Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Tuesday, April 26, 2016

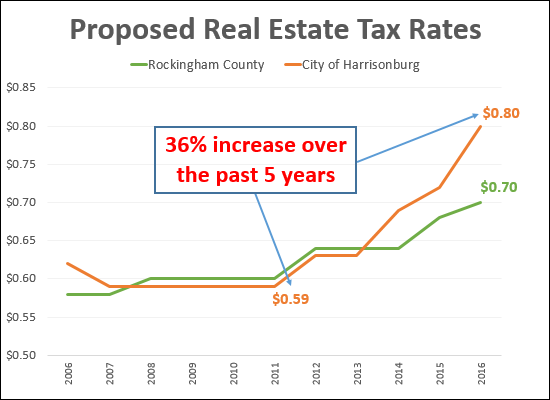

The real estate tax rate in the City of Harrisonburg might increase to $0.80 per $100 of assessed value per the City's proposed 2016-17 budget. As shown above, this would be a 36% increase in the tax rate over a five year period.

The context that might be missed by just looking at this increase includes....

- The proposed $0.80 rate is what is required to balance the budget. That might end up being lower depending on a variety of funding decisions that City Council might make.

- One of the main reasons for this increase is because two new schools are being built in the City of Harrisonburg. Bluestone Elementary School and Elon Rhodes Early Learning Center -- both of which will be built over the next year to open in Fall 2017.

- The population of Harrisonburg keeps on growin -- at a pace of approximately 1,000 people per year. Providing services to an ever increasing population is increasingly expensive.

- Real estate revenue could go up without increasing the tax rate -- if lots of new houses were being built (brand new tax revenue) or if home values increase (higher tax revenue). In the past year, the MLS only shows 25 new home sales in the City of Harrisonburg -- and the median sales price of a single family home in the City has only increased 1.2% over the past year.

Interested in knowing more?

Read today's article in the Daily News Record (City Eyes Tax Hike In Budget Proposal) or attend the public hearing on the budget this evening at the City Council meeting at 7PM in City Hall Council Chambers.