Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Monday, October 31, 2016

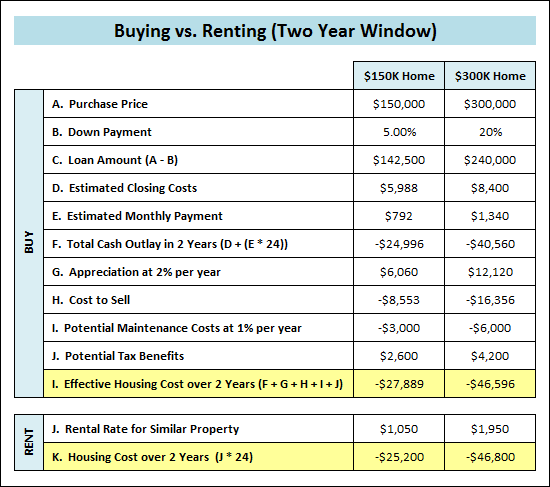

Does buying or leasing make more sense with a two year time frame?

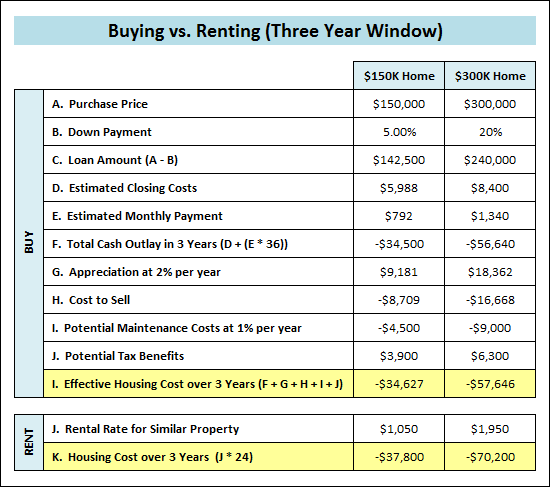

It depends on the price range, how much of a down payment you are making, whether you are willing to keep the property as a rental property after you move out, and many other factors. However, above I have included is a 2-year and a 3-year analysis of buying versus renting a property valued at $150K compared to $300K, which shows that....

- If you're buying at $150K with a 5% down payment, it makes more sense to lease if you'll only be there for two years. If you'll be there for three (or more years) it likely makes more sense to purchase.

- If you're buying at $300K with a 20% down payment, buying and leasing are almost equivalent in a two year timeframe, and it definitely makes more sense to purchase if you'll be there for three (or more) years.

There are, of course, plenty of extenuating circumstances. Many people might buy a $150K house (or townhouse) even if they are planning to be there for only 3 years --- because they want their own home (not their landlord's), or to get in a certain neighborhood, or because of the tax benefits, etc.

- your monthly mortgage payment

- appreciation in your home's value

- the cost of selling your home after the two or three years ends

- potential maintenance costs

- potential tax benefits of paying mortgage interest