Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Friday, November 13, 2020

Yes, you read that correctly.

Over the past year...

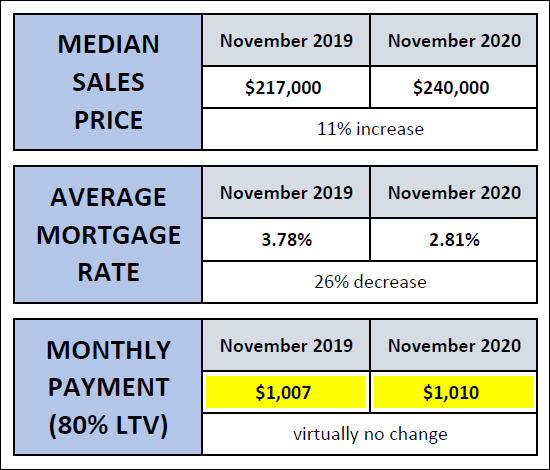

- The median sales price has increased by $23,000.

- The associated monthly payment has increased by $3.

Oh, the magic and mystery of declining mortgage interest rates! :-)

Over the past year we have seen a rather rapid increase in home prices. The median sales price in Harrisonburg and Rockingham County one year ago was $217,000. Today, it is $240,000. This is an 11% increase in the median sales price over the course of 12 months which is a much faster than normal increase.

And yet, if a buyer finances 80% of the purchase price, their mortgage payment will only be $3 per month higher than it would have been a year ago.

Wait! What??

That's all thanks to ridiculously low mortgage interest rates!

One year ago the average mortgage interest rate was 3.78%. Today's average mortgage interest rate is 2.81% -- which is 26% lower than the rate from a year ago.

So, if you're surprised that a buyer today is willing and able to pay 11% more for a house than they were a year ago -- don't be! Most buyers are financing their home purchases, and thanks to today's low mortgage interest rates, they are still paying basically the same amount as a monthly payment now as they would have been a year ago.

Put slightly differently...

A year ago, Fred was working in a job that paid him $X per year, which allowed him to afford a mortgage payment of around $1,000 per month, which allowed him to purchase a median priced home of $217,000.

Today, Fred's cousin, Ted, is working in a job that pays him $X per year (the same amount as Fred), which allows him to afford a mortgage payment of around $1,000 per month, which allows him to purchase a median priced home of $240,000.

Pretty wild.

Now, if (when!) those mortgage interest rates start rising -- then the cost of housing will start to increase -- though that's what we generally expect it to do.