Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

City of Harrisonburg real estate tax rate likely increasing 7%, mirroring Rockingham County increase

Wednesday, April 11, 2012

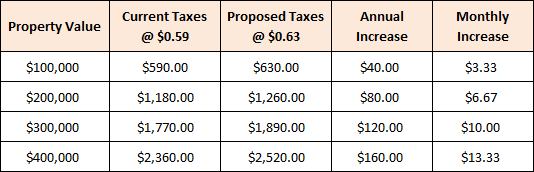

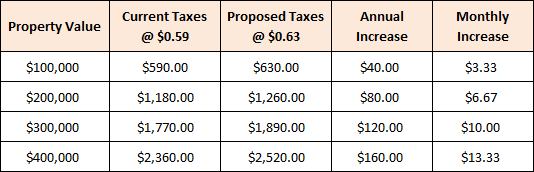

Rockingham County is considering raising the real estate tax rate from $0.60 to $0.64 per $100 of assessed value (details here). The City of Harrisonburg is now considering a similar increase, from $0.59 to $0.63 per $100 of assessed value.

The reasons cited for the proposed tax rate changes are increased Virginia Retirement System costs, and decreased property values. There are a few other tax rates that would change, but here is how the real estate tax rate changes would impact homeowners in the City of Harrisonburg....

Of note, the City's real estate tax rate was $0.62 per $100 of assessed value very recently -- it was adjusted down to $0.59 per $100 of assessed value in the 2008 fiscal year. Thus, looking at this over six years (2007-2013) this is only an increase of $0.01 per $100 of assessed value -- thus an effective 1.6% increase in the tax rate over the past 6 years.

Click here for the full article from the Daily News Record.

The reasons cited for the proposed tax rate changes are increased Virginia Retirement System costs, and decreased property values. There are a few other tax rates that would change, but here is how the real estate tax rate changes would impact homeowners in the City of Harrisonburg....

Of note, the City's real estate tax rate was $0.62 per $100 of assessed value very recently -- it was adjusted down to $0.59 per $100 of assessed value in the 2008 fiscal year. Thus, looking at this over six years (2007-2013) this is only an increase of $0.01 per $100 of assessed value -- thus an effective 1.6% increase in the tax rate over the past 6 years.

Click here for the full article from the Daily News Record.