Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Friday, May 31, 2024

Buying a home is expensive these days, given high sales prices and high more interest rates -- but renting a home can be quite expensive as well!

How can you best compare the financial impact of buying vs. renting?

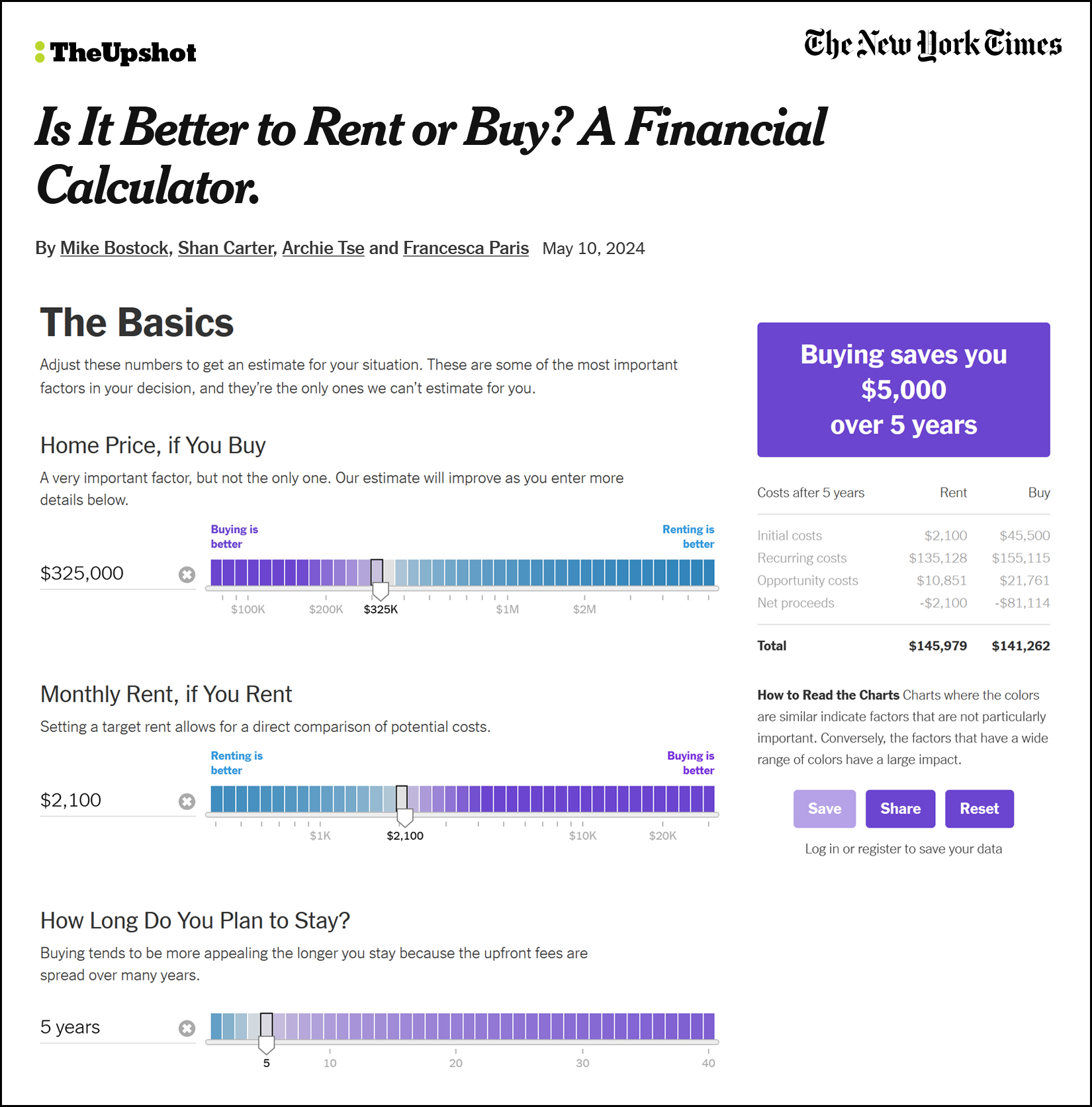

The New York Times has created a very helpful, interactive calculator that lets you dive into the details to better understand whether it will make sense for you to buy or rent based on the particular details of your situation.

You'll start with some basic inputs including:

- Home Price, if You Buy

- Monthly Rent, if You Rent

- How Long Do You Plan to Stay?

It is important to then adjust a few additional assumptions they have built into their calculator to match your scenario. The main sliders that seem important to adjust are...

- the amount of your down payment

- tax rate (1.01% City of Harrisonburg, 0.68% Rockingham County)

- costs of selling home (can be rounded to 5.5%)

- maintenance/renovation (depends on age of home)

- extra monthly utilities (set to zero unless they are paid by your landlord)

- monthly common fees (homeowners association dues)

The calculator will then show you your total costs of renting vs. buying over the timeframe you chose.

In the fictional scenario I have illustrated above, it made more sense (barely) to buy over five years when comparing a $325K purchase to a $2100 rental rate.

One final (important) note... the calculator assumes 3% growth in home prices. I don't necessarily recommend adjusting that to a higher percentage... BUT... over the past four years we have been seeing 10% growth in home prices each year. If we continue to see that type of home price growth it will almost always make sense to buy, regardless of your timeline.

In summary... $325K purchase vs. $2100 rental rate over a 5 year horizon with 3% annual growth in home prices... it's better to buy, but barely.

(If we see 5% growth in home prices per year for the next three years, it would be better to buy, even over that short three year timeframe)

Explore the calculator and all of your possible scenarios here.