Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Thursday, December 13, 2018

In some ways, my alarm bells are going off!

- The mortgage interest rate a year ago was 3.9% -- and now it is 4.81%.

- Thus, rates have increased 23% in a single year!

- It is certainly more expensive to finance a home than over the past few years.

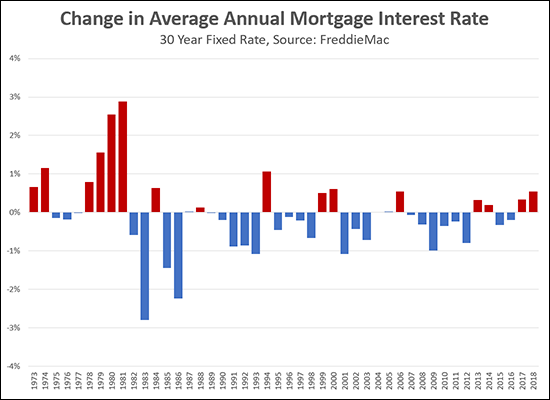

But yet -- it looks like the average rate for 2018 will only be 0.54% higher than in 2017 -- and the graph above puts that in what might be a somewhat more helpful context.

The last red bar (all the way to the right) is an indication of how much the annual average rate will have increased between 2017 and 2018.

Any red bar is an increase in the average annual rate.

Any blue bar is a decrease in the average annual rate.

As such -- the increases we have seen in 2017 and in 2018 are a far cry from the crazy increases seen in 1978, 1979, 1980 and 1981.

And there have been several times in the past thirty years when there has been a year or two of increases of less than 1% in a year, that were then followed by decreases in subsequent years.

So -- back to real rates -- you could get a mortgage with a rate less than 4% a year ago, and now it would be just under 5%. And it's possible that the rates will keep rising in 2019.

But in the big picture:

- The increase in the annual average rate over the past year has not been significant within a historical context.

- The actual rates are still lower than nearly all years over the past fifty years.