Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Monday, May 7, 2018

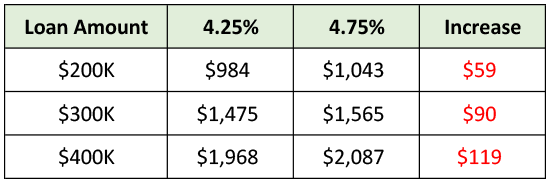

As mortgage interest rates rise, we are likely to see a bit more variation in interest rates between lenders. As such, it is important to check with at least two lenders to make sure you are getting the best possible interest rate on your new mortgage.

As shown above, a half of a percentage point shift in the interest rate can make a big difference in the monthly payment. Oh, and if we stretch out that difference over 10 years, assuming you stay in your home that long, here's how much extra you would pay with that higher mortgage interest rate....

- $200K Loan = $7,080 extra paid

- $300K Loan = $10,800 extra paid

- $400K Loan = $14,280 extra paid

Feel free to email me (scott@HarrisonburgHousingToday.com) if you would like recommendations of lenders in this area.