Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Tuesday, October 18, 2011

There are plenty of ways to compare the opportunities of renting versus when buying. For example, a tenant in Avalon Woods recently discovered that he is paying more in rent per month than he would have to pay for a mortgage in purchasing this fantastic townhouse.

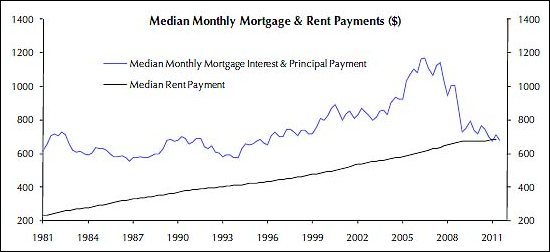

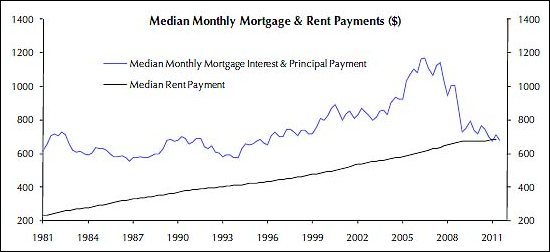

This phenomenon is apparently also happening from an overall perspective as well, though, as median rental payments have now increased enough and mortgage payments have now decreased enough such that the median values are equivalent. The extraordinarily low interest rates we're seeing these days definitely help!

Source: Capital Economics, Thomson Reuters

As this insightful article points out, however, the up front costs of buying (closing costs) are typically much higher than those related to renting (a refundable security deposit). Furthermore, it is quite a bit easier to decide to stop renting (provide notice to landlord) than it is to stop owning a home that you bought (sell it).

This phenomenon is apparently also happening from an overall perspective as well, though, as median rental payments have now increased enough and mortgage payments have now decreased enough such that the median values are equivalent. The extraordinarily low interest rates we're seeing these days definitely help!

Source: Capital Economics, Thomson Reuters

As this insightful article points out, however, the up front costs of buying (closing costs) are typically much higher than those related to renting (a refundable security deposit). Furthermore, it is quite a bit easier to decide to stop renting (provide notice to landlord) than it is to stop owning a home that you bought (sell it).