Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Wednesday, December 5, 2018

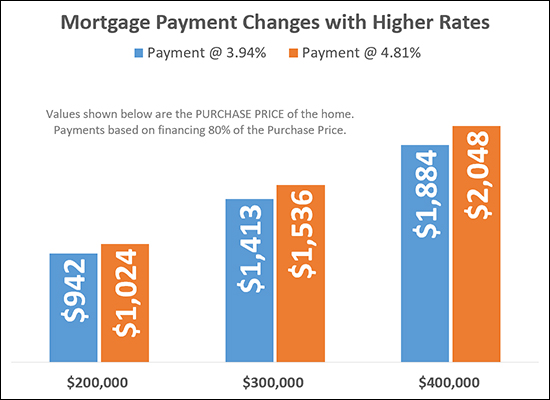

One year ago, the average 30-year fixed mortgage interest rate was 3.94%.

Today, that same average rate is 4.81%.

Does this rise in mortgage interest rates impact buyers? It sure does!

A buyer purchasing a $200K home would pay $82/month more for their mortgage payment -- with the increased interest rate causing it to increase from $942/month to $1,024/month.

A buyer purchasing a $300K home would pay $123/month more for their mortgage payment -- with the increased interest rate causing it to increase from $1,413/month to $1,536/month.

A buyer purchasing a $400K home would pay $164/month more for their mortgage payment -- with the increased interest rate causing it to increase from $1,884/month to $2,048/month.

Of note -- the estimated mortgage payments above include principal, interest, taxes and insurance -- and assume that the buyer is financing 80% of the purchase price.

So.....

- If you're about to buy a home, you'll be paying more per month than if you had purchased a year ago. Hindsight is 20/20.

- You will still be locking in a pretty low (sub 5%) mortgage interest rate.

- It seems that mortgage interest rates will likely continue to (hopefully slowly) rise over the next year, so buying sooner rather than later may serve you well.