Negotiations

| Newer Posts | Older Posts |

200 Home Buyers Paid More Than 5% Over Asking Price For Their Homes In The Past Year |

|

Sometimes, you have to be willing to pay the price to get the house... Over the past year-ish (Feb 7, 2021 - Feb 6, 2022) there have been 1,660 home sales in Harrisonburg and Rockingham County. As noted earlier this week, 73% of buyers paid full price or more for their home -- which is 1,229 of those 1,660 home sales. But going a bit further... 200 buyers paid more than 5% over the asking price for the home they purchased in the past year. Looking just at those 200 transactions where buyers paid more than 5% over the asking price... on average, buyers paid $25,561 over the list price! How does that number strike you? It was much higher than I thought it would be... I guess the guy in the photo above is holding out $40,000 of cash -- slightly higher than the average of $25,561 noted above -- sorry for my illustrative exaggeration. ;-) | |

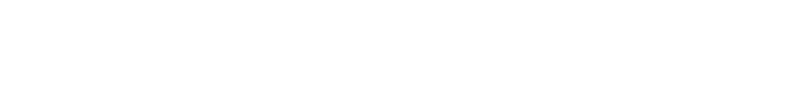

74% of Homes Sold for Full Price or Higher in the Past 12 Months! |

|

A somewhat shockingly high number of homes sold at or above asking price over the past year...

So, what does that mean for you if you are selling or buying in 2022? SELLERS: If you want to sell for $400K, you likely don't need to list your home for $420K in order to leave yourself room to negotiate down on price. Listing it for $400K will likely do the trick, and might result in the house selling for more than $400K. BUYERS: Understand that you are likely to need to pay full price or higher for the house you plan to buy -- though that needs to be put in the context of the value of the home. Certainly, if a $400K house is listed for sale for $475K then you shouldn't pay full price or higher... Understanding the local real estate market is more important than ever for buyers and sellers in 2022! | |

Home Inspection Contingency Modifications |

|

In this competitive real estate market -- when buyers are often finding themselves competing with multiple other buyers for their perfect home -- some buyers find themselves considering whether to make an offer without a home inspection contingency. Certainly, an offer without a home inspection contingency is likely to be seen by the seller as a stronger than an identical offer with an inspection contingency. Of late, I have seen some buyers (or their agents) trying to find space between having a home inspection contingency and not having one. Here are three modifications of home inspection contingencies I have seen lately that don't seem to be all that helpful... Repairs Will Only Be Requested If Total Repair Cost Exceeds $1,000 - I suppose this is intended to communicate that a buyer won't ask the seller to make small or minor repairs, but most sellers still see this as being almost identical to a regular old home inspection contingency. After all, just about every inspection report has enough needed small repairs that they would have a total cost of over $1,000. So, this ends up being some "feel good language" that doesn't actually make an insightful seller feel any better than a contingency without the language. Inspection For Informational Purposes Only - This is usually accompanied by language that allows a buyer to terminate the contract if they do not like what they find during the home inspection, so this modification really just seems to be a promise to terminate the contract instead of asking for repairs if there are issues. This often isn't seen as much stronger than an offer with a regular old home inspection contingency. If There Are Issues, Buyer Will Request Repairs, Not Terminate - Again, I think this is often intended to try to make the seller feel better about the inspection contingency. The buyer is promising not to just give up and walk away -- they will at least request repairs and try to work things out. But, this one is also pretty subjective -- those repairs that are requested (instead of terminating the contract) can be requested in a manner that would make it almost impossible to come to an mutually acceptable resolution -- essentially working a buyer back towards being able to get out of the contract, technically by having required repairs instead of having terminated the contract. I have nothing against a buyer (or buyer's agent) trying to soften the impact of a home inspection contingency -- but most sellers look at things in a bit more of a black and white perspective -- is there an inspection contingency or not? So... instead of spending lots of time and energy trying to fine tune the language of a cleverly crafted modification of an inspection contingency... focus on deciding whether you want the opportunity to reconsider whether you will purchase the property after having gathered additional information during a home inspection. If you do want the chance to reconsider the purchase, then you're going to have an inspection contingency - and regardless of what additional language you add in to try to soften the impact of that contingency - a seller is almost certainly going to see it as being less favorable than an offer without an inspection contingency. | |

Why In The World Are You Buying A House Without A Home Inspection?? |

|

Yes, sometimes buyers these days are making offers on houses without a home inspection contingency. As Paige asked yesterday... Is everyone else in the world significantly more handy, a better gambler, or just have that much cash laying around? Good question, Paige! :-) Here are some of the reasons why buyers are making offers without home inspection contingencies...

A few more thoughts and observations...

Home buyers have some difficult decisions to make these days as they formulate a plan for pursuing a house in a housing market with very low supply levels. Deciding whether to include a home inspection contingency is just one of those difficult decisions. | |

All The Cool Kids Are Offering To Pay Over Appraised Value These Days |

|

Escalation clauses are so YESTERDAY!?! ;-) Not really -- many/most buyers are still using them -- but they don't matter much if an appraisal is going to rein a sales price back in... Consider these three offers on a fictional home listed for $300K...

Hooray, the house sells for $355K to buyer #3, right? Well, probably... though if it then appraises for $300K, then none of the offer prices over the list price or the escalation clauses really amounted to anything. Thus, these days, many buyers are not only asking themselves how high they are willing to go with an escalation clause -- they are also asking themselves how much above the appraised value they are willing to pay for a house. Consider, then, the following three offers on the same house listed for $300K...

Clearly, a seller would toss out the first offer. Some sellers would then immediately jump to the third offer, since it is $10K higher than the second offer -- but -- that depends on your best guess as to the appraised value of your house. If you listed your home for $300K, presumably you think it should sell for around $300K and thus might appraise for $300K. If that is the case, then the second offer above is likely a better choice for you. That offer would stay at $325K even if the appraisal came in at $300K, whereas the third offer would start off higher at $335K but would then drop to $310K if the appraised value were $300K. So, as a buyer -- consider how much above the appraised value you are willing to pay for a house when you are competing with multiple other offers -- and as a seller, consider how an appraisal will impact each offer that you might accept. | |

Several Ways To Think About Appraisal Contingencies |

|

It used to be pretty common for real estate contracts to be contingent on the property appraising at or above the contract price. If a buyer was to be paying $350K for a house -- they wanted to make sure the appraised value was $350K or higher. These days many buyers understand that they might need to be willing (and able) to pay above the appraised value in order to actually buy a home. After all, if a house is listed for $350K and there are six offers on the house, all with escalation clauses and the winning offer is $370K -- that buyer may need to be willing to still pay $370K even if the appraised value ends up being $350K or $360K. Here, then, are a few ways that buyers are thinking about and dealing with appraisal contingencies... Contingent On Appraisal Some buyers are still making offers that are contingent on the appraised value being equal to or greater than the contract price. These offers are often going to be the ones that are least likely to be accepted in a multiple offer scenario if all other terms were the same. It is fine to include this contingency in an offer -- but it greatly reduces the likelihood that the seller will choose to move forward with your offer. An Unspoken But Implied Contingency If you are financing 90% or 95% or 97% or 100% of the purchase price -- even if you don't have an appraisal contingency explicitly included in your contract -- your offer may effectively be contingent on the property appraising at/above the contract price due to the financing contingency. When a buyer is financing 95% of a $250K purchase price -- and the appraisal comes in at $240K, their lender will likely require the buyer to bring extra cash to closing. If the buyer has extra cash -- great. If not, the buyer will not be able to move forward with the purchase as a result of the low appraisal -- even without an appraisal contingency -- because of the financing contingency. A Limited Contingency Perhaps you're offering $310K for a house and you are willing and able to move forward with the purchase so long as the property appraises at or above $300K. As such, you're willing to pay $10K above the asking price. We can make your offer contingent on the property appraising for at least $300K -- which will give the seller more peace of mind because you are willing to pay $10K over the appraised value. Not At All Contingent Maybe you love a house soooo much that you do not even care about the appraised value -- and your financing or cash situation is such that it won't change things if the appraisal comes in slightly or significantly low. In such an instance, we don't need to make the contract contingent on the property appraising at any particular price -- and we might even go so far as to say in the contract that you will proceed with the purchase regardless of the appraised value. In Summary... It's a fast moving market these days and with so many buyers making offers on properties, many buyers are often willing to pay above appraised value for a property that is a great fit for them. It is important to think about and talk about the appraisal process and strategically incorporate (or don't incorporate) whatever contract terms make the most sense given your level of interest in the property, your financing situation, your cash situation, etc. | |

Consider Strategically Crafting An Escalation Clause Based On Your Other Contingencies |

|

So, let's consider this scenario... Offer #1 = $255K Offer #2 = $250K with an escalation clause to increase $1K above all other offers up to $270K Based on this information, buyer #2 wins, right? Their offer is effectively $256K and the first offer is $255K, so the seller would definitely pick offer #2, right? Well -- maybe. What if we had these additional details... Offer #1 = $255K, contingent on the buyer financing 80% of the purchase price, and no home inspection Offer #2 = $250K with an escalation clause to increase $1K above all other offers up to $270K, contingent on the buyer financing 97% of the purchase price and contingent on a home inspection and contingent on the property appraising at/above the contract price I suspect you may see where I'm going with this. In this situation, why would a seller pick offer #2, just for a sales price that is $1K higher, to then voluntarily be subjecting themselves to possible further negotiations related to the home inspection, the appraised value, and with a buyer who would appear to be less financially qualified (3% down payment instead of 20% down payment) than the first buyer? Most sellers would likely pick Offer #1 in this more nuanced scenario. So -- extrapolating from this specific "what if" -- if your offer will include contingencies or terms that are bound to be less favorable to the seller, you may want to consider being willing to pay a higher price compared to other offers. Here's how that might look... Offer #1 = $255K, contingent on the buyer financing 80% of the purchase price, and no home inspection Offer #2 = $250K with an escalation clause to increase $5K above all other offers up to $270K, contingent on the buyer financing 97% of the purchase price and contingent on a home inspection and contingent on the property appraising at/above the contract price Now, the seller has an offer of $255K and an offer of $260K. The higher offer still has more contingencies to work through -- but perhaps they are more willing to do so given that the sales price would be $5K higher in this scenario instead of just $1K higher. So, as you consider that "differential" that you put in your escalation clause -- consider the other terms and contingencies you are including and how they might compare to other competing offers -- and consider adjust that differential accordingly. P.S. No, I'm not an attorney. I'm not offering legal advise. I'm just a Realtor pondering negotiating strategies aloud. Consult with your Realtor about how to draft the most competitive offer on a property based on your situation and that individual property. :-) | |

Strategies For Securing A Contract WITH A Home Inspection Contingency |

|

Some would-be home buyers are, reasonably, not comfortable entering into a contract to purchase a home without an inspection contingency. But...in a competitive market where there are often multiple offers, it is harder to compete as a buyer if one or several of the competing offers does not include an inspection contingency. Of note, we won't really know if competing offers do or do not have inspection contingencies, but when there are multiple competing offers in the current market, it seems that there will often be at least one without an inspection contingency. So, how can a buyer who desires an inspection contingency compete in such an environment? Here are a few ideas... 1. SHORTEN THE TIMELINE Proactively get on a home inspector's schedule so that you can include a shorter timeline in your offer for the inspection contingency to be resolved. 2. REMOVE YOUR OPTION TO TERMINATE The standard home inspection contingency gives you the option to either request repairs or terminate the contract after completing the inspection. Give the seller a bit more peace of mind that you won't just terminate the contract even if the inspection goes reasonably well by removing that second option from your inspection contingency. 3. SACRIFICE YOUR DEPOSIT Consider offering to give the contract deposit to the seller if you cannot work your way through the inspection contingency. This will show that you are committed to making the deal work and successfully getting through the inspection contingency. 4. RAISE THE STAKES If you are including an escalation clause to make your offer $1K above any other offers -- consider raising that threshold, If your escalation clause takes your offer to $276K with an inspection contingency compared to another offer at $275K without an inspection -- the seller will probably choose the offer that is $1K lower without an inspection contingency. But if your escalation clause made your offer $5K higher than other offers, the seller might decide to accept your $280K offer with an inspection contingency instead of the $275K offer without. In the end, it can be a challenging time to secure a contract on a house regardless of the contingencies you want to include -- but including an inspection contingency can make it much more challenging to be successful. If you definitely want that inspection contingency in place, consider any or all of the strategies above to increase your odds of securing a contract to buy a house. | |

How Far Above The Asking Price Are You Willing To Go? |

|

In some long forgotten distance past era I might have asked a buyer if they thought they were willing to] pay the asking price for a house that was recently listed for sale. Now, the question is a bit different. It is more often a question of how far above the asking price you are willing to go when you make an offer. When you are competing with so many other home buyers who are also planning to make an offer it quickly becomes a question of which buyer is willing to pay the highest price for a particular property. Sometimes that top price is guided by past sales prices but more often than not in the current market buyers are deciding that they are willing to pay more than other recent buyers have paid for similar properties. Escalation clauses are being used in many if not most offers these days to allow a buyer to offer one price but commit to increasing their offer to exceed the offering price from other buyers. It is okay to get excited about a list price of a new listing but keep in mind that these days you probably won't be paying that price, you will be paying some amount above that price. Thus, start thinking early about how far above the asking price you are willing to go. | |

Finding Gray Areas In Inspection and Appraisal Contingencies |

|

It's a crazy market right now. There are definitely many more buyers than sellers in most segments of our local housing market. As such, buyers are having to make difficult decisions about what contingencies to include in their offers. The two prime examples are the INSPECTION and APPRAISAL contingencies. INSPECTION...

APPRAISAL...

But maybe there can be a gray area between having and not having these contingencies in your offer? INSPECTION... Perhaps your offer could be contingent on a home inspection, but...

APPRAISAL... Perhaps your offer of $300K could be contingent on an appraisal, but...

These are some basic examples of how to aim for that gray area between overtly contingent and not at all contingent. If you are buying in this market, have these conversations earlier than later to know what levels of contingencies you are comfortable having in your offer to buy any particular property. | |

Should You Waive An Inspection Contingency? |

|

Many buyers in many price ranges are finding it difficult to compete against SOOO many other buyers making offers on a house. They are left asking themselves how to make their offer stand out amidst multiple other competitive offers. As a buyer in this crazy market... Should You Wave An Inspection Contingency? As you might expect, it depends. Here are a variety of perspectives to consider... NO. Don't waive the inspection contingency. There could be serious issues with the house -- a failing foundation, mold in the crawlspace, a leaky roof, broken roof trusses, unsafe electrical wiring, and more! An inspection can help root out most issues with a property to give you a full and thorough understanding of the condition of the property you are purchasing. YES. Waive the inspection contingency. You'll end up spending money on your home over the first few years for maintenance or upgrades anyhow, and even if there are some surprises, you can just lump them into that cost of homeownership. YES. Waive the inspection contingency. The house is only __ years sold. What could possibly be wrong with it at this point? YES. Waive the inspection contingency. How else will I actually secure a contract on a house in such a competitive market!? In the end, I suppose it depends both on the house and you... The House: How old is it? Has it been well maintained? How old are the major systems of the house? Were you able to view the basement or crawlspace during a showing? Were there any red flags? You: Are you relatively handy with home repairs or are you overwhelmed by even the slightest need for improvements? Are you comfortable with risk? How badly do you want to buy a house. I am still recommending that my buyer clients include an inspection contingency in their offers but I am being clear about the downside of doing that as it relates to competing with other offers -- and some of my buyer clients are deciding to waive the inspection contingency after all. | |

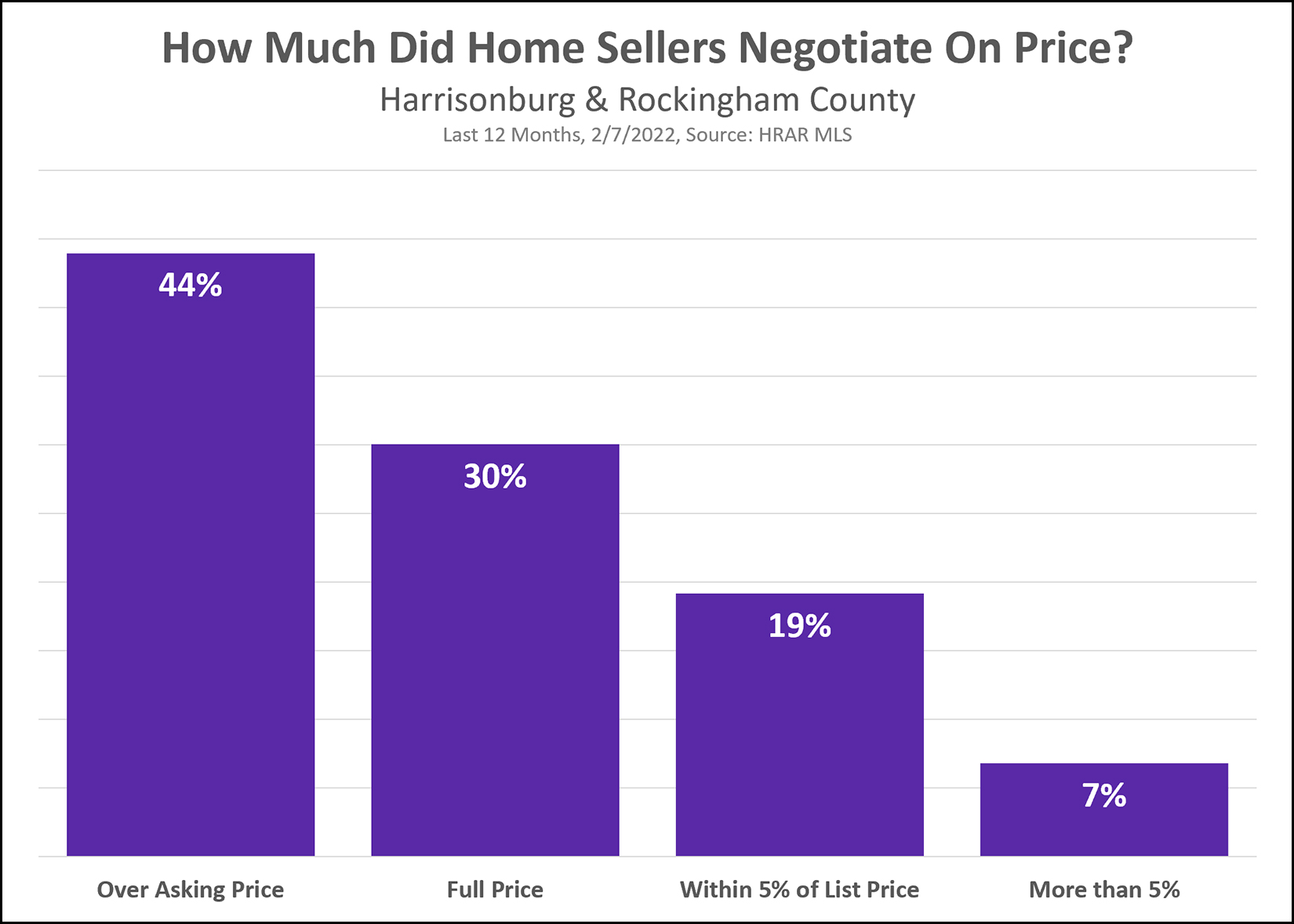

Comparing Home Pricing Strategies |

|

Above I have included an overly complicated illustration of an overly simplified comparison of two pricing strategies. A few key points for understanding the graphic above...

So... the two strategies... STRATEGY #1 In this scenario, the seller decides to price their home just barely above market value. If most would agree that a house is worth $315K, then maybe that is pricing it at $319K. Pricing a home so close to (but just above) what you believe to be its market value is likely to (in this market, now) generate a LOT of showings. A fairly priced house in a market with extraordinarily low inventory levels results in a lot of early showing activity. Houses listed for sale with prices very close to their market value also typically see quite a few offers, which leads to the most important differentiation between these two pricing strategies... With so many offers, you are bound to have a buyer or buyers who are willing to go above the asking price, maybe with an escalation clause, maybe with an escalation clause that goes up to a silly/high number, maybe without a home inspection contingency, maybe without an appraisal contingency, maybe cash, etc. You see where I'm going here. The more offers you have, the more likely you are to have an offer (amongst the many) with terms that will be very favorable to you. STRATEGY #2 In this scenario, the seller decides to price the house a good bit above the assumed market value, you know, because the market is strong! If most would agree that a house is worth $315K, then maybe that is pricing it at $329 or $335K. Even if most buyers (and buyer agents) suspect the price is a bit too high, you are likely still to have a good number of showings, though definitely not as many as if you had priced the home closer to its market value. Of the smaller group of buyers who looked at the home, you are likely to have a smaller number who make an offer. You'll have fewer offers because the price is not quite as realistic, and because some buyers will assume you won't come down much on your price since you just listed your home, which leads to that key difference again... Having priced your home a good bit above its market value, you are less likely to have full price offers, less likely to have escalation clauses, less likely to have buyers waive an inspection contingency or appraisal, etc. You will likely still have very good terms as far as price, but not great terms. Again -- this is an oversimplification of how to best price your home -- and every house and segment of the market is different -- but at some point you will need to decide what type of a strategy you will take in pricing your home, as to what results you are hoping to see. | |

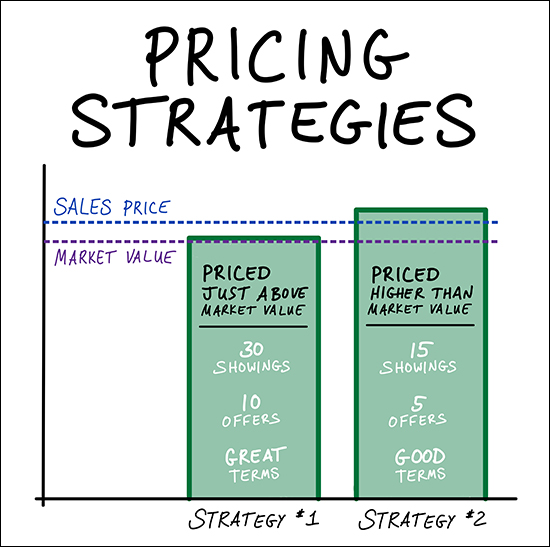

Not Much Negotiability In Home Prices In 2020 |

|

Looking back at a full year of data now for 2020, it is impressive to note that the median "list price to sales price ratio" was 100% for the year. This means that at least half of sellers sold at or above their list price! Home buyers likely aren't surprised by this revelation as they have experienced it first hand if they bought - or tried to buy - in 2020. New listings that are prepared well, priced well and marketed well are receiving multiple offers within days of hitting the market. Oftentimes, buyers are not discussing whether to make a full price offer - they are discussing how far above list price to go with their offer. Home sellers must still remember that this is not a blank check. Just because buyers are so eager to buy that they are often going above list price does not mean that you can list your home for any price you'd like. If your home is potentially worth $300K in the market right now, you ought not list it for $350K and then be surprised when you don't have a rush or showings and don't have any offers. You still need to price your home based on recent sales, though you might be able to round up a bit more than you had in the past when pricing your home. I expect this dynamic (most homes selling for the list price or higher) to continue as we move through 2021. | |

It Is Hard For Home Buyers To Compete If They Have A Small Downpayment Or If They Need Closing Cost Assistance |

|

A few short years ago...

These days...

A few short years ago...

These days...

So, it's not that you can't buy a home with a small down payment or if you need a closing cost credit -- but it will be a lot harder to do so these days, largely because of other competing buyers who have a larger down payment and/or who do not need a closing cost credit. | |

How High Will You Go When Competing With Other Buyers? |

|

Over the past month I have represented multiple buyers who have made offers on homes where they were competing against anywhere from three to seven other buyers. Given that our market is so high competitive in many locations and price ranges, buyers find themselves facing all sorts of difficulty questions...

The list could go on and on. It's a tough time to be a buyer right now and just because you find a house that you like, and you want to buy, and that you are qualified to buy, and even if you have a lender letter, and even if you see the house on Day 1 and make an offer on Day 1 -- you still might not get the house. There might be someone else who is willing to pay more than you or take more risks than you are, or who has a larger down payment than you have. So, be ready to act fast, and make a strong offer - and be ready to carefully calculate how high you are willing to go on price - but know that you still might not get the house despite your best efforts. | |

Three Ways To Make A Contingent Offer |

|

If you have to sell your current home in order to buy a new home - there are (at least) three ways to do that...

If you're making an offer on a new-ish listing then Option 1 and Option 2 are not likely to be successful strategies to securing a contract on the house you want to buy. The best bet is to wait until you have your house listed for sale AND under contract - Option 3 - because at that point your have positioned yourself (and your home sale contingency) as best as you possibly can from the seller's perspective. A few additional, related, notes...

Selling and buying simultaneously can be tricky, complicated and frustrating -- but it is possible! Feel free to be in touch if you want to talk through the options outlined above as they pertain to your situation. | |

Think Twice Before Ignoring That Low Offer On Your Home |

|

If you have not yet had an offer on your house (that is listed at $300K) and you receive an offer of $250K, that doesn't necessarily mean your house is only worth $250K, nor does it necessarily mean that you should accept $250K or something close to it. It does, however, mean something quite exciting --- somebody wants to buy your house!!! Of course, negotiations won't always work out with low offers -- but recognize a low offer for what it is -- a buyer who wants to buy your house, and perhaps the first buyer who has declared as much through a written offer! If there is any way to put a deal together with those buyers, you ought to pursue it, as it's hard to know when the next buyer will work up the courage to tell you that they want to buy your house! | |

Sometimes Buyers React Irrationally To Home Inspections |

|

The purpose of a home inspection contingency is to allow a buyer to learn more about the property they have contracted to purchase -- and then to request repairs to the property if they discover new issues of which they were unaware when they contracted to purchase the property. For example -- a buyer contracts to buy a home for $250K and believes the electrical wiring and plumbing are all in good condition. The home inspection takes place and the inspector discovers that there are four plumbing connections that are leaking in the unfinished basement. It is then reasonable for the buyer to ask the seller to repair these plumbing leaks prior to closing. They agreed to pay $250K for a house that they did not believe had plumbing leaks -- and thus they request the seller restore the house to being a leak-free house. This is certainly an oversimplification of the matter, as there are often many discoveries during a home inspection -- of varying levels of seriousness or complexity -- but stick with me for now. Back up at our prior example -- rarely would a seller be disappointed, surprised, or unhappy if a buyer asked for plumbing leaks to be repaired. But what is a seller to do when a buyer starts to behave irrationally -- in a way that the seller believes no other buyer would certainly ever respond? For example --

I could go on and on. The point is -- sometimes buyers behave irrationally -- for whatever reason they have decided that they cannot / will not buy the house, and they are going to dig in their feet and make irrational repair requests until the seller finally caves and releases them from the contract. Or, rather, given the standard Virginia home inspection contingency, the buyer just terminates the contract on the basis of the home inspection even though their decision to do so was based on a view of the property condition (and of needed repairs) that is unlikely to be shared by any other buyer, ever. So, what in the world is a home seller to do in such a situation?

Of course, I hope this advice is absolutely never pertinent to you. May you never be in the midst of a home sale -- under contract -- just working your way through contingencies and excitedly anticipating a closing in the near future -- and then have the rug pulled out from under you by a home buyer with unreasonable expectations or demands. But if you do find yourself in this situation, try to move on quickly and be transparent with future buyers -- after getting angry, frustrated and discouraged, of course! | |

How Far Can You Or Should You Round Up The List Price For Your Home? |

|

Sometimes it is tempting for a seller to want to round up their list price. The seller says (or thinks)... "We think the house is worth $240K? And you're saying we should list it for $245K or $249K? I'm optimistic -- I think someone is going to be willing to pay $250K, so let's list it for $260K! A buyer can always make an offer!" That's all well and fine and good -- and somewhat logical -- unless every buyer that comes to see the house in the first three weeks really thinks it is worth $240K. Then, when leaving the house priced at $260K, if they are willing to pay $240K, they are likely thinking they'd need to offer $220K in order to negotiate you down to the value of $240K. And they almost certainly won't make the offer. If a house priced at $260K has been on the market for a few days, most buyers aren't going to make an offer of $220K. They might think it is a waste of their time. They might not want to insult the seller. Regardless of the reason, you are not likely to have $220K offers on a $260K listing within the first few weeks. Thus, the buyer who excitedly came to see your $260K house, and then concluded that it is probably worth $240K (where we started this conversation) is likely to conclude that they should just wait a month or so and see if you eventually reduce the price to $250K -- and then they might consider an offer. But by the time you reduce the price to $250K, you are bound to get significantly less buyer/market attention with that price reduction since it is no longer a new listing. And some of the originally interested buyers will have found something else to buy. And there will be much less urgency for any buyer to make a decision about an offer. | |

Buyers Seem To More Frequently Be Willing To Pay Above Appraised Value For Houses |

|

In today's local housing market we're seeing...

This disconnect (buyers being willing to pay more than appraised value) is likely because of how appraisals are defined and conducted. An appraisal is an indication of the value of a property based on what other buyers have paid for other similar houses in the recent past - often the last six months. What we now seem to be seeing is that today's buyers are willing to pay more for houses than buyers paid zero to six months ago - which can cause an appraisal to come in lower than the price that the buyer had agreed to pay for the house. So, when there is a low appraisal, where do things go from there? It's different in every transaction and it's all negotiable.

If the appraisal on your house comes in low...

Current conditions in your segment of the local housing market will likely ultimately dictate what a buyer and seller will agree to do with a low appraisal. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings