Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Tuesday, June 23, 2015

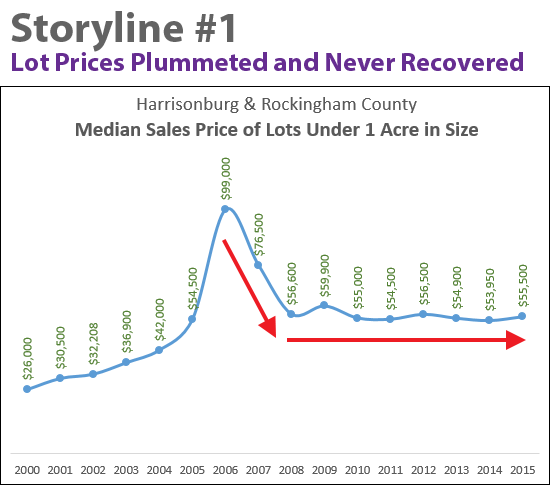

The story illustrated above (lot prices plummeted 50% and have never recovered) is the one I've been running with over the past few years. It takes the $100K lot value as the "new norm" and then looks at all values after that point ($55K-ish for years and years) as depressingly low.

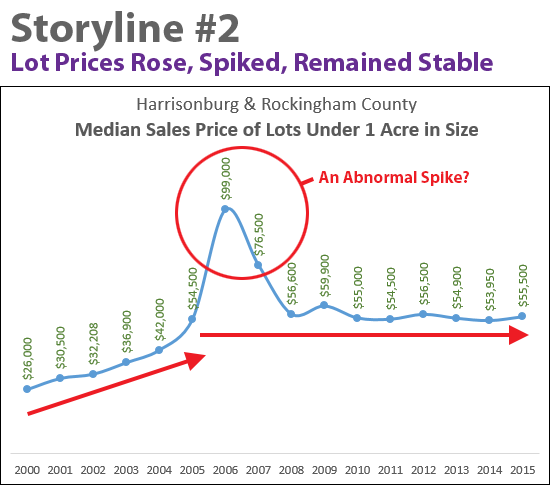

Perhaps that's not the correct storyline. What if this is really the story....

Perhaps the story to be told is that lot values steadily increased between 2000 and 2005 (from $26K to $55K), then had an abnormal, unnatural, unsustainable spike (to $99K) before settling back down to the then continued norm of $55K-ish.

If this, is, the more important story to be embracing, then we need not be quite as depressed. Other than a brief two year wild party (for sellers of building lots) the median sales price of these lots has been around $55K for the past decade....