Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Thursday, May 18, 2017

Here is a grand oversimplification:

- Harrisonburg High School is filled beyond capacity.

- The school-aged population in the City of Harrisonburg is continuing to grow.

- The high school needs to be expanded or a new high school built.

- Any such expansion or new build will be very expensive.

- This large expense is likely to be paid for primarily via an increase in real estate taxes.

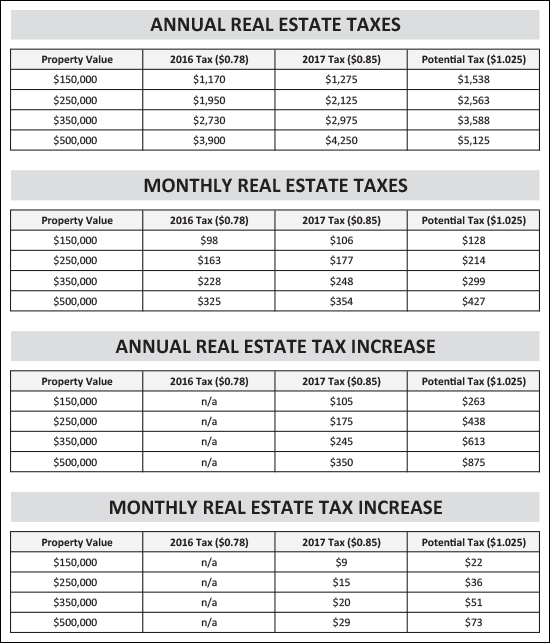

As shown above, it depends on the value of your home. These examples are based on the potential need for a $0.175 increase (per $100 of assessed value) in the tax rate.

Increasing the tax rate from $0.85 to $1.025 would result in....

- The owner of a $150K property paying $22 more per month.

- The owner of a $250K property paying $36 more per month.

- The owner of a $350K property paying $51 more per month.

- The owner of a $500K property paying $73 more per month.

So -- yes -- this would be a drastic increase (20.5%) one-year increase in the real estate tax rate. But when broken down to the actual increased cost per month, it does not seem quite as overwhelming.

Further reading from the Daily News Record: