Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Wednesday, November 13, 2019

Despite rapidly declining temperatures (15 degrees last night!?) the local housing market is still rather hot! Read on for an overview of the latest market trends in Harrisonburg and Rockingham County, or download a PDF of the full report here.

But first, check out this new listing at The Glen at Cross Keys, pictured above, by visiting 285CallawayCircle.com.

OK, now, diving into some data...

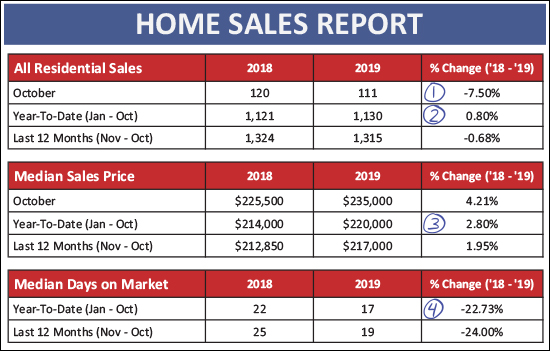

Several things to note above, as we can now look at 10 out of 12 months of 2019...

- We only saw 111 home sales in October 2019, which was a 7.5% decline from last October when there were 120 home sales.

- Despite that monthly drop, the pace of home sales is up slight (+0.8%) when looking at January through October sales this year vs. last year.

- The median sales price is also on the rise, with a 2.8% increase to $220,000 when looking at January through October of this year vs. last year.

- Homes are selling even faster (!?!) than last year -- with the median days on market dropping to only 17 days for the first 10 months of 2019.

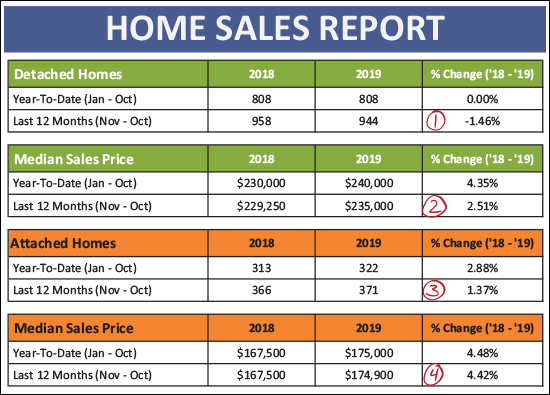

Now, looking at the detached sales trends vs. attached trends, we see similar but slightly different trends...

Above, you might note that...

- Sales of detached homes (single family homes) have declined slightly (-1.46%) over the past year when looking at the first 10 months of the year.

- The median sales price of those detached homes has increased 2.5% over the past year, rising to $235,000.

- The pace of sales of attached homes (duplexes, townhouses, condos) has increased slightly (+1.37%) over the past year.

- The median sales price of those attached homes has increased more significantly than we saw with detached homes -- given the 4.42% increase to a median sales price of $174,900.

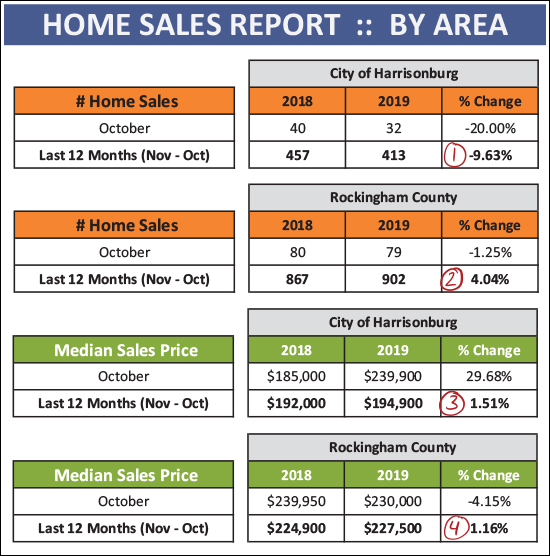

Next, let's pause for a moment to evaluate sales in the City vs. the County...

As you'll see above...

- City home sales have slowed down quite a bit in 2019 - with a 9.63% decline in the number of homes selling.

- Comparatively, the pace of County home sales have increased 4% over the past year!

- The median sales price of homes selling in the City has increased 1.51% to $194,900.

- The median sales price of homes selling in the County has increased 1.16% to $227,500.

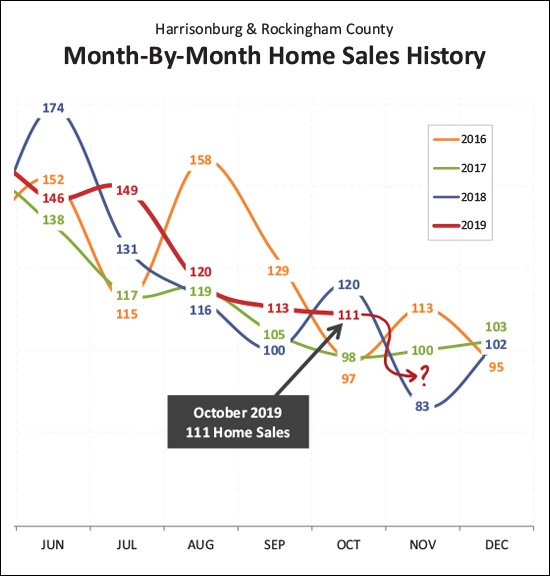

Now, for the roller coaster of the month-by-month activity...

As shown above, October home sales in 2019 were certainly stronger than we saw in 2016 and 2017 -- but not as strong as last year. That said, home sales then slowed down quite a bit (!!) last November, so perhaps we'll see a stronger performance this November? I'm guessing we'll see 90 to 100 home sales in November 2019.

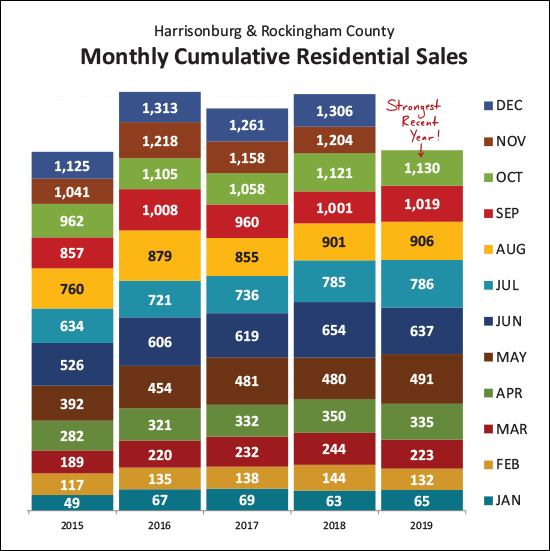

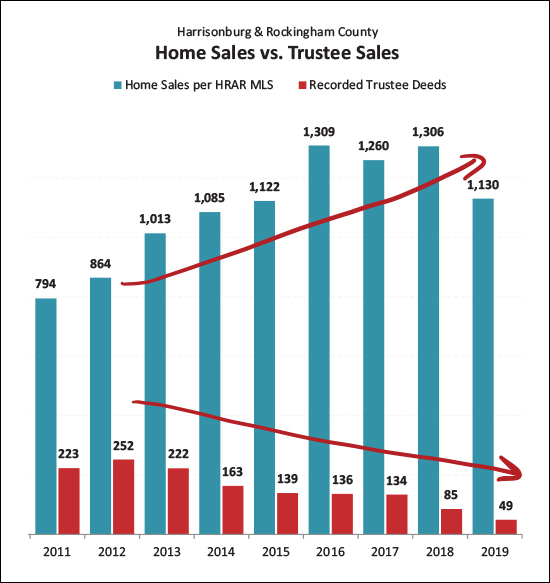

How do these monthly home sales stack up towards annual sales? The graph above breaks it down -- and we're moving at the fastest pace this year (1,130 sales in 10 months) that we've seen anytime in recent years. We seem to be on track to eclipse 1300 home sales again in 2019 - just as we did (barely) last year.

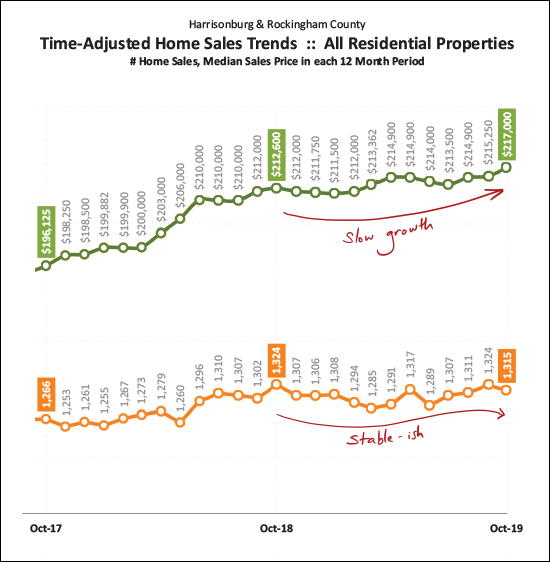

We can often get the best sense of long term trends by looking at a rolling 12 months of data, as shown above. Here we see that growth in the median sales price has been relatively slow over the past year (compared to a faster increase last year) and the pace of homes selling has remained relatively stable over the past year.

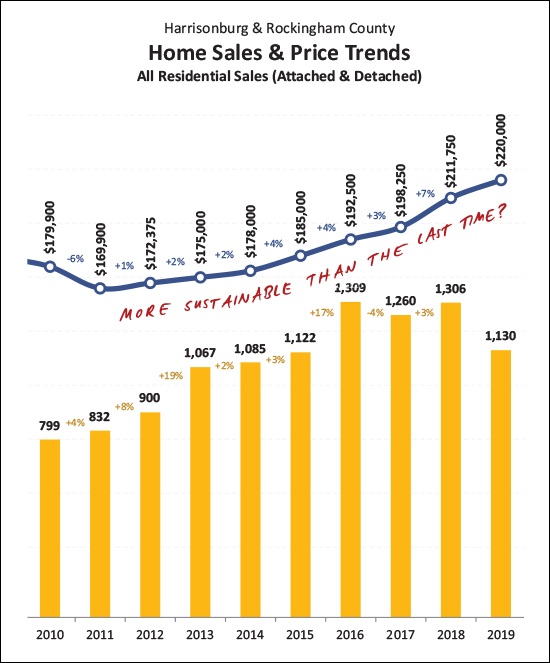

Looking back a few more years, it is clear that median sales prices (and home values) have been increasing steadily for quite a few years now -- ever since 2011 per this data set. But, the increases per year are smaller (1%, 2%, 2%, 4%, 4%, 3%, 7%, 4%) than during the last real estate boom when we had three years of double digit (17%, 14%, 14%) increases in the median sales price. So, perhaps this increase in home prices is more sustainable than the last time we saw steady increases over time.

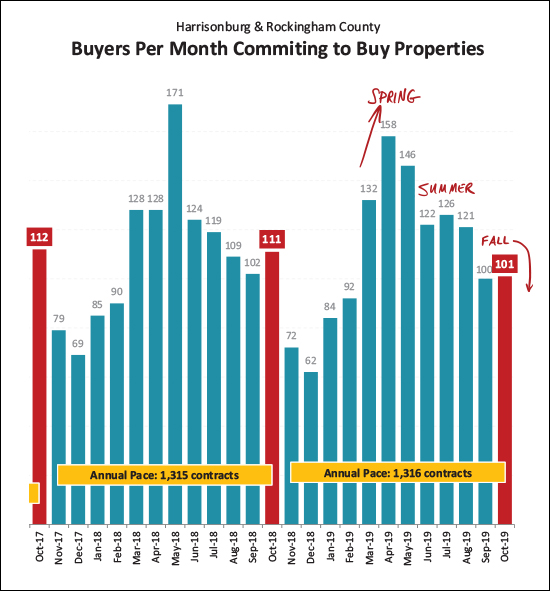

Back to temperature and seasonality - even though the annual pace of buyer activity is up, right now contract activity is starting to decline. The strongest months of buyer activity are typically in the Spring and Summer. We have started to see the usual slow down this Fall and will likely see continued declines in monthly contract activity as we move through November, December and January.

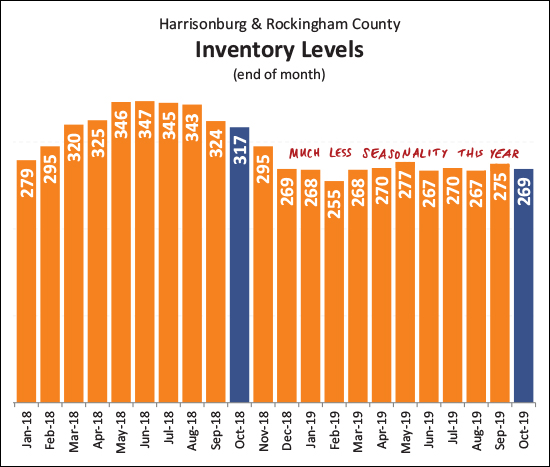

Somewhat curiously, despite the seasonality of buyer activity -- the inventory levels have stayed relatively steady for the past year -- or at least the last 10 months. We did not see the usual increase in inventory levels in the Spring and Summer this year -- perhaps because buyers were poised and ready and snapped up the new listings as soon as they hit the market. Thus, we may not see much of a decline in inventory levels over the next few months either.

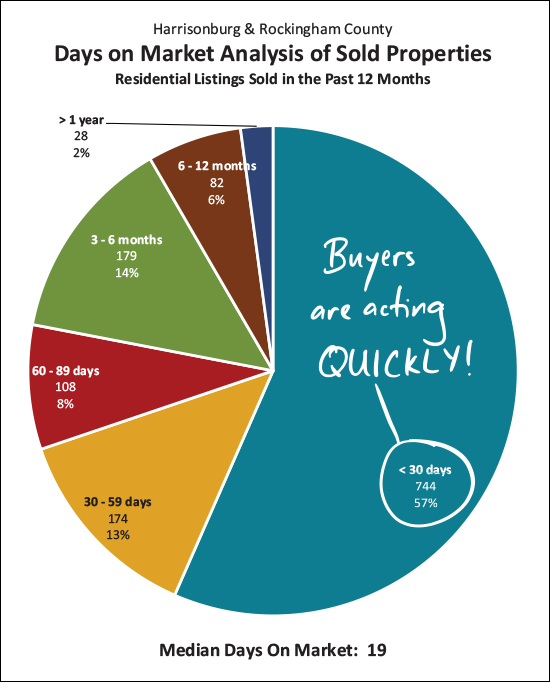

Ah, yes, the buyers DID snap up the listings quickly! In fact, over the past 12 months, 57% of homes that sold were under contract in less than 30 days -- and the median days on market was only 19 days!

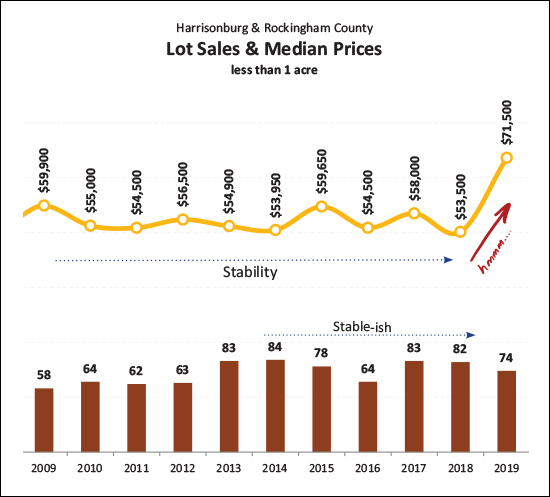

Breaking out of the "house" mold for a moment -- look at lot sales this year It seems we'll likely see a similar number of lots of less than an acre selling this year (around 80) but the median sales price has increased quite a bit over any recent past year!?

If you're looking for a sign of relative health in the local housing market -- look no further than the declining foreclosure rate in this area. As shown above, we have seen fewer (and fewer) foreclosures over the past eight years as more and more homes have sold.

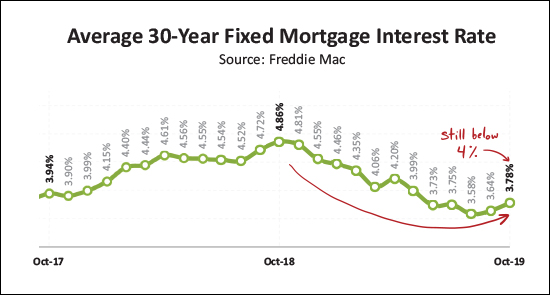

And finally, if you're buying now or soon, you'll likely still be locking in a fixed mortgage interest rate below 4%. The average mortgage rate has risen a bit over the past two months, but we're still seeing absurdly low mortgage interest rates for folks buying principal residences.

OK -- that's it for now. Again, you can download a PDF of my full market report here, or feel free to shoot me an email if you have follow up questions.

In closing...

If you're planning to sell over the Winter -- let's chat sooner than later about timing, preparations for your house, pricing within the current market and more. Call (540-578-0102) or email me and we can set up a time to meet to chat.

If you're planning to (or hoping to) buy a home soon, be ready to be patient and then to ACT QUICKLY! :-) Make it a bit easier for yourself by knowing the market, knowing the process, knowing your buying power, and closely monitoring new listings!

That's all for now. May we find warmer days ahead! :-)