Numbers are funny.

All of these statements are true based on current projections:

- City Council might decide to pay $76 MILLION for a new high school.

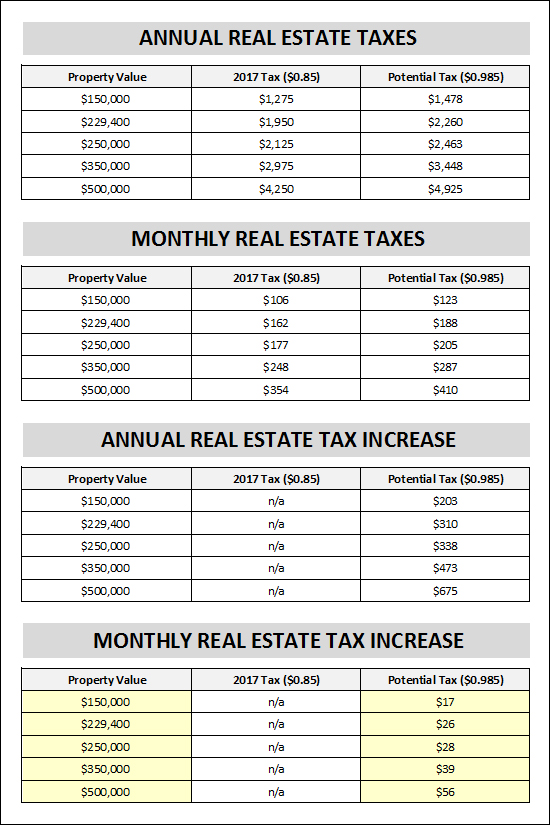

- City property owners might see a 16% increase in their real estate taxes!

- The owner of a $350K home in the City would pay nearly $500 ($473) of extra real estate taxes each year!?!

- This tax increase would result in the owner of a median priced city home paying $26 more in real estate taxes each month.

I'm guessing that if you ask most parents of school aged kids in the City if they'd be willing to pay $26 per month such that their child would not be in an overcrowded, not-so-ideal, learning environment for high school, they'd likely be quick to say yes.

That said, this $26 per month increase would need to be paid for 25 years -- but for a parent of a child in the school system, I'm guessing that would still seem to be a reasonable cost.

I'm also guessing that City property owners who do not have children in the local school system would LOVE for their property taxes to NOT increase. And I'll even go a step further -- I am guessing that they don't really want school aged children to have an overcrowded, not-so-ideal, learning environment -- it's probably just more about the increased tax burden.

Anyhow. Numbers are funny.

Read today's Daily News Record article, and feel free to form your own opinions. There seem to be plenty of them circulating through our community about this topic. :)