Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Friday, June 21, 2019

Getting a bit further into this topic -- yesterday I was looking only at the changes in the property tax rates in the City and County -- as shown here.

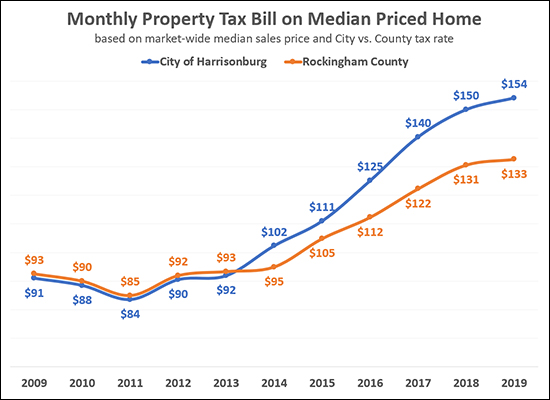

Today (thanks for the idea, Mike) I looked at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County.

To be clear, this analysis uses:

- The median sales price of a home for the City + County during each year.

- The property tax rate for the City vs. County for each year.

As shown above, it has become more expensive (16%) to pay property taxes on a home in the City of Harrisonburg as compared to a similarly priced (assessed) home in Rockingham County.

Now -- does this cause anyone to move from the City to the County? Or does it cause anyone new to the area to buy in the County instead of the City? Not necessarily - or at least that has not been my experience in working with buyers and sellers in the past ten (+) years.