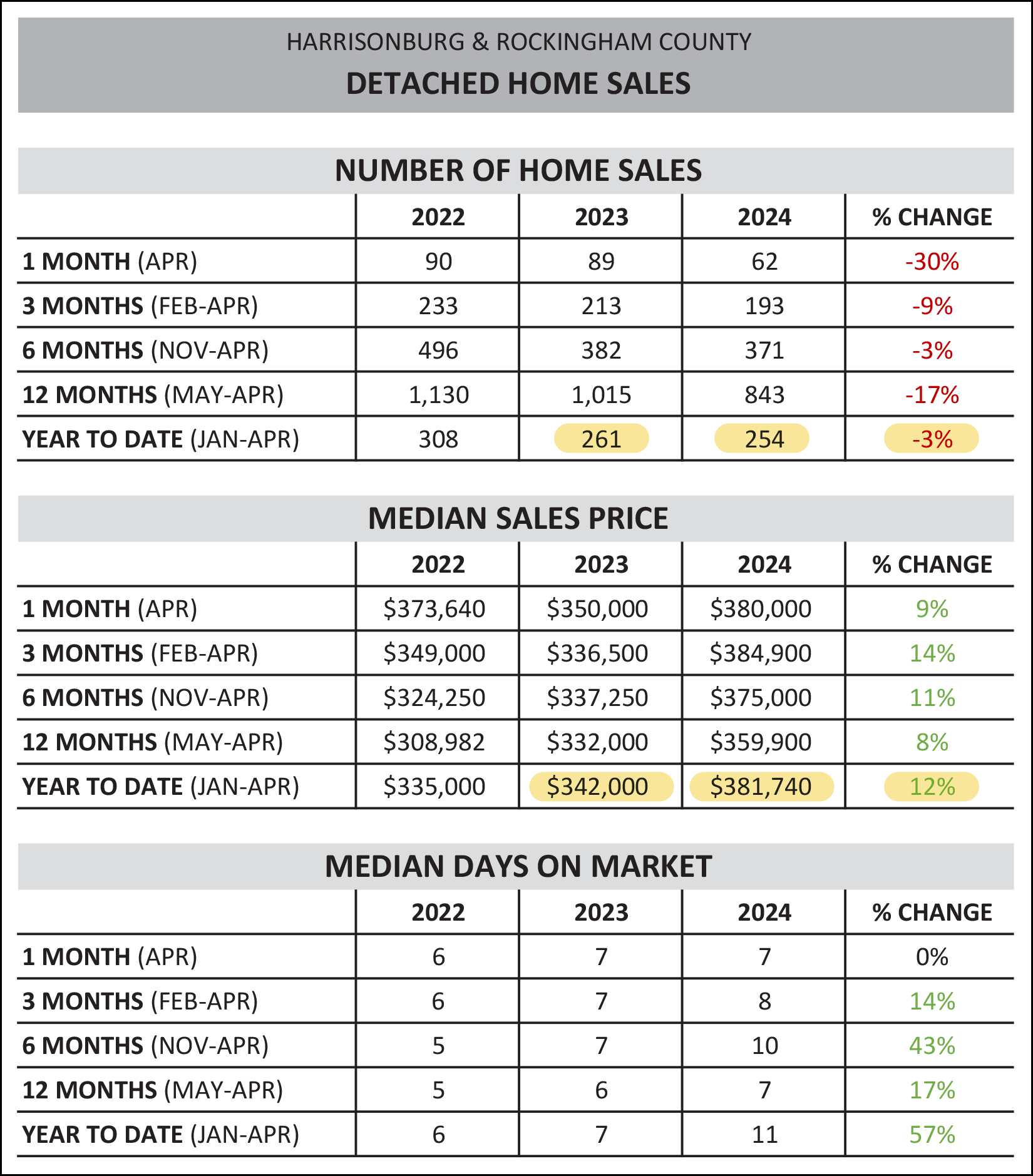

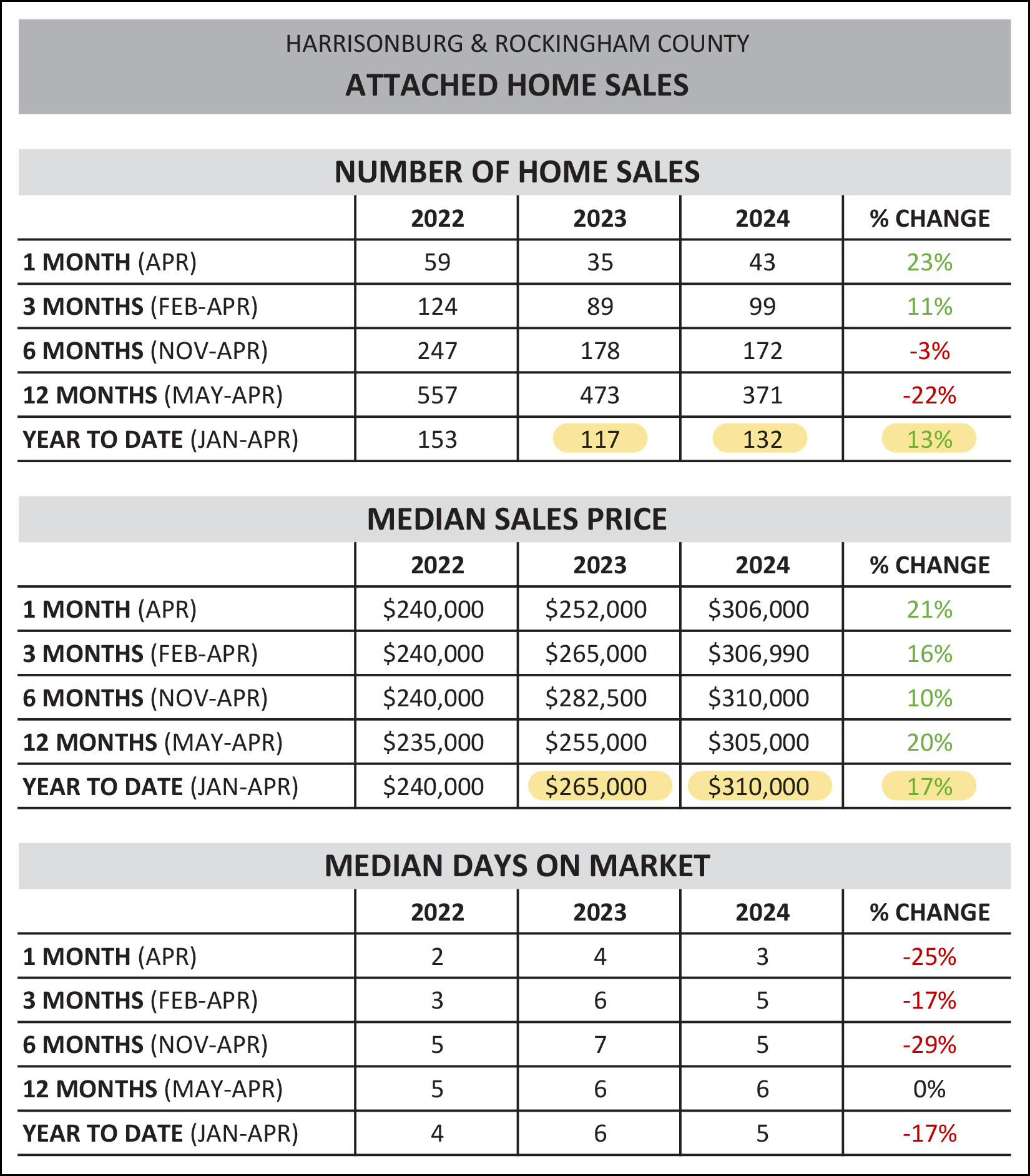

Happy Monday, friends, and Happy Summer! Summer is well underway over here at the Rogers household, with Luke having finished his first year of college and Emily wrapping up 10th grade. The start of our summer has included getting away for a few days to the lake for some water skiing and tubing, celebrating my niece's graduation (congrats Sofia!) and looking forward to Red Wing Roots Music Festival in less than two weeks! I hope your summer is off to a great start and that you'll find some time to relax or get away for a few days at some point this summer.  Before we dive into the lake, or rather, the real estate data... each month I offer a giveaway for readers of my market report. This month I'm giving away a $50 gift card to Bruster's. Yes, I realize that is a lot of ice cream... but they have SO many delicious flavors! Click here to enter to win the gift card. Now, on to the latest happenings in our local housing market...  Above you'll find the basic numbers related to how many homes are selling in Harrisonburg and Rockingham County and the prices at which those homes are selling. Here are a few things that stand out to me... [1] Home sales this May (last month) were much higher than expected... with 20% more sales than last May. [2] Despite seeing a 15% decline in the number of home sales in the past 12 months compared to the 12 months before that, we are now seeing a 7% increase in year to date home sales, thanks in part to the strong month of sales in May. [3] You might recall that for the past few years we have been seeing a (surprising) 10% increase in the median sales price each year. The median sales price over the past 12 months ($336,010) is now 8% higher than in the 12 months before that -- and the year to date median sales price is only 5% higher than in 2023 year to date. Thus, it seems that the median sales price may be increasing a bit more slowly this year than in recent years. Looking for a moment just at detached single family homes...  Sometimes it can be helpful to look only at detached home sales to see how they are comparing compared to the overall market. This month I am noting that the median sales price of all homes sold has only increased by 5% year to date (from $325K to $340K) but the median sales price of detached homes has increased by 13% year to date (from $342K to $385K). If you're trying to buy a home, you are likely paying a higher price now than you would have a year ago. If you are trying to buy a detached single family home, you are likely paying a much higher price now than you would have a year ago. As one final subset of the overall market data, here's a look at only existing homes... excluding new construction homes...  If you don't happen to want to buy a new home (based on their size, location, price, etc.) then you'll be focusing just on resale homes -- and there have been far fewer of those home sales over the past 12 months. We have seen 17% fewer resale home sales over the past 12 months (compared to the 12 months before that) mostly due to sellers not selling - rather than buyers not buying. In slightly better news, we have only seen a 2% decline in existing home sales year to date, so as to say that the decline is slowing in the number of existing homes that are selling. Perhaps it is unsurprising then that the median sales price of existing homes is 10% higher this year to date compared to last year to date, which shows a higher rate of increasing prices for existing homes as compared to the overall market. Now, I started off by mentioning that May home sales exceeded expectations... and you can see that more clearly here...  April home sales (106) were much (!) lower than last April (124) but May did not follow that pattern. After only seeing 114 home sales last May... there were 137 this May! Adding up those two months to see how April+May is tracking year over year, we find 243 home sales this year compared to 238 home sales last year. As you can see from my abundance of purple arrows above, it's hard to say where things will head in June... will home sales drop below 2023 again, or match 2023, or exceed 2023? It's hard to know for sure, but keep reading for the latest on contract activity and pending sales, both of which should give us somewhat of a hint of what is ahead. But first, let's see how this year stacks up compared to prior years...  We have been seeing a decline in the number of home sales over the past few years (2021 to 2022 as well as 2022 to 2023) but that might be reversing itself in 2024. The 525 home sales we have seen in the first five months of 2024 puts us ahead of 2023, though certainly still behind 2022 and 2021. Stay tuned to see if we can come out ahead of the 1,206 home sales we saw last year. Next up is a monthly look at rolling 12 month trends...  The top (green) line shows (barely, if you squint) what I have already mentioned in this month's report... median sales prices are increasing, but maybe not quite as quickly over the past six months as compared to their trajectory over the past few years. But, we'll need to continue to watch this metric to see if price increases are indeed settling down a bit. The bottom (blue) line shows that after almost two years of a downward trend in the number of homes selling in Harrisonburg and Rockingham County... we might finally be seeing things level out and increase a bit. We peaked above 1,700 home sales a year... and over about two years then saw things bottom out at just over 1,200 home sales a year. Will this trend slowly make its way back up to 1,300 home sales a year? If so, how soon? I mentioned new vs. existing home sales a bit earlier, but here's how the breakdown looks over the past few years...  We have seen a steady decline in the number of existing homes selling in our market... and in the percentage of home sales that are existing homes. Three years ago 81% of home sales were existing homes and only 19% were new homes. This year only 71% of homes that are selling are existing homes and 29% are new homes. Many homeowners have low mortgage interest rates on their existing mortgages and thus do not want to sell their homes -- which is contributing to lower numbers of existing home sales. We are also seeing many more new home communities in our area -- from local builders, but mostly from regional builders. I suspect we will continue to see new homes making up 25% or more of all home sales over the coming years. Now, for predicting the future...  After a strong month of sales activity in May, one might wonder what the next few months will hold. As shown above, we have now had three straight months of solid contract activity (red line) compared to those same months last year (blue line). Over the past three months, 423 buyers (and sellers) have signed contracts compared to only 364 in the same three months last year. These strong levels of contract activity suggest that we will continue to see at least several more months of strong home sales. Trends in pending home sales also supports that theory...  A year ago (blue line) there were only 275 homes under contract (pending) in Harrisonburg and Rockingham County. Today, that has risen to 336 homes under contract in our market. The overall declines in the number of homes selling may be behind us at this point given recent months of strong contract activity and the current trends in pending home sales. Perhaps unsurprisingly, inventory levels are also declining a bit...  Back in July 2023 we saw inventory levels start to rise... and they have stayed higher than expected since that time. But... at least as of today, inventory levels are trending back down a bit. Will this trend continue? Or is it a one month blip? Stay tuned. Keep in mind that even as inventory levels rose from the 100-130 range to the 180-200 range, all of those levels are well below pre-COVID inventory levels. Days on market -- how quickly homes go under contract -- is also keeping things interesting lately...  After several years of a median days on market of four or five days, we started to see this metric drift upward in late 2022, corresponding in large part to increases in mortgage interest rates. Last summer we saw days on market start to decline again (back down to five days in August 2023) but then it rose through early 2024. Has the market slowed back down since that time -- or are we starting to see a seasonality to this metric? We'll need to see how things develop as we progress through the remainder of the summer months. And, finally, those mortgage interest rates...  Two years ago the average rate was just above 5%, and rates peaked last Fall just under 8%, but the average 30 year fixed mortgage interest rate has been consistently above 6.5% for a year now... and there are not any indications that we'll see anything below 6.5% anytime soon. Most home buyers (or would be home buyers) have now adjusted to this new interest rate environment, and hopefully nobody is planning to wait to buy until rates get below 5%. There is talk of mortgage interest rates potentially coming down some over the remainder of the year, but we've heard that talk quite a few times over the past six (+) months and it hasn't measurably happened yet. As I bring this monthly market recap to a close, I'll point out that I post even more charts and graphs for your perusal each month over here. And finally, as we look ahead through the summer and towards the fall... If you plan to sell your home in the next six months, let's chat sooner rather than later about market conditions, your home preparations, your timing objectives and more. If you are considering a home purchase in the next six months, I'd be happy to chat with you about the buying process, the market and introduce you to some mortgage lenders who can help you consider your financing options. Reach out to me anytime via phone/text at 540-578-0102, or by email here. | |

Slightly More Homes Are Selling This Year Than Last, At Significantly Higher Prices |

|

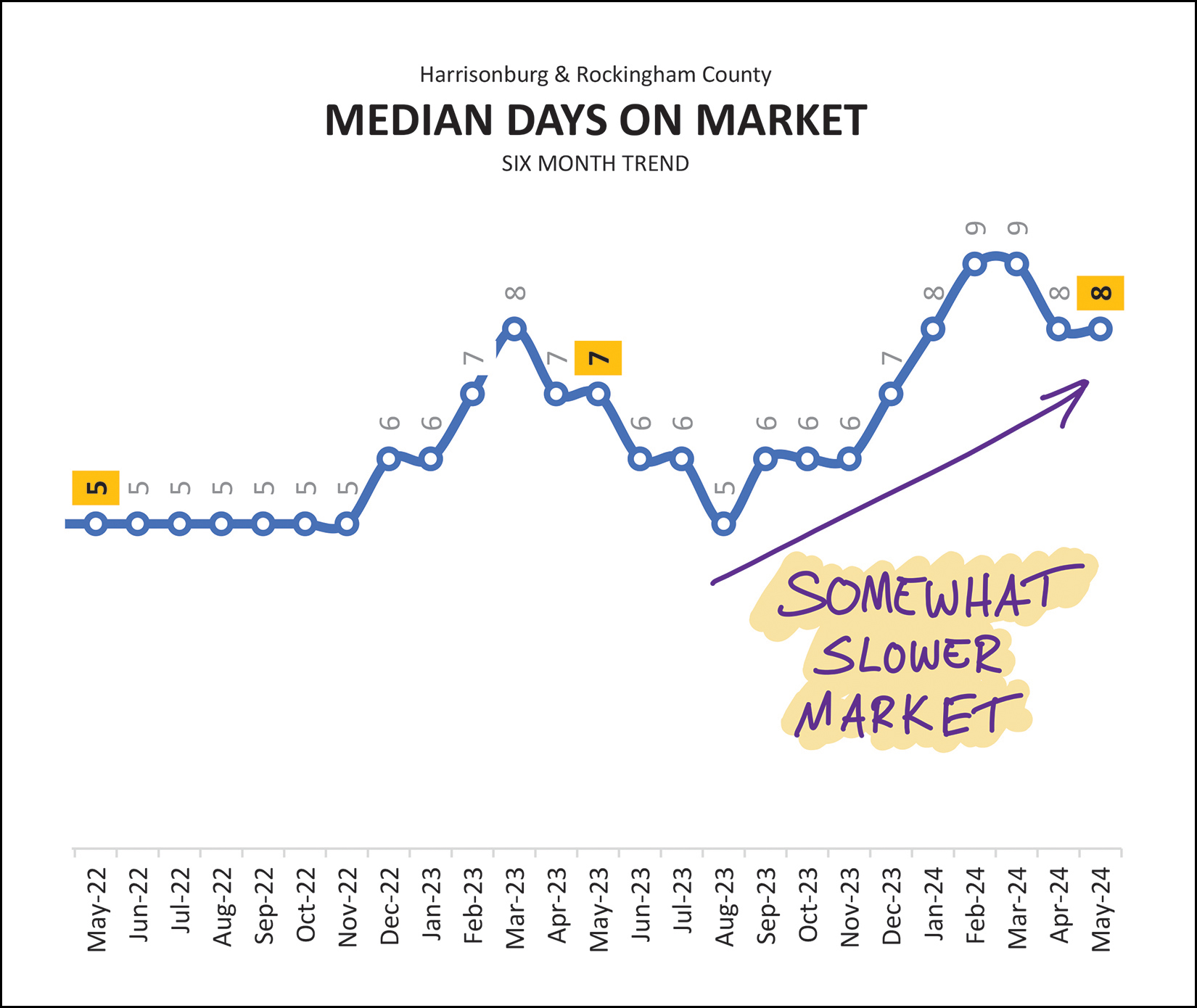

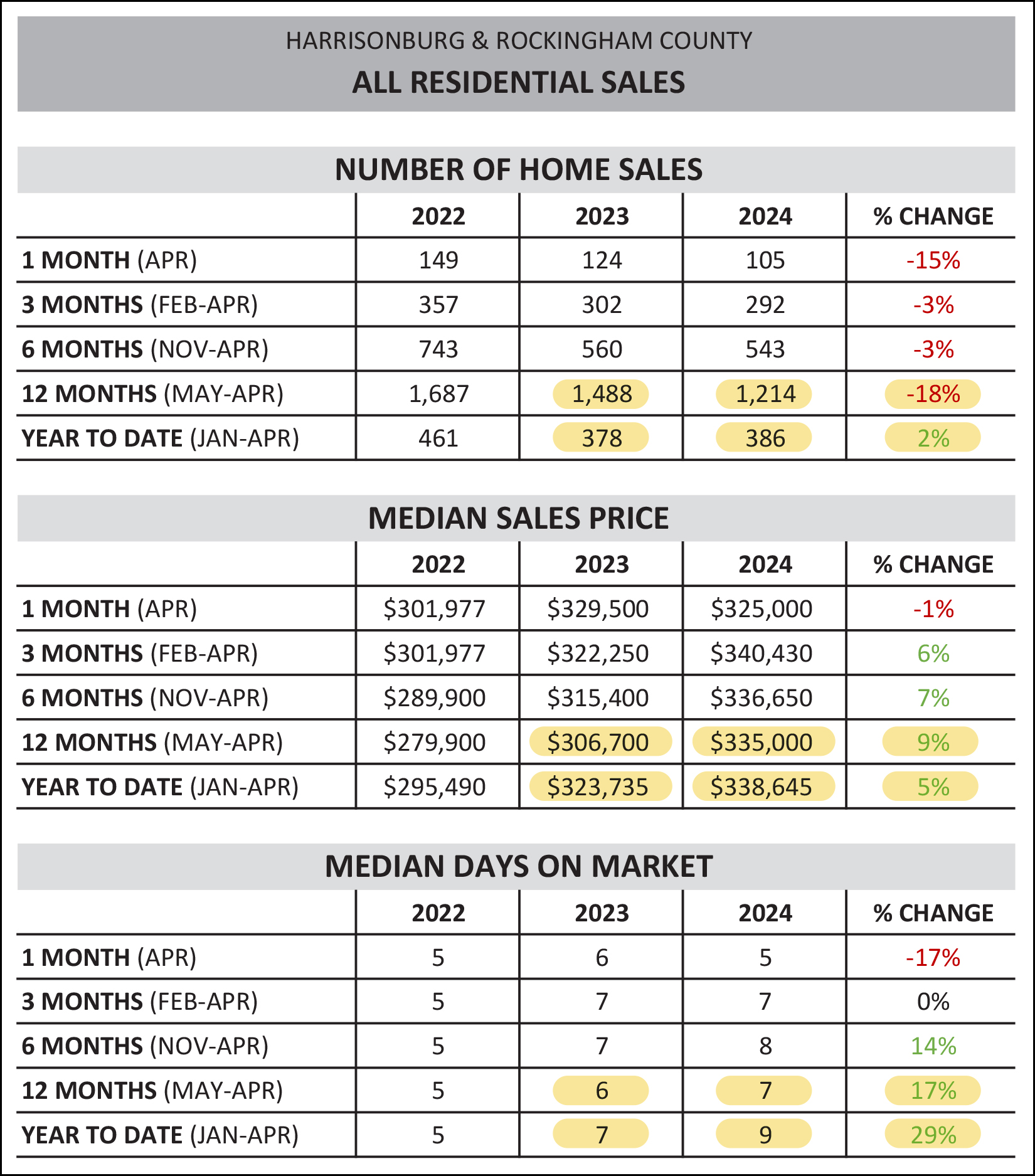

Happy Monday morning, friends! I hope you had an enjoyable weekend of seeing (or in my case, not seeing) the Northern Lights, celebrating the mothers in your life, and soaking in some delightful not-too-hot and not-too-cold spring weather here in the Shenandoah Valley! I was still at least partially in rest and recuperate mode this past weekend after running VA Momentum's Perfect Day 50K trail run the prior weekend with Luke. It was an amazing event with a community feel and great support from the family and friends as individuals and teams ran a 5K every hour on the hour for 10 hours straight, from 8AM until 5PM. It was definitely the longest Luke or I have run in a day!  Speaking of amazing events... each month I offer a giveaway for readers of this market report, and this month... I'm giving away a pair of 3-day tickets to one of my favorite events of the summer... the Red Wing Roots Music Festival!  This super-relaxing and family-friendly music festival from June 21 - 23 at Natural Chimneys Park in Mt Solon features wonderful music (on multiple stages throughout the weekend), great food, lots of activities (hiking, biking, running, yoga, kids events), and all around great fun with family and friends. Have you considered going to Red Wing but haven't been yet? Maybe this summer is the time for you to make it one of your favorite family traditions. I am looking forward to being there with my family and I'm hoping you'll join in on the fun... from June 21st through 23rd. And now, let's move on along to the latest numbers in our local housing market...  The chart above takes a look at our overall market during a variety of timeframes. Number of Home Sales -- As shown in the first set of highlighted numbers, over the past 12 months we have only seen 1,214 home sales in Harrisonburg and Rockingham County, compared to 1,488 during the 12 months before that. As such, we have seen an 18% decline in home sales when looking at a 12 month period -- but when looking just at this year, thus far, we are seeing a 2% increase in home sales, from 386 this January through April compared to 378 last January through April. Median Sales Price -- Over the past year we have seen a 9% increase in the median sales price in Harrisonburg and Rockingham County, which has now reached $335,000 (over the past 12 months) as compared to only $306,700 over the 12 months prior to that. Looking just at the first four months of this year we see a slightly smaller (5%) increase in the median sales price ($338,645) when comparing it to the first four months of last year ($323,735). Median Days On Market -- Homes are selling a bit more slowly this year than last. The median number of days it took for new listings to go under contract over the past 12 months has been nine days... which is an increase from the median of seven days during the 12 months prior to that. Now, looking at a subset of the market, for a moment, here are the same numbers when looking just at detached homes, and excluding townhomes, duplexes and condos...  Focusing just on the first four months of 2024 compared to the first four months of 2023, here are the differences we see between the detached home market and the overall market... There has been a 3% decline the number of detached homes that are selling... compared to the 2% increase in the overall number of homes selling. There has been a 12% increase in the median sales price of detached homes that are selling... compared to the 5% increase in the median sales price of all homes that have sold. So, when looking just at detached homes, slightly *fewer* are selling in 2024, and the increase in their median sales price is higher than that of the overall market. Meanwhile, in the attached home market...  When looking just at attached homes (townhomes, duplexes, condos) we have seen a 13% increase in the number of such homes selling in the first four months of 2024, compared to the first four months of 2023 -- and a 17% increase in their median sales price. As such, the attached home market is seeing a strong start to the year both in number of sales and the price of those homes. Now, let's switch gears learn about the latest trends via some graphs...  As you read above, we are seeing slightly more home sales in the first four months of 2024 compared to the first four months of 2023... but... April was not a contributor to that trend. Strong months of home sales in January and February were the biggest reason why we're seeing slightly more home sales in the first third of 2024 compared to the first third of 2023, as we saw fewer home sales this April (105) than we saw last April (124). Where do we go from here? We'll have to look at contract activity and pending sales (a bit further down this overview) to guess at whether home sales activity will rebound at all in May 2024. But first, let's see how the start of this year compares to the last few years...  The 386 home sales during the first four months of 2024 puts us slightly ahead of the 378 in the first four months of last year... though well below the 447 and 461 home sales levels reached during the first four months of 2021 and 2022. It seems reasonable to conclude we'll probably see around 1,200 home sales this year (similar to last year) and not 1,500 - 1,700 home sales such as were seen in 2021 and 2022. Now, then, looking at slow moving trends by examining rolling 12 months of data...  The top green line, above, shows the median sales price over a 12 month period, measured each month. Over the past year that median sales price has increased 9% from $306,160 to $335,000. Despite fewer home sales and higher mortgage interest rates, the median sales prices keeps... on... rising. The blue line, above, shows the number of homes selling in 12 months time, measured each month. Ever since the middle of 2022 we have seen this metric of annual home sales steadily falling... though in early 2024 that trend seemed to be reversing itself as the pace of annual home sales started to rise again. But... not so much in April 2024. Stay tuned to see if the annual pace of home sales levels out, declines even further, or starts rising again as we head through May, June and July. I haven't touched on it yet in this report, but a large portion of homes that are selling this year are new homes....  Thus far in 2024, 25% (1 in 4) home sales have been new home sales. This is a rather significant change from just a few years ago when only 13% (2019) and 15% (2020) of the homes that were selling were new homes. With soooo many current homeowners having rather low (to super low) interest rates on their current mortgages, we seem poised to have lower numbers of resale home sales for several years to come. As such, the new homes offered for sale (and being purchased) help to at least partially satisfy buyer demand for housing, and we are likely to continue to see around 25% (more or less) of buyers buying new homes over the next year or two. To get a sense of where the market might go next, let's look at contract activity...  Despite fewer home sales in March and April of 2024... the amount of homes going under contract was MUCH higher this March and April (red line) compared to last year (blue line). Given these higher months of contract activity, I believe we are likely to see higher numbers of home sales in May and June. This is reinforced when looking at the number of homes under contract at the end of March and at the end of April...  There are currently 333 homes under contract (waiting to go to closing) in Harrisonburg and Rockingham County... compared to only 275 homes being under contract at the same time last year. Higher numbers of homes going under contract in March and April of this year has resulted in this higher number of pending sales, which should (within the next month or two) translate into higher numbers of closed sales. And yet, just to throw one more metric into the mix to at least partially make you scratch your head and think on this Monday morning...  As shown above, inventory levels are tracking a good bit higher at the start of this year (172-185) than they were last year (109-129) and also well above the four year average (132-147). So, why are there more homes on the market (at any given point) this year than last? My two leading theories are... [1] Homes are going under contract (days on market) a bit more slowly this year than last, which could result in slightly higher inventory levels. [2] Quite a few (31%) of these active listings (58 of 185) are new homes... some of which have not yet been built or have not yet been finished, which might result in them remaining as active listings and not going under contract. Think on that mystery... home sales rising, contract activity rising, prices rising, but inventory... also rising... and let me know if you have any other theories. While you think on that, here's one more thing that is rising...  Mortgage interest rates have been above 6.5% for the entirety of the past year, and the sub-5% rates are now a distant (two years ago) memory. After steady declines in rates between October 2023 (7.79%) and December 2023 (6.61) we have seen rates trend back up over the past four months. Anyone who is waiting to buy a home until mortgage interest rates get back down to 5% -- or even 6% -- will probably have a long wait. So, what does all of this mean for you? Home Sellers - As has been the case for quite a few years now, you're in a great position. You will likely be selling your home at a higher price than would have been possible over the past few years. Remember, though, that mortgage interest are high, which make mortgage payments for buyers quite high, so make sure your list price is in line with recent sales so that you have enough buyer interest to hopefully see your home quickly go under contract. Home Buyers - Depending on your price range and the type of property you hope to buy, you may or may not have LOTS of competition. I am currently seeing some properties linger on the market for a week or more without any offers... and some going under contract within days with multiple offers. Talk to a lender to get a sense of where you can be and where you want to be with your mortgage payment and purchase price, and then let's start getting out there to see some homes and get a feel for the market so that you're ready to confidently move forward when the right house hits the market. Home Owners - If your current home works well (or well enough) for you - enjoy your likely low housing payment (depending on when you bought or refinanced) and enjoy the increasing equity you likely have in your home. As much as excited would-be home buyers might wish you would sell your home so they have more options for buying... I can't blame you for staying put and enjoying where you are. Renters - Plenty of folks are not homeowners and are not planning to buy anytime soon, or do not see themselves being able to buy anytime soon. This is completely understandable given the significant increases in sales prices and mortgage interest rates over the past five years. If you are on the edge of being able to or interested in buying, don't hesitate to have a preliminary conversation with a lender and/or with me to get a sense of what it would look like to buy a home... especially given how rental rates keep on increasing. And... that's a wrap, folks. You are about as well informed as is possible on the overall Harrisonburg and Rockingham County real estate market on this Monday morning. But if you have questions about a specific segment of the housing market, or about your neighborhood, or about your home... feel free to ask! Until next month... [1] Check out the complete set of May 2024 charts and graphs here. [2] If you're getting ready to buy, let's chat about the process, the market and what you hope to buy. You'll also want to talk to a lender sooner rather than later. [3] If you're getting ready to sell, let's meet soon to talk about the market, the process, your house, your timing and your goals. To touch base with me about any of the above, call/text me at 540-578-0102 or email me here. Enjoy your Monday! | |

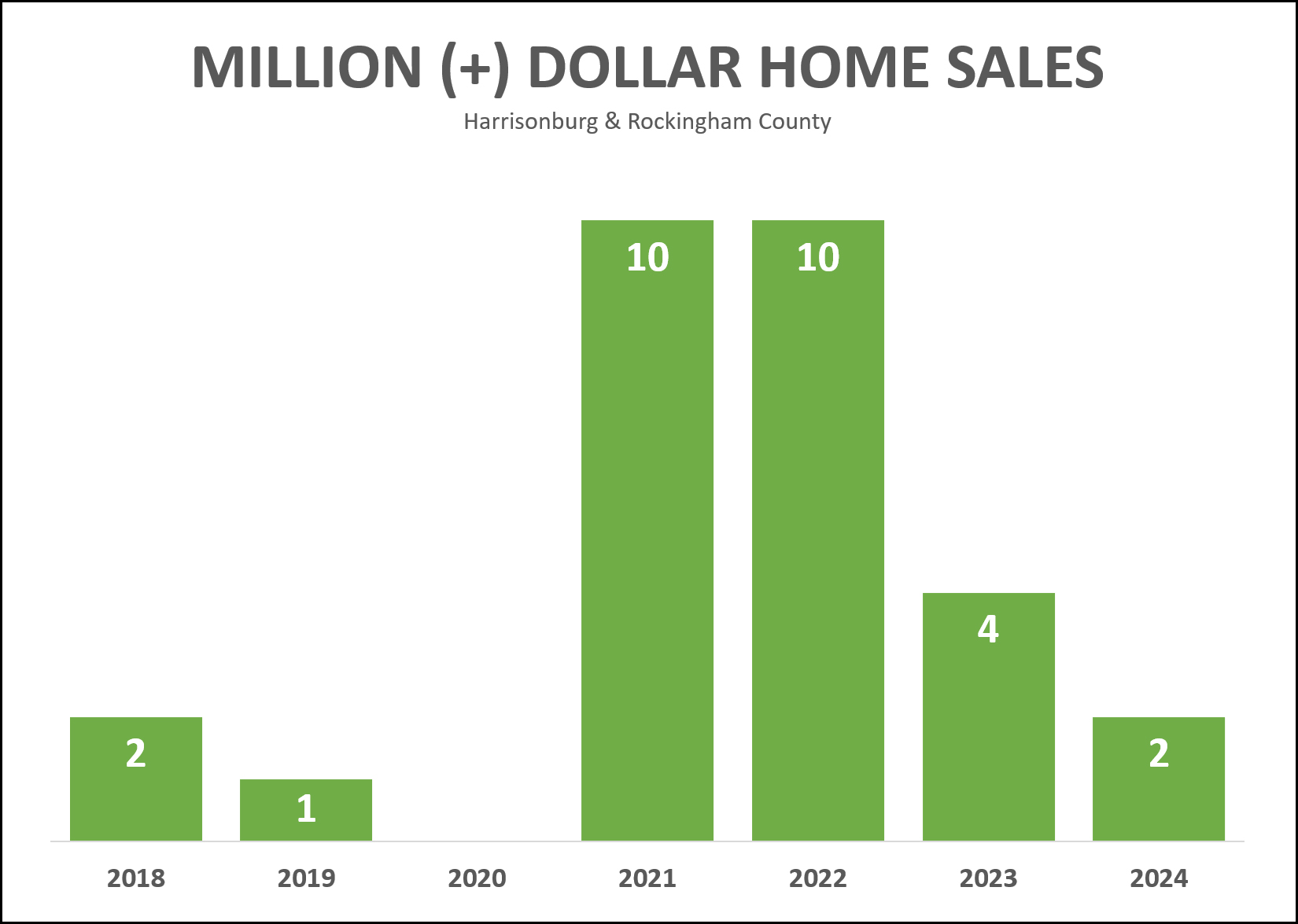

Million Dollar Home Sales Peaked In 2021, 2022 |

|

Between 2018 and 2020 there were only three million dollar home sales in Harrisonburg and Rockingham County area as recorded in the HRAR MLS. Then, in 2021, we saw (10) million dollar (+) home sales, and then (10) more such sales in 2022! Home prices were certainly increasing between 2018 and 2021, so one of the reasons we saw more million dollar home sales was certainly because of increases in those home values. But then -- we only saw (4) such sales in 2023. One theory here is that the increase in mortgage interest rates in 2022 and then 2023 resulted in fewer buyers being willing to pay a million bucks (or more) for a home. Thus far in 2024, we have seen two of these million dollar (+) home sales in the first four(ish) months of the year -- though there are four other million (+) dollar listings that are under contract and waiting to make it to closing. If you're eager to purchase a million dollar home in Harrisonburg or Rockingham County, these are your (14) current options. | |

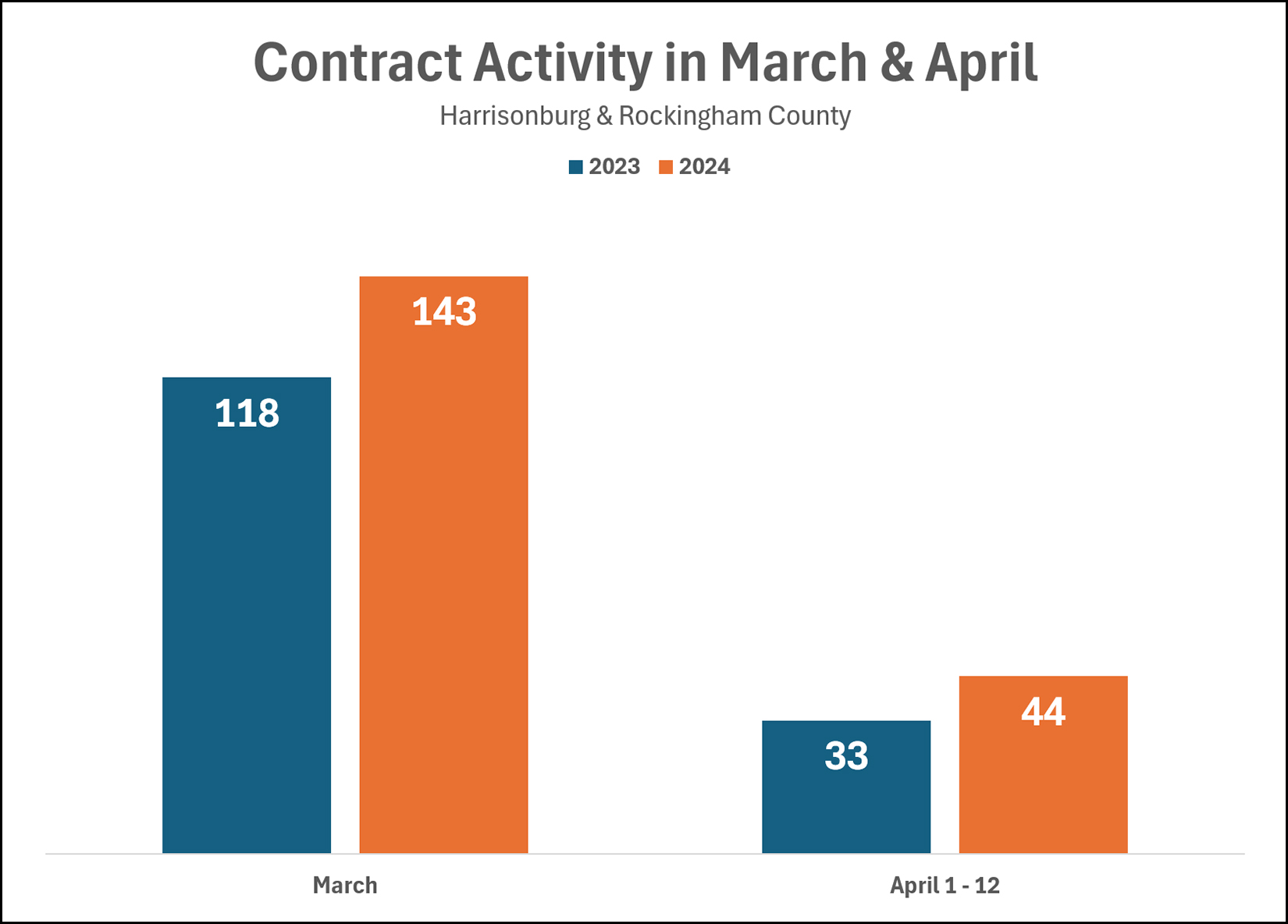

Strong Contract Activity Continues Into April |

|

We saw a surprisingly high number of homes go under contract in March this year... 143 of them, compared to only 118 last March. And... this April is also starting off strong compared to last April. In the first 12 days of this month (through this past Friday) we saw 44 houses go under contract in Harrisonburg and Rockingham County compared to only 33 last April. It is turning into a busy spring in the local housing market! | |

Monetary Policy Enacted By The Fed Contributed To Current Housing Affordability Challenges But Monetary Policy Does Not Seem Likely To Fix The Problem In The Near Future |

|

If you're hoping to understand the current housing affordability challenges (in many or most markets across the US) and how we came to be in the current situation, this article is a good one to read... The Fed won't fix the housing market (Yahoo Finance) Below are a few pertinent excerpts...

Indeed, the drastic rate cuts by the Fed at the start of the pandemic resulted in pandemonium in the housing market with an abnormally high number of buyers seeking to buy a home.

Indeed, both here in the Shenandoah Valley and in many other markets across the country, there is a shortage of housing. And so, what will get us out of this challenging time for housing affordability? It does not seem that the Fed plans to make any rapid or significant monetary policy changes that would impact housing affordability... and, since the Fed doesn't build houses, they won't be creating any further housing inventory. We can likely expect slow interest rate cuts over the next year or two and hopefully we will see continued construction of new residences to house those who already live in the Shenandoah Valley and those who wish to make it their home now or in the future. | |

Home Prices In Harrisonburg, Rockingham County Might Not Shoot Upwards Quickly If Or When Mortgage Interest Rates Fall Because Prices Did Not Drop When Rates Rose |

|

If or as mortgage interest rates drop, will we see home prices shoot upwards? Let's back up a few steps... When mortgage interest rates rose from 3.2% to 7.1% within 10 months (Jan 2022 - Oct 2022) some housing markets saw home prices decline. Understandably, if the mortgage interest rate doubles, a buyer's monthly housing payments will be much higher than the previous year -- directly and immediately affecting housing affordability. Thus, some markets saw prices decline during 2022 at least partially as a result of higher mortgage interest rates. Harrisonburg and Rockingham County, notably, did not see a decline in the median sales price during that (2022) timeframe. Many people in markets (often larger cities) where home prices did decline are now (reasonably) wondering if home prices will spike upwards if or when mortgage interest rates fall. If you are in a market where home prices dropped as interest rates rose... then yes, it is reasonable to think you'll see home prices rise (or rise faster) if or as mortgage interest rates drop. But... back to Harrisonburg and Rockingham County... I am not expecting that we will see an uptick in home prices if or as mortgage rates decline... mainly because we did not see prices drop when rates rose. This is not to say that home prices won't continue to rise in this area -- I think they will -- but I don't think we'll see an increase in home prices specifically related to mortgage rates dropping. | |

Has The Value Of Your Specific Home Increased By Thirty Percent Over The Past Three Years? |

|

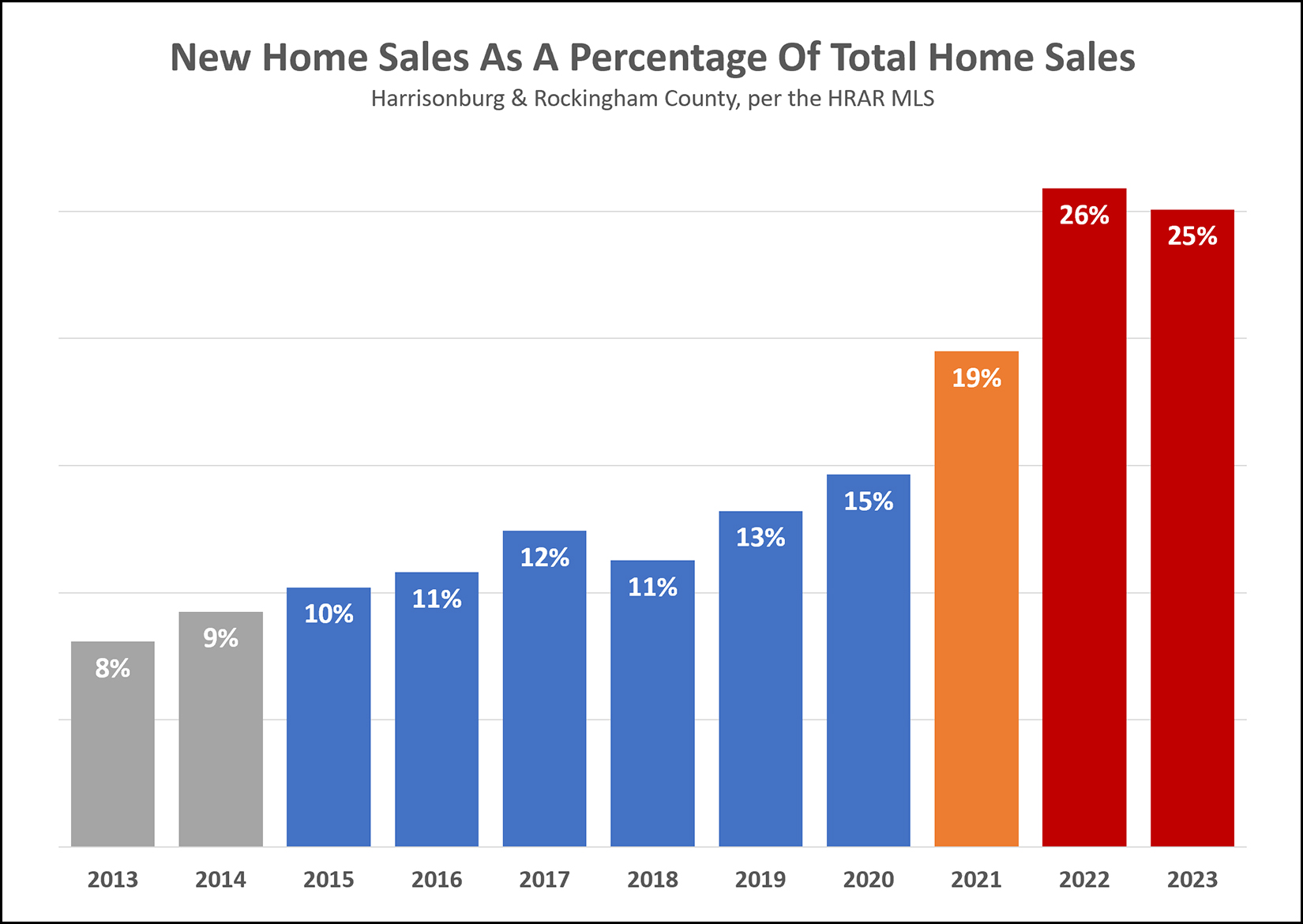

It's a reasonable question! The median sales price in Harrisonburg and Rockingham County has increased 10% per year for each of the past three years. Combining all three of those years together, the median sales price has increased 34% over the past three years. In real numbers... the median sales price has jumped from $246,500 to $330,152 during that timeframe. So, if you owned a $246,500 home three years ago, is your home worth $330,152 today? Possibly. But quite possibly, not. The other variable hidden within median sales price trends is WHAT sells, beyond HOW MUCH it sells for. For example (just an example - not real) if only tiny houses sold three years ago and only mansions sold this year, the median sales price would increase more than we might otherwise expect. As a slightly real-er example, we have seen a steady increase in the share of new construction homes that are selling in Harrisonburg and Rockingham County over the past five years... 2019 - 13% new home sales 2020 - 15% new home sales 2021 - 19% new home sales 2022 - 26% new home sales 2023 - 26% new home sales Given that new homes are almost universally more expensive than a comparably sized resale home, an increased share of new homes selling would push the median sales price higher than it would have been simply via changes in market values. All that is to say... while the median sales price has increased over 30% during the past three years... your home might not have increased in value by 30%. The median sales price is an evaluation of the prices at which particular homes sold and is not always a reasonable substitute for overall changes in market values. | |

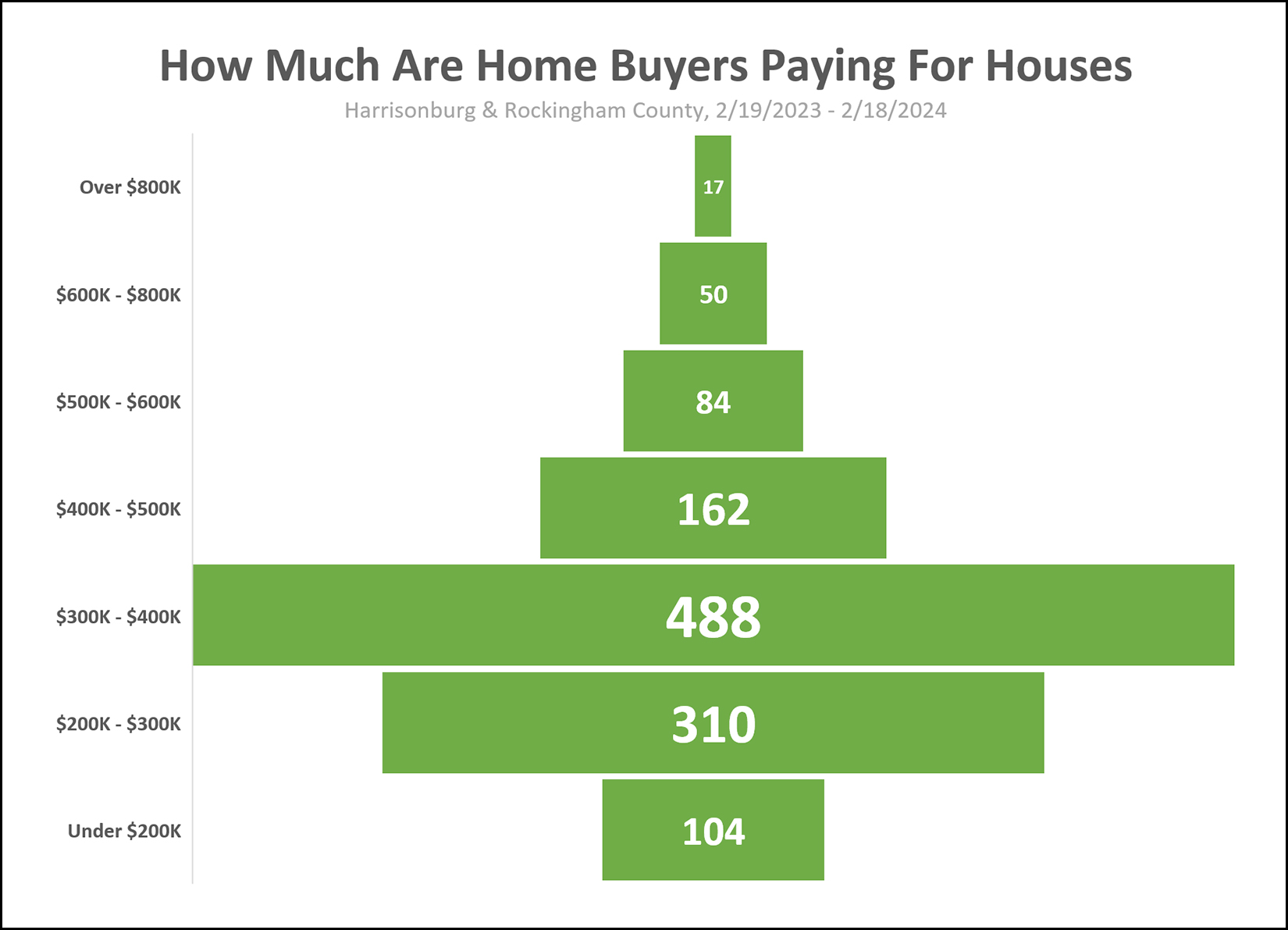

How Much Are Home Buyers Paying For Houses? |

|

How many buyers in the past year have been able to purchase a property for less than $200K? 104 buyers... or 9% of the buyers who bought in the past year. How many buyers paid more than half a million dollars for their homes? 151 buyers... or 12% of the buyers who bought in the past year. In what price range are the largest number of buyers buying? Just over 40% of home buyers paid $300K - $400K over the past year. As you prepare to sell your home you should take time to understand the size of the pool of buyers who will be potentially interested in buying your home. | |

Despite An Increase In Home Sales In January, Contract Activity Is Down, Inventory Levels Are Up, Days On Market Is Up |

|

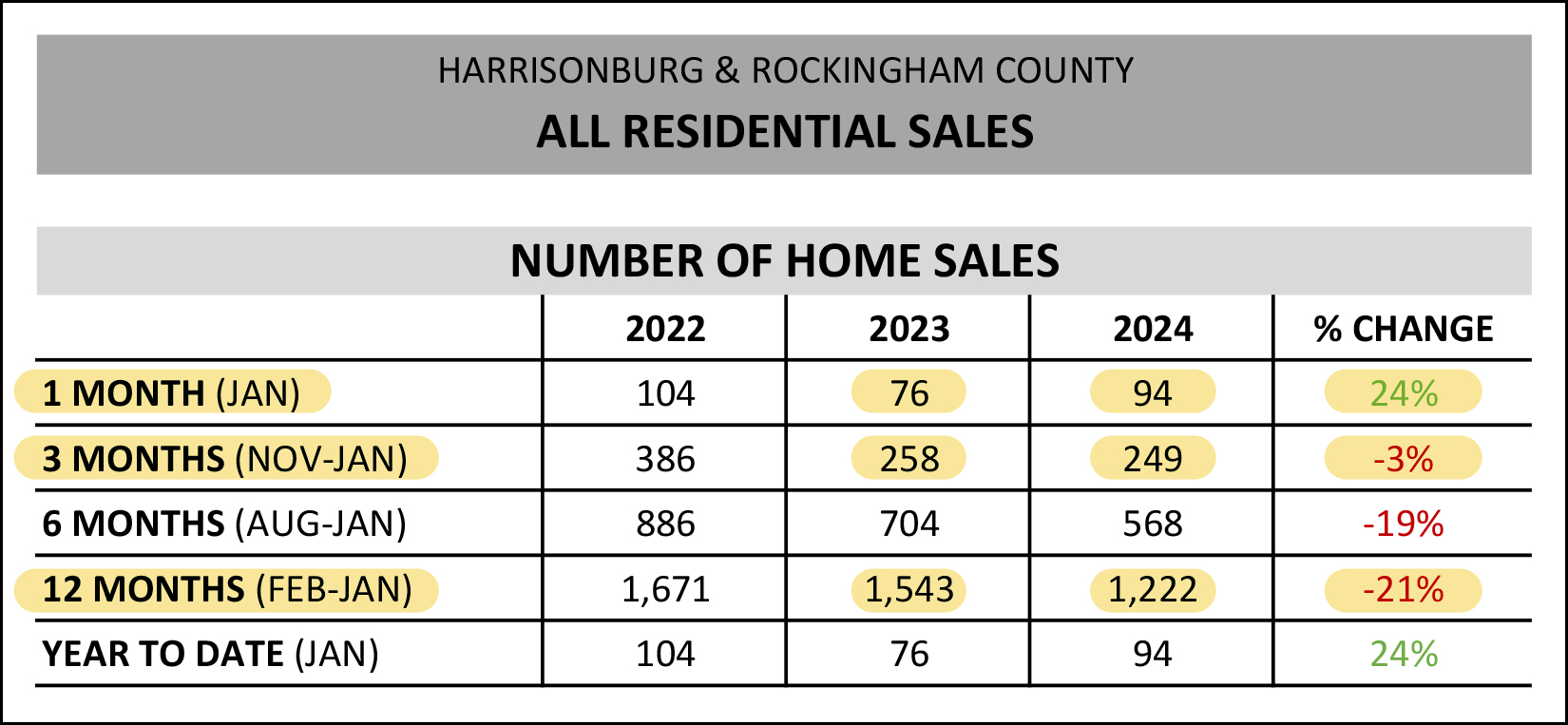

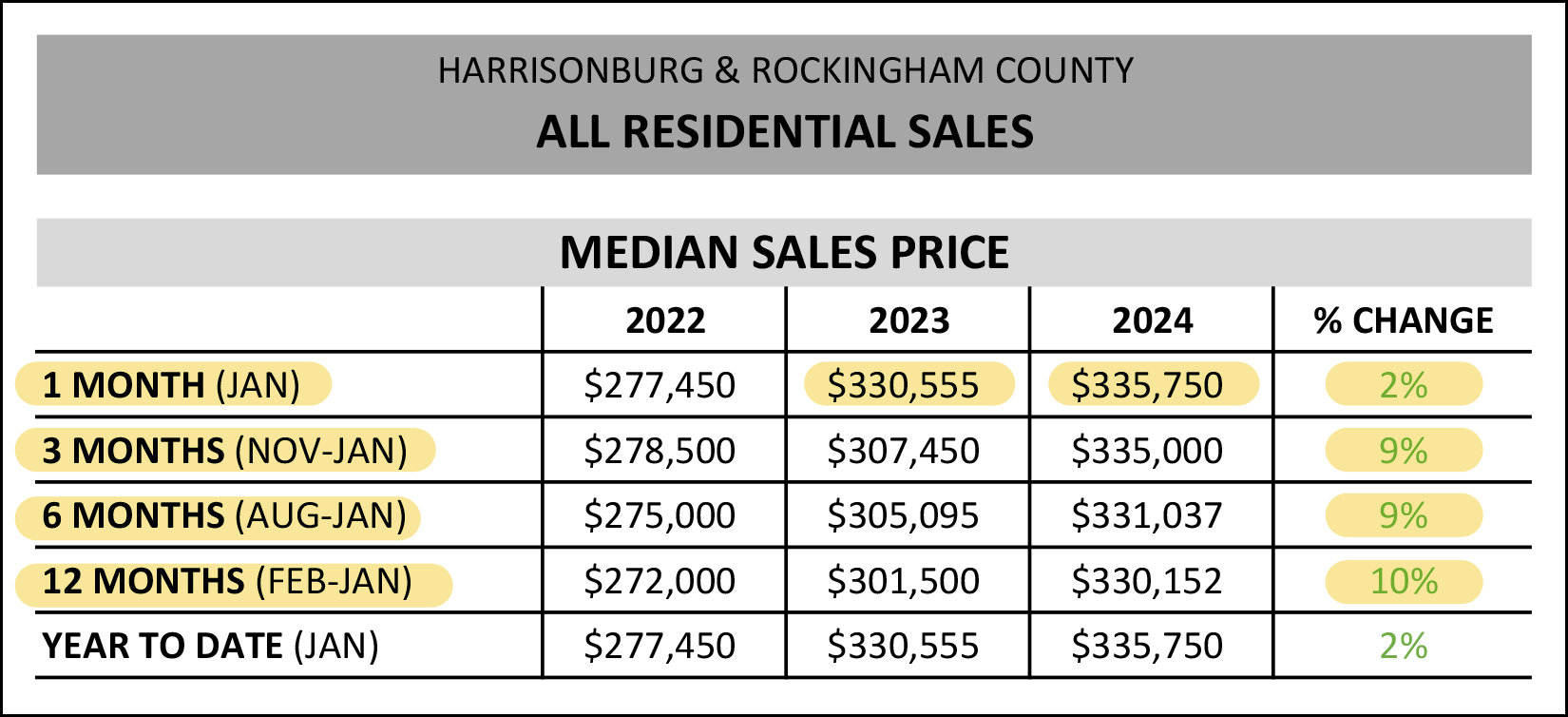

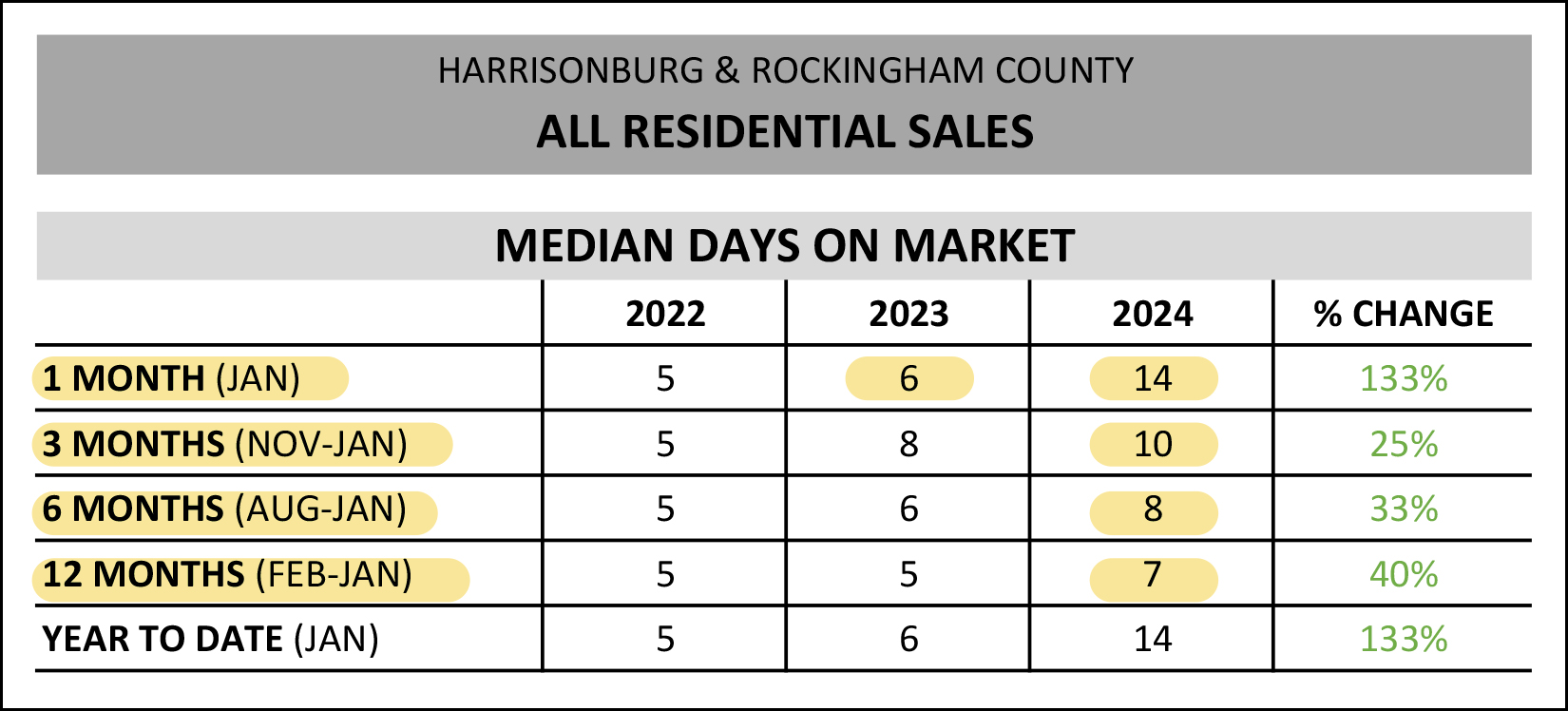

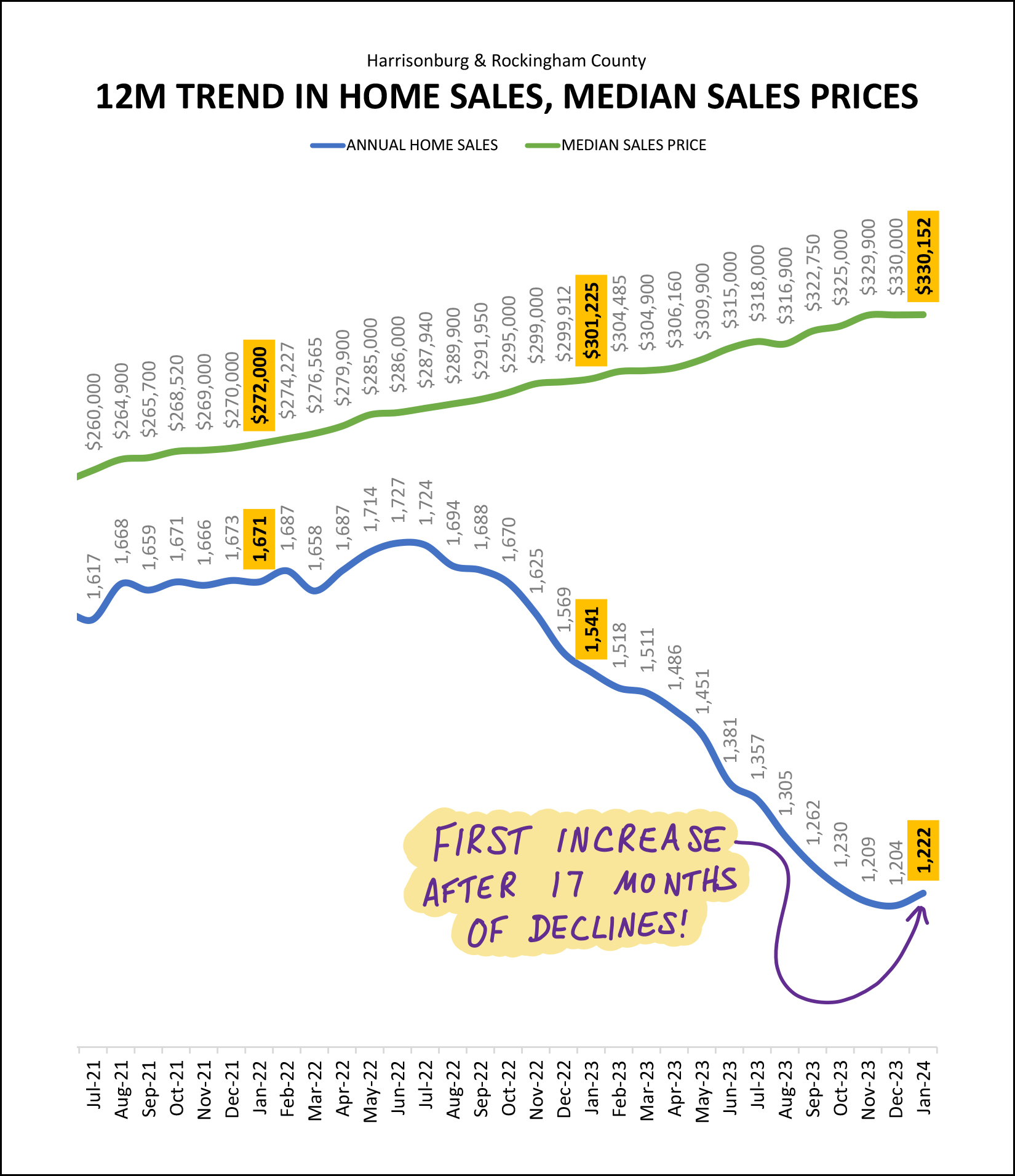

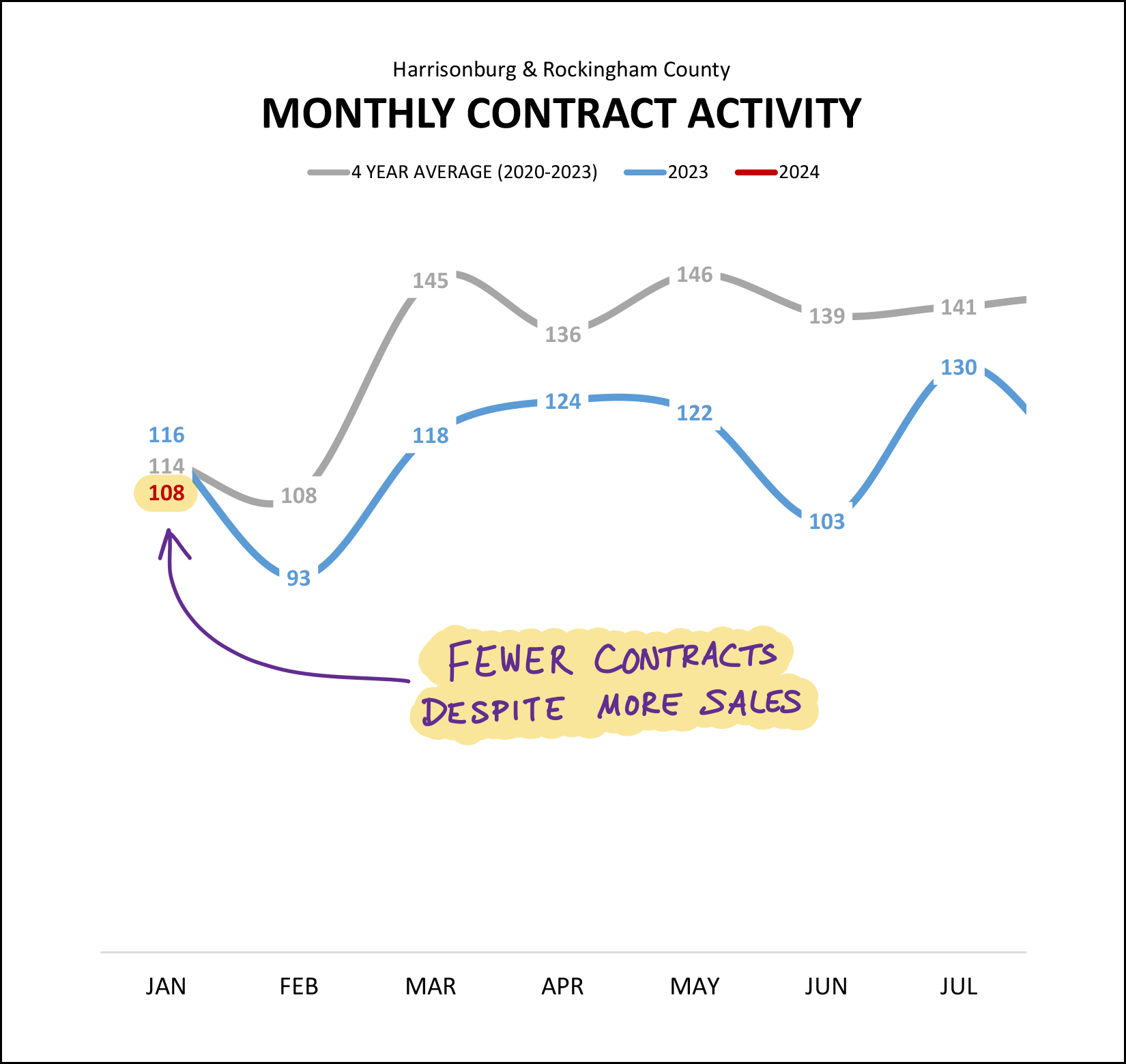

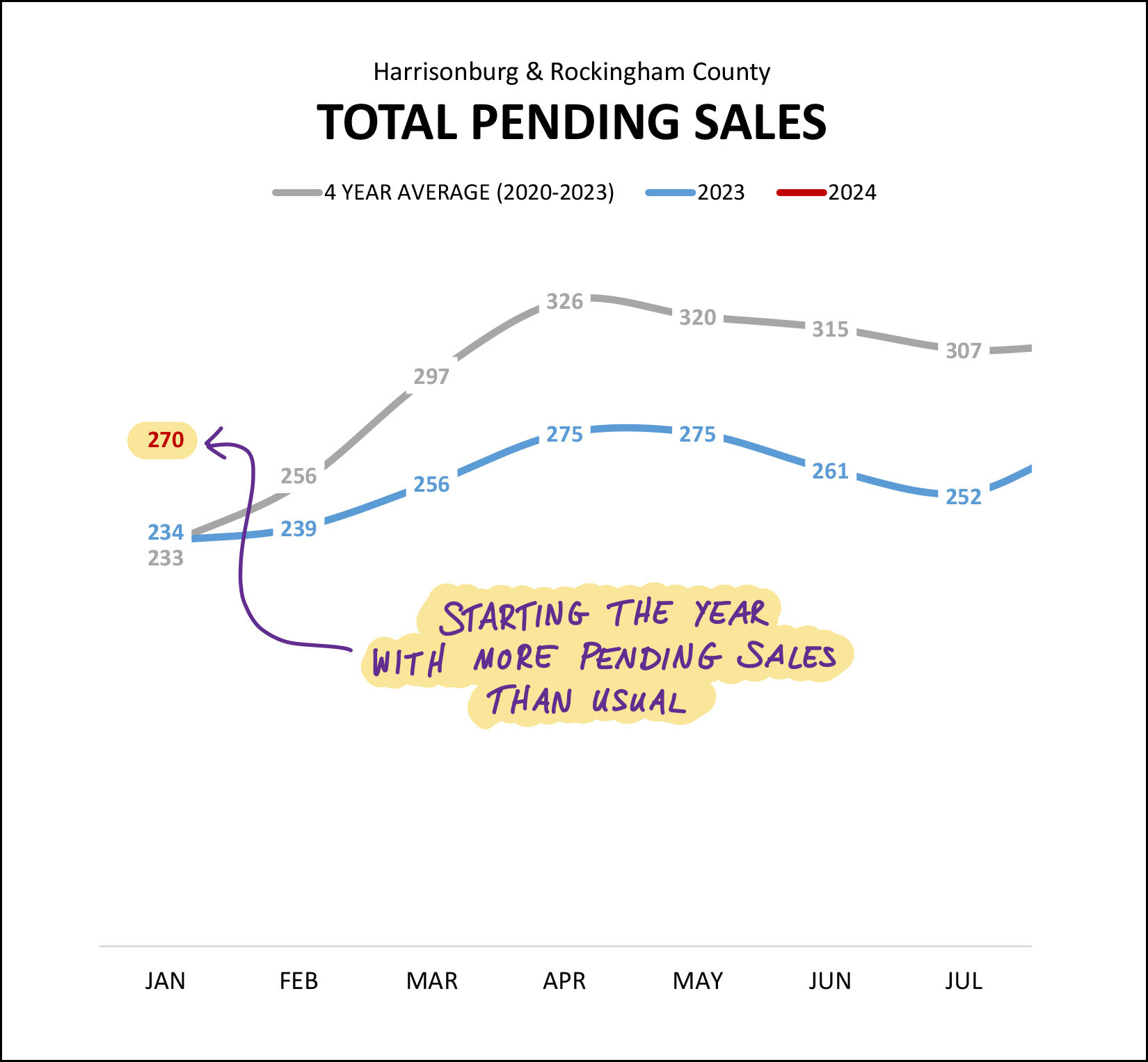

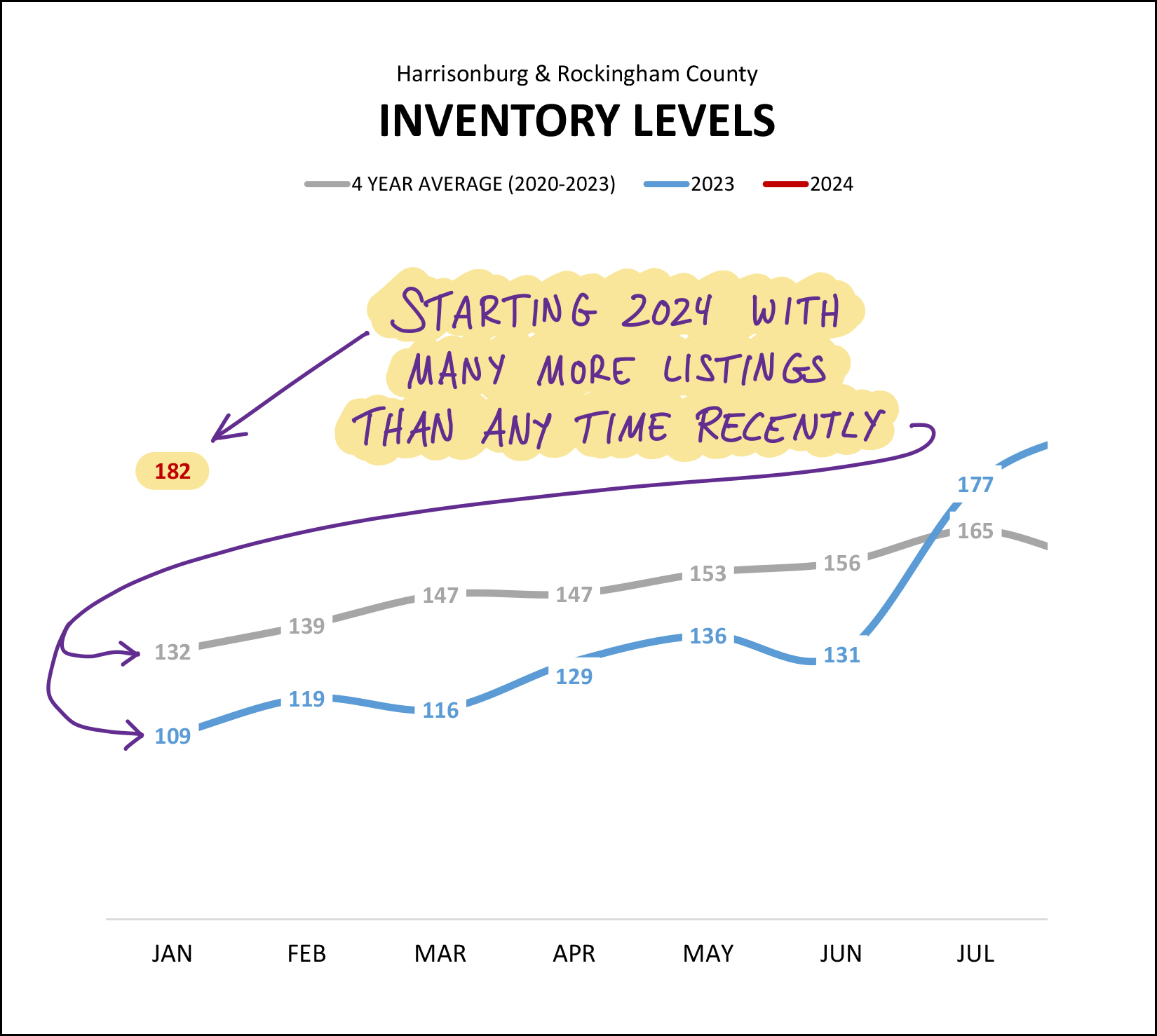

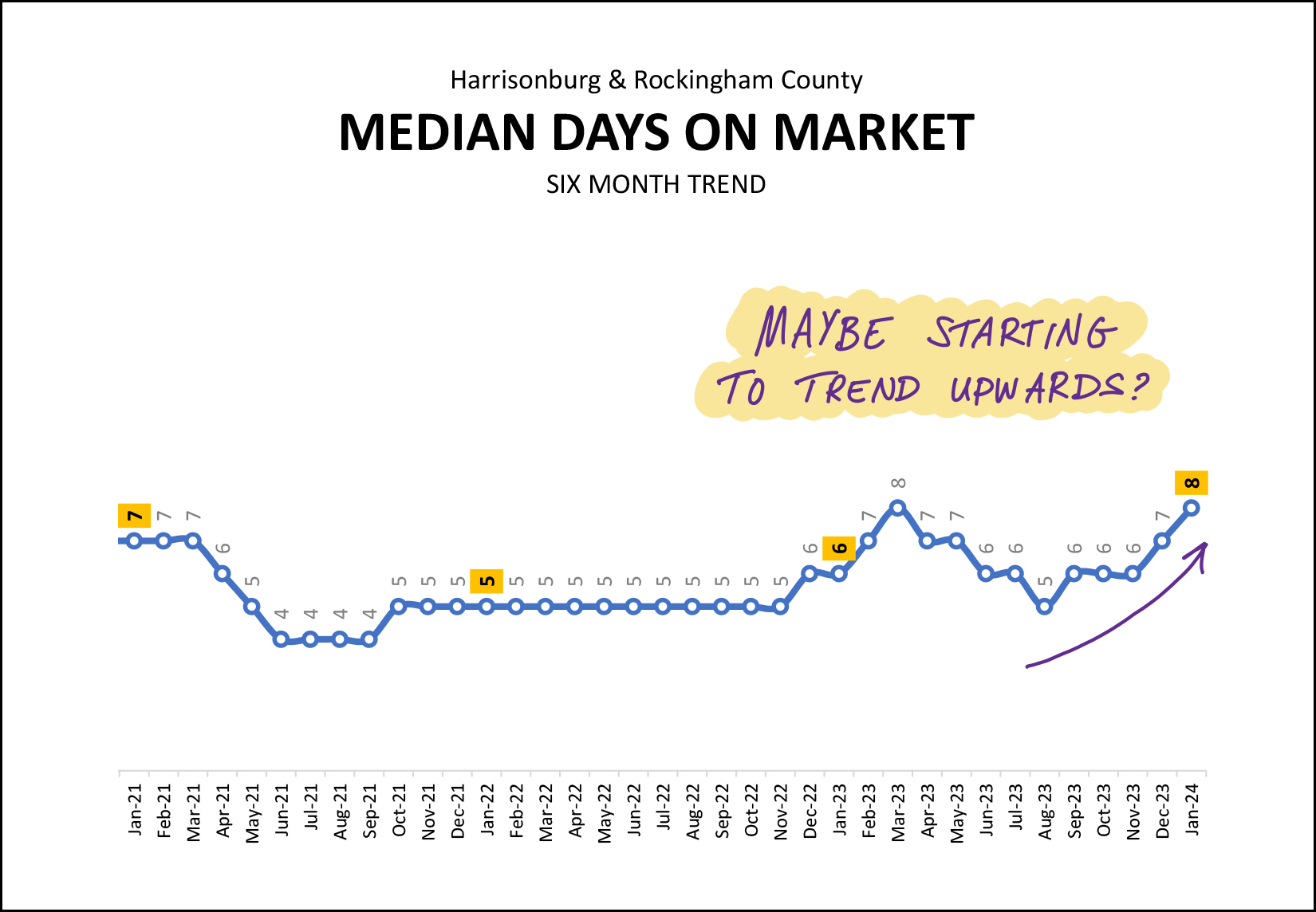

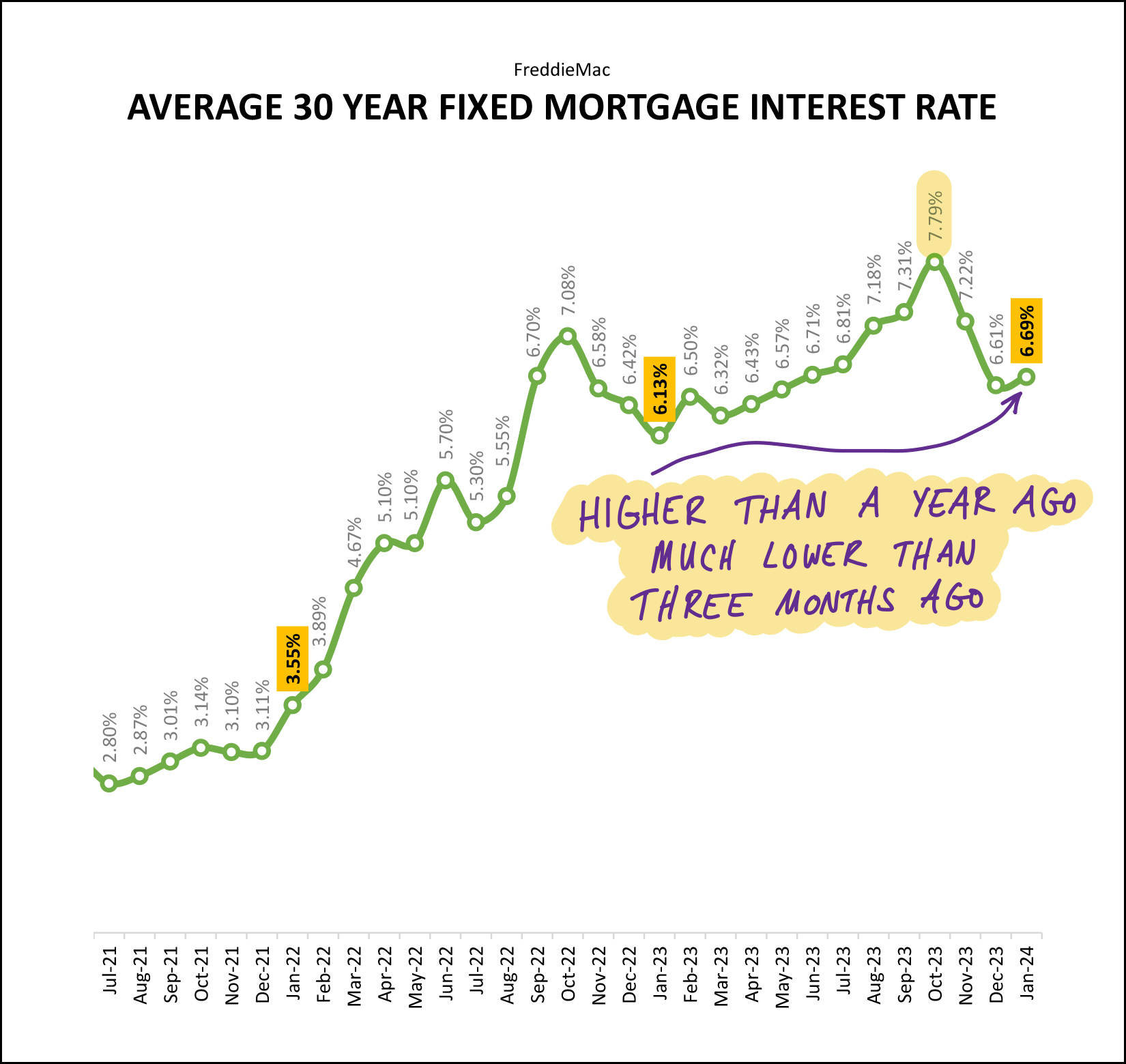

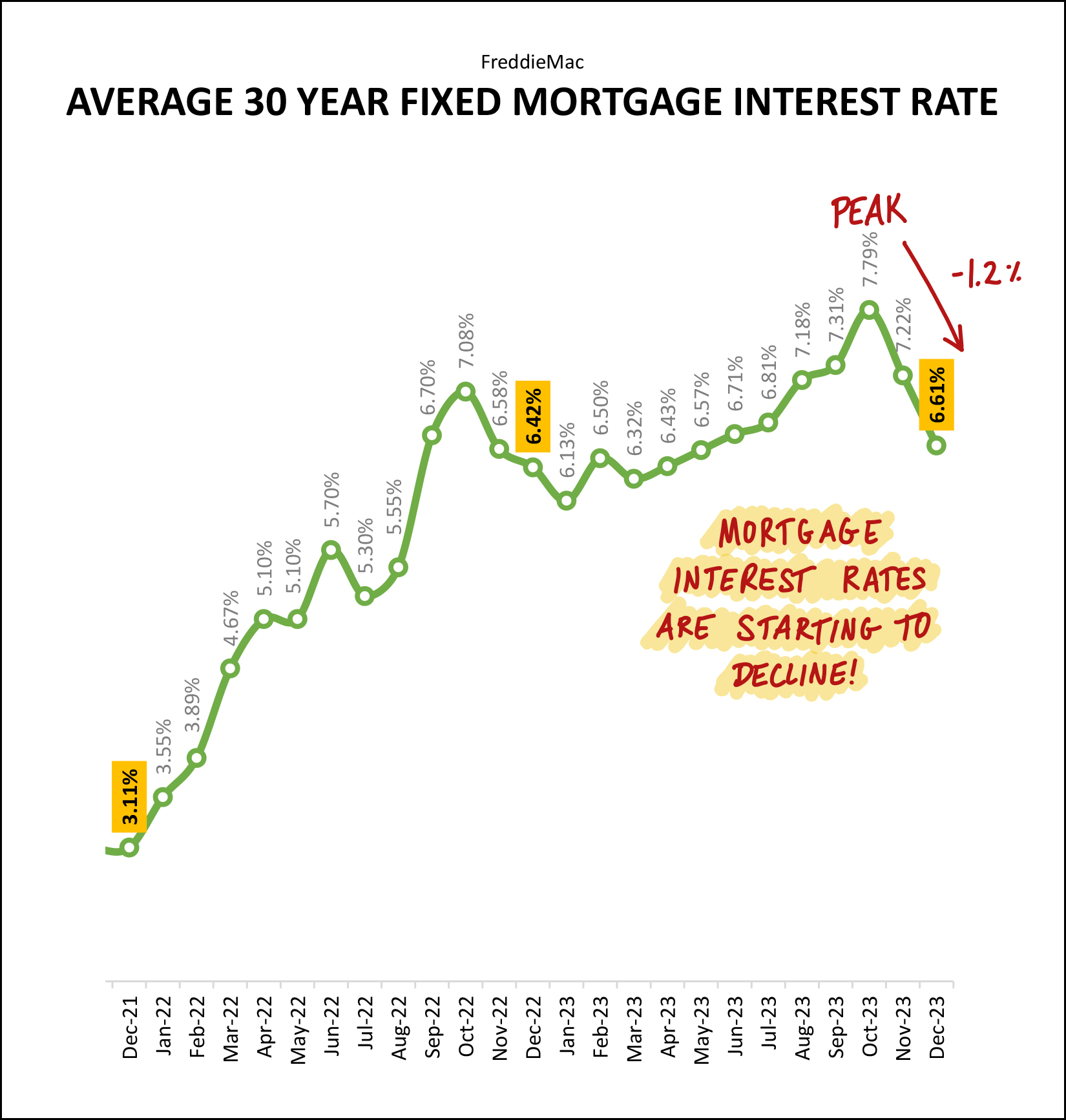

â¤ï¸ Happy Valentine's Day! â¤ï¸ For those of you that just *love* reading my market reports each month... consider today's report my valentine to you. ð That said, the real estate indicators this month aren't all hearts and candy and hugs and kisses... so TBD if you'll still consider this to be a loving Valentine's Day message by the end. But first, as a peace (love?) offering... each month I provide a giveaway, of sorts, for readers of my monthly market report. This month I'm highlighting a delightful cafe / coffee shop just outside Dayton called Harvest Table. They offer great coffee beverages, a delicious array of baked goods, and a solid (all-day) breakfast and lunch menu as well! If you haven't checked out Harvest Table -- you should -- and click here to enter your name for a chance to win a $50 gift certificate use on your next visit! Now, on to the real estate data, starting with how many home sales we saw in the first month of 2024.  If we start with how many homes are selling right now (see above) we'll be starting with some rather positive news. After over a year of steady declines in the number of homes selling in our area, we did see a bit of a turnaround in January 2024. A few things I am noticing above... [1] After only 76 home sales in January 2023 we saw 94 in January 2024. I wasn't expecting that we would see this 24% increase in the first month of 2024. I don't necessarily think that means we'll see a 24% increase in the number of homes selling throughout 2024 -- as this is just one month of data -- but it was a pleasant surprise to see more buyers able to buy homes this January than last January. [2] The third highlighted line (above) shows that over the past year we have seen a 21% decline in the number of homes that are selling in Harrisonburg and Rockingham County. This certainly stands in contrast to the 24% increase in January 2024... but if we want to broaden our view a touch we see (in the second highlighted line) that home sales have only declined by 3% when looking at the most recent three months (Nov-Jan) compared to the same three months a year prior. So... based on several bits of data... maybe (just maybe) we won't see another 20-ish percent decrease in the number of homes selling this year in our market... maybe we could actually see some stability in this metric, or a slight increase in the number of homes that are selling in 2024? Wait and see... only 11 more months to go. And how about those home prices...  Just as we can't necessarily believe that the 24% increase in home sales in January 2024 will be a lasting trend, we also shouldn't necessarily believe that the 2% increase in the median sales price in January 2024 will be a lasting trend. As shown above, when looking at three, six or twelve months of data, the median sales price in our area has been rising by 9% - 10%. When looking at just one month of data (January 2024 vs. January 2023) we only see a 2% increase in that median sales price, but I don't think we'll see that low of an increase once we get a few more months into the year. And how about how quickly homes are selling...  There are enough changes on this table (between 2023 and 2024) to give me confidence in saying that the market will almost certainly move at least a bit more slowly in 2024 than it did in 2023 (and 2022). The median "days on market" was 14 days in January 2024, which means that of the homes that sold in January, half of them took more than two weeks to go under contract. This is quite a bit slower than the median of six days last January. Also, if we zoom out a bit to look at the three month, six month and twelve month metrics, we also see higher median days on market in those timeframes as well. We started to see days on market creep up a bit in 2023 but I think we will see an even more significant increase in this "speed of sale" metric in 2024. Many homes will likely still sell very quickly in 2024, but not all homes. This next graph is a bit hard to read with only one data point for 2024, but see if you can find it... hiding on the left side, and highlighted...  That highlighted "94" is showing the number of homes that sold in January 2024... which was well above the 76 home sales we saw last January (in blue) and only barely above the four year average of 2020 through 2023. Looking and thinking ahead towards the next few months the question that remains is whether home sales in 2024 will remain stronger than in 2023, or whether the monthly sales count will drift back down towards 2023 levels. I'll hit on contract activity and pending sales a bit later to allow us to think more about what the coming months might look like. And now, a look at the overall big picture trends as it relates to how many homes are selling and the prices at which they are selling...  At this point you might be wondering why I warned you in the beginning of the report about some of the metrics not being entirely positive this month. Well, keep reading, but this graph (above) is still in the positive category. The blue line above tracks the number of annual home sales taking place in Harrisonburg and Rockingham County (per the HRAR MLS) when measured on a monthly basis. After 17 months of a declining pace of annual home sales, we saw the first increase in January 2024... from 1,204 home sales to 1,222 home sales. This change in direction in this trend is a result of strong January 2024 home sales compared to January 2023 home sales. If that continues in February 2024, we'll see this line continue to rise again. The top (green) line shows the median sales price over a year's time, measured each month. Clearly, the median sales price has been increasing for many (!!) months (years) now. This metric has flattened out a bit over the past two months, so stay tuned to see if the median sales price continues to increase in 2024 as quickly as it did in 2022 and 2023. Here's another look at that possible change in how quickly prices are rising...  At first glance, it would seem that the rapid increases in the median sales price that we saw in 2020, 2021, 2022 and 2023 might finally be coming to an end in 2024. And, that might be true. We could see a much smaller increase in the median sales price this year. But... keep in mind that the graph above is comparing 12 months of data in 2023 to only one month in 2024. Once we have a few more months of data to consider in 2024 -- a larger data set than the 94 January home sales -- we'll be able to have a better sense of whether we will see similar or smaller increases in the median sales price in 2024. Next up, contract activity, one of the indicators of what we should expect next...  I suppose I shouldn't focus too much on contract activity being slower in January 2024 than in January 2023 because it wasn't that large of a difference... a decline from 116 contracts last January to 108 contracts this January. But, after seeing a big uptick in closed sales in January 2024, I was expecting to see more contracts in January as well -- which would allow us to more confidently expect to see overall home sales activity to increase in 2024. So, with more sales in January, but fewer contracts, what will February (and March) look like in 2024? Well, here's another potential indicator... pending sales...  Pending sales is a measure (a count) of how many properties are under contract (pending) at any given moment in time. A year ago there were 234 pending sales at this time, which was in line with the four year (2020-2023) average of having 233 pending sales at this time of year. But then, January 2024. At the end of January (beginning of February) we are now seeing 270 pending sales -- much more than any time recently. So, despite fewer homes going under contract in January, the total number of homes waiting to make it to closing is much higher than we might have otherwise expected. All of this points to the possibility that we will actually see an increase in the number of homes selling in 2024 as compared to 2023. Give it a few more months to see if the data keeps reinforcing that hypothesis, but I am starting to think we'll see an increase in home sales this year as compared to last year. And perhaps more homes are selling because more are available for sale?  Not only are there many more (15% more) pending sales right now as compared to a year ago, there are also many more (67% more) homes for sale right now as compared to a year ago. That's actually a pretty significant (67%) increase in inventory levels in a year's time. One year ago a buyer would have been able to choose from 109 homes to give to their special someone on Valentine's Day. This year, they can choose from 182 homes for sale. If you've been hoping your loved one will give you a new home for Valentine's Day... you might be in luck, there are sooo many more options this year. If you don't get that new home along with some roses and a box of chocolates, don't let them blame it on the low housing inventory levels... Now, back to that median "days on market" metric...  Way back in mid-2021 the median days on market dropped all the way down to four days... and then stayed at five days for more than a year after that. We started to see the median days on market bounce around a bit more in 2023 as we went from a market where absolutely every home seemed to sell very (very) quickly to a market where many homes still sold very quickly, but not all of them did. As we look at the increase from a median of five days on the market back in August to a median of eight days on the market today, we may just be seeing a seasonal increase that we will start to see every year... or we may be seeing the beginning of a slight slowing in the market. But... keep in mind... if the median days on market increases from five to eight days, that is not a drastically different market. It's an increase, but it's not an increase to 10 or 20 or 30 days on the market. Thus, it will be important to continue to monitor this metric over the coming months to see if 2024 is and will be a more slowly moving market than last year. Finally, how about those mortgage interest rates...  One of the main causes for the decline in the number of home sales in 2023 was rising mortgage interest rates. In 2022 mortgage interest rates rose from 3.11% to 6.42%. Then as 2023 went on, they rose even further, up to a peak of 7.79%. Can you blame buyers for not wanting to buy with a mortgage interest rate above 7%... or for sellers not wanting to sell and then have to buy with an interest rate above 7%? Over the past few months we have started to see mortgage interest rates decline, back to around 6.7% by the end of January. If we continue to see declines in mortgage interest rates in 2024 that will likely encourage further buying activity, though I don't expect that they will get all the way down 6% by the end of the year. And there we have it, very much a mixed bag of market metrics this month. More home sales, fewer contracts but more pending sales, higher inventory levels, higher days on market. All of that likely adds up to 2024 being yet another interesting and not entirely predictable year in our local housing market. If you plan to buy this year - talk to a lender soon and then frequently over time to understand how changing mortgage interest rates affect your budget and monthly payment. If you plan to sell this year - prepare your home well, price it in line with recent similar home sales, and know that your home might be on the market for more than a few days. If you own a home and do not plan to sell it - this will likely be another good year for you with your home increasing in value and another year of paying down a mortgage that likely has a very low interest rate. And to each of you -- if I can be of any help to you with real estate or otherwise, don't hesitate to reach out. You can contact me most easily at 540-578-0102 (call/text) or by email here. I hope you have a wonderful Valentine's Day! XOXO -Scott | |

Will We See A Fast Moving Real Estate Market In Spring 2024 In Harrisonburg And Rockingham County? |

|

Many or most resale homes have been going under contract very quickly when they have been listed for sale over the past four years in Harrisonburg and Rockingham County -- largely because demand for these homes has exceeded supply. I don't expect that we will see supply exceeding demand this coming spring, but I also don't know that most sellers should expect to have their homes under contract within just a few days as has often been the case for the past few years. Looking at resale homes that have closed in Harrisonburg and Rockingham County over the past 60 days...

Will we see a fast moving real estate market in Spring 2024 in Harrisonburg and Rockingham County? Likely so. Will most home sellers be able to count on their homes being under contract within a few days? Maybe not. | |

2023 Recap On Our Local Housing Market Shows 23% Fewer Home Sales At 10% Higher Prices |

|

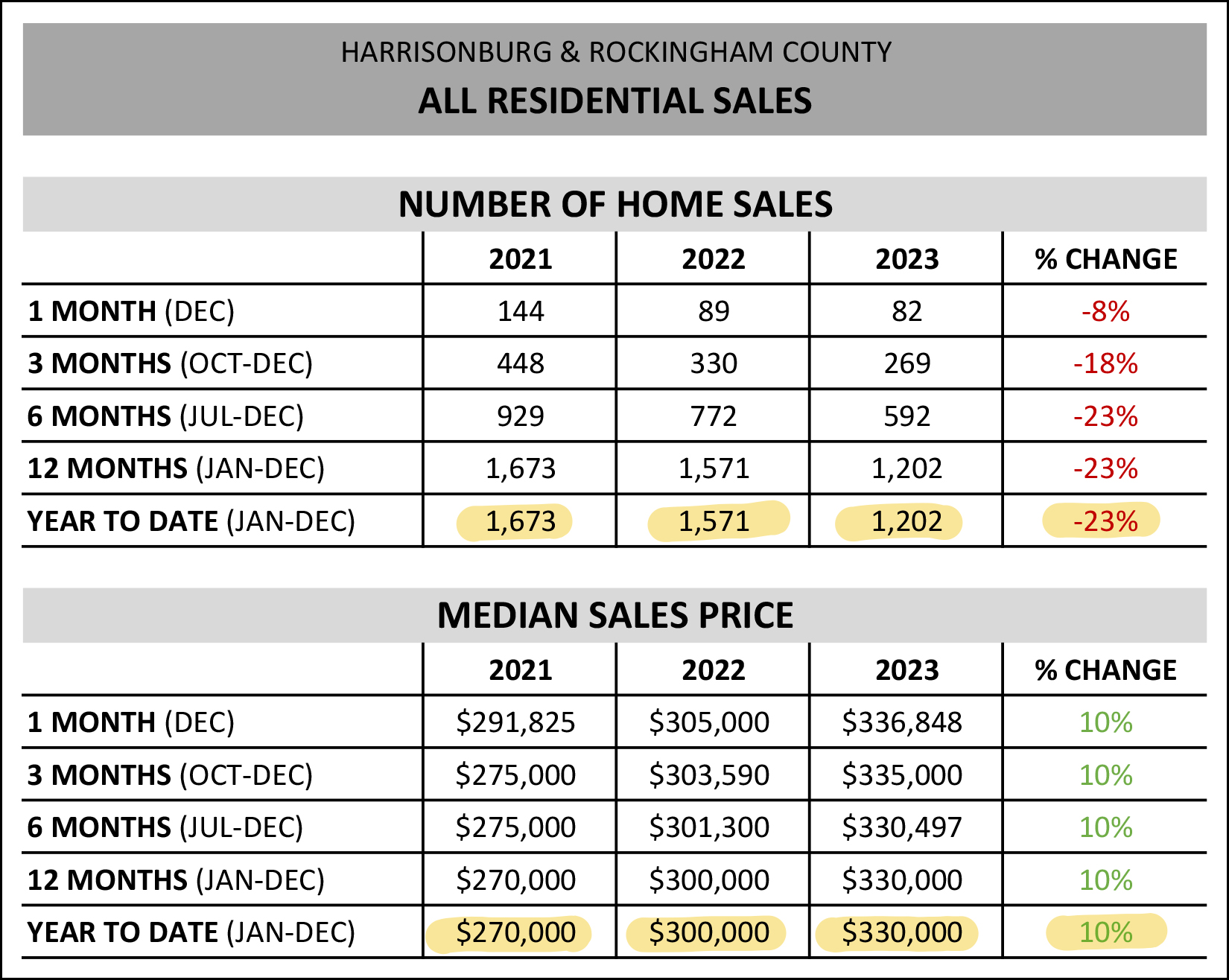

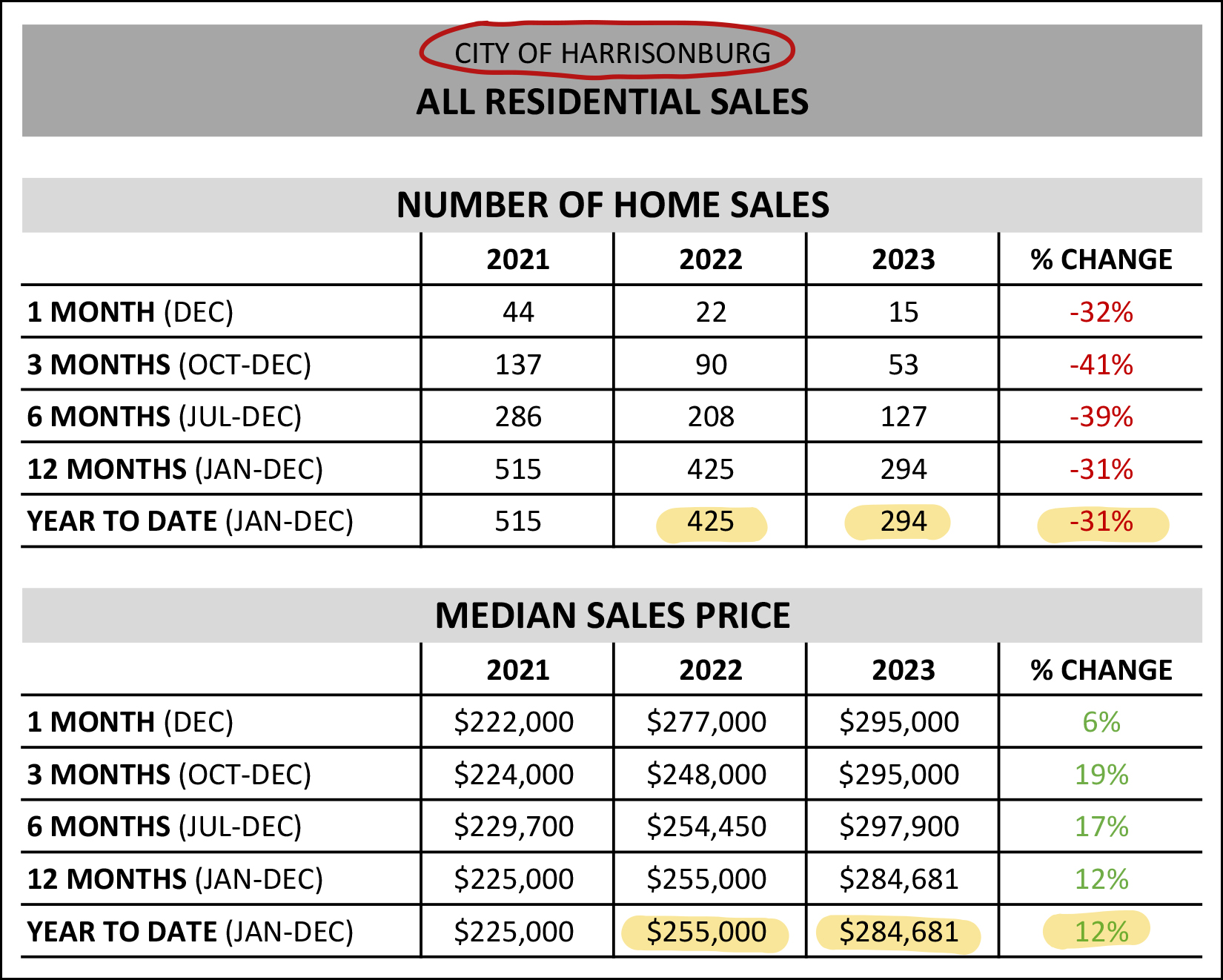

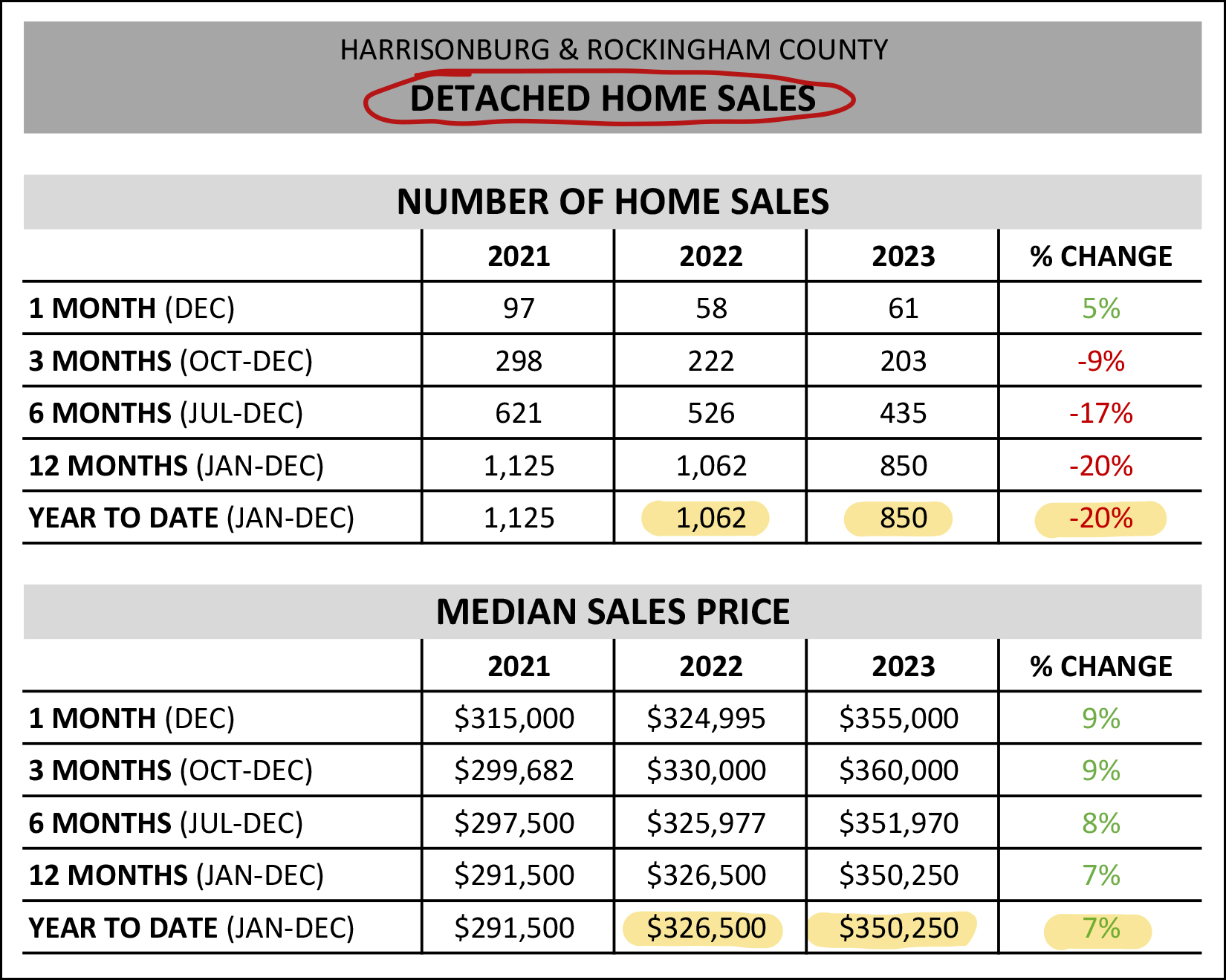

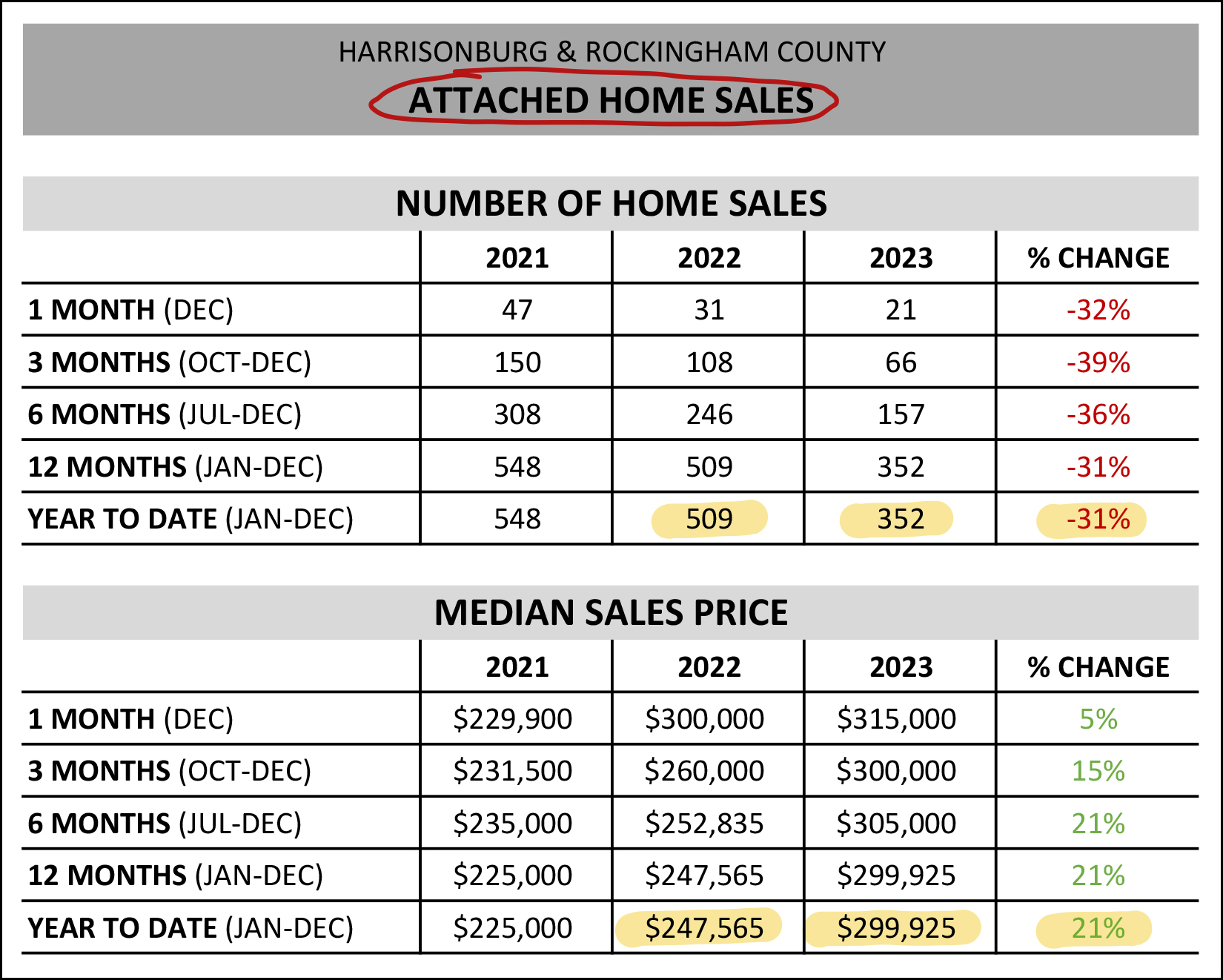

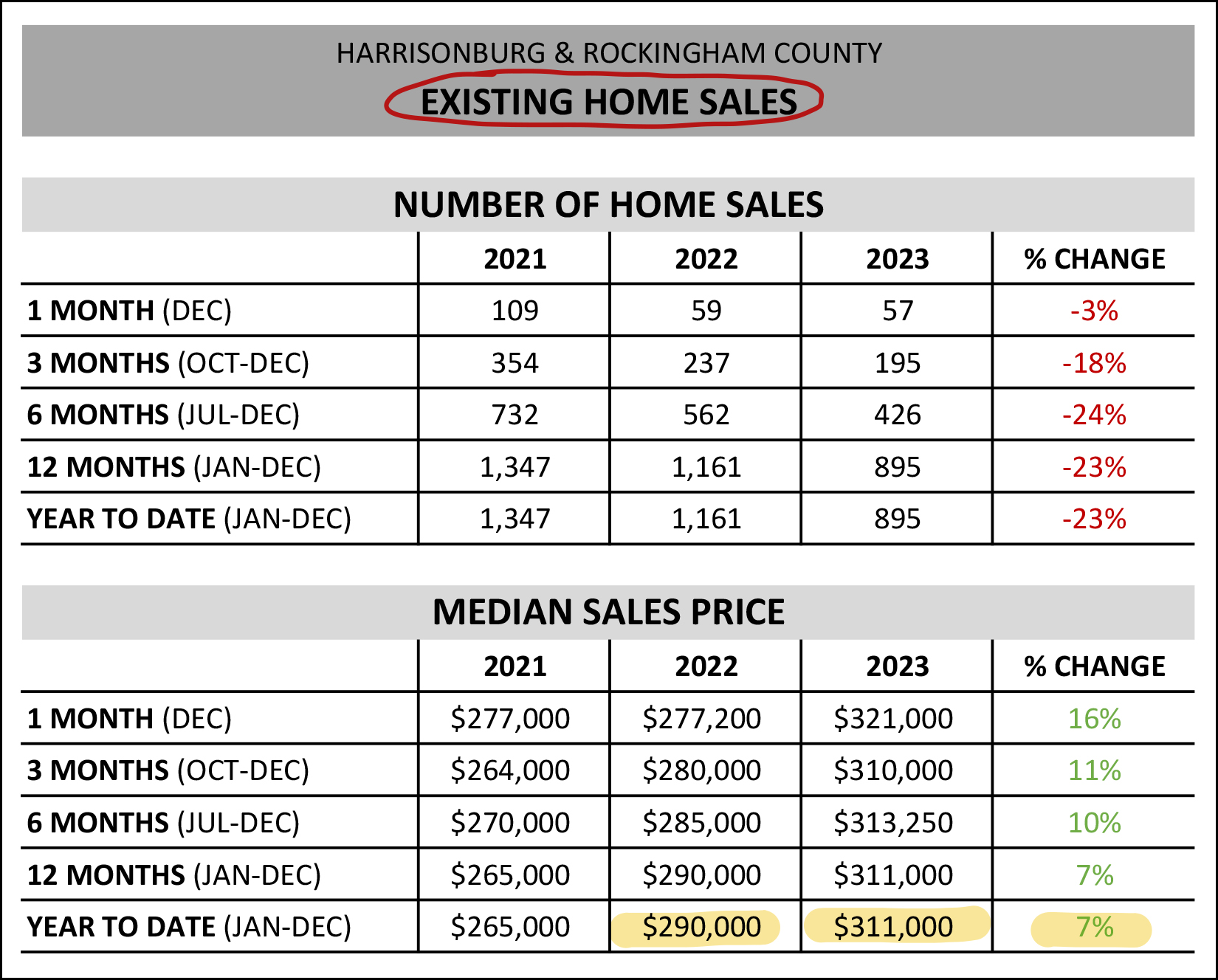

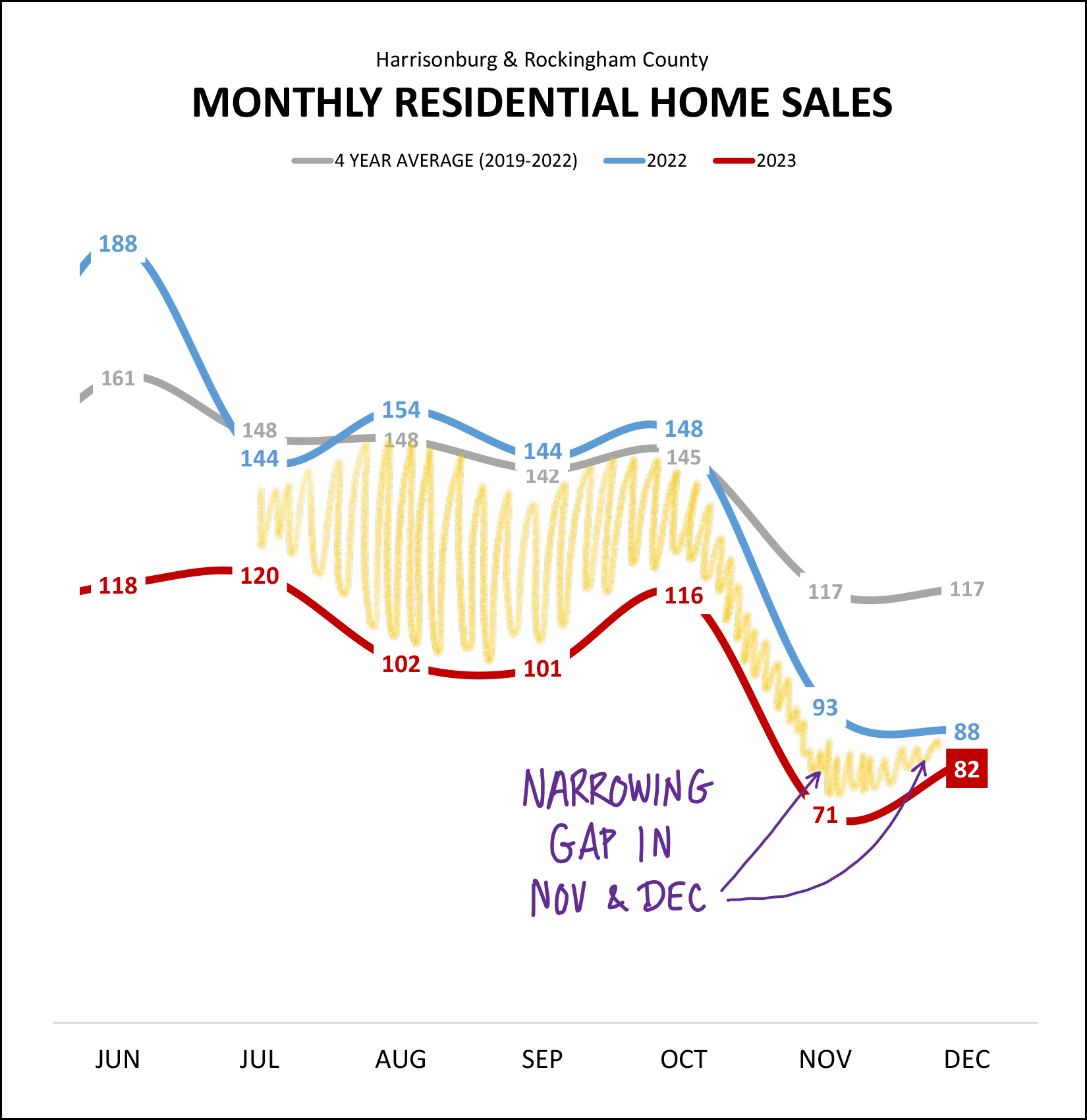

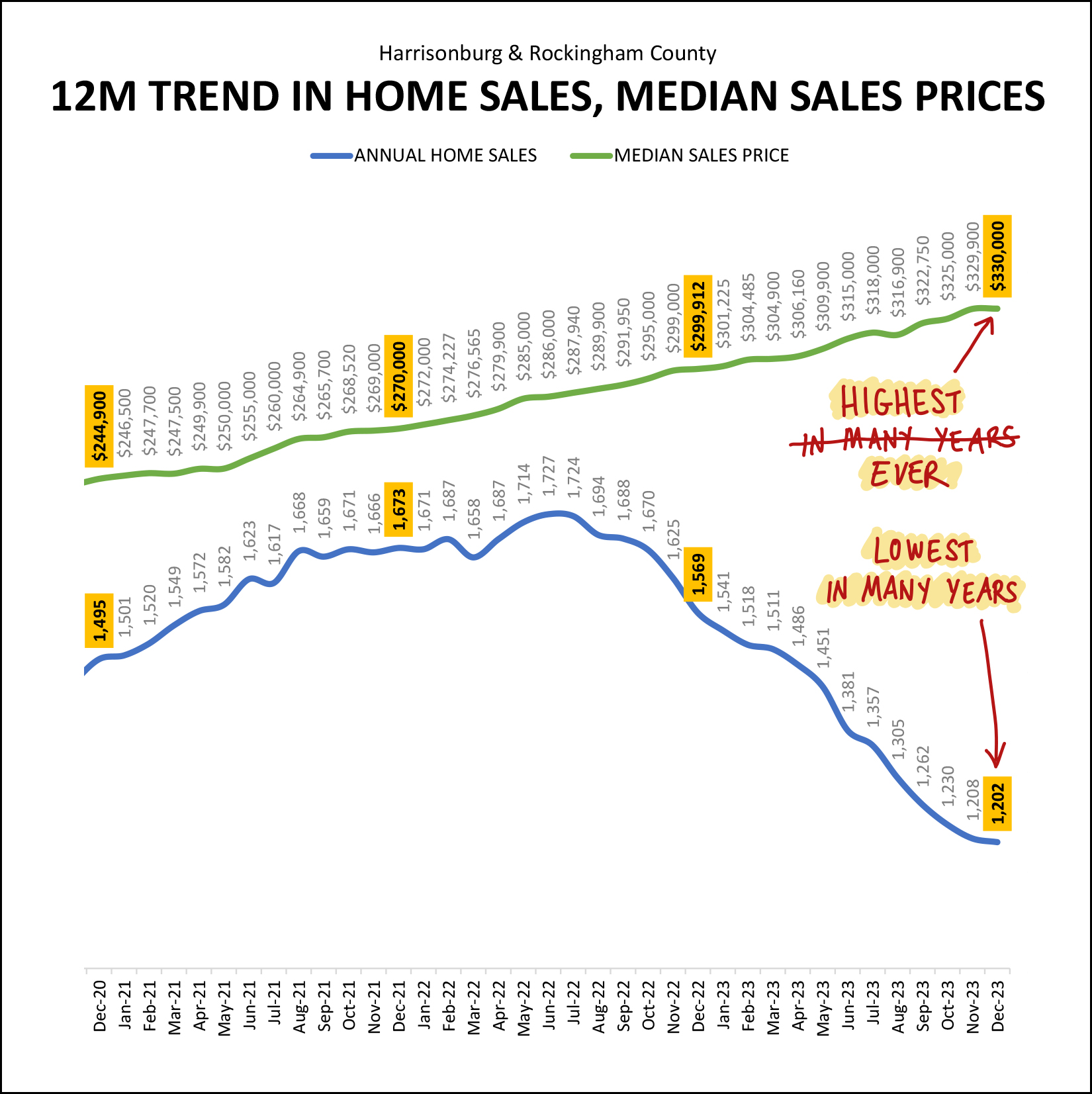

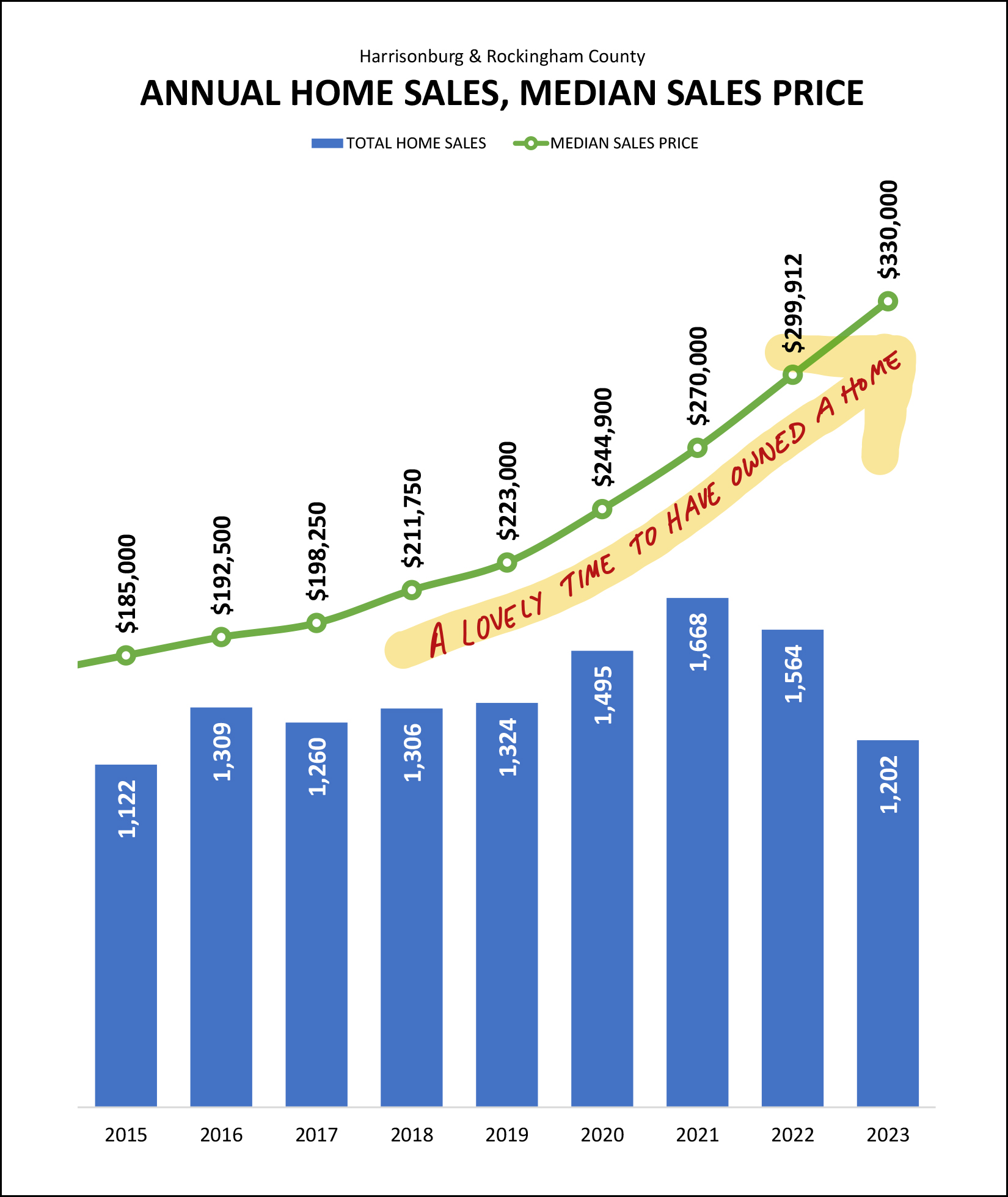

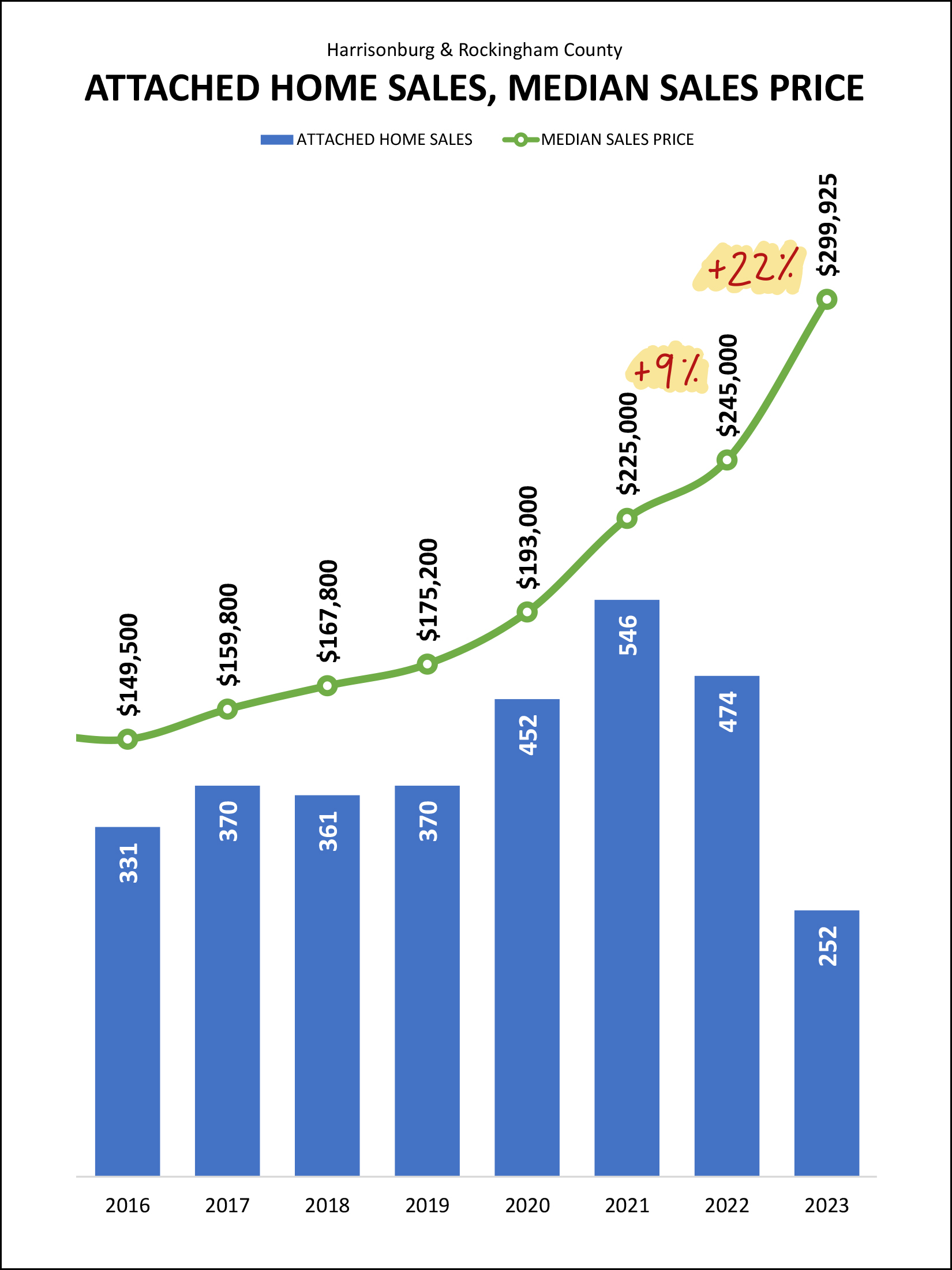

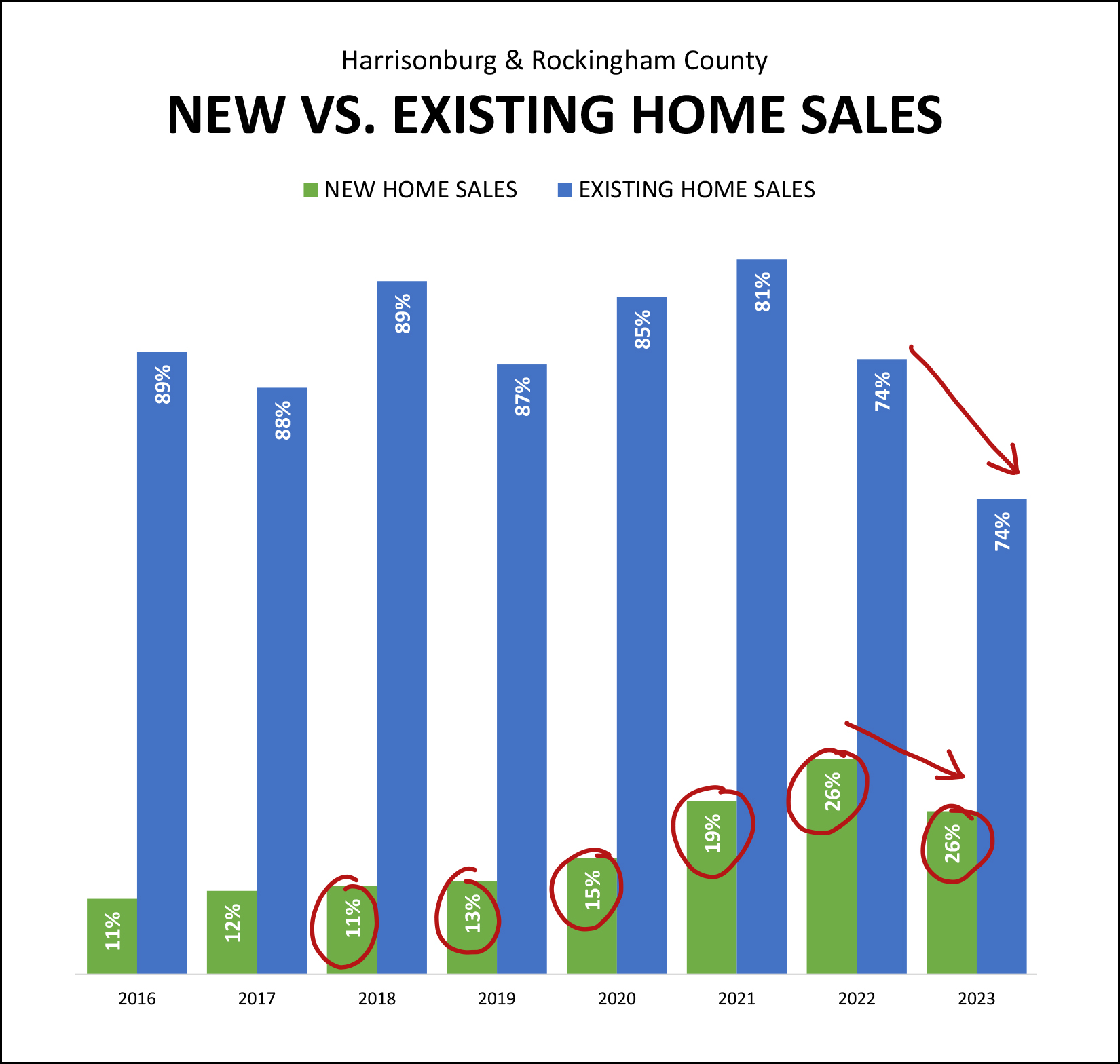

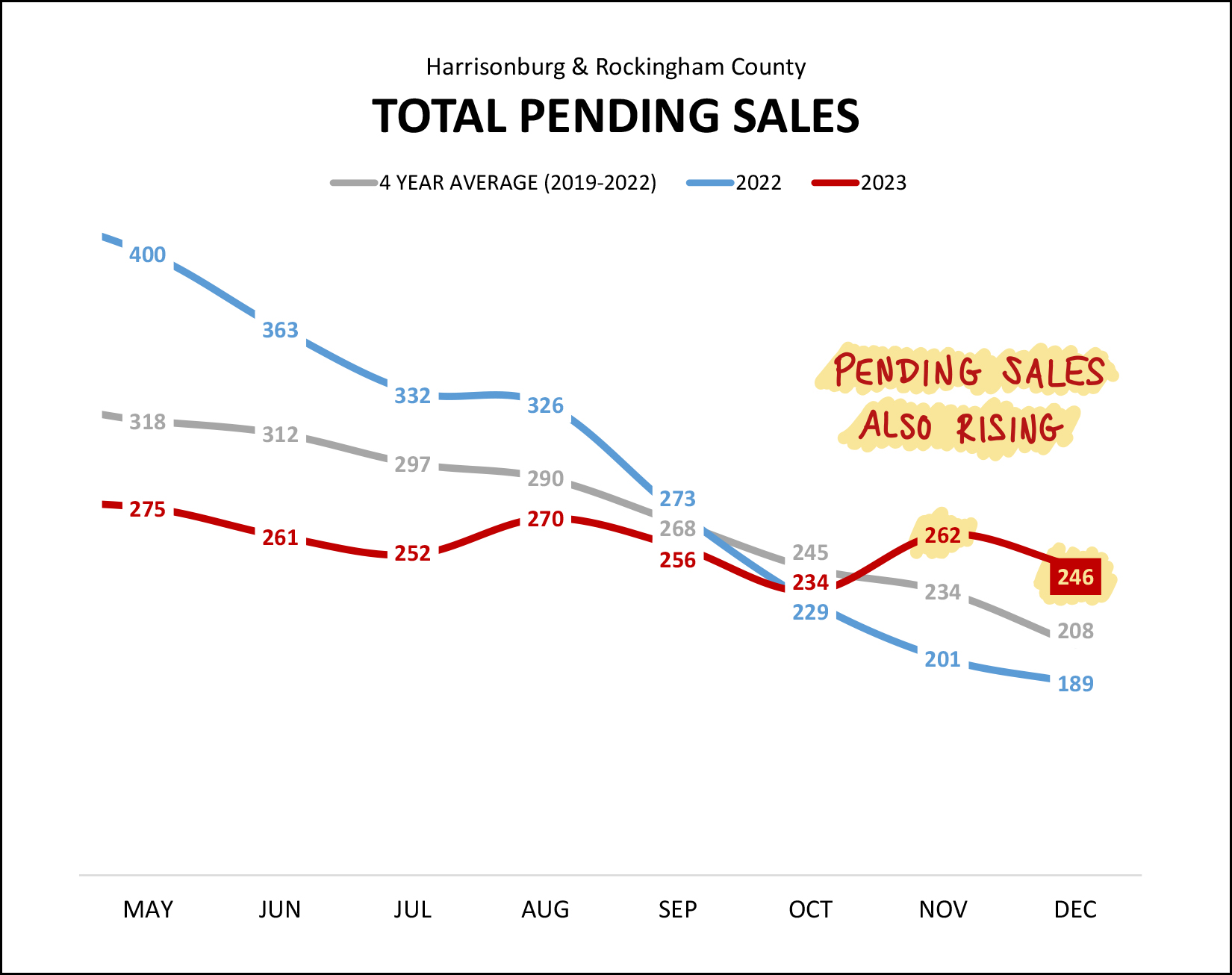

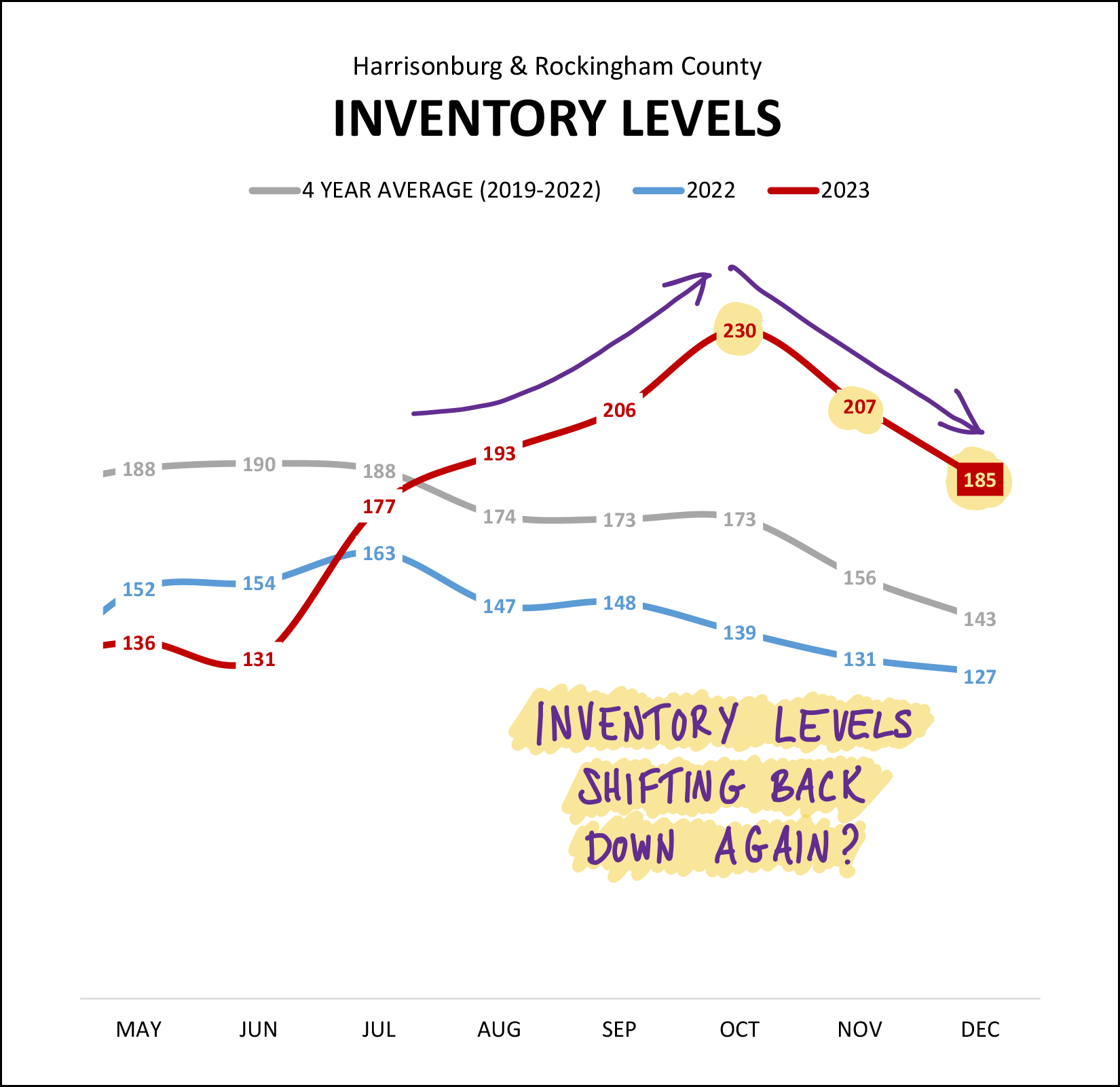

Happy New Year, Friends! I hope your 2023 wrapped up nicely and that you had some time with family and friends over the holidays! I had a wonderful time over the past few weeks making tons of great memories with family (including my brother and his family visiting from out of state and so many others), eating lots and lots of delicious food (including plenty of Christmas cookies), relaxing, sleeping in, and I closed out the year by running in (and badly spraining my ankle in) the New Years Eve Glow Run. My ankle buckled after about 2.5 miles (I think when I landed on some uneven ground?) and I managed to cut up my knee as I rolled off the path... so I had to fake my way to the finish line with a bloody knee...  As a result, I have found myself limping and hobbling my way into the New Year -- but beyond this temporary mobility setback, I couldn't be more excited for the year ahead. ;-) Below I have outlined a variety of trends we are currently seeing in the local real estate market, but before we get started with the numbers and charts and graphs... each month I provide a giveaway, of sorts, for readers of my monthly market report. This month I'm highlighting one of my favorite sandwich spots downtown... Lola's Delicatessen. They create some amazing sandwiches and are a great spot to stop for lunch in downtown Harrisonburg. If you haven't checked out Lola's -- you should -- and click here to enter your name for a chance to win a $50 gift certificate to Lola's Delicatessen! Now, let's take a look at some data on our local housing market...  First up, the big picture of where we ended up after a full year of real estate data in Harrisonburg and Rockingham County in 2023... We continue to see fewer homes selling in Harrisonburg and Rockingham County. After a 6% decline in the number of homes selling between 2021 and 2022... we saw a much larger, 23%, decline in the number of homes selling in our market in 2023. As we'll see on a later graph, this is the lowest number of homes selling in quite a few years. The prices of those homes that are selling continue to rise, quickly. After an 11% increase in the median sales price in 2022, we saw a very similar, 10%, increase in the median sales price in 2023. As we'll see on a later graph, this is the highest median price we have seen in this area, ever. Let's now use that 23% drop in the number of homes selling and that 10% increase in median homes prices as a benchmark against which to understand other similar but slightly different trends in 2023...  The chart above analyzes the sale of only homes located in the City of Harrisonburg. Compared to the market-wide 23% drop in number of homes selling and 10% increase in median sales prices... [1] The number of homes selling in the City of Harrisonburg declined even further (31%) than the market-wide (23%) change in home sales. [2] The median sales prices of homes selling in the City of Harrisonburg increased even more (+12%) than all homes in the market (+10%). Now, beyond location, let's break things down briefly by property type...  The chart above evaluates only detached homes (single family homes) in the City of Harrisonburg and Rockingham County. Compared to the market-wide 23% drop in number of homes selling and 10% increase in median sales prices... [1] The number of detached homes selling didn't decline quite as far (-20%) as the market overall (-23%) in 2023. [2] The median price of detached homes only increased 7% over the past year, as compared to the market-wide increase of 10%. This a good example of why every homeowner in Harrisonburg and Rockingham County shouldn't necessarily assume that their home's value increased by 10% over the past year. If you own a detached home that change may very well have only been 7%. And how about those attached homes?  The chart above evaluates only attached homes (duplexes, townhomes, condos) in the City of Harrisonburg and Rockingham County. Compared to the market-wide 23% drop in number of homes selling and 10% increase in median sales prices... [1] We saw a somewhat larger decline (-31%) in the number of attached homes selling in 2023 compared to the overall market (-23%). [2] We saw a much (!!) larger increase in the median sales price of these attached homes (+20%) as compared to the overall market (+10%). But... before you assume that your attached home increased in value by 20% over the past year... remember that plenty of these attached homes were new homes, thus selling at higher prices, thus helping elevate this median sales price. Speaking of new homes, let's look at how things trended for just the existing homes in our market...  When looking at only existing home sales (not sales of new homes) we find... [1] The decline in existing home sales is exactly in line (-23%) with the overall market. [2] The median sales price of existing homes only rose 7% over the past year, compared to the market-wide increase of 10%. If you love the data and want to dig into these charts and related charts even further, you can do so here. :-) Now, let's see if some pictures (graphs) can help us further understand the current state of our local housing market and where we might be heading next...  The graph above tracks the number of home sales that took place each month in 2023 (red line), 2022 (blue line) and the average number taking place per month over four years (2019-2022). As you can see from the shaded yellow area, all through the summer and through most of the fall we were seeing monthly home sales at levels quite a bit below last year's levels. But... then came November and December. In those final two months of the year we started to see the most recent year of home sales (2023) almost catching back up to the same month of home sales in 2022. To put things into an even longer / broader perspective...  The current annual trend of home sales in the City and County has been falling (blue line) for the past year and a half. This annual sales pace peaked at 1,727 home sales in a year back in June 2022... but has been falling ever since. The current pace of 1,202 home sales a year is the lowest in many years! The current annualized median sales price in the City and County has been rising for just about a decade now, and at $330,000 it is at the highest point point it has ever been in our local area. To be clear, we've been setting new annual records for the median sales price for each of the past five (+) years -- so the "highest ever" isn't a new phenomenon -- it has been happening year after year since 2018. If you own a home, look at the next graph. If you don't... maybe don't look at the next graph? :-/  As shown above, it has been a LOVELY time to have owned a home over the past five years. Home prices have been blazing their way upward between 2018 and 2023 with a total of a 56% increase in the median sales price during that timeframe! What happens next, you might ask? I think it is highly unlikely that we will see another 56% increase in the median sales price over the next five years... but home values do seem poised to continue to increase in our local area over the next few years, even if not as quickly. And now to help you visualize the faster than the overall market increases in the median sales price of attached homes...  Indeed, as shown above, the median sales price of attached homes (townhouses, duplexes, condos) is increasing QUICKLY! Between 2021 and 2022 we saw a 9% increase in the median sales price of attached homes in Harrisonburg and Rockingham County. In 2023, we saw a 22% increase in this median sales price! Again, at least a portion of this is the influence of higher prices of new attached homes -- but regardless of how you slice and dice the data, the price of attached homes is rising, quickly. This next graph looks at new (vs. existing) home sales -- in two ways...  First, we should note that the number of both existing homes (blue bars) and new homes (green bars) declined between 2022 and 2023. We saw fewer sellers selling and buyers buying -- both existing homes and new homes. But... five years ago new home comprised 11% of the total number of home sales in 2018... and this past year new home sales made up a much larger 26% share of overall home sales. I expect that we will continue to see a significant share of total home sales being new home sales... especially since so many existing homeowners (would be sellers) have very low fixed mortgage interest rates and won't be all that excited to sell their homes while interest rates are still at/above 6%. Now, looking at some of the most recent market activity... contracts being signed...  The red line above shows the number of contracts signed per month compared to the same month last year in a blue line. You'll note that most of this year's (red) data points are a good bit below last year. But... not November of December. Contract activity this November snuck (barely) past last November... and contract activity this December blasted past last December with 105 contracts this December (2023) compared to only 67 the prior December (2022). And, as you might imagine, the increased pace at which contracts were signed in those two months pushed the "pending sales" numbers past where we were a year ago...  For most of 2023 we saw pending sales levels (total number of under contract properties) below where they were in the same month last year. But... that changed in October 2023 and contract activity in November and December pushed the pending sales numbers well ahead of where things were a year ago. We closed out 2022 with 189 properties under contract... compared to 246 properties under contract in December 2023! Have these contracts being signed start to make a dent in inventory levels that were otherwise rising? Good guess...  After seeing steady (rather rapid) increases in inventory levels between June 2023 and October 2023 (131 up to 230) those inventory levels started to decline again in November (to 207) and followed that trend in December (down to 185). Certainly, a higher than expected number of buyers signing contracts goes a long way towards reducing inventory levels. Was there anything else that declined, similarly, in November and December 2023? Let's see...  Indeed, if we're looking for at least one of the answers to why contract activity rose and inventory levels decline in November and December -- it's likely that we are looking at it above. Mortgage interest rates rose throughout most of 2023 from a low of 6.13% in January all the way up to a peak of 7.79% in October. But... they have been falling steadily since that time -- and in just two months they have dropped all the way back down to 6.61%. I suppose it's no surprise, then, that we saw contract activity start to tick back up in November and December -- it became (slightly, relatively, progressively) more affordable to do so in November and again in December! That, then, brings us to the end of the charts and graphs. So, let's take a look at what various people ought to be focusing on as they look ahead to the remainder of 2024. If your home is on the market now but not yet under contract... Lower mortgage interest rates seems to be bringing new buyers to the table for many properties. Let's hope that is the case for your home, but let's also examine our current pricing and determine whether an adjustment might be necessary to make your house attractive enough to buyers. If you plan to sell your home in 2024... Preparing your house well will likely be more important than ever this year so let's start developing and implementing those plans sooner rather than later. We'll also need to make sure to price your home appropriately to sell for the best possible price for you -- but also in a timeframe that works best for you. If you plan to buy a home in 2024... If it's been a few months since you talked to your lender, do so again soon. Mortgage interest rates have dropped quite a bit and your projected monthly payments will likely be lower than you had anticipated. Keep in mind that many new listings are likely to go under contract very quickly again in 2024, so be ready to go see new listings quickly and be prepared to make a speedy-ish decision about buying. If you own your home and don't plan to sell it anytime soon... Congrats to you on your (likely) ever increasing home equity. Enjoy the ride, and enjoy the likely low mortgage interest rate on your mortgage. :-) If you're me... Try really, really hard not to run for at least the next few weeks in order to follow the doc's orders and to avoid further injury to my ankle. And for ALL OF YOU reading this market report... If I can be of help to you related to real estate, or otherwise, don't hesitate to reach out. You can contact me most easily at 540-578-0102 (call/text) or by email here. I'll send you another update in about a month... now, who wants to guess how much snow we'll see between now and then? A foot? A few inches? None??? | |

An Increasing Portion Of Home Sales Are New Home Sales |

|

Between 2015 and 2020 the portion of annual home sales that were new homes ranged from between 10% and 15% per year. But... we started to see the share of new home sales increase significantly in 2021 when the shared of new home sales jumped up to 19% of total home sales. Then, in 2022 that rose to 26% and dropped off a touch in 2023 to 25% of all home sales being new homes. A few thoughts regarding this trend... [1] New home sales are and will continue to be an important segment of our local housing market given that our local population is increasing. [2] This increase in the share of new home sales in 2021 (and continuing through 2022 and 2023) coincides with when we started seeing more regional or national home builders in our marketplace. The three main regional or national builders we are seeing develop communities in our area are Evergreen Homes, Ryan Homes and DR Horton. [3] Super low mortgage interest rates between 2019 and 2022 has resulted in a LOT of homeowners currently having very low interest rates (below 4%) on their current mortgages. This will likely result in less turnover (resale) of existing homes over the next year or two so long as current mortgage interest rates stay at or above 6%. | |

My Predictions For The 2024 Real Estate Market In Harrisonburg, Rockingham County |

|

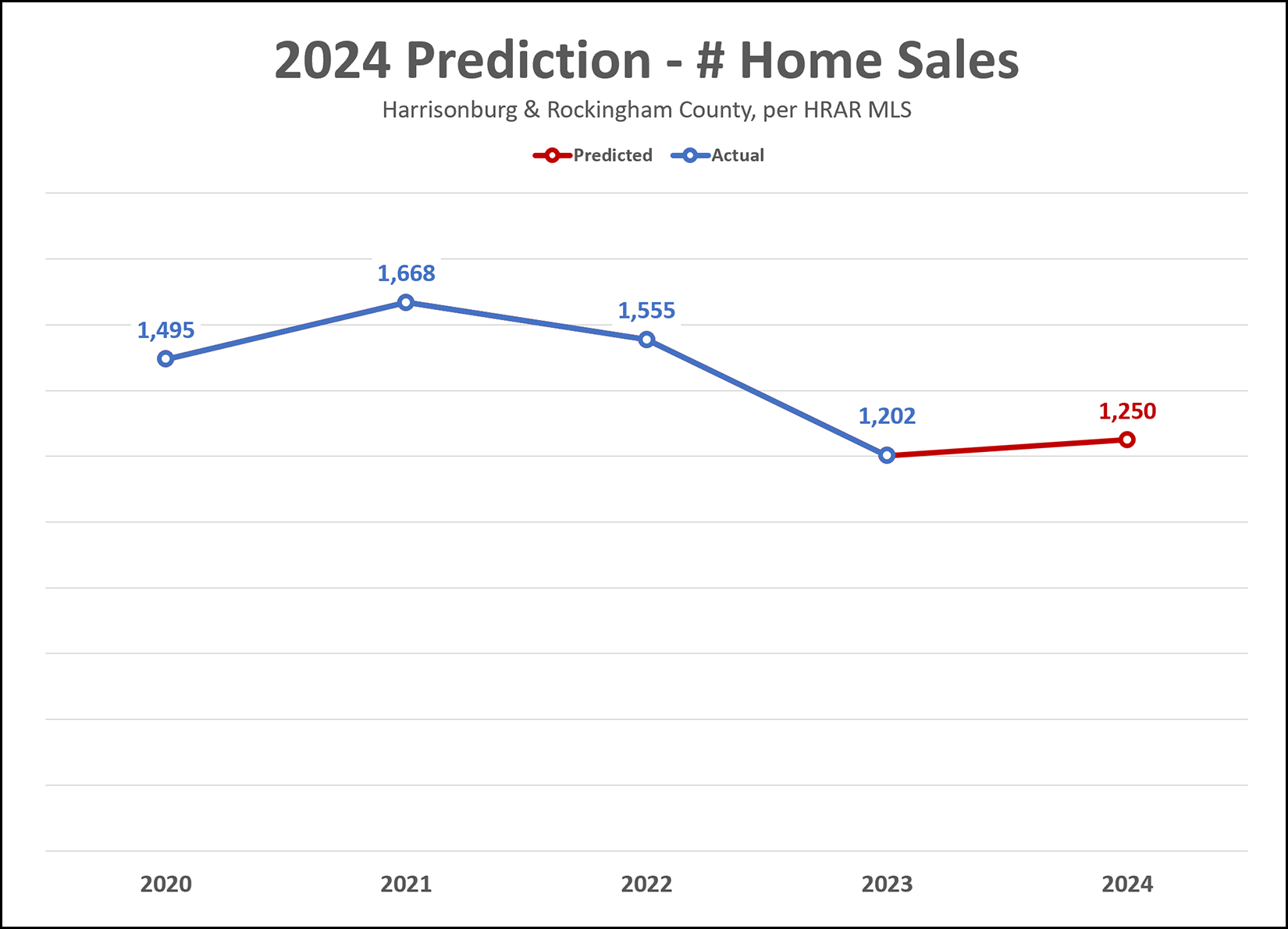

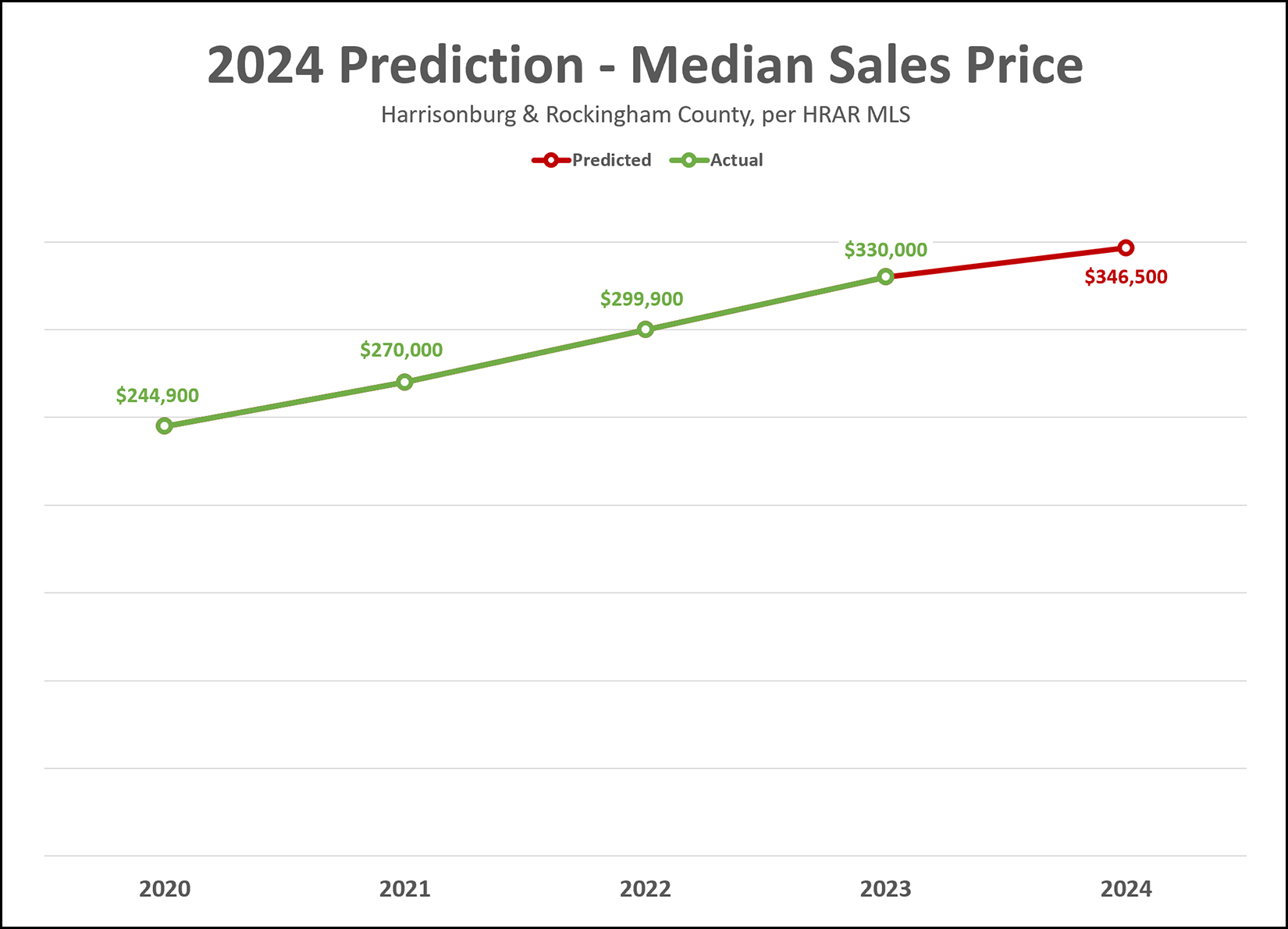

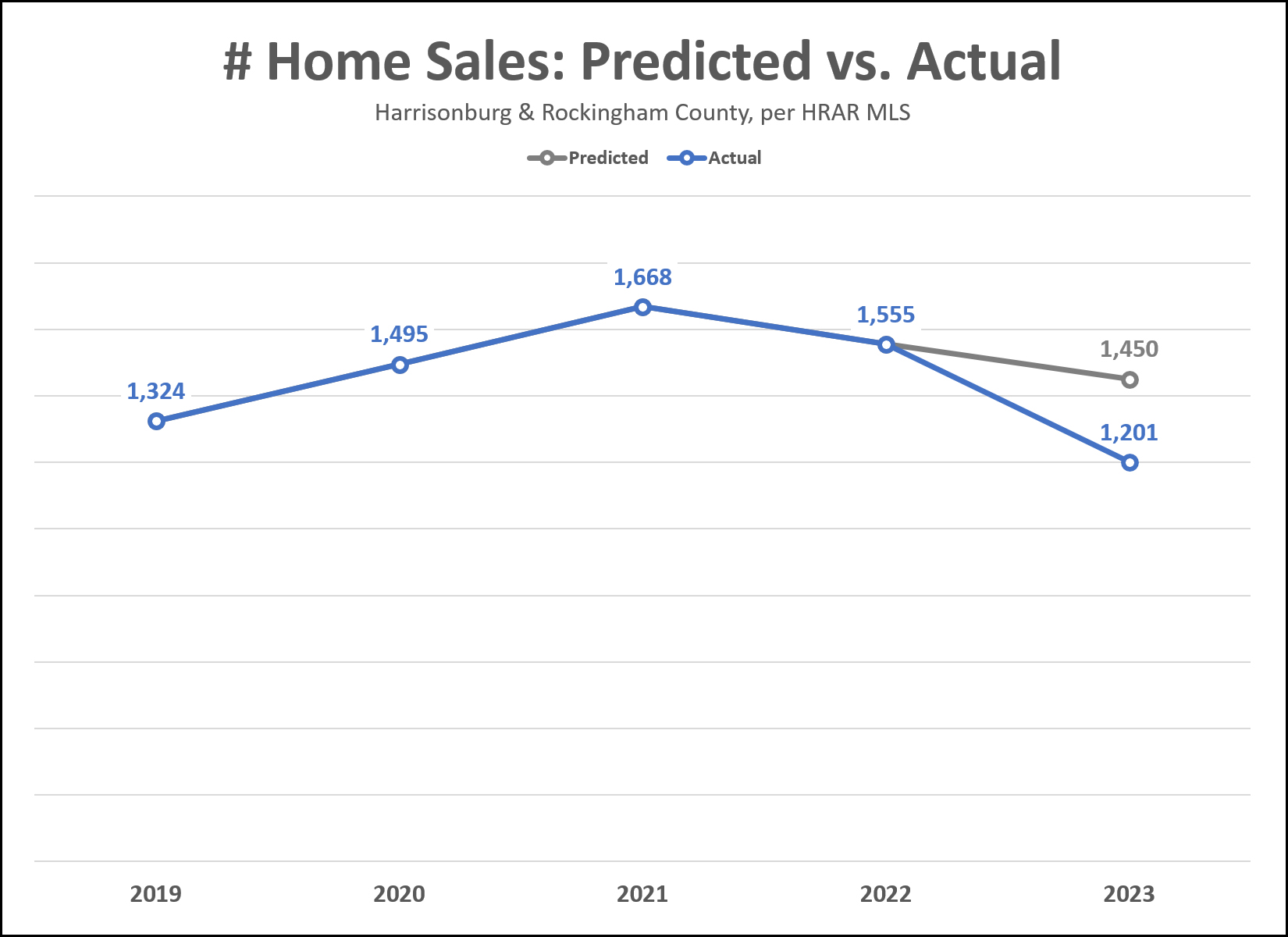

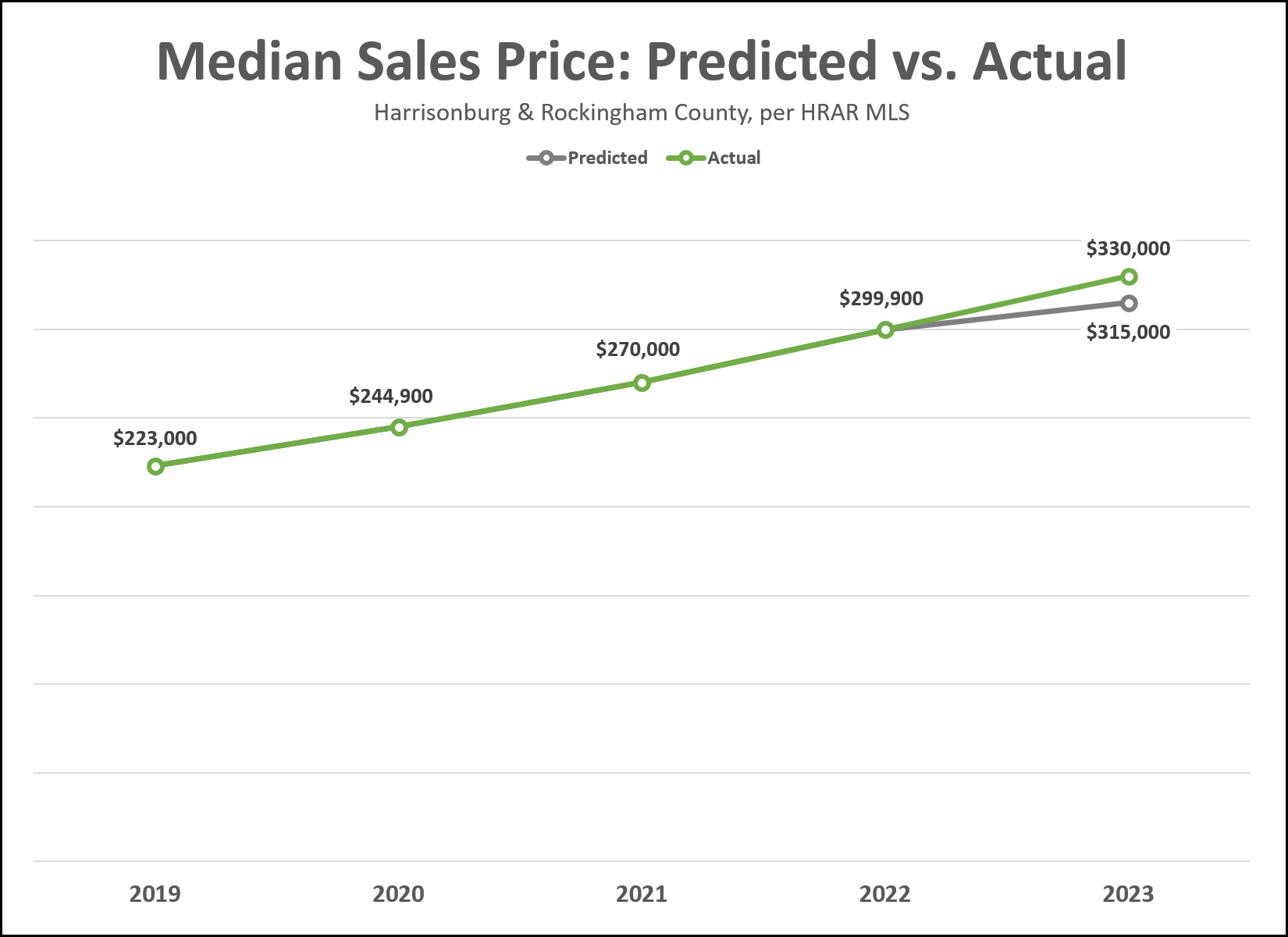

The real estate market has been anything but predictable over the past few years, but read on for my predictions for what we'll see in the Harrisonburg and Rockingham County real estate market this year... 4% Increase In Number of Home Sales As shown above, I am predicting that we will see a 4% increase in the number of homes selling in Harrisonburg and Rockingham County in 2024 -- an increase from 1,202 home sales last year up to 1,250 home sales this year. If we do indeed see 1,250 home sales in 2024 this will be the second slowest year of home sales since 2015. I think we'll see (4%) more home sales this year than last because we are starting to see mortgage interest rates decline after they hit 20+ year highs. Over the past two-ish months the average 30 year fixed mortgage interest rate has dropped from 7.8% to 6.6%. I suspect that lower mortgage interest rates this year than last will lead to slightly more (4%) home sales this year than last. I am not, however, envisioning a 10% or 20% increase in home sales as interest rates above 6% will still likely keep many homeowners in their homes (not selling) if they have an interest rate below 4% -- and most homeowners with mortgages do have rates that low, so long as they have not bought in the past two years. So, I'm predicting we'll see slightly more (4%) home sales this year (1,250) than last, but certainly not much of a rebound towards the 1,400+ home sales we saw in 2020 (1,495 sales), 2021 (1,668 sales) and 2022 (1,564 sales). And how about those sales prices...  We have seen steady gains in the median sales price over the past several years... 2021 = +10% 2022 = +11% 2023 = +10% Despite three years in a row of double digit increases in the median sales price, you'll note that I am only predicting a 5% increase of the median sales price in 2024. I do think that continued buyer demand in the context of limited seller supply will keep prices rising, but I don't think they will rise as much as they have for the past three years. The inflation rate was above 5% between May 2021 and March 2023, which I believe makes the above increases in the median sales price seem even larger than they were once you consider them in the context of changes in inflation and the consumer price index. The inflation rate is now back down to around 3%, but mortgage interest rates (which directly affect house payment affordability) are still above 6%. As such, I think we will continue to see home prices rise, but not quite as quickly as we saw in 2021, 2022 and 2023. But enough about my predictions -- what about your predictions? Will we see more or fewer home sales in 2024 than in 2023? Will we see higher or lower sales prices in 2024 than in 2023? Email me with your thoughts or predictions! | |

Reviewing My Predictions From Last January For The 2023 Real Estate Market |

|

Well... my predictions for last year's local housing market weren't exactly spot on. :-) Let's take a look. Above you'll see actual versus predicted number of home sales in Harrisonburg and Rockingham County within the context of the past few years... [1] We saw a decline in home sales between 2021 and 2022 -- and I was predicting another decline in 2023. [2] I predicted a 7% decline in annual home sales. [3] We ended up seeing a 23% decline in annual home sales! So, yes, the number of homes selling in our area did indeed decline -- but much further than I had predicted. And how about sales prices...  Again, the realities of the 2023 real estate market didn't quite match my predictions... [1] We saw an 11% increase in the median sales price in 2022. [2] I predicted a smaller (5%) increase in the median sales price for 2023. [3] We ended up seeing a 10% increase in the median sales price last year. So... the market slowed down more than I thought it would... and median sales prices rose much more than I thought they would. But don't worry... soon I'll put my prediction failures behind me and will make some new predictions for 2024. :-) | |

The Median Sales Price Of Detached Homes Has Been Rising Faster Than Attached Homes In The City Of Harrisonburg |

|

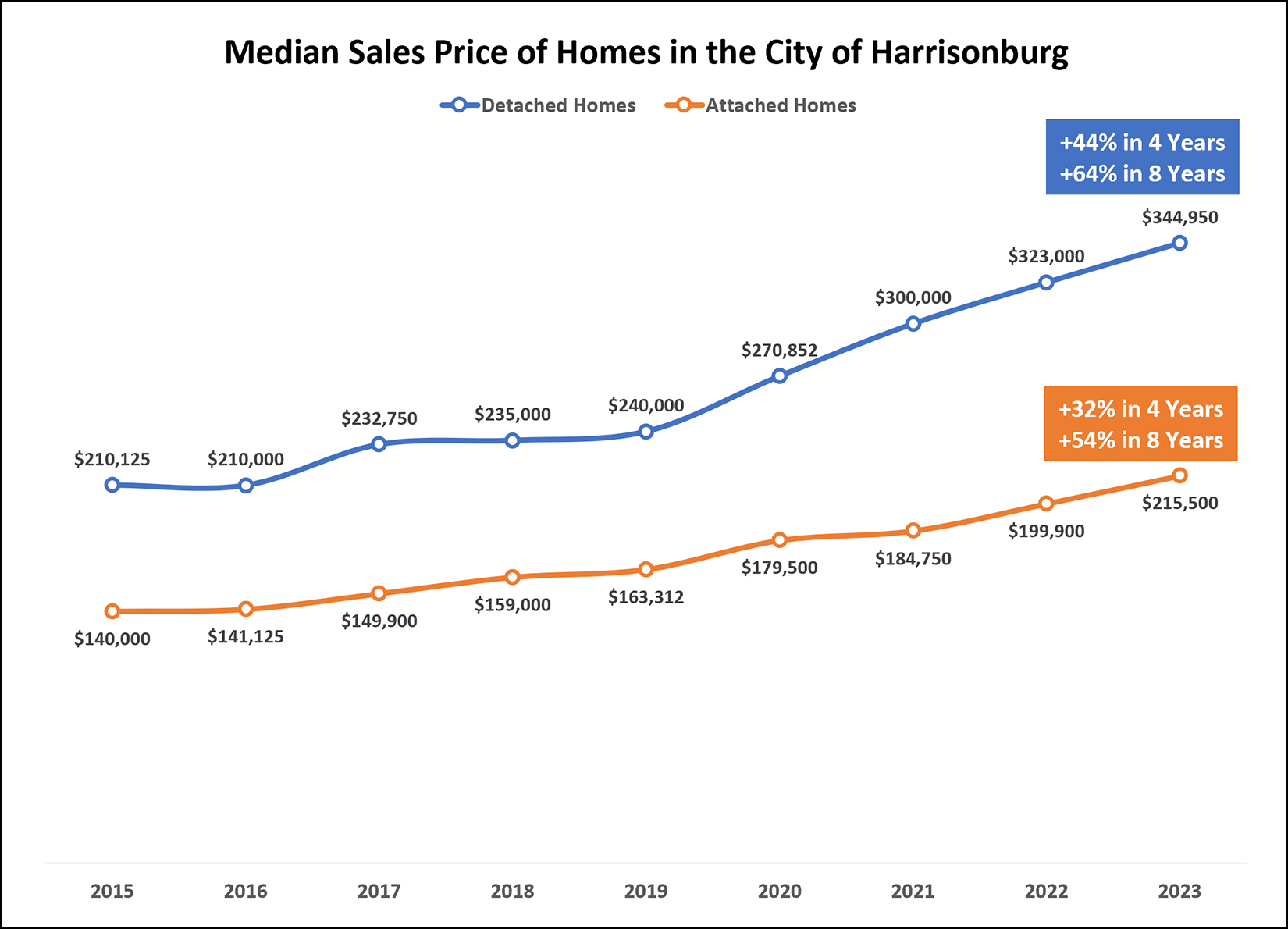

The median sales price both detached and attached homes has been rising rapidly in the City of Harrisonburg over the past eight years -- but the median sales price of detached homes has been rising somewhat faster than that of attached homes. Over the past four years we have seen:

Over the past eight years we have seen:

Looking ahead, I suspect we will continue to see both of these metrics rise... but we will likely still see detached home prices increasing faster than attached home prices. | |

Number Of Homes Selling Per Year In Harrisonburg And Rockingham County |

|

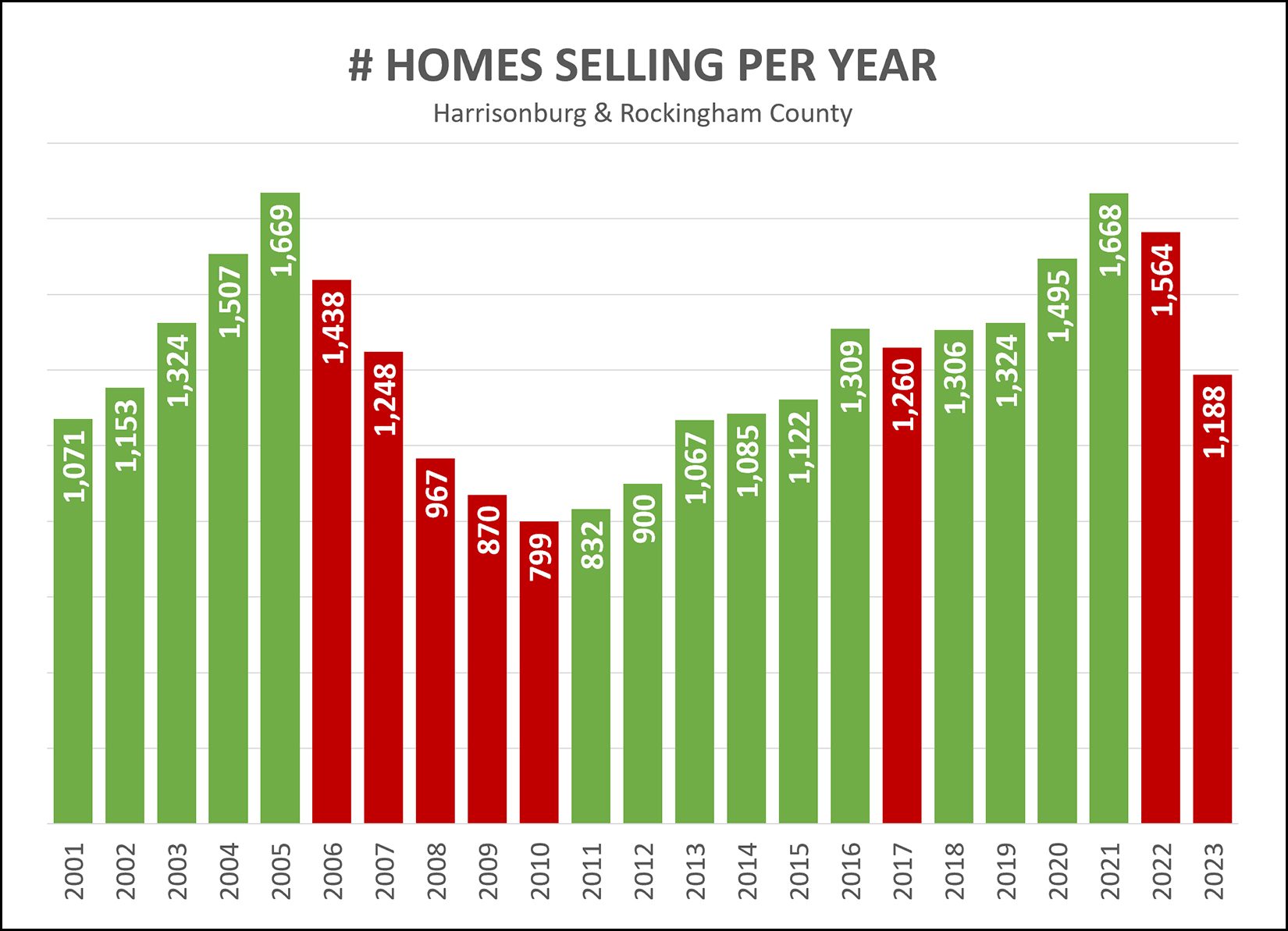

A few more 2023 home sales might be reported in the HRAR MLS over the next week -- but the total shown above will be relatively close to the total number of home sales for Harrisonburg and Rockingham County last year. A few observations about the graph above... [1] The 1,188 home sales that took place last year was the lowest number of home sales since all the way back in 2015. [2] Interestingly, annual home sales peaked in 2005 at 1,669 home sales -- and then again at 1,668 home sales in 2021. Will we ever get up to that 1,670 mark? ;-) [3] After the 2005 peak of 1,669 home sales, we saw declines in the number of home sales for five straight years. Since the 2021 peak of 1,668 home sales we have seen two years of declines -- will we see another in 2024? [4] The peak of 1,668 home sales in 2021 was the culmination of a long run of year after year growth in annual home sales with 10 out of the 11 previous years showing an increase (green bar) in annual home sales. Mortgage interest rates jumped to 22 year highs in 2023, which significantly impacted the number of homes that sold. Now that mortgage interest rates are coming back down, somewhat, will that result in a leveling off of the decline in the number of homes that are selling? I think it is too early to predict whether we'll see more 2024 home sales than in 2023 -- but I'll go ahead and make predictions anyhow in the coming days. :-) | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings