Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Monday, March 7, 2022

Sometimes a home buyers doesn't have all the cash on hand that they need for both a down payment and the closing costs.

In that situation, sometimes a buyer might propose a higher sales price with the seller providing a closing cost credit at settlement.

For example... instead of the buyer paying $240K for the house, they could pay $245K and the seller would give them a $5K credit back at closing.

But... these days... that isn't happening as often.

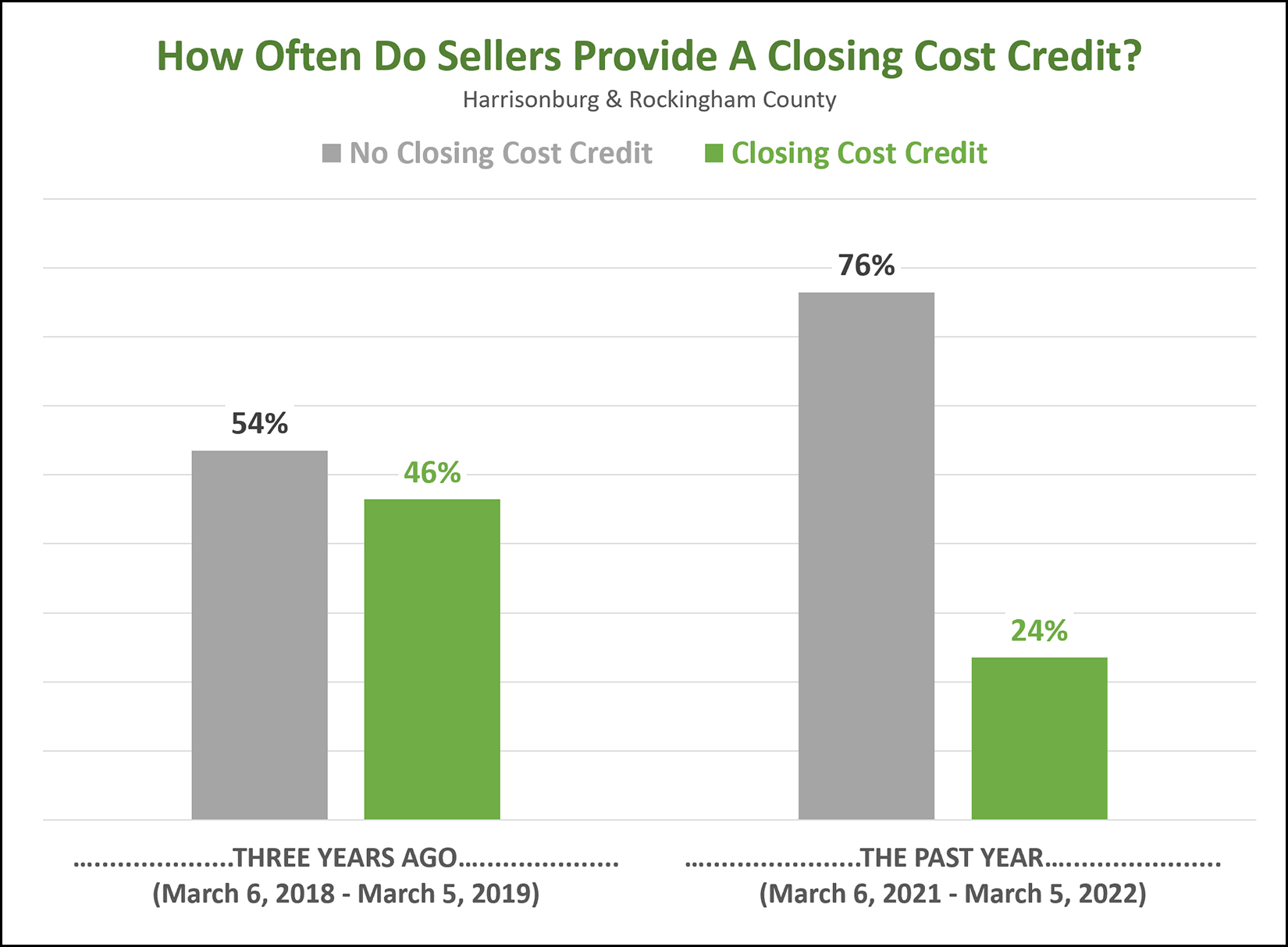

Three years ago sellers were giving closing cost credits to buyers in nearly half (46%) of all home sales in Harrisonburg and Rockingham County.

These days, it is only happening about one in four times.

Why might these types of transactions (with closing cost credits) not be happening as frequently right now?

First, many or most sellers seem to gravitate towards buyers who have the strongest financial position (largest downpayment) as that is often an indication that they will be more likely to make it successfully through the contract contingencies (inspection, financing, appraisal) to settlement.

Second, artificially increasing a contract price in order to have part of your closing costs included in that contract price will most often raise the bar as far as the the price for which the house will need to appraise. If presented with a $240K offer and a $245K less $5K offer, nearly all sellers will choose the $240K offer so that the house only has to appraise for $240K and not $245K.

So... if you need a closing cost credit when buying a home... that's fine, it's still happening sometimes... but not nearly as frequently as it was in the recent past.