Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Tuesday, November 23, 2010

Property assessments are used to determine the amount of taxes that each property owner will pay. Can these assessed values also be used to estimate the value of a home? In theory, yes --- after all, the assessed value is intended to be the true market value of the home --- but it doesn't always seem to work.

Case in point....one of my clients is considering two homes (among others) that have very similar assessed values, but have asking prices over $50k apart. Is the owner of the higher priced home just being unrealistic? Or are the assessments less than accurate?

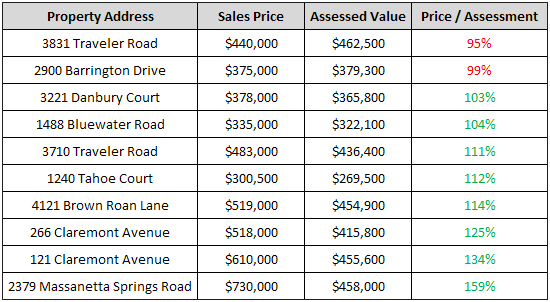

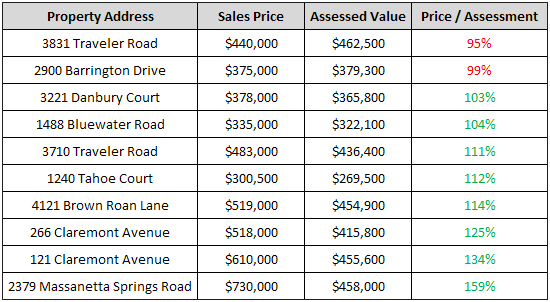

One way to examine this is to compare recent sales prices to assessed values. I'm going to focus on homes over $300k, as I sense that there might be more disparity in assessments with higher priced homes.

In the past three months, there have been 10 sales of homes in Rockingham County with sale prices over $300k, with Harrisonburg mailing addresses.

As you can see, there is an enormous swing in the ratio between sales prices and assessed values. These ten buyers paid, on average, 16% more than assessed value for their homes.

A few inconclusive conclusions:

Case in point....one of my clients is considering two homes (among others) that have very similar assessed values, but have asking prices over $50k apart. Is the owner of the higher priced home just being unrealistic? Or are the assessments less than accurate?

One way to examine this is to compare recent sales prices to assessed values. I'm going to focus on homes over $300k, as I sense that there might be more disparity in assessments with higher priced homes.

In the past three months, there have been 10 sales of homes in Rockingham County with sale prices over $300k, with Harrisonburg mailing addresses.

As you can see, there is an enormous swing in the ratio between sales prices and assessed values. These ten buyers paid, on average, 16% more than assessed value for their homes.

A few inconclusive conclusions:

- If you are considering an offer on a house that is assessed at $350k, the only thing you can glean from that assessed value is that it will probably sell for somewhere between $332k and $560. That range is based on the -5% to +60% swing shown above.

- If you are pricing your home to sell, you will quite likely be pricing it above the assessed value -- based on the data above, which is only $300k+ homes, in Rockingham County, with Harrisonburg mailing addresses.