Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Thursday, March 4, 2021

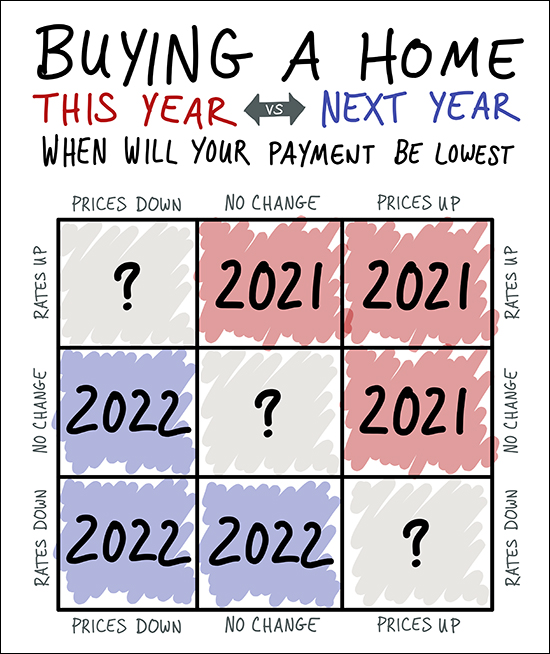

If you are hoping to minimize the amount of your monthly mortgage payment, should you buy a house this year? Or next year?

Well, as shown above, it depends on whether you think home prices will be higher or lower (or the same) next year -- and whether you think mortgage interest rates will be higher or lower (or the same) next year.

Most folks think mortgage interest rates will be higher next year than they are now. If so, it's most likely that you'd be better off buying this year rather than next to have a lower monthly payment.

Even if rates continue to be this low, if prices continue to rise (as they seem likely to do) then again, you'll be better off buying this year than next.

Since it seems relatively unlikely (highly unlikely?) that interest rates will go down over the next year, the only way you'd have a lower mortgage payment next year than you would now is if mortgage interest rates do NOT rise AND homes prices decline.

So -- as to whether you should buy this year or next -- you tell me, based on your best guesses as to what interest rates and home prices will do over the next year.

My best guess is that you'll pay more in a monthly payment for a house if you buy next year than you would if you buy this year.

Now, all that said, we'll have to somehow secure you a home amidst a competitive market with lots of buyers -- but it's possible!