Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Thursday, June 20, 2019

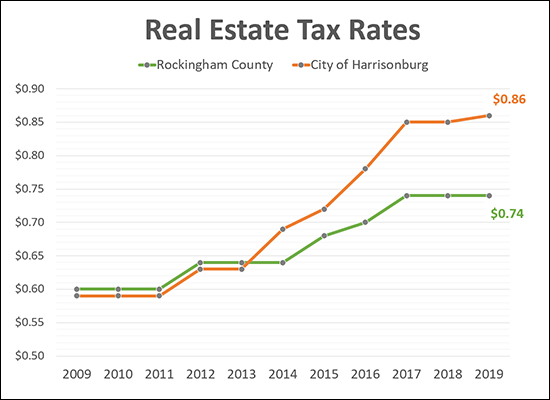

The real estate tax rates have been finalized for the 2019-20 fiscal year...

- City of Harrisonburg = $0.86 per $100 of assessed value

- Rockingham County = $0.74 per $100 of assessed value

For some context...

- The Harrisonburg tax rate has increased 10% over the past three years.

- The Rockingham County tax rate has increased 6% over the past three years.

For an even broader context...

- The Harrisonburg tax rate has increased 46% over the past ten years.

- The Rockingham County tax rate has increased 23% over the past ten years.

And to translate it into monthly costs...

- The median sales price in the City of Harrisonburg is $189,500 which would result in a property tax bill of $136/month.

- The median sales price in Rockingham County is $225,000 which would result in a property tax bill of $139/month.