Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Wednesday, June 3, 2020

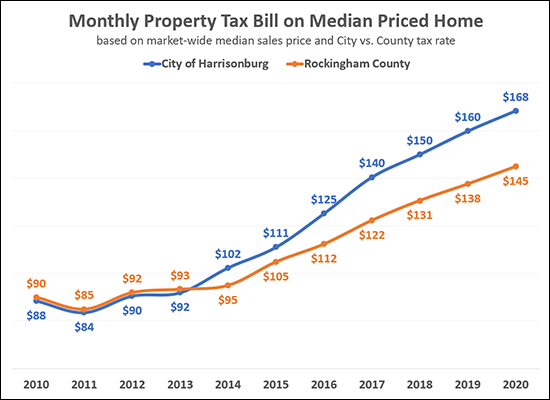

It seems that the real estate tax rate will stay the same in Harrisonburg and Rockingham County for 2020-21...

- City of Harrisonburg = $0.86 per $100 of assessed value

- Rockingham County = $0.74 per $100 of assessed value

Despite no change in the real estate tax rates, many homeowners will see an increase in their real estate tax bill due to rising property values.

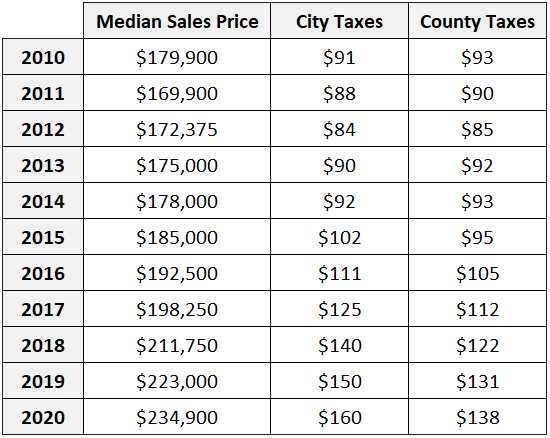

The graph above tracks the City vs. County real estate tax bill for a median priced home -- and here is the underlying data...

As shown above, it has become more expensive (16%) to pay property taxes on a home in the City of Harrisonburg as compared to a similarly priced (assessed) home in Rockingham County.