Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Friday, December 10, 2021

If you own a property in the City of Harrisonburg you likely recently received a "Change of Assessment Notice" in the mail. Harrisonburg updates the assessed value of every parcel of real estate every year... and some years (like this year) the assessed values increase quite a bit!

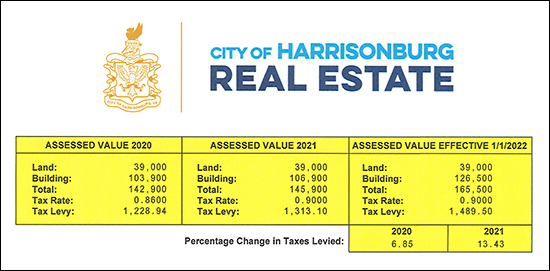

The sample change in assessment notice above, for a townhouse in the City of Harrisonburg, shows the following assessed values...

- $142,900 in 2020

- $145,900 in 2021 (2% increase)

- $165,500 in 2022 (13% increase)

You might also note that the tax rate changed a bit over time...

- $0.86 per $100 of assessed value in 2020

- $0.90 per $100 of assessed value in 2021

- possibly $0.90 per $100 of assessed value in 2022 (yet to be set)

The increased assessed value, combined with the increase in tax rate results in the following increase in annual taxes...

- $1,228.94 in 2020

- $1,313.10 in 2021 (7% increase)

- $1,489.50 in 2022 (13% increase if rate remains at $0.90)

In speaking with Lisa Neunlist, the real estate director for the City of Harrisonburg, she shared that there has been a 10.5% increase in the median assessed value of the approximately 9,600 residential properties (single family, townhomes, duplexes, condos that are not primarily students) in the City of Harrisonburg.

Should this increase in assessed values surprise us?

Probably not. The median sales price in our local area (City+County) has increased 12% over the past year. As such, a 10.5% increase in the median assessed value is not shocking.

It will be interesting to see whether the tax rate is changed at all for 2022. The tax rate increased 4.6% (from $0.86 to $0.90) between 2020 and 2021 -- at least in part to help pay for building a second high school in the City of Harrisonburg -- though there was discussion of a possible need to increase that rate even further in 2022. Perhaps the increase in tax assessed values of properties in the City of Harrisonburg will provide enough additional tax revenue that the tax rate will not need to increase further at this time?

Of note -- for the sample property I referenced above, if the tax rate remains at $0.90 in 2022 the annual taxes will increase by $176, which is a $15 per month increase.