Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Thursday, May 5, 2022

There's a good article to read over at Fortune from earlier this week...

In a nutshell...

[1] Moody's Analytics believes the housing boom will wind down in the coming year, perhaps leading to no year-over-year home price growth a year from now.

[2] Zandi, chief economist at Moody's, does not think we will see large price corrections, but some markets might.

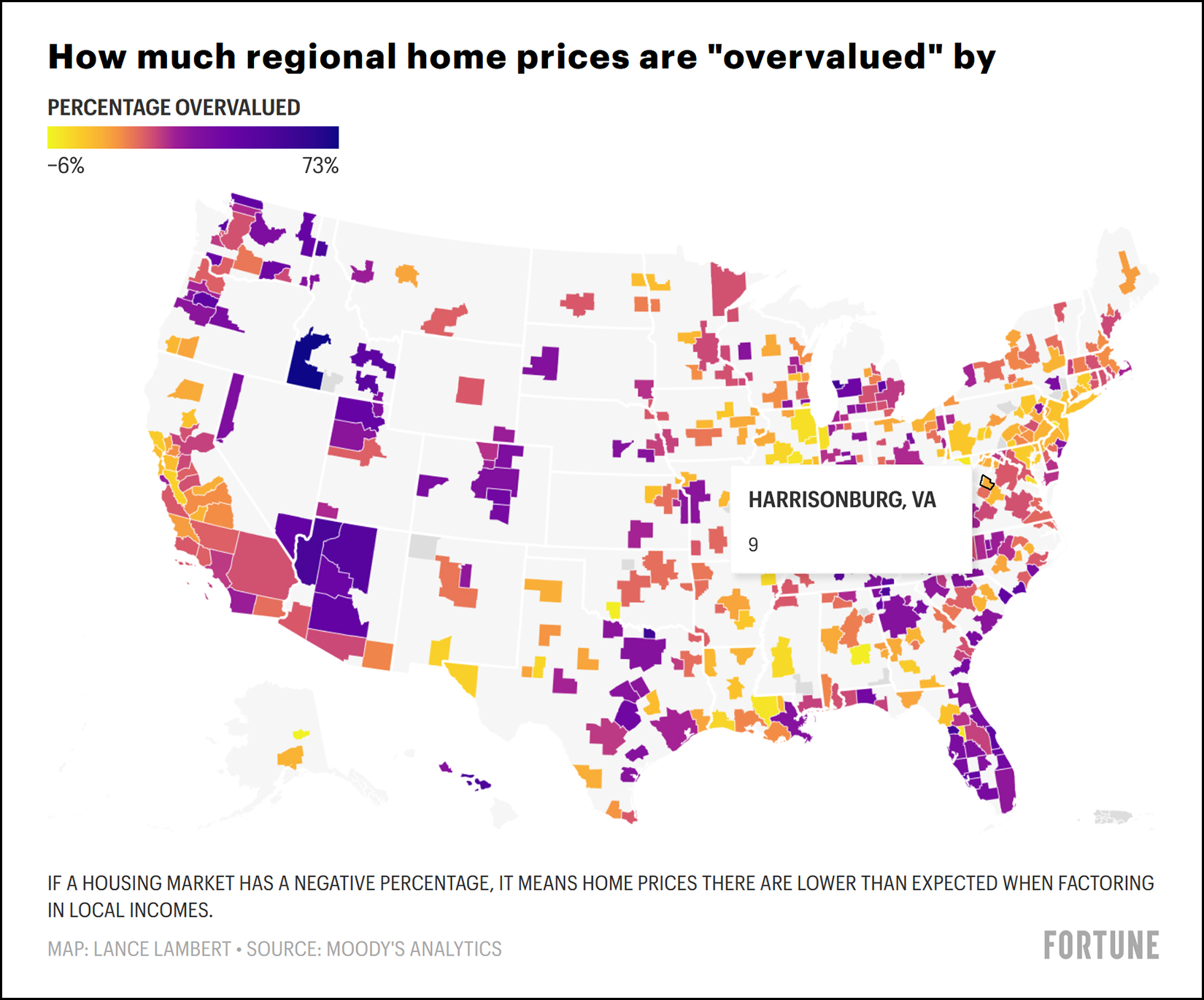

[3] Moody's ran an analysis of local housing markets within the context of local income levels to estimate which markets might be overvalued.

[4] Of the 392 metropolitan statistical areas they studied, 149 markets are overvalued by at least 25%... with a high of 73% in Boise.

As you can see from the map above (embedded in the article at the link above) the analysis by Moody's indicates that the Harrisonburg market may be 9% overvalued within the context of income.

Read the entire article for much more commentary and further insights...