Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Tuesday, July 7, 2020

If you will only be in your next home for two (or 1, 3, 4 or 5) years -- should you buy that home? Or just rent a home instead?

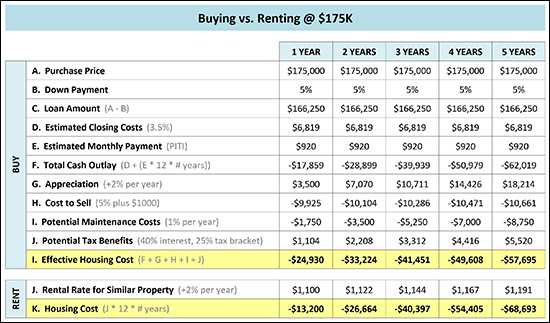

Let's take a look, assuming a price point in the current market of around $175K - which is likely to be a townhouse and might be what you are considering as a first time buyer...

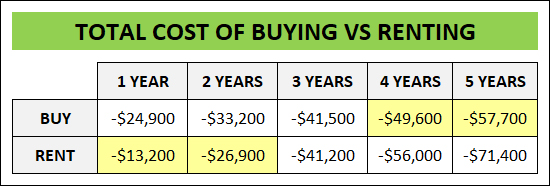

As becomes pretty quickly, above, it doesn't necessarily make much sense to buy if you are only going to be in your home for 1 or 2 years -- and once you get to a time horizon of 4 or more years, it almost certainly makes sense to buy a home.

For clarity, let's look at how I'm determining the cost of renting and buying this fictional house...

The Total Cost of Renting Includes...

Monthly rental rate x 12 x # years

Yep, that's it

The Total Cost of Buying Includes...

Monthly mortgage payment x 12 x # years

+ closing closing costs when buying your home (3.5%)

+ cost of selling your home (5% + $1K)

+ potential maintenance costs (1% / y)

- appreciation of your home's value (2% / y)

- potential tax benefits of interest paid (int x 40% x 25%)

Here's a visual (click for a closer look) as to how those numbers line up over a one through five year time horizon...

I should also note that it is quite possible to be "just fine" from a financial perspective if you buy and only end up being in the home for a year or two if...

- your home's value goes up much more than expected during that time frame

- you have little to no maintenance costs during the time that you own the property

- you decide to keep the property as a rental property and thus do not need to factor in the cost of selling the home

As you are thinking through whether you should buy or rent -- at a $175K price point or otherwise -- feel free to touch base with me and I can give you some feedback and advice based on your overall circumstances.