Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Friday, May 9, 2025

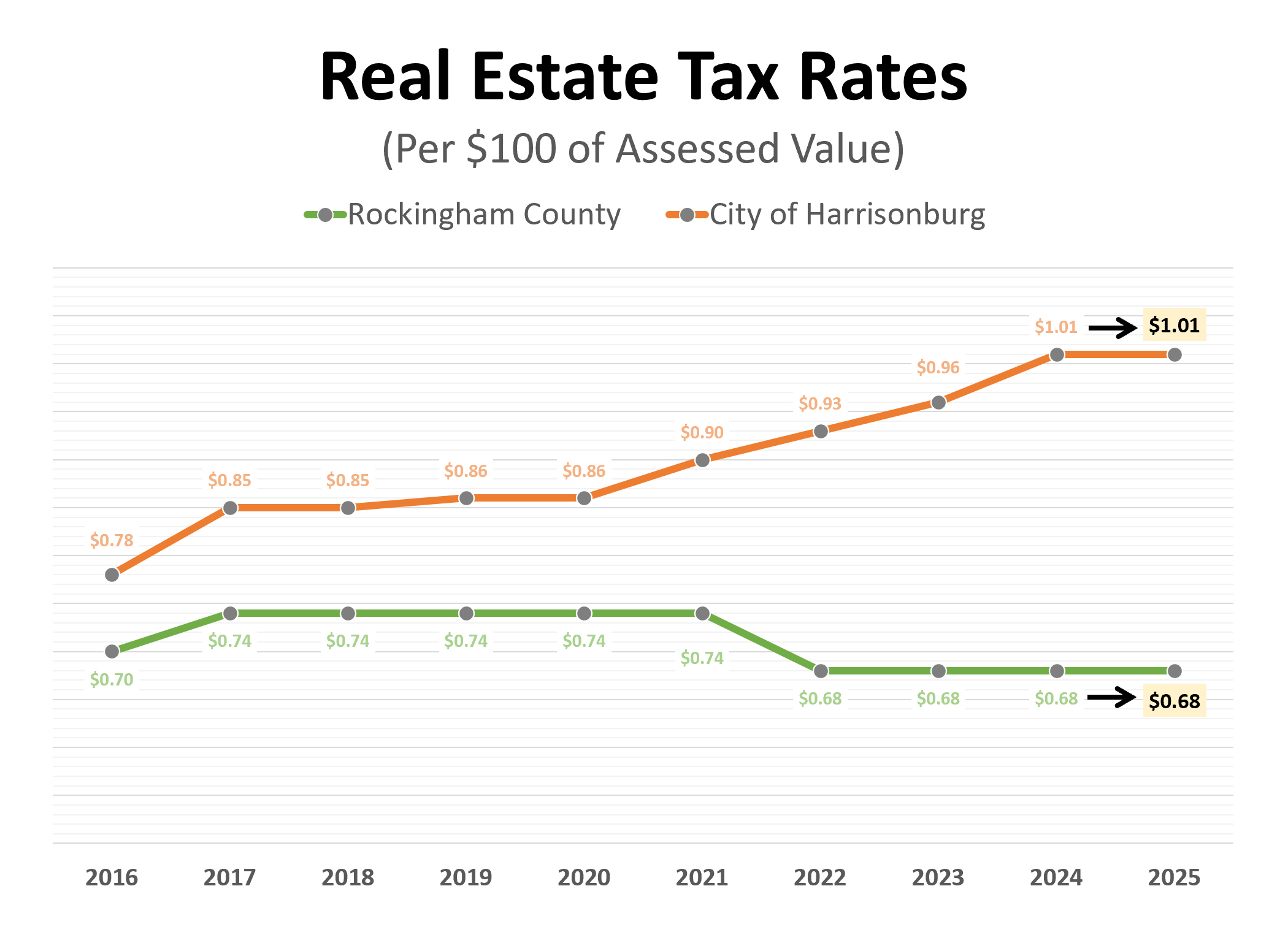

There won't be any changes in the real estate tax rates for the City of Harrisonburg and Rockingham County for the coming (2025-26) fiscal year...

City of Harrisonburg Real Estate Tax Rate

2024 = $1.01 per $100 of assessed value

2025 = $1.01 per $100 of assessed value

Rockingham County Real Estate Tax Rate

2024 = $0.68 per $100 of assessed value

2025 = $0.68 per $100 of assessed value

Keep in mind, this doesn't mean your real estate tax bill won't change.

Your real estate tax bill is calculated based on two factors:

- real estate tax rate (see above)

- your home's tax assessment

It's that time of year when we will all be receiving updates on the tax assessed value of our homes... which might show that your tax bill will be rising... not because the tax rate increased... but because your home's assessed value increased.

Your home's tax assessment is intended to be at or very close to the market value of your home, though that is not always the case.

So, when you get that tax notice in the mail, remember - while the tax rate isn't increasing, you might see a higher tax bill due to updated assessments. If you're surprised by your new assessed value - or if it seems too high compared to your understanding of your home's market value - it might be worth taking a closer look.

If you have questions about your new assessment - or if you're wondering how it compares to your home's current market value - feel free to reach out. I'm happy to help you understand how your home's tax assessed value aligns (or doesn't align) with the current local housing market.