Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Wednesday, August 21, 2019

Should You Rent or Buy With a 2, 3 or 5 Year Time Frame?

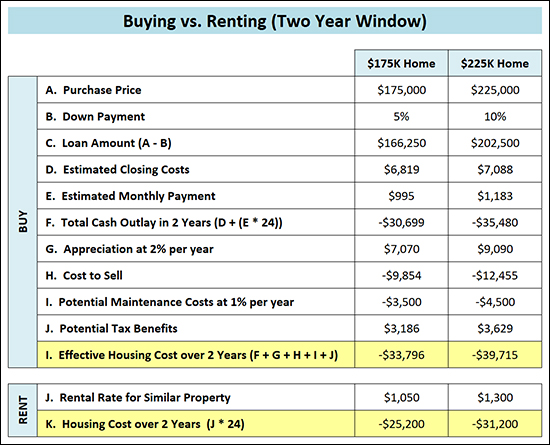

Looking at two different price points for townhouses ($175K, $225K) a quick analysis would indicate that...

- $175K townhouse = $995 to buy, $1050 to rent

- $225K townhouse = $1183 to buy, $1,300 to rent

So, buy the townhouse, right?

Well, sort of...

The comparison above ONLY accounts for the monthly payments and does not account for...

- the closing costs when purchasing (-)

- the potential increase in your home's value if you buy (+)

- the cost of selling down the road (-)

- the potential maintenance costs (-)

- the tax benefits of mortgage interest (+)

So, let's look at it again, a bit more thoroughly...

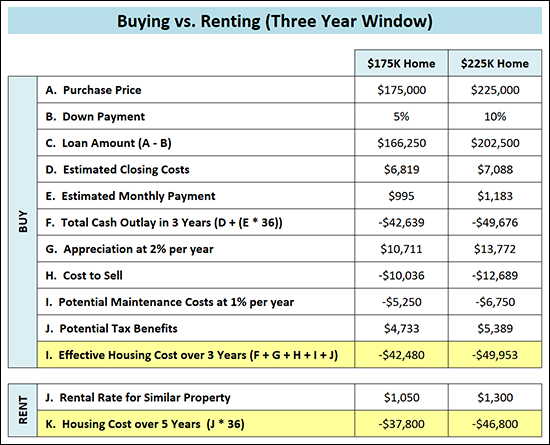

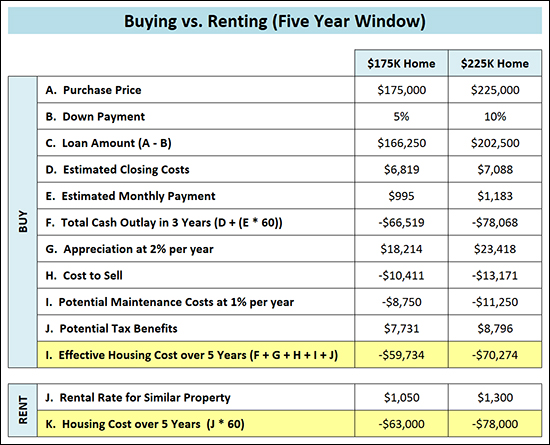

Above I have tried to account for ALL of those factors, and looking at a two year window, three year window and five year window.

This analysis indicates that you should probably plan to be in your home for 5+ years if you want the total financial transaction(s) to be a net positive.

That said, there are, of course, plenty of extenuating circumstances. Many people might buy a $175K house (or townhouse) even if they are planning to be there for only 3 years --- because they want their own home (not their landlord's), or to get in a certain neighborhood, or because of the tax benefits, etc.

Every buyer's situation is different, and I'd be happy to help you run an analysis similar to those shown below if you're interested in analyzing your best housing move.