Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Wednesday, October 15, 2025

Happy October, Friends!

It's my favorite time of year! Cool and crisp mornings and evenings, but warm afternoons. The beautify of trees changing colors - viewed from near and far. Fun with family and friends at JMU football games. My birthday. ;-) Plus, the Harrisonburg Half Marathon, which is always a blast.

I hope you are enjoying October as well... what are some of your favorite parts of this month or this season?

While you think on that... a few precursors to my monthly analysis of our local housing market...

[1] Monthly Giveaway

Each month, I offer a giveaway to the readers of my monthly market report... and this month you have the chance to win a $50 gift card to... La Morena, over on Chicago Avenue! Enter here for a chance to win the gift card to La Morena... or let me know if you want to meet me over there for lunch one day!

[2] Do you receive my Daily Real Estate Newsletter?

Each weekday (M-F) I send out a quick note related to our local market, the buying and selling process, and more. Recent stories have included...

What to Expect When You Make an Offer with a Home Sale Contingency

Be Careful What You Say During a Showing

Rates Are Lower… Does That Mean I Should Refinance?

Why Sellers Are Sometimes Quickly Accepting the First Offer They Receive

How Price Impacts Buyer Interest, Even in the Same Neighborhood

Be Careful What You Say During a Showing

Rates Are Lower… Does That Mean I Should Refinance?

Why Sellers Are Sometimes Quickly Accepting the First Offer They Receive

How Price Impacts Buyer Interest, Even in the Same Neighborhood

Stay informed by subscribing to this daily email in addition to receiving my monthly market update.

[3] Ready to Buy or Sell in October or November?

If you will be selling your house soon, or if you are starting to consider a home purchase, I'd be delighted to help you with the process. Reach out anytime by phone/text at 540-578-0102 or by email.

Now, on to the latest trends in our local housing market!

First, a big picture look at Harrisonburg and Rockingham County...

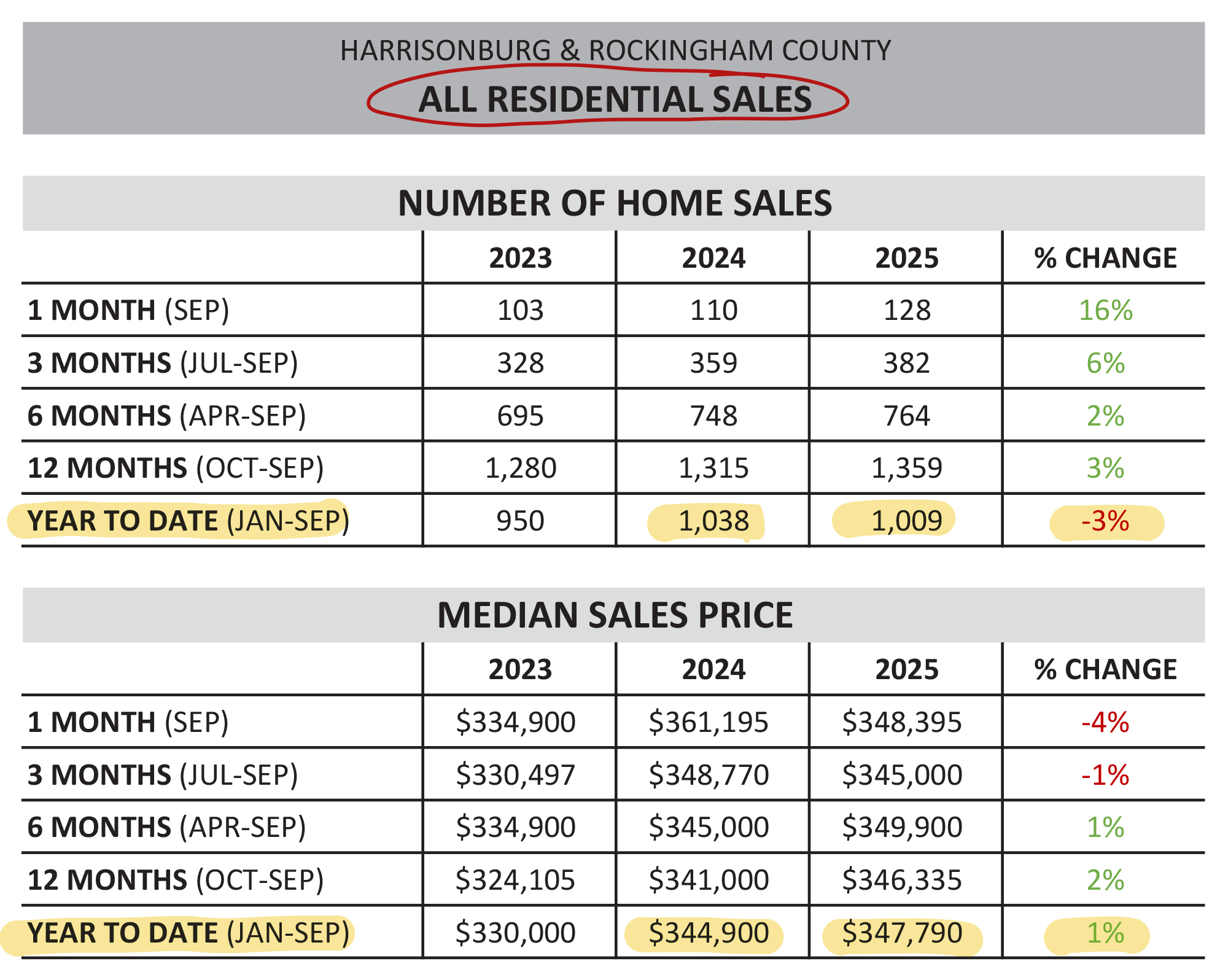

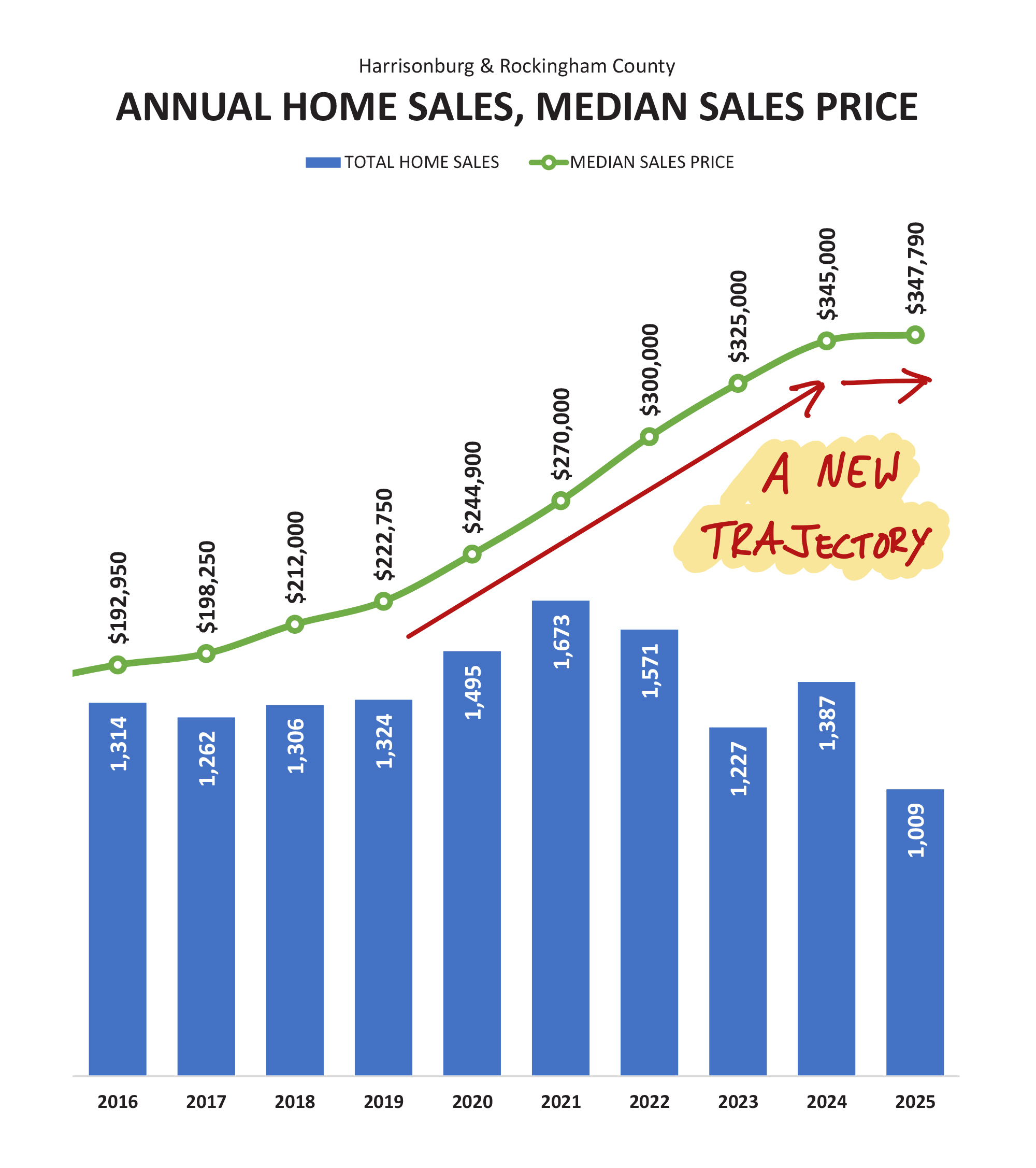

As referenced in the headline... we are seeing slightly fewer home sales this year than last. In the first nine months (Jan-Sep) of last year we saw 1,038 home sales in Harrisonburg and Rockingham County... while there have only been 1,009 home sales this year. That 3% decline in the number of homes that are selling is not a huge shift, but it may be related to why we are seeing smaller price increases and rising inventory levels.

As also shown above, the median sales price has only increased 1% over the past year... from $344,900 in the first nine months of last year... to $347,790 in the first nine months of this year. So, slightly fewer home sales... and only a tiny increase in the median sales price.

We'll get a bit of further insight when we look at only detached homes, followed by only attached homes. Here are the latest numbers for detached homes...

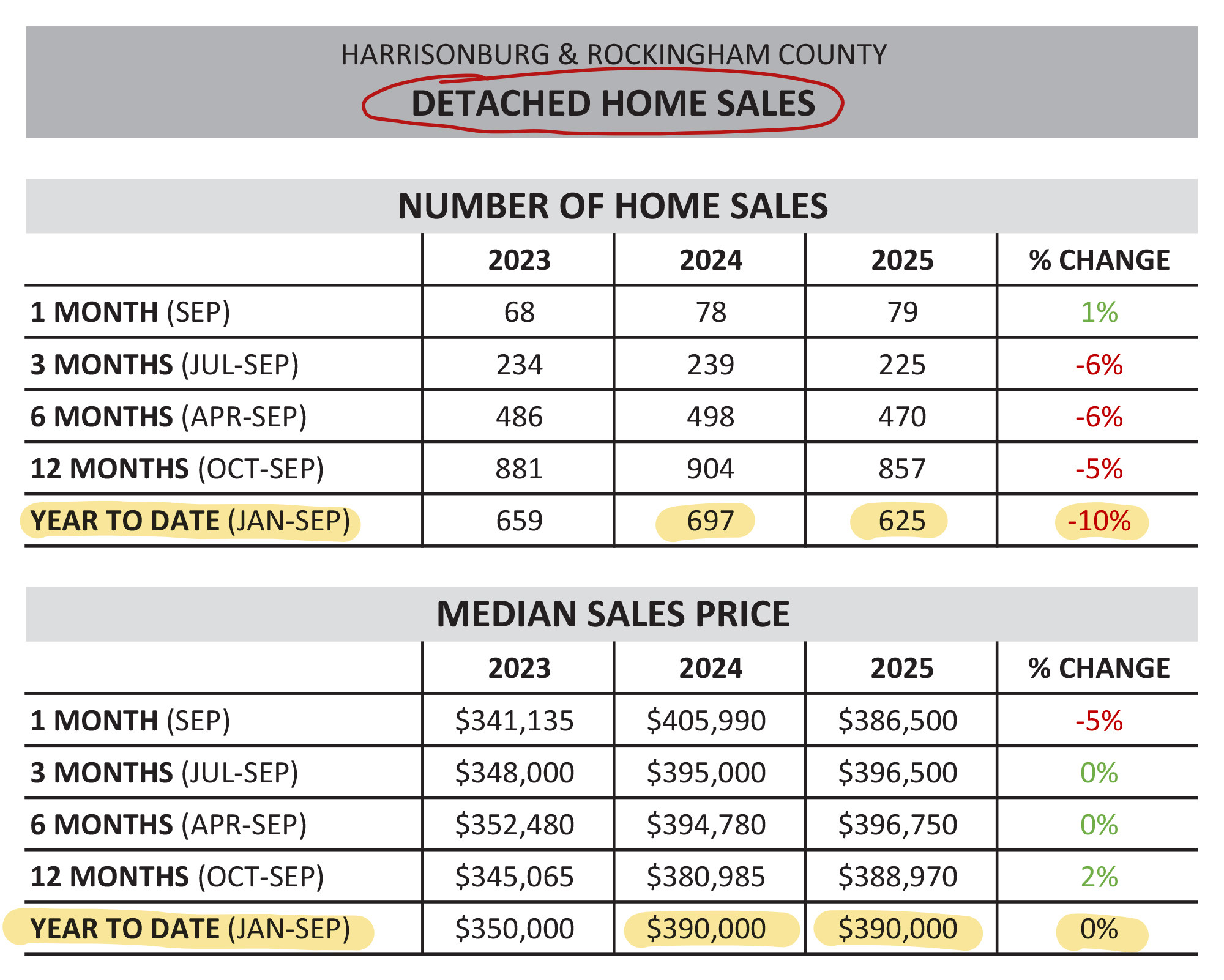

While the overall market has seen a 3% decline in home sales... there has been a 10% decline in the number of detached homes being sold this year in Harrisonburg and Rockingham County. This is likely, however, a result of fewer homeowners selling single family homes AND fewer new construction homes being single family homes.

Also shown above, the median sales price of a detached home is the same now ($390K) as it was a year ago.

Now, about those attached homes, which includes townhomes, duplexes and condos...

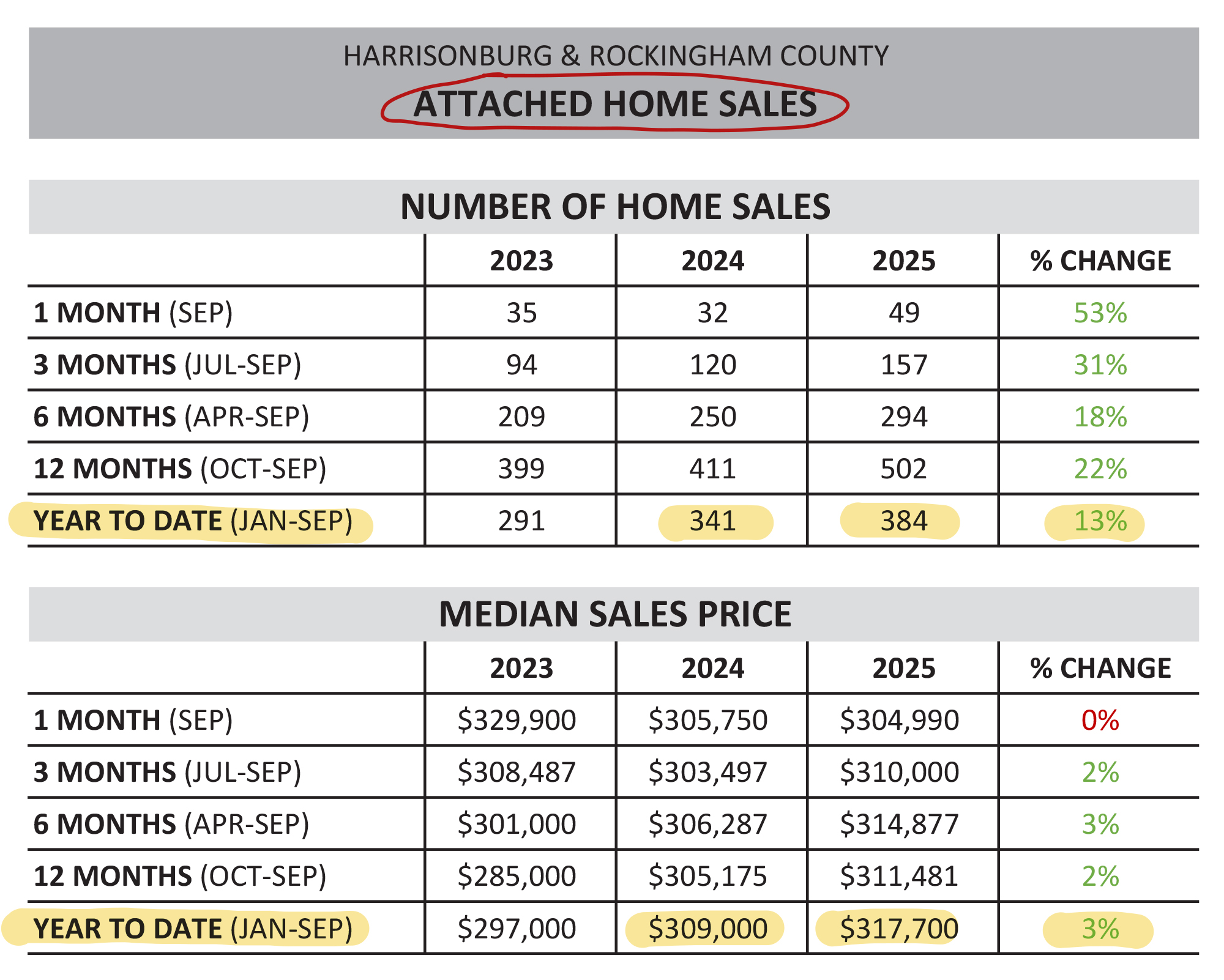

There have been 3% fewer home sales overall... and 10% fewer detached home sales... but lookie here... we have seen 13% more attached home sales this year as compared to last year. And... the median sales price of those homes has risen 3%.

Now, let's dive into some graphs that can help show illustrate these trends we are seeing in our local housing market...

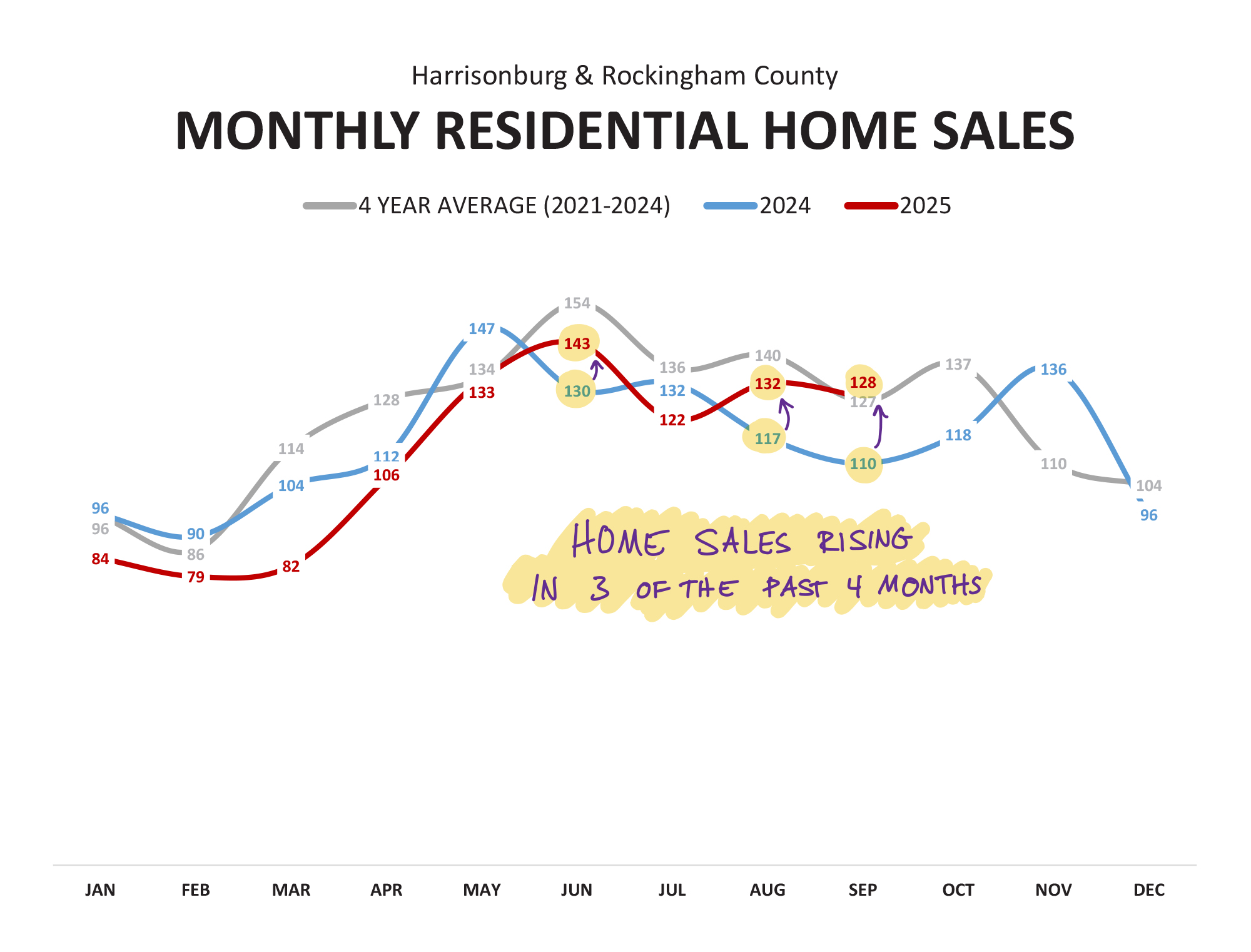

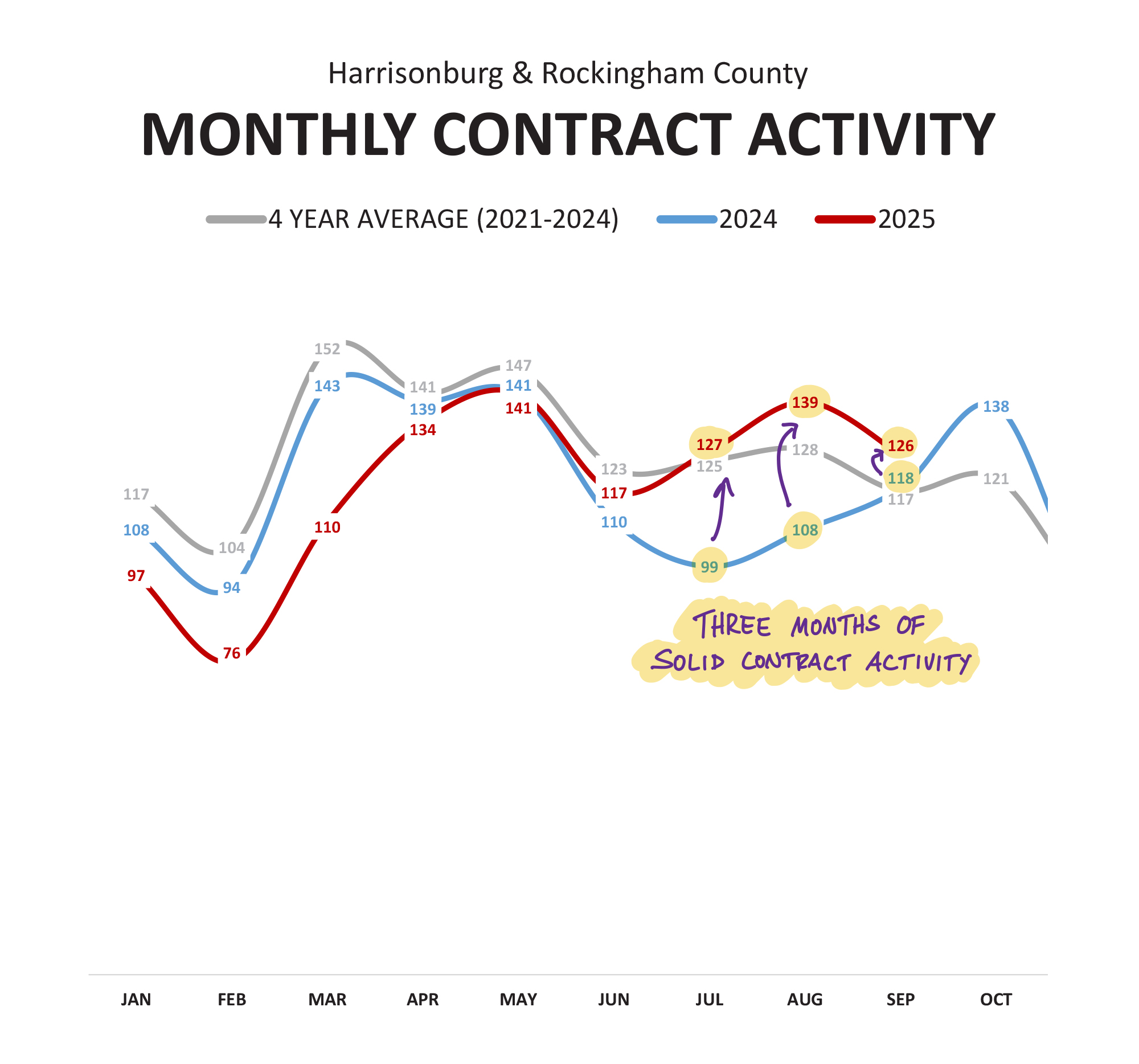

The red line above tracks the number of home sales per month in 2025... and you'll note that three of the past four months have shown stronger sales this year than last. But... given that we have seen an overall 3% decline in home sales this year, the recent increases in home sales has not yet been able to counteract the significantly slower months of home sales in early 2025.

Looking ahead... it is likely we will see another month or two of strong home sales (October, November) before we get to the three slowest months of the year... December, January and February.

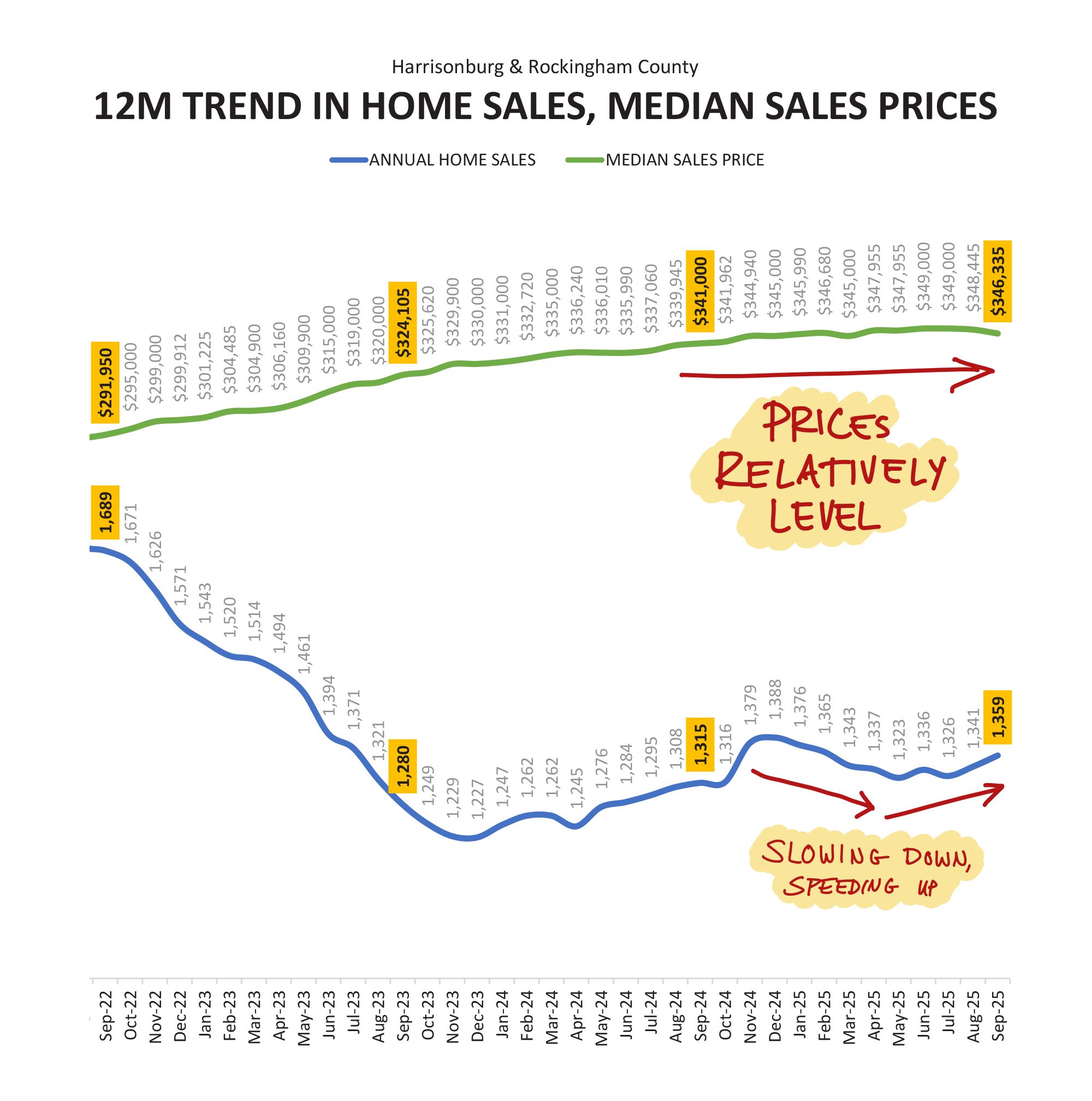

While the chart above looks at each month as a single data point, this next graph looks at a moving 12 month data set to see big picture trends that reveal themselves slowly over time...

As shown on the top green line... the median sales price has been relatively level over the past year. Technically, there has been a slight increase over the past 12 months ($341K to $346K) but it has actually dropped down a bit over the past few months ($349K to $346K).

Meanwhile, after a slow (and slowing) start to 2025... the number of annual home sales is on the rise again (blue line above) as of the past four months.

Looking ahead, I expect we'll continue to see a slow increase in the number of homes that are selling... but i think we may continue to see relatively level sales prices over the next three to six months.

Here, then, is another view of that new trajectory for home prices...

After five years (2020, 2021, 2022, 2023, 2024) of about a 10% (or higher) annual increase in the median sales price in our area... the increase has cooled down to only about 1% over the past year. I expect we'll continue to see minimal or relatively small increases in the median sales price over the next three to six months.

But now, let's look ahead a bit and see what's happening with recent contract activity, which is typically the best indicator of the number of home sales we will see over the next few months.

Interestingly, the past three months (July, August, September) have shown sizable year-over-year increases in contract activity. During that three month period last year 325 contracts were signed... and this year it was 392 contracts. This recent burst of contract activity is likely the reason why we have started to see more active months of closed home sales... and why we are likely to continue to see higher number of closed sales over the next month or two.

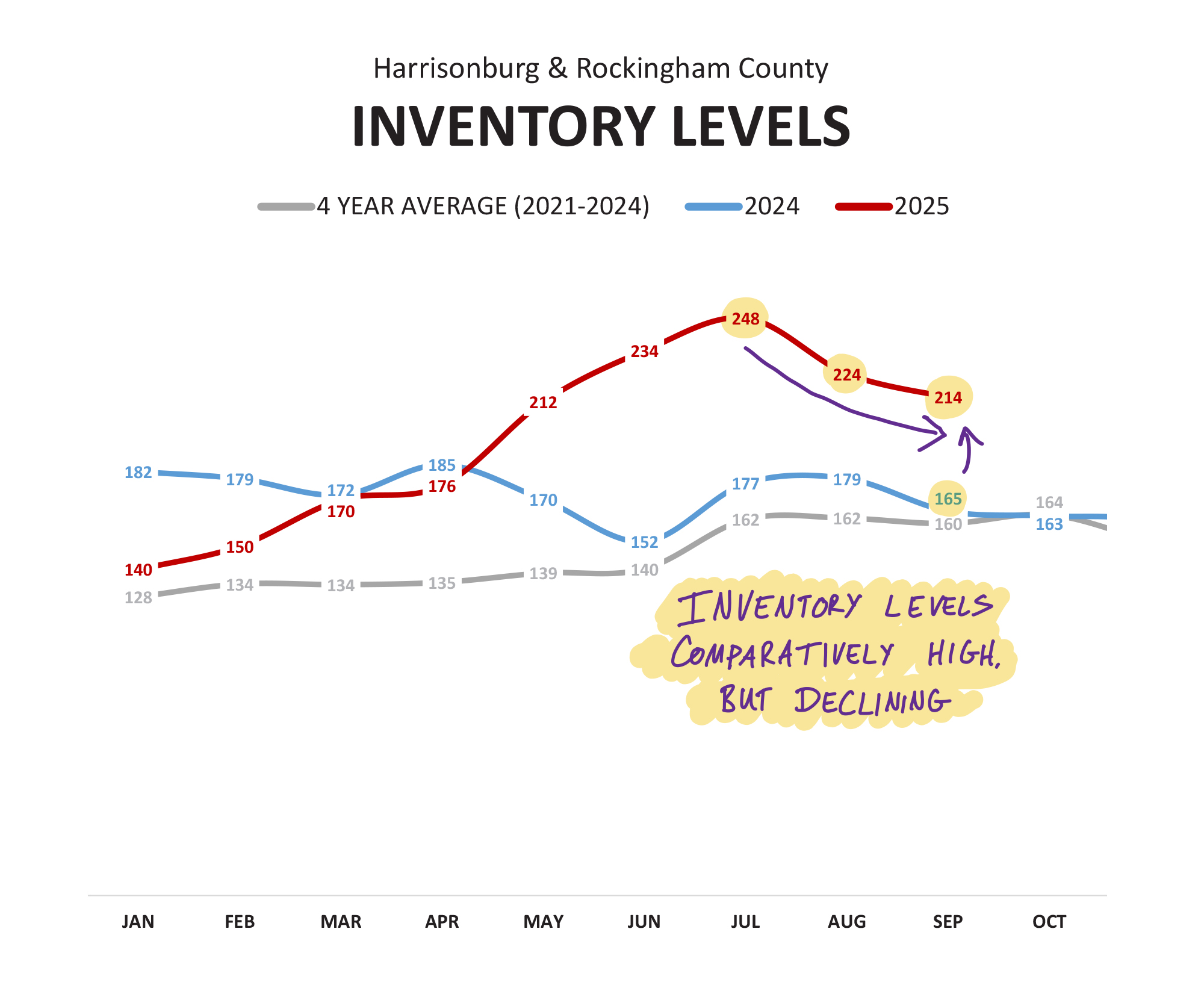

Meanwhile, how about those inventory levels!?

In the middle part of 2025 we were seeing a sudden and dramatic increase in the number of homes listed for sale. But... that trajectory reversed itself in August 2025 and continued in that same direction in September 2025. We are still seeing considerably more homes on the market now (214) than a year ago (165) but the gap between 2025 and 2024 inventory levels is starting to close.

Perhaps the shrinking inventory levels are partly a result of the higher number of signed contracts.... or perhaps the higher number of signed contracts are partly a result of the higher inventory levels. Did more homes for sale cause more buyers to contract to buy homes? Probably. Did more buyers contracting to buy homes cause the number of homes listed for sale to diminish? Probably.

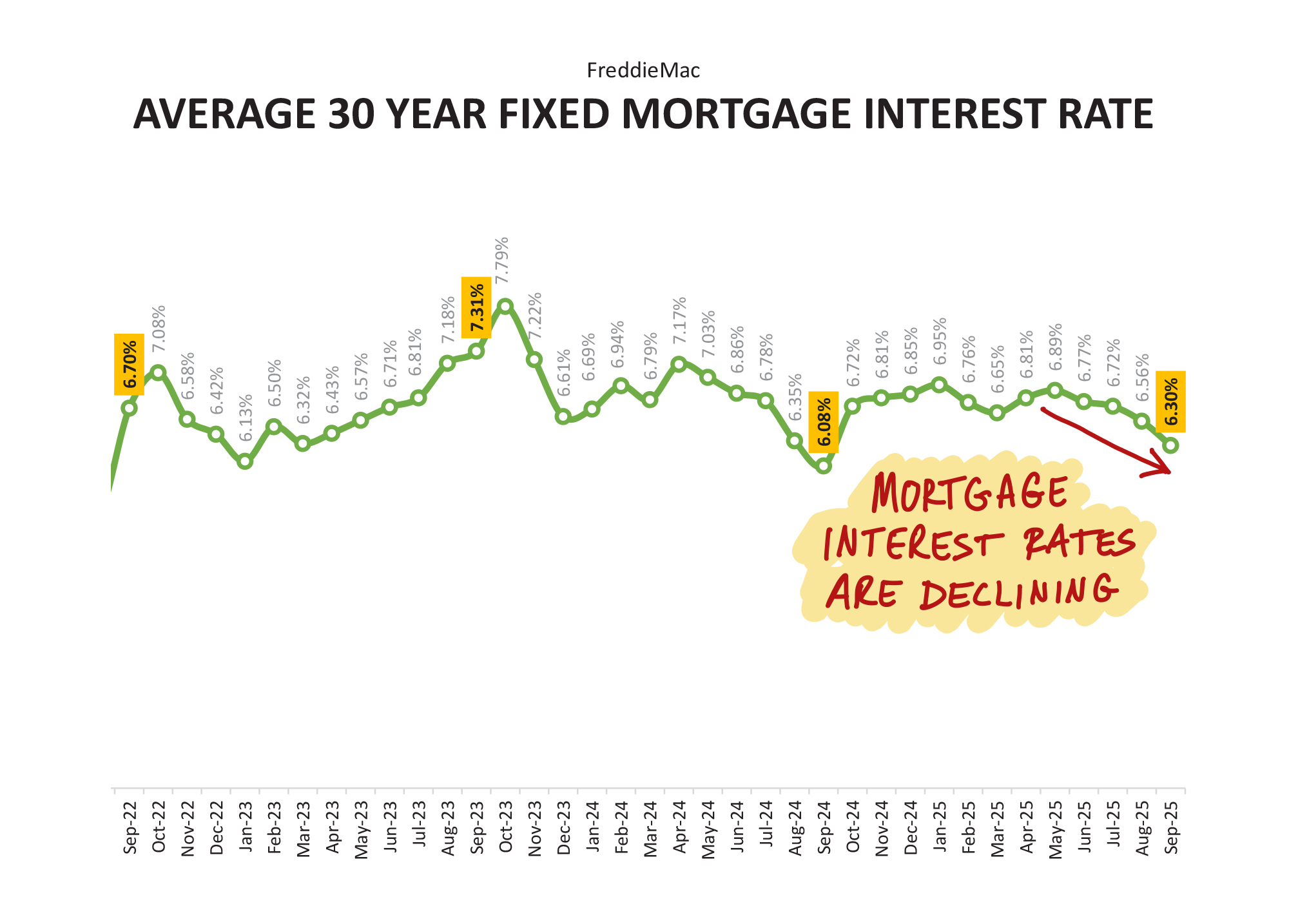

One last graph here... mortgage interest rates...

In good news for anyone contemplating a home purchase now or soon... mortgage interest rates have dropped from about 6.9% (four months ago) to 6.3% as of the end of September. Slightly lower mortgage interest rates allows more buyers to qualify to buy (or to buy at slightly higher prices) so the declining rates over the past four months may be a part of why we are seeing more buyers contracting to buy homes.

So, given all of the data above, how should buyers, sellers and homeowners be feeling these days?

Buyers - Happy for slightly more choices (higher inventory) than in recent years, and happy for slightly lower mortgage interest rates.

Sellers - Slightly less than enthusiastic that the 10% annual increases in sales prices are not continuing in 2025, but relieved that we are only seeing a 3% decline in home sales over the past year.

Homeowners - Happy to see relatively stability in sales prices, and possibly still delighted to have a mortgage with a fixed rate lower than those currently offered.

If you'll be buying soon... let's meet to chat about the market and the process... and you ought to get preapproved for a mortgage sooner rather than later.

If you'll be selling soon... let's meet to chat about pricing, preparation and your desired timing, especially as we roll on towards the holiday season.

If you have questions... about the local market, about the trends noted above, about your particular home, about your hopes to buy a home... reach out anytime by phone/text at 540-578-0102 or by email.

Happy October!