Financing

| Older Posts |

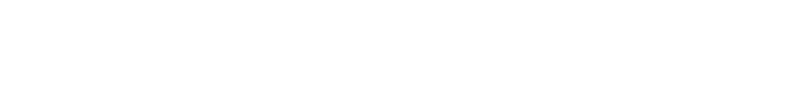

Mortgage Interest Rates Declining Steadily Through Start Of Summer |

|

Outdoor temperatures may have been HIGH during the first few weeks of summer... but mortgage interest rates have been falling! Over the past years, the average 30 year fixed mortgage interest rate has been 7.01%. The average rate peaked last October at 7.79% and then fell relatively steadily through December... but then (mostly) climbed again all the way through May when it hit 7.22%. Since that time we have seen a decline almost every week, and the average rate is now 6.87%. That is nearly a full percentage point lower than the high of 7.79% this past October. Home buyers are certainly enjoying these lower mortgage interest rates though they hope they will continue to decline. | |

Listings Hitting The Market On Fridays Make It Important For Buyers To Have A Lender Letter Ready To Go |

|

A buyers says... I plan to buy a home as soon as "the right one" comes on the market. I talked to a lender six months ago and they didn't have any concerns with being able to approve me for a mortgage. I'll just wait until the right house hits the market and then I'll get a prequalification letter from my lender. This works out OK some of the time to most of the time - but not all of the time. Sometimes a new listing hits the market on a Friday. We might go see it on Saturday afternoon. By the time we are looking at the house there are already two offers in hand and a few more might be received at any moment. If you love the house, and want to make an offer, we might be in a tight spot, because... 1. An offer without a lender letter won't typically go anywhere. 2. An offer with a promise to deliver a lender letter on Monday won't typically go anywhere. Certainly, sometimes a seller won't be making a decision until Monday or Tuesday and sometimes offers don't materialize that quickly. But... if you want to be ready to make an offer on a house that you love when it hits the market, you should already have a lender letter ready to go. | |

Mortgage Interest Rate Fluctuations Do And Do Not Seem Likely To Impact Local Housing Market Activity |

|

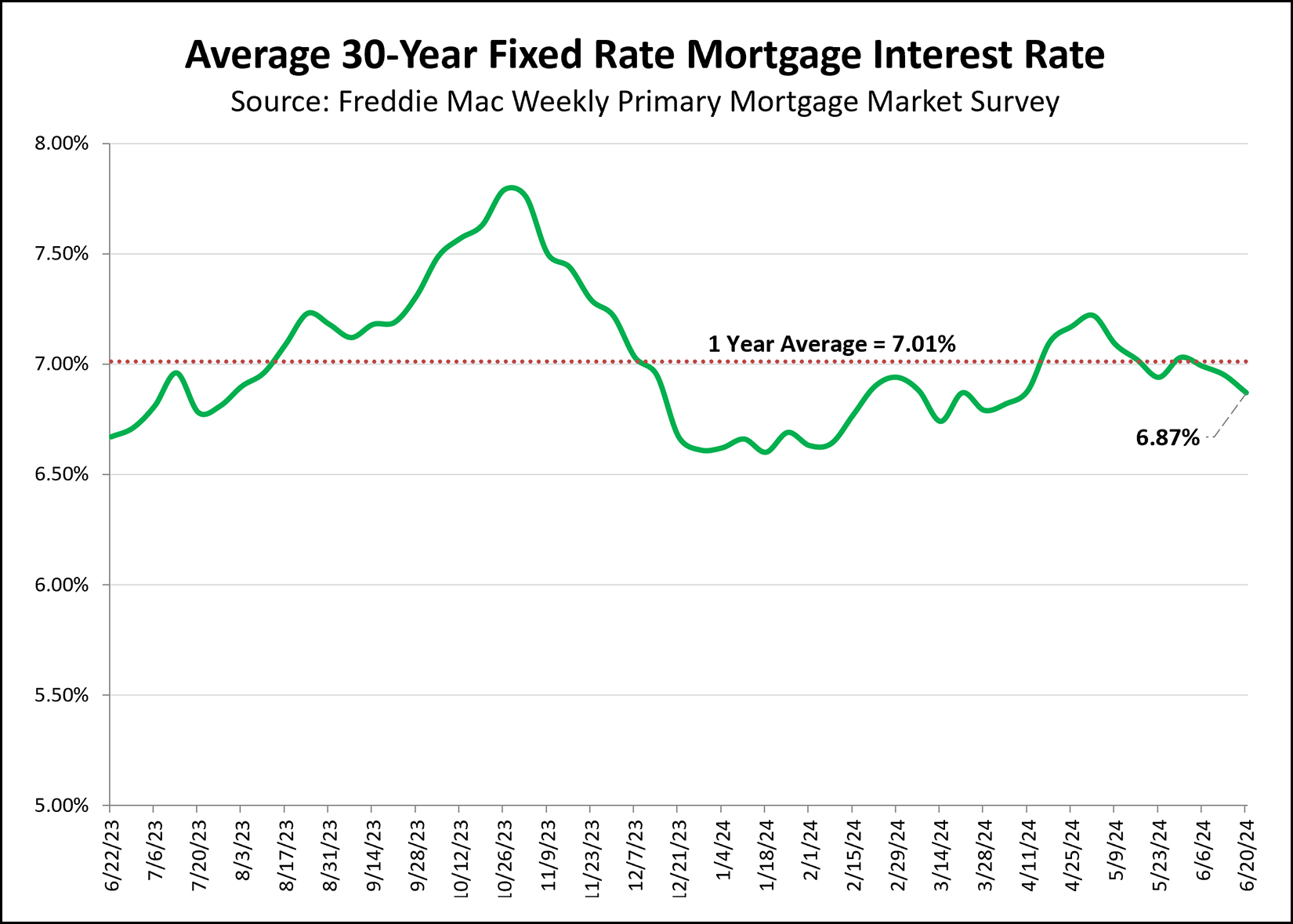

Will mortgage interest rate fluctuations impact market activity in the local housing market? Yes and no. For context, first... Over the past year, rates have fluctuated between 5.75% and 7.75%. That's a pretty broad swing over just a single year. The current average rate of 7.09% is lower than the 7.5% rate we saw six months ago. Rates have been mostly rising over the past four months from 6.6% to 7.1%. So, will rates impact market activity? Yes... if/as rates get back below 7% or closer to 6.5%, more buyers are likely to more seriously consider more offers on more properties. Likewise, if/as rates rise further and if they approach 7.5%, fewer buyers are likely to consider offers. But, no... rate swings between 6% and 7% (for the most part) seem unlikely to drastically change the number of buyers who will choose to buy a home this year. So, if you will be selling a home, you likely don't need to try to time your listing with when mortgage interest rates are lowest. And if you will be buying a home, it will be convenient if the home you like the most hits the market when mortgage interest rates are the lowest... but you'll probably still pursue it if rates are a bit higher when that perfect house hits the market. | |

How Much Can You, And Should You, Spend On Your Next Home? |

|

There are LOTS of ways to answer this question, usually within the context of a monthly payment...

The other question (how much should you spend) could be discussed with your spouse, your family, your loan officer, your peers, me, etc. The most important part -- is to have these conversations. We need to know how much money you can spend and how much you are willing to spend on your new home, so that we can be looking for the right houses for you! | |

A Year From Now, Mortgage Interest Rates Seem Unlikely To Be Much Below Six Percent |

|

The current average 30 year fixed mortgage interest rate is 6.82%. If you are waiting to buy a home until mortgage interest rates fall below 6% you might be waiting a while. A compilation of mortgage interest rate projections by Fast Company (here) show the following projected mortgage interest rates for the first and second quarter of 2025... Mortgage Bankers Association: 5.9% in 2025-Q1 5.8% in 2025-Q2 Fannie Mae: 6.3% in 2025-Q1 6.2% in 2025-Q2 Wells Fargo: 6.0% in 2025-Q1 5.9% in 2025-Q2 It seems that mortgage interest rates may very well stay near, at or above 6% for at least the next year. Read more here. | |

Monetary Policy Enacted By The Fed Contributed To Current Housing Affordability Challenges But Monetary Policy Does Not Seem Likely To Fix The Problem In The Near Future |

|

If you're hoping to understand the current housing affordability challenges (in many or most markets across the US) and how we came to be in the current situation, this article is a good one to read... The Fed won't fix the housing market (Yahoo Finance) Below are a few pertinent excerpts...

Indeed, the drastic rate cuts by the Fed at the start of the pandemic resulted in pandemonium in the housing market with an abnormally high number of buyers seeking to buy a home.

Indeed, both here in the Shenandoah Valley and in many other markets across the country, there is a shortage of housing. And so, what will get us out of this challenging time for housing affordability? It does not seem that the Fed plans to make any rapid or significant monetary policy changes that would impact housing affordability... and, since the Fed doesn't build houses, they won't be creating any further housing inventory. We can likely expect slow interest rate cuts over the next year or two and hopefully we will see continued construction of new residences to house those who already live in the Shenandoah Valley and those who wish to make it their home now or in the future. | |

Home Prices In Harrisonburg, Rockingham County Might Not Shoot Upwards Quickly If Or When Mortgage Interest Rates Fall Because Prices Did Not Drop When Rates Rose |

|

If or as mortgage interest rates drop, will we see home prices shoot upwards? Let's back up a few steps... When mortgage interest rates rose from 3.2% to 7.1% within 10 months (Jan 2022 - Oct 2022) some housing markets saw home prices decline. Understandably, if the mortgage interest rate doubles, a buyer's monthly housing payments will be much higher than the previous year -- directly and immediately affecting housing affordability. Thus, some markets saw prices decline during 2022 at least partially as a result of higher mortgage interest rates. Harrisonburg and Rockingham County, notably, did not see a decline in the median sales price during that (2022) timeframe. Many people in markets (often larger cities) where home prices did decline are now (reasonably) wondering if home prices will spike upwards if or when mortgage interest rates fall. If you are in a market where home prices dropped as interest rates rose... then yes, it is reasonable to think you'll see home prices rise (or rise faster) if or as mortgage interest rates drop. But... back to Harrisonburg and Rockingham County... I am not expecting that we will see an uptick in home prices if or as mortgage rates decline... mainly because we did not see prices drop when rates rose. This is not to say that home prices won't continue to rise in this area -- I think they will -- but I don't think we'll see an increase in home prices specifically related to mortgage rates dropping. | |

If Or As Mortgage Interest Rates Decline, Buyers Will Likely Jump Back In Sooner Than Sellers |

|

Mortgage interest rates peaked this past Fall at 7.79% and have been mostly declining since that time, to current levels of 6.74%. But, 6.74% can still feel high after interest rates were below 5% for 13 years... and below 4% for three years. As mortgage interest rates potentially continue to decline, perhaps back down to 6%, what will we see happening in the market? Will the lower mortgage interest rates spur on more home sales activity? Maybe, but perhaps not as much as you would likely expect. If / when / as mortgage interest rates move back down towards 6% -- or the low 6%'s or the high 5%'s we are likely to see more would be home buyers interested in buying. They will be able to afford higher sales prices and/or their monthly mortgage payment will be lower. But... in order for a home sale to take place... we need both a buyer AND a seller. Many homeowners (would be sellers) have mortgage interest rates below 4%. Quite a few have interest rates below 3%. Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 6% mortgage interest rate? Somewhere between no and probably not? Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 5.5% mortgage interest rate? Somewhere between probably not and maybe? Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 4.99% mortgage interest rate? Maybe? I expect that as we move through 2024 and 2025, and as mortgage interest rates (likely?) continue to decline (at least somewhat) we are likely to see more buyers jumping back into the market before sellers are doing the same. Which means... that we are likely to still see a competitive market... if buyer demand rises more quickly than seller supply. | |

Planning To Buy A Home? Yes, Talk To Me, But Talk To A Lender Too! |

|

If you are getting ready to buy a home -- whether your first or your last -- you will probably have plenty of questions.

If you're new to home buying, or new to the area, you'll probably have more questions than some other buyers, and that is OK! If you're getting ready to buy your fourth home and have lived in Harrisonburg for decades you might have fewer questions than some other buyers, and that is OK too! I am happy to meet with you to talk through all of this, and much more. We can do that in person, by phone, by Zoom, etc. But another important conversation to be having in parallel is with a mortgage lender. Unless you will be paying cash for your home, you'll need a loan to make your home purchase, and having a conversation with a lender sooner rather than later will serve you well. When meeting with a lender you will be...

So, if you're planning to buy a home this spring... Yes, talk to me... but talk to a lender too! Call/text me at 540-578-0102 or email me here. We can set up a time to meet and I can send you contact information for several qualified, professional and responsive local lenders. | |

A Slightly Smaller Downpayment Allows You To Hold Onto Reserve Funds But Does Not Keep You From Paying Ahead On Your Slightly Larger Mortgage |

|

So... you're getting ready to buy a house... but you don't know how much of a downpayment you should plan to make. You have enough savings on hand to pay for your closing costs and have up to a 15% downpayment based on your purchase price. This would leave you with a bit of remaining savings, but not much. Should you... [1] Go for the 15% downpayment, financing 85% of the purchase price, and leaving you with minimal remaining savings? [2] Reduce your downpayment to 10%, financing 90% of the purchase price, and leave a bit more in savings. [3] Reduce your downpayment to 5%, financing 95% of the purchase price, and leaving a solid amount in savings. In most cases, I would recommend scenario #2 or #3. Reducing your downpayment *will* increase your monthly mortgage cost, but it will allow you to have savings on hand in the event that you need to pay some unexpected medical bills, make a major repair on your home, replace a vehicle, etc. And... you will still have the flexibility to pay more on your mortgage payment if you continue to have savings accrue and you want to pay down your mortgage more quickly. So, as you meet with a mortgage lender, don't assume that you will or you should put every last dollar of your savings into your downpayment and closing costs. Explore other possibilities that will result in a slightly larger mortgage but will allow you to still have some savings on hand in case you need them. | |

Lenders Will Likely Want To Compete For Your Mortgage Business Right Now |

|

Mortgage interest rates have been dropping for the past three months -- BUT -- they are still much higher now than where they have been for most of the past 10+years. As a result, we are seeing lower levels of home buying activity, which means fewer mortgages -- and there are definitely far fewer refinances happening right now. All of this means that lenders will very likely want to compete for your business. If you are buying a home, have good credit and maybe even a downpayment -- there will likely be many lenders who would love to finance your home purchase for you. Some general recommendations are... [1] Start by talking to one lender to get a pre-approval letter prior to making an offer. [2] Once you are under contract to buy a home, knowing the specific property and specific price, go back to that first lender as well as several others to compare rates and terms. [3] Try to get each lender to simplify things down as much as possible related to closing costs and monthly payments so you can compare apples to apples. [4] Don't hesitate to take one lender's quote to the other to ask them if they can match or beat it. [5] If two lenders are pretty close in the terms they can offer you, give some preference to a local lender (who you can meet with in person if things go awry) and to a lender that is prompt, professional and detail oriented in their communication. Happy mortgage shopping! | |

Depending On How Long You Plan To Be In Your Home, A Rate Buy Down May Make Lots Of Sense! |

|

One option you will have when finalizing your loan terms with your lender will be buying down your mortgage interest rate. Current mortgage interest rates are right around 6.7% -- but you very likely will have the option to pay some extra closing costs to buy down that mortgage interest rate. The more you pay, the lower that rate will go - and the that lower rate will last for the life of your loan. Of note, if you think you might be selling your home within two to three years, it might not make sense to pay thousands of dollars up front to secure a lower than market interest rate -- but your lender can help you determine the length of time you would need to be in your home to make the cost of the rate buy down make sense. If you know (or believe) you will be in your home for many (many!) years to come, you may very well want to go ahead and buy down that interest rate. There are lots of options to consider when securing a mortgage, and if you have questions about the many different options, feel free to run them by me. | |

Would Be Home Buyers Are Finally Finding (Some) Relief In The Way Of Mortgage Rates |

|

For over 10 years (Feb 2011 - Apr 2022) mortgage interest rates were below 5%. For about 3 years (May 2019 - Mar 2022) mortgage interest rate were below 4%. But since that time, they shot past 6%, past 7% and nearly hit 8%. Perhaps unsurprisingly, many buyers have found themselves priced out of the homes they want to buy over the past year. Not only were these buyers facing ever higher mortgage rates -- home prices were also continuing to climb, with the median sales price increasing 10% over the past year. But finally, some buyers are finding some relief in the way of lower mortgage interest rates. After peaking at 7.79% in October 2023 we have seen the average 30 year fixed rate mortgage drop steadily to it's current level at 6.60%. We're still not back down to 4% or 5% -- but a mortgage payment at 6.6% certainly makes many houses more affordable than they were at 7.79%. If you plan to buy a home in 2024 and you last talked to your lender in October or November of this past year, connect with them again soon -- you will likely be pleasantly surprised at how your projected monthly payment has adjusted given declining rates.

| |

Many Homeowners Are Not Motivated To Sell Their Homes And Do Not Anticipate Being So Motivated Anytime Soon |

|

Over the past five-ish years we were all living in a world of rapidly rising home prices, a fast moving real estate market and super low mortgage interest rates. Thus, if you owned a home but saw another home hit the market for sale that tickled your fancy, you might very well decide to sell your home. After all... [1] Your home was worth a good bit more than it was last year or a few years ago. [2] You were certain to be able to secure a contract on your home very quickly. [3] Your new mortgage payment would be oh, so low given 3% - 4% mortgage interest rates. But... some of these factors have changed now, though admittedly, some have not... [1] Your home is still likely worth a good bit more than it was last year or a few years ago. [2] Your home still relatively likely to go under contract quickly, though that is not the case for all homes any longer. [3] Your new mortgage payment will be oh... so... high !?! given mortgage interest rates above 6%. That last point... the potential housing payment for your new place if you decide to sell... is what is keeping many homeowners right where they are. Most homeowners are not very motivated to sell their homes right now -- because of their current low mortgage interest rate compared to the much higher rate if they sold and bought today -- and that low motivation level to sell does not seem positioned to change anytime soon. | |

Will Your New Years Resolution Be To Buy A House? |

|

For whatever reason, the close of one year and the start of a new year cause many of us to pause and reflect on the big picture. What do we hope will remain the same in the new year? What do we hope to change in the new year? If you are considering a home purchase in the new year, here's one bit of welcome news... Mortgage interest rates have been falling steadily for the past eight weeks! In October, the average 30 year fixed mortgage interest rate peaked at 7.79%. Since that time, they have dropped all the way down to 6.67%. Rates actually started the year (Jan 2023) at 6.48% -- so we're closing out the year a touch higher than that, but things are headed in the right direction. It definitely seems possible that we'll see mortgage interest rates between 6% and 6.5% some time in the first few months of 2024. So, if your new years resolution is to buy a home, let's set up a time to meet to discuss the process and the market -- and you should talk to a lender sooner rather than later to get prequalified for a mortgage. | |

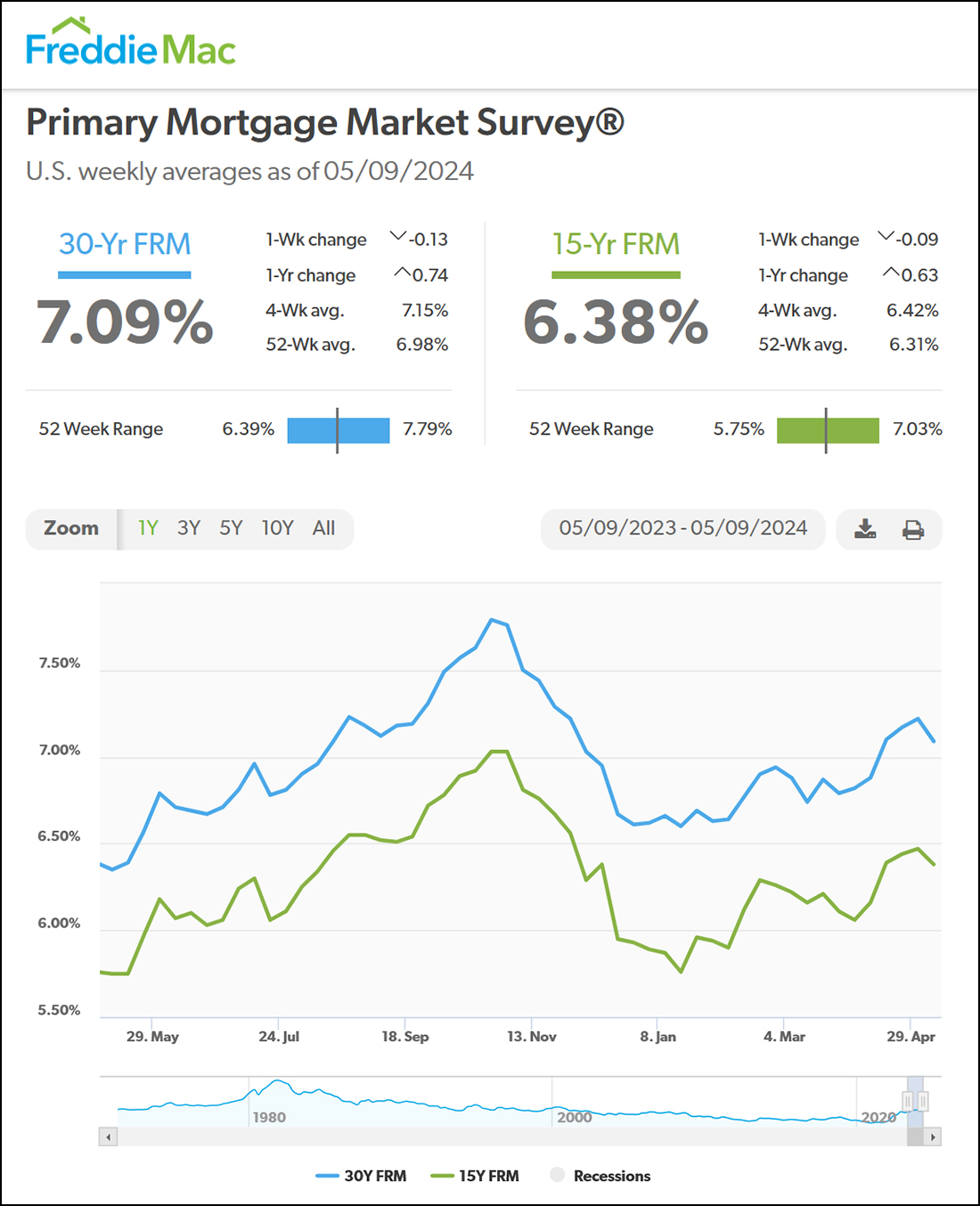

Ho, Ho, Ho, Is Santa Bringing Lower Mortgage Interest Rates For Christmas? |

|

We'll see where the remainder of December takes things, but mortgage interest rates on 30 year fixed rate mortgages have been dropping steadily for the past four weeks. They were all the way up to a peak of 7.79% back in late October. This past week they were all the way back down to 7.03%. Will we see 6 point something before Christmas? | |

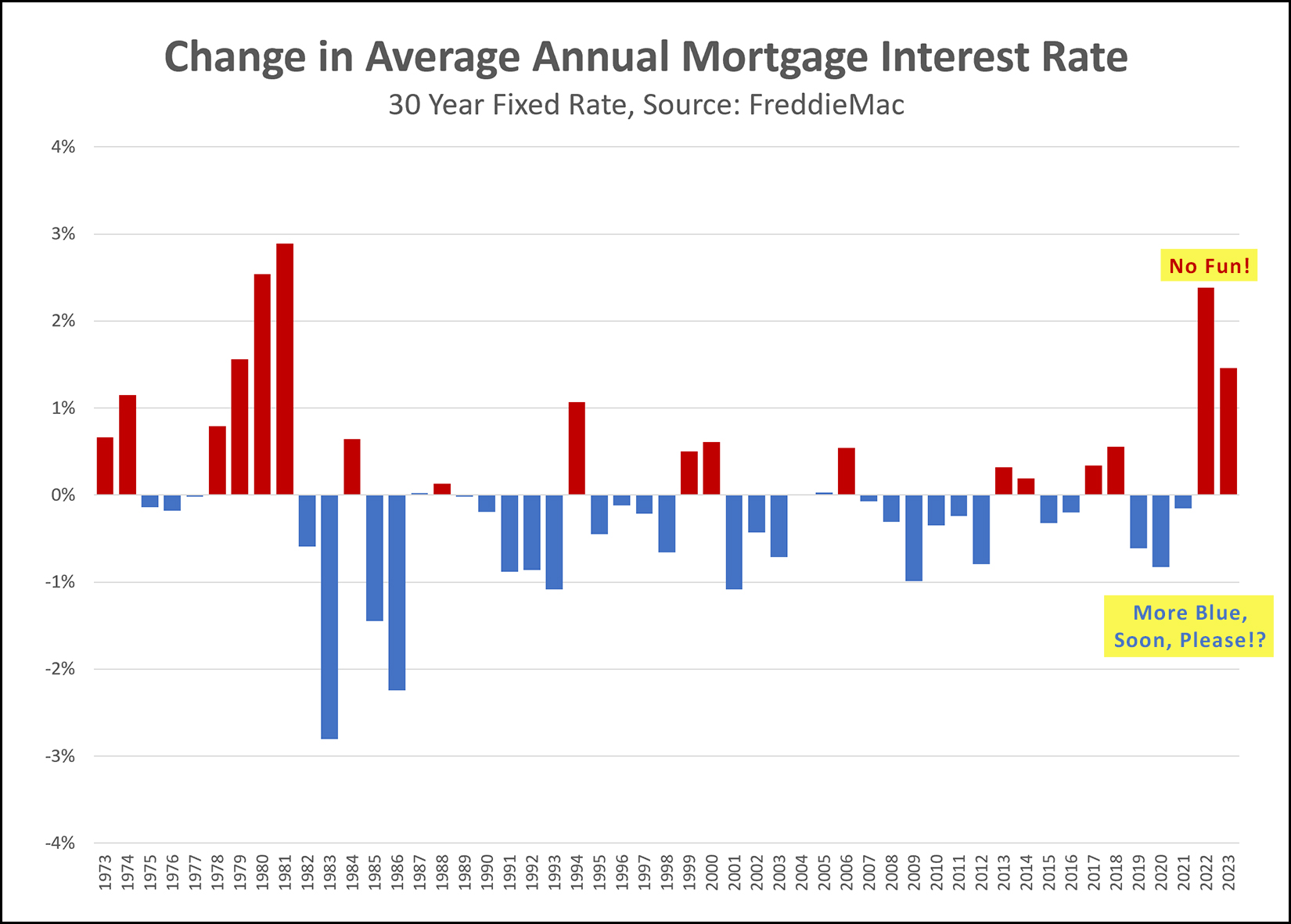

A Rough Two Years For Rising Mortgage Interest Rates |

|

Mortgage interest rates have been declining on a weekly basis over the past month, but... let's not forget exactly where we are relative to the past 30, 40 and 50 years... The graph above shows the amount that the average 30 year mortgage interest rate changed from year to year. All of the red bars are showing years when the average mortgage interest rate increased as compared to the prior year. For example... Between 2003 and 2004 it didn't really change at all.. it increased by 0.01%. Between 2008 and 2009 it dropped 0.99%. But more recently... Between 2021 and 2022 it increased by 2.39%. Between 2022 and 2023 it has increased by 1.46%. So, it has been a rough two years of increasing mortgage interest rates... with the 2022 and 2023 increases being some of the largest increase in the annual average, ever, only surpassed by 1979, 1980 and 1981. Let's hope for a blue bar in 2024 with a decline in the average mortgage interest rate as compared to 2023. | |

Sometimes Upgrade Your Home (Selling And Buying) Results In An Even Larger Upgrade In Your Monthly Payment |

|

"Our house isn't working well for us anymore. We are thinking of selling it and buying a new house." Sounds good, but let's look at a few basic numbers first... You bought for $190K, put $20K down and have a mortgage payment of $955 per month thanks to a refinance a few years back at 3.5%. Your house is now worth $275K and you are thinking of selling it to move up to a house priced at $375K. When you sell your $275K house, you'll end up with about $90K in your pocket after closing costs and paying off the $170K balance on your mortgage. You'll spend about $10K of that $90K on closing costs for your purchase, so you'll put down $80K as a downpayment. You'll be borrowing $295K ($375K - $80K) and you'll be financing it at a current mortgage rate of about 7.25%. Your new monthly payment will be $2,392. Wait... what!? You're moving from a $275K house to a $375K house and your monthly mortgage payment is going to increase from $955/month to $2,392/month. Yikes! Why is this happening? [1] Your current mortgage payment is based on your initial purchase price of $190K... which is a good bit lower than your home's current value of $275K. [2] Your current mortgage payment is based on on a mortgage interest rate of 3.5%... which is a good bit lower than the current rate of 7.25%. [3] The costs of selling and cost of buying reduce the amount of equity that you can roll from one home into the next. So... before you dive right into upgrading your $275K house (with a $955/month payment) to a $375K house... let's run your version of the numbers above to help you determine your new potential monthly payment. | |

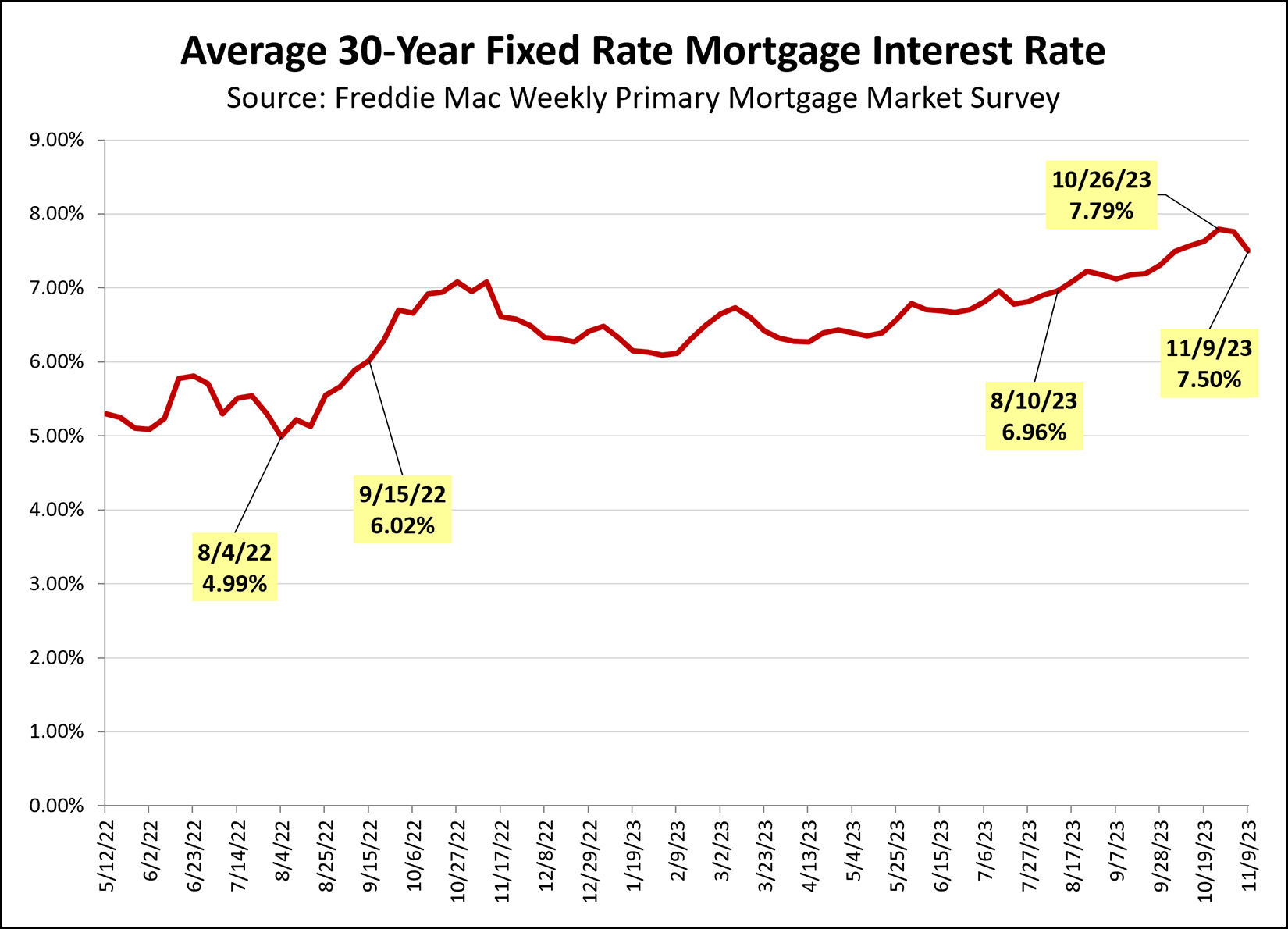

Checking In On Mortgage Interest Rates |

|

Mortgage interest rates have been declining for the past two weeks... or "plunging" as I saw it described in one news article. Let's put it all in a bit of a larger context. Mortgage interest rates rose above 7% in August... ...they peaked two weeks ago at 7.79%... ...and they have now dropped back down to 7.5% as of last week. Looking back further... ...rates rose above 5% in August 2022... ...and then very shortly thereafter rose above 6% in September 2022. I suspect we will see rates above 6% for at least the next year. I think it's possible that we'll see rates get down to 7% over the next few months, but if they stay above 7% I won't be completely surprised. If you are planning to buy a home, it will be important to check in with your mortgage lender for an updated payment projection. Here's a potential payment in Rockingham County for a $300K purchase with 90% financing... 7.79% mortgage interest rate = $2,175 / month 7.5% mortgage interest rate = $2,121 / month 7% mortgage interest rate = $2,029 / month 6.79% mortgage interest rate = $1,992 / month Lower or higher mortgage interest rates certainly affect a monthly payment pretty quickly. A full 1% drop from the peak of 7.79% down to 6.79% would reduce your mortgage payment by $184 / month. Let me know if you'd like some recommendations for qualified local lenders with whom you could talk through a variety of financing scenarios. | |

Monthly Housing Payments Are High But Seem Unlikely To Be Lower Over The Next Year |

|

Mortgage interest rates are higher they have been in over 20 years. Home prices are higher than they have ever been. Combine these two factors and you'll find monthly housing payments that are high. Quite high. Too high? Some would be home buyers are hesitating to move forward with a home purchase because of how high the monthly mortgage payment will be on their new home. This is understandable and quite reasonable. If your lender approves you for a mortgage payment of $2500 per month but you are only comfortable committing $2200 per month to a housing payment then perhaps you shouldn't buy that house that you love that would require a $2500 monthly housing payment. But... if you decide not to buy now (or soon) you probably shouldn't come to that decision within the context of waiting to buy in six to twelve months when you hope to have a lower housing payment. After all... what would we need to see in order to be experiencing lower housing payments? We'd need to see either... [1] Meaningfully lower mortgage interest rates -- which most economists don't seem to think will be showing up anytime in the next year. [2] Lower home prices -- which don't seem likely to exist anytime in the next year. Is it possible that mortgage rates will decline back to 5% or 6%? Sure, it's possible - but it doesn't seem likely, at all. Is it possible that home prices will decline over the next year? Sure, it's possible - but it doesn't seem likely, at all. So, a year from now, you'll likely have a very similar mortgage payment as you would have today -- or possibly even higher. Now, for all you contrarians out there -- tell me I'm wrong -- and tell me how. Will mortgage interest rates decline over the next year? Will home prices decline over the next year? | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings