Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Thursday, December 20, 2012

The bulk of Preston Lake subdivision (mostly undeveloped building lots) was foreclosed on in 2011, but last week was purchased by a neighboring land owner --- a developer from Maryland.

After some further research, here is what was conveyed:

- 82 platted single family home lots

- 109 platted rowhouse lots

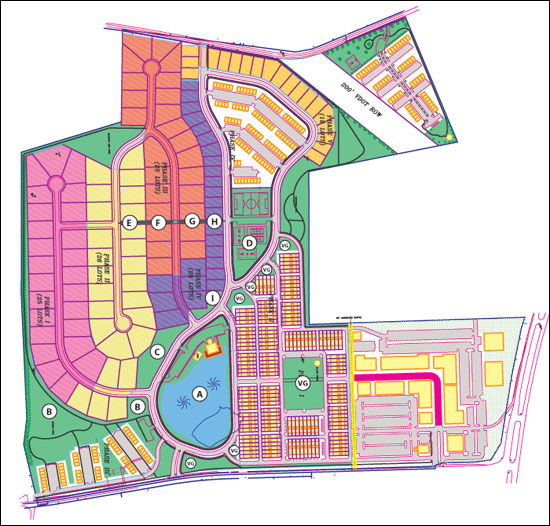

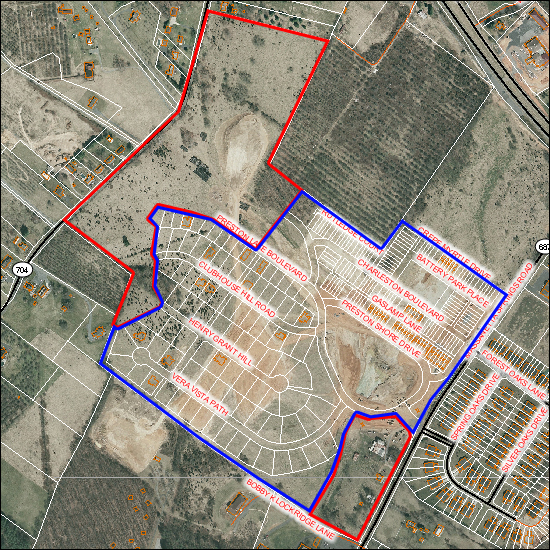

- 43.5 acres that have not yet been platted, but are planned to include:

- 28 single family home lots

- 202 rowhouse lots

Thus, if we ignore the fact that roads, water and sewer need to be installed on those 43.5 acres (outlined above in red), this was essentially the purchase of:

- 110 single family home lots

- 311 rowhouse lots

And here is a bit of context on the purchase price:

- $20,500,000 = the amount of the loans that were foreclosed on in 2011

- $4,530,000 = the appraised value at the time of the foreclosure

- $3,500,000 = Wells Fargo's opening bid at the foreclosure sale

- $2,000,000 = last week's sales price to Preston Lake's new developer

So, how much was paid for each lot? Well, let's assume that a single family home lots is worth twice as much as a rowhouse lot --- and that a finished lot (with infrastructure) is worth twice as much as a planned lot. If that were all the case, this new developer essentially paid:

- $9,950 per platted single family home lot (82 in total)

- $4,975 per platted rowhouse lot (109 in total)

- $4,975 per planned single family home lot (28 in total)

- $2,488 per planned rownhouse lot (202 in total)

If you refer back to the amount of debt that was foreclosed on ($20M) and compare that to the new purchase price ($2M) we can assume that the previous developer's lot basis was 10 times higher ($100K for single family home lots, etc).

Stay tuned!

UPDATE: After further review of the deed transferring the property from Wells Fargo, I am now noticing that the new developer has agreed to pay a "Subsequent Fee" to Wells Fargo of 2% of the gross sales price of any of their newly acquired properties (building lots or lots where they have built homes) when it closes. This only applies to transfers within the first five years.