Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Friday, July 6, 2012

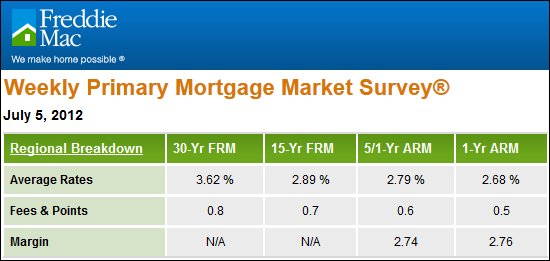

I bet you thought rates were low on 30 year mortgages at 3.62%.

How about a 15-year fixed rate mortgage at 2.89% -- now that is low!

If you are refinancing your mortgage because you have a high current interest rate --- be sure to check to see what would happen if you reduced the term of the mortgage.

Let's consider the scenario of someone who bought a $250,000 house ten years ago with 80% of the purchase price financed at 6%. Somehow, this homeowner has still not refinanced (suspend your disbelief) but now is finally considering it.

Current Mortgage Payment (principal and interest only) = $1200

Option 1: Refinancing balance of $167,371 at 3.62% over 30 years.

New Mortgage Payment = $763

Option 2: Refinancing balance of $167,371 at 2.89% over 15 years.

New Mortgage Payment = $1147

So.....after having paid for 10 years, this homeowner can take their remaining 20 years of intended mortgage payments ($1200/m) and lower that payment to $1147/m all while paying off the mortgage in 15 years instead of 20 years!

Opportunities abound given today's low (low) mortgage interest rates. Whether refinancing or buying, now is a great time to consider taking out a new mortgage and locking in your interest costs at all-time record lows.