Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Monday, January 16, 2012

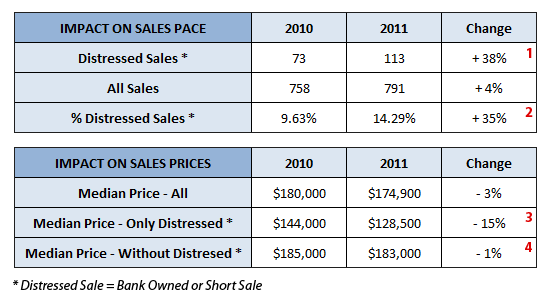

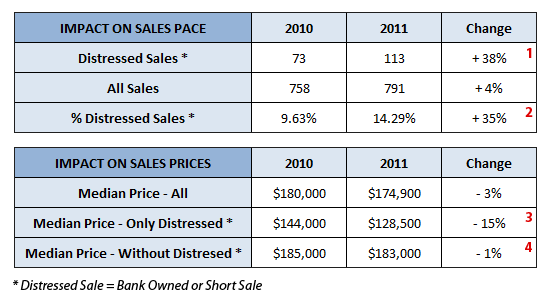

Housing markets across the country have been affected by an increase in distressed sales over the past few years -- both bank owned homes (that were foreclosed on) and short sales (where the sales price didn't pay off the mortgage). So, what was the impact in our local area?

A few observations based on the data above....

A few observations based on the data above....

- Distressed sales increased significantly (+ 38%) between 2010 and 2011. Thankfully, the number of foreclosures declined (- 17%) between 2010 and 2011, so we are likely to see fewer distressed sales in 2012.

- As could be expected, distressed sales made up a larger portion of home sales in 2011 (14%) as compared to 2010 (10%). This marks a 35% increase in the percentage of local home sales that were distressed sales.

- The median price of distressed sales declined by 15% over the past year. This may have been a combination of better deals on distressed properties and/or lower valued homes being sold as distressed sales.

- Thanks for reading to this last point, because this is the important one! While the overall median sales price in our local area declined 3% over the past year --- if you take out distressed sales, the median sales price only declined 1%.

Again, given the decline in foreclosures in 2011, I am hopeful that we'll see a smaller number of distressed sales in 2012, leading to greater stability in our local housing market.