Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Tuesday, March 27, 2018

It's exciting if your home value is increasing, right? Well -- mostly, it seems.

Certainly, if you bought your home for $250K and it is now worth $260K or $270K or even $300K -- that can be a good thing. At some point in the future, you'll recoup that equity when you sell your home -- plus or minus any shifts in value between now and then.

But in the near-term, increasing home values can actually hurt a bit.

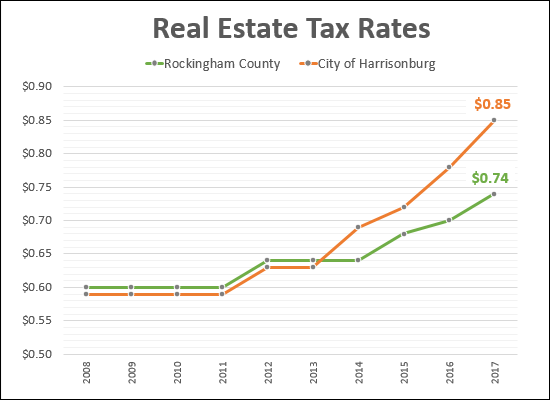

The amount of real estate taxes that a homeowner pays to their locality (city, county) are based on two factors -- the assessed value of the home, and the local real estate tax rate.

In Rockingham County, the current real estate tax rate is $0.74 per $100 of assessed value....

Tomorrow, the Rockingham County Board of Supervisors will hold a public hearing to receive input before adopting a real estate tax rate for fiscal year 2019 -- which runs from July 1, 2018 through June 30, 2019.

But here's the thing -- even if the tax rate remains the same (at $0.74) there are many homeowners who will see an increase in their real estate taxes -- because of increases in home values, and thus increases in assessed values.

Rockingham County revises their property assessments once every four years -- and the most recent increase resulted in a 2% increase in the assessed value of an average home.

This is good news for the County, as the increase in property values, even with no change in the real estate tax rate, will likely generate over $2 million in additional tax revenue.

It is sort of good news for County property owners -- because it means your property value is (likely) increasing -- but it is also potentially bad news, as your tax bill will likely be increasing.

To put some numbers to it:

- The median sales price of homes in Rockingham County over the past 12 months was $212,500.

- Assessed values are typically a bit low in the County, but we'll ignore than fact, and pretend that a house that sold for $212,500 is also assessed at $212,500.

- A home assessed at $212,500 would pay $1,572.50 per year in real estate taxes.

- A 2% increase in the value of a median priced home would be an increase of $4,250.

- The resulting increase in real estate taxes would be $31.45 per year.

And -- you can both celebrate and mourn the news that property values are increasing, and that your real estate tax bill likely will be as well.