Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Monday, May 24, 2021

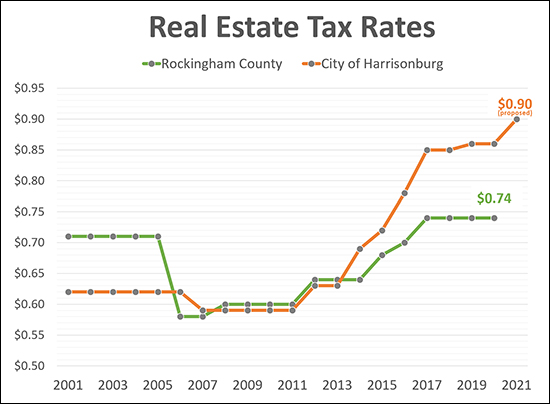

Here's the current lay of the land as it relates to real estate taxes in the City of Harrisonburg...

- The current tax rate in the City of Harrisonburg is $0.86 per $100 of assessed value.

- Over the past (12) months the median sales price of homes in the City of Harrisonburg has been $225,000.

- If a home that sold for $225K was assessed for $225K the annual tax bill at the current rate ($0.86) would be $1,935.

- The owner of this median priced house would thus, theoretically, pay about $161.25 per month in real estate taxes.

Harrisonburg City Council is considering an increase in the real estate tax rate...

- City Council might increase the real estate tax rate from $0.86 to $0.90.

- The owner of a $225K (median priced) home would then pay $2,025 per year in real estate taxes.

- This would be an increase of $90 per year.

- The owner of this theoretical home would then potentially pay $168.75 per month in real estate taxes.

- This would be an increase of $7.50 per month.

Stay tuned for further news of decisions from City Council as to changes in the real estate tax rate!