Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Friday, February 17, 2012

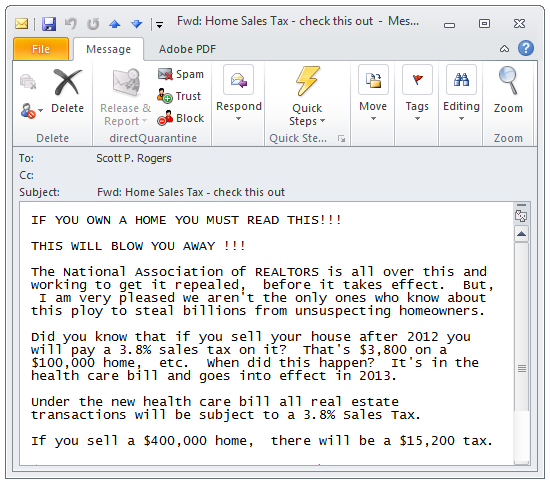

I have had several people ask me about this in the past week, so I thought I'd clarify. The e-mail above is an example of what you might hear about -- a scandalous part of the health care bill that will charge everybody a sales tax of 3.8% of their home sales price starting in 2013.

Is it legit? Will you pay this sales tax if you sell? Most likely not. Let's take a look....

The 3.8% tax is a tax on a very narrow band of investment income for high-wealth households (those who earn $250,000 in a joint return or $200,000 as an individual) that could come into play on the sale of a house if the sales gain is more than $500,000 for a married couple or $250,000 for an individual.

Even in the unlikely event the sales gain is more than that amount, the tax would only apply based on other considerations having to do with the household’s income and tax situation. The bottom line is that the tax, which was imposed to help shore up Medicare, will hit only some portion of investment income. (source here, and more here)

So, here's a quick test to help you understand how wide of an affect this 3.8% tax will (or will not have):

- Do you have household income above $200K as an individual, or $250K as a couple? If not, this tax does NOT apply to you.

- Did you turn more than a $250K profit on the sale of your home as an individual, or more than $500K as a couple? If not, this tax does NOT apply to you.

- Even if you answered yes to both #1 and #2 (unlikely) there are still quite a few other aspects of your financial and tax picture that would have to be true in order for the tax to apply.

So, back to the original e-mail ---

Will the seller of a $100K home pay $3,800 per this tax? Absolutely not -- how could they have had a $250K profit if they sold their house for $100K?

Will the seller of a $400K home pay $15,200 per this tax? It's possible -- if they are single, and they bought the house for only $150K, and they make over $200K/year.

Hopefully you can see how far from reality the rumors are of this 3.8% real estate sales tax. Feel free to call me (540-578-0102) or send me an e-mail (scott@HarrisonburgHousingToday.com) with any questions..