Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Tuesday, February 15, 2022

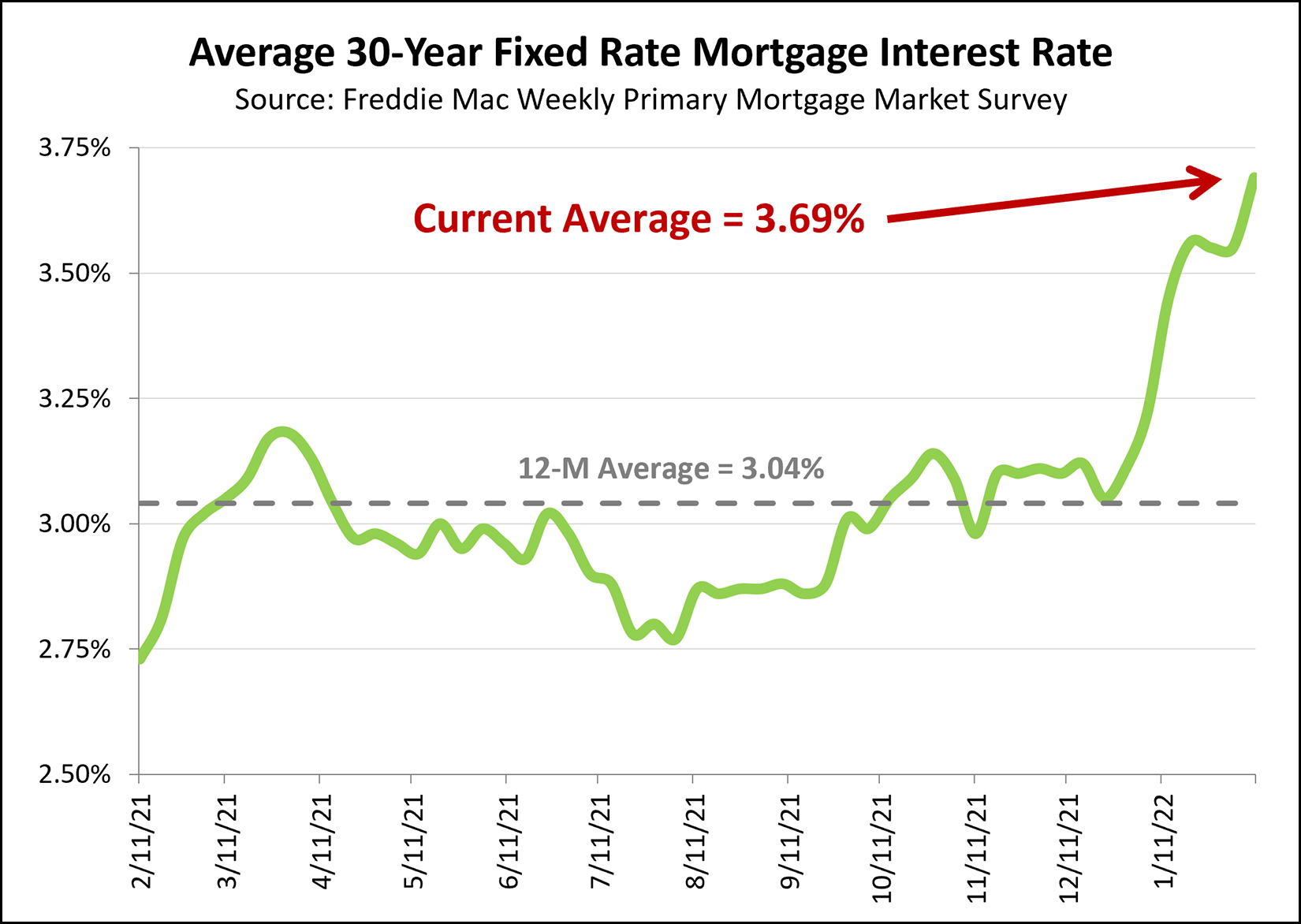

About a year ago, on February 11, 2021, the average 30 year fixed mortgage interest rate was 2.73%.

A few days ago, on February 10, 2022, the average rate was 3.69%.

So, yes, rates are rising, which means mortgage payments are rising for anyone who is not paying cash. In other words, for most home buyers.

For example, if you were financing 90% of your $300K purchase...

- One Year Ago at 2.73% = $1,347 / month

- Today @ 3.69% = $1,489 / month

- That's an increase of $142 / month.

But if you were buying a $300K home a year ago, given roughly the 10% increase in the median sales price over the past year it would be a $330K home today. So it's really more like...

- Financing 90% of $300K a year ago at 2.73% = $1,347 / month

- Financing 90% of $330K today at 3.69% = $1,638 / month

- That's an increase of $291 / month

The cost of housing is certainly increasing rather quickly right now given increasing prices and increasing mortgage interest rates!