Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Friday, September 4, 2015

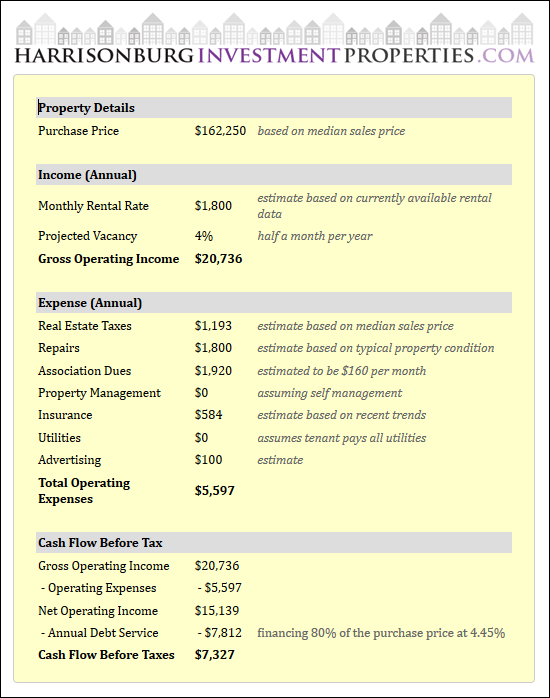

As shown per the above analysis, found on HarrisonbugInvestmentProperties.com, the purchaser of a condo at Campus View could potentially invest $32K (20% of the purchase price as a down payment) and be making $7K(+) per year in positive cash flow before taxes.

Not bad, not bad, not bad at all! Despite the abundance of caveats (some listed below) this is a great investment opportunity to explore depending upon your tolerance for risk....

- This assumes that you buy at the median sales price.

- This assumes that the seller pays your closing costs. If not, you might be investing $36K or $37K.

- This assumes a fully leased property. Miss a tenant for a semester or a year, and your cash flow will look less favorable.

- This assumes you manage the property yourself.

- There are a few other assumptions built into the model above. Let me know if you have questions about it.