Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Friday, April 14, 2017

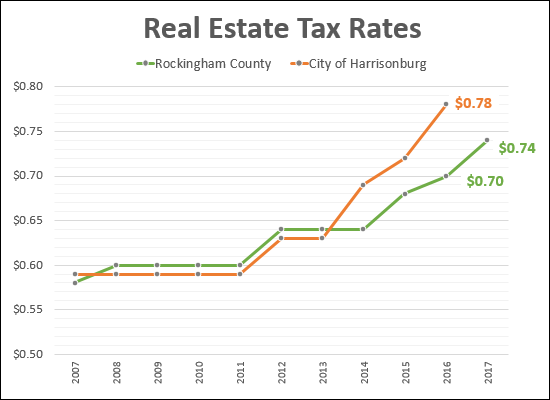

Rockingham County's budget for the 2018 fiscal year (which begins July 1) includes a proposed $0.04 increase in the real estate tax rate, which would increase from $0.70 to $0.74 per $100 of assessed value.

Some context....

- It would appear that this $0.74 real estate tax rate may be the highest real estate tax ever levied on property owners in Rockingham County. The previous high was $0.71, which was in place between 2000 and 2005.

- It seems that this will be the third consecutive year of increased taxes -- which will have jumped from $0.64 (2014) to $0.68 (2015) to $0.70 (2016) to $0.74 (2017). This will mark a 15.6% increase in the real estate tax rate over a three year period.

- The median sales price of homes in Rockingham County in 2016 was $203K. If all homes were assessed at their market values, this $0.04 increase between 2016 and 2017 would equate to an annual increase of $81.20 in real estate tax on a median priced home. This would be an increase of $6.76/month -- just a bit less than a Starbucks Venti, Quad-Shot Caramel Macchiato.

- Rockingham County held a public hearing this week and nobody (that's right, count them, zero people) made any comments about whether they thought it was OK for these tax rates to increase.

Read lots more about WHY the tax rate needs to increase here....

County Eyes More Taxes, Fees

Daily News Record, April 5, 2017

No Comments At Budget Hearing

Daily News Record, April 13, 2017