Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Friday, November 16, 2012

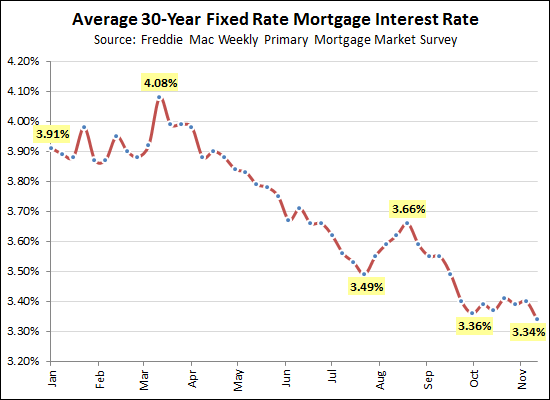

Another new record low -- average 30-year fixed mortgage interest rates are now hovering at 3.34%, a level never seen before!

If you bought a $250K house in the first week of January with 80% financing with the interest rate at the time (3.91%) you would be paying $945/month in principal and interest.

Buying a $250K house today with 80% financing with the current interest rate (3.34%) will result in a payment of $880/month in principal and interest.

That means that since the first of the year, the cost to own a $250K house has decreased by $65/month --- which is an annual savings of $780. Wow!

It has been very rewarding to see many of my clients closing on home purchases this year and locking in their housing costs at such historically low levels. Will you be next?