Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Thursday, July 23, 2020

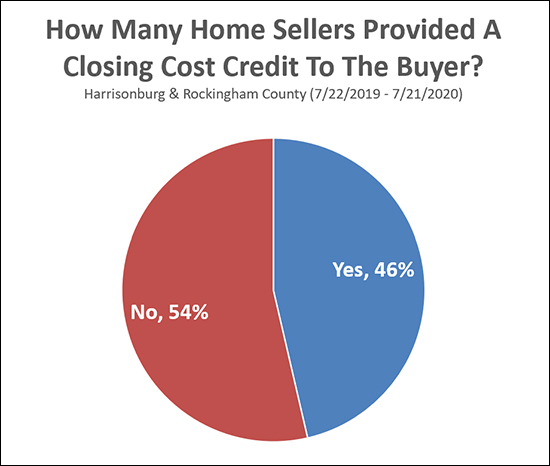

Looking back over the past year it seems that slightly fewer than half (46%) of home sellers provided a closing cost credit to the buyer for their home. It is not altogether surprising that many buyers ask for a seller paid closing cost credit. With interest rates so low, it is not a crazy idea to incorporate some of your closing costs into the mortgage by increasing the purchase price and mortgage amount by a few thousand dollars.

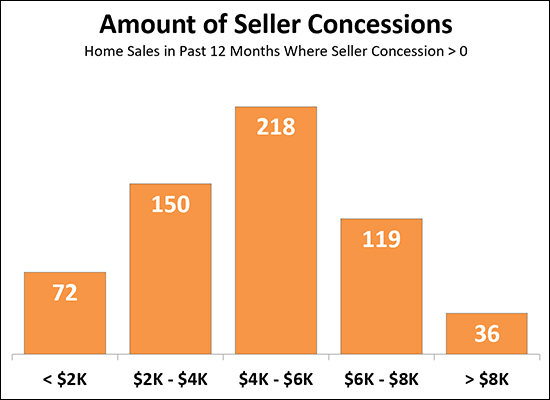

Here, then, is how much sellers paid in buyer closing costs over the past year in the 46% of the cases where the seller did provide such a credit...

So, if, as a seller, you are paying part of a buyer's closing costs, you are most likely to be paying between $4K and $6K --- or between $2K and $4K.

And again, as a seller, if you pay part of the buyer's closing costs -- you are not alone -- 46% or so of sellers do so!